12 minute read

The Future Of Coal

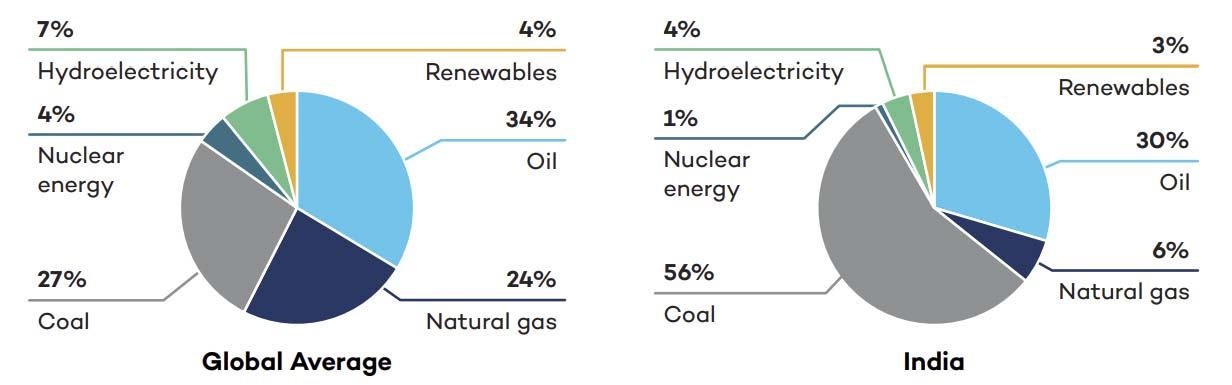

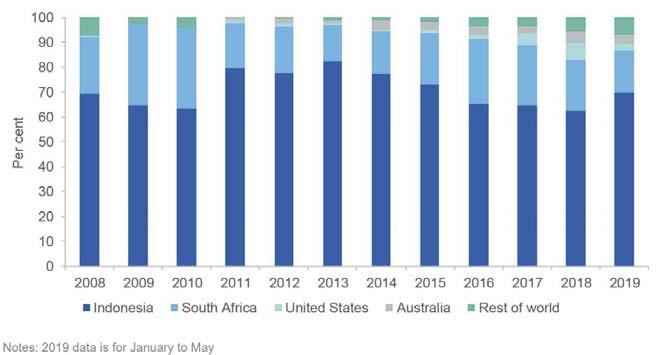

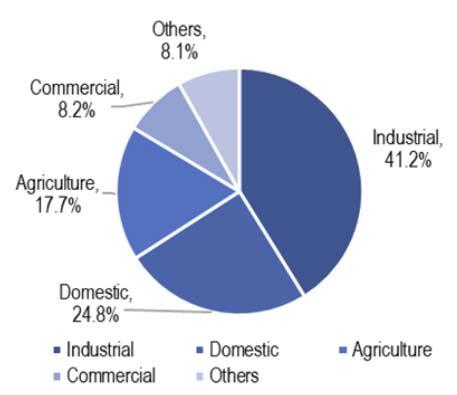

cost renewable substitutes. According to PRS Legislative Research, an Indian non-profit organisation which conducts independent research, the total contribution of coal in power generation reduced Figure 1. Primary energy consumption of commercial fuels in 2018 (global average and in India). from an average of 72.5% to 65.6% between March and April 2020, amidst the rise in number of COVID-19 cases. There are a lot of factors responsible for this, including lower running cost of renewable power plants compared to coal-based thermal power plants. According to Power System Operation Corp. Ltd (POSOCO), a government owned enterprise under the Indian Ministry of Power, the plant load factor (PLF) of thermal power plants has declined considerably in the past decade, reducing from 77.5% in 2009 – 2010 to 56.4% in 2019 – 2020.1 A lower PLF suggests that coal-based plants in the Figure 2. India’s thermal coal production and consumption. country have been lying idle for long durations. The declining utilisation of the total capacity, in addition to weakening demand, is expected to undermine the financial sustainability of thermal power plants even more in the coming years. Figure 3. Power consumption by consumer segment in 2018 – 2019. Sources: Central Electricity Authority; PRS. Figure 4. India’s thermal imports by source. Source: IHS India coal data tables, June 2019.

Coal production

The Indian government is focusing on pushing self-reliance strategy in different industrial sectors following the COVID-19 pandemic, which also includes capacity expansion of Indian coal production. This is reflected by the government’s coal mining liberalisation initiative for the deregulation of the domestic coal market, which would significantly increase coal production in order to meet the expected demand growth. In June 2020, the Prime Minister of India, Narendra Modi, conducted the auction of various mining blocks for commercial purposes. This decision was part of the recent government campaign, Atmanirbhar Bharat Abhiyan, and was proposed through the Mineral Laws (Amendment) Ordinance, 2020. These 41 coal mines are located in different regions of the country including: Chhattisgarh (9), Odisha (9), Madhya Pradesh (11), Jharkhand (9), and Maharashtra (3). The resources also include two metallurgical coal reserves and two coal mines with both metallurgical and non-metallurgical reserves.

