1 minute read

After Powell NABE Speech Mentions 50bps Hike

Fed Chair Jay Powell uses his speech to the National Association for Business Economics (NABE) in Washington, DC, to message markets that a 50-bps hike in the short-term policymaking interest rate is coming soon. Markets are already adjusting to the future path of several 50-bps hikes during the year. Some are pricing in four or five successive interest rate hikes in one year.

Advertisement

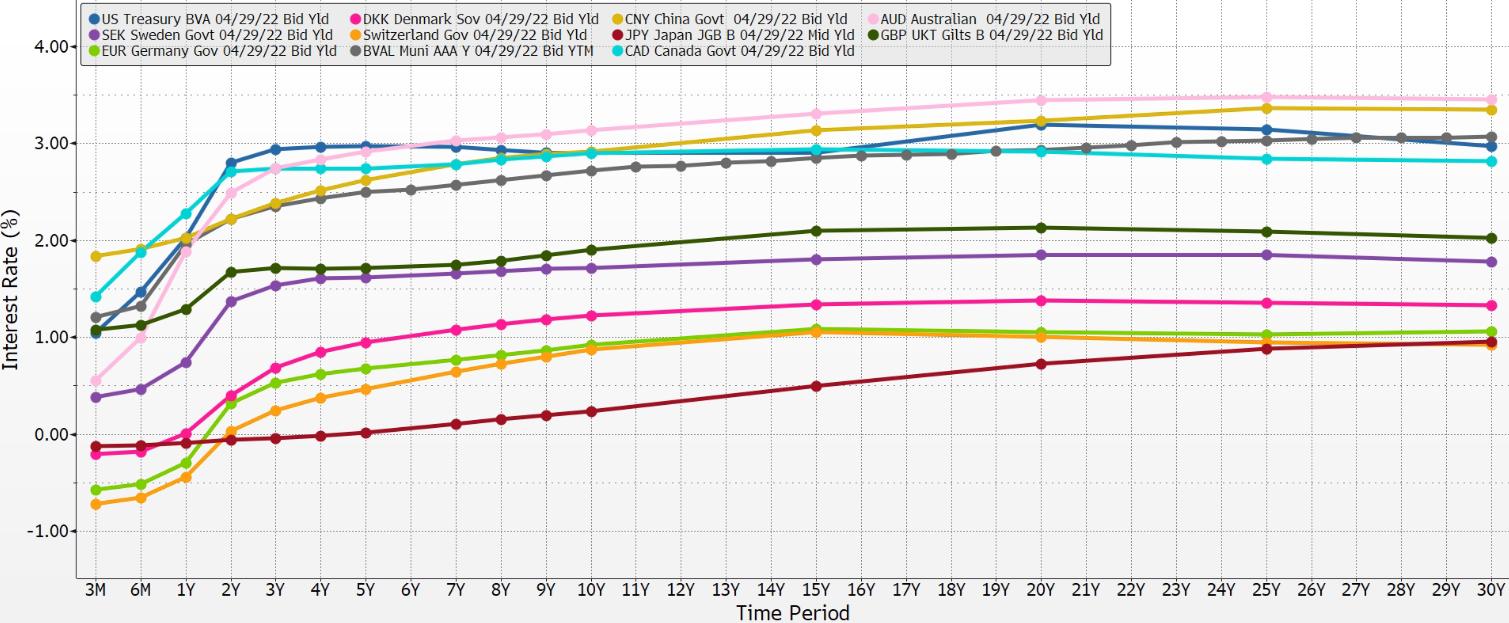

Notice how the curves remain parallel from about 2-years to 30-years maturity. The reason? The swaps mechanism still works and dampens volatility and causes alignment. Market agents adjust quickly, and the rolling feature of the currency one-month and three-month currency swaps continues to work for the currency adjustment portion of the swap. In the use of derivatives and swaps, the world’s expertise is well developed, and there is an immediate response to any news item or change.

When we step back from the day-to-day and look at these yield curves and their parallel nature occurring in the midst of a pandemic shock and, now, a shooting-war shock, we can see how the swaps structure has worked in global finance. The currency exchange rates take the volatility. When central banks do not align with others in policymaking, the market does the aligning for them. Outlier central banks are quickly punished by market forces, as we saw with Switzerland and Canada. The process is very fast.

We are coming up on the end of the chart sequence and the cutoff date for this pamphlet. In the spring of 2022, all eyes are on Japan, which is still managing yield curve control and still trying to anchor both ends of its yield curve. Markets are positioning against this outlier just as they did against Switzerland and Canada. We see that in the dramatic change in the market value of the yen against other currencies.