2 minute read

Farmowners Multi-Peril

Source: © A.M. Best Company — Used by Permission

© 2023, Big I Kentucky. All rights reserved.

Advertisement

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

© 2023, Big I Kentucky. All rights reserved.

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

© 2023, Big I Kentucky. All rights reserved.

Source: © A.M. Best Company — Used by Permission

© 2023, Big I Kentucky. All rights reserved.

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

Source: © A.M. Best Company — Used by Permission

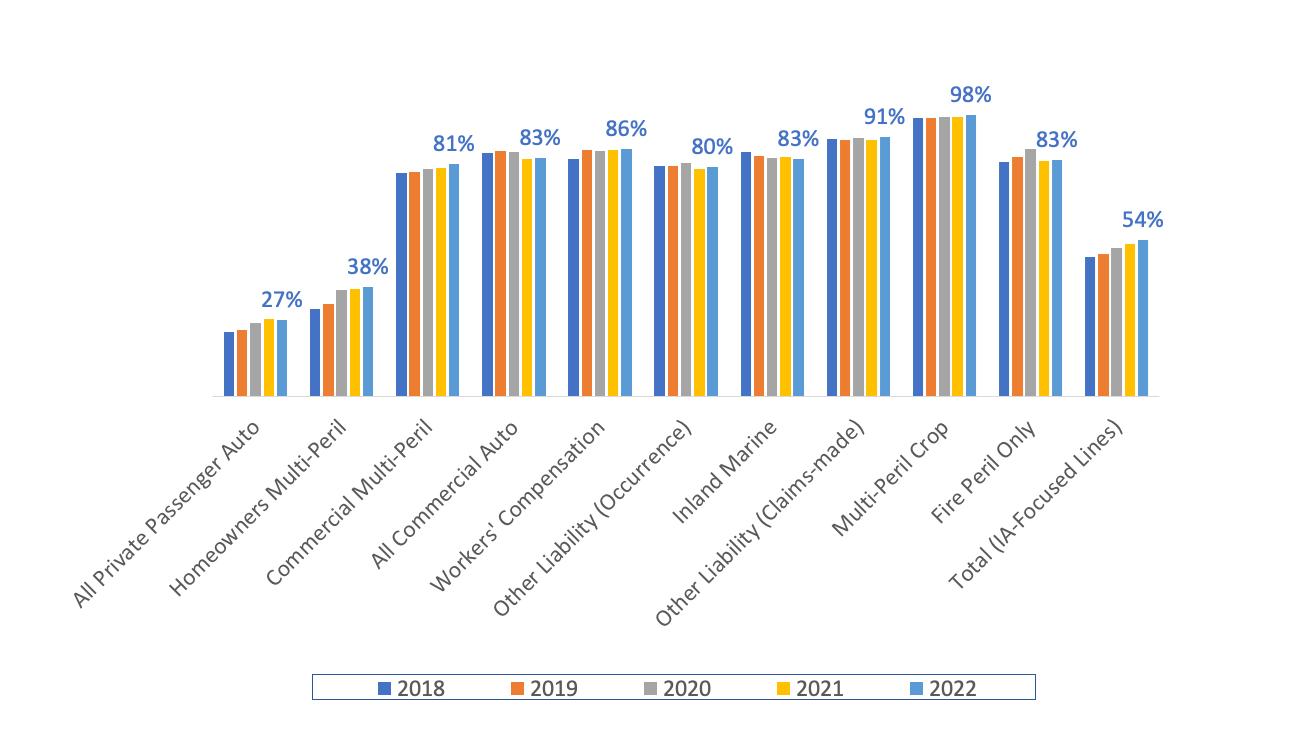

Source: © A.M. Best Company — Used by Permission. (Note: Independent Agent-focused lines of business are bold and underlined, and the total for just those lines is provided in the last line of the compendium, Total (IA-Focused Lines).

This Kentucky P&C Marketplace Summary classifies insurers into distribution styles based on the insurer’s reported marketing type(s). These marketing types are provided as part of what is known as a “Galley Process,” and made available by A.M. Best as part of various insurer attributes in their Best’s Financial Suite. Below are the various marketing types reported by insurers in 2022.

Marketing Types:

• Affinity Group Marketing

• Bank

• Broker

• Career Agent

• Direct Response

• Exclusive/Captive Agent

• General Agent

• Inactive

• Independent Agency

• Internet

• Managing General Agent

• Not Available

• Other

• Other Agency

• Other Direct

• Worksite Marketing

Distribution Style Classifications:

The approach used by this P&C Marketplace Summary is to take each insurer’s reported marketing type and put data from that insurer into one of 6 distribution styles. Some insurer classifications are obvious and straight forward. Others less so. When insurers list multiple marketing types, more weight is given to the marketing type listed first that closest aligns to each distribution style. About 10% of insurers have “Not Available” for their listed marketing type. These insurers represent less than 1% of all written premiums in 2022, and those insurers are categorized as “Other.”

There are 6 distribution styles into which each insurer is categorized in this Summary: (1) Pure IA or Broker, (2) MGA/Wholesale, (3) IA-Mixed, (4) Exclusive-Captive, (5) Direct, and (6) Other. When general independent agent distribution figures are needed, data for the first three distribution styles are combined, and are of the most interest. The remaining three distribution styles stand on their own. Other industry analysis of distribution and penetration may vary in how the impact of insurer distribution choices are determined, but generally the results are similar to the approach taken in this Summary.

By controlling the distribution style classification in this way for each insurer, flexibility is attained in providing data that matches an independent agent’s view of the marketplace. It allows determination of approximate penetrations of the distribution styles by line of business. It also allows creating lists of insurers by line of business for each distribution style.

Featured in the table below are the premiums as calculated based on the proprietary classification of insurers into distribution styles. Premiums are shown first for each line of business and All Distribution styles combined, and then for the 6 distribution styles just listed above separately. Bold and underlined in the table below are the 26 P&C independent agent-focused lines of business. The total for those 26 lines is provided in the last line of the table, Total (IA-Focused Lines).

Source: © A.M. Best Company — Used by Permission , and the Real Insurance Solutions Consulting proprietary classification of policy issuing insurer based on reported “Marketing Types.”