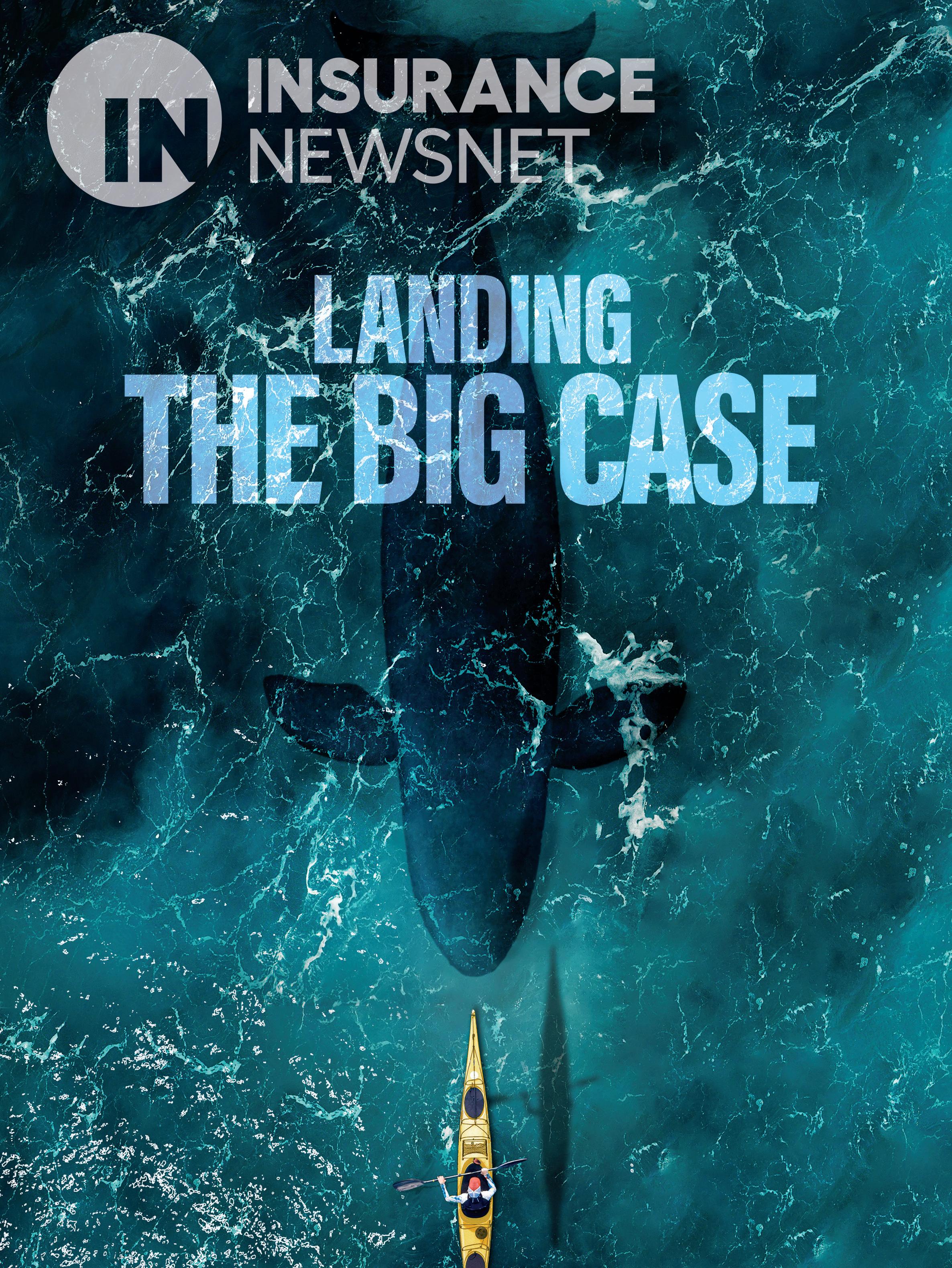

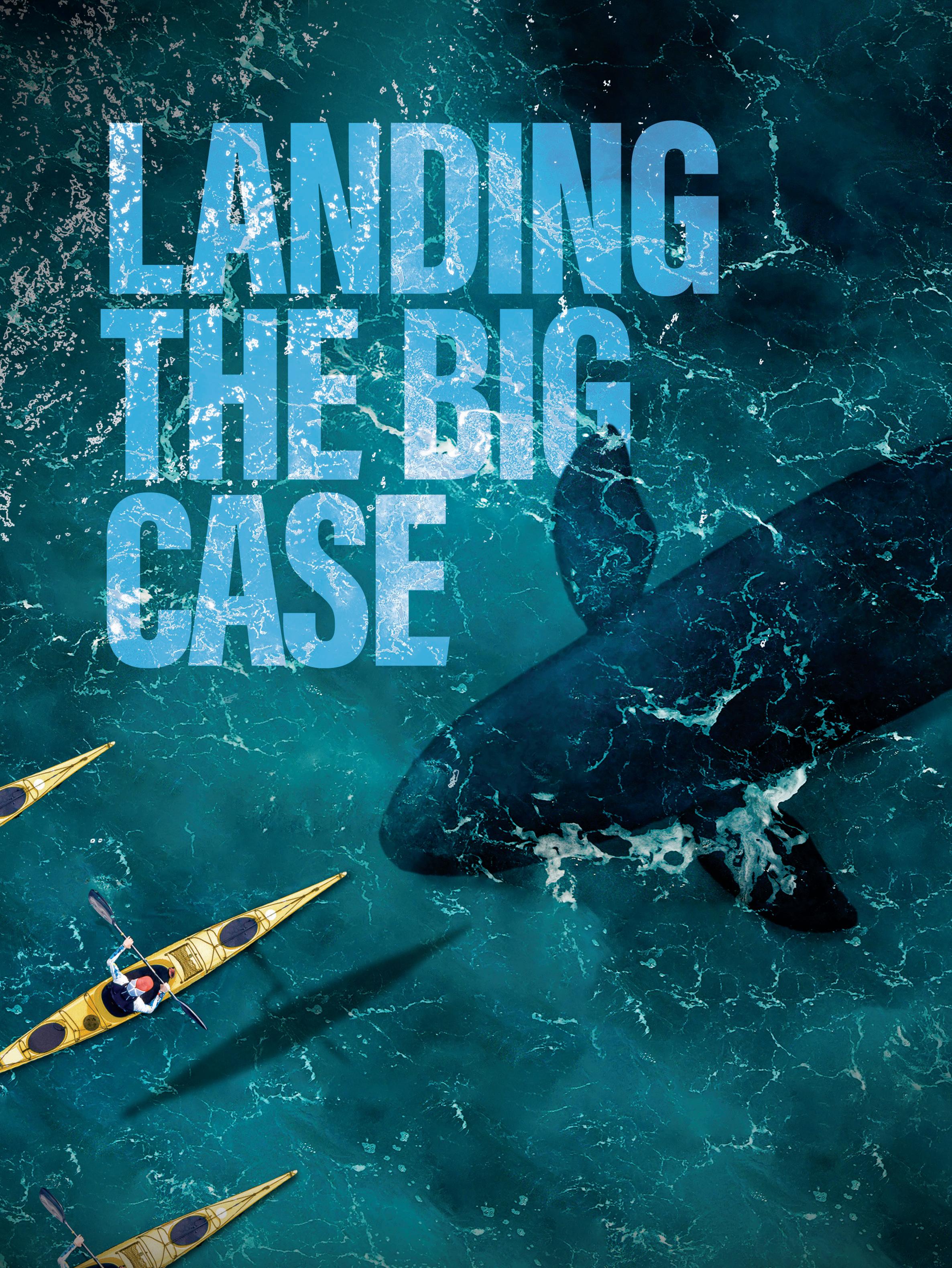

A big case doesn’t just fall into your lap. Here are stories of how advisors prepared and worked as a team with other professionals to be ready to win over the big client.

PAGE 12

ALSO INSIDE: A life lesson in success — with John Wheeler

PAGE 6

Amerilife focuses on ‘organic growth’ in next step

PAGE 44

out

THIS MONTH: COUPLES FINANCIAL PLANNING Life • Health/Benefits Annuities • Financial Services FEBRUARY 2023

PLUS: Check

our Couples Financial Planning Thought Leadership Special Section PAGE 17

How top agents and advisors close bigger, better sales by relying on this proven system.

The 'easy button' for 10X- ing annuity and life sales...

See why and how this works to predictably increase sales...

Turn to page 4

even 10X production.

Most agents and advisors are bombarded with lead programs, new products, new sales ideas, and the latest tools and tactics — all of which can be good …

But the truth is, the key to doing more business is the ability to close. Consistently.

