11 minute read

Market recovery in the Middle East

Global oil and gas markets are accustomed to the highs and lows of economic cycles, but the slump triggered by the COVID-19 pandemic was unprecedented and hit all parts of the oil and gas supply chain. Fuel consumption and oil demand plummeted, prompting the OPEC+ nations to reduce production and global upstream operators to defer projects worth US$170 billion from 2020, and US$135 billion from 2021.

Now that oil prices and activity are picking up again, the projects that were delayed in 2020 and 2021 will be critical to the recovery. Global upstream projects with a greenfield investment value of US$545 billion are expected to be sanctioned between 2021 and 2023. The Middle East, with projects worth US$110 billion aimed at developing 38 billion boe, will be crucial to this global recovery phase (Figure 1). This article will take a closer look at the status of major projects in the region scheduled over the next couple of years.

The Middle East has re-emerged as one of the most appealing regions for suppliers, with Middle Eastern nations such as Qatar, the United Arab Emirates (UAE) and Saudi Arabia keen to boost their oil and gas production capacity. The rebound in oil prices is also expected to spur more sanctioning elsewhere in the region, most notably in Turkey, Oman, Iraq and Iran (Figure 2).

Qatar

Qatar has maintained its crude oil and gas production levels, even though it has been narrowly overtaken by Australia as the world’s top exporter of LNG. The country is further developing its giant North Field by kicking off projects such as Qatargas’s North Field Expansion (NFE) to boost its gas output from 158 billion m3 in 2021 to a target of 220 billion m3 in 2030.

Qatar aims to lift its LNG capacity to 126 million tpy from the current 77 million tpy through two phases of the NFE project (Figure 3). The recently sanctioned first phase includes four new liquefaction trains to raise the capacity to 110 million tpy, with the remaining capacity coming from the two-train second phase, which is currently at the FEED stage. Key facility work for the first phase of NFE is divided into four main packages: � Package 1 for building the four liquefaction trains was awarded to a consortium of Chiyoda and France’s TechnipEnergies in

February 2021.

� Package 2 for LNG storage tanks, associated pipelines and expansion of loading facilities went to Samsung C&T in

March 2021. � Package 3 for pipelines and utility facilities at the terminal was awarded to Tecnicas Reunidas in August 2021.

Qatar Petroleum has also invited ExxonMobil, Chevron and ConocoPhillips to form a joint venture for the NFE project. Qatar Petroleum is pushing ahead with the second phase of NFE to take advantage of the field’s low breakeven prices and is currently finishing up the pre-qualification process for the initial tenders for offshore jackets. Rystad Energy expects the second phase to get approval in 2023. In addition to NFE, Qatar has also announced further phases of the North Field Sustainability project, worth over US$6 billion, with an award due later in 2021. These developments aim to sustain current gas production levels from the North Field. The first two phases, worth more than US$3 billion, were awarded in 2019 and 2021 respectively. Furthermore, Rystad Energy anticipates a greenfield investment of US$1.7 billion before 2023 in new oil projects, including Idd El Shargi phase V and the third phase of the Gallaf development. The latter project is aimed at maintaining output capacity from the Al Shaheen oilfield at 300 000 bpd at a cost of US$1.37 billion, and was kicked off in July 2021 by operator North Oil Co. The US$340 million first phase of Gallaf was awarded in 2018, followed by the US$240 million second phase the year after. Apart from Gallaf, Rystad Energy estimates that the other developments are scheduled for between 2022 and 2023.

Figure 1. Global final investment decisions 2021 – 2023 by region.

Figure 2. Middle East greenfield investments by country and approval year, 2021 – 2025.

UAE

The UAE aims to boost its oil and gas output and has scheduled projects worth approximately US$23 billion in greenfield investments from 2020 – 2023 (Figure 4). Approximately 85% of this investment is planned for projects involving sour oil and gas fields.

The Upper Zakum Phase 2 expansion and the Lower Zakum long-term development projects (LTDP) are two of the most significant sour oil field projects. The two projects are worth US$6.5 billion and US$2.8 billion respectively, and are expected to be approved in 2023.

Among the biggest sour gas condensate field projects are Dalma (US$1.6 billion) and Umm Shaif gas cap (US$1.8 billion). Dalma is approved in 2021; Umm Shaif is projected to be approved next year, and the long-delayed Hail & Ghasha, worth US$12 billion, with approval currently expected in 2023. Hail & Ghasha is the largest sour gas project being carried out in the Middle East, with resources of 1.3 billion boe.

All of these gas projects assume an oil price range of US$55 – US$80/bbl. Even with a breakeven gas price of US$5 – US$6/thousand ft3, a steady pricing environment has opened the path for these projects to be scheduled from 2021 – 2023. However, as Abu Dhabi’s national oil company, ADNOC, is pushing ahead with a tender for revised FEED for Hail & Ghasha to reduce costs, the project could face further delays in the engineering, procurement and construction (EPC) stages and approval timeline.

