1 minute read

2022 Kentucky Annual P&C Marketplace Summary

You are being provided this 2022 Kentucky Annual P&C Marketplace Summary covering the Kentucky property and casualty (P&C) insurance marketplace as a benefit of your membership in the Big I Kentucky.

What follows is a graphic and numeric presentation of the Kentucky P&C industry data from an independent agent’s perspective. The data used is the most recently available from A.M. Best Company. For this Summary that is the annual data for 2022.

Advertisement

Source: © A.M. Best Company — Used by Permission; US Census Bureau

This Summary emphasizes direct premiums, direct losses, and the associated direct underwriting results before reinsurance. Also included is data from nearly 3,000 insurers that are domiciled in the United States, and if they have written premiums in Kentucky then their data is incorporated. As independent agents, this is the marketplace experience for the business we place (or compete against) for our clients in Kentucky.

This 2022 Kentucky Annual P&C Marketplace Summary provides you with the following important information on the Kentucky P&C Marketplace:

• Premiums for all 32 P&C lines of business in Kentucky,

• The Top 10 lines for independent agents,

• Growth rates,

• Loss ratios,

• Penetration rates and trends,

• Commission rates, and

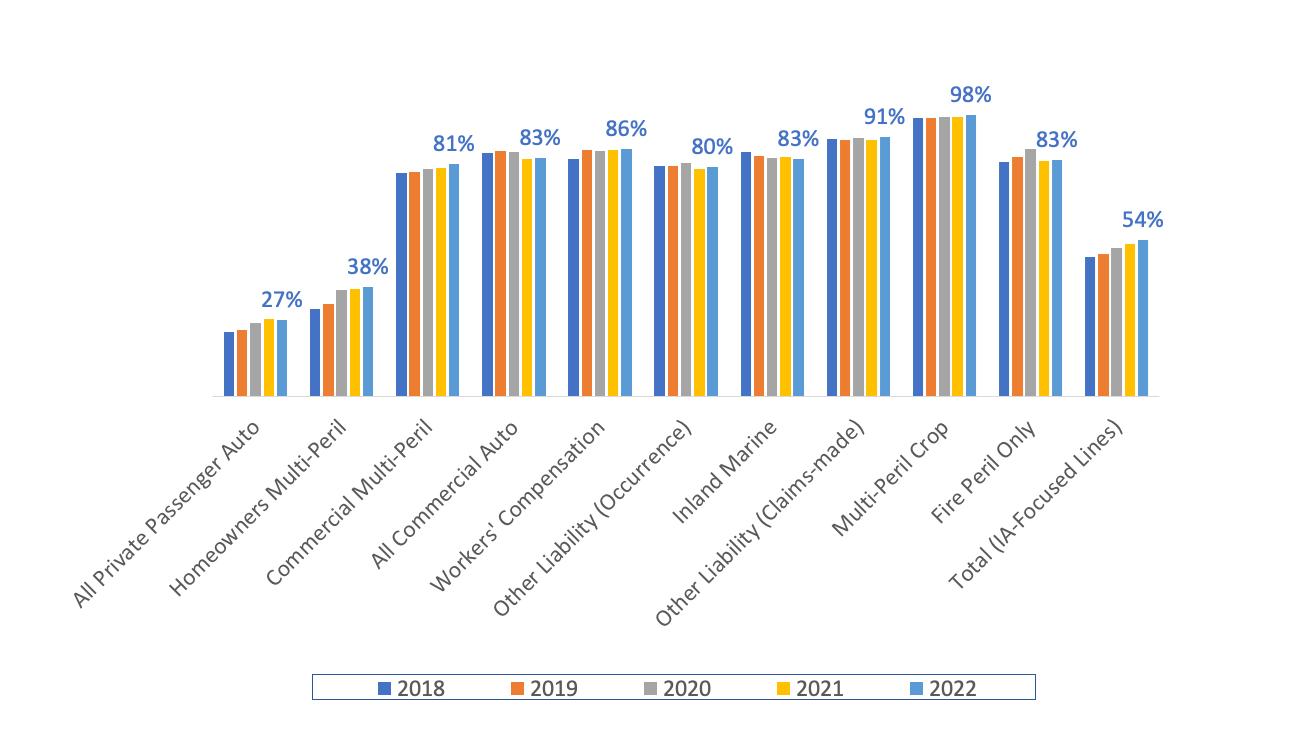

• Surplus lines utilization rates.

United States national data on each of the above is also furnished, to give perspective.

For those readers interested in line of business details, a separate page is provided for each of the lines of business that independent agents work with most in Kentucky. For each of these lines of business data on premiums, loss and combined ratios, top insurers, surplus lines utilization rates and other facts are provided.

For detailed information on approaches taken in the research, formulation, and presentation of this 2022 Kentucky P&C Marketplace Summary, four appendices are provided for the reader.

© 2023, Big I Kentucky. All rights reserved.

Kentucky Premiums: All 32 P&C Lines of Business

The above chart shows all 32 P&C lines of business that P&C insurers are required to report on, state-by-state, in their annual statement. They are listed in alphabetical order and in all subsequent tables/charts and graphs in this Summary. Of these 32 lines, 26 are primarily focused on by independent agents in Kentucky and are emphasized above with an asterisk (*).

For more detail Appendix #1: All Lines of Business-Additional Details provides further data on the premiums, loss ratios, growth and penetration of these 32 P&C lines of business.