ONE thing is your “easy button” to help you say and do the right things at the right time, every time, so that prospects are ready to buy.

It helps you efficiently scale your practice, so you can live the life you want to live — without having to do it all yourself.

It helped an advisor who’d never sold an indexed annuity write their first case for $1 million in premium. And helped another advisor gather more than $50 million in new assets in one year. And another to go from $200,000 to $2.7 million in gross revenue.

Turn to page 4, where we’re peeling back the curtain and walking you through what these producers have in common — it’s the easy button for annuity and life sales.

To discover how you could achieve an exponential increase in your annuity and life production this

year, visit BiggerBetterAnnuitySales.com

See what YOU can achieve with a system developed for advisors by an advisor that's helped 3X, 4X and

We’re changing the game

Our winning strategy helps you deliver meaningful results to your clients.

DELIVER MORE with Optavise Now, our powerful communication and scheduling tool.

BOOST PARTICIPATION with in-person or virtual enrollments.

PROVIDE ONGOING ADVOCACY that helps employees make informed healthcare decisions.

OFFER A BROAD PORTFOLIO of voluntary benefits and services your clients need.

209001 © 2022 Optavise We’re changing the game. What’s your next move? Find out how we can help » visit: Optavise.com/INN

www.insurancenewsnet.com/topics/magazine

FEATURE Landing the big case

By Susan Rupe

HEALTH/BENEFITS

36 Most long-term care doesn’t qualify for insurance benefit

By Robert Pokorski

For many clients, death occurs at an earlier stage of disability.

ADVISORNEWS

40 Conventional wisdom and a three-year plan

By Jeff Snyder

INTERVIEW

6 A life lesson in success — with John Wheeler John Wheeler discusses how his early life lessons in a small Illinois town inspired him to help others obtain financial security, which he has been doing for 50 years.

LIFE

27 How to talk to teens and adult children about life insurance

By Diana Angelini

The more advisors encourage clients to talk to their children about financial issues, the less taboo those issues become.

Taxes are going up in the future. Help your clients plan for those tax hikes now.

BUSINESS

42 Will ‘quiet quitting’ cause your clients to quit?

IN THE FIELD

22 A lioness in the industry — with Angie Ribuffo

By John Forcucci

Angie Ribuffo is a champion for women in the industry and for the women she serves.

28 This overlooked asset could help optimize your clients’ financial plan

By Hector Martinez

By Hector Martinez

How to use life insurance to create tax efficiencies for tomorrow.

ANNUITY

31 The cost of ignoring annuity training compliance

By Bill Wienhoff

By Bill Wienhoff

By Bhavana Rana

THE KNOW

12 FEBRUARY 2023 » VOLUME 16, NUMBER 02 INSURANCE & FINANCIAL MEDIA NETWORK 150 Corporate Center Drive • Suite 200 • Camp Hill, PA 17011 717.441.9357 www.InsuranceNewsNet.com

44 AmeriLife focuses on ‘organic growth’ in next step

By John Hilton

EDITOR-IN-CHIEF

DATABASE ADMINISTRATOR Sapana Shah

STAFF ACCOUNTANT Katie Turner

John Forcucci MANAGING EDITOR Susan Rupe SENIOR EDITOR John Hilton VP, SALES & MARKETING Susan Chieca CREATIVE DIRECTOR Jacob Haas GRAPHIC DESIGNER Shawn McMillion SENIOR CONTENT STRATEGIST Lori Fogle EMAIL & DIGITAL MARKETING SPECIALIST Megan Kofmehl TRAFFIC COORDINATOR Sorayah Talarek MEDIA OPERATIONS DIRECTOR Ashley McHugh NATIONAL SALES DIRECTOR Sarah Allewelt NATIONAL ACCOUNT DIRECTOR Brian Henderson NATIONAL ACCOUNT DIRECTOR

of, the information published herein. Address Corrections: Update your address at insurancenewsnetmagazine.com

INSURANCE & FINANCIAL MEDIA NE TWORK 6 22 February 2023 » InsuranceNewsNet Magazine 1

Doing your homework on state rules and course choice can prevent problems down the road. View and share the articles from this month’s issue IN THIS ISSUE online » read it

Everyone dreams of winning over the reluctant client or landing the big case. But it doesn’t happen overnight.

PUBLISHER Paul Feldman

Dominic Colardo

Copyright 2023 Insurance & Financial Media Network. All rights reserved. Reproduction or use without permission of editorial or graphic content in any manner is strictly prohibited. How to Reach Us: You may e-mail editor@insurancenewsnet.com, send your letter to 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011, fax 866.381.8630 or call 717.441.9357. Reprints: Copyright permission can be obtained through InsuranceNewsNet at 717.441.9357, Ext. 125, or reprints@insurancenewsnet.com. Editorial Inquiries: You may e-mail editor@insurancenewsnet.com or call 717.441.9357, ext. 117. Advertising Inquiries: To access InsuranceNewsNet Magazine’s online media kit, go to www.innmediakit.comor call 717.441.9357, Ext. 125, for a sales representative. Postmaster: Send address changes to InsuranceNewsNet Magazine, 150 Corporate Center Drive, Suite 200, Camp Hill, PA 17011. Please allow four weeks for completion of changes. Legal Disclaimer: This publication contains general financial information. It should not be relied upon as a substitute for professional financial or legal advice. We make every effort to offer accurate information, but errors may occur due to the nature of the subject matter and our interpretation of any laws and regulations involved. We provide this information as is, without warranties of any kind, either express or implied. InsuranceNewsNet shall not be liable regardless of the cause or duration for any errors, inaccuracies, omissions or other defects in, or untimeliness or inauthenticity

Staffers who are unhappy in their jobs will have a negative impact on the client experience. IN

This high-growth marketing company sees opportunity in the annuity space.

Out like a lion?

As we near the end of winter, the question inevi tably arises as to whether we’ll get a smooth en try into spring or if winter will go out like a lion, battering us with harsh conditions. For those who are among the 10,000 baby boomers retiring ev ery day in the U.S., the conditions under which they are exiting their working years and entering the retirement phase definitely fall into the “going out like a lion” category, as they face daunting economic conditions.

A combination of factors creating those adverse conditions includes rampant inflation, an unsteady market with forecasts of recession and fear of outliving retirement savings as life spans in crease. For women, the situation is more extreme. They, on aver age, have longer lifespans than men. This means that wives often outlive their husbands. When retirement resources become an issue, therefore, women are most likely to experience shortfalls that could impact their quality of life.

According to a number of studies, women also feel less confi dent in their financial preparedness and understanding, and so are at an additional disadvantage compared to men. To compli cate matters, women born in the older generations often took a back seat in financial decisions, and this left them with less knowledge about financial matters and their individual financial situations.

Changing this dynamic is difficult for a couple of reasons. First, the percentage of female financial advisors is far smaller than their male counterparts. And while there are a number of female advisors serving as mentors and role models for women new to the industry, these efforts have yet to make a large impact on the gender disparity in the workforce. This is an area where more needs to be done. Bringing more women into the industry will almost certainly mean bringing more female clients in as well.

Second, women most often head single-parent households, adding financial strain for those in that situation and making them less attractive clients for advisors who are seeking high-income clients.

These factors mean that more financial advisors should make a special effort to reach out to the women who could most use their services. Providing needed education — and confidence — will serve these clients in good stead, especially as they are more likely to become the surviving partner in the marriage.

Studies have shown that the youngest generations — especially Generation Z — are cognizant of retirement planning. In addition, many in those youngest generations hope to retire at a younger age than previous generations, with age 59 as a popular target age to exit the workforce.

This interest in financial planning provides a strong potential entry point for advisors to connect with younger female clients who are motivated to start saving — and who have the advantage of time on their side. While many younger clients may not currently have the high income that makes them the ideal client, a good number will develop careers that bring higher income into the picture later on. Providing the basic support and education

Helping women prepare for, and feel more confident in, their retirement planning is a service that will benefit both the new clients it will bring into the industry and their advisors.

Out like a lamb

While the economic forces are not at their most ideal for current and soon-to-be retirees, more advisors are bringing sophisticated strategies to bear to help the transition into retirement be more of the “out like a lamb” variety.

Annuities have made a big comeback, due to higher interest rates as well as the need for predictable retirement income in an unpredictable economic environment. The variety of products provide a wide set of offerings that meet most financial situations. Indexed products are also growing rapidly in number, with all manner of indexes being devised and providing many options for advisors and clients.

And while life insurance sales, which spiked during the pandemic, have receded somewhat, using life insurance more strategically to help ensure a segment of retirement income that is impervious to economic conditions is something we’re hearing from more advisors now.

