Remaining competitive in a rapidly changing world.

Disruptive technology improves efficiency and sustainability.

Siemens supplies Arkansas steel mill with new system.

How software will enable steel’s green transformation.

DIGITALIZATION: BUILDING FACTORIES OF THE FUTURE

www.steeltimesint.com Digital Edition - August 2023 - No.27 DIGITALIZATION ARTIFICIAL INTELLIGENCE DECARBONIZATION INNOVATIONS SPECIAL

Since 1866

CONTACT US: www.solarturbines.com, +41 91 851 1511 (Europe) or +1 619 544 5352 (US) infocorp@solarturbines.com ONE DAY IT COULD BE LIKE THIS BETTER ENERGY RECOVERY LESS CO2, HIGHER RETURN Hydrogen Off Gas High hydrogen, high CO, low or high BTU - Solar Turbines designs and manufactures gas turbines in combined heat and power applications with wide fuel capabilities to help our customers improve their bottom line and CO2 footprint. Syngas (H2 + CO)

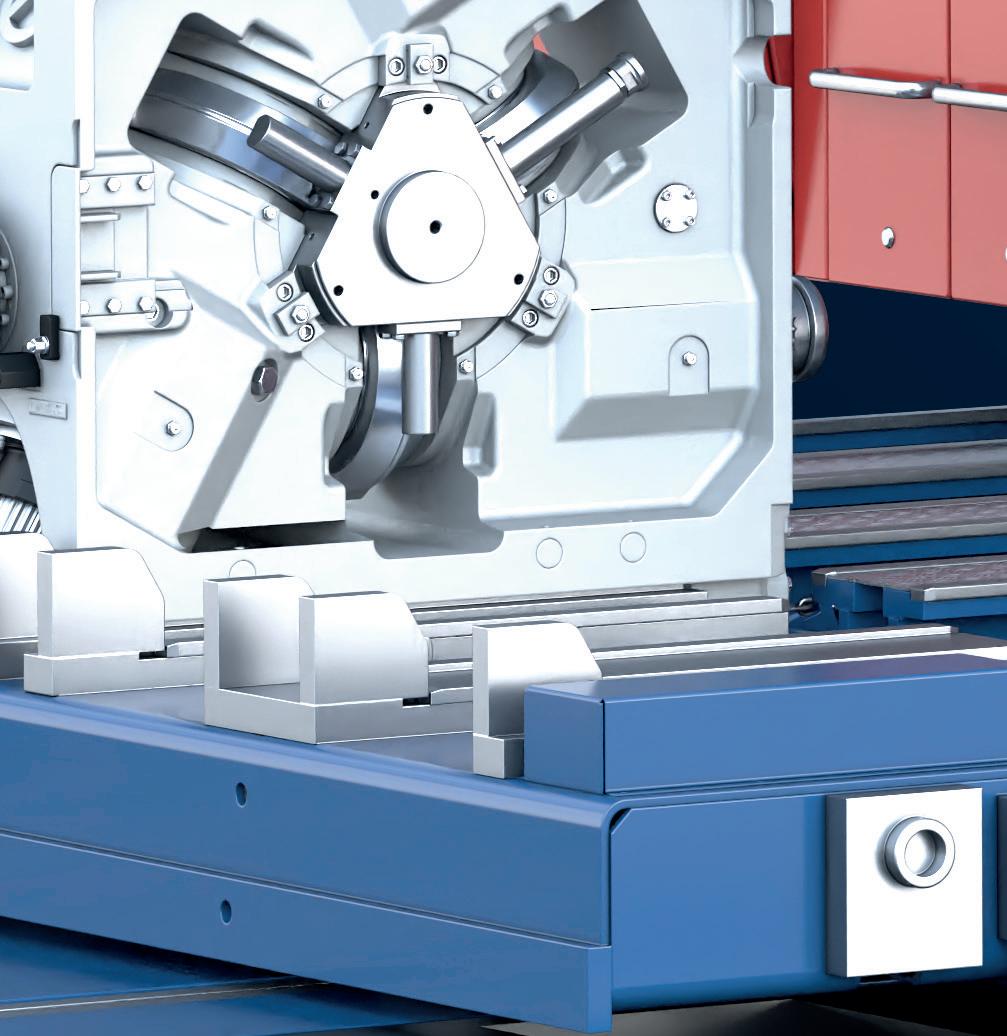

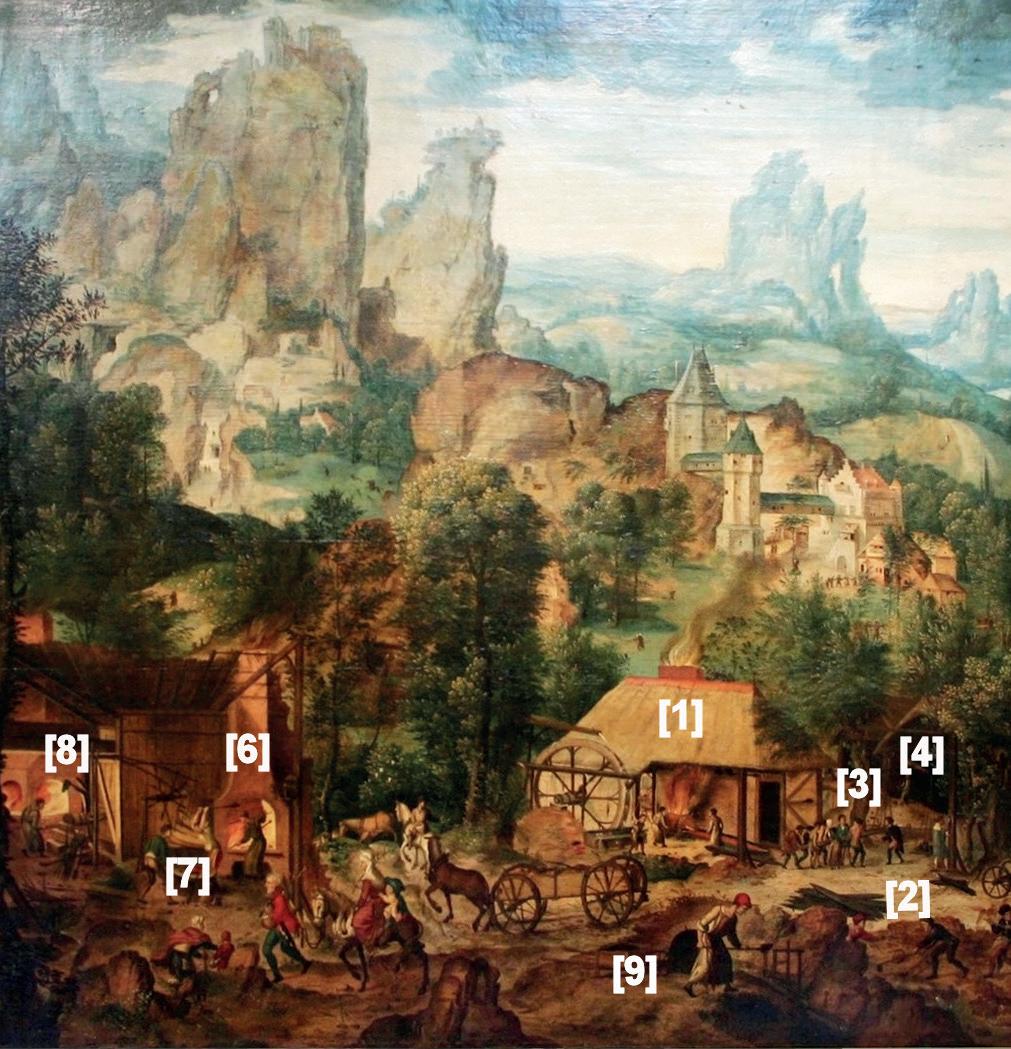

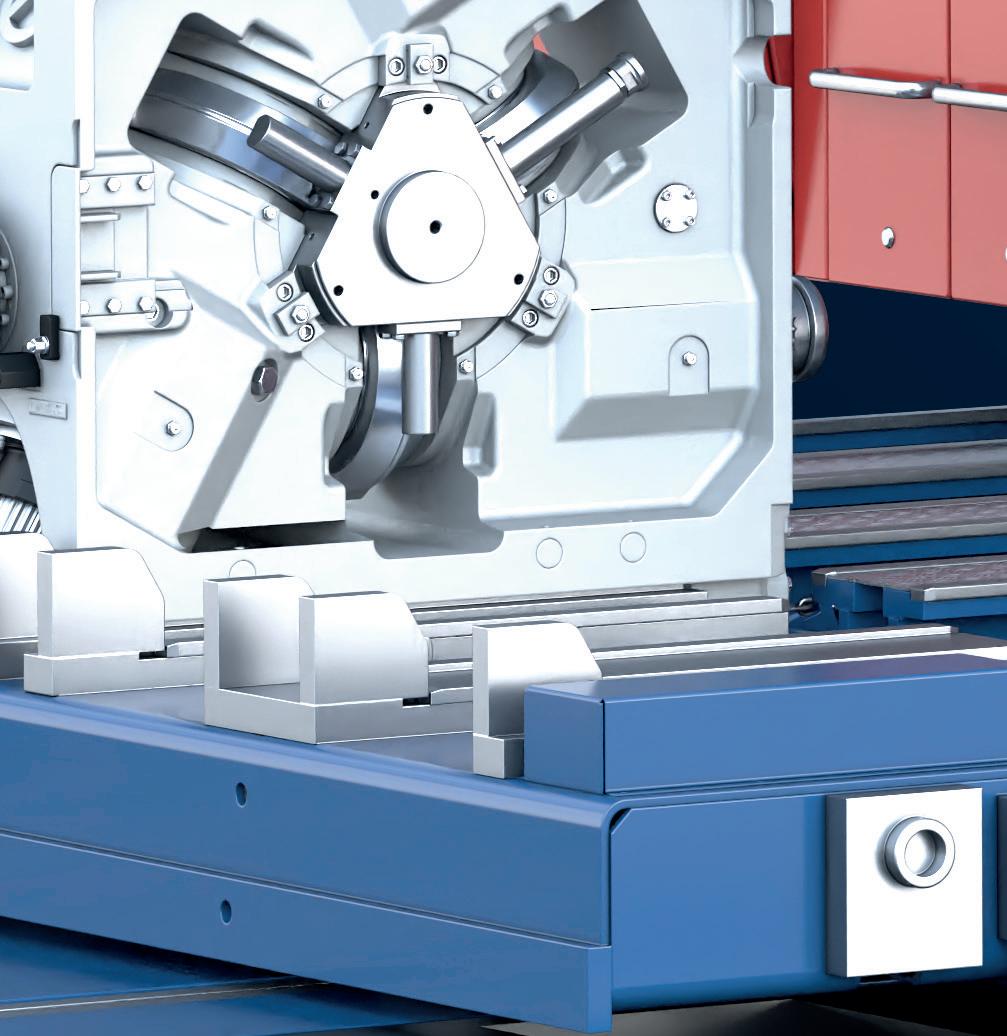

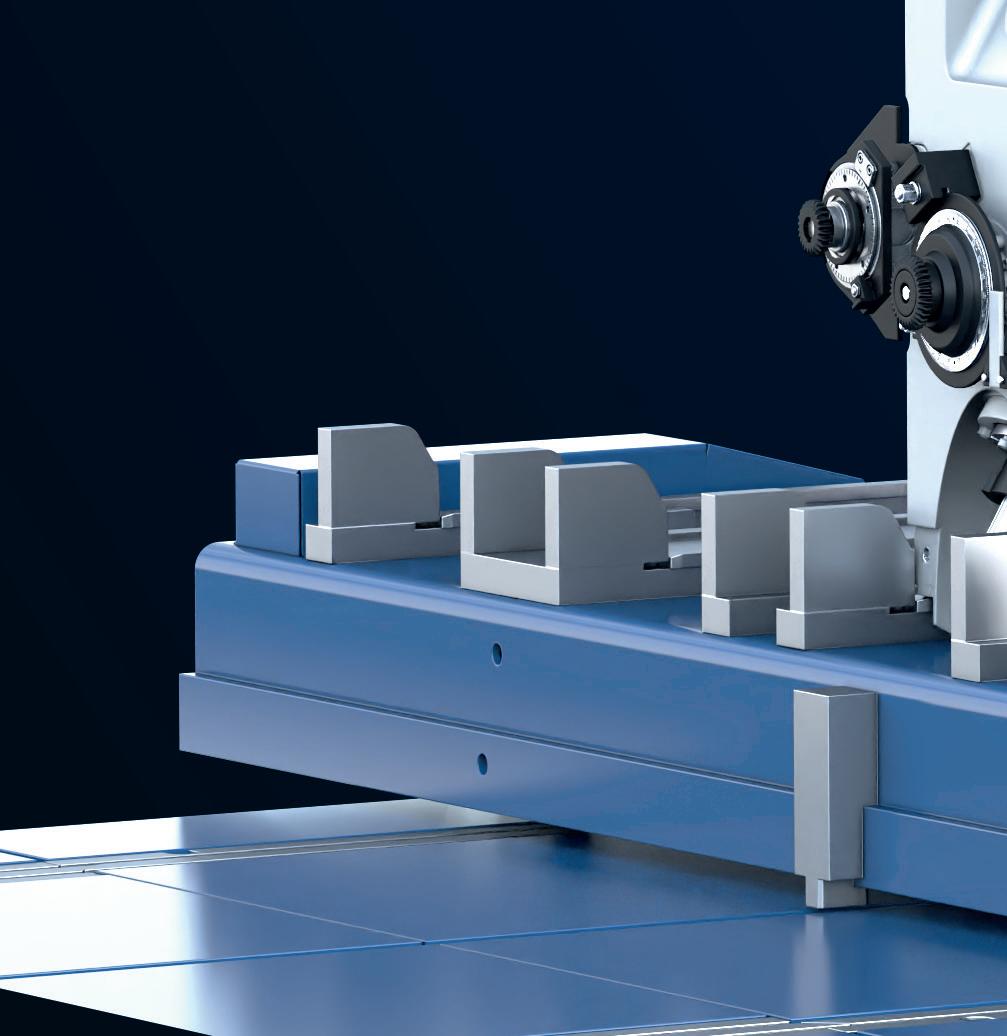

Front cover photo courtesy of KOCKS

Successful commissioning of RSB® 370++/4 in China. Steel producers can rely on KOCKS’ expertise and innovative technology solutions.

EDITORIAL

Editor Matthew Moggridge

Tel: +44 (0) 1737 855151 matthewmoggridge@quartzltd.com

Assistant Editor Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor Annie Baker

Advertisement Production

Martin Lawrence

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer Steve Diprose

SUBSCRIPTION

Jack Homewood subscriptions@quartzltd.com

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

Steel Times International is published 12 times a year (including four digital issues) and is available on subscription. Annual subscription: UK £215.00 Other countries: £284.00

ISSN0143-7798

1 www.steeltimesint.com

CONTENTS – DIGITAL EDITION AUGUST 2023

Other

3 years subscription: UK £431.00 Other countries: £595.00 Single copy (inc postage): £47.00 Email: steel@quartzltd.com Published by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com Steel Times International (USPS No: 020-958) is published monthly by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. ©Quartz Business Media Ltd 2023 2 Leader by Catherine Hill. 4 News round-up Five pages of global steel news. 11 Innovations New products and contracts. 14 Future Steel Forum 2023 Details of the upcoming Forum. 18 Innovations special Siemens supplies ‘motion picture’ at steel mill. 21 USA update Trading: a case of fair or free. 23 Latin America update Offshore wind energy: Brazil’s new player? 25 India update Fuelling the fire. 28 Decarbonization Pursuing greener operations in the steel industry. 30 Artificial intelligence Data analytics and AI for energy and emission control. Digitalization 36 Adapting to demand. 41 Enabling production efficiency. 44 From manual to digital. 48 Perspectives Q&A: Metsen Measuring up. 50 History Pictures of history. 36

2 years subscription: UK £387.00

countries: £510.00

Unmanning the factory

In Tim Burton’s seminal take on the Roald Dahl classic, Charlie and the Chocolate Factory, Mr Bucket, father of the eponymous Charlie, is laid off from his job at the toothpaste factory, with the culprit being a shiny red robot that replaces his work as toothpaste cap screwer-onner. This holds major plot implications for the Bucket family; first and foremost, the Buckets have less money than the less they were already struggling by on. The holes in the roof gape wider, cabbage soup is served sans bread.

A subtler commentary, however, lies in the glittering metal arm of the Smilex 2000 – of automation holding the capacity to lower costs and increase efficiency – while rendering its human precursor obsolete. The rise of digital manufacturing in the steel industry has certainly achieved its mission of improved productivity, safety, and capex, but the implications on the manual labour force once so intrinsic to the material creation of steel remain unknown.

Digitized plants offer a multitude of advantages, particularly given the dangerous, extreme, and often

unpredictable environment of a steel mill. However, the culture of a blue-collar labour force is ingrained deeply into the skin of industrial towns. The aftermath of a digitalized production line strikes parallels with Thatcherite-era mining communities that were no longer required to mine – causing long-term economic decline, mass unemployment, rising crime rates, and crises of personal and political identity.

After Charlie secures his golden ticket, bests the other ‘rotten’ ticket winners, and eventually moves into the factory alongside his family, Mr Bucket finds a new job as the repairman for the very robot that replaced him. Like Mr Bucket’s eventual recompense, the automated era of manufacturing will in turn, demand new workers. Gaps will be filled, and spaces created, but the seismic shift in culture and environment, whether it be a Smilex 2000 laying off the parent to a chocolate mogul, or a sensor that detects flaws that were once inspected by the human eye, will have far-reaching repercussions that extend beyond streamlined production into territories uncharted, and unmanned.

