05 19 www.bakingbiscuit.com FRITSCH is part of the MULTIVAC group IBIE A world of benefits Interview Data determine the environment for producers Research Australian wheat in South East Asia

up to 20% less fossil fuel-based resin than the standard closure, uses up to 20% fewer greenhouse gas emissions to produce, and advances industry sustainability levels.

But that’s just the beginning. Eco-Lok delivers that same reliability and rigidity you’ve come to expect from plastic bag closures. It also has the same print-on capability, is compatible with all existing machinery, and has the global market leader in bag closures standing strong behind it… Kwik Lok.

So we invite you to join us in our efforts to make the world a more sustainable place and check into Eco-Lok. Because it’s the little things that make a big difference.

TO LEARN MORE, VISIT: KWIKLOK.COM

THE FUTURE HAS ARRIVED. AND IT’S SUSTAINABLE.

KWIK LOK and ECO-LOK are trademarks of KWIK Lok Corporation.

Be extraordinary

Being exaordinary and standing out from competitors is certainly not a new strategy when the aim is to attract attention. It’s also true in the baking sector, and applies to both artisan and industrial baking. However, I sense that a new, young generation is now implementing this strategy even more consistently. When one looks at newly opened businesses, whether they are in Berlin, Vienna, Hungary or Stockholm, or even in North America and Asia, new artisan bakery locations are conspicuous by their unusual design. Beumer & Lutum’s organic bakery in Berlin, for example, has opened their sixth branch in the Metropolenhaus am Jüdischen Museum: a bakery and bistro with an oriental flair. Georg Öfferl and Lukas Uhl have opened the first branch of their Weinviertel steam bakery in Vienna’s city center. Their location is really extraordinary, as the photos show:

How much does your software know about bread?

Ours knows a good deal. Industry-specific processes, integration of machines and systems, monitoring and reporting, traceability, quality management and much more.

Opportunities to be extraordinary do exist, and clever entrepreneurs use them very skillfully. The important factor, however, is that consumers are also convinced by the quality of the baked products, and return to buy more. We should also not forget that the price of the baked goods is also an important purchasing factor for some consumers, because supplying the population’s basic needs is one of the baking sector’s duties.

Regards,

The CSB-System is the business software for the bread and bakery goods industry. The end-to-end solution encompasses ERP, FACTORY ERP and MES. And best-practice standards come as part of the package.

Would you like to know exactly why industry leaders count on CSB?

EDITORIAL

Bastian Borchfeld

Your commments or suggestions are always appreciated: phone: +49 40 39 90 12 28 borchfeld@foodmultimedia.de www.csb.com

++ Bastian Borchfeld, Editor-in-Chief

ADVERTISEMENT

© Öfferl

PUBLISHING COMPANY

f2m food multimedia gmbh Ehrenbergstr. 33

22767 Hamburg, Germany

+49 40 39 90 12 27 www.foodmultimedia.de

PUBLISHER

Hildegard M. Keil

+49 40 380 94 82 keil@foodmultimedia.de

EDITOR-IN-CHIEF

Bastian Borchfeld

+49 40 39 90 12 28 borchfeld@foodmultimedia.de

EDITORIAL STAFF

Helga Baumfalk

+49 40 39 60 30 61 baumfalk@foodmultimedia.de

ADVERTISING DEPT.

International sales director Dirk Dixon +44 14 35 87 20 09 dixon@foodmultimedia.de

Advertisement administration

Susanne Carstens +49 40 38 61 67 94 krause@foodmultimedia.de

DISTRIBUTION

+49 40 39 90 12 27 vertrieb@foodmultimedia.de

TRANSLATION

Skript Fachübersetzungen Gerd Röser info@skript-translations.de

TYPESETTING

LANDMAGD in der Heide Linda Langhagen; design@landmagd.de

PRINTED BY Leinebergland Druck GmbH & Co. KG Industriestr. 2a, 31061 Alfeld (Leine), Germany

BAKING+BISCUIT INTERNATIONAL is published six times a year. Single copies may be purchased for EUR 15.– per copy. Subscription rates are EUR 75.– for one year. Students (with valid certification of student status) will pay EUR 40.– (all rates including postage and handling, but without VAT).

Cancellation of subscription must be presented three month prior to the end of the subscription period in writing to the publishing company. Address subscriptions to the above stated distribution department.

No claims will be accepted for not received or lost copies due to reasons being outside the responsibility of the publishing company. This magazine, including all articles and illustrations, is copyright protected. Any utilization beyond the tight limit set by the copyright act is subject to the publisher’s approval.

Online dispute resolution in accordance with Article 14 Para. 1 of the ODR-VO (European Online Dispute Resolution Regulation): The European Commission provides a platform for Online Dispute Resolution (OS), which you can find at http://ec.europa.eu/consumers/odr

Valid advertising price list: 2019

www.bakingbiscuit.com 05/2019 CONTENT 04 IMPRINT

cover photo: © FRITSCH © BakeTran © f2m 10 18 Interview 06 Cyrille Filott: Data determine the environment for producers Fairs and Exhibitions 10 IBIE: A world of benefits Raw materials 12 Handling enzymes safely: Webinar series from October onwards 16 AZO: Small quantity handling Production 14 Debag : La Place on course for expansion 24 Vemag : Automatically topping sandwich slices 25 GEA : When variety is in demand 25 BAKON : Compact and easy to operate 26 Opelka : Consistent progressive development 28 Van Maanen : “Baker of the future” Research 18 BakeTran : Australian wheat in the SE Asian bread market IT 32 Staropolska: A digitized production facility Management 36 RAU INTERIM : Experts on call Regulars 03 Editorial 38 News 39 Trade fair calendar © Fillot 06

MUESLI BREAD MIX

The new Muesli Bread Mix o ers a range of options. Whether as bread or bars, classic or with nuts, berries and other fruit, it’s the perfect o ering for consumers looking for an enjoyable power snack.

www.backaldrin.com

Data determine the environment for producers

Cyrille Filott is one of more than 90 staff in Rabobank’s analysis and strategy unit working on worldwide developments in agricultural and nutrition markets. Our dialogue partner’s specialisms also include worldwide baked products markets.

+bbi: Mr. Filott, During your speech at the Annual Meeting of the German Plant Bakery Association you talked about major consumer trends and the possible impact on bakery business. Most bakery markets in Europe see a declining volume and a more or less flatish turnover. Do you see trends that will give bakeries a chance to boost their business?

+ Filott: For the market as a whole I am not that bullish. In some markets such as the Netherlands lower prices (e.g. 4 croissants for 1 euro) are driving volume, but not value. Also consumer trends, especially for at home consumption, are not that positive. Consumers are ordering more hot food, are eating breakfast on the go, etcetera. Key for bakers is to understand the important consumer trends (e.g. convenience, nutrition, sustainability) and create products that play into these trends. An example I used was the Digestion Boost bread range by Roberts bakery in the UK, focusing on nutrition.

+ bbi: Focussing on regional products or ingredients is a major trend in the bakery market. Now big companies like Mondolez, Nestlé etc. adopt these strategy. What is the strategy behind and what impact this will have on local, regional or national producer who identify their products with the region?

+ Filott: The idea is that the consumer increasingly focusses on local origin of food products. Especially in France this is a very strong trend, but it is important in other countries as well. Also important is that the technology is increasingly available to distinguish local preferences, making it “easier” to tailor to local needs. The impact is mostly on sourcing (local ingredients) and potentially also a preference for local production, local brands.

Rabobank

Cooperatieve Rabobank U.A. is a Dutch cooperative bank headquartered in Utrecht and offering international banking & financial services focused mainly on the agriculture & food sector. Worldwide turnover in 2018 was EUR 12,020 billion, the number of employees was 41,861 and the number of branches 802. Women occupy 30% of managing board positions, and there are 31.3% in the level below that. All figures are taken from the 2018 annual financial statements

+ bbi: Consumer are looking for guidelines to find the right personal nutrition or the right product. Do you see more statutory rules or more impact of information shared by organization and or even companies like Yuka via internet?

+ Filott: Both. I believe governments are going to play a more important role in either recommending better nutrition or even taxing unhealthy and unsustainable food. But as the consumer tends to trust other institutions over the government, apps like Yuka will find an audience as well. The latter empowers the consumer to make a better choice – this is very important.

