BEYOND PREPARED

to keep your operations running

In today’s oilfield, the status quo isn’t good enough anymore. Oil and gas companies must be more efficient than ever before, eliminate downtime at every possibility and be ready for anything that can affect productivity. At Cudd Well Control we are beyond prepared with the industry’s leading experts, a broad portfolio of advanced well control services and the latest technology-driven equipment to keep production flowing. Whatever the challenge, wherever the location, we are ready with the next generation in preventive, critical intervention and recovery services.

Call us today to ensure you are beyond prepared. cuddwellcontrol.com

Martin Findlay, KPMG, UK, reviews the current state of the oil and gas sector operating across the UKCS, and discusses the industry’s journey towards net zero.

he oil and gas industry has recently contended with a series of extremes. After a run of years absorbing heavy financial losses, the pandemic caused demand for oil and gas to effectively dry up. Then, the global COP26 summit in November 2021 put further pressure on the industry to accelerate plans for transitioning to a greener future.

At the start of this year, rising gas prices were exacerbated by the war in Ukraine, and were driven by a combination of strong demand from China, as well as Western oil majors cutting back on exploration and production.

The Energy Transition Survey, one of the Aberdeen and Grampian Chamber of Commerce’s flagship pieces of research, which KPMG UK sponsors, has followed Scotland’s energy sector through these ups and downs, but never has so much changed so quickly in such a short space of time.

The survey, which launched its latest findings in May 2022, says that for now the good times may be back, but there are some important caveats to be aware of to get the full picture of where the industry operating in the North Sea currently sits.

The research shows that the value of international work is rising across all sectors, and confidence has rebounded, with 84% of energy firms believing their revenues will grow in 2023. There are positive indicators for the transition as well. Concern about the return on investment from renewables is falling, which bodes well for the future, and companies here now believe that almost half of their operations will be outside of oil and gas by 2030.

The skills gap remains a big issue

A big concern of companies operating in the North Sea is access to skills and labour one of the most important pieces in the energy transition puzzle. There is so much about the energy sector that is different to other parts of the economy, but when it comes to human capital, the sector faces similar headwinds to almost every other business in the world right now – the skills and talent needed to move us towards a greener future are in sharp demand.

The firms surveyed by KPMG are clearly concerned about how to attract new people from outside the industry to work in oil and gas. The firms who can demonstrate their willingness to embrace the energy transition and their desire to flourish in the economy of the future will find that retaining and attracting talent will not be as challenging.

Workers are as precious a commodity as the energy they produce Skilled workers have again become almost as precious a commodity as the energy they produce. KMPG’s latest research suggests this problem is only going to become more acute. There has been a 16-percentage point increase in the loss of staff to other oil and gas basins globally, suggesting that the battle for workers has become an international one.

10 |

| 11

At the same time, seven out of ten firms say they will need to grow their headcount over the next three years to cope with an increase in work. Something must give. Following the decline in production seen in the UK Continental Shelf (UKCS) over the last decade, it seems odd to be talking about labour shortages. But the data clearly points in this direction and history tells us that this has potential to inflate wages and put pressure on costs. In the case of oil and gas, this is bad news in what is already a mature and expensive basin.

Careful planning and investment at a corporate and government level are needed to make sure Scotland’s decades of experience, the current skill sets, and existing infrastructure are used to their full potential as we move towards a greener future. Doing so will allow key cities such as Aberdeen to prosper as a major player on the global energy stage and continue its long tradition as a powerhouse for the local and UK economies.

Change is afoot

Clearly the perennial issue of climate change is not going away, and change must continue to happen. The industry is leading on that, and understands that it has the potential to grow Scotland’s economy and be a driving force in facilitating the transition to a lower-carbon economy and a net zero future.

The direction of travel is clear amongst oil and gas firms. They are expecting their businesses to transform substantially and at pace across the next decade. The firms KMPG surveyed predict that, on average, the share of their business outside of oil and gas will jump to 50% by 2030. With growing demand to support North Sea offshore wind development via leasing rounds, as well as traditional decommissioning projects, the work will continue to grow and vary.

The clock is ticking

Despite the clear need for companies to transition faster, the survey shows that more than a third of companies have yet to develop a net zero strategy.

Most across the sector are diversifying outside of oil and gas in some shape or form, although one in five still have no plan to change. Most pure play oil and gas exploration and production companies are addressing their own carbon footprint. But for those without a blueprint for transition, and where external stakeholders are increasingly looking for substantive transition plans, the clock is ticking.

Individually firms must ensure they remain focused on the long-term objective. This will allow firms to succeed, workforces to grow, the economy to benefit, and the planet to thrive.

What companies do now across the three strands of environmental, social and governance (ESG) will determine the talent they attract, the customers they serve, the profits they make, and ultimately the impact they will have on society.

What comes next?

Given the very real consequences of global warming, it is clear we must inject pace and clarity into the energy transition. It has become increasingly obvious that there is a need for clearer regulatory alignment between the UK and Scottish governments. Only 28% of firms surveyed believe support for an energy transition is visible, and this lack of clarity needs to be tackled urgently.

Delivery of offshore wind, for example, is a long and complex process. However, we must do all we can to speed this up. ScotWind an auction of seabed plots for major offshore wind

projects around the Scottish coast which netted £700 million earlier this year will be crucial to Scotland’s net zero targets. Consideration should be given to a new offshore wind directorate to speed up delivery of this and other offshore renewables projects, given the complexity around sequencing, supply chains, and the number of stakeholders involved.

The ScotWind leasing auction attracted more than 70 bids from major oil companies, utility firms and investment funds from around the world. Most of the sites are on the east, north east or northern coast, with just one on the western side of Scotland.

Successful bidders include Scottish Power, which won the seabed rights to develop three new offshore wind farms with a total capacity of 7 GW. The farms include two new floating projects in conjunction with Shell and one fixed project.

The seventeen successful projects cover a total of 7000 km. 2 They have a combined potential generating capacity of 25 GW well above the expected auction outcome of 10 GW.

Scotland has 1.9 GW of operational offshore wind, and another 8.4 GW in construction or advanced development. While these leasing rounds are welcomed, it will be some time before these come online.

Windfall tax

Meanwhile, in the UK, a new windfall tax was introduced earlier this year, described as a 25% Energy Profits Levy. It applies to profits made by companies from extracting UK oil and gas and the Treasury expects it to raise about £5 billion in its first year.

When the Energy Profits Levy was announced in May of this year, it included an Investment Allowance which made energy companies eligible for tax savings worth 91p in every £1 on investments in fossil fuel extraction in the UK. Even though only temporary, the new levy means UK energy companies, which have been taxed higher than any other sector since the 1970s, now face a larger tax burden.

When tax on energy companies was last increased under previous chancellorship, the appetite to invest in the UK energy sector reduced. The UK Government will not want to see the same thing happen again, at a time when energy security and funding the energy transition are front and centre of the political agenda –hence the inclusion of an 80% investment allowance in the levy.

Many in the oil and gas industry feel strongly that this latest tax could make the North Sea – already one of the world’s most mature basins less attractive to some investors and possibly put recruitment at risk.

Various players across the industry are calling for politicians to take a pragmatic view and be wary of the impact that short-term tax policies and continuing doubts over the future of exploration and drilling will have on investment and confidence in a sector that is of critical importance to our economy.

A bright future ahead as transition feels certain

The oil and gas industry is in a strong position overall. Producers and companies throughout the supply chain remain committed to the transition but individually they must remain focused on the long-term objective. That is the only way firms will succeed, workforces will grow, and the planet will thrive.

Keeping both eyes firmly on the future will allow those operating across the UKCS to prosper as major players on the global energy stage and continue the region’s long tradition as a powerhouse for the local, UK, and European economies. The test that firms are facing now is how firmly to keep the pedal pressed to the floor on the journey to net-zero.