2 www.steeltimesint.com LEADER

Catherine Hill Editorial assistant catherinehill@quartzltd.com

Digital Edition - August 2023 Temperature Profiling Solutions In the Steel Reheat Industry Comprehensive • Passes through furnace with Slab • Get an accurate Slab temperature profile • Measurement at up to 20 points • Live 2 way radio communications Safe • Safe system installation without production delays • Reliable protection of data logger up to 1300°C Easy • Optimise your process accurately • Validate your furnace mathematical model. PhoenixTM GmbH Germany info@phoenixtm.de PhoenixTM Ltd UK sales@phoenixtm.com PhoenixTM LLC USA info@phoenixtm.com Benefits • Optimise furnace programs • Save energy and increase production • Obtain optimal drop out temperatures • Minimise scale build up • Prevent hot roller wear & tear

experience counts ! www.phoenixtm.com

Where

PROFILEMASTER® SPS Profile Measuring System

The PROFILEMASTER® SPS is a light section measuring device for measuring contours and dimensions on profiles of all kinds in cold and hot steel applications.

Benefits:

Maximum measuring accuracy thanks to temperature-stabilized measuring systems

Shape fault detection (SFD) thanks to high sampling rate

High-precision measurements

Detects process problems at an early stage

Fast maintenance and easy cleaning

Zumbach Electronic AG | Hauptstrasse 93 | 2552 Orpund | Schweiz Telefon: +41 (0)32 356 04 00 | Fax: +41 (0)32 356 04 30 | sales@zumbach.ch | www.zumbach.com 4 - 8 Number of cameras min 5 Min. object diameter (mm) max 720 Max. object diameter (mm)

AM/NS India, and Festo India, manufacturer and supplier of automation technology and technical education, have partnered to develop an education initiative, with an emphasis on manufacturing and sustainability. The project, named New Age Makers Institute of Technology (NAMTECH), aims to deliver an integrated model of high-quality engineering and technical education, and will begin operating at an interim campus in August 2023.

Source: Realty Plus, 8 July 2023.

ArcelorMittal has won its appeal against the closure of its Fos-sur-Mer steelworks in France. The labour inspectorate ordered ArcelorMittal to close the site on 19 June, but the steelmaker won its appeal to the Marseille Administrative Court to maintain activity at the site. The court said ArcelorMittal had already taken several measures to clean the operations and has asked it to take new measures to reduce the exposure of employees to harmful emissions. The company welcomed the ‘favourable’ decision and said it was expediting the implementation of its action plan, with several measures already in place.

Source: Argus Media, 10 July 2023.

SteelAsia has exported over 36Mt of steel bars for infrastructure construction in Canada. The company said in a statement that the high-strength steel bars will be used for Canadian infrastructure and were manufactured via green steel production methods. According to SteelAsia, the latest figure is the company’s fifth shipment, bringing the total value of its exports to $24 million. “We have invested in the best available technology to produce the highest quality steel products and these shipments are a validation of our reliability and capability,” SteelAsia chair and CEO Benjamin Yao said.

Source: Business World, 10 July 2023.

Austrian steelmaker voestalpine will temporarily close blast furnace five at its Linz site for relining from August to October. The site has three blast furnaces capable of producing around 5Mt/yr of pig iron. Number five is one of the smaller two at the site, with production capacity of around 840kt/ yr. The larger furnace, A, produces two-thirds of the site's pig iron. Linz is a large supplier to the automotive sector, with 38% of voestalpine's steel division shipments by revenue going to the sector.

Source: Argus Media, 10 July 2023.

New Zealand start-up Avertana has signed a deal with a Chinese steelmaker that continues its goal of commercialising its titanium recycling technology. According to reports, the deal follows on from nine years of research and development into extracting titanium dioxide from slag heaps created by steel manufacturing. Aucklandbased Avertana signed the deal on 28 June with the Tranvic Group to refine slag

by-products into titanium dioxide pigment, which the companies claim will then be used in paints and a range of chemical and mineral products.

Source: Avertana, 11 July 2023.

Murray Capital, an Edinburgh-based metals and investment company, has sold its Asian steel business to the company’s management. The family business, now majority owned and run by David and Keith Murray, said the move represents a shift of focus to the UK steel market, with the sale of the international steel business, Murray Energy Asia. The new owner is Teresa Chong, who has been at Murray Energy for eight years and has held a variety of leadership positions, most recently as managing director.

Source: The Herald, 12 July 2023.

4 NEWS ROUND-UP Digital Edition - August 2023

www.steeltimesint.com

Steelwatch, a new global organisation monitoring carbon emissions from steelmakers, is urging Australian company Bluescope to abandon plans to reline its main blast furnace at Port Kembla in Wollongong. Bluescope's current main blast furnace at Port Kembla is due to reach end-of-life between 2026 and 2030, prompting a billion-dollar investment to replace it. Steelwatch director Caroline Ashley said that if the companies continue investing in emissions-heavy blast furnaces, ‘’We will blow the carbon budget out of the water and we will blow any hopes of stabilising climate change’’.

Source: ABC News, 12 July 2023.

JFE, Japan's second-biggest steelmaker, sees the usage of technology known as 'gigacasting' as a risk to the company's business as it could lead to a reduction of steel demand, its president Koji Kakigi told reporters.

Pioneered by Tesla, gigacasting allows for the production of larger and lighter parts – essential for electric vehicles with heavy batteries – reducing costs, and attracting interest from automobile giants including General Motors and Hyundai Motor. "The amount of crude steel used will obviously decrease," Kakigi told a press conference, calling gigacasting ‘a very big problem’.

Source: Reuters, 12 July 2023.

Teesside International

Airport's business park has reached a new milestone with the first steel now in place at the site. Once operational, Business Park South will comprise 1.9 million sq ft of logistics, distribution and industrial buildings and will create up to 4,400 jobs. More

than 40 tonnes of UK steel is now on-site, sourced from British Steel's Lackenby plant. An extra 42 tonnes of steel is set to be delivered to the site next week to allow all beams to be in place.

Source: Insider Media, 14 July 2023.

ArcelorMittal Hamburg, a subsidiary of Luxembourgbased steelmaker ArcelorMittal, has announced that it has started using granulate from municipal waste instead of coal to produce crude steel from sponge iron and recycled scrap. The company has been working on developing this process for two years, and now around half of the coal previously used in the electric arc furnace is being replaced by a more resource-saving alternative. With this project, the company is claiming to save 3.5kt/yr of carbon emissions.

Source: Steel Orbis, 13 July 2023.

In a bid to raise awareness on the conservation of snakes, Tata Steel Mining organised a ‘Snakes Are Friends’ campaign at its Chromite Mine campus located in Odisha’s Jajpur district, Eastern India. The programme focused on the practical aspects of snake conservation, including measures to be taken when encountering a snake in the wild or near residential areas. During the interactive session, Subhendu Mallik, general secretary and founder of ‘Snake Helpline’, popularly known as the snake man of Odisha, debunked common myths and misconceptions surrounding snakes while shedding light on their important contribution to the natural environment.

Source: DevDiscourse, 14 July 2023.

ArcelorMittal Europe has launched a new low-carbon steel pipe in line with its decarbonization targets. The new product, made from recycled and renewably manufactured XCarbTM steel has up to 75% less carbon emissions, the company claims, which is one of the lowest carbon rates in the steel tube industry. The company is now able to offer the first low-carbon hollow sections, produced using a high percentage of scrap and 100% renewable electricity.

Source: Steel Orbis, 14 July 2023.

NEWS ROUND-UP 5 Digital Edition - August 2023 www.steeltimesint.com

Buy the Original

Italy, Germany, Sweden, Austria, France, The Netherlands, UK, Spain, Turkey, USA, Brazil, Thailand, India, China, Japan

DAN IELI T R U E GRE EN ME T A L

MIDA–QLP QSP–DUE

in

www.danieli.com

Danieli Headquarters

Buttrio, Udine, Italy

@danieligroup

MIDA–QLP and QSP–DUE are the winning Danieli direct-rolling technologies for the most competitive production of long and flat green-steel products.

They are the result of the research and continuous improvement profused over 20 years, along with multi-million dollars of investment. Their unmatched performances have fueled their success worldwide, thanks to lower resource consumption and carbon emissions, unbeaten OpEx, and outstanding product quality.

So, top technology becomes copied technology, the shortest route for competitors that, abandoning their solutions, now try to imitate MIDA–QLP and QSP–DUE Equipment and layout may be copied, but experts know that details make the difference. Automation and process solutions are not easy to copy, and this will be the experience of anyone trusting in those imitations.

The competitive advantage for our customers, obtained by field results, is the best defense for our technology – more than court rulings protecting our patents.

Danieli offers the best guarantees for speedy learning curves, steady performances, and now Digital Plants with no men on the floor. Buy the Original.

GIANPIETRO BENEDETTI CHAIRMAN OF THE BOARD OF DIRECTORS

Emirates Steel Arkan has signed an agreement with Oman’s leading steel products manufacturer, Al Jazeera Steel Product Company (AJSP), to establish a ‘strategic framework for collaboration’. As part of the agreement, Emirates Steel Arkan said it has the opportunity to supply semis, including billets, blooms and beam blanks to AJSP’s upcoming factory in Abu Dhabi or its existing factory in Sohar, Oman.

Source: Zawya, 14 July 2023.

An executive at UK-based recycling firm, EMR Ltd. says that its membership of a decarbonization consortium has led to experimenting with finding effective scrap blends at a nearby steel mill. In a blog post, EMR cited its involvement in RECTIFI, a

Port of Sines, a major port in Portugal, and Companhia Siderúrgica Nacional (CSN), a leading steel producer in Brazil, have signed a MOU as part of the Global Gateway initiative of the European Commission. The agreement aims to establish the scope, rules, and guiding principles of the joint action to develop sustainable, green, and digital logistics corridors to support a strategy focused on three fundamental pillars: ‘logistics resilience’, ‘energy resilience’, and ‘physical and digital connectivity’.

Source: Offshore Energy, 14 July 2023

project that brings together the steel, cement and recycling industries, as leading to the scrap blend melt shop research. “In preliminary trials with Tata Steel, our teams have demonstrated how new grades of recycled steel can be delivered with the chemistry performance required for high-quality, low-carbon steelmaking, lowering the demand for virgin iron ore,” said Roger Morton, director for technology and innovation at EMR.

Source: Recycling Today, 14 July 2023.

Bathroom manufacturer

An emergency construction programme has succeeded in returning water supplies to the ArcelorMittal Kryvyi Rih steel mill affected by Ukraine’s Kakhovka dam breach. A statement issued

by the steelmaker said the development of the fivekilometre pipeline, along with electricity supplies to two new water pumps, had taken 20 days of ‘around the clock’ work to

complete. Drawing water from the Ingulets River, the pipeline will fill the southern Kakhovka reservoir at a level of about 3,000 cubic metres per hour, it said.

Source: Hellenic Shipping News, 17 July 2023.

Bette has announced it has produced more than 100,000 products using sustainable glazed titanium steel. In 2020, the German-based company changed its glazed titanium steel manufacturing process to one that uses CO2neutral steel. Bette achieved this by working with its steel suppliers and helping them to adopt sustainable manufacturing processes. By using titanium sheets supplied by manufacturers with sustainable credentials, Bette says that its products are CO2neutral.

Source: KBB Review, 17 July 2023.

Siemens Energy is set to invest around €1 billion in Germany as part of its €2 billion investment strategy. The Erlangen campus, which is to be built in the west of Erlangen, will focus on sustainable and future-oriented high-tech manufacturing, related research and development activities, and the opening of the location for an ecosystem of partners from the business and scientific communities. “The leading-edge manufacturing facility being built in Erlangen is a good example of how our economy is moving toward a climate-neutral future – as a strong industrial country with good sustainable jobs,” said German chancellor Olaf Scholz.

Source: Metal AM, 17 July 2023.

8 NEWS ROUND-UP www.steeltimesint.com Digital Edition - August 2023

Mining company BHP, Monash University and Chinese steelmaker Baowu have initiated a new Industry Knowledge Centre, with its initial phase including piloting and plant-scale trials of potential carbon abatement technology for steel production. According to a statement from BHP, it said it would provide $8 million over three years to the initiative, with Baowu contributing in-kind support for the initial phase of work, and the Monash Suzhou Research Institute focusing on administrative duties.

Source: AU Manufacturing, 18 July 2023.

Steel and logistics companies in the UAE and Japan have signed a Memorandum of Understanding (MOU) for establishing a low-carbon iron supply chain following the Japanese prime minister’s visit to the country. The agreement is to collaborate on activities for building a low-carbon iron complex in Abu Dhabi. The complex aims to produce lowcarbon emission raw materials for use in steelmaking as part of a partnership between the countries to co-operate on economy, trade, technology, energy, space, and education.

Source: Supply Management, 18 July 2023.

The owner of Jaguar Land Rover has unveiled plans to build an electric car battery factory in the UK. Tata Group says it's planning to invest more than £4 billion, with British prime minister Rishi Sunak declaring that the new plant in Somerset will create thousands of skilled jobs across the country. The deal is the culmination of months of talks with the government over taxpayer subsidies to fend off reported competition for the investment from Spain. Source: Sky News, 19 July 2023.

ArcelorMittal has started production of low carbon heavy steel plate, up to 18 tonnes in weight, using slab from its Belgian asset and processing these at its heavy plate mill in Asturias, Spain. Slab will be produced at the company’s electric-arc furnace-equipped Industeel mill in Charleroi, Belgium, using feedstock that is almost 100% scrap as well as electricity from 100%

renewable sources. The slabs will then be rolled into heavy plate at ArcelorMittal’s heavy plate mill in Gijon, Spain. Source: Fastmarkets, 20 July 2023.

Ukrainian steelmaker Metinvest has accused the Hungarian government of selling a steel plant to Sanjeev Gupta, chair of mining conglomerate GFG Alliance, for less than a third of its true value. Metinvest, which was excluded from the bidding process for the bankrupt firm ISD Dunaferr Zrt., alleged in a statement that the auction had not been transparent, and called on the European Union to investigate it. The Hungarian government has hailed the deal as ‘saving’ the plant.

Source: Bloomberg, 20 July 2023.

According to media reports, Japanese steelmaker Tokyo Steel Manufacturing will transition to round-the-clock operations at all of its electric-furnace facilities by the end of the decade, with plans to harness solar power and other renewables. Tokyo Steel normally operates mills at night on weekdays and idles them during daytime hours, due to electric arc furnaces consuming an outsized amount of energy and with electricity rates being cheaper at night. However, as the company is located close to multiple solar farms, it has decided to go forward with daytime operations in an attempt to reduce outages.

Source: Nikkei Asia, 23 July 2023.

www.steeltimesint.com NEWS ROUND-UP 9 Digital Edition - August 2023

Australian iron ore producer Fortescue Metals has shipped the first batch of ore from the 22Mt/yr Iron Bridge magnetite project in Western Australia to a customer in Vietnam. The Iron Bridge project is designed to increase the overall grade of Fortescue's products, but it remains unclear if it will remain a standalone product or be included in a blend with the firm's lower-grade direct shipping ores. The company hopes to ship 10Mt of Iron Bridge concentrate in 202324.

Source: Argus Media, 25 July 2023.

ArcelorMittal has announced that it is suspending plans to construct a pellet plant in Kryvyi Rih, Ukraine, until the current war with Russia has concluded, the company announced in its report for the first six months of 2023. "The previously announced strategic capex envelope has now been revised... whilst the Ukraine pellet plant project, previously on hold, is removed," said the report,

The European Commission (EC) has approved, under EU State aid rules, a €850 million French measure to support ArcelorMittal France in partially decarbonizing its steel production processes. The measure will contribute to the achievement of the EU Hydrogen Strategy, the European Green Deal and the Green Deal Industrial Plan targets, while helping to end dependence on Russian fossil fuels and fast forward the green transition in line with the REPowerEU Plan, according to the EC.

Source: BioEnergy Insights, 25 July 2023.

A spillage of a chemical from a waste facility operated by ArcelorMittal Liberia has polluted water sources in Nimba County, Liberia. The situation, according to the Environmental Protection Agency (EPA), is ‘depriving villagers of their livelihood’ and has resulted in a ‘eutrophic’ condition leading to overgrowth of vegetation. According to the EPA, contaminated sewage from the steel giant was directly discharged into wetlands that border communities in its operational areas. “The sewage discharge resulted in microbial proliferation, causing a corresponding negative impact on surface water quality,” EPA executive director Wilson Tarpeh commented.

Source: Daily Observer, 25 July 2023.

JSW Steel plans to utilise green power from the 3.8kt hydrogen plant being set up at its Vijayanagar plant, which will enable it to supply green steel in 18-24 months. The company has signed a contract with JSW Energy to source green hydrogen and green oxygen. JSW Steel will have nearly 25 MW of roundthe-clock renewable power and will receive carbon credits based on the amount of thermal power being replaced with green energy.

Source: Projects Today, 26 July 2023.

which was published on 27 July.

Source: Yahoo! news, 1 August 2023.

Indian special chief secretary (environment, forest, science and technology) Neerabh

Kumar Prasad urged the country’s steel industry to adopt innovative practices

Indian steelmaker JSW Steel plans to spend $666 million to construct a plant for cold-rolled grain-orientated steel (CRGO), in collaboration with JSE Steel, the company announced this month. In a regulatory filing, JSW Steel said the project will be funded through equity contributions from multiple partners, as well as other financial institutions. The plant will be located within JSW Steel’s existing mill in Karnataka, southern India.