The UAE’s greenfield investment total in 2021 will be nearly US$4.3 billion, mostly comprised of the Shah sour gas debottlenecking project, the Al Dabbiya and

1 . 877 . PDC . DRILL

THE GOLD STANDARD

Belbazem oil developments and the Jebel Ali gas project. ADNOC seeks long-term collaboration with contractors to realise capital and efficiency gains and, as a result, there is a rise in joint FEED-EPC agreements being witnessed. ADNOC has inked accords totalling US$204.4 million with nearly 15 international engineering contractors for concept and FEED projects, which will support the company in achieving its 2030 goals. During the first phase of the award, in August 2021, ADNOC signed agreements totalling US$1 billion with eight engineering contractors for planned FEED work over a 5-year period, with an option for a 2-year extension.

Figure 4. UAE greenfield investments from 2020 – 2023 and new supply additions.

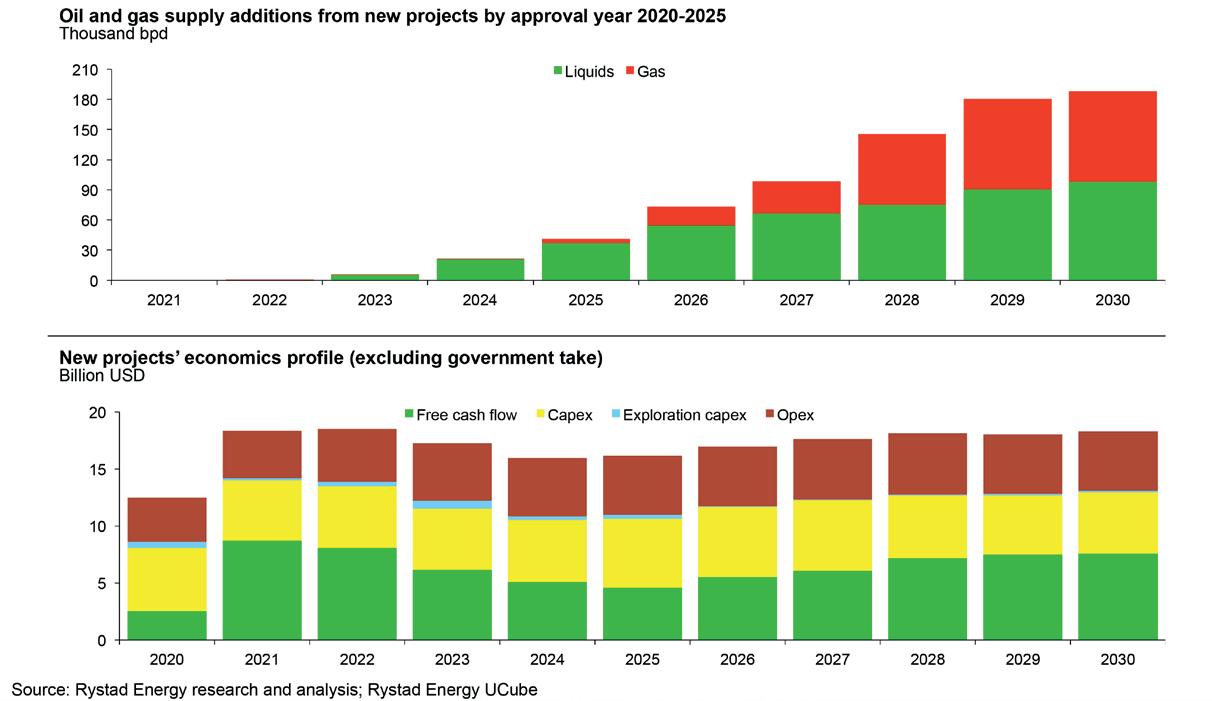

Figure 5. Saudi Arabia oil supply additions from new projects by approval year, 2020 – 2025.

Figure 6. Production and economics outlook from Zuluf Expansion Project.

Saudi Arabia

The key development in Saudi Arabia is the Saudi Aramco-operated Zuluf oilfield – a US$10 billion project aimed at expanding the country’s oil-processing capacity by 600 000 bpd (Figures 5 and 6). After garnering contractor interest in 2019, Saudi Aramco was expected to begin the tendering process in March 2020, but this has been postponed again. Rystad Energy now expects project approval will be moved to 2023, with potential field start-up in 2027.