12 | Oilfield Technology Autumn 2022

For more information, please contact: ben.macleod@oilfieldtechnology.com Advertising with us Learn more about our advertising opportunities • Brand exposure • Lead generation • Premium packages

Bhavesh Ranka and John Hatteberg, Cudd Well Control, USA, describe the advantages of automated cloud-based audit programs over more traditional manual methods of wellhead inspection.

14 |

The oil and gas inspection industry operates according to stringent standards that strive to keep equipment running efficiently while maintaining workplace safety. Oil and gas companies demand a low failure rate to stay profitable. Their assets, however, are subject to heavy use and are constantly exposed to the elements. Therefore, one of the most important steps a well owner can take is to visually check the wellhead and the surrounding area to detect potential issues before they become problems. Typically, trained technicians conduct these wellhead inspections to detect welding flaws, corrosion development, and cracks. However, previously they have had to rely on spreadsheets to note any findings, then write a report, and send it to the operator. This approach has proven to be time-consuming and can easily lead to human errors, both of which can negatively impact operations.

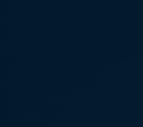

To help address this challenge and aid operators in increasing the efficiency, traceability, and accuracy of their wellhead audits, Cudd Well Control has launched a fully automated wellhead audit tool that can help save operators time and money. The new wellhead audit platform is an efficient tool that allows operators to inspect the surface of a wellhead faster than traditional pen and paper methods while helping to identify any problems with corrosion, valve functionality and pressure. As a cloud-based solution, the tool can provide customers with advantages when conducting wellhead audits.

Streamlined software

The wellhead audit tool is a streamlined system that enables users to inspect and write wellhead audit reports in under an

| 15

hour as opposed to what used to take several days to complete. Engineers can conduct these audits onsite with an iPad or tablet, enter the data, and the program will create customised,

immediate reports. For customers with wells in remote locations, the platform allows them to complete more audits in a day and access that information immediately.

Since the size and scope of each operator’s assets can vary, the platform was created to be flexible in order to meet customer needs based on their data/well count. Inspectors see the well condition immediately on one platform instead of having to go to multiple resources or sources. This new solution is based on API standards with all findings uploaded and shown on a customer’s wellhead audit dashboard that is accessible 24 hours a day. As security of information is always a critical issue, the platform features a private and secure portal where users access the information via a login name and password protected interface. The site administrator can add or delete user access as needed.

Digital solutions: a new chapter for the oilfield

With the industry adopting more digital solutions, wellhead audit tools are the next step at the oilfield. Customers can go online via a private portal and review all the data, results, maps, recommendations, print reports and more. Currently, this is done by hand and with an excel spreadsheet. Using the platform, users can pull up every inspected well in their region and see the visual inspection data and status. The interface graphically displays what is nearby the wells, such as schools, residences, pipelines or rivers – anything that needs to be considered when taking steps to conduct remedial activities on the well. Users are provided with a map view of the wells, which are identified with their status coloured coded in green for ‘all good,’ yellow for ‘caution,’ and red for ‘requires immediate attention.’

Users of the platform can also look at the history of the wells and see how they have been treated over time. This advantage also extends to companies considering buying a well or a series of wells, as it confirms what condition the wells are actually in. The tool features pop up details of the wellhead including its overall condition and details on any potential issues or problems that need to be addressed, such as corrosion or a valve not functioning. To provide comprehensive information, the software provides historic data from previous audits. These findings are further supported by photos as well as comments from the auditor. When the audit report is completed, an email is sent to the customer with a link to the portal.

Identifying which wells to address first

Operators must constantly work according to budgets and schedules. With this tool, problem wells go to the top of the risk matrix, allowing operators to deduce which wells to take care of first, so they can keep production flowing. The condition of the wellhead dictates what takes priority – repairs or remedial work. As a result, operators can quickly

16 | Oilfield Technology Autumn 2022

Figure 2. Map view of wells and API number on the right hand table.

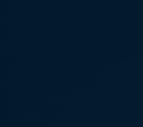

Figure 1. Wellhead images taken during an audit and a schematic drawing to the right, displaying that all components of the wellhead have passed the audit and are in good condition.

Figure

3.

A closer view of the map with the well icon defining the well type, such as production or storage.

take preventative measures to avoid further issues and possible catastrophic events, preventing injuries whilst also saving time and money.

Assurance for the insurance industry

Older wells represent the biggest liability insurance companies can face when underwriting wells. Often, these companies do not have the accurate information needed to make the decision on which wells to underwrite and which wells to pass by. To address this, the wellhead audit tool has access to the API 10 numbers database. So, if an underwriter has wells to underwrite, they input the wells’ 10 API numbers and the tool goes to that database to see the age of the wells, how deep they are, the types of wellheads used, the well types, and much more. With this vital information, insurance providers can make the right decision on which wells to underwrite.

Asset protection

Figure 4. Problem wells go to the top of the risk matrix, allowing operators to know which wells to focus on first.

Oil and gas wellheads provide the structural and pressure-containing interface for drilling and production equipment. Ensuring all equipment at the wellhead is in working order is key to remaining online and productive. When wellhead equipment fails, the cost can be incredibly high both from an environmental perspective and from the time and expense it takes to remediate any failure. For those reasons, operators need to be consistently proactive about conducting wellhead inspections.

Wellhead audit tools help operators ensure that assets, equipment, and related componentry at the wellhead remain free of defects and damage. Users benefit from a combination of software development expertise and asset protection. Whether operating 10 wells, 100 wells, or more, this automated solution allows operators to inspect larger quantities of wells faster and more accurately, so they can strengthen their well control barriers, avoid incidents, and enjoy safer and more reliable operations.

Keep up to date with us to hear the latest in upstream oil and gas news Stay informed www.oilfieldtechnology.com

n upstream process plant collects production data from many different wells, sometimes hundreds. A general concern among oil and gas field operators is reducing their oilfield factors. This is the percentage between the production of the surface facility and the actual reporting from wells. It is not only because oil and gas are limited resources, but they are also crucial for financial and technical reasons. Wells do not always behave as operators expect. It is important to close the systematic gap between actual and planned production. Yet, no technology is available that completely solves this problem which causes companies to lose money.

Once a day, operators usually close the balance and compute the production of each oilfield facility. In the process, they estimate the flow that each well, reporting to that facility, has contributed. The proportion between the production of the surface facility and the wells reporting to it is the ‘oilfield factor.’ In oilfields with low levels of instrumentation, well measurement methods, and control

Gustavo Cerezo, Yokogawa, and Federico Neira & Lucas Nieto, KBC (A Yokogawa Company), Argentina, describe an approach for precise well measurement in order to reduce losses and meet production goals.

18 |

| 19| 19

mechanisms, the factor may vary between 0.75 and 0.9. Most of the variations are due to ‘non-localised losses,’ where operators have yet to locate the reason for the loss.

A combination of Yokogawa hardware and KBC software was tested at a major Argentine upstream facility to provide an approach for operators to frequently and precisely measure wells reducing non-localised losses. This solution identifies the

wells that are bad or good actors in a timely manner so operators can act accordingly. The result is that they are able to meet production goals and save money.

The proper operation of an upstream oilfield for accounting and planning purposes includes a systematic activity called ‘well testing.’ A well test is simply a period during which the production of a well is measured, either at the well head with portable well testing equipment, or in a separation facility. Nowadays, well-test measurement mechanisms are complex, expensive, and sometimes inaccurate. This procedure is executed with tanks or separators (two-phase or three-phase, depending on the wells’ characteristics).

Well testing is associated with two key challenges:

Ì High CAPEX: the number of wells far exceeds the available testing facilities.

Ì High OPEX: a well test is expensive and time-consuming so assessing a well may only occur once every several weeks or months.

Therefore, well testing needs to follow a set schedule but results in the following issues:

Ì Daily production estimates are based on flawed information.

Ì Testing schedules are determined with imperfect information.

Ì Downtime estimates are unreliable.

Ì ‘Non-localised’ losses can go undetected.

In 2019, Yokogawa and a major Argentine upstream operator agreed to conduct a pilot project using existing hardware and software technology to allow, through a real-time solution, improvement in procedures associated with production allocation, downtimes estimation, well testing assistance, and non-localised losses estimation.