According to the Coal Ministry of India, the 41 coal mines, which are now open for auction, can hit a peak production of 225 million t by 2025 – 2026, which can potentially save subsequent foreign exchange for thermal coal imports. Despite having such high availability of coal reserves, coal is still among the top five commodities

A Trusted Partner in Meeting Your Coal and Mineral Processing Separation Needs

Tabor Norris Clinch River CMI CSI Vibrating Screens Screening Media Custom Fabrications HVC Centrifuge Rotary Breaker

Quality Products, Services and Performance Excellence You Can Rely On.

CMI centrifuges are the industry standard in coal dewatering, offering a full line of horizontal and vertical configurations in a wide range of sizes. CSI rotary breakers and reconditioned centrifuge assemblies are known for a full line of superior quality replacement components and screens for both products. Tabor vibrating screens and feeders are the established leader for dewatering and sizing in the coal and mineral processing industries since 1961. Norris screening media provide high quality screens for stationary and vibrating screen systems and other diverse applications. Clinch River custom fabrications have met some of industry’s toughest challenges in material handling for power, coal prep, aggregate and underground mining applications. Elgin Separation Solutions is committed to delivering performance excellence and value-added service that earns your trust on every project. Visit www.elginps.com for more information on our specialized capabilities.

imported into India. Moreover, the country spent US$21.28 billion (Rs. 1.58 trillion crore) on importing approximately 247 million t of coal, of which 197 million t was of thermal grade, in 2019. Nearly the entire requirement of metallurgical coal, which is a crucial raw material for steel producing industries, is imported as the availability of high-quality metallurgical coal is very limited in the country. These 41 coal assets will be auctioned off via a newly determined revenue share model, through which private players will be allowed to mine coal for commercial mining purposes, unlike before, where mines had stringent end-use restrictions – i.e. companies coud only produce coal for designated captive purposes and could not trade coal in the market. However, as of now, foreign players have been shunned from participating in these coal mine auctions, contradictory to what the government expected. Global investors are gradually recognising the climate impact, as well as the financial risks involved in stranded assets. A rise in the number of divestments made by global players in the thermal coal mining sector reflects this trend. For example, in June 2020, BHP Group Ltd, one of the global leaders in resources and mining business, sold its last Australian thermal coal mine, subsequent to the commitments made by the company in 2019 to progressively reduce its thermal coal mining business.

Instead, the highest number of bids were placed by major domestic companies such as Adani Group, an infrastructure conglomerate which is also India’s largest private sector thermal power producer, which placed a bid for 12 of the 19 mines initially put up for auction. This was followed by other major players, such as: Aditya Birla Group, JMS Mining, Naveen Jindal Group and Vedanta Group, among others. However, this does not reduce the challenges for the government. During recent years, there has been a gradual decline in financial interests by corporates in the coal sector, due to rising concerns regarding coal’s environmental and social consequences. Long term capitalisation of this business space is not only challenging, considering the unfolding events towards a green economy, but also poses a question relating to the value proposition and brand image of any entity involved in the coal industry. Instances where new coal plants are being built in the country are now even fewer, and those being built are ones which were mainly planned approximately 5 – 10 years ago. According to the Institute for Energy Economics and Financial Analysis (IEEFA) report, in 2012 – 2016, India commissioned approximately 20 GW of net new thermal power capacity annually. But, between 2017 and 2020, this rate of adding net new capacity was reduced by 80% to an average of 4 GW annually. Furthermore, the quality of coal produced in the country is very low when compared to the global standards. The average energy content of the coal produced is 3000 – 4000 kcal, with up to 20 – 40% of ash content. This is in comparison to thequality of imported coal, which is 5000 – 6000 kcal with a lower ash content of up to 10%.

Table 1. The details of state-wise geological resources of coal (million t). Source: Indian Bureau of Mines, 2019

State Proved Indicated Inferred Total

Total

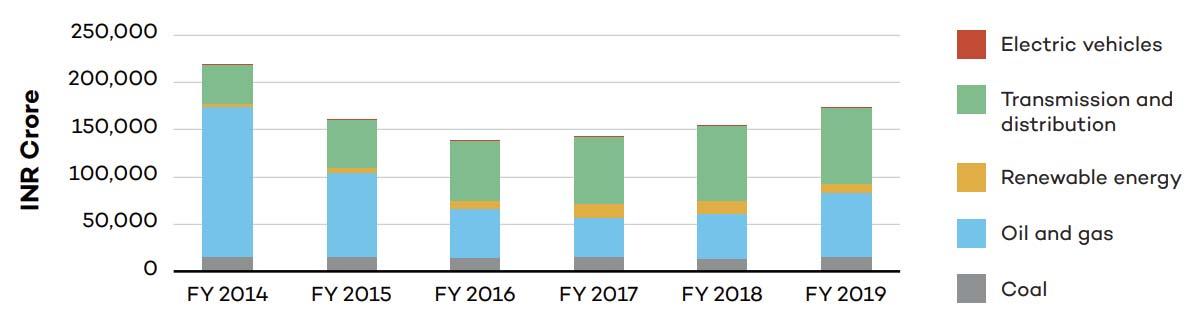

148 787 139 164 31 069 319 020 Jharkhand 45 563 31 439 6150 83 152 Odisha 37 391 34 165 7739 79 295 Chhattisgarh 20 428 34 576 2202 57 206 West Bengal 14 156 12 869 4643 31 667 Madhya Pradesh 11 958 12 154 3875 27 987 Telangana 10 475 8576 2651 21 702 Maharashtra 7178 3074 2048 12 299 Andhra Pradesh - 1149 432 1581 Bihar 161 813 392 1367 Uttar Pradesh 884 178 - 1062 Meghalaya 89 17 471 576 Assam 465 57 3 525 Nagaland 9 - 402 410 Sikkim - 58 43 101 Arunachal Pradesh 31 40 19 90 Figure 5. Total quantified energy subsidies, FY14 – FY19.