+ bbi: Will retail play a decisive role in this game, for example asking for a specific labelling?

+ Filott: Yes. Some retailers will do this, especially those that are looking for differentiation. Albert Heijn in the Netherlands will make Nutriscore mandatory on private label products. A very interesting a move. And yes, I know in Germany Nutriscore is not well liked, but regardless, we will see labels front of pack.

+ bbi: Free from, meatless – not everybody needs to void gluten or lactose and not every meatless burger is really healthy – how important it will be in future, to meet the perception of consumers?

+ Filott: It is really important – for some consumers. Others will not care. And see here the challenge: how to cater to all? Or perhaps food companies should give up on that… a few food companies are looking into catering into tribes, groups

www.bakingbiscuit.com 05/2019 INTERVIEW 06

++ Cyrille Filott © Filott

++ Trending in China: Product development stimulated by online portals: since then, Oreos have been available in China with wasabi and chicken wing flavors, Snickers in a savory version and KitKats in a smaller format, as well as in family packs. All three products are extraordinarily successful

of consumers that have the same preferences or characteristics. Think age groups, think hobbies (sports), think lifestyle.

+ bbi: A platform like Yuka – in its own words "a mobile application that scan food & cosmetics products to get clear information on the health impact of the products you consume" is privately owned and paid by the millions of user. The most important criteria are the Nutri-Score and the presence of additives. Will platforms like this guide consumer behavior? Who can control its independence and when will there be the first one manipulating the results?

+ Filott: Great questions which I really cannot answer. We do see some retailers having an interest in this space. Albert Heijn in the Netherlands acquired the FoodFirstNetwork, a health and wellbeing platform that provides advice to consumers. The platform will remain independent, however ofcourse Albert Heijn will now have a propriety data source.

+ bbi: You presented a new kind of product development and marketing in the UK bakery sector – a Bread line special tapping gut health Trends with a range of Digestion Bloomers and packed into a paper bag. The product line is only available in London. What is the strategy behind it? Why only for urban region and what kind of consumer expectation will be met by this kind of product, packaging and marketing?

+ Filott: The strategy on where the product is sold was determined by the retailer. Retailers are starting to think in tribes as well. The London tribe is very different from the Birmingham tribe. This is because the cities consist of different types of people. In the example the retailer sees that in London there are much more millennials, young people, who are (more) interested in sustainability and nutrition.

+ bbi: You also talked about Digitization to impact all suppliers and pointed to platforms like Alibaba, JD.com which in China drives new product development. Can you show us some example and describe the way and the success of their influence?

+ Filott: Yes, the retailers over in China are supporting food companies and others with innovation, thereby a) making sure the right products are produced that fit consumer demand and b) shortening innovation cycles. A famous example is the development of the Spicy Snickers – Alibaba through their Tmall innovation center suggested to Mars that this flavor would be a hit to Chinese consumers. So Mars produced it, and it was/is a success.

+ bbi: Coming back to bakeries and their chances – platforms who tell you what to develop and manage the sales, ingredients companies, who are serving not only

www.bakingbiscuit.com 05/2019 INTERVIEW

PosiDrive Spiral™ • High Tension

Heavy Loads

Greasy Products • Product Movement Proven Solution For: Call for System Audit +31 20 581 3220 www.ashworth.com

© Oreo

•

•

ingredients but complete product solutions and last but not least equipment supplier who control the process automation via cloud – is there still space and margin left for a producer himself ?

+ Filott: This is a bleak picture you paint, but you are not wrong. And this will not happen overnight, this is a long term thread to the sector. Therefore bakeries need to think: what is it I stand for? How do I differentiate? Should I think about catering to certain tribes? Or perhaps more generically – where can I add value? And this still may be process technology, this may be product development. But then the bakeries should invest accordingly.

+ bbi: What are the main issues bakeries should think about to have a future and why we should look to china to see the future of consumption?

Yuka, or “I’ll tell you what you should eat”

+ Filott: Especially those bakeries that sell into retail should have a look at China (then again, food service is changing quickly as well). Technology developments in China are going so quickly, and they are all data-lead. China is, and I am exaggerating a bit here, going to bypass modern retailing the way we know it. Platforms such as Alibaba and JD.com are taking the lead. What is important, is that these platforms have the connection with the consumer. The platforms will use this connection to direct trade, to direct products and product innovation. Of course we are a bit behind in Europe (and slightly more in Germany I have to say), but the direction is clear. This will not be a revolution, but an evolution into a data-lead food production and sales environment.

+ bbi: Mr. Filott, thank you for the interview. +++

It’s a textbook example of a startup – three young people, an idea, a database and an app. Their logo is a carrot and their idea is a database accessed via an app and providing understandable-by-all information about ingredients and the health value of foodstuffs, cosmetics and drugstore articles. Those behind it are the Benoit and François Martin brothers and Julie Chapon. According to their self-portrait, it was Benoit who had the idea for Yuka, because he asked himself how healthy the foods he gave to his three children really were.

The app can be used to scan the barcode of supermarket products to see their Yuka score, a rating derived from three sources. Nutritional quality according to NutriScore makes up 60% of the rating, and 30% relates to the presence of additives. Data for these are obtained from EU and national supervisory authorities and other institutes. 10% of the rating depends on whether or not the product is organic. The result displayed by the smartphone shows the categories in which the product ends up: which are in the red field (not good), and which are in the green (good). On request, users are given recommendations of an alternative product that

has a better rating and can generally be found in supermarkets. A filter also states retailers. Alcoholic products, infant foods and protein powders are not analyzed or assessed due to their very specific composition.

Yuka is financed exclusively by premium users of the app and via a nutrition program publicized through a blog, although available only in French up to now. As the company itself says, support, money or manufacturers’ advertising are all refused on principle.

The database, complied in early 2018, currently includes 450,000 foods plus around 150,000 cosmetics and drugstore articles, and around 2,000 new articles are added every day. An internal audit system checks the data for conformity with the package declaration and to ensure that identical products receive the same rating, regardless of the name or brand under which they are sold. Since the database began, ten million users have accessed the information, and viewed the rating of three million products as a daily average. A British offshoot of Yuka has existed since June of this year. +++

www.bakingbiscuit.com 05/2019 INTERVIEW 08

++ Th e Benoit & François Martin brothers and Julie Chapon founded an independent food ratings portal now used by millions of consumers in France and the UK

© Eveline de Brauw © Yuka

Specialists

Rademaker Academy

Quality in Knowledge

Knowledge is power. When detailed know-how about sheeting processes, production line operation and dough processing is lacking, problems affecting overall production costs and product quality might occur. In the Rademaker Academy, bakery knowledge is preserved and shared through education and training, enabling you to maximize the profitability of your bakery.

www.rademaker.com www.rademaker.com www.rademaker.com

in food processing equipment www.rademaker.com

A world of benefits

With the largest offering to date, IBIE delivered a superior attendee experience and provided insights and thought-provoking perspective.

+The 2019 International Baking Industry Exposition (IBIE) recently wrapped up its largest show to date at the Las Vegas Convention Center after welcoming baking industry professionals from around the world on September 7-11, 2019. With nearly 1,000 exhibitors – 237 new to IBIE – and the largest show floor in its 100-year history, IBIE continues to break records reflecting the growth and health of the industry. More than 20,000 baking industry professionals walked the exhibit hall – with baker participation increasing nearly 10 percent over the previous expo in 2016. IBIE’s new all-in-one exhibitor booth pricing also encouraged exhibitors to bring more equipment and machinery than before – totaling nearly 600,000 pounds of additional freight –a huge benefit for bakers to experience multitudes of product and equipment on the show floor.

Much of the growth has come from international markets with attendees hailing from more than 100 countries and making up nearly 30 percent of the total attendance, with the largest

participation from Brazil, Canada, China, Colombia, Japan and Mexico.

“IBIE continues to provide the platform for the entire baking community to gather and celebrate the vibrancy of this industry, innovative trends and digital automation technologies, advances in baking processes and the thousands of bakers and support services who have a passion and commitment to the success of this industry,” said Joe Turano, IBIE chairman.

“IBIE is focused on meeting the professional and business needs of every attendee. We take pride in crafting content that is cutting edge, interactive, engaging and thought-provoking. With a sold-out show floor, we experienced innovations and exciting technology that will lead this industry into the future.