To complete the proof of concept (POC), the operator made available a battery with 10 wells located at a major oilfield in a western province of Argentina as shown in Figure 1. The solution was developed using two technologies; firstly KBC’s Visual MESA® -Production Accounting (VM-PA), and secondly Yokogawa’s ROTAMASS TI – a Coriolis type meter (Figure 2) which excels in measuring multiphase flows very accurately even with large quantities of gas present.

The solution aimed to achieve the following objectives:

Make production data available to corporate accounting systems in near real-time.

Allow operators to quickly identify inefficient ‘bad actor’ wells, detect differences, and respond accordingly.

Improve the well testing process in terms of frequency and scheduling to reduce CAPEX and OPEX.

Calculate downtimes more accurately.

During the following years, information was collected to build the solution while the operator installed three Rotamass meters in certain lines. These lines were chosen based on their position to achieve the expected results of the pilot, as shown in Figure 3.

The solution

The solution ran autonomously and allowed manual interaction. Data was collected and stored in the local historian. Then, the algorithm evaluated the data in

20 | Oilfield Technology Autumn 2022

Ì

Ì

Ì

Ì

Figure 1.

Oilfield study location.

Figure 2.

Rotamass meters installed.

near real-time and generated results such as oilfield factor, downtimes per well, adjusted production per well, deviations, and bad actor wells. Results appeared through dashboards, data tables, and reports in the system’s web interfaces as depicted in Figure 4.

The solution produced the following main outputs: daily production closure (Figure 4), an ordered list of wells to be measured at high frequency through the Rotamass meter on the test line, and an ordered list of wells for conventional testing (Figure 5). As a result, the solution achieved higher quality and more timely data available for more efficient accounting and planning. Using these ordered lists as a guide, the operator can now guarantee the quality of the data through a prioritised well test schedule.

The following factors have been agreed upon as key success indicators (KSI) of the solution.

Identifying bad actor wells that affect the plant

On a near real-time basis, the system generates two lists of bad actor wells, which should be sent for high frequency testing through Rotamass control, and conventional control through a three-phase separator. In normal operation, the system sends wells to Rotamass for high frequency testing according to this ordered list. When the system detects an abnormal state, the second list should be considered to help prioritise the schedule and reduce the frequency of conventional controls. As the system successfully maintains an ordered list of suspicious wells, the KSI is achieved.

Reducing production deviation below 10%

By using the solution alone, a more accurate calculation of the oilfield factor was possible. It is possible to further reduce this deviation by frequently controlling the wells using Rotamass as per the solution’s recommended ordered list and feeding the data back into the system.

Measuring liquids despite significant presence of gas

The Rotamass meters operate normally, even though 40% of the volume is gas.

The solution is prepared for estimating downtimes in at least three different ways depending on the available information and the oilfield’s automation level. The selected oilfield ran the three methods simultaneously for comparison.

Conclusions

The implemented solution allows for near real-time calculation of well downtimes in at least three ways, depending on data availability and technical conditions of different batteries. Despite the presence of gas, the implemented solution can calculate production values and allocate the production of individual wells. Detecting bad actors quickly and remediating them reduces their losses and impact.

Since various downtime estimation methods successfully underwent testing, this same system can connect to other, less automated collectors. CAPEX costs can decrease as the demand for two-phase and three-phase separators decreases, allowing each to serve more wells, while operating the conventional control less often reduces OPEX. More accurate daily accounting for planning and finance improves decisions about well operations and reduces losses due to missing production. A preliminary study is useful for other less automated batteries with no operating status information, as the average logarithmic temperature difference has demonstrated satisfactory accuracy as an empirical factor for the application of the downtime algorithm.

Autumn 2022 Oilfield Technology | 21

Figure 4. Daily production closure dashboard.

Figure 5. Main operational outputs dashboard.

Figure 3. Representation of the selected battery.

anaged pressure drilling (MPD) and wired drill pipe (WPD) can significantly improve the identification and management of downhole events while augmenting surface automation and wellbore visualisation.

While MPD has been recognised for some time, the industry has since undergone changes both commercially and technologically. Initially offered as a third-party service, MPD has started to shift towards an integrated service offering of the rig contractor. One of the more significant technological improvements is the embedding of hydraulic models to automatically operate the MPD choke, removing humans from the control loop. Although MPD has become more sophisticated with time, there is still more value that can be derived from its use.

MPD and WDP improving MPD workflows

Fingerprinting is an essential task performed before the start of an MPD section. Online hydraulic models are calibrated against measured downhole conditions to mitigate the compounding effects of instrument resolution error and rounding errors. In more conventional approaches, as shown in Figure 1, the crew inputs configuration data and live instrumentation data into the hydraulic model. The crew then corrects the model to match the measured pressure from the pressure-while-drilling (PWD) system data. This process can take anywhere from several hours to more than a day. Over time, the cost of fingerprinting the well before an MPD section can be significant.

NOV is working to solve this problem by incorporating WDP into an optimised MPD workflow, enabling high-speed electronic downhole telemetry data to calibrate the hydraulic model (Figure 2). Incorporating WDP data into the model calibration sequence allows the system to capture and transmit data faster, particularly during low or zero flow steps where conventional PWD telemetry systems stop transmission. This approach enables the rig to spend less time in low or zero flow states to capture and transmit data to the surface. Notably, although the online model accounts for downhole conditions, the model is based entirely at the surface, and once calibrated, relies exclusively on surface-acquired data.

WDP availability also enables new operating modes to supplement contemporary MPD workflows. Electronic telemetry of WDP downhole tools provides a reliable signal

22 |

Jessica Stump and Austin Johnson, NOV, USA, discuss how optimised workflows can help improve choke control and downhole event detection and consider how the MPD-WDP combination is boosting the industry’s move towards autonomous drilling.

| 23

through the pump ramp transient period. This means that MPD connections may be simplified using a high-speed sampling of WDP downhole tools with measured downhole pressure feeding the choke controller directly, adjusting for time delays and depth offsets (Figure 3). Downhole pressure may be extrapolated from a single measurement and corrected with the assistance of the hydraulic model. This feature enables the choke to control directly from a sensor at or near the zone of concern rather than a sensor located up to five miles away.

WDP enabling downhole event detection

Coupling online hydraulic modelling with WDP presents significant advantages through downhole event detection in operations with MPD and WDP or in WDP standalone operations. One of the major drawbacks of contemporary event detection technology is that the data flowing into an algorithm is surface-acquired or single-point time delayed low-frequency data. Any alarms or automated functions are triggered with very limited direct knowledge of downhole conditions. While estimated hydraulic

model data closely matches measured downhole data under normal conditions, actual downhole conditions may not match the model during contingency events.

Surface-based models may not match real downhole conditions during an influx if the gas enters the solution. A contemporary kick detection system will detect the influx when the flow out the well exceeds the flow coming in. In the solution gas case, however, the gas volume may not displace significant volumes of drilling fluid from the well, limiting the effectiveness of conventional kick detection systems. The entry of the solution of gas into the mud may continue undetected for several minutes until the gas saturates the mud and displaces it or the gas in the mud reaches the bubble point pressure.

Surface-based models may also not match real downhole conditions during a wellbore stability event. In a wellbore stability event, insufficient wellbore pressure may cause compressive failure of the wellbore to occur. Material from the borehole wall collapses into the well and is circulated out with the cuttings. The collapsed material has the same effect on average fluid density as cuttings do, leading to a cuttings load that is higher than modelled. The model only accounts for drilled cuttings; no such corrections are applied for collapsed material, and no surface change is immediately seen after a partial collapse. Kick detection systems are not designed to detect wellbore stability events; the value of a flow-out flow-in comparison is diminished because the volume of the collapsed material matches the void left by the collapsed material. Mass balance tools such as a Coriolis return flow meter are ineffective because the collapsed material is located downhole and is not detected until it is circulated to the surface.