Source: Steel Orbis, 3 August 2023.

to reduce environmental footprint and contribute to sustainable development during a steel and alloy conference. Speaking at the event, Prasad emphasized the importance for steelmakers to ‘minimise the environmental impact of the industry’. Prasad also estimated that the country’s annual steel production capacity will increase to 300Mt by 2030, and to 500Mt by 2047.

Source: The Hindu, 2 August 2023.

10 NEWS ROUND-UP

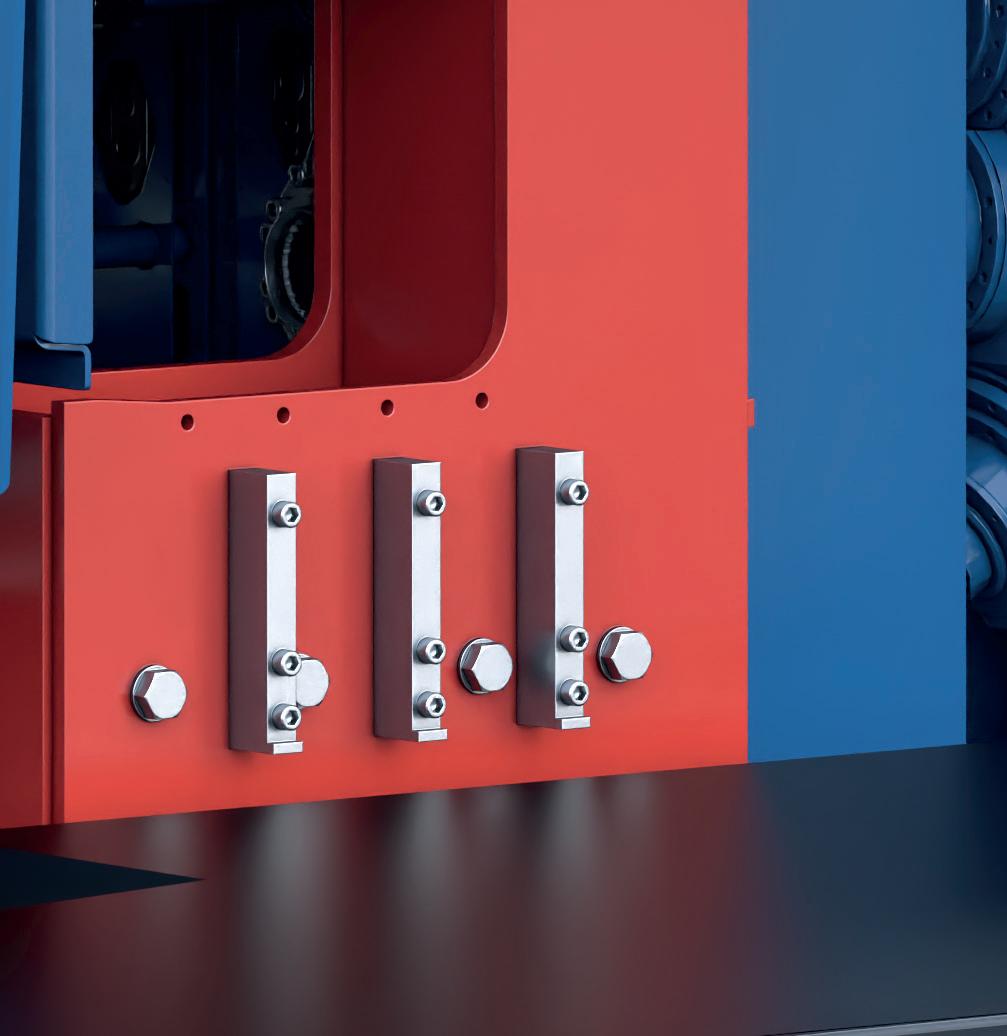

Fives to supply tubular goods solution to Husteel facility in Splendora, Texas

Fives, an international engineering group headquartered in France, has signed a contract with Husteel to design and supply a complete solution to manufacture oil country tubular goods for its new plant in the USA. Husteel, part of South Korea’s Shinan Group, is a welded tube and pipe manufacturer. The company is investing $122 million into a greenfield plant in Splendora, Texas.

Fives will provide engineering, manufacturing and supply of the complete solution to produce tube and pipe with a diameter of 60mm to 114 mm and a wall thickness of up to 10mm for the oil and gas industry.

“The new plant in Texas will be our first facility

in the United States. We are relying on Fives’ presence in the local market, its long-standing reputation as a supplier of reliable equipment, and their vast experience. We look forward to starting production in this new facility in 2025,” commented Hoon Park, CEO of Husteel.

The scope of supply from Fives will include:

• Abbey slitter

• Abbey mill for welded tube and pipe

• Bronx 6-roll straightener

• Taylor-Wilson end facer

• Taylor-Wilson blow out station

• Taylor-Wilson triple-head hydrostatic tester

• Taylor-Wilson dual-head drifter

• Weight measure stencil and coating stations

• Taylor-Wilson packaging system

“We are very proud and excited to be part of this new project delivering our complete solution from slitting to tube finishing. This is our largest fully integrated contract with a renowned manufacturer in our history,” said Jon Dunn, president and chief executive officer of Fives Bronx, Fives subsidiaries in the US and UK.

Both companies specialize in slitters, mills and finishing equipment under historical brands of Abbey, Bronx and Taylor-Wilson.

For further information, log on to www.fives.com

INNOVATIONS www.steeltimesint.com 11

Digital Edition - August 2023

Tenova revamps EAF

ORI Martin, a European integrated steel group which produces steel for the automotive, fastener, mechanical and building sectors, has awarded sustainable solutions provider Tenova a new contract to replace its EAF at its mill in Brescia, Italy. This latest contract continues the decades’ long partnership between the two companies which began in 1998, when ORI Martin commissioned Tenova’s Consteel® EAF, making it the first Consteel® in Europe at the time.

In 2015, after more than 15 years of production, Tenova was contracted to modernize the Consteel® unit, as well as install a heat recovery system on the primary off-gas line exiting the new Consteel® to recover the available thermal energy in the off-gas for the production of steam. The iRecovery® system continues to deliver thermal energy to Brescia’s district heating grid during winter, as well as feeding an ORC turbo-generator to produce electric energy for ORI Martin’s internal use. In 2019, Tenova partnered again with ORI Martin on the Lighthouse

Plant ‘Acciaio_4.0’, a project supported by the Italian Smart Factory Cluster which created a Cyber Physical Factory by integrating Industry 4.0 technologies in the steelmaking process.

Tenova has now been contracted to revamp the 25-year-old EAF, which the company states represents the reliability of its technologies. With this new contract, ORI Martin will finalize the revamping of their plant, optimizing consumption and process for the safe production of steel with minimal environmental impact.

The Brescia plant will also be ready for the installation of an Electro-Magnetic Stirrer with Tenova’s Consteerrer® process which, says Tenova, will increase process efficiency. The Consteerrer® technology is an electro-magnetic stirring system, developed through an exclusive worldwide partnership with ABB. According to Tenova, it offers significantly low operating costs, extremely reliable and safe operations, as well as superior quality steel.

“We are delighted to continue this decades’

long partnership with ORI Martin, which is a true testament to the reliability of Tenova’s technologies and a great manifestation of ORI Martin’s trust in our company,” said Mario Marcozzi, Tenova’s upstream sales and marketing director.

“Sustainability has always been a core value at ORI Martin, as we have pursued strategies to protect the environment and facilitate a circular economy. As early as 1998, we were investing in technologies to mitigate our impact on the environment, which is how we came to Tenova, who has been a trusted and reliable partner throughout. With this latest generation Consteel® EAF, we are confident ORI Martin will continue to be one of the most flexible, efficient and environmentally friendly steel meltshops,” said Natale Gaudenzi, ORI Martin plant manager.

Start-up of the new furnace is scheduled for June 2024.

For further information, log on to www.tenova.com

INNOVATIONS 12 www.steeltimesint.com Digital Edition - August 2023

#itsmorethanjustamachine

UNIQUE

3-ROLL TECHNOLOGY FOR SBQ SIZING. A Reducing & Sizing Block for long products keeping its promises. Achieve your goals with KOCKS RSB®.

up to 160mm

finishing size in round or hexagonal dimensions

up to 20%

increase in production

up to 10% energy savings in the mill line

WE MAKE YOUR PRODUCT GOLD www.kocks.de

FUTURE STEEL FORUM

2023

DIGITALIZATION AND

The Future Steel Forum, now in its SEVENTH successful year, is heading for Vienna this September to examine the important relationship between digital manufacturing and the decarbonization of the steelmaking process. Come and listen to experts from the two most important areas of global steelmaking at present. This is a must-attend conference

SPEAKERS FOR FUTURE STEEL FORUM IN VIENNA INCLUDE:

www.FutureSteelForum.com @Future_Steel Follow our LinkedIn Page

Anna Domènech, CELSA Group

Kurt Herzog Primetals Technologies

Michael Eder voestalpine

Pankaj Kumar Tata Steel Ltd, India

20-21 SEPTEMBER 2023 HILTON VIENNA PARK | AUSTRIA DECARBONIZATION SPONSOR OR EXHIBIT To discuss any sponsorship opportunities or exhibition enquires, please contact Paul Rossage now on paulrossage@quartzltd.com Sponsored by O cial Media Partner Since 1866 Organised by SCAN HERE TO REGISTER

Stanislav Zinchenko GMK Center

Dr. Roman Stiftner Austrian Mining & Steel Association

Carlos Russell Ternium

for anybody with an interest in the fast-developing world of Industry 4.0 technologies and those responsible for sustainable steel manufacturing.

Dr. Klaus Peters ESTEP

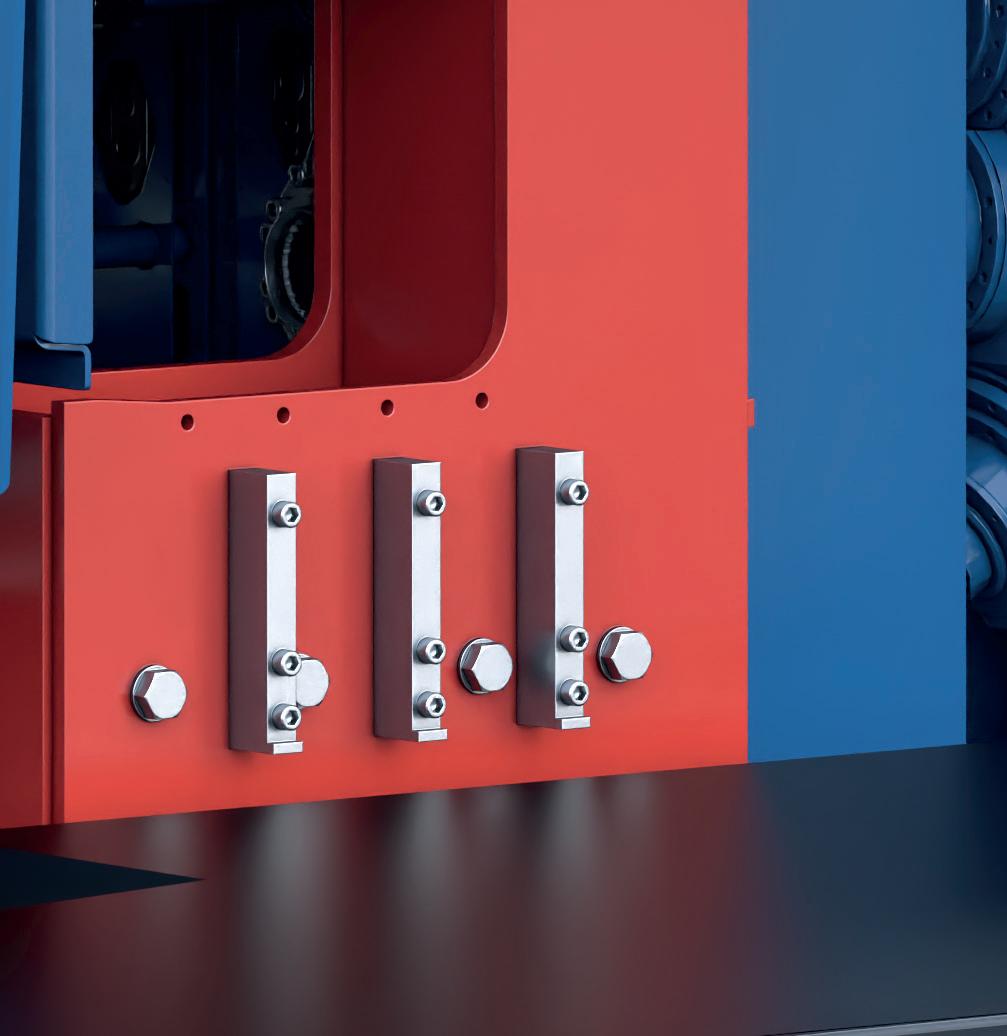

New order for KOCKS RSB® from China

The Chinese steel producer Xingtai Iron & Steel Co. Ltd. and Friedrich KOCKS GmbH & Co. KG have signed a contract for the installation of an RSB® 370++/4 Reducing & Sizing Block in 5.0 design, which is considered the centerpiece of the company’s new rolling mill complex for the production of special steels. This new order from Xingtai is in line with its plans to relocate production to the Chengdong Industrial Area, which is located in Wei County in Hebei Province

With an annual output of 3Mt, Xingtai Iron & Steel is known for its production of specialty steels. The steel producer is also the first steel company in China to manufacture bar in coil (BIC). In the new rolling mill of Xingtai Iron & Steel Co. Ltd., the KOCKS 3-roll RSB® 370++/4 will be located as the finishing block after 18 stands in H/V arrangement in a 900.000 t/a SBQ mill. It will produce BIC within a finished size range of Ø 16.00 to 52.00 mm with the highest

Thermo Fisher Scientific releases optical emission spectrometer

Thermo Fisher Scientific has announced the latest iteration to its range of ARL iSpark Series Optical Emission Spectrometers. The Thermo Scientific™ ARL iSpark™ 8860 Inclusion Analyzer with Spark-DAT includes all the features necessary for both thorough elemental analysis of steel and ultra-fast inclusion analysis, states the company. The spectrometer aims to keep the lowest inclusion content of steel products at the point of manufacture to prevent costly production issues, like nozzle clogging during continuous casting processes.

According to Thermo Fisher Scientific, the ARL iSpark 8860 Inclusion Analyzer is the first optical emission spectrometer on the market to combine full elemental coverage with rapid characterization of non-metallic inclusions in a single analysis. It can identify and determine features such as the type, number, size, concentration and volume fraction of inclusions, allowing steel manufactur-

ers to control inclusion content in steel products in real time. In turn, this can help to prevent costly process issues and the detrimental effects of inclusions on the mechanical properties of end products, ensuring high quality steel production and minimizing the risk of customer claims or product returns.

Features include:

• Part of the ARL iSpark Series – the trusted standard in optical emission spectroscopy

• Fully equipped to generate advanced elemental concentrations and inclusion data in steel

• 1m vacuum Paschen-Runge optics with photomultiplier tube (PMT) detectors

• Full elemental coverage, including gas elements

• Fast inclusion analysis

• Comprehensive inclusion analysis software tools, including Spark Explorer, Inclusions Report and Statistical Process Control (SPC)

dimensional tolerance, it is claimed. The scope of supply also includes the remote control for stand and guide adjustments, the equipment for the roll shop, and KOCKS software solutions for optimum rolling results. The commissioning of the RSB® is scheduled for the end of 2024.