I know that we are leaving feeling reenergized and recharged with fresh insights and new relationships to cultivate.”

The next IBIE will be held in Las Vegas, Nevada on September 17-21, 2022, with a full day of education on September 17. +++

www.bakingbiscuit.com 05/2019 FAIRS AND EXHIBITIONS 10

© f2m

IBIE innovations

A BI Ltd Canada

Showcased their “Brander”, an industrial thermal imprinting system which is a new automated application for branding baked products. www.abiltd.com

AMF

Launched their “Target Seed Strewer”, which precisely strews various toppings such as sesame, poppy seeds, oats and corn onto buns and rolls, saving up to 60% of toppings required. www.amfbakery.com

Houdijk Holland

Were present at the IBIE show with their innovative, “Houdijk Capper Mark III”, a full belt width creamer and capping system. This system can handle jams, fat creams and other deposit material as well as multiple product sizes and shapes. www.houdijk.com

Intralox

Demonstrated their “Active Integrated Motion, (AIM), bread switch which they plan to launch in August 2020. AIM technology revolutionizes bread switching by automating handling from the spiral cooler outfeed to the bread slicer. www.intralox.com

Lesaffre Corporation

Launched their “Fleurage seeds” and ”Fleurage semolina”, flavour toppings. Perfect for use in a wide variety of products. www.lessafreyeast.com

Rademaker

Showcased their newly launched “Radini”, which was manufactured with craft baking automation in mind. A flexible sheeting, laminating and makeup process designed for the craft baker, who can’t compromise on quality. www.rademaker.com

Rheon

Launched their “High Speed Croissant” make up system during IBIE. Its new design features a continuous motion turning system that will run speeds up to 200 RPM along with a unique curling system that has precise control over the shaping of any croissant. www.rheon-europe.com

Zeppelin

Showcased the launch of their,”KROMix”, developed in conjunction with W&P Kemper for more efficient dough production. It reduces kneading and mixing times up to 50% and increases hydration up to 10%. www.zeppelin-systems.com +++

MIXING SOLUTIONS

for bread, pastries, cakes and snacking industries

FAIRS AND EXHIBITIONS ADVERTISEMENT

HANDLING ENZYMES SAFELY

Webinar series from October onwards

A webinar series organized jointly with FEDIMA 1 and AMFEP 2 supplies information about the safe handling of enzyme-containing ingredients in baked goods production.

+Enzymes are proteins and, like other proteins, can act as respiratory tract sensitizers if persons are repeatedly exposed to air containing them. Such sensitization can ultimately lead to respiratory tract allergy, although not all individuals develop symptoms. As FEDIMA and AMFEP report, the sensitization and allergy risk potential can be controlled by suitable process monitoring, product formulations and the observance of appropriate handling instructions.

The two associations intend the webinar initiative to bring together dust pollution monitoring/control knowledge, best practice and tools, and for this information to reach as many people working in the bakery sector as possible. FEDIMA and AMFEP had already published a sector guideline entitled “Guidelines on the Safe Handling of Enzymes in the Bakery Supply Chain”3 in 2018. A poster4 about handling enzymecontaining ingredients safely has also been prepared, and is available in twelve languages.

According to the associations: “Our work is strongly inspired by the detergents industry, represented by the International Association for Soaps and Maintenance Products (AISE). In 2015, for example, the AISE published a guideline on the safe handling of enzymes in detergent production.”

What can participants expect from the webinars?

The webinars will be given in English and are free of charge. Participants will receive an overview of the steps that need to be taken to reduce risks in all areas of baked products manufacture: from milling and baking ingredients production to artisan and industrial bakeries. The webinars are particularly relevant for:

+ SHE managers, WHS managers and/or OHS managers

+ All plant operational staff, including managers

+ R&D employees in the bakery sector

+ Program managers and teachers in bakery education centers

+ Representatives of occupational health and safety organizations

Dates/times and topics

Webinar 1 - October 15, 2019 (14:00 CET): Introduction to safe handling of enzymes in the bakery supply chain, including regulatory aspects

Webinar 2 - October 29, 2019 (14:00 CET): Control of exposure during handling of enzymes in the bakery sector – Artisan bakeries, bakery schools & demonstration bakeries

Webinar 3 - November 19, 2019 (14:00 CET): Control of exposure during handling of enzymes in the bakery sector – Flour millers, Industrial bakeries & ingredients manufacturers

Webinar 4 - November 26, 2019 (14:00 CET): Health surveillance and air monitoring

Costs: Free of charge

Language: English

Registration: Register via this link: https://form.jotformeu.com/90783021551351

For more information and questions please contact FEDIMA: fedima@kellencompany.com

+ Craft/artisan bakers

+ Baker’s union representatives

The webinars will describe:

+ Health hazards associated with enzymes

+ Current regulatory framework concerning the use of flour and enzymes in the baking industry

+ Management procedures required to ensure adequate controls and staff training

+ Process and equipment design to minimize and maintain low exposure levels

+ Air monitoring procedures to assess enzyme exposure levels

+ Recommendations on health surveillance

+ Enzyme allergy as a consumer issue

Links

1 FEDIMA: Federation of European Union Manufacturers and Suppliers of Ingredients to the Bakery, Confectionery and Patisserie Industry, www.fedima.org

2 AMFEP: Association of Manufacturers and Formulators of Enzyme Products, www.amfep.org

++ Poster about the safe handling of ingredients containing enzymes

3 The Guidelines can be found on the FEDIMA web site at: http://www.fedima.org/content/public-documents

4 The posters are available for download in 12 languages. Please follow the link: https://www.fedima.org/resources/ safety-at-work +++

www.bakingbiscuit.com 05/2019 RAW MATERIALS 12

© FEDIMA

A Markel Food Group Company Your recipesimple,125-year for success. For over 125 years, the Thomas L. Green brand has been supplying biscuit and cracker manufacturers with the industry’s most efficient, reliable and sanitary production systems. As the world’s most trusted brand, we offer a full line of modern, high volume systems for laminated and sheeted products. The unmatched baking experience and advanced technology that goes into every Thomas L. Green system ensures that you consistently bake your best product, day in and day out. Call us at (01) 610-693-5816 today or visit us at www.readingbakery.com Thomas L. Green, your partner for better biscuit and cracker systems.

La Place on course for expansion

The Dutch restaurant chain La Place intends to stand itself out from its competitors with the concept of absolute freshness at a moderate price.

+P izzas are rolled out and topped in front of customers, meat for burgers freshly fried, juice freshly pressed and baked products made up from fresh dough and baked on the spot. The Dutch restaurant chain La Place pursues this quite labor-intensive concept consistently and entirely successfully. The company, which also operates self-service restaurants at motorway service areas, airports and rail stations, uses it to compete against various burger and fast food chains. Explaining the idea, Manager Paul Tönis told our Editor: “We intend to stand out from our competitors with the concept of absolute

freshness at a moderate price.” La Place’s branches have a modular structural design ranging from 50 m2 (Express Shops) to restaurants with an area of 5,000 m 2. Kitchens and preparation stations are always open-fronted. Customers can watch sandwich toppings being cut and baked products topped, for example, and ready-topped baked goods are always available to take away. Dough for breads and rolls is supplied by local bakeries, then made-up and baked by La Place staff. All in gredients are expected to be fresh and natural – in other words additive-free. Paul Tönis explains: “We also prefer regional raw materials, organic quality if possible.”

Depending on the size of the outlet, the selection of goods can include the following product groups: pies, homemade soups, pizzas, burgers, sandwiches, juices and smoothies, desserts, homemade pasta, grilled dishes, breakfast products, oriental cuisine and salads. Menus and product ranges change weekly. La Place has a total of around 3,500 different recipes. Four product development staff are responsible for the product diversity.

Food prices are moderate: A lavishly topped cheeseburger costs EUR 6.95 in Dutch branches and EUR 4.95 as a special offer. An over-the-counter topped focaccia is EUR 5, which

www.bakingbiscuit.com 05/2019 PRODUCTION 14 KOENIG BACKMITTELGMBH & CO. KG • Postfach 1453 • D-59444 Werl Tel. 02922/9753-0 • Fax 02922/9753-99 E-Mail: info@koenig-backmittel.de Internet: www.koenig-backmittel.de The Nut specialists Quality-brand and freshness with long tradition Almond- Hazelnut- and Peanut-Products, roasted, sliced, diced and slivered. Hazelnutfilling and Multi-Crunch. Please ask for products meeting your specifications. KOENIG Motiv4 NTS 91x53.qxd 12.02.2007 11:10 Uhr Seite 1

© f2m

++ Choose a pizza topping, and it can start right now. Dough is rolled out in front of the customer, topped, and off it goes into the oven

is the same cost as a topped baguette. A freshly prepared pizza (28 cm diameter) starts at EUR 5.50 and ends (four different toppings) at EUR 10.50. Desserts and small tartlets cost EUR 3.

