S.T.A.R. Awards Recipient

Architectural Sheet Metal Inc.

Craftsmanship in Roofing

A Publication of FRSA – Florida’s Association of Roofing Professionals February 2023

Florida

ROOFING

under

Regardless of the project, big or small, commercial or residential, Ultra HT is the premium, high temperature, self-adhering underlayment engineered to take on any roof application Give your project the best protection before, during and after installation of the final roofing system. Peace of mind you and your customer will appreciate. Visit mfmbp.com for a free sample or call 800.882.7663 today.

the sun. • High temperature rated up to 250°F • Non-slip, cross-laminated construction • Self-seals around roofing fasteners • Split release liner for easy valley installation

The best roof protection

FRSA-Florida Roofing Magazine Contacts: For advertising inquiries, contact: Lisa Pate at:

lisapate@floridaroof.com

(800) 767-3772 ext. 157

All feedback and reprint permission requests (please include your full name, city and state) contact: Lisa Pate, Editor, at: lisapate@floridaroof.com

(800) 767-3772 ext. 157

Florida Roofing Magazine, PO Box 4850

Winter Park, FL 32793-4850

View media kit at: www.floridaroof.com/ florida-roofing-magazine/ #FRSA #roofingprotects

www.floridaroof.com | FLORIDA ROOFING 3 Florida Roofing (VOL. 8, NO. 2), February 2023, (ISSN 0191-4618) is published monthly by FRSA, 3855 N. Econlockhatchee Trl. Orlando, FL 32817. Periodicals Postage paid at Orlando, FL. POSTMASTER: Please send address corrections (form 3579) to Florida Roofing, PO Box 4850, Winter Park, FL 32793-4850. Any material submitted for publication in Florida Roofing becomes the property of the publication. Statements of fact and opinion are the responsibility of the author(s) alone and do not imply an opinion or endorsement on the part of the officers or the membership of FRSA. No part of this publication may be reproduced or transmitted in any form or by any means, without permission from the publisher. Available Online at www.floridaroof.com/florida-roofing-magazine/ ROOFING Florida February 2023

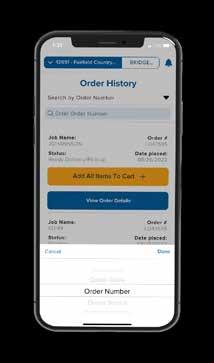

Contents On Mobile Devices Ergonomic Guidelines – Using Four-Wheel Carts in Roofing 26 | Five Myths About Payroll Taxes 30 | When You Think You Have Seen It All 12 | Multi-Pipe Penetrations: The Bane of Roofing 20 | Accident Investigation 34 | S.T.A.R. Awards recipient in the Craftsmanship in Roofing category is Architectural Sheet Metal Inc. for this residence in Winter Park.

S unshine S tate S olution

Equally strong and attractive , these metal roofing panels are available in Florida in our full line of PAC-CLAD painted steel, aluminum and Galvalume Plus coatings, ensuring that your roof will endure whatever comes its way. All panels are Miami-Dade County and Florida Building Code approved.

Sandra Stetson Aquatic Center, DeLand, FL Installing contr.: Quality Metals Inc. Architect: Preston T. Phillips GC: Charles Perry Partners Inc. Profile: PAC-150 Color: Custom Stetson Green Photo: hortonphotoinc.com

Snap-Clad

Tite-Loc Plus

PAC-150

Sandra Stetson Aquatic Center, DeLand, FL Installing contr.: Quality Metals Inc. Architect: Preston T. Phillips GC: Charles Perry Partners Inc. Profile: PAC-150 Color: Custom Stetson Green Photo: hortonphotoinc.com

Snap-Clad

Tite-Loc Plus

PAC-150

102 Northpoint Parkway, Acworth, GA 30102 P: 800 272 4482 F: 770 420 2533 PAC-CLAD.COM | INFO@PAC-CLAD.COM MIAMI DADE COUNTY APPROVED View the case study VISIT US AT THE IRE

3112

BOOTH

Roofers Can Expect Growth in 2023 But Labor, Inflation Woes Keep Pressure On

Brad Bush, Senior Vice President, HUB International

The US roofing industry can expect to see continued growth in 2023 and further into the future. But even a healthy backlog of work won’t be sufficient to offset the forces keeping the squeeze on profit margins. Protecting the bottom line and building resilience for the long-term will be the challenge. Here are the forces facing the roofing industry in 2023.