For further information, log on to www.kocks.de

• Inclusion analysis method customization and training with

Thermo Fisher Scientific experts

• Automated with the ARL Sample Manipulation System (SMS)

For further information, log on to www.thermofisher.com

16 www.steeltimesint.com Digital Edition - August 2023

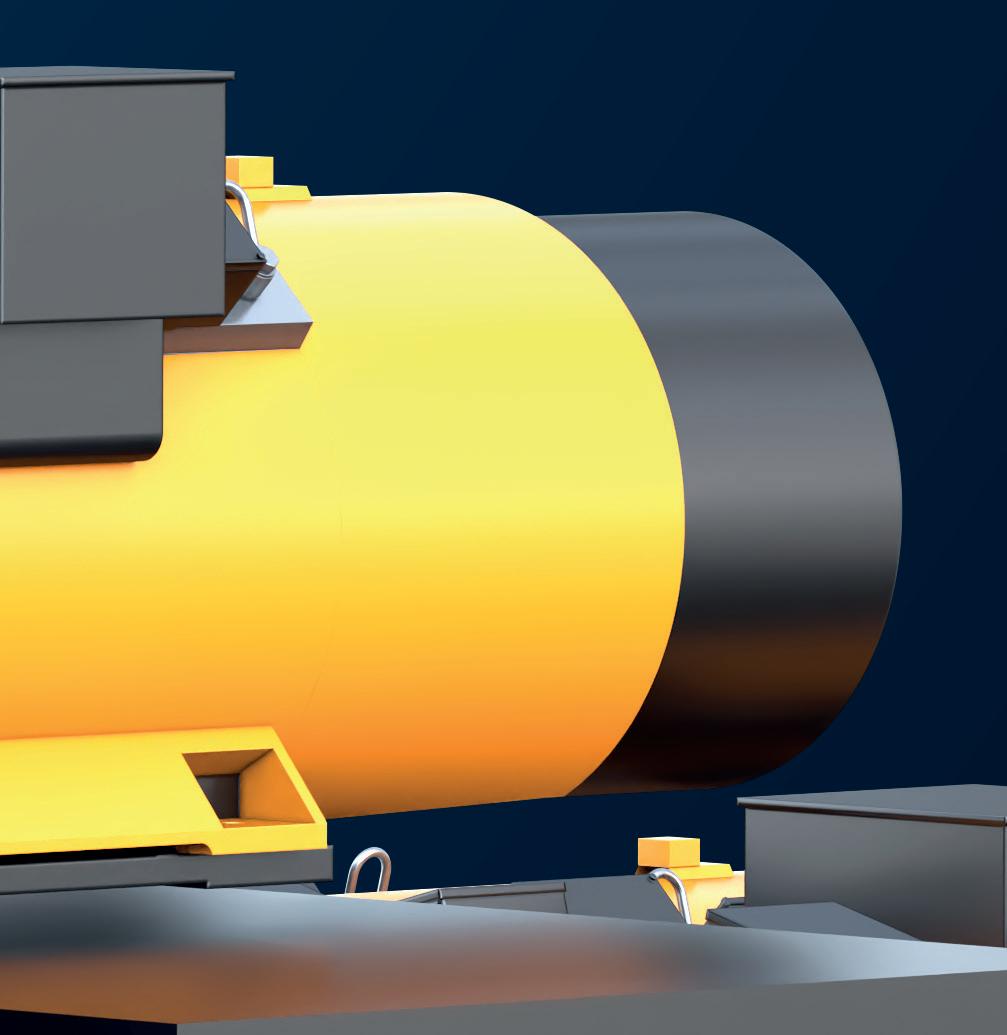

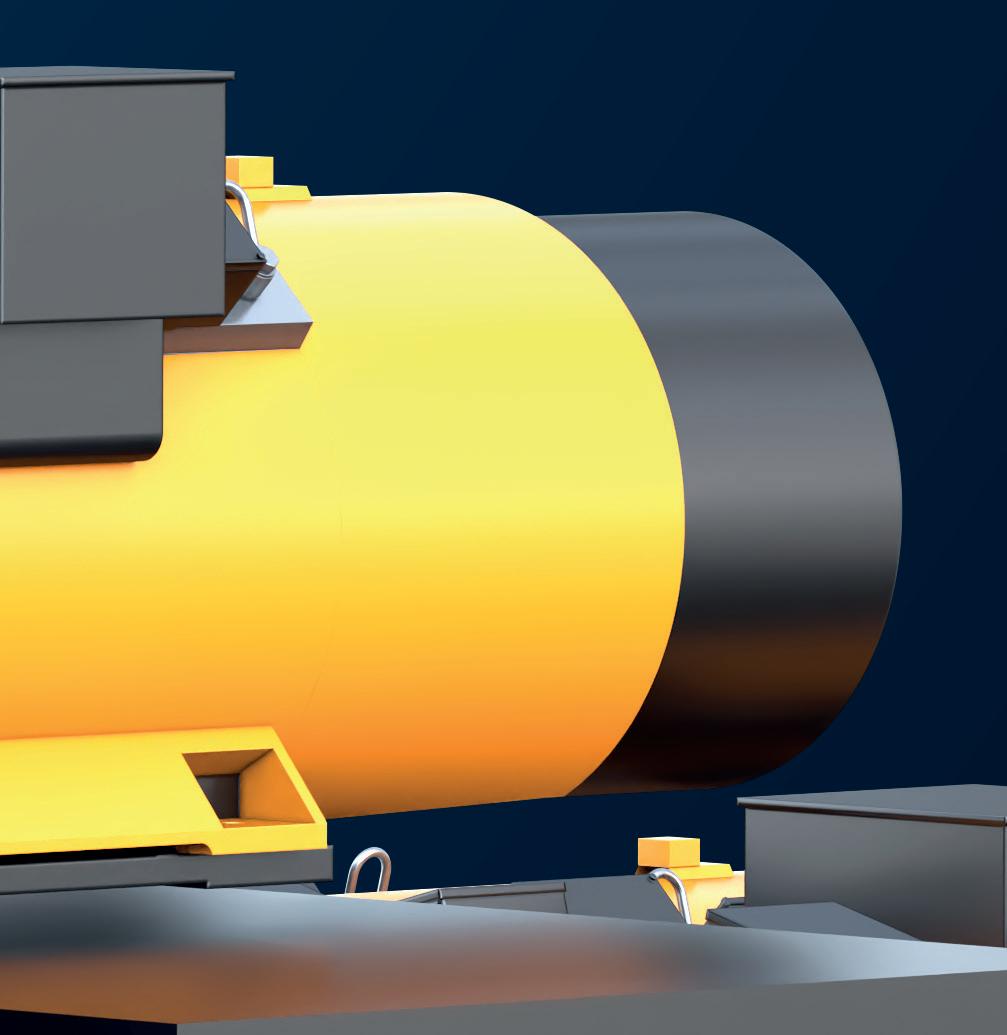

ABB launches new generation of NEMA motor

ABB has developed the new generation AMI 5800 NEMA modular induction motor to offer energy efficiency and reliability in demanding applications such as pumps, compressors, fans, extruders, conveyors and crushers. Rated for a power output of up to 1750 HP, the AMI 5800 offers the capability for a high degree of modularity and customization to suit both new build and upgrade projects in a wide range of industries including chemical oil and gas, conventional power generation, mining and cement and metals.

The AMI 5800 motor is a true NEMA design that aims to meet both electrical performance requirements and mechanical mounting standards.

Manufacturing company Resonac Corporation has decided to acquire 100% of outstanding shares in AMI Automation. Resonac acquired 50% ownership in AMI on 5 February 2021 with an option to acquire the remaining 50% of shares within five years from that date. Resonac will acquire the remaining 50% to complete the acquisition of 100% shares in AMI by the third quarter of 2023.

AMI is a global provider of automation solutions, including hardware, software, and services for a wide range of industries. AMI provides software and services to optimize the operation

A key feature is a high-strength welded steel frame typically found only in motors with larger frame sizes. This, says ABB, lowers stress on the motor while mitigating vibrations and resonance to ensure reliable operation in harsh conditions with a design life of 25 years or 20,000 starts.

A further important advantage of the AMI 5800 is a shorter bearing-to-bearing span compared with previous models. This innovative feature improves performance at high speeds and enables the motor to be used as a simple drop-in replacement to upgrade existing equipment.

Sam Patrick, ABB product manager large motors and generators, said: “We have engineered the AMI 5800 motor to meet customer requirements for high energy efficiency and reliability as well as sustainable manufacture and use. Its modular design in terms of cooling methods, bearings, shaft extensions and terminal boxes also provides the flexibility to match the North American installed base. That makes the

AMI 5800 ideally suited for both upgrading existing installations and next generation designs no matter how harsh the environment it will be operating in.”

The majority of regular AMI 5800 designs not only meet but exceed North American standards for energy efficiency. Further customization will allow some models to operate above the IE4 equivalent level of energy efficiency while meeting NEMA electrical performance standards.

The new motor is configured for optimal airflow, meaning that it is designed to run as cool as possible, whether in an open-air installation or completely enclosed with a cooler. According to ABB, the time-tested MICADUR® insulation system makes the motor suitable for starting high inertia loads direct online (DOL) while it is also an ideal partner for variable speed drives (VSDs).

For further information, log on to www.abb.com

of EAFs, which are used by the steel industry. In North America, where the EAF market is expected to expand further, about 90% of EAF steel is produced using AMI’s software. Resonac is a global provider of graphite electrodes, with the world’s largest graphite electrode production capacity in six manufacturing facilities strategically located around the world.

The acquisition of 100% of AMI shares will allow Resonac to make its graphite business evolve from simple provision of electrode products into provision of total solution services for EAF including support to digitalization of the pro-

duction process, according to a company press announcement.

Resonac plans to invest heavily in new product development for the current metals, paper, mining, and cement markets, and expects to leverage this expertise in automation and control software, hardware, and power systems to accelerate digital transformation in areas such as Condition Based Maintenance (CBM) and predictive analytics.