As these strategies and others grow to help build resources — and the confidence — of those planning retirement, we’ll be reaching out to learn more about what products and strategies advisors are finding most successful in this changing economic landscape.

If you’d like to share some of your strategies with our readers, please reach out: editor@innemail.com.

John Forcucci Editor-in-chief

2 InsuranceNewsNet Magazine » February 2023 WELCOME LETTER FROM THE EDITOR

Guaranteed Cash-Out Rider

Three opportunities to fully surrender the policy and receive a partial or full return of premiums paid.1

Guaranteed Death Benefits

Between ages 95 and 121 to ensure your client does not outlive their policy.

Accelerated Benefit Riders

Should your client become seriously ill, a full or partial accelerated death benefit may be available.2

1) Cash-Out Rider may not be available on all substandard rated policies and some may only qualify for the Cash-Out option in the 15th Policy anniversary. 2) The riders are offered at no additional premium. However, the accelerated payment will be less than the requested death benefit because it will be reduced by an actuarial discount and an administrative fee of up to $500. The amount of the actuarial discount is primarily dependent on American National’s determination of the insured’s life expectancy at the time of election. A request for an accelerated benefit may only be advisable if the qualifying event results in a significant reduction in the insured’s life expectancy. A shorter life expectancy will result in a larger benefit offer. Outstanding policy loans will reduce the amount of the benefit payment. SGUL18; GCOR15; ABR14-TM; ABR14-CH; ABR14-CT ND & SD Form Series ABR22-CT, ABR22-CH and ABR22-TM (Forms may vary by state). The contract and riders may not be available in all states. See Policy for details and limitations. American National Insurance Company, Galveston, Texas.

Put your clients in charge now. Call 1-888-501-4043 today or visit img.anicoweb.com for more information or to run a quote.

SIGNATURE GUARANTEED UNIVERSAL LIFE

THE GIFT OF A GUARANTEE

UL puts your client in charge of

policy with flexible guaranteed death benefits, guaranteed access to cash and competitive premiums. For Agent Use Only; Not for Distribution or Use with Consumers. AMERICAN NATIONAL INSURANCE COMPANY 888-501-4043 | img.anicoweb.com IMG23026 | INN 02.2023

Signature Guaranteed

their

Could this be the 'easy button' for 10X- ing your life and annuity sales?

Ifyou’re a successful insurance or financial advisor, you know that closing the sale is dependent on everything you do leading up to getting a signature on the dotted line.

Most importantly, your clients must see you as an expert they trust rather than simply as a salesperson.

To do that, you have to diagnose their problems.

And reveal a need in their current financial situation.

You also know you need to take complex concepts and make them simple.

But what many agents and advisors don’t know is that producers have been using a proprietary system for almost 20 years that makes all of this easy to accomplish — and empowers them to close more business.

In fact, one agent went from $2 million to $12 million in production by using this system.

Multimillion-dollar producers use it to train subagents and scale their practices more efficiently.

And now this system is available to you. Create a sales presentation in just 15 minutes that takes away the fear of the unknown for the client, builds relationships with them and boosts your confidence in closing sales.

Demonstrate your expertise to prospects and clients so that it naturally leads to more life and annuity business. Show clients how surprisingly little market risk they need to take to achieve their retirement goals and dreams — by allocating more to principal-protected financial vehicles.

In the first month using [this sales software], we exceeded our total sales of the last 6 months from the previous year. I can recommend [this system] to any advisor looking to get more production from each prospect or client visit. —Dan R., VA

In this article, we’ll explain how you can get access. But first, why do some financial professionals struggle to increase their annuity and life insurance production?

SOLVE THE REAL PROBLEM

A major reason agents and advisors miss out on life insurance and annuity sales they could be making is because they hav en’t solved the real problem.

You need a consistent way to set up the sale that establishes credibility, evokes emotion, shows you’ve been listening and gives clients greater clarity about their financial future.

If you can check all these boxes, it doesn’t matter if you’re an insurance agent, a financial advisor, completely new or a seasoned veteran — you can make bigger and better sales.

One advisor went from never having sold an indexed annuity to closing their first case for $1 million in premium.

GET THE ULTIMATE ADVISOR ADVANTAGE

What the typical advisor is lacking — that’s helped savvy advisors 3X, 4X, even 10X their production — is the ultimate advantage, because it walks you through what to say and do (and when) during an appointment.

And yes, the strategies will change from client to client. The desired income will be different, their life situations will vary, but what you do should remain the same. Just follow the same simple steps to make more sales.

If you want to streamline your practice and save time — especially if you plan to scale — you need a proven process to grow the business without always having to be working in the business.

If you’re relying on a sales script that only exists in your head and that changes every time you speak to someone, it’s nearly impossible to scale.

With this system, you can simply give subagents a login and they will have the

few million in FIA premium to $20 million in one year — and that equated to his annual gross revenue increasing from $200,000 to $2.7 million. Even he didn’t realize how powerful this would be in client meetings.

Because this system was developed by an advisor for advisors and agents, it’s intuitive. Just enter information from the fact-finder and a comprehensive financial plan will be produced that accounts for the client’s retirement needs, what Social Security will provide them, the income gap they need to solve for and how they can reposition assets to accomplish their goals.

TAKE AWAY THE FEAR OF THE UNKNOWN

One of the most important steps to closing an annuity sale is identifying the amount of assets the prospective client has at risk.

The fact is, no one knows what the markets will do or when the market will bounce back, especially now.

How much of a surprise is it when they look at their investment balances?

If their retirement is based on hope and surprise, they’re likely taking on more risk than they want or need to.

But when they know they only need “X” rate of return, why wait to see what the market’s going to do? Why take on risk that could delay their retirement date?

These are the kinds of conversations you should be having with prospective clients,

which often lead to an annuity purchase — and the potential for 200%-300% more in assets under management.

I had one prospect go to my dinner event and thought he would want to invest $300,000 in an annuity. When he came back, I decided to try out the … presentation. He immediately decided to do $550,000 after seeing [the output]. He sent me a referral who came in thinking about $100,000. After presenting [the system], this prospect decided instead to do $850,000 into an annuity. Finally, I had a third prospect intending to invest $20,000 to “put his foot in the water,” [who] after [this system] changed his investment to $750,000. $2.1 million of annuities … not bad for my first week with [this system]! —Lawrence

BUILD RELATIONSHIPS

The road map you’ll generate lets clients see how they are going to go from where they are now to where they want to be in retirement — and beyond — with an emphasis on retirement income, taxes and investments (in that order). Additionally, with this system, you have a shared language or terminology.

Presenting information in this way creates a positive impression that can open the door to gathering more assets and referrals.

everyone involved.

[This system] has been the shining light when it comes to having my clients understand their files and, in turn, ensure that I close many, many more deals. I am able to close higher amounts in one appointment, saving me time and [providing] clarity to my clients… —Matt

D., NJ

DECREASE SKEPTICISM

O., LA

As you know, building relationships is also key to closing business. While remembering birthdays and providing great service improve the client experience, it’s crucial to inspire trust to build stronger relationships.

When you share concerns and challenges you believe the client may face down the road, clients trust that you have their best interests at heart. That trust deepens the relationships you have with them.

With an easy-to-understand output, clients can clearly see what it means to have a diversified portfolio and, importantly, that they may need more guaranteed products like an annuity or life insurance to truly be diversified.

[This system] has allowed me to tackle much bigger clients than I ever felt possible, and even more clients from $200k-$2m, and they all seem to get it. The [system] is easy to understand and helps make the sale because they can understand the sale much better. This in turn helps my bottom line of production. —Mark

K., GA

ENSURE REGULATORY COMPLIANCE WITH EACH CLIENT

Part of your job as an agent or advisor is making sure you stay compliant with the ever-changing rules and regulations that govern our industry. And that’s not an easy job. However, when you have this easy button, you’re more confident the proper steps are being taken every time with every client.

This leads to “better” sales because they are compliant and well documented for both you and your clients. You have a record of what was discussed and why you made the recommendations you did. It’s a greater measure of protection for

DON'T MISS OUT!

Most clients want to know the recommendations you’re making are sound. In other words, what are your recommendations based on? If you don’t have an answer for that, it can be difficult to get the sale. On the other hand, when you can provide your clients with documentation to support your recommendations, you establish credibility.

The short four-page document you receive as an output of this system details everything you’ve shared with the client. What’s even more important is it shows clients your recommendations don’t originate with a product you want to sell them.

Instead, you can show a client the rate of return they need each year to have enough income to sustain their lifestyle in retirement. Then the question becomes “How do I achieve that?”