Weathering the Squeeze

The predictable growth of the past – about 2.2 percent annually since 2017 – can be counted on to drive the roofing business into the future, as the size of the market holds steady at $56 billion. The majority of companies are small to mid-sized with a local or regional footprint and replacement services comprise 94 percent of roofing projects. As buildings age, the potential for work expands. However, the economic pressures in 2023 abound. Not only are workers hard to come by, but they’re more expensive, too – with labor costs easily up 10 percent in recent years. There continue to be shortages of roofing insulation and materials, although supplies are stabilizing from the long lead times in 2022.

Inflation is having an across-the-board impact on costs. Adding to the pain are ongoing boosts in interest rates, making revolving credit lines and other types of financing more expensive. All combined, roofers will have to manage more strategically in the face of these risks as their profit margins are diminished.

The Labor Issue

The struggle to find and keep qualified workers is relentless and roofing’s reputation as the most dangerous segment of construction doesn’t make the task any easier. Construction, as a whole, needs an additional 650,000 workers to meet the current pace of demand.

Making the job more attractive will take a renewed emphasis on safety, no small order for one of the most hazardous industries in the US. While construction workers comprise 7.3 percent of the workforce, they accounted for nearly 22 percent of fatal injuries in 2020, according to the Center for Construction Research and Training. And roofers had the highest fatality rate at 47 per 100,000 full-time employees.

A business with a reputation for unsafe working conditions can’t be sustainable. The cost of neglecting safety is not just the burden of government fines but higher insurance costs, the loss of contracts and people willing to do the work. Creating a culture of safety shows workers their employer cares about their well-being and gives them a sense of security in their job.

Also important, especially for non-union and smaller shops, are enriched benefits. Paid leave policies like vacations and sick days, along with employersponsored retirement plans, will go a long way toward attracting and retaining workers.

Build Resiliency by Managing Exposures

Roofers should be prepared for uncertainties ahead and there are plenty of them. They need to be aware of what’s on the horizon and secure sufficient insurance against the risks.

Overall, the construction insurance marketplace is stabilizing, but certain coverages are under pressure. Those in areas prone to catastrophic losses such as severe storms, flooding, wildfires and record heat need to be ready. Builder’s risk insurance will likely jump 40 percent in 2023 and the potential for subcontractor default is growing. Roofers need to tighten their operations so they are well-positioned as preferred partners, because general contractors will be extra choosy in awarding contracts in this environment.

On another front, the industry needs to step into the times. It is behind other segments of the construction industry in its deployment of technology. Only 57 percent of roofers use estimation software for bid preparation. Fewer than 20 percent use drones to inspect or measure. Only a third use wearables for mobile devices on the job site.

Tech solutions are essential if the roofing industry expects to streamline its operations, keep up with other segments of construction and appeal to current and new workers who want to learn and use new skills. The downside is the risk of cyber intrusions: construction is a big target for hackers. Cyber insurance is increasingly necessary but also expensive. It makes cyber security planning essential, with an eye to managing and training staff in safety protocols.

Brad Bush is a Senior Vice President in the Jacksonville region for HUB International Florida. He works throughout the Southeast and specializes in construction, working with contractors on both their surety and insurance needs.

www.floridaroof.com | FLORIDA ROOFING 5

FRM

6 FLORIDA ROOFING FRSA GENERAL COUNSEL Trent Cotney, Partner, Adams and Reese LLP Indemnification: Understanding the Three Levels This year there will be a new category: Hurricane Response A project where a company responded to hurricane damage in an unusual or extraordinary way. Submit projects online by April 3, 2023 at: www.floridaroof.com/star-awards/ Submit your premier roofing projects from 2022. Your company could be featured on the cover of Florida Roofing magazine.

unless the loss was caused solely by owner negligence. For example, if the owner is 90 percent at fault for the damages, the contractor is responsible for the entire loss. However, if the owner is 100 percent at fault, the contractor is not obligated to make any payment. The contract language will state the damage was “caused in part” by the contractor. The intermediate form clause uses a contributory fault analysis, meaning that if the contractor contributed to the loss in any way, the contractor is wholly liable. Many states have restricted intermediate form provisions, preventing owners from being entirely unaccountable for their negligence.