For further information, log on to www.amiautomation.com

17 INNOVATIONS

Resonac to acquire 100% of shares in AMI Automation

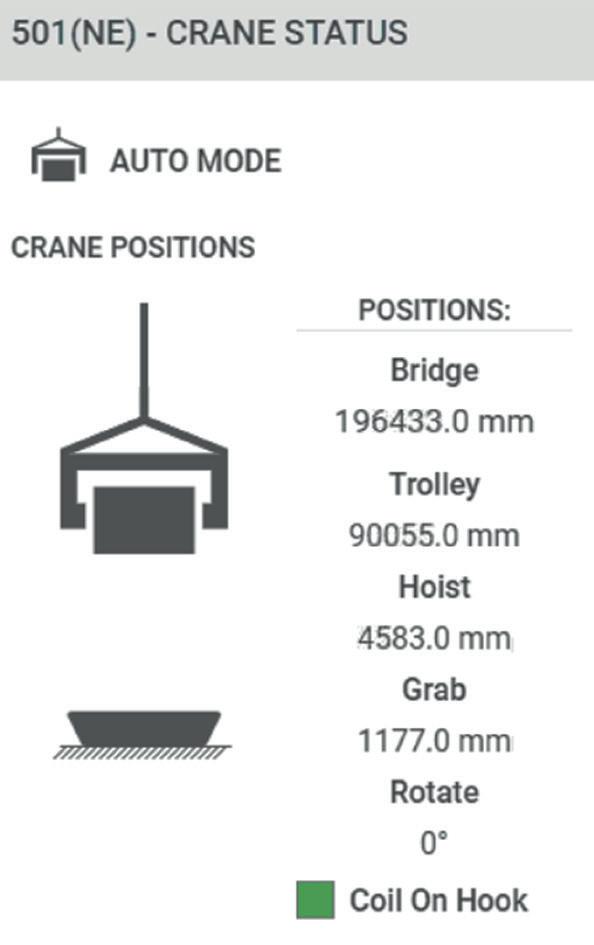

Siemens supplies ‘motion picture’ at steel mill

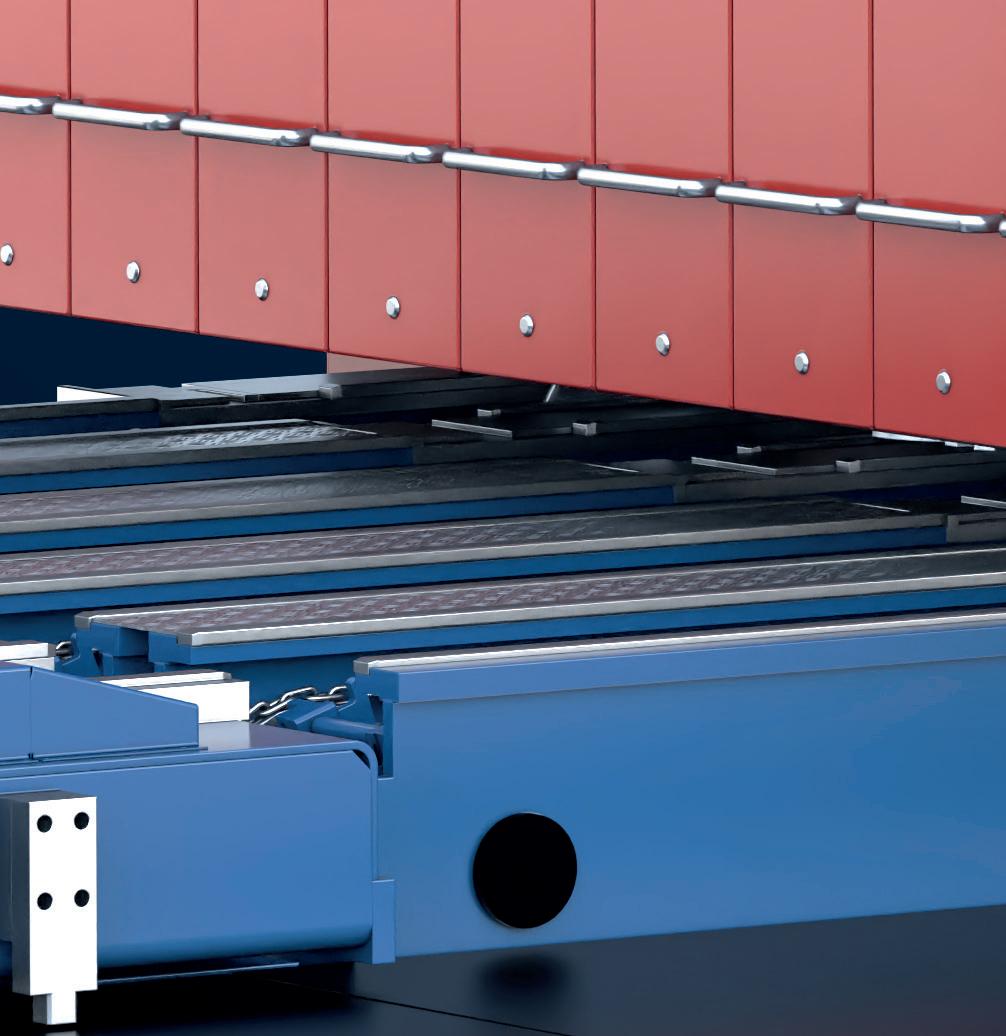

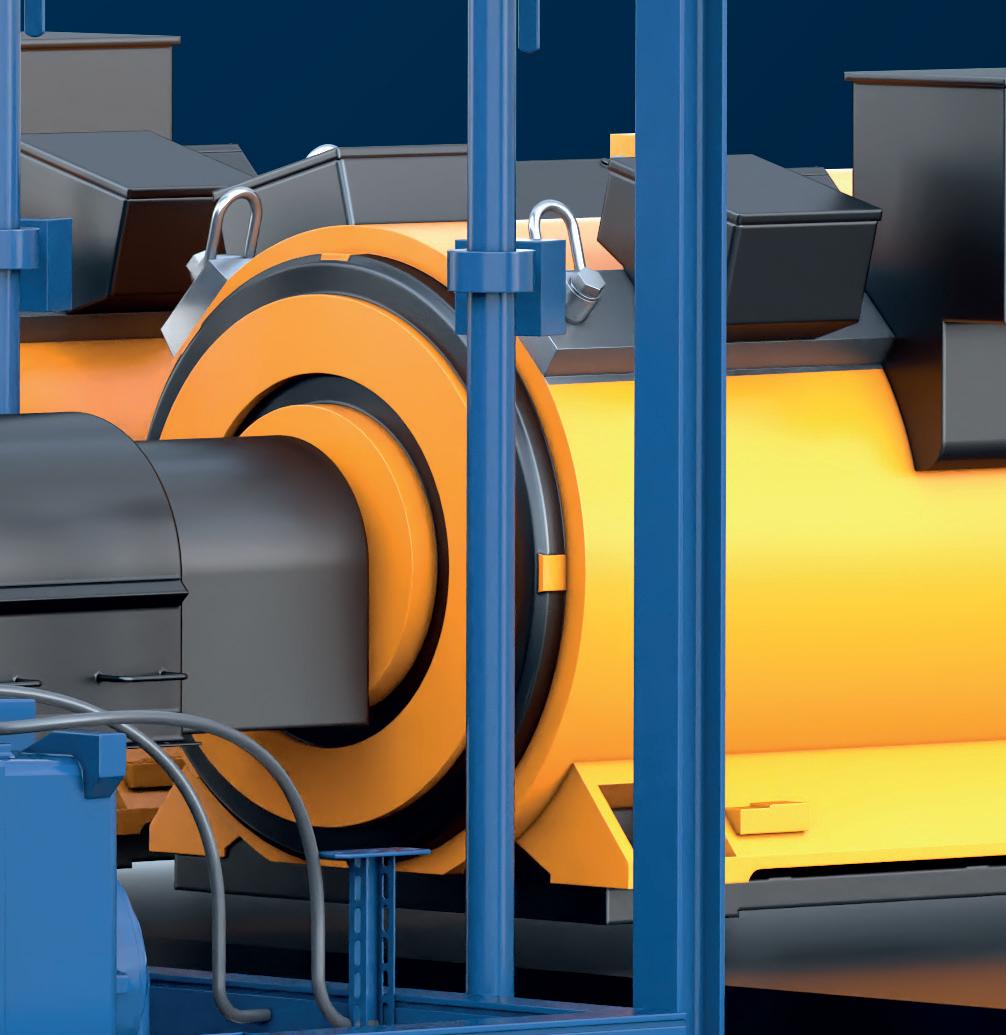

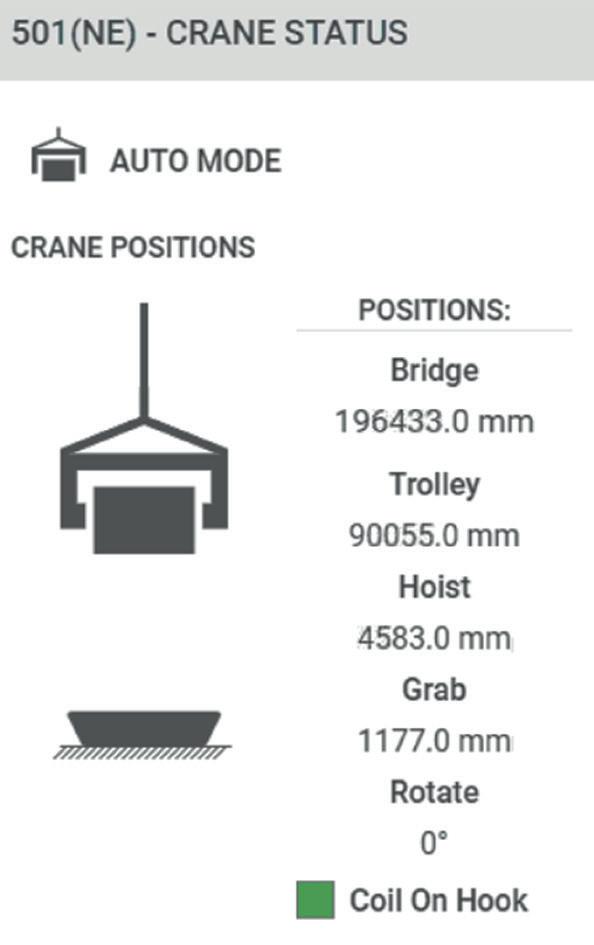

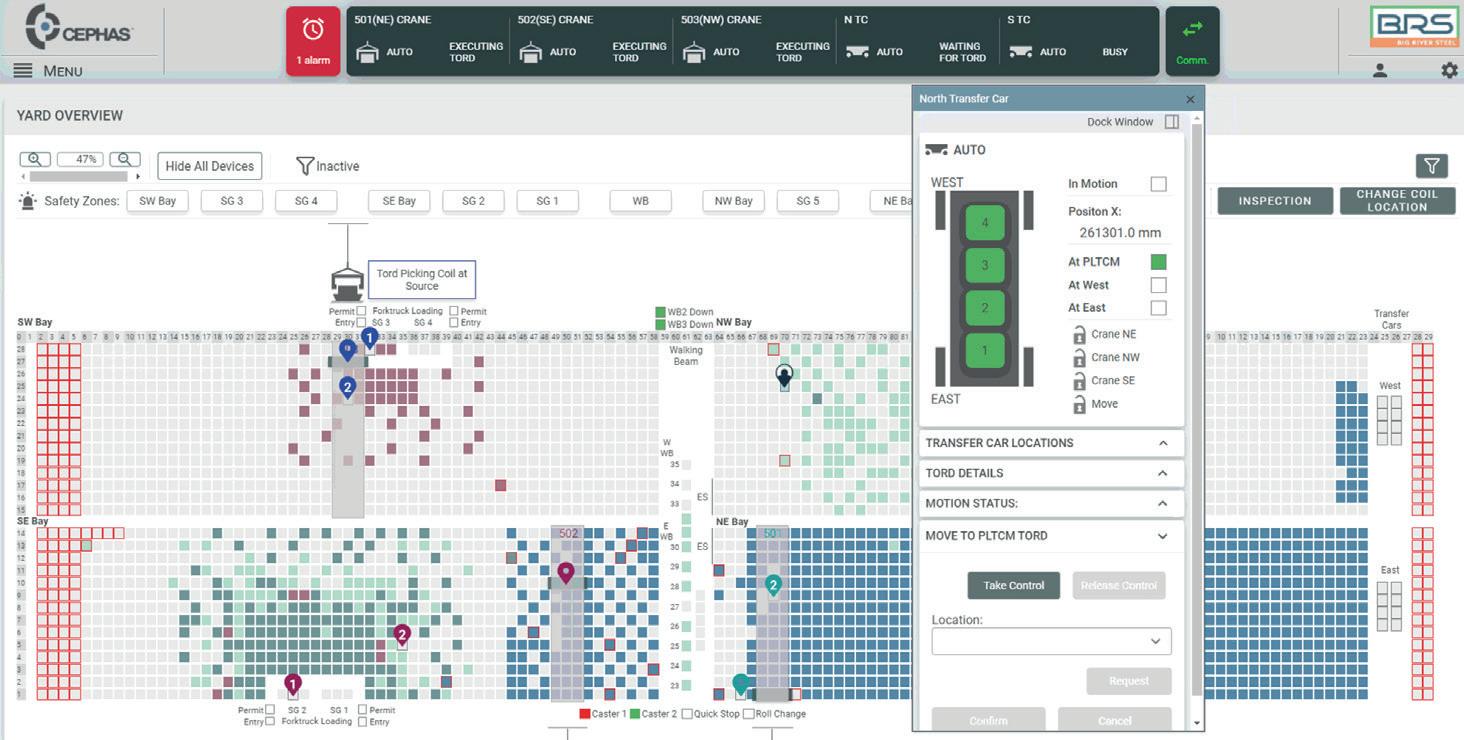

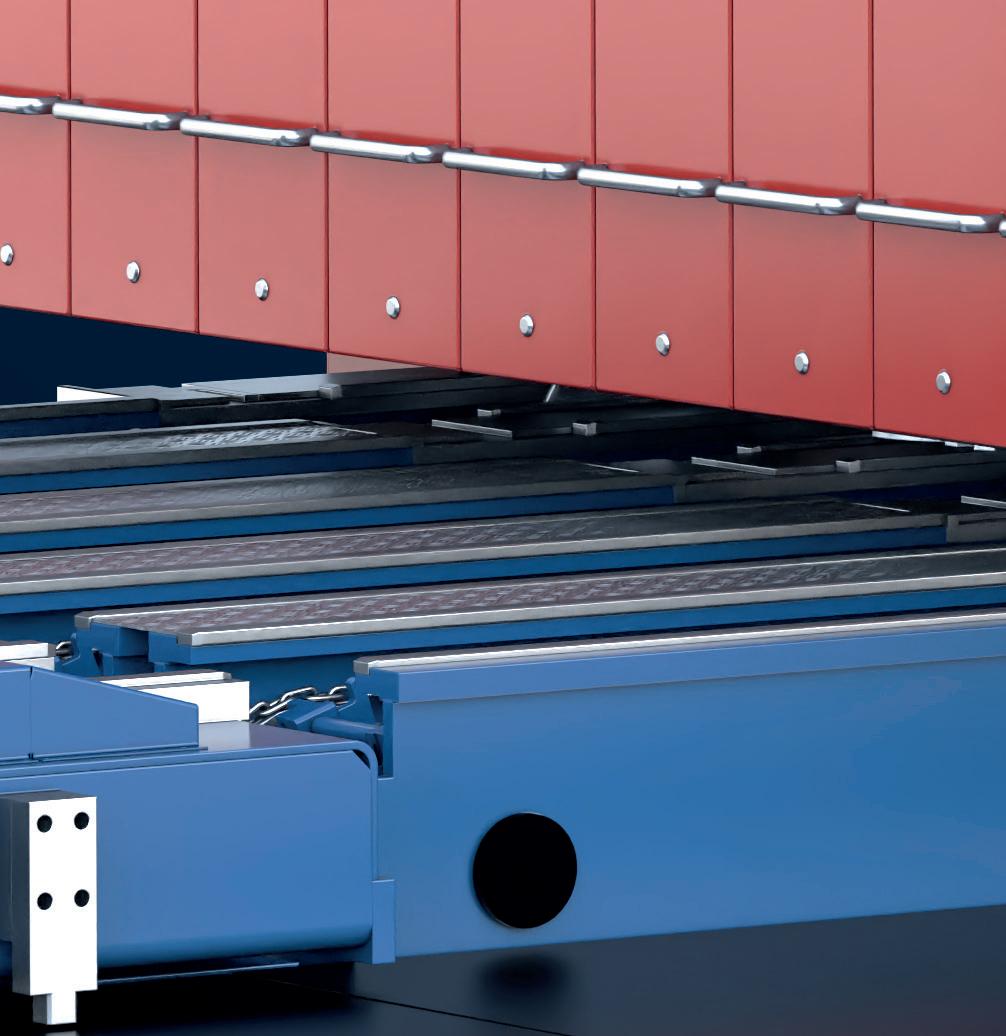

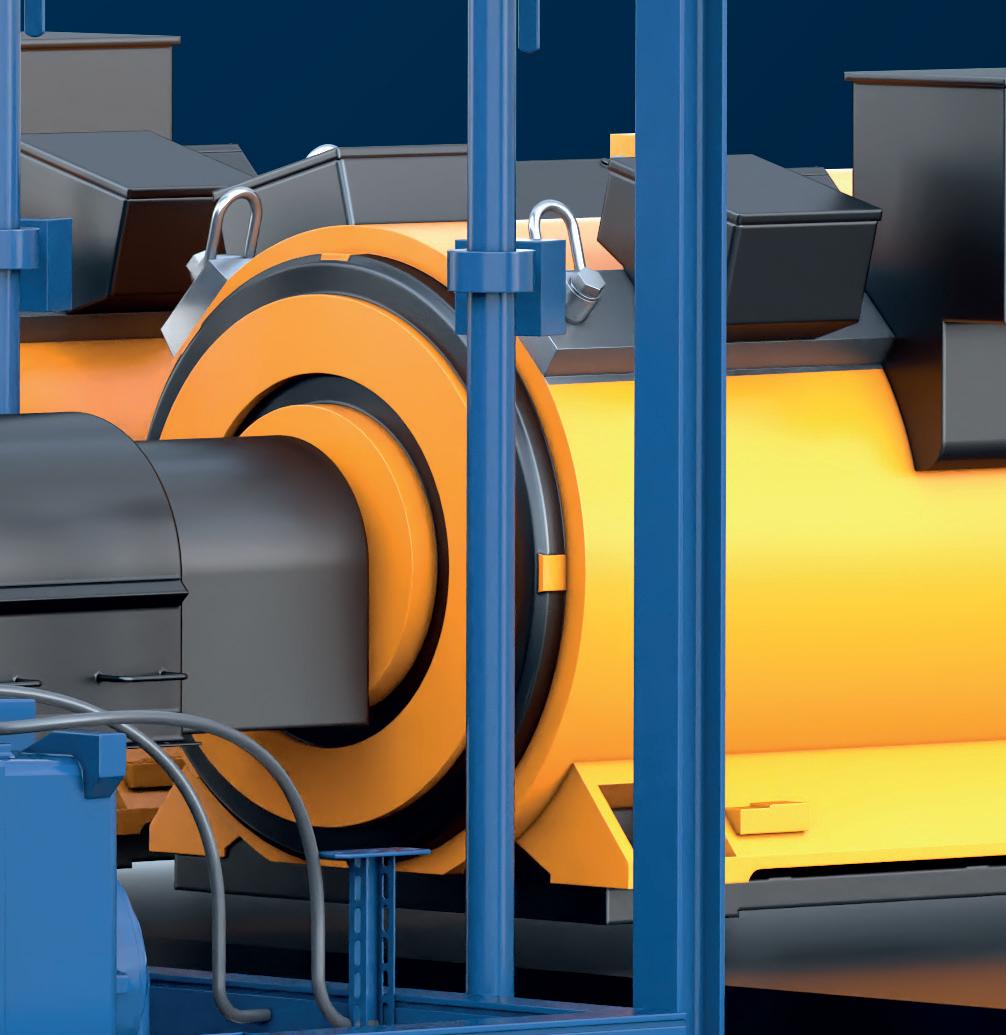

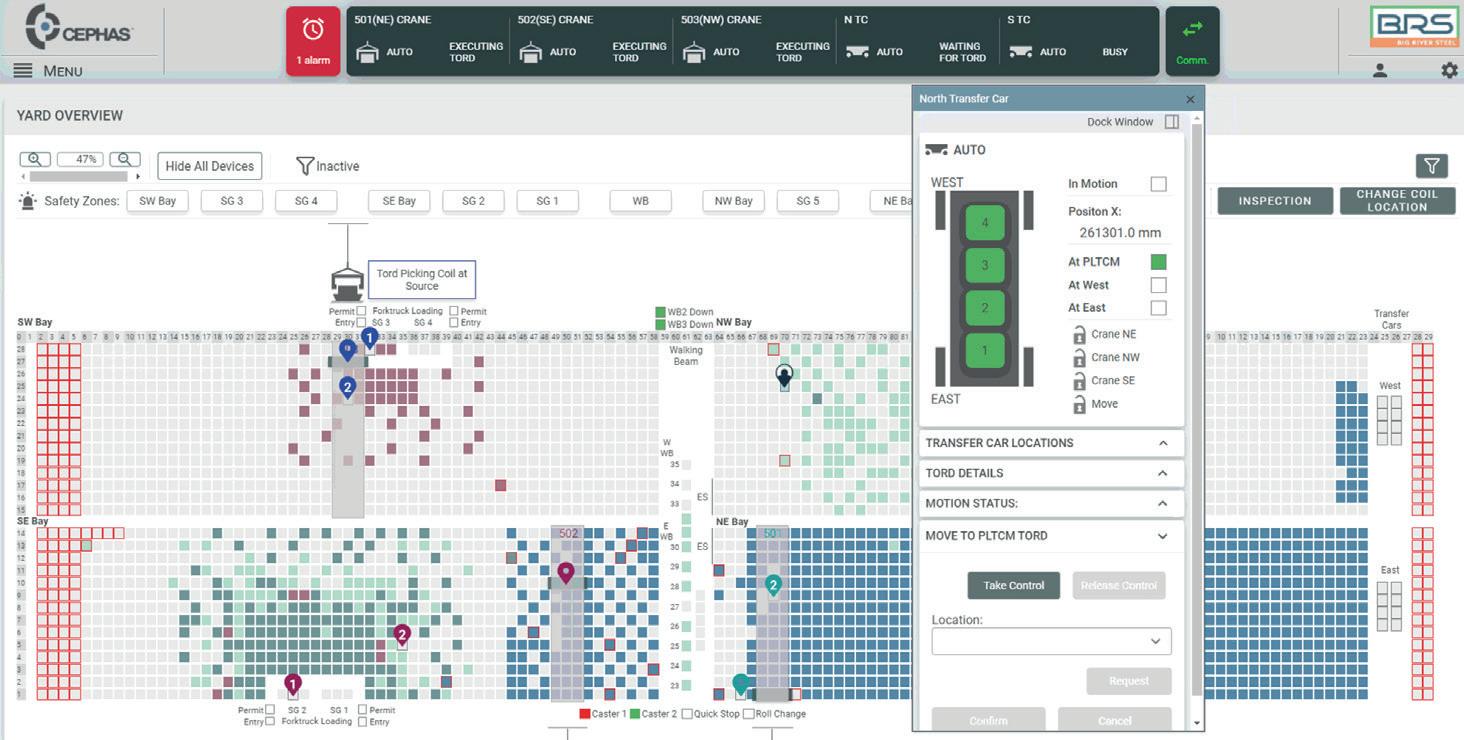

A major US steel mill in Arkansas required an entirely new approach to coil handling for its rolledto-order production strategy. Its engineering and materials handling equipment partner, Morgan Automation, devised and implemented a fully automated, non-manned series of three cranes to work with two coil transfer cars accepting hot coils off the walking beam from the hot mill. In manufacturing this system solution, Morgan turned to its long-time drives and motion control partner, Siemens, who provided a full complement of drive, plc, safety I/O, power quality meters, PCs, wireless hardware plus communication software and its TIA Portal for commissioning and monitoring on the project. According to the president of Morgan Automation, Mark Sharamitaro, “The excellent reliability and performance of the Siemens solution on this project was invaluable in helping us achieve complete operational efficiency and zero downtime during the first six months of operation.”

This greenfield project involved the handling of approximately 1,000 coils or 30kt of steel a day at the mill. A typical coil in this yard is approximately 83” OD x 82” W and weighs 28 tons on average. As the mill operates on a ‘made

to order’ mindset, there is a dual challenge of handling hot coils from the mill and organizing their staging for shipment by truck, rail or barge, with an additional quadrant on the ground for coils heading via the coil transfer cars provided by Morgan to the Pickling Line Tandem Cold Mill (PLTCM) on the premises. In the proposed and enclosed coil yard, the walking beam would deliver the coils from the hot mill, then the crane grab would secure the individual coil and place it in the coil transfer car or on a saddle in the appropriate quadrant on the floor. During low production times, the system would defrag the coil assortment into the proper positions to conserve storage space with full tracking in real time. Each crane has a thermal imaging camera for temperature sensing plus a patent-pending laser positioning system. The comprehensive data tracking is clearly displayed in the mill control room with real time KPI calculations.

The goals for this new autonomous coil yard (ACY) included the indoor facility to reduce rust and corrosion, improved coil handling to meet the shipping protocols, reduced energy costs by eliminating lift truck handling and reducing physical distancing of coils, plus faster location of

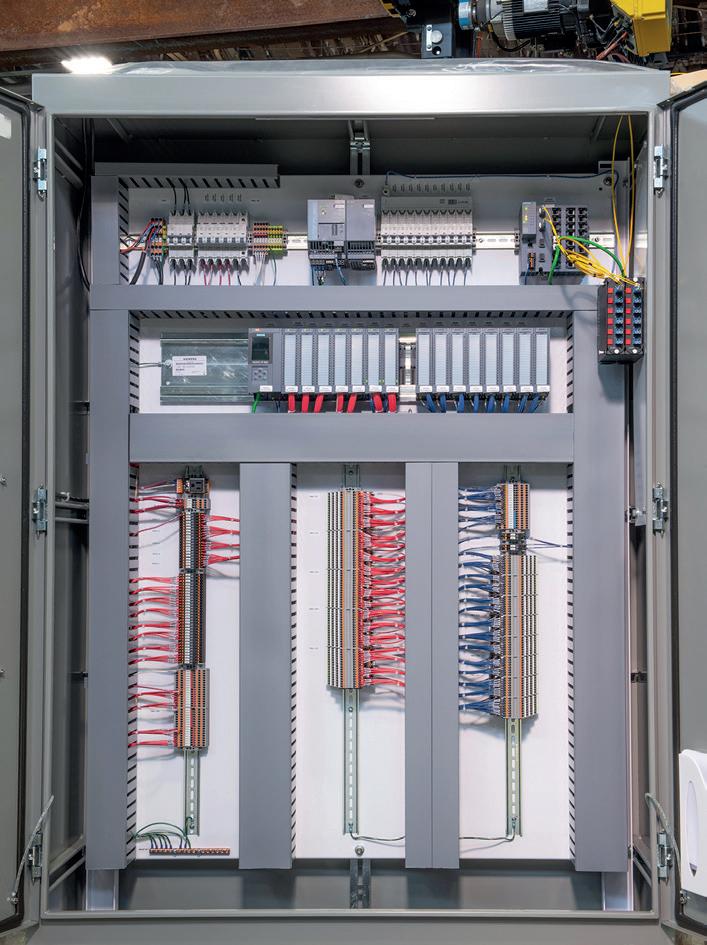

the coils on their saddles for crane handling into shipment staging areas. Critical overall was the safety of the personnel, so a system of nine remote I/O cabinets and 21 safety gates was to be implemented. Integration of the entire operation was to be handled by the proprietary Morgan CEPHAS logistic management system with a rules-based engine for algorithmic decision-making. All the information management would be transmitted and handled by mill personnel, using the in-house platform and virtual private network (VPN).