La Place, which has been a subsidiary of the Dutch supermarket chain Jumbo since 2016, operates most of the branches, approx. 130, in the Netherlands and employs a workforce of around 3,000. It also has restaurants in Spain, France, Germany (Zweibrücken and Montabauer), Switzerland, Belgium, the USA and England, as well as in the Middle East and Indonesia. There are also franchise partners in addition to its own restaurants, and the company plans to expand worldwide and to open other locations. Explaining the successful concept, Manager Tönis says: “It is important that staff bring with them a corresponding amount of passion and enthusiasm, because preparing fresh foods requires intensive training. However, if the employees have prepared the baked products themselves for example, they also feel responsible for the product and can sell it correspondingly well.” +++

15 PRODUCTION

++ La Place tested German technology for the ovens. The DEBAG instore oven can bake rolls, pies and even tray cakes

sandwiches and focaccia – costs are around EUR 5

© f2m

Small quantity handling

With ManDos, AZO, the specialist in automated handling of raw materials, has developed an operatorcontrolled manual weighing centre for the provision of micro quantities.

+ManDos is particularly well suited for adding micro quantities such as flavourings, raw baking ingredients, emulsifiers, dyes and other ingredients where this cannot be fully automated in a profitable manner owing to their consistency (physical properties) or production need (quantity and frequency), for instance in the case of:

+ Low batch frequency

+ Raw materials that are not suitable for automation

+ Frequent change of ingredients

+ A large number of components

+ Limited investment resources

+ Requirement for end-to-end documentation

ManDos is of modular construction. It combines subassemblies, such as scales, surge bins, work tables, suction systems, barcode readers and label printers, and the software solution needed for this. The system works with a standard operating concept for a very wide range of terminals. The intuitive user guidance makes use of icons and graphic elements.

The weighing centre can be used in a stand-alone capacity, but can also be expanded to a networked batch production system with host interface. The raw material identification using barcode and the documentation of all work steps and weighing results ensures traceability of every batch at any time. Furthermore, the system has its own master data management (order and recipe management as well as item and stores management). ManDos meets the requirements of Regulation (EC) No. 178/2002, can be validated, and can also be used in explosive atmospheres.

How it works

When an order has been started, the operator is informed as to the component that needs to be weighed. After identifying the raw material using a barcode reader, the operator weighs the required amount in a container. A large weight display and a graphic bar diagram with change of colour make it easier to carry out manual dosing within the required tolerance. All the components are weighed into the container in the same way, one after another. If necessary, a label can be printed to identify the target container. The raw materials used and the entire weighing process are recorded and documented. +++

www.bakingbiscuit.com 05/2019 RAW MATERIALS 16

© AZO

++ ManDos is an operator-controlled manual weighing centre for the provision of small and micro quantities

AMFBAKERY.COM | sales@amfbakery.com USA | Netherlands | UK | China | Singapore | Canada | Mexico | UAE MIXING | MAKEUP | BAKING | PACKAGING | POST-PACKAGING overall energy e ciency, or take your first step into automation, AMF’s Den Boer, Vesta, and BakeTech Baking Systems o er best-in-class equipment solutions with unparalleled support for the life of your bakery.

Australian wheat in the SE Asian bread market

While rice and noodles remain staple foods throughout Asia, the production and consumption of bakery products and in particular bread is growing, in part at the expense of rice.

+T he demand for flour from the baking sector now ac counts for 26% of total flour use in South East Asia (SEA). Within the bread segment, sweet buns (Figure 1) have a market share of approximately 70%, white bread 24- 26% and wholemeal 1%. Approximately 70% of all bread products are produced in small and medium sized enterprises (SME) which manufacture mostly sweet buns with fillings. Around 18% bread products come from industrial-scale and 1 2% are produced in boutique bakeries. There is an expanding artisan bakery market. While SME bakeries currently deliver the greatest proportion of bakery products, the indicators are that automation and industrial-scale bakeries will continue to grow their market share, not necessarily at the expense of SME’s but because the market for bread products will in crease. Growth in the bakery manufacturing sectors has increased steadily and is expected to continue (estimated at 5% per annum by Euromonitor International in 2015).

Currently a significant proportion of bread production in SEA is based on smaller scale, batch processes, using long fermentation or sponge & dough. In SME’s there is limited if any, process control. Industrial-scale bakeries tend to use similar production methods and practice better process control, there is, however, a trend towards shorter processing methods and the application of dough improvers. In contrast to Europe, typical SEA bread recipes are dominated by high sugar and fat recipe contents (Cauvain and Clark, 2020). Bread quality is described by its volume (the larger the better) and crumb softness (freshness). Other quality traits such as loaf symmetry and crumb structure are important but secondary to bread volume. Breadmaking is based on using high protein flours to yield ‘stable’ doughs, though in some cases, enzymes are used to weaken the dough for processing. Post-mixing

processing of the dough is often based on the use of doughbrakes, especially in SME’s.

Australian wheat in South East Asia

The climatic and agricultural conditions in SEA are not conducive for growing wheat and so supplies must be imported for milling and conversion to bread. Key SEA wheat importing countries include Indonesia, Malaysia, Singapore and the Philippines. Collectively they import 31% of all wheat exported from Australia, valued at over A$ 1.8 billion per annum (pa). Along with Vietnam and Thailand (12.2% of total Australian wheat exports), these key importing countries underpin the Australian wheat industry. SEA is the largest and fastest growing market for Australian wheat, importing 42.6mmt of wheat valued at A$13.1 billion over the past 5 years. The volume of imports has increased from 3.6 mmt in 2008 to 8.5mmt per year, averaged over the 2011-2015 period. Proximity to grain ports, timeliness of shipping, low biosecurity risk, competitive pricing and quality suitability all contribute to this region’s growth in Australian wheat imports (Figure 2).

With a population of 257 million according to the World Bank in 2015, Indonesia is the fourth most populous country in the world. The country’s population has grown steadily over the past 30 years with the annual growth rate averaging 1.5% and the total population is expected to increase to 322 million by 2050. The economy has been growing steadily at a rate of 5.5% pa since 2010 The Indonesian economy continues to improve from an average annual income per person of US$ 464 in 1998 to US$ 3,350 in 2015. Indonesia continues to be one of the largest wheat importing nations globally, sourcing nearly all of

www.bakingbiscuit.com 05/2019 RESEARCH 18

1 2 PART I - AN OVERVIEW

© BakeTran

© BakeTran

its 7.4mmt of imported wheat during 2015 from Australia and Canada.

Nippon Indosari is the largest baked goods manufacturer in Indonesia. Apart from bread, biscuit, pastries and cake production combined account for 11% of flour consumption. This segment is dominated by sweet biscuits (84% volume) and further growth is expected. Growth projections are based on an increasing demand for small affordable packs of sweet biscuits sold through traditional venues.

Australian Export Grains Innovation Centre and BakeTran

Australian Export Grains Innovation Centre (AEGIC)

Formed in 2012, AEGIC provides national research leadership and strong international linkages to export markets. AEGIC is a research, development and market intelligence organisation focused on increasing the competitiveness of Australian export grains. Offices and research laboratories are based in Perth and Sydney and are staffed by highly qualified and experienced grain scientists and industry experts. AEGIC administers a diverse range of projects, mainly focusing on Australian key grain markets in Asia. The Innovation Center works across four areas:

+ Market Insights

The experts identify trends and opportunities for the Australian grains industry through market intelligence gathering and in-depth economic analysis

+ Market Engagement

AEGIC regularly assists customers to use Australian grain by conducting overseas seminars and workshops and providing information on the quality, functionality and end-uses of Australian grain

+ Grains Innovation

The grain quality research programs aim to identify new and innovative uses for Australian grains through cuttingedge laboratory research

+ Analytical Services

The Perth and Sydney offices offer commercial grain quality testing and food analysis

BakeTran

Based in the UK, provides independent technical and research services to bakers, flour millers and bakery supply industries worldwide. Formed in 2004, BakeTran has a strong focus on innovation, product and process development. Coming from a research and development background, the founders gained international recognition for developing new ideas and most importantly, providing technical tools and practical solutions for the baking industry. By combining practical experience in milling and baking with a sound understanding of the underpinning science and technology, BakeTran works with many clients to deliver product and process improvements.