Another significant project is the Jafurah tight gas field, announced by the Saudi government in 2020, with a total price tag of approximately US$110 billion. The state operator cancelled all key tenders during 2020’s price slump in a bid to reduce costs by revisiting the work scope to use existing facilities. International onshore contractors are vying for numerous EPC packages under the umbrella of the Jafurah unconventional gas development project. Bids for up to five EPC packages have just been filed with Saudi Aramco, which expects to award contracts for the mega-project in 2021.

Iraq

Iraq intends to increase domestic oil output while decreasing its reliance on imported gas. Most of the projects seek to raise oil and gas output from Iraq’s main fields. Rystad Energy forecasts a total investment of US$5.5 billion in greenfield projects from 2020 through to 2023, evenly split between oil and gas-condensate projects. Among oil projects, prominent developments include the Ratawi oilfield redevelopment project and early development of the Eridu field, both with approval estimated in 2023. The key gas-capturing projects at West Qurna-2 phase I and Majnoon phase I are also in the pipeline to be approved around 2023.

Iran

Despite US sanctions, Iran aims to enhance its oil export capacity. Iran’s oil exports have dropped after the US reimposed sanctions 3 years ago as former President Donald Trump abandoned the 2015 nuclear deal between Iran and leading world powers. However, in early 2021, Iran and other countries started talks to resurrect the nuclear accord and have had several rounds of negotiations that have yet to be concluded. Iran is confident it will be able to recover to pre-sanction oil output levels if US sanctions are eased.

Iran has scheduled projects valued at approximately US$7 billion in greenfield investments from 2020 through 2023. Almost 80% of this investment will go into sour oil fields, with the remaining 20% going towards gas field projects. The most significant oil project is the redevelopment of the Azadegan South field, which is expected to be approved in 2023. Among gas projects, Farzad B phase 1 (x-Farsi) was approved in May 2021 and is estimated to hold original reserves of

approximately 800 million boe. Rystad Energy estimates the field’s gas production plateau to be approximately 9.34 billion m3/y.

Rystad Energy expects Iran’s greenfield investment to total more than US$3 billion in 2021, led by the Farzad B phase 1 (x-Farsi) project, the Ahvaz development and the Sepehr/Jufair phase 1 oilfield redevelopment.

Oman

Oman is continuously working to boost its oil and gas capacity, using both new development projects and considerable work on enhanced oil recovery (EOR) technologies to squeeze all economically viable drops of hydrocarbon from its fields and reserves. National player Petroleum Development Oman (PDO) has become a global pioneer in EOR due to its mature asset base in Block 6 and the complexity and challenging nature of Oman’s geology. Thermal, chemical and miscible high-pressure gas injection are the three primary EOR technologies now in use. PDO expects that by 2030 around 36% of its production will come from EOR projects. Among new developments, Rystad Energy forecasts a total of US$930 million in greenfield investments between 2020 and 2023, almost 90% of which will be oilfield projects (Figure 7). Bisat stations B and C are the most significant, with approval dates in 2020 and 2021 respectively. Figure 7. Oman’s production and economics outlook.

Turkey

Turkey strives to enhance its oil and gas production output and has projects worth more than US$3.5 billion in greenfield investments planned from 2020 – 2023. The nation’s Sakarya gas project in the Black Sea is the most significant project under the operatorship of state-owned Turkish Petroleum (TPAO). Sakarya was discovered in 2020 and is projected to have around 400 million boe of original reserves. In addition to engineering and procurement, TPAO is conducting an appraisal and exploratory drilling programme to firm up Sakarya’s resources and locate additional gas fields. The field is projected to have a substantial impact on Turkey’s imports of gas from Russia and the Caspian area. The project was approved in September, and Rystad Energy estimates more than US$1.5 billion in greenfield investments from 2021 – 2023.

EPCI contract awards in the Middle East

As operators prepare to meet aggressive energy targets, mega-projects are returning to the market, providing EPC vendors with an opportunity to reload their order books (Figure 8).

The Middle East’s revenue contribution to EPC firms has expanded considerably over the years, with 40% of 2020 revenues for key engineering, procurement, construction and installation (EPCI) players coming from the region, particularly Saudi Arabia, the UAE and Qatar (Figure 9). A similar pattern is expected to continue in the future, with the Middle East accounting for a sizeable share of backlogs and bid pipelines.

Conclusion

The COVID-19 pandemic slashed crude oil consumption and hit the economies of oil-exporting countries in the Gulf region, but it did not damage the foundations of the Middle East’s oil and gas sector. As the market recovery continues, Rystad anticipate several significant E&P and EPC projects across the region will get the go-ahead – QatarGas Trains 8-11, for example, is the largest project greenlighted internationally this year. Even as the shift to sustainable energy gains traction and peak oil demand approaches, the Middle East’s economies will remain inextricably linked to the oil and gas sector.

Figure 9. Revenue contribution from the Middle East for major EPCI players.