Curiously, wellbore stability events can occur undetected in self-perpetuating cycles. Low wellbore pressure, the root cause of many wellbore stability problems, results in mixing collapsed

Figure 1. Conventional MPD workflow. Download technical white papers for free from companies across the upstream industry Review new trends and technologies www.oilfieldtechnology.com/whitepapers/

material with cuttings, increasing the average fluid density. The increased average fluid density temporarily mitigates the cause of the wellbore stability problem. Eventually, the collapsed material is circulated out of the well undetected, and the initial condition leading to the wellbore stability problem returns; the cycle repeats undetected while wellbore quality deteriorates.

Both in kick events and wellbore stability events, even the most accurate drilling models using surface-acquired data may not truly reflect downhole conditions.

Combining WDP with MPD in a downhole event detection system significantly improves the rig crew’s visibility of subsurface events. As with contemporary systems, an online hydraulic model estimates drilling variables along the drillstring using surface-acquired data. The WDP enables the system to take measurements of the actual drilling variables along the drillstring. The downhole WDP measurements represent the downhole conditions as they are, whereas the estimates from the hydraulic model represent the downhole conditions as the rig control system can observe. This allows the downhole event detection system to directly compare measured values to expected values; a mismatch indicates an unexpected event or deteriorating downhole conditions, as shown in Figure 4.

In the solution gas kick case, the downhole event detection system may compare measured vs expected temperature along the string for early indications of a kick. Gas mixing heats or cools the drilling mud in unexpected ways. Comparing the measurement to the model allows the system to take along-string drilling fluid temperature deviation as an indication of a kick. This deviation may occur before solution gas reaches the bubble point, allowing the rig crew to act before a contemporary kick detection system sees a flow change. Notably, kick size is determined by inflow rate and event duration; by responding to a kick earlier, the rig faces fewer challenges circulating and reconditioning the well, saving time and cost.

In the wellbore stability case, the downhole event detection system may compare measured vs expected density along the string to indicate that a wellbore stability problem exists. Excess material falling into the well affects the average fluid density in unexpected ways. Along-string measurements pick up the density-changing effects of the drilled cuttings and collapsed material. Simultaneously, the hydraulic model accounts for the density-changing effects of the drilled cuttings but not the collapsed material. The resulting mismatch between the expected density and estimated density indicates an active wellbore stability event.

Other applications in downhole event detection include advanced visualisations. Advanced displays of the downhole event detection system show where the expected and measured values differ in time and along the well path. This allows a human to quickly determine where an issue is taking effect in the well to aid in the event response.

The next step

Detecting problems and responding to the well early is essential in reducing both costs and the occurrence of unplanned events. The industry is looking forward to taking the next steps toward autonomous drilling systems. Improved methods of fingerprinting and advanced downhole event detection allow operators to get drilling faster and respond to surprises sooner. Earlier characterisation of a problem allows the crew to form an appropriate response sooner, mitigating an event before it grows in magnitude and scope.

Figure 2. MPD workflow incorporating WDP.

Figure 3. WPD integrated into MPD workflow enables choke control from direct measurement.

Figure 4. Combining MWD and WDP allows the downhole event detection system to compare measured vs. expected values.

Autumn 2022 Oilfield Technology | 25

ENERGY GL BAL Sign up to receive a digital copy of the magazine www.energyglobal.com/magazine The future is looking clean and green

ive years ago, the UK’s North Sea Transition Authority (NSTA) set an ambitious target for the UK continental shelf (UKCS) oil and gas decommissioning industry to achieve a 35% cost saving by the end of 2022. Each year, progress has been tracked, and the latest report published in July 20211 showed that a saving of 23% had been achieved. The NSTA has called for faster decommissioning of inactive wells, with increasing collaboration between and amongst licensees and the supply chain, for example, to combine wells into decommissioning campaigns to achieve cost efficiencies.

Over 8000 wells have been drilled in the UKCS to date. The current active well stock comprises 2625 wellbores with 1736 producing and 871 inactive/suspended.2, 3 With cost and speed high on the industry’s agenda, new technology and processes introduced by innovative supply chain vendors are helping operators to deliver these targets. One area where significant cost and efficiency improvements can be realised offshore is in rigless or offline, rather than rig-based, well intervention. This is particularly applicable in the later and simpler stages of near-surface well decommissioning when all

Stuart Slater, Unity, UK, explains the merits of employing more agile technology solutions for shallow intervention operations.

| 27

permanent barriers have been installed and heavyweight well control is not necessary. This includes the setting of environmental/surface barriers and the removal of near-surface and surface equipment including the casing strings, conductor, and wellhead. By dividing the full P&A sequence into phases and applying fit-for-purpose solutions for each phase and each well, the operator has the opportunity to deliver significant cost savings.

North Sea P&A challenge

This approach has been implemented to great effect at a fully integrated fixed offshore platform in the Northern North Sea, equipped with manned production, drilling and utilities facilities. Operating since the late 1970s, the platform is now undergoing phased decommissioning, with well P&A work currently active.

The operator’s P&A programme had earmarked a number of wells on this platform which were suitable for an offline approach to set shallow plugs in preparation for the removal of the wellhead equipment, however, several challenges needed to be overcome. The well intervention work would need to be conducted while simultaneous rig-based drilling and slickline operations were ongoing at other wells on the same platform, resulting in limited deck space and POB allowance. Height access was also restricted due to the wells being located under the drilling rig. The final challenge was an extremely tight schedule to fit around other planned operations, so the plug setting solution would need to be simple to deploy and compact, yet also manoeuvrable and fast.

Compact technology

To combat these challenges, the operator chose a technology from Unity, which was launched in 2019. The surface intervention system (SIS) can be used for a variety of near-surface operations such as setting shallow plugs and tubing hanger plugs, Xmas Tree removal, well inspection, milling or well-bore clean out, with interchangeable tools on a sectional rod-based intervention system. Powerful hydraulic cylinders apply a push force of 70 000 lbs and a pull force of 40 000 lbs, whilst an ATEX rated motor can be added for a 300 rpm/1200 ft/lbs rotational function, delivering an agile solution to rival conventional intervention methods.

The current model is rated for operations up to 10 000 psi with an integral pressure control package. This uses upper and lower seal cartridges, each with three separate uni-directional seals which straddle the rods to ensure a minimum of two seal contacts at all times. The rods are retained with a rod catcher mechanism which must be operated by two separate personnel before the rod can be released, providing enhanced prevention controls for human error. The seal stack housing also incorporates a grease injection port to allow additional well control measures to be applied if required and allow safe retrieval from the well.

Additional safety aspects include the SIS shear sub which is the tool’s primary disconnect device. In the event of any equipment becoming stuck, the shear sub can quickly be activated, and SIS rods pulled out of hole, leaving behind a standard fishing neck profile.

This year, Unity has developed a data gathering version of the SIS, which utilises the same assembly but deploys ported rods to allow through-rod communication. This further investment in product engineering will allow for enhanced

28 | Oilfield Technology Autumn 2022

Figures

1 & 2.

A lightweight and compact SIS is deployed for surface plug setting operations in a cramped and busy wellbay on a North Sea platform.

pressure control and fluid circulation, improved direct injection, and could lead to live electrical communication, potentially including a live camera feed to give clients instant access to valve conditions or frac sleeve wear.

Enhanced well control

To complement the SIS, Unity has recently developed another technology in the form of a compact shear-seal (CSS) valve. This upgrades the well control offering with a fast-acting isolation function, but ensures the lightweight, compact offering is still retained. The new CSS utilises a hydraulically actuated dual ram but is 50% lighter and 30% smaller than the next closest comparable product, being designed for tight spaces and small rig hatches. Additional models are currently in development to offer solutions for higher pressure or more aggressive fluid environments, which could benefit from the compact design, or potential bespoke cutting requirements in already large stack up designs. The SIS system measures in at 660 mm x 3455 mm and is lightweight at 1060 kg. Adding the CSS increases the weight by 952 kgs. The compact size and reduced weight help improve handling and reduce concerns over structural integrity on late-life assets.