AEGIC-BakeTran Collaboration

In 2014 AEGIC and BakeTran began a collaborative project aimed at achieving a greater understanding as to what

contributed to the development of dough and could improve process efficiency for the manufacture of bread. With AEGIC’s clear interest in the SEA bread market, the project was run under the heading of Australian Wheat for Asian Baking (AWAB) but from the start it was recognised that the study of dough development through mixing and processing would have wider implications and offer new opportunities for breadmaking throughout the world.

The practice of controlling energy delivery to dough during mixing has been used for some time (Cauvain and Young, 2006). A guiding principle with respect to final bread properties is that around 90% of quality is determined when the dough leaves the mixer and relatively little quality is ’added’ during dough processing (Cauvain, 2015). The behaviour of dough during the processing stages post-mixing and pre-proof is less well understood. While only a small part of bread quality is added during processing, there are many opportunities to ‘subtract’ quality between the mixer and prover. The dough leaving the mixer has elastic behavioural properties which are not best suited to subsequent processing and commonly this results in texture quality losses, not least the formation of unwanted holes in the crumb (BakeTran, 2012). Dough and bread improvers are used in many breadmaking processes which adds to the complexity of the changes which occur during mixing and dough processing. In recent years there has been a move to so-called ‘clean-label’ improvers in which new and very specific enzymes are used to deliver particular dough and bread properties. With the increased use of such ingredients there is a need to study dough development and identify a new set of paradigms which define the complex relationship between involved in bread making.

Thus at the heart of the AWAB project was the need to better understand and quantify the relationship between energy input (total and more importantly, rate of delivery), the rheological properties of dough leaving the mixer and its behaviour during processing to the prover, and the influence of key ingredients. The delivery of consistent bread quality to consumers (however defined) is a key requirement for bakers and consistency is based on good process control. The introduction of new improver formulations requires all bakers to re-consider their current process control methods. Calvel (2001) identified the control of final dough temperature as being critical for the delivery of consistent quality; in this respect, nothing has changed in baking for hundreds of years. Modern dough mixing methods have necessitated an improved understanding between energy input, temperature rise and control of final temperature which adds to the challenges facing bakers operating in warm climatic conditions, such as SEA. The use of ice and cooling jackets on mixers contributes to more consistent dough ex-mixer but adds to the baker’s energy bill (and ultimately to the price of bread).

It was anticipated that outputs from the AWAB project would have practical benefits for:

19 RESEARCH www.bakingbiscuit.com 05/2019

+ Emerging markets through delivery of the most relevant bread technology for their needs.

+ Bakers through improved process control, and reduced wastage and baking energy.

+ Alternative methods for more efficient and effective processing of dough ex-mixer.

+ Unique opportunities for the manipulation of product cell structure to deliver specific textural characteristics for consumers.

+ Wheat breeders through identification of specific quality traits for different end-uses and markets

+ Flour millers through more effective gristing

Mixing studies in the AWAB project

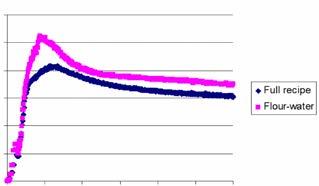

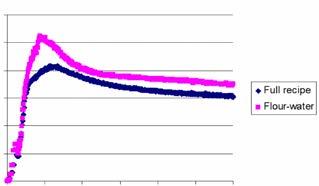

There have been many studies related to the changes in the rheological properties of dough during mixing. Common evaluation methods involve analysing mixer torque data and identifying a number of long-established quality parameters. However, the methods employed are mostly based on the evaluation of flour-water mixtures and as such, are removed from bakery practices. A fundamental decision within the AWAB project was that all mixing studies would be carried out with a ‘full’ recipe to make the project outputs more immediately relevant to commercial practice. A Perten doughLab was used to mix the doughs and capture relevant data. Preliminary work with a flour-water mixture comparing the effect of mixing speeds is illustrated in Figure 3 and shows how the mixing peak occurred earlier during a fixed mixing cycle. Just as importantly, the data also show that peak height increased as mixing speed increased, confirmation of the importance of changing the rate of energy input during mixing.

In Figure 4 the mixing curves for a flour-water mixture and a full recipe are compared. A clear difference is the loss of peak height and average mixer torque throughout the mixing cycle. In addition, the peak is less distinctly formed and occurs slightly later in the mixing cycle, with the major differences concentrated in the region 50-150 sec. Tests showed that the lubricating effect of the recipe fat was not a major contributor to the lower curve height, though the presence of salt was. The

roles of the ascorbic acid and enzymes present in the improver would be considered later in the project.

As the AWAB project had a focus on SEA, a standard pan bread recipe was set up to reflect commercial practices in that region. As noted above, the bread recipes contain fat and sugar at much higher than would be common in many parts of the world. The experimental work was based on a no-time dough; that is the dough was taken from the mixer and processed without a deliberate resting period. This method was chosen as being one being in common use around the world and one which was attracting significant interest in SE Asia. The test recipe is given in Table 1.

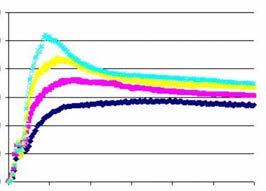

The cooling jacket fitted to the doughLab mixer facilitates close control of final dough temperature and provides the opportunity to closely examine effects on dough rheology and bread quality. The impact of final dough temperature on some doughLab parameters (full SEA bread recipe) is illustrated in Table 2. As would be expected both peak height and total energy input decreased as dough temperature increased. At higher temperatures the dough was less viscous and therefore offered less resistance to mixing. However, bread volume increased as the dough temperature increased.

www.bakingbiscuit.com 05/2019 RESEARCH 20

3 12000 10000 8000 6000 4000 2000 0 0 100 200 300 400 500 600 0 100 200 300 400 500 600 Average torque (FU) Effect of mixing speed (rpm) flour-water Mixing time (secs) Mixing time (secs)

++ Effect of changing doughLab mixer speed with a flour-water mixture

4 12000 10000 8000 6000 4000 2000 0 Average torque (FU) Comparison of full recipe and flour-water curves (200 rpm)

++ Comparison of doughLab curves with flour-water mixture and full recipe dough

1 The recipe water is lower than the measured flour water absorption to account for the dough consistency softening effect of the fat and sugar.

Ingredient % flour weight Weight (g) Flour 100 330 Water 1 61.2 202 Dried yeast 1.52 5 Salt 1.97 6.5 Sugar (sucrose) 5 16.5 Fat 4 13.2 Ascorbic acid 100 ppm 0.033 Fungal alpha -amylase 12 ppm 0.004 source: BakeTran source: BakeTran source: BakeTran

Table 1: Test mixing recipe

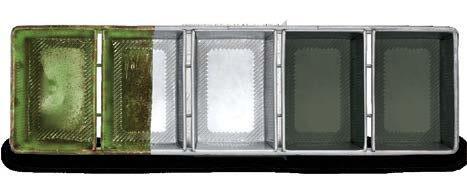

contact@americanpan.com | americanpancom For more than 30 years, American Pan has led the way in baking tin and tray innovation; from energy-saving designs to industry-leading coatings. We don’t believe in “one size fits all.” By engineering trays, applying exclusive coatings and providing economic refurbishment programs to fit your exact product and facility needs, we help you save money, increase quality, and outpace the competition. Bundy Baking Solutions: American Pan | Chicago Metallic | DuraShield | Pan Glo | RTB | Shaffer SKELMERSDALE, UK | +44 (0) 1695 50500 IRLAM, UK | +44 (0) 161 504 0771 THE PERFECT PAN from the first bake to the last. Contact our sales team to get started on your custom pan or cleaning program today. BARCELONA, SPAIN | +34 93 781 46 00 ALEXANDRIA, ROMANIA | +40 247 306170

While warmer doughs ex-mixer undoubtedly prove to a greater height for a fixed proof time (i.e. more gas production), there is also a contribution to increased volume, in part because of improved oxidation from the ascorbic acid. Oven spring (the difference in height of the dough entering the oven and the height of the loaf leaving it), is the manifestation of gas retention. It occurs in the early stages of baking and once the dough has made the foam-to-sponge conversion, it ceases because internal and external pressures are equal.

conditions which require significant energy to be used to control dough temperatures to less than 30, let alone 24°C. As discussed by Cauvain (2018), significant energy is required in order to raise dough piece temperatures to that of the prover and the lower the dough temperature entering the prover, the greater the energy input required to deliver a fully-proved dough piece to the oven.