Broad Form

This type of indemnity is the most extreme. Under a broad form clause, the contractor agrees to be fully responsible to the owner for any damage, liability or cost, no matter who is at fault. The contract language will state the damage was caused “in whole or in part” by the contractor. The broad form indemnity is seen by many as incredibly unfair and has become rare. The majority of states have adopted anti-indemnity statutes, deeming the broad form indemnity to be against public policy.

Florida has specific laws and requirements on the use of broad form indemnity contained in Section 725.06, Florida Statutes, which requires, among other things, that there is a commercially reasonable monetary limit to the indemnity.

Advice for Contractors

Before you sign your next contract, be sure to read the indemnity clauses carefully. A limited form clause can seem reasonable, whereas the intermediate and broad form clauses could be financially devastating for you if a third party files a damage claim. It is crucial that you

know the laws in your state, verify your insurance coverages and exclusions and are familiar with which form types are legal in other states where you do business.

If you have any questions about indemnity clauses, take advantage of your FRSA member benefit and contact me at 813-227-5501 or email me at trent.cotney@arlaw.com. FRM

The information contained in this article is for general educational information only. This information does not constitute legal advice, is not intended to constitute legal advice, nor should it be relied upon as legal advice for your specific factual pattern or situation.

Trent Cotney is a Partner and Construction Practice Group Leader at the law firm of Adams and Reese LLP and FRSA General Counsel. For more information on this subject, please contact the author at trent.cotney@arlaw.com.

Free Legal Helpline for FRSA Members

Adams and Reese LLP is a full-service law firm dedicated to serving the roofing industry. FRSA members can contact Trent Cotney to discuss and identify legal issues and to ask general questions through access to specialized counsel. They offer free advice (up to 15 minutes) for members. If additional legal work is required, members will receive discounted rates. This is a pro bono benefit provided to FRSA members only. To use this service, contact Trent Cotney, 813-227-5501.

www.floridaroof.com | FLORIDA ROOFING 7

Growing. Expanding. Remaining True to Quality & Service. integritymetalsfl.com 772-584-2654

Property Insurance Special Session

The Florida Legislature convened in December for a second special session on property insurance, yielding another round of reforms to try to prop up the state’s struggling marketplace. During the three-day special session, legislators also tackled issues related to Hurricane Ian and Hurricane Nicole relief and toll rebates for frequent travelers on Florida’s toll road systems. In this month’s article, let’s review the highlights of the special session legislation passed by the legislature and signed by Governor Ron DeSantis.

Additional Property Insurance Reforms

SB 2A Property Insurance by Senator Jim Boyd (R – Bradenton) – The bill requires insurers to more promptly communicate, investigate and pay valid claims. Anticipated shortages in the reinsurance market are addressed through a new optional state reinsurance program. Excessive litigation is addressed by eliminating one-way attorney fees for property insurance and instead allowing both parties to obtain fees through the offer of judgment statute. The bill strengthens the regulatory authority of the Office of Insurance Regulation over property insurers. More specifically, the bill:

■ Eliminates assignment of benefits.

■ Eliminates one-way attorney fees.

■ Requires a bad faith breach of contract before a policy holder can sue a property insurer.

■ Creates the Florida Optional Reinsurance Assistance Program (FORA) that provides optional hurricane reinsurance that property insurers can purchase at near market rates.

■ Reduces the time limit for providing notice of a loss to a property insurer from two years to one year for initial or reopened claims and from three years to 18 months for supplemental claims.

■ Changes the prompt pay statute to encourage property insurers to settle claims in a timely manner.

■ Provides Mandatory Binding Arbitration – codifies that companies, for a premium discount, may issue an optional endorsement with consent from the policyholder that requires participation in binding arbitration to settle a claim.