Now they are open to a discussion about the products you can offer because you’ve pre-framed them with everything leading up to this point.

So, are you ready to have conversations with prospects and clients that naturally lead to sales of life and annuities?

You've just found what may be your easy button for 10X-ing your life and annuity sales. Visit BiggerBetterAnnuitySales.com today to find out more, including how you can get exclusive access.

A LIFE LESSON IN SUCCESS

Growing up poor, JOHN WHEELER got into the insurance business to make a better life for himself. When he realized that he could improve the lives of others, he says, the business “got into me.” Fifty years later, he’s still going strong as a financial advisor helping others.

An interview with Paul Feldman, publisher

6 InsuranceNewsNet Magazine » February 2023 INTERVIEW

John Wheeler, senior executive partner of Totus Insurance Agency LLC has an extensive background in the financial services industry that began in 1969. Growing up in a small town, where life insurance could mean the difference between a family keeping and losing their home, he quickly learned that having tough conversations with friends and acquaintances could change their future as well as create a path to success for him.

Those early lessons quickly taught him the important role a financial advisor can play in the lives of others. He’s worked to continuously educate himself about the business and share what he knows with others. A lifelong learner, Wheeler is one of only three people in the U.S. who has taught the entire CFP certification program, which he began teaching in 1985.

He’s served as an NAIFA national trustee and past president of NAIFA Illinois, has served two terms as president of NAIFA Chicagoland, will be serving on the NAIFA Texas Board beginning in January 2023, and is currently president of Forum 400, an exclusive community that brings together elite insurance producers to openly share practical strategies and fresh ideas. A frequent conference speaker, he has taught at DePaul University’s School of Continuing and Professional Studies and has been a frequent lecturer for The Insurance Sales Institute at Purdue University.

Having grown up in a small town in Illinois, Wheeler decided he wanted to go into the insurance business when he discovered that the most successful-looking man in the county seat sold insurance. Well, I guess that’s as good as anything, he thought. He’s never looked back.

Paul Feldman: You grew up in a small town in Illinois. How did you get into the insurance business?

John Wheeler: I grew up in a town of 54 people, a county population of 8,000 — so it wasn’t a booming metropolis by a long shot. My father worked in the oil field. He made $10,500 in 1972, the last year of his life, when he was killed on the job in an explosion. That’s the most money he’d ever made. From the time I was 13 years old, I pretty well bought my own

clothes, provided for myself, did every odd job that I could.

We grew up what most people would consider poor. We didn’t necessarily know we were poor. There were a lot of families around me that had more than we had, but we still had our pride. We never received assistance of any type. We just worked. My father taught me a good work ethic.

There was a guy in McLeansboro — the county seat of Hamilton County — which had 2,600 people. He always drove a nice car and dressed nice, and everybody liked him. I asked, “What’s he do?” “Well, he’s in the insurance business,” I was told. I said, “Well, I guess that’s as good as anything.”

So, on my 18th birthday — which was the soonest I could do it — I drove 3 1/2 hours to Springfield, the state capital. I took the insurance exam, which, at that

my shoulder and I’m crying on her shoulder. She said, “I wish Jeff had a chance to talk to you about life insurance. He knew we probably needed to buy it, and he wouldn’t have bought it from anybody but you. But he said, ‘John’s new in the business. When he gets settled down, I’m sure he’ll talk to us.’” Well, we never did talk. She and the two kids lost their home, had to move back in with her parents.

It was my fault because I didn’t want to impose on friends and family when, in fact, my friend was relying on me and I didn’t know it. I think that’s one mistake a lot of people make when they first start in the business. Well, after that happened with Jeff, I even had the courage to approach an old girlfriend’s parents. Now, in a small town, that’s real courage. The fellow was 58 years old, and he had never bought life insurance. Didn’t believe in

time, was a legal-page-sized essay question test. All of a sudden, I’m in the insurance business.

I had a good friend who had returned from serving in the Navy and had gone to work with a major carrier. The major carrier promoted him into management. After a year, he recruited me, and that’s where my career started.

That’s how I got into the business. What I think is more important, though, is when the business got into me.

I got into the business because I knew I wanted something better out of life. When I started out, I had promised myself that if I was going to make it in the business, I wouldn’t impose on my friends and family. I was going to make it on my own. About six months after I went to work for the major carrier, a good friend of mine was killed in a car accident.

Well, at the wake, his wife is crying on

it. I went to see him and he said, “Look, I know you’re in the insurance business.” Because in small towns, there are no secrets. He said, “I don’t believe in it. I don’t want to talk to you.” I told him about my experience with Jeff and what that had made me feel like.

I said, “I care about you and your family. I never want to feel like that again. All I ask is you give me 30 minutes to have a conversation. If at that point you still don’t want to do anything, the monkey’s off my back.” After about 45 minutes, he bought a $250,000 whole life policy with a waiver premium. In 1969, that was a pretty big sale. That was great from a financial standpoint, and I felt, OK, I provided a service.

Well, six months later, he’s out on the tractor one day and he has a heart attack, but he didn’t die. That gave me the chance to see how a waiver premium worked. He

February 2023 » InsuranceNewsNet Magazine 7 A LIFE LESSON IN SUCCESS — WITH JOHN WHEELER INTERVIEW

At the wake, Ruby, his wife, was crying on my shoulder. She said, “If it hadn’t been for you, we’d have lost the farm.”

was eventually able to get back to work. About two years later, he ended up having another heart attack. This time, he wasn’t as fortunate. At the wake, Ruby, his wife, was crying on my shoulder. I’m crying on her shoulder. She said, “If it hadn’t been for you, we’d have lost the farm.”

That’s when the business got into me. When I found my purpose, that’s when things got meaningful.

Feldman: That’s a powerful story. You’re a constant learner and also a constant teacher. You’ve taught the CFP program and you’re one of three teachers in the country who has taught the entire program, correct?

Wheeler: Yes, that’s what I’ve been told. I’m one of three people in the U.S. crazy enough to teach the entire program. And that was baptism by fire. Because when you’re standing in front of a group of other people from a very diverse background — I mean, I’d have CPAs, attorneys, trust officers, real estate people, insurance people, securities people, people trying to change careers — you have to learn how to explain things in different ways so that they are able to internalize the information.

The CFP education is not just a matter of memorization and regurgitating that information. It’s a matter of application. I think most people would say that it’s one of the more grueling exams there is. I’ve even had attorneys and CPAs say it was the worst exam they ever took.

When you get to the point when you think you know it all, that’s when you’re in trouble because life is continually changing. The industry continues to change. As the old adage goes: Even if you’re on the right track, if you just stand there you’ll get run over. The same thing applies to learning.

When I started in the business, I didn’t know anything. So I decided, “OK, I’m going to commit an hour to an hour and a half per day to improving my knowledge and my skills.” I’ve done that for 53 years. Learning is a continual process. I can’t stress that enough.

Feldman: You work primarily with high-wealth clients. What are the major differences between high-wealth and other clients?

Wheeler: The only difference, in my opinion, between a high net worth client and someone who barely has two nickels to rub together is that the problems of high net worth individuals are magnified. Whether we’re dealing with high net worth individuals or anybody else, I start based on three questions. First, what’s important to you? What are your goals and your desires, your dreams? Tell me what really matters to you. I’ll drill down as deep as you will go, continuing to ask questions to get a depth of understanding about what makes you tick and what’s important to you.

Second, I’ll ask you what are the things that could jeopardize reaching those goals and objectives? Now, I know the answer to that. But if you tell me, that’s altogether different from me telling you. God gave us two eyes, two ears and one mouth, and when we’re dealing with clients or prospects, we ought to use them in that proportion. Let’s say you can’t work for a period of time, for example. Or you’re on the wrong side of a lawsuit. You get divorced. You’ve lost your job. If I ask more questions and make fewer statements, we’ll typically have better communication.

The third question I ask — when it’s appropriate, and most of the time it is in one way or another — is how do you want to be remembered? If it’s a family situation, do you want to be remembered as a

mother or father who loved your family so much that you wanted to be sure they’re taken care of? Or do you want to be the mother or father who had good intentions but never got around to taking care of business?

Or if you’re a business owner and you told me that you want your business to continue and to be passed on, do you want to be known as that business owner who made sure everything was in sync for the continuation of that business or for the value to be preserved for the family? Or do you want to be the business owner who just never quite got around to taking care of your legacy?

Any conversation, whether it’s with someone who has a $10,000 net worth or $100 million net worth, is around those three questions.

Feldman: What is a piece of advice you offer through your courses that your students find most interesting or shocking? A real lightbulb-changer for them?