Ultimately the processability of bread dough is determined by its rheological character and the choice of processing equipment. Thus, a better understanding of the relationship between dough development in the mixer and rheologyequipment interactions offers more efficient and cost-effective dough processing options for all bakers, not just those operating in warmer climates, such as SEA. +++

References:

BakeTran (2012) Unwanted holes in bread: why they form and how to limit them. Chorleywood Bookshelf Monograph No.1, www.bake-tran.com/ chorleywood-bookshelf/

Calvel, R. (2001) The taste of bread, Aspen, Gaithersburg , MN.

Cauvain, S.P. (2015) Technology of breadmaking 3 rd edn. Springer AG, Cham, Switzerland.

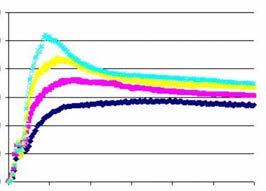

++ Impact of speed/temperature combinations on loaf volume with different flours and the standard level of ascorbic acid and fungal alpha-amylase

Some effects of combining mixing speed and final dough temperature from the AWAB project are illustrated in Figure 5. Five different Australian flour types were used and the pattern of results was similar in all cases. They show that oven spring was markedly affected by the final dough temperature ex-mixer and was greater at higher temperatures. With a dough temperature of 30° C, the effect of mixing speed was limited by comparison with that of dough temperature alone.

The importance of final dough temperature

Conventionally the choice of final dough temperature in a no-time breadmaking process depends on factors such as:

+ The time taken to process the dough from the mixer –warm doughs gas faster and are more difficult to divide and mould.

+ Dough consistency – soft doughs are more difficult to mould.

+ Dough stickiness – sticky doughs can lead to disruptions on the plant.

The bakers’ response to soft and sticky doughs is to reduce recipe water. Many bakeries operate under environmental

Cauvain, S.P. (2018) Improving the processing of dough to bread. In, The future of baking: Science-Technique-Technology , baking+biscuit international year book, f2m food multimedia gmbh, Hamburg, Germany, 36-41.

Cauvain, S.P. and Clark, R.H. (2020) Baking Technology and Nutrition: Towards a healthier world. Wiley, Oxford, UK.

Cauvain, S.P. and Young, L.S. (2006) The Chorleywood Bread Process . Woodhead Publishing Ltd., Cambridge, UK.

Authors: Dr. Larisa Cato and Stanley Cauvain

Stan Cauvain is a Director and co-founder of BakeTran, an international consultancy providing technical services to bakeries, mills, and related ingredient and equipment suppliers. He is particularly active with new process innovation and product development. He has published many technical books and articles on baking and milling technology.

Dr. Larisa Cato is an internationally recognised expert in the field of wheat quality and end-product requirements. As the WHEAT QUALITY TECHNICAL MARKETS MANAGER FOR THE AUSTRALIAN EXPORT GRAINS INNOVATION CENTRE she has been leading the project Australian Wheat for Asian Baking which aims to identify key requirements of wheat quality for bakery products in South East Asia.

www.bakingbiscuit.com 05/2019 RESEARCH 22

2700 2500 2300 2100 1900 1700 1500 100/24 100/30 150/30 200/30 200/36 Speed/temperature combination 8 rpm/°C Loaf volume (ml)

AA/FAA

Flours +

5

Target dough temperature (°C) Peak height (FU) Total energy (wh/kg) Bread volume (ml) 24 899 10.3 1,805 30 836 9.4 2,120 36 682 8.3 2,424 source: BakeTran

Table 2: Impact of final dough temperature on doughLab parameters (mixing speed 100 rpm, mixing time 300 sec)

source: BakeTran

See RONDO equipment on video RONDO Burgdorf AG, 3400 Burgdorf, Switzerland, Tel. +41 (0)34 420 81 11, info@rondo-online.com RONDO stands for quality: For quality in advice and service. For the quality of machinery and equipment, and for the quality of installation and training. Our commitment to quality will allow you to benefit. Our quality forms the basis for your success. www.rondo-online.com Our Quality – Your Success

Automatically topping sandwich slices

The VEMAG Slice Depositor made by the US-American company Reiser can automatically top sandwich slices with chicken salad, peanut butter, cream cheese or similar toppings, and even cheese slices.

+R aw materials costs and personnel expenses are rising, and so are the ready-to-eat market’s demands for longer guaranteed shelf lives. With this in mind, VEMAG, a partner of the US-American company Reiser, developed a Slice Depositor for a well-known sandwich producer. The Depositor is a combination of a Robot 500 vacuum filler, al ready established for several years as a dough divider, and a WFK863 roller filling head. The machine can handle a variety of paste-like mixes, with or without chunky compon ents. It automatically and uniformly applies accurate weights of peanut butter, cream cheese, jellies, and toppings containing egg or tuna, as well as pumpable prepared cheeses in the form of “slices”.

The Depositor uses a sensor to identify sandwich or bread slices, and applies a pre-specified weight of topping at a rate of up to 100 slices/minute. Multi-row systems are used when

for a sandwich producer, combines a Robot type 500 dough divider with a WFK863 roller filling head. The machine can apply a variety of pasty mixes, with or without chunky components, to sandwich slices.

higher output rates are required. There are no limits on the area to be topped, i.e. in terms of sandwich slice dimensions. Size and shape, width and thickness can be adjusted individually depending on the product to be applied. Topping portion size is also unlimited. The roller filling head can be individually preset, and can pre-portion almost any weight from 5 g of topping or 35 g of cream cheese to 200 g of chicken salad if required.

Because the company uses a modular principle to manufacture its plants – which consist of a central component, i.e. the machine with its curved conveyor and attachment – the machine can be converted from a roller filling head to a dough portioner for cookies or wholegrain breads. The whole changeover is the same in the opposite direction, of course. +++

Robert Reiser & Co Inc. (Reiser)

Reiser headquartered in Canton, Massachusetts/USA, develops and markets process solutions for industries including the baked products sector. The company is a partner of VEMAG Maschinenbau GmbH in Verden, Germany.

www.bakingbiscuit.com 05/2019 PRODUCTION 24

©

VEMAG

When variety is in demand

+T he GEA Comas DV3 Multi-Depositor system allows simultaneous extrusion and deposition of two doughs and an additional medium-viscosity filling input. The doughs can also contain solid ingredients such as nuts or candied fruits. According to the company, the single-rotor principle ensures gentle discharge with narrow weight tolerances. All the functions run under PLC control, and the operator can easily store and recall operating data for each product. With its comprehensive range of accessories and supplementary a ssemblies, these machines can be used to make a wide variety of products, e.g. filled cookies, shortbread cookies or bar-type baked goods. The metering assembly is available in working widths from 800 to 1,500 mm, and can be moved out of the production line to clean and maintain it. +++

Compact and easy to operate

+Metering and depositing – machines in the Dutch manufacturer

BAKON’s BD series can also undertake these tasks. The BD3 Multi-Depositor is designed as a bench-top equipment for smaller bakery businesses, bigger machines such as the BD9 variant allow the metering and depositing process to be increasingly automated. All the variants are compact, simple to operate, easy to clean and mobile. The BD9 model meters mixes such as cake or muffin doughs, jams or fruit fillings, crèmes or cream cheese highly accurately. Equipped with a touchscreen, recipes and parameters such as working height, metering speed or cylinder type are easy to set and save. The machine, which can be used stand-alone or in a line, works at an operating pressure of 4 Bar and is capable of 60 strokes/minute (depending on product, volume and settings). Metering cylinders for 10 – 100, 36 – 180, 110 – 475 and 220 – 1,100 ml are compatible. For the iba 2018 trade fair, the company also developed a robot arm that automatically feeds trays to the depositor, removes the loaded trays again and places them in a defined position – e.g. in a rack trolley. +++

www.bakingbiscuit.com 05/2019 25 PRODUCTION METERING AND DEPOSITING

++ Th e GEA Comas Multi-Depositor system can meter two different doughs and a filling as a third component, all at the same time

++ Th e DV3 MultiExtruder can produce a wide range of baked products

© GEA © GEA © BAKON

++ The BD9 Multi-Depositor BD9 meters cake or muffin doughs, jams or fruit fillings, crèmes or cream cheese

Consistent progressive development

Opelka GmbH’s designers in Remseck/Neckar have made further developments to its fat fryer plant without a heating coil. The new MasterLine plant type has now been presented to the public.