Well intervention often requires multiple vendors with considerable manpower, heavy well control packages and a large wellsite footprint, resulting in significant cost and risk for the operator, especially offshore. While this equipment is necessary for deeper well intervention, the SIS and CSS provide a high performing, compact, and cost-effective solution for shallow operations.

Offline deployment

For this multi-well, surface plug-setting project in the North Sea, the SIS was deployed by Unity as part of a fully managed, independent service. Work on the first two wells was successfully completed in March and May 2022, with a third deployment scheduled for 3Q22. In this third deployment the CSS will be included as part of the well control package, serving to complete the first field application of this new technology.

Unity’s rig-up, for both wells, took place in an extremely confined and busy wellbay below deck. Following detailed pre-job planning, the SIS and the pressure control equipment were quickly mobilised and installed to the Xmas Tree using a small A-frame gantry crane.

For both projects, SIS rig-up and testing were complete in under five hours, then a 4.5 in. bridge plug was successfully set in the well at around 90 ft MD-BRT. The plug was set first time, within 30 minutes of rig-up. Rig-down was complete in around six hours and just one overnight stay was required for two technicians.

Operator benefits

Both completed plug-setting projects delivered significant savings to the operator, with a cost and personnel package reduction of 66% with a 60% faster turnaround compared to traditional solutions. This is particularly important as the industry looks for ways to reduce the unavoidable decommissioning cost burden on many operators.

SIS plug setting work is now planned for a further 14 wells on this platform to support the operator’s wider decommissioning programme. The multi-disciplinary support service from Unity may also include pre and post SIS intervention operations, such as suspending the well or tree removal, thereby delivering further project efficiencies.

The technology offers operators the benefit of an onsite surface intervention system that can be deployed instantly to rectify surface safety concerns or production inhibiting issues, returning wells to a safe or productive status. It has delivered similar savings in other projects around the world, including North Africa and the Middle East, as well as in other European applications. The technology can be mobilised quickly with only 48 hours redress required between deployments.

With targets to reduce near-surface integrity issues in producing wells and the cost of well decommissioning programmes still high on the agenda of the NSTA and other regional authorities, this is one example of how supply chain innovation and pragmatism in developing new technology can meet this need.

References

1. North Sea Transition Authority (NSTA): UKCS Decommissioning Cost Estimate 2021 - 2021 - Publications - News & <br/>publications (nstauthority.co.uk)

2. North Sea Transition Authority (NSTA): Wells Insight Report reveals activity slowdown in the UK North Sea and untapped potential in well maintenance - 2021 - News - News & <br/>publications (nstauthority. co.uk)

3. UKCS Suspended Well Stock (arcgis.com)

Autumn 2022 Oilfield Technology | 29

Figure 3. The Surface Intervention System (SIS) is complemented by a compact shear seal (CSS) valve and small pressure control and operating units.

30 |

Finlay Johnston, 4C Global Consultancy, UK, shares his insight into whether the oil industry is on track for a rig rate super cycle in the North Sea.

ince mobile drilling rigs first appeared on the UKCS in the late 1960s and early 1970s, oil prices have gone through numerous cycles. This has driven rig demand and, consequently, rig price. Looking forward to what could become a super cycle in rig rates, it is crucial to equip ourselves with the best market knowledge we can find to help us chart a course through the challenges to come.

Whilst offshore drilling rigs are unique in many ways, they are also a commodity just like any other: when demand is high, prices are high. It is interesting to note that the market has fluctuated

more in the UK section of the North Sea than on the Norwegian side, even though they both charter very similar, and in some cases, the same type of rigs. The key difference is that, in Norway, rigs tend to be chartered for five years or more at a time, whilst average charter durations are shorter in the UK, resulting in faster changes to pricing.

The UK has therefore always been seen as a rig ‘spot-market’ that does not offer the relative stability of the Norwegian market –or at least that is how it was until everything changed in 2014. Since then, there have been several industry developments which have

| 31

changed what was an almost predictable oil price and rig rate cycle, to a place where market volatility and unpredictability are the norm.

The collapse

In 2014, the oil price collapsed and most of the world’s mobile rigs had no work. At the same time, there was a historically large number of rig owners at play, creating fiercer-than-normal competition for work. As a result, rig day rates reached new lows, and a considerable number of rigs that could not find work were stacked in sheltered waters such as the Cromarty Firth in Scotland. Adding to the ‘perfect storm’ for rig owners was the fact that the drilling industry was carrying an unprecedented level of debt, meaning that fleets required high long-term day rates to service their debt and continue paying shareholder dividends. Adding to the pain in 2014 was the fact that the majority of the world’s 1970s and 1980s-built rigs were nearing the end of their working lives. This was a drilling industry where work prospects had evaporated, large numbers of old rigs stood idle, share prices were tumbling, debt default was escalating, and any road to recovery was hard to envisage.

To survive, drilling contractors needed to adapt their business models quickly and dramatically, through massive cost cutting and debt restructures. This had a very real human cost, with large-scale redundancy programmes of rig crews and onshore staff. It also triggered the industry’s first fleet rebalancing, with owners electing to scrap large numbers of rigs. At first, older units were scrapped. But, as the downturn continued, more than 100 relatively-modern rigs were decommissioned and sent to scrapyards. An industry-wide debt restructure also began, with drilling contractors filing for ‘chapter 11’ creditor protection whilst they renegotiated their respective bank and bond obligations. Tens of billions of dollars of debt were lost

during this process, with many financial institutions recovering only a small portion of their original lending. The result, however, was a leaner and more fit-for-purpose collection of drillers that were able to survive in a low-margin environment.

Following on from this, ‘fit’ drilling companies became easier to compare in terms of their valuation. This in turn triggered the next phase of the post-2014 drilling industry metamorphosis, whereby a programme of consolidation began.

The recovery

The consolidation led to a still-reducing number of drilling companies through mergers and acquisitions, the purpose of which was to reduce the customer’s choice of rig provider, achieve greater market pricing leverage as a consequence, and maximise returns to battle-weary drilling contractor shareholders. As a result of this, the drilling industry will soon comprise of a small number of rig owners, with most electing to become ‘pure players’ by specialising in only one rig type in order to further strengthen their leverage. This small pack of drillers will push hard for rate increase against a backdrop of reduced rig supply and increasing demand driven by higher oil pricing and the need for non-Russian crude.

The drilling industry is comprised of various rig sub sectors such as deepwater drill ships, harsh environment semi-submersibles, and commodity jack ups – to name but a few. Despite the strong market recovery that is underway, each sub sector is recovering at a different speed for a variety of unique reasons. In the UK, harsh environment semi-submersibles have always been prevalent, but this fleet has endured an above-average level of scrapping over the last eight years, leaving only a handful of active and stacked rigs. What is three today would once have been a couple of dozen that were constantly active.

a global

requires

publication Global publication Subscribe online at: www.oilfieldtechnology.com/subscribe

The main reason for this is that the UK fleet was predominantly older, ‘vintage’ rigs that were ripe for scrapping. Additionally, regional day rates saw one of the sharpest industry falls from circa US$400 000 to US$100 000, resulting in some larger multi-national rig owners losing interest in the basin.

Rig demand and supply

UK rig demand is clearly increasing, especially following on from recent investment tax breaks. However, it is increasing relatively slowly. A slow increase in demand results in a slow increase in day rate increase. This all changes, however, when the region edges close to running out of rigs, and then day rates suddenly surge.

Working out how many rigs are available in the region is not as easy as it may sound, as some active rigs that have near-term contract end dates are highly likely to remain with the same customer if the contract has an option for extension. Several units have been secured either through direct negotiations, or simply by extending contracts. Both are key indicators that there is concern in the boardrooms that costs will escalate, and so the decision has been made to avoid the risk of a sudden increase in day rates, cost of change, and rig acceptance.

The next supply uncertainty relates to a small number of rigs that have avoided being scrapped, but instead have been stacked for years. These require considerable reactivation costs that can be funded by either a confident rig owner or a desperate rig customer. Either way, it is not abundantly clear how these stacked rigs are viewed in terms of supply, and it very much depends on where we are in the cycle.