■ Notice to Policyholders – requires that a property insurer place the “Flood Coverage Not Included” statement on the policy declarations page rather than just “with the policy documents.”

■ Strengthens the Office of Insurance Regulation (OIR) – enhances OIR’s ability to do market conduct examinations of property insurers after a hurricane, including examinations of managing general agents; allows OIR to discipline insurers for abuse of the appraisal process; adds information regarding the use of appraisal to the list of information that a property insurer must include in its quarterly reports to OIR; allows OIR to review property insurers’ forms, withdraw approval and suspend an insurer’s ability to invoke appraisal for up to two years; requires OIR to add the names of insurers who abuse the appraisal process to its Property Insurer Stability Unit biannual report and post those names to its website; at OIR’s option, allows additional time for agents to place policyholders during insolvencies.

Citizens Property Insurance Corporation (Citizens), for renewals and take-out offers (depopulation), establishes that if a renewal or take-out offer from an authorized insurer is within 20 percent of a policyholder’s Citizens premium, including surcharges and assessments being levied, a policyholder is ineligible to remain in Citizens; for new policies, establishes that the risk is ineligible for Citizens coverage if the admitted-market policy is within 20 percent of a policyholder’s Citizens premium; requires Citizens residential lines policyholders to obtain flood insurance as a condition of having coverage from Citizens by 2027; provides a different glidepath for the rates that Citizens charges non-primary residents so that those policies become actuarially sound more quickly; authorizes Citizens to combine its three policyholder accounts into a single account upon eliminating all outstanding financing obligations to allow Citizens to use its entire surplus to pay claims.

Targeted Hurricane Relief

SB 4A Disaster Relief by Senator Travis Hutson (R – Palm Coast) – The bill provides a partial property tax refund for residential property owners whose real property was destroyed or rendered uninhabitable for at least 30 days by Hurricane Ian or Hurricane Nicole.

8 FLORIDA ROOFING | February 2023

FRSA LEGISLATIVE COUNSEL

Chris Dawson, Attorney, GrayRobinson

■ The partial refund of taxes is based on the number of days the home was uninhabitable and requires property owners to first pay their property taxes on time and in full.

■ The bill establishes the “Florida Emergency Management Assistance Foundation,” a directsupport organization of the Division of Emergency Management (DEM). The foundation will provide assistance, funding and support to DEM in its disaster response, recovery and relief efforts for natural emergencies.

■ The bill provides an appropriation to cover the entire match requirement for FEMA Public Assistance to local governments within counties designated in a FEMA disaster declaration for Hurricane Ian or Hurricane Nicole.

■ The bill appropriates $150 million from the General Revenue fund to the Florida Housing Finance Corporation.

The bill authorizes the Department of Environmental Protection (DEP) to waive or reduce match requirements for eligible local governments for beaches located in areas impacted by Hurricane Ian or Hurricane Nicole; creates the Hurricane Restoration Reimbursement Grant Program within DEP to assist coastal property owners with beach erosion costs as a result of Hurricane Ian or Hurricane Nicole and creates the Hurricane Stormwater and Wastewater Assistance Grant Program within DEP to provide financial assistance to certain local governments that operate a stormwater or wastewater system that sustained damage from Hurricane Ian or Hurricane Nicole.

Frequent Driver Toll Relief

SB 6A Toll Relief by Senator Nick DiCeglie (R –St. Petersburg) – The bill directs the Florida Turnpike Enterprise (FTE) to establish a toll relief program effective January 1, 2023 through December 31, 2023 for all Florida toll facilities or Florida toll facility entities that use a Florida-issued transponder or are interoperable with the Department of Transportation’s (DOT) prepaid electronic transponder toll system.

■ A person must have a prepaid SunPass account or another Florida-based electronic prepaid toll program account in good standing and a SunPass or other transponder issued by a Florida toll entity must be linked to the qualifying account.

■ A qualifying account that records 35 or more “qualifying transactions” per transponder per calendar month is eligible for an account credit equal to 50 percent of the amount paid in that calendar month for the qualifying transactions per transponder.