O pelka GmbH in Remseck/Neckar, Germany, has presented its new MasterLine plant type. The company reports that the MasterLine type represents another milestone in the development of fat fryer plants without heating coils. It’s a logical further development of the MultiLine plants, which were developed to make mainly a single kind of baked product (e.g. fritters or donuts made from yeast dough) at a very high hourly production rate. The MasterLine is seen primarily as an entry level automated production plant.

The new MasterLine plant type has the following characteristic features:

+ Hygienic design – 95% of the moving parts are above the frying fat. This allows easy cleaning.

+ A low fat level due to a shallow frying tank ensures economical consumption and long frying fat lifetime with minimum deterioration.

+ Simple, intuitive touch operation.

+ Good accessibility to the parts that need cleaning – after baking, the transport system can be raised by a motor to the cleaning position. There are no heating elements to get in the way of cleaning the frying tank.

Intelligent linking of the movement sequences (everything runs through a single transmission) saves around 80% of the motors used compared to MultiLine plants, while considerably increasing operator friendliness at the same time.

+ Chain drive throughout, and up to three individually positioned turnarounds.

+ Fast help via a remote maintenance option if service is needed. +++

www.bakingbiscuit.com 05/2019 PRODUCTION 26

+

++ An overview of the entire new MasterLine

++ Go od accessibility makes cleaning plant components easier

++ A shallow frying tank and low fat level ensure economical consumption

++ Th e MasterLine is seen as an entry level automated production plant

© Opelka © Opelka

© Opelka

© Opelka

with this master baker mindset, like our modular AMF Den Boer Tunnel Ovens, which allow us to engineer the most optimal baking solutions for today while preparing your bakery for future growth.

G et in touch with the industry ’s only tr uly g lobal complete system supplier for the best unit equipment and integ rated solutions for your operation.

TROMPGROUP.NL | sales@amfbak ery. c om USA | Netherlands | UK | China | Singapore | Canada | Mexico | UAE

“Baker of the future”

When Jan van Maanen opened his baker’s shop in the Dutch village of Katwijk aan den Rijn in 1907, little did he know that over a century later, his name would be attached to 52 stores with over 100,000 weekly customers.

+T hrough a series of acquisitions and collaborations, f our savvy generations of Van Maanens have turned their family business into the Netherlands’ largest artisan bakery. By focusing on the smaller regional cities between Amsterdam and Rotterdam and slowly spreading out from there “like an oil stain”, they’ve been able to keep “logistics in mind in order to avoid unnecessary costs”. And, for some time, the Van Maanens managed perfectly well with their chain of classic bakery shops, until the current management saw that it was time to change things around.

About Henk-Jan Van Maanen

The fourth-generation CEO of Van Maanen went to bakery school in Wageningen before joining his family business 26 years ago. More recently, he completed an MBA at the Business School Netherlands in Buren. “As a little boy I always dreamed of being an entrepreneur in the food sector. I thought I’d become a chef, but having been involved with the family company from childhood it was a natural step to go into the baking business,” he says.

Changing retail-scape

Says CEO Henk-Jan Van Maanen, “In the 60s there were still some 16,000 bakers in the Netherlands, now there are only 2,500. This went hand-in-hand with the impact of the supermarket bakery, which meant that by the 80s and 90s it was all an efficiency game. Then there was the rise of the so-called ‘bakery café’, which is about creating a place where people want to spend time, but also where they come into contact with a more diverse product range than that offered by traditional bakeries.” The classic corner bakery concept no longer fit within this landscape. It’s a familiar conundrum for traditional retailers in a world where the retail-scape is changing faster than many organisations can keep up with.

In 2015, brothers Henk-Jan and Johan van Maanen decided to transition their bakery shops into bakery café’s where connection, not retail, is central. This required a complete overhaul of their company. Tells Henk-Jan Van Maanen, “We looked at bakeries abroad, where it’s quite ordinary to consume bread and pastry at the place you buy it, but it’s still a great departure from where the Dutch bakery market came from. A bakery was just a place you went to buy your bread.

www.bakingbiscuit.com 05/2019 PRODUCTION 28

++ Th e company decided to transition their shops into bakery café’s where connection is central

© van Maanen

And while the concept of bakery cafés isn’t new, our point of difference is that we make a lot of our products fromscratch on location to guarantee freshness. We are also very innovative in our product range, regularly changing the assortment according to season, in order to give our ‘guests’ – that’s what we call our customers – a surprising taste moment. And, with a lot of personal attention paid to each guest, we’ve seen that people really enjoy spending time at our bakery cafes. If you have a Van Maanen in your neighbourhood, it’s part of your daily ritual. A place to pick up your fresh bread, something for the kids or a special occasion cake, or where you can catch up on the neighbourhood news over a cup of coffee.”

Another major change at the traditional family business was finding a new way of working with employees; by giving them more autonomy. Explains Van Maanen, “This doesn’t mean you give them complete freedom to do what they like – this is often misinterpreted – what it does mean is that you involve them with entrepreneurship and when people are directly involved in business decisions they will have more pleasure in their work and this is carried out in everything they do, also in their interactions with guests.”

Early signs positive

It’s been two years since the changes were implemented, so how are things looking now? “The early signs are positive,” says Van Maanen, “but it often takes some time. This is quite normal, especially the first 3 years after a big change. Turnover-wise it’s been going well, even though keeping costs down remains critical. But we’re already making as much turnover from coffee as from our brown bread. I think the biggest challenge we faced was just to dare to do it, because it takes a lot of courage to do something different,” he says. “Of course, this is harder than it seems – hospitality is a different game than retail; it requires a different mentality and different behaviour - and we, and our people, had to learn to do both. We’ve made mistakes along the way, but I think making mistakes is part of being an entrepreneur. It’s through your missteps that you discover your successes. Innovation is the future, but there is a learning curve involved and that costs money. Still, we have a lot of faith that this will be successful.”

In 2017, the Van Maanens also opened a new style of bakery café in Delft, where baked goods sit side-by-side with inspiring books, homewares, organic produce and cookbooks, and an all-day restaurant where people can enjoy coffee and cake, but also lunch or dinner. This is simply the latest example of Van Maanen’s transformation from “a classic baker to a meeting place where people come together over bread”. Says Van Maanen, “We use this flagship store as a place to test new ideas, which we then roll out to other bakery cafes.” What’s next? “The last few years were all about change and growth and this year is the year of consolidation and organisational optimisation. Other than rolling out our concept further, we have no concrete plans yet.”

QUALITYVAC THE SYSTEM FOR OPTIMIZED PRODUCT QUALITY

With Koenig’s QualityVac vacuum technology, bread, rolls and pastries can be cooled and stabilized for further processing in just a few minutes.

PRODUCTION ADVERTISEMENT

THANK YOU FOR YOUR VISIT AT SUEDBACK 2019!

We set our focus on your product!

Central production facility

So, how does the Netherlands’ largest artisan bakery operate on a day-to-day basis? The company employs 700 employees in the various bakery shops and bakery cafés, 25 office workers, and 80 people in a 6,000 m 2 central bakery in Rijnsburg. Completed in 2005, the Rijnsburg facility is currently operating at 70% of its capacity, producing a large percentage of Van Maanen’s products, including some 2,400 loaf breads and about 7,000 bread rolls and buns per hour, all under the watchful eye of a Director of Production. Van Maanen also employs two product developers, one each for pastry and bread, who are responsible for developing new and seasonal products. Their latest innovations include a range of crispy sourdough buns with no extra additives and a 600 g chocolate babka, inspired by a recent trip to Tel Aviv. But the team also scour Instagram and Pinterest for inspiration, we’re told, looking for trending topics.