Wheeler: The better I can get to know a client and their situation, the more I’m there for them. I want people to feel comfortable about their retirement. Well, what is going to make them feel comfortable? Some people, if they didn’t have $50,000 a week, would feel like they’re

8 InsuranceNewsNet Magazine » February 2023 INTERVIEW A LIFE LESSON IN SUCCESS — WITH JOHN WHEELER

When you get to the point when you think you know it all, that’s when you’re in trouble because life is continually changing. As the old adage goes: Even if you’re on the right track, if you just stand there you’ll get run over.

doing without. Others, if they had $50,000 a year, they’d think they’re all set. Again, it’s a matter of understanding perspective.

Not everybody can get on a roller coaster after eating tacos and have the same experience. Sometimes they don’t have the stomach for the ride. It’s all about the questions we ask and how we really get into what’s important. I don’t consider myself a salesperson. I just help people make educated decisions.

I tell clients every day, “Look, I don’t have to live with the results of your decisions — you do.” They have to be committed to those results because they have to live with them.

Feldman: Given the way this economy’s been going, how have your recommendations changed over the past couple of years?

Wheeler: Well, I think the key thing is you have to have a process. A process may be adjusted, but it doesn’t really change. Again, I go back to my three questions. Now, the solutions may vary to some degree. I may have champagne taste and a beer pocketbook.

The key thing is doing something to either work toward or help you achieve what’s important. I haven’t seen that change in 53 years. There are a lot more products and services available today than there were 53 years ago. When I started, you had a rate book that you could put in your pocket because there weren’t many products. Today there’s a litany of products, and the biggest challenge sometimes is confusion because of that — because you have apples and oranges … and watermelons.

If you look at term insurance, it’s great as long as you die on time. All term insurance is actuarially priced to lapse before you die. Again, can it be a BandAid? Absolutely. Because here again, you want to be sure that there’s enough death benefit in place to take care of what’s imperative today. But it isn’t going to be a long-term solution.

A lot of people say, “Well, when I build enough wealth, I no longer need insurance.” My response to that would be: At what point are you wealthy enough that you would intentionally overpay for anything? Did you see yourself walking up to the Mercedes dealer and saying, “I want

to pay full sticker plus 40% just because I can.”? They laugh and say, “Well, no.” I’ll say, “Well, that’s what you’re telling me.”

The high net worth individual’s biggest problem normally is liquidity. If you have to sell something at the wrong time, that can be catastrophic. We know the market goes up and the market goes down. We know interest rates go up and interest rates go down. If you want surety and certainty, that’s where proper planning comes in.

The biggest challenge in retirement is health. We talk about how long-term care, if needed in retirement, can be more catastrophic than any market volatility we’ve ever seen. People don’t worry about that as much when they’re young as they do when they get closer to retirement. When they’re younger, it’s usually more about providing replacement of income for my family if something happens to me, perhaps, or to cover debts. Hopefully by the time we get closer to retirement, covering debts isn’t as big an issue and I’ve got assets to provide. But at that point, I have to be able to preserve them.

We talk about accumulation of assets, preservation of assets and then finally distribution of assets. That’s when we get into the more advanced tax issues. If I know what matters to you and what’s important to you, then we can have those follow-up conversations to get to that point. As the great philosopher Yogi Berra said, “If you don’t know where you’re going, how can you be sure you’re not already there?”

Feldman: Is life insurance playing a more prominent role in retirement strategies given the current economic circumstances?

Wheeler: Yes, in many situations. When you get into tax issues, properly structured permanent insurance can provide a volatility buffer or can provide tax-free income. The only other thing that truly is tax-free is Roth, but there’s a limitation on how much you can put in Roth. The more tax-free income you can have, the more flexibility you have from a planning perspective. Life insurance can provide that. By the same token, life insurance can replace part of what I spent while I was alive in my retirement years, so that helps provide a legacy or security for my surviving family.

Feldman: How about annuities? Is this a good time to buy annuities, with interest rates going up?

Wheeler: An annuity, used properly, can do something nothing else can: provide an income that you can’t outlive. If you’re talking about having it for income purposes, an annuity, in my opinion, should be a part of the planning process because it provides a base. An annuity, when you think about it, is not a lot different from a pension. Fewer and fewer people today have pensions.

In the pre-retirement years, it can be something to look at, certainly. For a younger individual, I would want an annuity that perhaps would change either with some type of cost-of-living adjustment or some type of potential growth. What are you trying to achieve? It’s another tool in the toolbox.

Feldman: Any final thoughts that you want to impart to our readers?

Wheeler: First, it’s important to get involved in your community. I was one of the founders of DuPage County’s Habitat for Humanity because I believed in helping people help themselves. I was one of the founders of the Carol Stream Chamber of Commerce. People will get to know you, and they get to know that they can trust you and that your word is good. My father said, “Your word is your bond, and there’s never a right way to do a wrong thing.”

Second, you have to continue to hone your craft. You always have to be trying to improve. The definition of luck is when preparation meets opportunity. If you put in the time, you’ll always be prepared.

Finally, I think you have to decide whether this is just a job or a career. If it’s a job, you’re looking at it purely as a paycheck. If it’s a career, you’re looking at it with more of a purpose.

I think, overall, our industry provides one of the greatest services to humanity that there is, outside of possibly medicine or the clergy. Because when I go to a wake, I’m carrying a check while everybody else is giving sympathy and prayers. I’ve never known a widow or a widower yet who sent back money to the insurance company because they got too much.

A LIFE LESSON IN SUCCESS — WITH JOHN WHEELER INTERVIEW February 2023 » InsuranceNewsNet Magazine 9

Americans’ worries shift from COVID-19 to inflation

With the COVID-19 vaccination rate up and the number of deaths significantly declining, only 1 in 5 adults are “very” or “extremely” concerned about the virus today, according to LIMRA. LIMRA’s research found more than 3 in 5 adults said their lives are largely back to what they were like before the pandemic.

While less concerned about the pandemic, 56% of adults are “very” or “extremely” concerned about the economy.

More than 8 in 10 consumers acknowledge one or more changes in their behavior. For nearly all, the changes include “favorable actions” or steps that are likely to improve their financial stability and security. Most often, this involves changes to their spending and becoming more budget conscious; although some consumers have also been able to put more money into a savings account, invest more, and/or increase contributions to a retirement plan.

Over half of consumers, however, have taken “unfavorable actions,” such as saving or investing less, increasing one’s debt, cutting back on retirement contributions, or skipping medical care.

AIG SUBSIDIARY FILES BANKRUPTCY AMID ONGOING SUIT

An AIG subsidiary filed for Chapter 11 bankruptcy, a move panned by a group of former executives suing the insurer.

AIG Financial Products Corp. made the filing in the U.S. Bankruptcy Court for the District of Delaware and plans to reorganize. AIG said in a regulatory filing that the reorganization won’t have a material impact on its consolidated balance sheets or those of Corebridge Financial (formerly AIG Life & Retirement).

AIG Financial Products has no material operations or businesses and no employees.

Meanwhile, a group of former executives say the timing of the bankruptcy filing is designed to avoid legal obligations. “The real impetus for AIGFPC’s bankruptcy filing is to avoid repaying certain deferred compensation it owes to the Employee Plaintiffs, 46 former employees from whom AIGFP borrowed approximately $194 million during the 2008 financial crisis but has never repaid,” the plaintiffs said in a court filing.

QUOTABLE

independent contractors or working with them. Financial and insurance industry advocates are concerned that individual agents and brokers are subject to a patchwork of state and federal regulations under changes favored by the Democrats.

MORE PEOPLE HAVE SIDE GIGS TO COPE WITH INFLATION

DOL RECEIVES NEARLY 50K COMMENTS ON INDEPENDENT CONTRACTOR RULE

The U.S. Chamber of Commerce is calling on the Department of Labor to scrap its independent contractor rule.

The DOL independent contractor proposal would make it harder for companies to treat workers as independent contractors, potentially upending several industries, including financial services. Controversy continues to follow the rule proposals, which affect various industries in different ways.

The DOL initially planned to close a comment period in November but tacked on an extra 15 days, extending the deadline to Dec. 13. According to the website, the department received 49,734 comments on the proposed rule.

Many of the thousands of comments came from independent real estate agents, financial professionals and others who wrote of their experiences being

If it seems as though more people are working a side hustle in addition to their regular 9-to-5, you’re right. More than 4 out of 5 Americans who have or plan to take on a side gig, seasonal job or extra hours at work say inflation played a role in their decision. In November, Bureau of Labor Statistics reported a 165,000 jump in the number of people holding multiple jobs. That was the largest rise since June.