With those logistics, performance goals and system integration requirements, Morgan began the process of working with the Siemens team to utilize the full range of product and software options for construction of the optimum materials handling, motion control and data management system for the ACY. According to Mark Sharamitaro, “We were bringing our established CEPHAS warehouse management system to this challenge and seeking to marry it to a single user interface, driven by the rules established by our customer, so there’s essentially a single bucket of data on each coil.” In that ‘bucket’ are all the physical characteristics and temperature of the

INNOVATIONS SPECIAL www.steeltimesint.com 18

Digital Edition - August 2023

coil plus the determined location for placement. All this data is transmitted through a series of Siemens SINAMICS drive modules, SIMATIC PLCs and the SINEMA network monitoring server, complemented by WinCC V16 supervisory control for monitoring over long distances. In addition, Siemens offered its SCALANCE wireless suite of ethernet switches and access points to communicate the ring topology and VLAN data to the mill control room personnel.

Sharamitaro noted the need for an embedded quality system to identify secondary coils on the floor and determine their transfer path. As each coil is grabbed, a full battery of sensors, switches, I/O power supply, drives, PLCs and wireless communication sends information from the crane trolley directly to the control house. The three 190-ton cranes are thus fully synchronized for handling the incoming coils from the hot mill plus the placement of the coils in the transfer cars and staging lines. The information feeds the CEPHAS system of Morgan Automation, which makes the algorithmic determinations for each coil, based on predetermined parameters set by the mill. An efficient and reliable system of coil handling is achieved, as a result.

To evidence the energy savings, Siemens also provided its PAC3200 power meters that track and record power consumption ongoing in a system and efficiently communicate data over a network protocol. Another key component in the Siemens solution was the SINAMICS S120 Smart Line Module for crane applications, which features onboard regenerative drive. This feature takes the excess motor power from a crane hoist, for example, during descent, and feeds it to another component in the system or back to the grid for trackable energy savings to the customer. Furthermore, this Smart Line Module has particular application in the crane world, as it features a line-commutated infeed that is enhanced by the use of insulated gate bipolar transistors that avoid commutation faults typical of thyristor-based rectifiers.

For further information, log on to www.siemens.com

INNOVATIONS 19

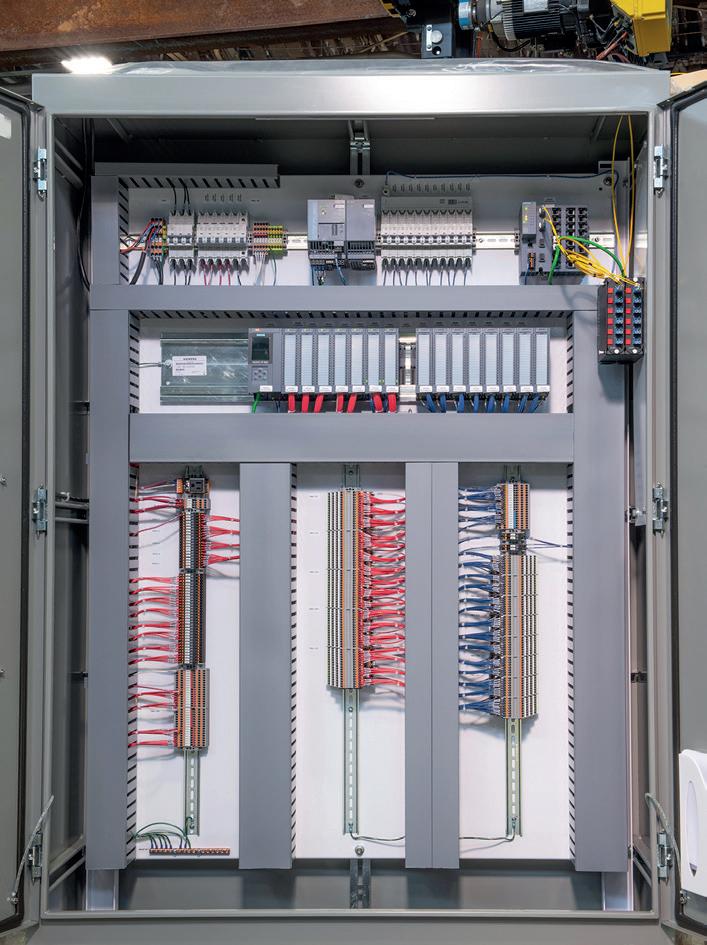

A. Typical control cabinet houses drives and other hardware to run the crane system.

B. Morgan technician programmes the Siemens PLC to co-ordinate with the Morgan CEPHAS system for ACY control.

C. CEPHAS logistic management system tracks every coil being handled.

D. CEPHAS system provided by Morgan tracks the position and status of every coil in the ACY, divided by grid location for staging of shipments.

E. PLC unit controls the drives to position the crane for handling of each coil from the mill and position the coil in the proper staging area of the ACY.

A B C D E

Autonomous Coil Yard (ACY) run at major steel company in the Midwest, operated by crane system provided to the mill by Morgan Automation of Alliance, Ohio. Myriad Siemens controls are onboard the system, both hardware and software.

DIGITALIZATION AND DECARBONIZATION

The Future Steel Forum, now in its SEVENTH successful year, is heading for Vienna this September to examine the important relationship between digital manufacturing and the decarbonization of the steelmaking process. Come and listen to experts from the two most important areas of global steelmaking at present. This is a must-attend conference for anybody with an interest in the fast-developing world of Industry 4.0 technologies and those responsible for sustainable steel manufacturing.

SPONSOR OR EXHIBIT

To discuss any sponsorship opportunities or exhibition enquires, please contact Paul Rossage now on paulrossage@quartzltd.com

FUTURE

2023

STEEL FORUM

@Future_Steel Join our Future Steel Forum Group

SEPTEMBER 2023

VIENNA PARK | AUSTRIA FSF-23-Half-Page-Vertical-Ad-Print.indd 1 02/08/2023 15:49

www.FutureSteelForum.com

20-21

HILTON

Trading: a case of fair or free

FROM its past calls for free trade, when US industry needed to penetrate foreign markets riddled with bureaucratic red tape, high import duties and other obstacles that impeded American exports, the US industry is today increasingly talking about fair trade to curb the inflow of heavily subsidized products that are produced in excess by the regimented economies of the supplying countries.

The term ‘fair trade’ is applied today to China which exploited the free trade concept and recklessly exported what many American steel executives and workers describe as ‘huge quantities of excessive and dirty steel’ that is produced with heavy government subsidies and with high C02 emissions. Many steel executives and the United Steelworkers (USW) had urged lawmakers to stop the rising imports of subsidized steel from China, which had been exporting record quantities of excess steel to provide jobs to its workers and prevent social unrest.

The Trump administration imposed tariffs of 25% and 14% against imports of steel and aluminium respectively under Section 232 of the Trade Expansion Act of 1962 after determination by the Department of Commerce that certain imports threaten to impair US national security.

The much-discussed issue of unfair

trade and its threat to American steel jobs was raised by steel industry executives representing Cleveland-Cliffs, US Steel, Nucor Corp., etc., along with the USW, during a recent hearing of the Congressional Steel Caucus (CSC) in Washington DC, with both labour and steel industry representatives urging the CSC not to let down its guard in view of continuing unfair trade. Steel leaders say that the American steel industry is coming off two strong years but global overcapacity continues to pose a threat, and warn that steel dumping posed a threat to mills and high-paying union steelworker jobs. Both the steel executives and the USW want the enforcement measures to be retained, to maintain a robust domestic industry.

Section 232 trade action, they argued, had helped stabilize the industry, creating thousands of new steel jobs across the country and leading to major investments in new and existing steel plants. Indeed, American steel manufacturers were taking the lead in reducing carbon emissions, with Cleveland-Cliffs investing $1 billion to build a direct reduction plant that has helped the company reduce scope 1 and scope 2 greenhouse gas emissions by 32%, Cleveland-Cliffs president and CEO Lourenco Goncalves testified. Likewise, US Steel has publicly announced that it would

*US correspondent, Steel Times International

work towards its goal of achieving net zero carbon emissions by 2050.

But the problem of global steel excess capacity remains largely unresolved. While many countries are contributing to the problem, US steel producers and steelworkers allege that China continues to be the worst offender. A 2021 report from the Economic Policy Institute found that China ‘used subsidies and other forms of distortionary government support to expand steel capacity by 418%, or 930Mt since 2000, such that by 2019 it controlled just shy of half of global steel capacity.’

The US industry is also alarmed at China’s attempts to circumvent US trade laws by investing in steel production in a number of third countries. USW legislative director Roy Houseman testified that China will add ‘nearly 100Mt of steel capacity in Southeast Asia alone if all planned investments in the region go forward’. There is considerable unease among US steel producers that this excess capacity will find its way into the US market through third countries where China has set up operations.

Houseman said American steelworkers needed a level playing field, a continuation of tariffs, an update of trade laws and ‘Build America, Buy America’ requirements.

“The continued growth of excess steel production capacity demands the

21 www.steeltimesint.com Digital Edition - August 2023

Amid continuing fears of excessive global steel supply being dumped into the US market, the American steel industry has called for legislation to prevent rising imports of ‘dirty steel’.

USA UPDATE

By Manik Mehta*

continued defense of a domestic industry vital to our national security. According to the OECD, over 630Mt of excess steel capacity exists today, with another 166Mt of new steelmaking capacity coming online primarily in the Middle East and South East Asia,” he said. “China accounts for roughly half of the world’s steel capacity output, and the country’s Belt and Road Initiative includes investing in greenhouse gas intensive steelmaking in multiple countries.”

The retention of Section 232 tariffs is being drummed up by steel executives, joined by the steelworkers, who also call for implementation of new trade tools like those found in the ‘Levelling the Playing Field 2.0’ initiative launched recently, Houseman testified.

This initiative aims to modernize the trade remedy tools America needs to counter the unfair economic practices of China and other nations, according to the Alliance for American Manufacturing whose President Scott Paul criticized China: “The Chinese Communist Party has flooded the global market with dumped and subsidized steel and other products for decades. This trade cheating has had very real consequences for communities around America, eliminating millions of family-supporting jobs. In addition to the economic havoc wreaked by China’s cheating, these practices have also threatened to compromise our national security.” He described steel as an essential component of much of America’s infrastructure and defense supply chain.

“Without a stable domestic steel sector, America endangers its ability to quickly respond to the needs of war and grants our foreign adversaries access to our most sensitive systems, including infrastructure.”

The Inflation Reduction Act, the CHIPS and Science Act, and the Bipartisan Infrastructure Law had helped “spark an American manufacturing renaissance”.

The USW union underscored the fact that the Infrastructure Investment and Jobs Act contained ‘Build America, Buy America’ provisions that strengthened the Buy America laws for all federal assistance infrastructure spending. The USW also noted that many agencies and departments had been slow to implement these provisions.

The infrastructure bill itself, along with the existing Buy America policies, the trade union argued, had led to increased work and added jobs at USW represented iron foundries, like at a fire hydrant manufacturer in Albertville, Alabama where USW Local 65B represents over 450 workers. To build on this, the CSC was urged to encourage agencies to speedily implement ‘Build America, Buy America’ by moving from the use of blanket waivers to narrow, transparent waivers.

US Steel senior vice president and chief strategy and sustainability officer Rich Fruehauf, addressing the CSC, cited examples of his company’s investments such as the $60 million invested in a new pig caster at Gary Works. However, he administered caution on the risks to the American steel industry from a recent surge in imports from Mexico.

“Global steel overcapacity, and the actions of foreign governments and producers that feed overcapacity, are a very real threat. This excess steelmaking in China and other countries distorts global steel trade flows,” he said. “Strong trade enforcement and continuation of the

Section 232 national security action on steel imports is critical. “

Nucor Corp’s chairman, president and CEO Leon Topalian told the CSC that his company had experienced robust demand for its products across a range of enduse markets, but he called for vigilance to protect investments in American manufacturing.

“Since the beginning of 2020, Nucor is now more than two-thirds of the way through a $14 billion CAPEX plan that is going to double our earnings potential from our pre-pandemic levels. We recently started up a new state-of-the-art plate mill in Kentucky, and we have announced the addition of new steel mills in West Virginia and North Carolina. We have also added new capabilities at several of our existing steel mills that position us to meet the demand for steel that will be generated by public and private investments in infrastructure, clean energy, and advanced manufacturing facilities producing semiconductors, pharmaceuticals and EV batteries,” he said.

Steel executives representing a cross section of the supply chain gathered in Washington late June for the annual members’ conference of the Steel Manufacturers Association (SMA) and the Metals Service Centre Institute. The conference, called Building the World Together, featured high-profiled speakers who addressed issues of leadership, trade, environmental protection, geopolitics, and policymaking in Washington. The US trade representative, ambassador Katherine Tai, had what some analysts called an ‘informative exchange of views’ with the SMA president Philip K. Bell. �

www.steeltimesint.com Digital Edition - August 2023 USA UPDATE 22

Offshore wind energy: Brazil’s new player?

In a previous article, we investigated how Latin American steel companies are investing in wind energy to clean the energy matrix (Steel Times International, June digital issue 2023, p. 25-26). Now, we must analyse how wind energy can generate additional demand for steel products, with a focus on the Brazilian market. By Germano Mendes de Paula*

2030-2050 (GW)

CURRENTLY, Brazil has 24.14 GW installed capacity of wind energy, distributed among 869 wind farms, which are located in 12 states. There are currently 9,770 wind turbines in operation. Moreover, it is estimated that one additional MW of wind energy capacity requires more than 100kt of steel. Up to now, all wind energy generation in the country has been based on onshore wind farms. Indeed, the absence of a regulatory framework for the production of offshore wind energy blocks such development. Big players are getting ready to invest in such activity, but they need well-defined regulations.

Brazil’s perspectives of offshore wind energy

The Brazilian Wind Energy Association (ABEEólica) has asked the Institute for Graduate Studies and Research in Engineering at the Federal University of Rio de Janeiro (Coppe/UFRJ) and the consultancy firm Essenz Soluções to conduct a huge study, aiming to quantify

the economic impacts of offshore wind energy in Brazil. The report consists of eleven technical notes, co-ordinated by Maurício Tolmasquim. One of the notes focused on demand and supply of components and materials, including steel, and was written by Eliab Ricarte and Bruna Guimarães. The following paragraphs summarise the 65-page document.

To ensure an accurate representation of

an offshore wind energy project, the study was divided into the following components: a) wind turbines; b) monopile foundations; c) monopile transition parts; d) jacket bases; e) gravity-based foundations; f) floating semi-submersible platforms; g) mooring systems; h) cables; i) offshore substations; j) onshore electric networks.