Currently, about 60% of total production at the central Rijnsburg facility is fresh, 30% is frozen and 10% is bake-off. The bread production process is largely automated with a “robot

system from Belgium”, which is not only “more efficient” but “prevents strain injuries”. The last piece of equipment purchased for the bakery was an Everbake sourdough installation, “which allows you to make your own sourdough culture”. We chose it because it is dependable with a good price/quality ratio,” says van Maanen.

At the moment, Van Maanen offers 35 bread varieties from loaf breads to stone baked breads, including bread rollls and focaccia, and some 50 types of cakes, cookies and pastries. One of Van Maanen’s biggest sellers in bread is called Duinenbrood , or “dune bread”, a proprietary multi-grain bread made with pure water filtered through the Dutch sand dunes, with 20,000 sold each week. Another unique product that sells by the thousands every week is Van Maanen’s twist on Dutch gevulde koeken (a large cookie stuffed with spijs, or almond paste). And, while the recipe of these traditional cookies is jealously guarded we’re told that part of the cookie production is done at the central bakery in Rijnsburg and delivered frozen, after which it is finished and decorated in the bakery shops, and then baked there.

Largely consumer focused

Of Van Maanen’s 52 bakery cafes, 14 have “100% handmade bread and pastry”, which means that here the bread and pastry are baked on location from freshly made dough. It’s a popular concept that the company intends to continue rolling out in the coming years. And while the bakery cafes continue to be the face of the brand (the web shop is still only generating 4% of turnover), Van Maanen is convinced that online will continue to be increasingly important for future growth.

“We know that people see our shops more and more as a collection point, so if you facilitate online selling, you can still distribute it via your shops,” he says. “I see the online purchasing of basic products as the next big game changer, with people reserving their real-life shopping hours for unique or special products, sold in a convivial environment where shopping is an experience.” Considering that Van Maanen is the Netherlands’ largest artisan bakery, it’s perhaps not surprising that only 20% of the company’s turnover is B-to-B. These clients include wholesaler’s, private label products for specific clients in the bakery sector and to a smaller extent the food service market, e.g. caterers and the hospitality industry. +++

Van Maanen is the Netherlands’ largest artisan bakery, with:

+ A 111-year heritage

+ 52 bakery cafes

+ 1 00,000 customers every week

+ A 6,000 m 2 central bakery

+ 35 bread varieties

+ 50 types of cake, cookies and pastries

+ 7,000 bread rolls and buns produced per hour

+ 2,400 loaf breads produced an hour

www.bakingbiscuit.com 05/2019 PRODUCTION 30

++ Th e company employs 80 people in a 6,000 m 2 central bakery in Rijnsburg

© van Maanen

© van Maanen

Passion for Dough

Perfection

Smooth-running: The experience, knowledge and skill of the baker’s trade shows in every step of each process performed by our IMPRESSA croissant systems. Effortless punching and turning, precise coiling along with fully automated bending of filled or unfilled croissants. The entire spectrum of coiled pastries – perfection and volume production combined. Find out more www.fritsch-group.com

FRITSCH is part of the MULTIVAC group

is when it all comes together.

POLISH PASTRY STAROPOLSKA

A digitized production facility

How can you turn a small crafts business into a medium-sized company? The Polish pastry shop Staropolska answered this question – with comprehensive steps towards digitization and automation.

The result speaks for itself: As the production volume had quintupled since 2008, a new production plant had to be built in 2017. For more than one year, the 250 employees have worked at the new place of business in Bydgoscz. They produce approximately 20 tons of pastries, bakery products and ice cream in three shifts daily. The products are offered in the 40 subsidiaries of the company, but also in the shelves of the customers. “Many of our products here are handmade and this shall stay the same in future, too. That is why our products have an unique character,” says company owner Wojciech Kozlowski.

Staropolska uses state-of-the-art technologies to make this business model economically viable – and the CSB-System as business software plays a vital role. “Back then, we were looking for an industry-specific software to be able to control all processes, no matter whether in Management or on an operational level,” says Kozlowski.

This philosophy originates from the consequent optimization thought of a company, which has to struggle against high raw material prices like many other food producers: Any improvement potential is to be used to render the company more efficient, so that it can produce faster and more costeffectively. Interfaces to a separate production planning system or even several different systems like Acces or Excel in parallel shall be avoided in order not to interrupt the information flow. Therefore, the CSB software is not only

used to order raw materials from the suppliers, but also to manage customer orders, organize the inventory, check the quality and ensure traceability. In addition, the subsidiaries with cash registers are connected to the central system.

A better production planning offers many advantages

Despite all progress, the company does not at all intend to give up its individual production processes, but wants to support them with the help of the software in an optimal way. “We see ourselves as a digitized manufacture,” explains

www.bakingbiscuit.com 05/2019 IT 32

+

© CSB-System

++ When combining the raw materials for production, the employees access the BOMs with their mobile devices and post the required materials directly to the respective production cost center by scanning their bar code

© CSB-System

Right hand model 9840 shown with optional water spray, stacked water splitter, conveyor and MPA auto fill system. SMART SEEDER CALL US TODAY +44 1638 668563 THE TOPPING EXPERTS P.O. Box 748 • Maysville, OK 73057• Telephone (405) 867-4467 • Fax (405) 867-4219 • e-mail: sales@burford.com www.burford.com Unit 4 Sam Alper Court, Depot Road, Newmarket, Suffolk CB8 0GS UK • +44 1638 668563 • e-mail: sales@burford.com

Wojciech Kozlowski. Production for example, basically takes place as before. Due to the short shelf life of the fresh products, exact and current data on orders, raw materials, ingredients, product calculations or quality information are increasingly important.

Through this close interconnection of physical processes with the world of data, the production planning has improved, too. Today, Staropolska is able to plan the use of raw materials, auxiliary supplies and operating materials in an optimal way, thus ensuring that the right raw materials are supplied with the right quality at the right time and at the right machines. In different levels of detailing, the employees plan the optimum sequence with the system. Thus, the orders in the sponge, cream or fruitcake sections can be produced with as few modifications as possible in a consistently high quality.

Therefore, the improvements in planning have a direct impact on the operational processes in the individual sections. “We could significantly reduce the stock on hand in the raw material inventory, optimize production and thus the effectiveness of our company.”

The shop floor is consistently digitized

The concrete advantages of digitization can be seen very clearly in the individual production sections. The CSB Racks are an essential element here. These IT workplaces for automated data capture are installed at important points such as dough production. If for example, a new production order is started, the recipes are transferred to the racks in Batch Processing and processed precisely. When the individual raw materials are weighed, the weight data of the scale are

directly transferred to the system. Thus, processing errors previously resulting from the “manual” reading of the scales are practically excluded. This ensures a high reproducible product quality and minimizes losses due to wrong weighing. Subsequently, all semi-finished and finished products are weighed and labeled at the racks in order to be able to quickly identify them later and trace them if necessary.

The transition to digital data capture lead to considerable improvements in the inventory and picking, too. Today, mobile end devices are used where previously routing slips existed. The delivered raw materials are scanned at Receiving and posted to the inventory after their successful quality check. When combining the raw materials for production, the employees access the BOMs with their mobile devices and post the required materials directly to the respective production cost center by scanning their bar code. In picking, the employees are given the optimum picking and loading sequence on their MDE devices.

Digitization enables more than just fast success

Staropolska is a good example for how digitization starts on a small scale and entails more than just fast success as it keeps bringing the company further advantages. The fact that today, all data are captured and processed digitally, is not only more efficient, but enables Wojciech Kozlowski to make evaluations that are more precise. Therefore, the investments were worth it and are a blueprint for the future according to the managing director. “We intend to build a new bakery as the current one has become too small in the meantime. In the new plant we will refer to the CSB software, too.” +++

www.bakingbiscuit.com 05/2019 IT 34

++ When the raw materials are weighed, the weight data of the scale are directly transferred to the system

++ All semi-finished and finished products are weighed and labeled at the racks in order to be able to quickly identify them later and trace them if necessary

++ The delivered raw materials are scanned at Receiving and posted to the inventory after their successful quality check

© CSB-System

© CSB-System

© CSB-System

ITS ALL IN THE FAMILY we make