Most adults (68%) either already have or plan to pick up a side gig — like delivering food with DoorDash or renting out extra space in their homes — according to a Neighbor.com survey. Additionally, 44% of Americans work or plan to work a seasonal job, like shipping packages for Amazon or stocking and unloading for Walmart. And 51% either work or plan to work overtime at their current 9-to-5 job, the survey said.

Of those taking on extra jobs, 18-to40-year-olds remain the largest group of side hustlers, said Kathy Kristof, editor at SideHusl, which researches opportunities to make extra money. “But over the past six months, we’ve seen an increasing number of seniors looking to help make ends meet,” she said.

10 InsuranceNewsNet Magazine » February 2023 WIRES

DID YOU KNOW ? Source: The Wall Street Journal

Everybody’s five times better off than they used to be.

—

Charlie Munger,

longtime investment partner and friend of Warren Buffett

U.S. government pension funds currently have the lowest cash holdings since the 2008 financial crisis.

• Marc Cadin, Finseca CEO

View all our past recordings and sign up for upcoming webinars at innwebinars.com. InsuranceNewsNet’s Webinar Series Monthly Conversations with Industry Leaders Join InsuranceNewsNet’s award-winning editorial staff as we host in-depth discussions with industry movers and shakers. These free, live webinars will explore the latest trends and research in the annuity, life, health and financial industries. Join us live for your chance to ask questions directly, or if you can’t make it, view recordings of each in our free on-demand library. Hear from experts in your field like...

President

CEO

Intelligence

• Sheryl Moore,

and

of Moore Market

President

• Diane Boyle, Senior Vice

of Government Relations at NAIFA

• Jamie Hopkins • David Levenson, LL Global CEO

A big case doesn’t just fall into your lap. Here are stories of how advisors prepared and worked as a team with other professionals to be ready to win over the big client.

By Susan Rupe

By Susan Rupe

12 InsuranceNewsNet Magazine » February 2023

We all dream of landing the big case or winning over the elusive client.

But that kind of success doesn’t just happen.

It takes preparation, patience and networking. While being in the right place at the right time can be a factor in winning the big case, having the right kind of expertise to give that big client what they need most can make the difference.

Three advisors share their “big case stories” with InsuranceNewsNet and provide their insights on how to win a big case of your own.

‘No does not mean never’

Sometimes it can take years for a seed to sprout and grow into a big case.

Jeff Chernoff met an attorney in his community through a business club they both belonged to. When they followed up over a cup of coffee, the attorney mentioned

But even though the key-person insurance discussion stopped, Chernoff’s business relationship with the attorney continued. Three years later, he brought up the topic of insurance again.

“I had a conversation with them, and I asked them, ‘Is this something that interests you?’ At that point in time, her husband had transitioned out of the financial services industry and had moved into becoming the chief financial officer of that small law firm. And she said, ‘You know, it does kind of interest me. Let’s talk about it.’”

Chernoff said he explained the benefits of key person insurance using a cash value policy. “I explained how this can be a benefit and how you can supplement retirement savings if it’s done correctly,” he said.

His client decided to take out a policy on her top-producing attorney. It was the largest life insurance case Chernoff had written after being in the business for six years.

Chernoff said his ability to continue the relationship with his client even after being told “no” was a big factor in his landing the sale.

“We continued the relationship, we were never deterred about being told ‘no,’” he said. “I was comfortable with being told ‘no’ and not upset about it and then when the time was right, asking the question again in as gentle a way as possible.”

Chernoff said he learned several lessons from this particular case.

“First of all, ‘no’ does not mean ‘never.’ Second, if you keep a relationship positive, you never know the opportunities you will generate from that. And don’t be shy or don’t be unwilling to simply ask the question — you might get a ‘yes.’”

that her business insurance was up for renewal and asked Chernoff to meet with her and her husband to review her coverage.

The client who gave Chernoff his first big sale ended up giving him another big sale two years later.

At a conference on advanced planning, Chernoff learned how a business owner or a business can have a 401(k) plan with a profit sharing plan. He also learned about a defined benefit plan that can hold cash value life insurance and would be a good fit for attorneys, particularly attorneys who are age 50 or older and plan to work another five to 10 years.

He thought his attorney client would be perfect for this plan. He reached out to the territory manager of the company that offered the plan to learn more, and the

LANDING THE BIG CASE COVER STORY February 2023 » InsuranceNewsNet Magazine 13

Chernoff

broker-dealer. “I found one that works really well with small plans with less than $250,000 in assets, I found another one that is comfortable working with midsize plans of $500,000 above and I found another one that’s comfortable with a $1 million plan.”

With his experts lined up and his information gathered, Chernoff approached his attorney client and asked whether her firm offered 401(k)s.

“They said, ‘No, we talked about it a few years ago, but it didn’t make sense for us at that time.’ So I broke it down in terms of how they can maximize saving for retirement. They were interested in learning more, so we sat down with the third-party administrator, we went over everything and they agreed to sign the deal.”

The law firm put about $30,000 into the plan the first year, Chernoff said. From there, the firm’s contributions increased to $125,000 annually and then to $300,000. “It just kept building and building,” he said. “And I believe I’ll be in the business long enough to keep creating this long-term relationship.”

two children. A few years after buying the policy, the client reviewed the coverage with Chernoff and told him he was bringing in a new business partner and was interested in life insurance to fund a buy-sell agreement with the new partner and his existing partners.

After putting that plan in place, the client asked Chernoff to assist his wife in creating an individual retirement account, as she planned to invest funds accumulated during her career in education.

“All because my client wanted life insurance for his two kids,” Chernoff said.

“Three years ago, he said to me, anytime I have an insurance thing or investment thing, I’m coming to you first because clearly you take care of me and you take care of my family.”

‘You have to know your stuff’

Sometimes it takes a village to help land a big client. And the successful advisor will be the one who can work with that client’s “village” of other professional advisors.

Eryka Morehead is president of Collaborative Planning Group in

who need help with estate planning and business succession planning.

To land a big case with this particular market, “You have to know your stuff, technically,” she said.

“Our firm has had a lot of success working with those types of individuals, because we have a lot of technical knowledge on the estate planning, business succession planning side. And so we can kind of help facilitate and work hand in hand with their other professional advisors.

“When you know your stuff, you can well represent yourself in the room with the client’s accountant, with their attorney, with their financial advisor,” she said. “All clients have their team. I think that in our industry, especially on the life insurance side, people will work to place a policy or have siloed conversations with the client regarding the life insurance.

“When you don’t have all the client’s professional advisors on board, all working off the same blueprint for the client’s overall planning goals, it makes it much harder to help the client implement life insurance for a funding strategy or as a protection solution if the rest of the team of advisors isn’t on the same page.”

14 InsuranceNewsNet Magazine » February 2023

“... if you keep a relationship positive, you never know the opportunities you will generate from that. And don’t be shy or don’t be unwilling to simply ask the question — you might get a ‘yes.’” — Jeff Chernoff

Morehead

Being successful in landing the big client is about more than simply knowing the product and how it works, Morehead said.

“You also need to understand all the ancillary lines that the product touches,” she said. “For example, with life insurance, you need to understand who the owner will be, who the payer will be, how the beneficiary is going to work. You must make sure you have the technical acumen for all the legal side to be able to participate in the discussions surrounding the structure.

Morehead said she was contacted by an estate attorney who was concerned that their client was being pitched an insur ance product that might not be appropri ate for their needs. She was asked to come in to review the insurance the client had in place at that time.

“Whenever we do a review, we also need to get the client’s tax returns, copies of trusts, financial statements — because in order to review an insurance strategy, you must understand the context of the client’s entire situation,” she said. “After reviewing the strategy and walking through the technical aspect of the product that the client had been presented, we pivoted and went toward a more comprehensive planning approach as opposed to merely suggesting a product.”

Morehead played the part of the coordi nator, getting the other professionals together to help him with his plan.

“Over the last seven years, our relationship has continued to build, continued to develop, and there have been multiple steps along the way where they have needed to purchase more insurance for this or for that — multiple hundreds of thousands of dollars in premium,” she said.

Morehead worked with the owner of a large cattle operation who said he didn’t believe in life insurance. But he also realized he needed to protect his business, so Morehead helped him assemble a team of experts and brought them all to her office. The business owner brought his chief financial officer to the meeting as well.

“That’s how you then build a reputation with the other professionals so they end up loving the work you do for that client. Then they start seeing you as a resource the next time a situation comes up that needs a similar solution.”

Trust is another factor in landing the big client, Morehead said.