The final uncertainty relates to incoming rigs. The UK is a protected market, as only rigs with a high technical capability can enter due to legislative requirements. From the rigs that can enter the UK, most are very high-spec units that are happily working in other regions on longer-term high day rate contracts. That said, there are still a few obvious contenders which would sit well in the UK market for drilling, intervention, and P&A, such as Dolphin Drilling’s Bideford and Borgland semi-submersibles, which are currently smart stacked in Norway.

Industry analysts state that there are currently almost four times as many customer rig enquiries as there are available rigs in the UK. This tells us that oil companies are confident about drilling and are in the final stages of their deliberation. With factors such as constantly high oil prices, significant new tax breaks, a new political will to utilise the UK oil resources, and investment flowing into oil companies, one may be tempted to ask why they are taking so long to deliberate when rig availability is already limited? Oil companies will have their own reasons, but what will trigger change is when the realisation that supply is tighter than they thought and the fear of missing out strikes. When customers realise that there is a real prospect of ending up with no rig, rates will spike in the fight for the last rig, and the super cycle will arrive.

Conclusion

In this type of market, there will inevitably be winners and losers. Rig owners will win as revenues and margins increase and rig crews will win as wage inflation kicks in due to limited availability of experienced personnel. Specialist industry suppliers, such as drilling tubular and tool providers (as well as well planning companies) will see a dramatic increase in demand too. The losers will be oil companies who wanted to drill for oil but waited too long and ended up with rigs that were so expensive that they test the limits of the field of economics – or no rig at all.

Whilst non-value adding works would typically be delayed in the current climate, this time there are several operators that are still committed to reducing liabilities that run into hundreds of millions. Again, this will only add to the removal of assets, thus constricting the market further.

So, what about the all-important day rate? In the newly-balanced drilling contractor landscape, and against the backdrop of a clear need for oil, recovery is underway. Consequently, there is no doubt that key locations such as Aberdeen, Scotland, will be energised once again, albeit not quite to pre-2014 levels.

Autumn 2022 Oilfield Technology | 33

Figure 1. Dolphin Drilling’s semi-submersible, enhanced Aker H-3 – The Borgland Dolphin.

Figure 2. The semi-submersible holds a current UK safety case.

Figure 3. The Borgland Dolphin is an ideal contender for both UK and International mid water work scopes.

INOVA Geophysical began exploring digital sensor technology with a solution-focused micro electrical mechanical systems (MEMS) seismic sensor chip in the late 1990s. Designed to overcome the limitations in sensor technology that are currently inherent in analog geophone sensors, the digital sensor helps to eliminate issues with broadband sensitivity and phase. Since the introduction of the MEMS technology, two products – including Vectorseis, a 3C all-digital sensor, and Accuseis, a single-component digital sensor have seen commercial successes on the market. The digital sensor technology is currently in its 5th generation of commercial products, and is continuing to evolve.

INOVA’s Quantum® nodal system was introduced to the market as a fully practical, standalone seismic node and offers advantageous operational properties, compact design, and reliability.

Quantum with Accuseis is the fusion of INOVA’s 5th generation MEMS technology and the Quantum node, creating a product with the benefits of both.

A foundation of research and field knowledge

The 5th generation Accuseis technology is based on a foundation of research and field experiences. The Accuseis sensor is formed from a sandwich of silicon wafers with a tiny mass suspended by etched silicon springs, forming a unit that is about 1 cm.2 The output of the sensor is a ratio of charges on either side of the suspended mass. Updating approximately 156 000 times/sec., the charge ratio is the source of the data stream for digitisation. This technology outputs units of gravity (g) with a very high degree of fidelity.

34 |

A secondary but important benefit is that the unit self-calibrates each time it powers up, and at random intervals while recording. This ensures that the sensor response is uniform, repeatable, and does not age with continued use. The sensor will respond identically during thousands of deployments throughout the product life. Since the silicon chip is tiny and very rigid, the sensor has a resonant frequency of approximately 2000 Hz, which results in amplitude and phase response curves that are above the useful frequency range for seismic data. In effect, the resultant phase and amplitude response of the sensor is nearly flat. Functioning in gravity units from 0 to 400 Hz with a nearly flat phase and amplitude response results in a truly broadband sensor that can overcome the historical limitations of analog geophone technology.

Since the introduction of the digital sensor in the late 1990s, many projects have been implemented with this technology. Originally marketed in a 3C sensor called Vectorseis, the units have successfully recorded data in every environment, with both 3C sensors and 1C sensors. Projects with over 180 000 live channels have been successfully completed with Accuseis sensors.

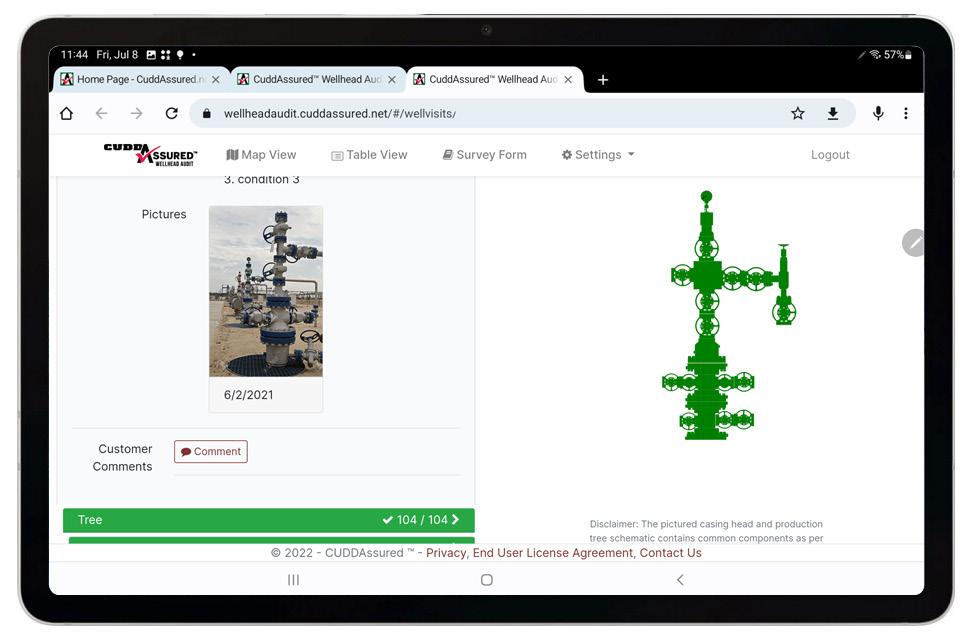

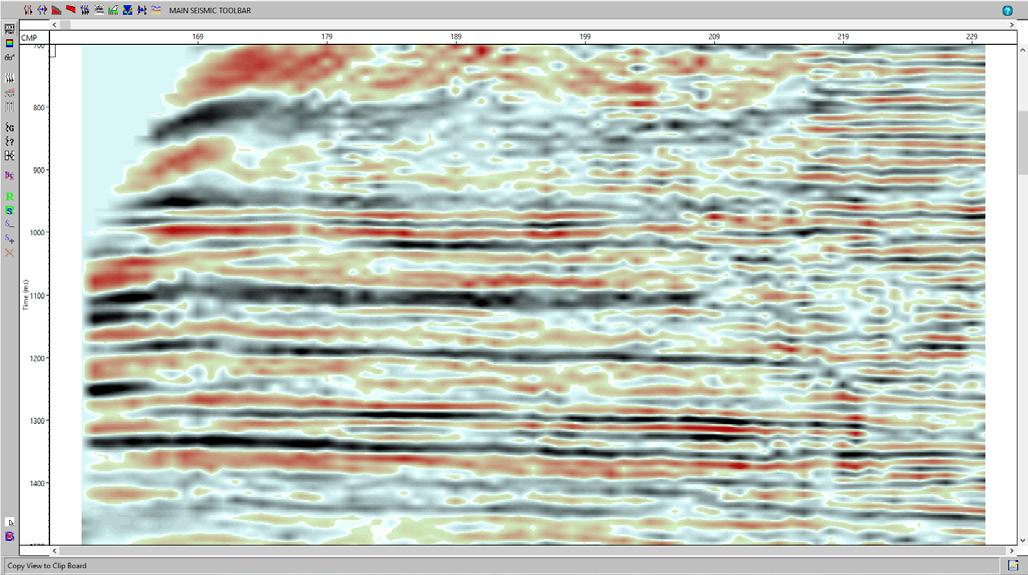

A data comparison from North Africa demonstrates the advantages of the technology. In this example, a 2D line was recorded with coincident sensors, including single high-sensitivity geophones and the Accuseis sensor. The 2D line was shot and recorded into two systems simultaneously. This set-up eliminates environmental issues and potential source variances, and provides data sets that can be utilised to compare sensor responses (Figure 2). In this case, the Accuseis sensor produced