In addition to this, many of the major coal-fired power plants in India are located in coastal regions, such as Mundra plant, which are not well connected by railway lines with the domestic Indian coal reserves, making the transportation of the domestically produced coal problematic.

The rise of renewable energy

In spite of government initiatives, current market trends challenge the importance of a thermal power generation expansion for sustaining the energy security in the country. Instead, recent instances of foreign investments into the renewable energy sector in India suggests that the current government grants for fossil fuels will be spent on supporting the capacity expansion of the renewable energy industry at the domestic level. For instance, in June 2019, ReNew Power, one of the leading independent renewable power producers in India, raised a funding of approximately US$435 million through dollar-denominated green bonds, together with an additional US$350 million debt funding from Overseas Private Investment Corp. Furthermore, in July 2020, ReNew Power also announced its plans to invest between US$200 million – US$280 million to set up a manufacturing facility for solar cells and modules in India with an initial manufacturing capacity of 2 GW.

Conclusion

Although the coal sector is likely to always play an important role in the Indian economy for many years to come, rapid expansions in domestic coal mining now seems a risky development strategy, as the growth prospects in this sector are limited. Therefore, a planning for a transition away from coal dependence should start as early as possible. According to International Institute for Sustainable Development (IISD), subsidies provided to the fossil fuel (oil, gas, and coal) industry by the government of India accounted for approximately US$12.4 billion in 2019, relative to just US$1.5 billion for renewable energy. Out of this, coal subsidies accounted for approximately US$2.6 billion. The rising uncertainties in the investment risks of coal-based power generation, reducing PLF and the higher costs involved in the commissioning of new plants and the import of coal, emphasise the preliminary benefits of shifting government subsidies and public investments away from the coal sector and more towards clean and renewable alternatives, especially solar and wind power.

References

1. ‘Power sector at a glance, all India,’ Government of India

Ministry of Power, https://powermin.nic.in/en/content/powersector-glance-all-india

SOME THINK THAT RAW MATERIALS TRANSPORT REQUIRES TRUCKING. WE THINK DIFFERENT.

Armin Waibel, UWT Level Control,

Germany, shines light on level measurement technology.

In order to define the correct level measurement technology, it is essential to analyse the diff erent process parameters of a particular application, such as material properties, process temperatures, pressure and connections, as well as the process atmosphere. The selection of the right level measurement technologies, their correct configuration, and smart positioning will save substantial costs and add up to a significant improvement in a plants’ economic eff iciency over its lifecycle.

For challenging conditions and material

A leading supplier of building materials in South Africa was looking to source a reliable continuous level measurement solution for a process hopper. The application revolved around a train tippler that tips the contents of the train truck with coal into the hopper below, which is then conveyed to the site. The measurement units have to meet high accuracy demands and cope in the challenging environment.

The mining sector in South Africa was once the primary driving force behind the history and development of Africa’s most advanced and richest economy. South African mining companies are key players in global industry and the country is the third largest coal exporter in the world.

The plant operator has been producing cement, aggregates, lime, ready mix, and fly ash since 1892 and now operates with 11 factories in South Africa, Botswana, the Democratic Republic of the Congo, Ethiopia, Rwanda, and Zimbabwe. With regards to the modernisation of the facilities close to Cape Town, the operator was looking for equipment to provide innovative continuous level measurement.

Due to the nature of the application, the electromechanical lot system – which is popular in the cement manufacturing sector – was not the ideal solution here. Due to the fast running process flow and the dust intensive atmosphere, UWT engineers, together with the local partner Morton Controls CC, configured a radar free-radiating measurement detection system. The NivoRadar® NR 3000 was installed with a dust tube, which was fitted with an air purge to keep the dust off the lens. The radar was installed on a beam that was hanging over the bulk of the coal. The measuring distance was approximately 45 m (147 ft ), with temperatures reaching up to 80˚C (176˚F), and process pressure reaching 0.8 bar (11.6 psi). The material density was approximately 800 g/l and the DK value ranges diff ered between 2.0 – 3.0 with a granular material characteristic. There are some vibrations within the application, low moisture and no electrostatic charge, but a very dusty atmosphere. Aft er 2 weeks of successful testing, the choice of the right sensor solution was confirmed and several units were implemented into the plant application. The dusty environment was successfully overcome by the dust tube and airline connected to purge the lens. Accurate and repeatable reliable readings demonstrated the success of this solution applied to this diff icult application.