“You build trust by your technical knowledge, people need to know that you know your stuff,” she said. “But you also build trust with good and pure intentions. Sometimes we work with clients where we think the case will go one way and it ends up going another way. But at the end of the day, when you’re working with that team of professional advisors, it becomes clear what better options or better choices are available for that client.”

Morehead said she believes “a product without a plan may or may not work. But if you have a plan and then you place the product, you’re specific on what role the product will play. And when the product is properly matched with the client’s plan and goals, it just makes sense.”

At the end of her second meeting with the client and professional team, the client told her, “We feel like we’re not being sold a product. For the first time, we feel like we’re starting to develop a plan.”

The planning paid off when the client agreed to a plan that included twice as much life insurance as what they originally had been pitched.

Several years ago, Morehead worked with two business partners who had an

“We even ended up working one of his oldest children into some of the conversations as well, because there were a lot of moving pieces and parts going on with this organization. But we were able to help get the estate plan and the trust set up. And then we did place a significant amount of life insurance in order to infuse liquidity into the estate.

“And then separately, they worked on some estate freezing techniques with their estate attorney. So it was kind of a blended effort of a gifting strategy and life insurance building some liquidity into their plan.”

Morehead said she is undaunted when she hears a prospect say they don’t believe in life insurance.

“We don’t have to call it life insurance. It’s not a religion. We don’t have to believe in it or not believe in it. It’s a tool, and we

February 2023 » InsuranceNewsNet Magazine 15

“When you know your stuff, you can well represent yourself in the room with the client’s accountant, with their attorney, with their financial advisor.”

— Eryka Morehead

need to find out if that tool would be helpful for their situation.”

‘It doesn’t come overnight’

“Persistence pays off” is Danny O’Connell’s motto when it comes to landing the big case. O’Connell is CEO of Next Level Insurance Agency in Addison, Texas.

“If somebody goes dark on you and you don’t hear anything, you know people want to do business with someone they know, like and trust. And that doesn’t come overnight. That takes time,” he said.

O’Connell eventually had a meeting with the business owner and told her upfront, “Before we go through this entire process, I just want to be sure that this is even a possibility. I don’t want to waste your time.”

To his surprise, the business owner agreed to continue with the process. As O’Connell and his team began working on a proposal, he learned that a year earlier, the owner had been determined to work with a close friend who was in the employee benefits business. But she decided

renew their business on a three- or fouryear deal and then move on,” he said. “But for our clients, we want to tell the story and we want to paint the picture and we would explain our strategy. Most of our competitors are like, ‘You send us the numbers and we give you a quote.’ But because we were able to tell the story and have a strategy, we got a much better outcome than this other advisor.

“And ultimately, we wound up winning the group and being able to meet their deadlines and save them a boatload of

One of O’Connell’s biggest clients came to him after his firm did some cold calling. It was a large employer, looking to renew their employee benefits contract.

“They didn’t renew until Jan. 1. And I was introduced to them the January right after they went through a renewal process. I knew that I was competing with some other people, much larger firms than we were. So, we took a holistic approach. We brought in all the different components that they may need.”

During the process of bringing the team together, O’Connell said, one of his partners warned him that the owner, a woman, wouldn’t do business with him because she didn’t like doing business with men.

“That was disappointing, but we went through our process,” he said. “We got some options from one of the carriers who I thought would be really competitive. And they weren’t.”

to perform some due diligence and look at other providers.

“We continued to do our work, continued to stay in communication and continued to do our part,” O’Connell said. “And ultimately, we wound up winning the group.

“It was what the executives were looking for. We provided a transparency that they had never been given before. We provided the ability to forecast and work on things and see trends, see numbers and things they never had seen before. We’ve had a great relationship with this group, and we went through their last renewal last year. And they’re pleased because they really got what they were looking for.”

In another case, O’Connell was able to win the benefits business of an 1,800-person company that initially approached him to solve one of the employees’ main sources of pain — a technology platform that didn’t work well. The technology situation eventually was resolved. But O’Connell wasn’t satisfied to stop there.

“The advisor they were working with thought they were automatically going to

money — $240,000 in the first year.”

O’Connell said relieving the frustration of his clients’ employees and giving them more options are some of the keys to keeping clients happy.

“What are the little things that we can do to avoid that frustration? How can we educate people? How can we guide them to get on the right plan so that they have a better experience, less frustration, fewer issues with their employer, fewer customer service issues? In most of life’s situations, you get what you pay for. But you must have somebody who’s willing to educate and go where your client needs you to go, and service their people the way that we all want to be treated.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents’ association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on Twitter @INNsusan.

COVER STORY LANDING THE BIG CASE

16 InsuranceNewsNet Magazine » February 2023

“Most of our competitors are like, ‘You send us the numbers and we give you a quote.’ But because we were able to tell the story and have a strategy, we got a much better outcome than this other advisor.”

— Danny O’Connell

O’Connell

THOUGHT LEADERSHIP SERIES

COUPLES NEED FINANCIAL HELP!

In this year’s special Couples Financial Planning Thought Leadership Series, we showcase products and solutions from carriers and financial organizations created with duos in mind.

INSIDE

Life insurance products can ease financial pain points of the middle market. But can you really make a living serving these clients?

by Allianz Life

PAGE 18

How Annuity.org is delivering hot, ready-to-buy annuity leads with Tom Hope, Riley Schott and Emily Powell of Annuty.org PAGE 20

Protective Aspirations variable annuity: the couples’ retirement income solution you’ve been missing with Corinne Anderson of Protective Life

21

PAGE

SPECIAL SPONSORED SECTION

Life insurance can ease financial pain points of the middle market. But can you really make a living serving these clients?

When you’re considering potential clients for life insurance, the middle market may not be your first choice. Certainly, high net worth clients who need tax planning strategies, flexible estate planning strategies and a larger death benefit are a lucrative market.

But you may be missing out on a large pool of potential clients who need life insurance coverage and could benefit from cash value life insurance like fixed index universal life (FIUL) insurance to potentially supplement a retirement planning strategy or college funding.

In a 2022 study, Allianz Life Insurance Company of North America (Allianz Life) took a deep dive into the financial needs and mindsets of middle market consumers. They surveyed 800 individuals, aged 25 to 45, who contribute to a company-sponsored 401(k) and have discretionary income to spend on products that can address common concerns around financial risks.1

Significantly, Allianz found that nearly half have never worked with a financial professional — a huge, often overlooked opportunity for referrals, increased revenue and new life insurance sales.

However, misconceptions about the middle market may be standing in your way. Let’s look at three myths and how they’re challenged by the findings of the 2022 Allianz Middle Market Study.

Middle Market Myth #1: They aren’t interested in life insurance.

The middle market cohort is made of people between 30 and 45 years old who’ve been pursuing their careers for a number of years. They understand the importance of retirement savings and tend to have a 401(k) plan into which they’re contributing up to the company match.

They’re also aware of a variety of financial risks. Concerns about inflation, access to cash in case of an emergency, market volatility and having multiple sources of income in retirement were all top of mind in the survey.

At the same time, respondents often believed cash value life insurance was too expensive or too confusing — pointing to a

29% of females surveyed said they have never used a professional financial advisor but would consider using one.

need for greater education about the ability of FIUL to address many of their financial concerns.

A large majority expressed interest in potentially tax-free sources of income in retirement, increasing the amount of inheritance to family or loved ones, and funds that can be accessed for a special need —all potential benefits of FIUL.

In fact, 84% of men said that the ability to accumulate money on a tax-deferred basis is important to them in retirement; 77% of women agreed this is very or somewhat important to them when it comes to deciding where to put their money.

Life insurance can also ease concerns by providing the potential for supplemental income in retirement (through policy loans and withdrawals from available cash value2) that could help fund their desired lifestyle and help with other costs like health care or vacations.

49% of male respondents worried that if they died today, their spouse/partner wouldn’t be able to save enough for retirement.

Consider Thomas and Mya, a hypothetical (but typical) couple with two incomes and two young children.3 After their mortgage, car payments and household expenses, they have $250 in discretionary income each month. They considered opening a Roth IRA, but their household income exceeds the 2023 limit for contributions. Instead, they decided to put that amount into an asset that can offer them financial protection and accumulate in value over time. Using their financial professional, Thomas and Mya purchased an Allianz Life Pro+® Advantage Fixed Index Universal Life Insurance policy.

Along with the death benefit it provides, Thomas and Mya will have accumulation potential through indexed or fixed interest, protection from loss due to market volatility, and access to any available cash value via income-tax-free loans and withdrawals. 2

Through the power of tax-deferral and compounding, after 20 years of funding their policy with that $250 a month premium, they theoretically have over $80,000 in accumulation value — enough for a down payment on a retirement home in Arizona when they’re 65.