Jason Criss, INOVA Geophysical, USA, discusses the use of a combination of digital sensor technologies to meet the demands of challenging projects in regions around the world.

| 35

a stronger amplitude response when compared with the analog 5 Hz high-sensitivity geophone.

In a second data example (Figure 3), the Accuseis data is compared with the results of legacy seismic data. In this example showing fully-processed data, the reshoot using the digital sensor resulted in higher resolution and greater fidelity.

The Quantum node is under improvement through the development of new features, utilising high-sensitivity geophones as the initial sensor technology. The original Quantum node is a small 650 g full-featured recording node that records seismic data continuously for up to 50 days with a high-fidelity, industry-standard, dynamic range and sensitivity. A new development, HyperQ, utilises a low-power, long-range wireless technology to transmit data over long distances. The technology enhances the original product by allowing the status of deployed units to be monitored at ranges of as far as several kilometers, depending on terrain and the antenna height.

The technology helps makes seismic projects more efficient and operationally-flexible, which in turn makes them more environmentally-secure, profitable and safer to operate. The addition of the Accuseis digital sensor as a replacement for the geophone results in a recording system with strong operational properties and a true broadband sensor.

Flexibility and feasibility

Areas with diverse topography, and zones ranging from urban environments and dense jungles, to shallow swamps and arid deserts, create tremendous operational challenges for seismic crews. The flexible technology can be configured and deployed to acquire data for many weeks, using duty cycling which turns nodes off during periods of no shooting activity and then begins recording at preconfigured times. This capability means that crews can work with a two-touch strategy, where the receiver station is visited once for deployment, and a second time for retrieval once the shooting has progressed past the area. This simplifies operations and the environmental impact, and is a key feature when analysing permitting issues.

Combined with HyperQ technology, the deployed Quantum nodes can be scanned for daily quality control through telemetry. Since the HyperQ technology is effective for use across long ranges, quality control can be accomplished with a variety of strategies including fixed masts, drive-by utilising work vehicles, and fly-by utilising drones. Drone QC has been proven effective in many regions, and is a growing technology that is ideal for this purpose, especially when ground access is restricted by wet areas and permit issues.

Furthermore, Quantum can be configured to work with a marsh geophone. This delivers a solution for areas where water is expected to cover zones of the project. When set up on purpose-built floats, marsh geophones are deployed in the soil at the water bottom, while the Quantum units remain active and record above water. This capability allows crews to maintain a consistent system type with a flexible and adaptable geometry that makes the Quantum solution a feasible and optimal one for challenging projects. The technology has made possible the acquisition of data in challenging environments around the world.

Technology fusion

The fusion of the Quantum technology with the Accuseis technology expands the capability of the system by providing a broader spectrum of user choices and solutions for deploying seismic equipment in any type of landscape. The technology is an effective solution in terrain types ranging from deserts with unrestricted access, to areas with dense jungles. The Accuseis technology is a seismic solution that helps overcome the technical disadvantages of the geophone, and is a truly broadband solution with a uniform phase and amplitude response. These technologies can help to expand and meet the needs of challenging projects in many regions.

36 | Oilfield Technology Autumn 2022

Figure 1. Accuseis sensor.

Figure 2. Stack sections from the 2D line show differences between the Accuseis sensor response (top) and the 5 Hz high-sensitivity analog geophone response (bottom).

Figure 3. Processed data comparing Accuseis sensor data against legacy data from the same location. Legacy data on the left and Accuseis data on the right geophone response.

Suki Gill, Enteq Technologies, USA, details how the latest MWD technology is helping advance the directional drilling industry.

Watching a rig crew on a mission to drill a borehole, plant a bomb and save the world in Armageddon was a moment of inspiration for many petroleum engineers working in the industry today. In the 1998 Michael Bay spectacular, the crew is on a mission to excavate and destroy an

asteroid that threatens the planet. The plan succeeds, and the crew are global heroes.

Needless to say, the technology and drilling process depicted in the movie is not an accurate representation of drilling today. The economics of drilling have shifted; it is known that the

| 37

pandemic has hit the oil and gas sector particularly hard. It was always a tough job, but it has become a whole lot tougher.

Many of these trends are irreversible. But the oil and gas sector has always adapted, survived, and ultimately thrived in the face of change. If we can think smarter – and fairer – about the technology drilling companies (specifically directional drilling companies) rely on to do their job, the industry will flourish again. Enteq Technologies is therefore is taking a new approach to the measurement- and logging-while drilling (MWD/LWD) market.

Different days for directional drilling – what has changed?

In 2014, in British Columbia, Canada, drilling a well could take 24 – 27 days. Today, a similar well could be drilled in

just 7 – 10 days. That is beneficial for the operator but not good news for the directional drilling company. Since directional drilling companies are paid a day rate, not a lump sum when the work is completed, drilling a well in less time decreases company revenue. For example, if one assumes a CAN$6000 day rate, the 2014 British Columbia job would be CAN$144 000. Compared to today’s drilling outlook, the job would only be CAN$42 000.

This is just one example, but the problem is widespread. The oil and gas market has always been cyclical, but a number of trends plus the pandemic have eroded the sector’s economic stability over time. Today, WTI stands at a reasonable US$104.41/bbl, but last year in 2021, it went negative for the first time in history and was predicted to tip US$100/bbl in the near future. Rig counts were slashed, as were day rates. This trickles down to hiring, and putting pressure on companies to rely on fewer employees. Now the numbers look healthier again – but for how long?

At the same time, the jobs themselves have become more demanding. Operators want to go deeper and faster, and demand that even small and mid-sized directional drilling companies have the latest MWD/LWD tech, such as resistivity-at-bit solutions. There is also increasing demand for hot tools capable of operating in high-temperature environments. Though this is still a relatively small proportion of the total market, it may well increase further as sectors such as geothermal energy expand.

The geography of the industry is changing too. The Middle East remains a juggernaut and US shale strength continues, but around the world operators are looking again at previously unattractive or uneconomic plays and re-evaluating their feasibility. To make these plays economic means keeping an iron grip on the cost per barrel.

There is a degree of geographic disparity to contend with. While North American directional drilling service providers may have to pay top dollar for the latest at-bit solutions, it is at least available to them. This is not always the case for those drilling in China, for example. Often, it takes years for tech to become widely available to independent service companies in the rest of the world, and even then, still at

38 | Oilfield Technology Autumn 2022

Figure 1. Enteq Technologies' in-house engineering team.

Figure

2.

Final equipment checks.

premium rates – potentially with forex disadvantages versus the US dollar, too.

High time for high tech

So, what can we do about it? We may not be able to do much about the underlying trends changing the economics of directional drilling, but we can offer technology to drilling companies to meet these challenges head-on.

For example, automation and IoT can be critical to assuaging cost and labour pressures. With day rates depressed, it can be painfully expensive to deploy fully qualified MWD engineers to every job. If COVID has taught us anything though, it is how effective remote working can be. So, by automating the operation of MWD/LWD tools and adding remote telemetry, highly-educated workforces can work from a central office (or a virtual one even, working from home) and from there they can look after a portfolio of five or six rigs rather than having to be deployed, on-site, to one. As a bonus, this also fits neatly with operators’ drive to reduce overall personnel footprint on rigs.

