1 minute read

After ECB Minutes & Fed Jackson Hole Meeting

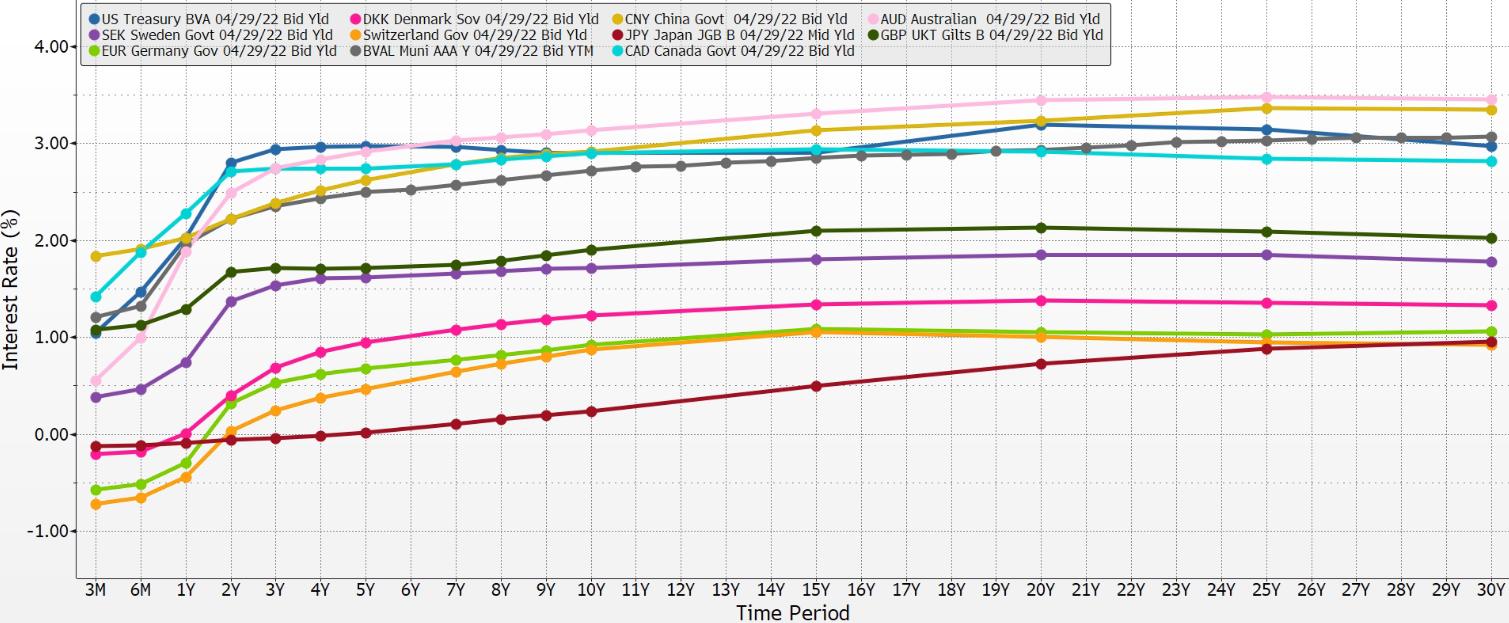

Markets are speculating about any forthcoming policy changes. Inflation statistics are still calm, but warnings about forthcoming rising inflation are percolating in the financial markets and among commentators. Meanwhile, the ECB and Fed offer no alarming signals, and the parallel structure of the yield curves remains in operational mode. Notice that curves are still parallel and bunching is still in place.

Advertisement

As of September 2021, markets are worried about contagion risk spreading from the development of default risk in Chinese real estate companies. Evergrande is the first company to raise concern. Speculation about how there is “never just one cockroach” prevails in discussions. No one knows yet how the Chinese policymakers will respond to this growing default risk. Interest rates at the longer end of the Chinese yield curve start to rise. Other yield curves that are sensitive to China’s economics also start to shift. The Australian yield curve is a good example. The shorter-term curves remain bunched.

Examination of the intermediate-term spread versus the longer-term spread shows this beginning of steepening in the yield curves. Swaps are still keeping the curves parallel. The short-term end of the swaps continues in the rolling mode, and that anchors the shorter-term end of the spread.