And because their policy will continue to earn interest, by the time they reach 85, they could have over $300K in the death benefit to leave as a legacy. They will want to carefully manage

2023 Couples Financial Planning • Special Sponsored Section 18 InsuranceNewsNet Magazine » February 2023

their policy values when taking policy loans to help prevent a policy lapse and potential tax consequences.

Middle Market Myth #2: They can’t afford permanent life insurance.

With household incomes of $100K+, middle market consumers report having between $150 and $400 available each month to put into a financial product that can help ease financial pain points.

This can be enough to fund a permanent life insurance policy, which will provide financial protection in the event of the death of a partner or spouse — and, depending on the policy type, could be a source of funds in the years to come.

Let’s look at another hypothetical couple, Caitlyn and James, married and both aged 35. 4 They would like to start saving for the future college education of their young son, Liam.

After paying their household bills and contributing to their 401(k)s, they have a few hundred dollars left over each month. Since Caitlyn already has a term policy through her work, they purchase an Allianz Life Pro+® Advantage Fixed Index Universal Life Insurance policy with James as the insured, since they rely on his salary for most of their household income.

Permanent life insurance will give them the long-term reassurance of a death benefit that is generally paid to beneficiaries income tax-free. But just as important, the cash value is a potential resource that could be accessed via income-tax-free policy loans and withdrawals 2 to help supplement Liam’s college education.

Assuming Caitlyn and James make $300 monthly premium payments, after 20 years, they could access $15,000 per year via policy loans to supplement college expenses — and still have a death benefit of more than $280,000 by the time they reach 85. They will want to carefully manage their policy values when taking policy loans to help prevent a policy lapse and potential tax consequences.

And unlike a 529 plan, if Liam opts not to go to college, the cash value in the policy could be used however they see fit.

Middle Market Myth #3: Financial professionals lose money pursuing these clients.

Admittedly, a few hundred a month may not sound like much premium to fund a permanent life insurance policy. And when you consider the amount of time it can take to acquire and provide services to a client, it may not immediately make economic sense.

However, if you take a long-term view, middle market clients can be well worth the time and effort you invest in them.

According to the 2022 Insurance Barometer study conducted by LIMRA and Life Happens, “Two in five parents say they are barely or not at all financially secure.

This is a critical issue, as most households haven’t prepared for the loss of a primary wage earner. Almost half (44%) said it would take less than six months to feel financial hardship if this loss happened in their family.” 5

Additionally, those in the middle market are generally approaching their peak earning years. There’s a good possibility they’ll have more assets available in the future and will need additional strategies and financial products as they age — especially given that 52% said they’re already concerned about having enough saved for retirement.

Building a relationship with these prospective clients now can lay the groundwork for more revenue (and referrals) in the years ahead.

Learn more

FIUL is not a source for guaranteed income in retirement and is not a traditional college funding vehicle.

1. The 2022 Allianz Middle Market Study was conducted by Allianz Life as an online survey in August 2022 with 800 respondents, ages 25-40 years. Respondents have an annual household income of $100,000+ and either 1) contribute $20,500 or more to retirement investment accounts, or 2) meet or exceed their employee sponsored match and is making/interested in making additional contributions to another account.

2. Policy loans and withdrawals will reduce the available cash value and death benefit and may cause the policy to lapse, or affect guarantees against lapse. Withdrawals in excess of premiums paid will be subject to ordinary income tax. Additional premium payments may be required to keep the policy in force. In the event of a lapse, outstanding policy loans in excess of unrecovered cost basis will be subject to ordinary income tax. If a policy is a modified endowment contract (MEC), policy loans and withdrawals will be taxable as ordinary income to the extent there are earnings in the policy. If any of these features are exercised prior to age 59½ on a MEC, a 10% federal additional tax may be imposed. Tax laws are subject to change and you should consult a tax professional.

3. This hypothetical example is provided for illustrative purposes and does not represent an actual Allianz client. Assumptions: Premium payment: $250 annually for 15 years, 35 old Male, Preferred Plus, 6.5% nonguaranteed illustrated rate.

4. This hypothetical example is provided for illustrative purposes and does not represent an actual Allianz client. Assumptions: Premium payment: $300 monthly for 10 years, 35 old Male, Preferred Plus, 6.5% nonguaranteed illustrated rate, indexed loan years 20 -23.

5. 2022 Insurance Barometer Study Reveals the Secret to Financial Security is Owning Life Insurance (limra.com)

This notice does not apply in the state of New York.

Allianz Life Insurance Company of North America does not provide financial planning services.

Product and feature availability may vary by state and broker/dealer.

Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America. Products are

www.allianzlife.com

Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. 800.950.1962.

issued by Allianz

2023 Couples Financial Planning • Special Sponsored Section COUPLES FINANCIAL PLANNING February 2023 » InsuranceNewsNet Magazine 19

To learn about other key findings from the 2022 Allianz Middle Market Study and the potential benefits of Allianz Life Pro+ Advantage, visit AllianzMiddleMarket.com.

How Annuity.org is delivering hot, ready-to-buy annuity leads

Could your agency or marketing organization benefit from more annuity leads? How about leads who have already expressed interest in purchasing an annuity?

Generating high-intent, pre-qualified leads is Annuity.org’s specialty. In this interview, INN talks to the organization’s director of business development, director of marketing and strategic projects, and managing editor about how they generate leads for agencies that have seen close rates as high as 50+% — generating $10 million in insurance premiums in 2022.

INN: Tell us about how Annuity.org fills a gap in the annuity landscape.

TH: Annuity.org got its start in 2013. We wanted to fill a niche for individuals seeking high-quality, unbiased information about a commonly misunderstood insurance product.

People come to our site organically, not through ads or social media. We educate consumers about annuities, answering their questions and offering facts rather than hype or false promises. We’ve come to dominate the digital space in this regard and are beginning to branch out into the broader insurance market, covering life insurance and personal finance.

INN: What have you seen with consumers over the past 10 years?

RS: Google search trends show consumers are increasingly turning to digital sources for education around complex topics like annuities. Fewer are relying on traditional forms of marketing. Instead, they are seeking out objective content before meeting with a financial professional.

INN: Can you explain how your business model works?

RS: When someone reads one of our articles, they can complete a lead capture form if they’re interested in speaking with an insurance professional. This form includes their name, contact details, state, and a verified email and phone number, as well as their annual income and the amount they’re looking to invest.

On average, we generate 500-600 leads per month interested in annuities and other retirement planning products. These leads, from throughout the U.S., are seeking to invest around $200K, on average. We’ve found the most effective way to structure our partnerships is to charge per lead.

Our key differentiator from other lead sources is the quality of our leads — which maps back to the quality of our content.

INN: How do you attract people to your site and generate qualified leads?

TH: We’ve built our brand around people-first content structured

in a way that fully answers consumers’ questions rather than writing purely for search engines. It is reviewed for technical accuracy by financial industry professionals who hold a variety of designations, including CFP, RICP and CPA.

People who visit our site have searched on the topic of annuities, are interested in learning more and are willing to provide contact information as well as some personal finance information.

INN: Can you speak to the importance of content transparency in the consumer decision-making process?

EP: We write about annuities and financial topics with objectivity, without references to specific carriers, and with factual representation of what an annuity can and can’t deliver. Our goal is to demystify what can be complex topics, which, in turn, makes conversations with a financial professional more beneficial and productive.

INN: How successful have agencies been, using the leads you provide?

RS: In 2022 alone, Annuity.org leads have generated $10 million in annuity premiums for our partners — and we’re projecting to grow by about 40% in 2023.

We recently ran a 10-lead test with a prospective partner in North Carolina. That agent was able to contact 90% of the leads within the first 24 hours — all of whom expressed further interest in purchasing an annuity. Six of those 10 are now in the process of purchasing from that agent.

INN: Who do you partner with?

RS: We partner with agencies and marketing organizations that are looking for new and better ways to generate leads that are further down the sales pipeline. We typically see the most success with teams that have the capacity to handle at least 30 leads per month in each state in which they’re licensed.

INN: What else should readers know about partnering with Annuity.org?

RS: It’s important to know that our leads are exclusive: A partner will not receive leads that are also sent to someone else. I’ll also add that we prioritize long-term, strategic relationships. We want to grow alongside the success of our partners. We’re not interested in the transactional “sell you a list of names and numbers” approach.

To learn more about partnering with Annuity.org to generate qualified annuity leads for your insurance agency or marketing organization, visit Annuity.org/partner-with-us, or email Riley Schott directly at rschott@annuity.org.

Managing Editor Emily Powell

Director of Marketing and Strategic Projects Tom Hope