For example, leading technologies today have built-in artificial intelligence (AI) to simplify decoding, meaning minimal input from the MWD tech on location. If and when there are decoding issues, that MWD tech can pick up a phone to a team of dozens of software engineers working around the clock to help them fix the problem. For the drilling company, it means a smarter, leaner operation with less need to deploy top-rate talent to every job and the ability to manage operations remotely, allowing them to take on more work and reassign money to CAPEX to invest in getting top tech into the fleet.

An expanding range of data types also works to the benefit of drilling companies. Better downhole batteries

enable real-time transmission of metrics such as collar RPM and BHA health. Real-time measurements then allow for drilling optimisation, pushing the equipment as hard as possible without exceeding risk thresholds the sweet-spot, so to speak. These are enhanced further by advances in electromagnetic (EM) telemetry systems boosting the rate and reliability of data transmission versus older EM or mud-pulse systems.

Newer sensor types such as micro electrical mechanical system sensors (MEMS) are also pushing the envelope on MWD design. If traditional sensors are hard disk drives, these are solid state – a genuine leap forward in technology with greater resilience to shock and vibration, but at a higher price point. They enable real-time measurements such as stick-slip to further optimise drilling and get the most out of equipment, though it is important not to over-specify where cheaper legacy systems are fit for purpose.

Upgrading downhole measurement

The tech is there to help directional drilling companies face their challenges head-on, but for companies in North America and beyond it can be difficult to cost-effectively access the best equipment for the task at hand. This needs to change.

We likely cannot expect another box-office blockbuster where drilling companies save the day anytime soon. Too much has changed since 1998. Although hero-status is too much to ask, directional drilling service providers worldwide deserve support. Enteq Technologies aims to offer that support by providing access to effective MWD and LWD tools, integrated into bespoke solutions based on real-world, downhole directional drilling expertise.

Mojtaba Moradi and Michael R Konopczynski, Tendeka, UK, analyse the role of flow control devices in improving the performance of matrix acid stimulation operations in carbonate reservoirs.

40 |

The use of hydrochloric acid to stimulate oil wells began in 1932. However, effective matrix acidising stimulation of heterogeneous carbonates, especially across long intervals, has long been a challenge. This is because a sufficient chemical reaction rate to the rock is required to establish a controlled flow and deep-reaching penetration into the formation matrix without excessively increasing bottom hole pressure that can cause the formation to break down.1

The issues associated with acid placement in carbonate reservoirs are numerous: from dealing with a complex depositional environment to issues around the effect of dissolution, recrystallisation, and variable permeability caused by natural fractures, faults, low matrix permeability and formation damage from pre-production or production operations. Reservoir fluid properties including saturation, relative permeabilities and mobility issues, also influence the effectiveness of the stimulation.

The selection of stimulation fluid, diverters, pumping rates, treatment pressures, and the correct planning of the pumping schedule are therefore, all crucial to the effectiveness of the stimulation.

A new autonomous outflow control device Addressing such complex reservoir properties and optimising the acid treatments for even fluid distribution along the wellbore can be problematic. For instance, thief zones, fractures, and hyper-reactive zones ‘stealing’ all the treatment and unsuccessful diversion for less conductive zones are culprits of inadequate and unoptimised acid stimulation.

Tendeka has developed FloFuse, a new autonomous outflow control device, to provide mechanical diversion during matrix stimulation (Figure 1).

The active flow control device was initially designed to control the injectant conformance in injection wells, and could significantly help to improve the distribution of stimulation acid, especially in carbonate formations. As an injection rate-limiting technology, the device ensures proportional distribution of treatment

| 41

fluid along the full length of the wellbore and between laterals. It allows repeat stimulation of carbonate reservoirs, providing mechanical diversion without the need for coiled tubing or other complex intervention.

It has two operating conditions, one, as a passive outflow control valve, and two, as a barrier when the flow rate through the valve exceeds a designed limit, analogous to an electrical circuit breaker. The natural state of the valve, which is mounted into the base pipe or screen section, is in the open position (biased open).

The injection outflow under normal operating conditions passes through the ‘normally operating nozzle’ and through the screen as required, as depicted by the blue baseline performance curve in Figure 2.

Once a zone has been sufficiently stimulated by the acid and the injection rate in that zone exceeds the device trigger point, the device in that zone closes and restricts further stimulation. Acid can then flow to and stimulate other zones. This eliminates the impact of the thief zone on acid injection conformance and maintains a prescribed acid distribution. The process can be repeated later in the well’s life to re-stimulate zones and can be retrofitted in existing completions or be used in a retrievable completion. As a spring-loaded valve, this trigger point can be altered based on the design parameters, including the nozzle diameter and spring constant.

Dynamic response to acid stimulation

Conventionally, passive flow control devices, which are completions with a fixed configuration that influence the well’s outflow, have been installed in wells. If the well completion is not properly designed, its impact is less effective, especially if dynamic changes in reservoir properties happen which is often the case for a well with regular acid stimulation operations.

FloFuse restricts the injection of fluids into dilating/propagating fractures, faults, and features, thus mitigating disproportional injection, which could potentially reduce the performance of the operation.

If the devices are installed permanently as a part of a downhole completion in the well, the completion would be used to optimise the fluid injection, plus it could be used as a mechanical diverter for acid stimulation negating the need for intervention. It could also be installed temporarily as a mechanical diverter and retrieved once the stimulation is finished. With either solution, acid could be bullheaded from the surface.

Several experiments including water, polymer and air injection have been performed to characterise the valve. The characteristics could be described for example by the curve of differential pressure drop (DP) across the device against flow rate passing through.

Figure 3 represents the performances of different sizes of devices namely: 2.2 mm, 3 mm, and 4.5 mm, for water-like fluids.

Modelling and operational design workflow

Once the completion is installed and acid bullheaded from the surface, FloFuse allows acid injection while controlling the flow of acid into higher rate intake (permeability) zones. Thereby, ensuring effective fluid placement across the whole length of the wellbore being treated initially, while each discrete zone is effectively acidised. As the volume of acid and injection rate is important in carbonate acidising to get the appropriate wormhole, this concern should be included in pump rate planning.

Once the FloFuse completion nominal design has been completed, additional sensitivities can be run to evaluate the impact on production or injection profiles from changes in the simulation treatment design. In addition, an understanding of the mechanisms that may cause deviation from the planned acid injection rates and distribution should be noted. Ultimately, the treatment design needs to be confidently executed in the field as per the design plan.

42 | Oilfield Technology Autumn 2022

Figure 1. Cross-section of FloFuse valve, open position.

Figure 2. The fluid flow path through the device mounted on the screen and its housing.

Figure 3. The FloFuse valve performance for injection of water-like fluids.

Figure 4. Production profile before and after stimulation operation for Well A.

Case study: acidisation of a vertical production well using FloFuse

Well A, located in the Middle East, passes through four main reservoir layers. It has been extensively studied and the pumping schedule and post-evaluation study of the real stimulation operation are provided.2

During pre-stimulation conditions, the well could only produce 25 MMScf/day of gas with a wellhead pressure of 3400 psi. Also, the contributions from the layers are non-uniform and zones 4 and 1 produce almost 51% and 32% of total produced gas respectively, while the other two zones’ share is only 17%.

The post-evaluation study shows that although the bottom layer was treated , the top layer may have been overtreated as evidence shows the existence of crossflow inside the tubing (Figure 4). This is mainly due to heterogeneity in the layer’s properties including skin, permeability, and reservoir pressure.

A static wellbore model was set up using a commercially available software. The result from the model, which agreed with the output of PLT data taken pre-stimulation, showed that more than 51% of gas was produced from layer K4 when assuming the gas production rate is 25 MMSCF/D. To investigate the impact of a new diverter (completion) on the acidisation performance for this well, a retrofit FloFuse solution was evaluated.