The study develops two scenarios regarding the diffusion of offshore wind energy in Brazil by 2050. The first scenario assumes that offshore wind energy will be developed on a commercial scale (including projects at the 1 GW level) from 2040. It foresees 1 GW capacity in 2040, 7 GW in 2045 and 15.6 GW in 2050, on a cumulative basis (Fig 1). The second scenario predicts that offshore wind energy will be initially developed for smaller projects from 2031 onwards (for example, an average of 675 MW in the first five years). It assumes 11 GW capacity in 2040, 18.8 GW in 2045 and 28.5 GW in 2050, on a cumulative basis too. Therefore, the offshore generation will be equivalent to

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

LATIN AMERICA UPDATE 23 www.steeltimesint.com Digital Edition - August 2023

Fig 1. Scenarios of Brazilian offshore wind energy’s cumulative capacity,

Fig 2. Scenarios of Brazilian offshore wind energy’s additional capacity, 2030-2050 (GW)

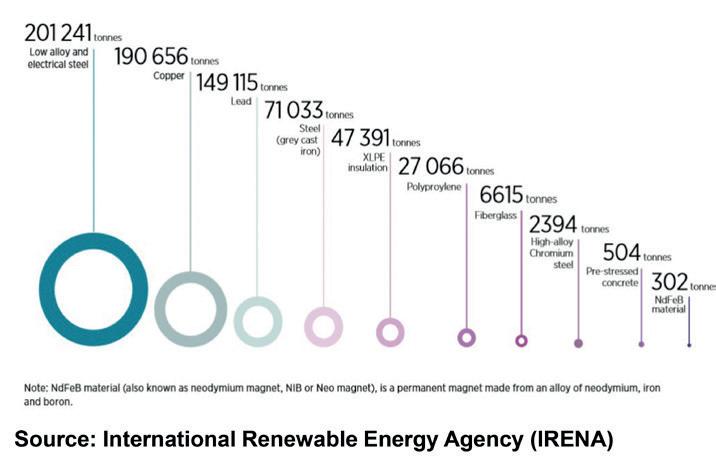

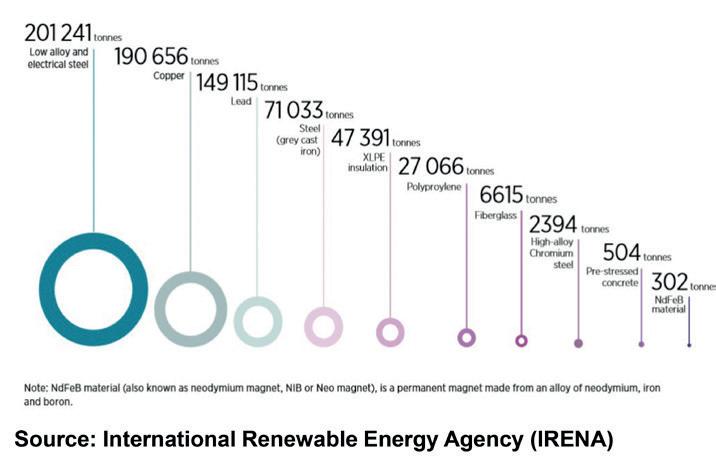

Fig 3. Materials required to develop a 500MW offshore wind farm (t)

Fig 4. Scenarios of Brazilian offshore wind energy’s steel demand, 20302050 (Mt)

15% of the onshore wind installed capacity as of 2035 and growing to 30% by 2050.

Fig 2 demonstrates the annual evolution of additional capacity of offshore wind energy during the period 2030-2050. Based on the first scenario, more than 2 GW will be added in years 2038, 2045, and 2050. The trajectory of the second scenario would be more linear, increasing gradually from 1 GW in 2040 to 1.91 GW in 2050.

Steel consumption

In order to project the demand for all the materials required to build offshore wind farms in Brazil by 2050, the configuration of a typical 500 MW project has been considered, according to a study conducted by International Renewable Energy Agency (IRENA). This consists of 63 direct-drive 8 MW turbines, 160m diameter blades and 120m height towers supported over a steel monopile foundation. Onshore and offshore substations were not considered for the purpose of analysis. It is important to point out that the materials used in the construction of offshore wind farms vary greatly between projects and depend on turbine models, distance to the shore,

depth of the seabed, among other factors.

Fig 3 shows the quantity of materials required to develop a 500 MW offshore wind farm (according to IRENA), totalling 696kt, which consists of 28.9% of low alloy and electric steel and 0.3% of high-alloy chromium steel. It should be stressed that IRENA considered grey cast iron as a type of steel, when in fact it is produced by foundries.

Fig 4 demonstrates the estimation of the low alloy and electric steel demand in Brazil due to the development of the offshore wind energy. According to the first scenario, it will generate 400kt in 2040, 550kt in 2045 and 770kt in 2050. In contrast, regarding the second scenario, the consumption will be equivalent to 400kt in 2031, 300kt in 2035, 550ktMt in 2040, 830kt both in 2045 and in 2050. For reaching the respective figures for high alloy chromium steel, just multiply by 1.2%. These are substantial numbers, especially when it is taken into consideration that Brazilian consumption in 2022 reached 23.5Mt. However, the values presented in the previous paragraph face two caveats:

a) it is assumed that the proportion of the materials will remain the same, when it is reasonable to experience some changes among the substitutes along the time, and

b) it is based on the assumption that the intensity of the material consumption will be maintained, while most probably, it will drop due to technological improvements. Despite this, the offshore wind energy market offers potential as a brand-new steel consumer in Brazil. �

The new COMBi-CB70E electric forklift is the most compact 7,000kg counterbalance truck on the market. It is loaded with a host of features that greatly enhance operator comfort, including excellent all-round visibility, a spacious gas-strut suspension cab, independent electric traction and our newly developed Auto Swivel Seat which intelligently swivels 15O in the direction of travel. To find out how Combilift can help you unlock every inch of your storage space.

www.steeltimesint.com Digital Edition - August 2023 24

LATIN AMERICA UPDATE 25 Introducing

Amazing performance, extensive battery life and unrivalled ergonomics combined with all the advantages of the Combi-CB range make the CB70E the most powerful, compact multidirectional forklift yet.

Contact Us Today combilift.com

Fuelling the fire

STEPPING towards sustainable growth in the steel industry, India is working on strategies to ramp up coking coal production in government-operated domestic mines. This initiative aims to strengthen the raw material supply and reduce reliance on imports. Coking coal, also known as metallurgical coal, is a crucial fuel in the blast furnace process for primary steelmaking, as it is used to produce high-quality coke. Consequently, the demand for metallurgical coal is closely coupled with steel consumption, and primary steel producers prioritize securing a sustainable supply of coking coal to capture the opportunities in steel production. Various grades of coking coal, including hard, semi-hard, semi-soft, and pulverized material for injection, are used in steelmaking. Approximately, 0.8 tonnes of coking coal are required for every 1 tonne of steel production, in addition to other raw materials such as iron ore and limestone. However, India currently has meagre reserves and production of coking coal, and it does not feature prominently in the global ranking of coking coal producers. The country’s coking coal reserves have remained stagnant over the last several years, leading to low availability and poor quality of the material in the domestic market. While total coal reserves in India increased to 7 billion tonnes during 201415, there was little to no addition to the coking coal reserves or prime category mines. According to the Ministry of Mines, India’s prime coking coal reserves currently stand at 5.31 billion tonnes, with proven reserves at 4.61 billion tonnes. The total cumulative coking coal reserves, including proved, indicated, and inferred reserves, have only increased by 333Mt to reach 34.40 billion tonnes from 34.07 billion tonnes. As a result, growing steel production in India has led to a significant increase in coking coal imports, which have surged by nearly 65% in recent years, while

steel production itself has increased by 36%.

Steel production growth

India has experienced a remarkable increase in steel production over the past 10 years. Starting from 56.72Mt/yr in the financial year (FY) 2012-13, India’s steel production has surged to 125.3Mt/yr in FY2022-23, enabling the country to meet domestic demand and boost exports. As a result, India has transitioned from being a net steel importer to becoming a net exporter of steel. During this period, India has also witnessed a significant rise in iron ore production. However, the growth in coking coal production has not kept pace with the speed of steel output expansion.

Data compiled by the Indian

*India correspondent, Steel Times International

government’s Ministry of Coal reveals that coking coal production in India has increased by only 18% in the last 10 years, despite growth of around 150% in steel output. India’s coking coal production reached 60.77Mt/yr in FY2022-23, compared to 51.58Mt/yr in FY2012-13, with intermittent fluctuations. Although the Indian government successfully increased coking coal production at local mines, overall production remains significantly lower than demand. Consequently, coking coal imports in India have soared over the past 10 years. Imports rose from 35.56Mt/ yr in FY2012-13 to 54.46Mt/yr in FY202223. Additionally, non-coking coal imports in the country increased from 110.23Mt/yr to 162.46Mt/yr in FY2022-23.

Coking coal plays a crucial role in steel

INDIA UPDATE 25 www.steeltimesint.com Digital Edition - August 2023

Production Dispatch 2012-13 51.58 55.86 2013-14 56.82 58.46 2014-15 57.45 56.44 2015-16 60.89 59.21 2016-17 61.66 59.31 2017-18 40.15 45.38 2018-19 41.13 43.32 2019-20 52.94 50.66 2020-21 44.79 44.00 2021-22 51.70 54.40 2022-23 60.77 53.28

Coking coal production has witnessed a rapid rise in India, but still lags far behind the country’s growth in steelmaking. Dilip Kumar Jha*

Production and dispatch of coking coal in India (Mt) Financial year (April-March)

India’s

Financial year (April-March) Coking coal Non-coking coal Total coal 2012-13 35.56 110.23 145.79 2013-14 36.87 129.99 166.86 2014-15 43.72 168.39 212.10 2015-16 44.56 159.39 203.95 2016-17 41.64 149.37 191.01 2017-18 47.00 161.25 208.25 2018-19 51.84 183.51 235.35 2019-20 51.83 196.70 248.54 2020-21 51.19 164.05 215.25 2021-22 57.16 151.77 208.93 2022-23 54.46 162.46 216.92

Source: Ministry of Coal, Indian government

import of coal and coking coal (Mt)

Source: Director general of commercial intelligence and statics (DGCI&S), Indian government

manufacturing through the blast furnace route. However, the coking coal available in Indian mines contains a high ash content ranging from 18% to 49%, making it unsuitable for direct use in blast furnaces. To mitigate this, coking coal is washed to reduce the ash percentage. Indian prime and medium-grade coal with ash content below 18% is blended with imported coking coal with ash content below 9% before being used in blast furnaces.

Meanwhile, the government-owned Coal India Ltd (CIL) has continued to increase its production. The company reported a 17.2% increase in coking coal output to 54.6Mt/ yr in FY2022-23 compared to 46.6Mt/ yr in the previous year. The significant increase of 8Mt/yr surpassed the country’s production target for FY2022-23 by over

electric arc furnace (EAF). However, to meet this steel production target, India will need 170Mt/yr of coking coal. To address this, the Indian government launched the Coking Coal Mission, which focuses on new exploration, production enhancement, capacity augmentation for coal washing, and the auction of new coking coal mines. The Mission’s key objectives include increasing coking coal production from 52Mt/yr in FY2021-22 to 140Mt/yr by FY2029-30 and enhancing coking coal washing capacity from 23Mt/yr in FY202122 to 61Mt/yr by FY2029-30.

To achieve these targets, the public sector coal miner CIL has been assigned a production target of 105Mt/yr, while the remaining 35Mt/yr will come from other sources, including allocated coal blocks.

Most auctioned mines to start by 2025

To increase the production of raw coking coal, the Ministry of Mines recently conducted auctions for 10 blocks, allowing the private sector to boost production from domestic sources and reduce dependence on imports. Most of these mines have already begun project work and are scheduled to start commercial production by 2025. CIL, which accounts for over 80% of domestic coal output, has plans to increase raw coking coal production from existing mines up to 26Mt/yr. They have also identified new mines with a combined peak-rated capacity of about 22Mt/yr. Furthermore, CIL has offered eight discounted coking coal mines (out of the total 30 discounted mines) to the private sector using an innovative revenue-sharing model, with a peak rated capacity of 2Mt/yr.

In another effort to increase India’s coking coal production, the Coal Ministry has identified four additional coking blocks. Additionally, Central Mine Planning and Design Institute (CMPDI) is finalizing a geological report for four to six new blocks which will be offered in subsequent rounds of auctions for private sector participation in order to further enhance domestic raw coking coal production.

107%. India’s Ministry of Coal has set a target for CIL’s coking coal production at 105Mt/yr by 2030. Bharat Coking Coal Ltd (BCCL) and Central Coalfields Ltd (CCL), the two Jharkhand-based subsidiaries of CIL, were major producers of coking coal, with a combined output of 54.3Mt/yr in FY2022-23. BCCL accounted for nearly 62% or 33.7Mt/yr of total production during FY2022-23, a 16% growth compared to the previous year’s 29Mt/yr, while CCL recorded an output of 20.6Mt/yr, reflecting a 20% growth over the previous year.

Mission 2030

The National Steel Policy 2017 aims to achieve a steel production target of 300Mt/ yr in India. Out of this, the blast furnace route is expected to account for 180Mt/ yr, while the remaining 120Mt/yr will be produced through other routes including

However, even if India achieves its coking coal production targets as planned, steel mills will still need to import approximately 30Mt/yr of coking coal by 2029-30.

Nevertheless, the government has taken several steps to explore new coking coal blocks, auction new mines, enhance raw coking coal production, and expand washing capacity. In line with the Coking Coal Mission, CIL has made continuous efforts to enhance coking coal production by adding capacity to existing mines and opening new blocks. Additionally, CIL has implemented mass production technology in its underground mines to increase raw coking coal production. The company has also offered coking coal blocks to the private sector (including some discounted mines) on a revenue-sharing basis through the Mine Developer and Operator (MDO) route.

In terms of raw coking coal washing, India currently has a total capacity of 23Mt/ yr, with the private sector accounting for 9.26Mt/yr. However, CIL is now planning to establish and operationalize nine new washeries with a capacity of 30Mt/ yr. This move will enable CIL to supply approximately 15Mt/yr of washed coking coal to the Indian steel sector. The total supply of washed coking coal by CIL to the steel sector was recorded at 3.45Mt/yr this year compared with 1.7Mt/yr the previous year.

Conclusion

Despite being the second largest producer of crude steel globally, India does not feature in the list of countries with significant coking coal reserves. Furthermore, the inadequate quality of coking coal for direct use in steelmaking necessitates a considerable capacity expansion for coal washing.

As a result, India requires substantial investments in discovering new mines and developing washeries to achieve selfsustainability in coking coal production in line with the ‘aatmanirbhar’ (self-reliance initiative). �

www.steeltimesint.com INDIA UPDATE 26

Digital Edition - August 2023

Pursuing greener operations in the steel industry

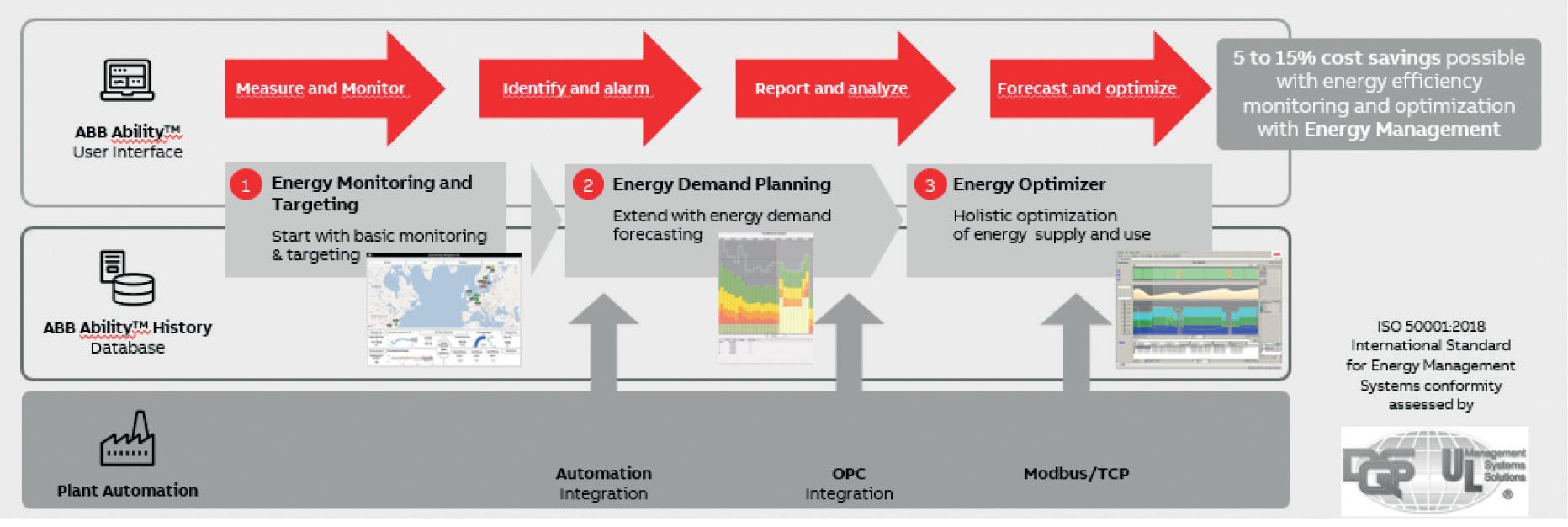

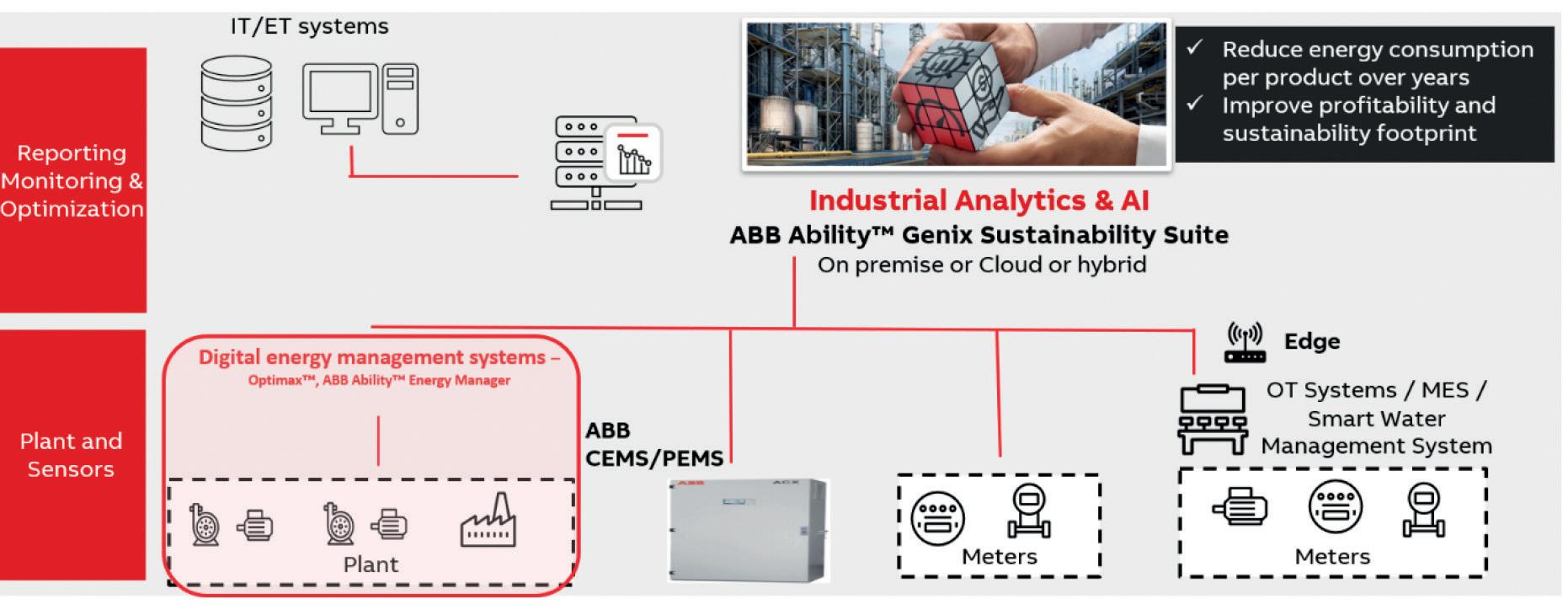

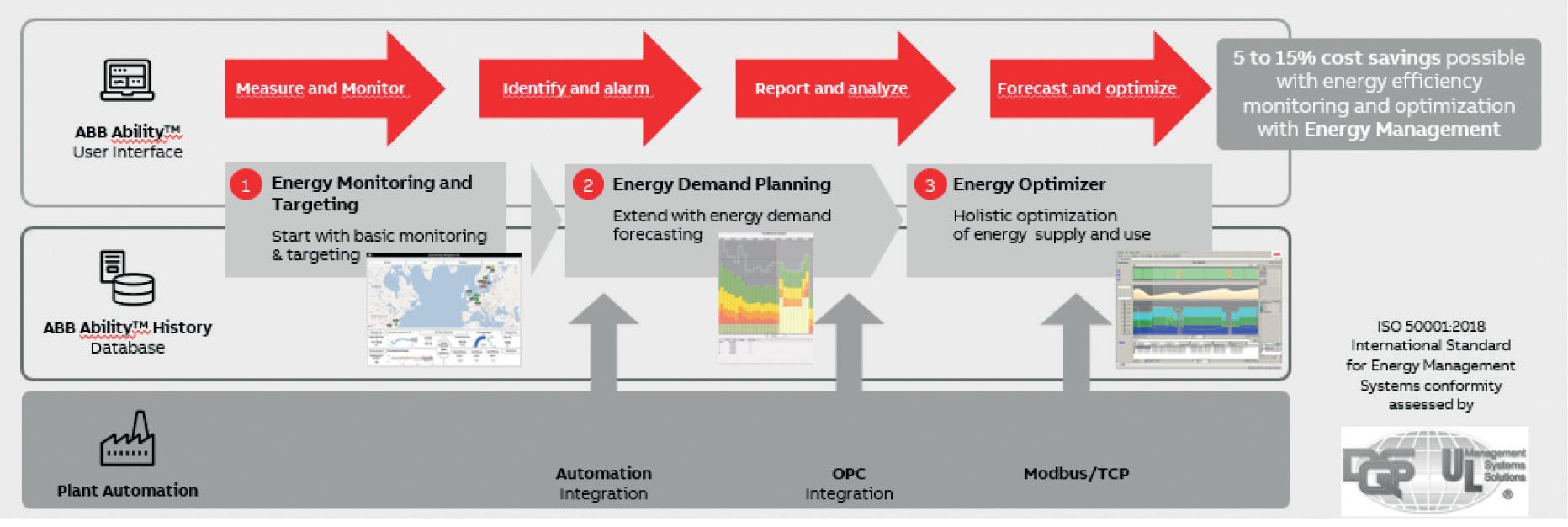

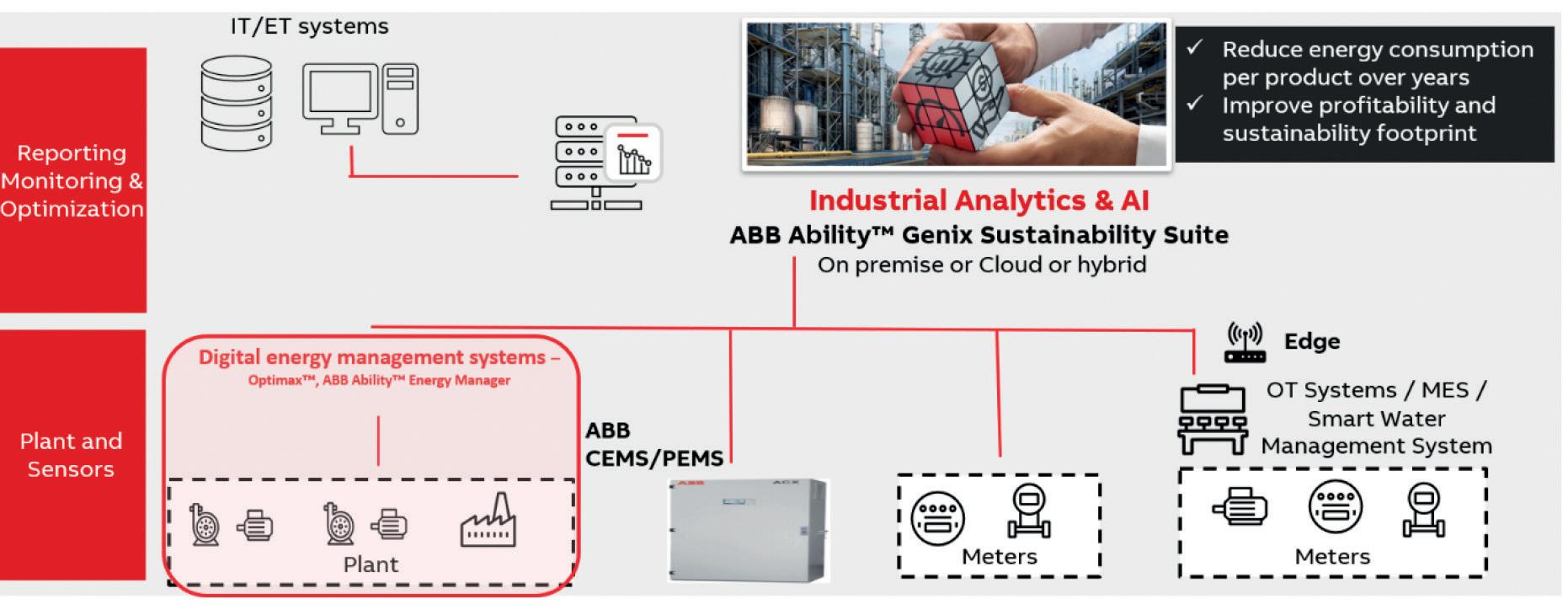

THERE is a growing focus in the steel industry on the use of technologies to manage energy consumption effectively. Organizations in energy-intensive industries such as steel recognize the need for additional energy, particularly when it comes to renewable or green energy sources.

However, the availability of multiple energy sources such as solar, wind, and nuclear creates a dynamic and open market for these companies. To remain profitable and improve margins, these organizations need to manage their energy needs and mitigate associated risks.

The role of technology in transforming traditional approaches

New technology and software play a crucial role in addressing these challenges. Traditional approaches to purchasing energy from a fixed-price utility source are no longer viable. Companies now need to determine where to source their energy and how to align it with their production requirements. They must consider the timing of energy acquisition, storage options, and base load requirements.

Managing complexities manually can be challenging given the dynamic nature of the energy market. Therefore, new technologies, such as artificial intelligence, can assist in analyzing production needs, market availability, and potential disturbances. This allows companies to make informed decisions such as adjusting production levels to mitigate risks associated with fluctuating energy prices. The steel industry alone is currently responsible for 9% of global emissions. In the pursuit of greener operations, steel companies must also consider the entire supply chain of energy to ensure it comes from sustainable sources – particularly when transitioning from CO2-intensive blast furnaces to electric arc furnaces. While companies may reduce their scope one and scope two emissions by eliminating coal usage, the origin of their electricity must be considered. Scope three emissions encompass the entire supply chain, so using electricity from a coal-based provider may not align with their goals of producing green steel. Technology can help in identifying and analyzing the proper sources of energy, enabling companies

to make more sustainable choices where possible.

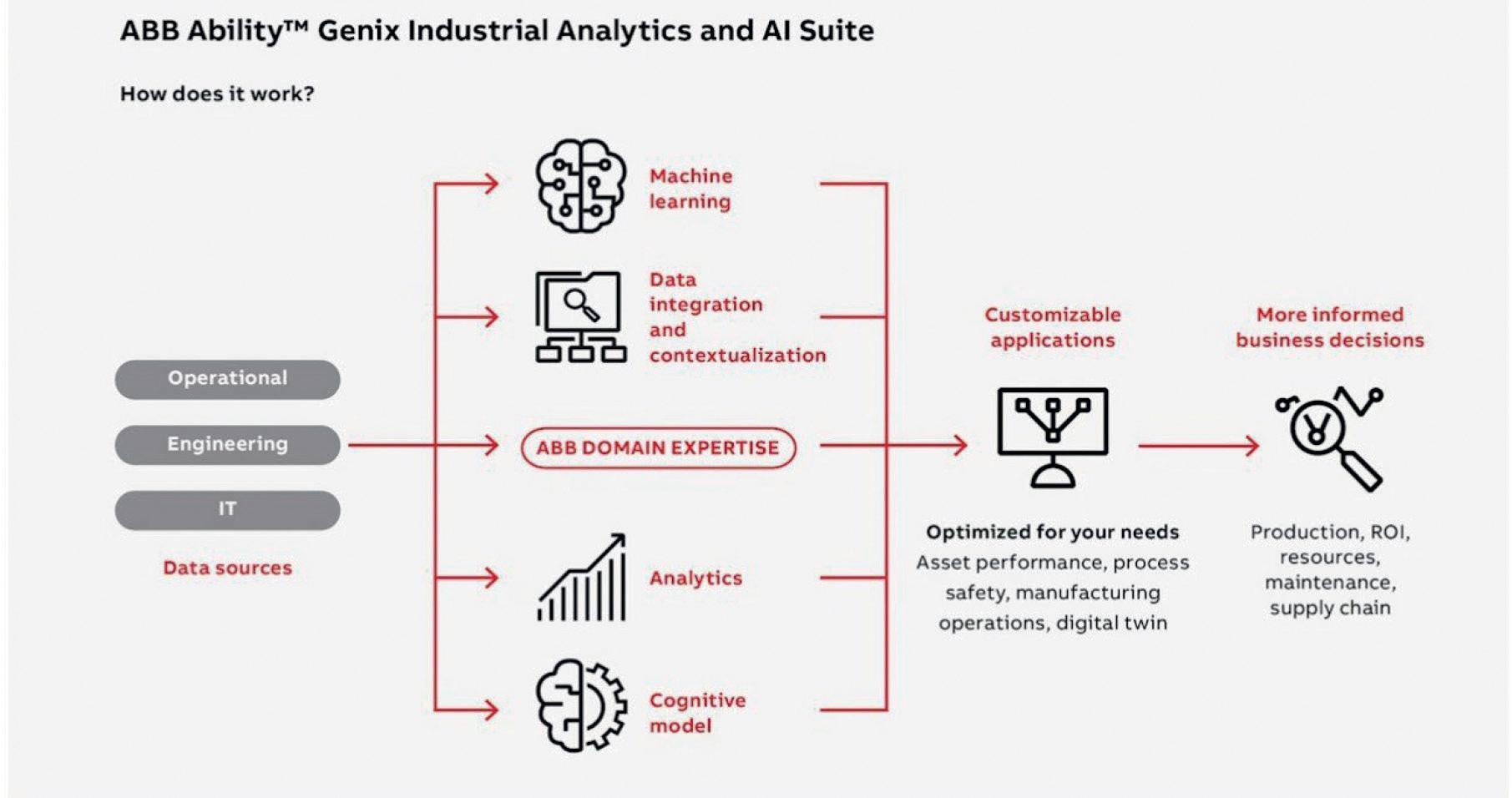

Strengthening the industry with Artificial Intelligence (AI)

AI has the potential to revolutionize the future of steel plants globally by playing a big role in improving energy efficiency and productivity. Firstly, AI can monitor realtime energy consumption in a plant and identify areas which are wasting the most energy across plants. By alerting operators and providing solutions to save energy, AI simplifies the process and reduces unnecessary equipment usage, saving on overall costs.

It can also optimize energy consumption during repetitive production cycles by comparing current energy usage to past optimized levels. Once this is complete, operators can take measures to improve energy efficiency based on AI insights. Forecasting future data and emissions using predictive analytics can help optimize operations and reduce energy consumption. Additionally, AI can be integrated into energy management systems to forecast future energy prices and

DECARBONIZATION 28 www.steeltimesint.com Digital Edition - August 2023

*Development lead, green steel, Schneider Electric. **Global industry principal, mining, metals and minerals, AVEVA.

Technological innovations are making it possible for the industry to accelerate the pace of industrial decarbonization, allowing producers to monitor and optimize production, and enabling proactive decision making.

By Mo Ahmed* and Martin Provencher**

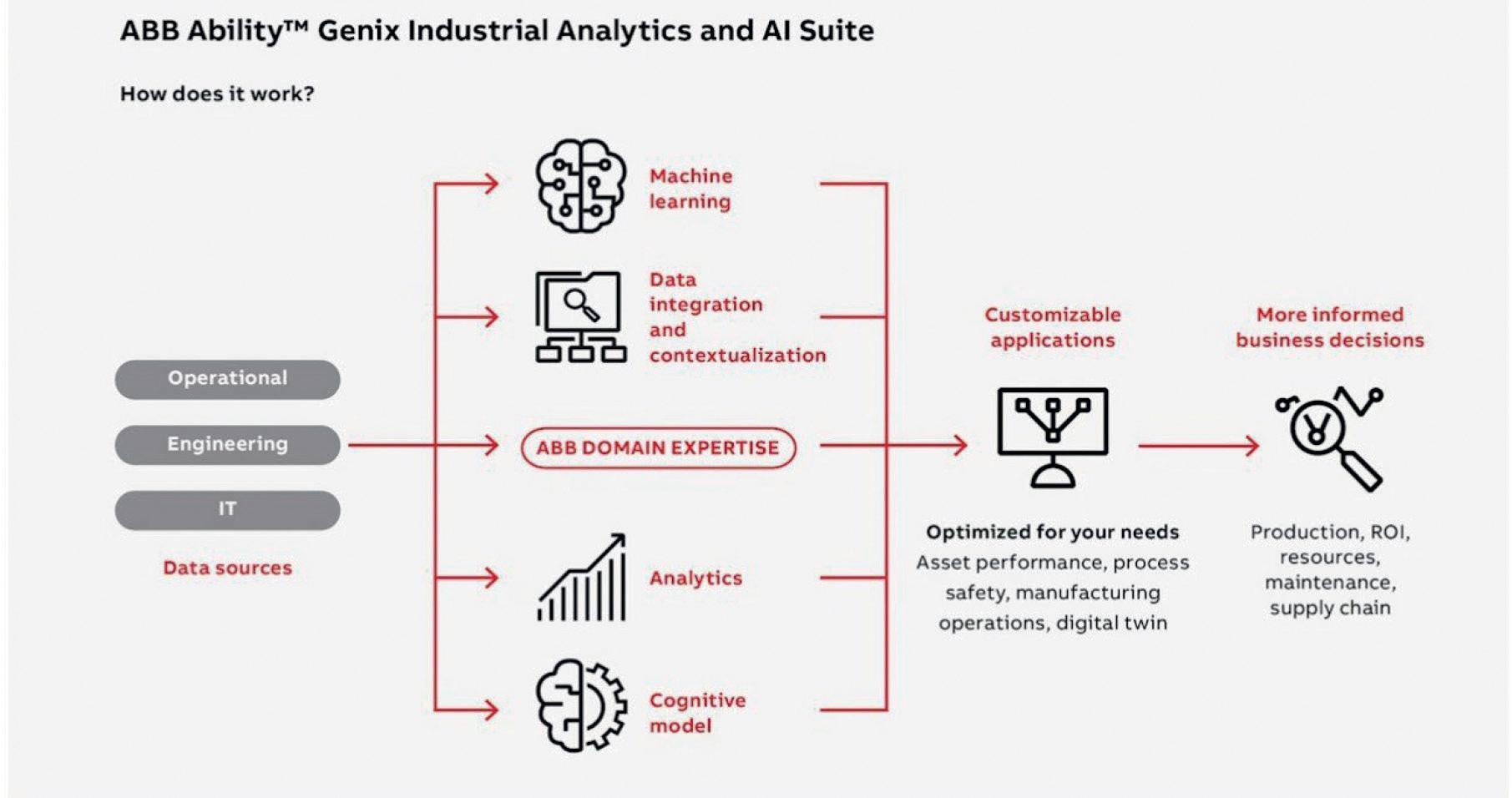

weather conditions, and plan production accordingly. AI-driven forecasting can enable proactive decision-making and minimize production disruptions due to energy fluctuations. With advancements in AI already transforming the sector, organizations need to remain alert about the potential of autonomous operations in the future and what that might look like for their plants, although safety considerations remain crucial.