■ A “qualifying transaction” is a paid transponderbased toll transaction incurred by a two-axle vehicle for travel on a Florida toll facility using a Florida

issued transponder linked to a qualifying account. The account credit must be posted to the qualifying account the month after the credit is earned.

FRM

Chris Dawson is an Attorney and professional Lobbyist for GrayRobinson’s Orlando office and is licensed to practice law in both Florida and Alabama. He primarily focuses on lobbying and government relations for public and private sector clients at the executive and legislative levels of state government. He is credentialed as a Designated Professional Lobbyist by the Florida Association of Professional Lobbyists. Chris also holds two degrees in Civil Engineering and has experience in construction litigation and design professional malpractice defense.

www.floridaroof.com | FLORIDA ROOFING 9

FRSA third page indd 1 FRSA third page.indd 1 10/19/2020 10:01:24 AM AM

Disaster Contractors Network Connects Homeowners to Contractors For Post-Hurricane Repairs

In the aftermath of Hurricanes Ian and Nicole, Floridians are working hard to rebuild their lives. When it comes to making home repairs, a Florida licensed contractor will help ensure homeowners don’t become victims of construction fraud.

Florida’s Disaster Contractors Network (DCN), founded in part by the Florida Roofing and Sheet Metal Contractors Association (FRSA) and the Florida Department of Business and Professional Regulation (FDBPR), is connecting homeowners to licensed contractors.

This is a free service that helps prevent fraud and has been helping homeowners for nearly 20 years. Ironically, DCN’s first hurricane tour-of-duty was following Hurricane Charley, which cut through much of the same southwest Florida region as Hurricane Ian.

“When it comes to making home repairs, we recommend that Floridians use licensed contractors,” said Melanie S. Griffin, Secretary of the Florida Department of Business and Professional Regulation. “We don’t want to see any Floridian become a victim a second

time and the Disaster Contractors Network can help prevent fraud.”

While the DCN is designed to help homeowners connect to licensed contractors, it also provides licensed contractors the ability to register to perform services for homeowners in need. FRSA members are encouraged to take less than five minutes to visit www.DCNOnline.org and register your construction company. It really is that easy.

“FRSA is a proud member of the DCN and we encourage our contractor members to list their companies on the site. It’s so important that consumers have somewhere to turn to when looking for Floridalicensed contractors for repairs and replacement of their valuable assets,” FRSA Executive Director Lisa Pate stated.

Working together, we can help ensure that homeowners are protected from predatory, unlicensed contractors and help ensure they have the licensed, trained and insured contractors they deserve to help rebuild from the hurricanes.

FRM

FOUNDING PARTNER CONNECTING Homeowners to Licensed Florida Contractors PROTECTING Homeowners Against Fraud PROVIDING Free Resources for 20 Years DCNOnline.org

Industry Updates

FRSA Training Center Open for Business

FRSA’s building, located in Orlando, is booking training sessions for 2023. The Training Center can accommodate up to 48 people plus instructors for classroom seating. Amenities include audiovisual equipment, dry erase board and flip charts, refrigerator and counter space for food and beverage service. There is also a conference room that comfortably seats 16 people and includes conference phone, audiovisual equipment and electronics for virtual meetings. Food and beverage services can be arranged through FRSA for a nominal fee.

For those requiring outdoor hands-on space in addition to indoor space, the facility offers ample parking lot space for use, along with tents and tables at no additional fee. Interested in rental space? Please contact John Hellein at 800-767-3772 ext. 123 or by email at john@floridaroof.com. See pages 18-19 for more info.

MFM Building Products Completes Expansion Project

MFM Building Products, a manufacturer of a full envelope of waterproofing and weather barrier products for the building industry, has recently finished a substantial expansion project that began in February 2021. The thrust of the expansion project was adding 48,000 square feet to the production area and the

acquisition of new production equipment to meet the rising demand for orders. MFM has been acquiring additional raw materials to ensure product availability for its customer base and the new facility now accommodates this additional inventory. The building, which was planned to be completed by the fall of 2021, was finished in June 2022 due to extended lead times for raw materials. The exterior portion of the facility was completed in November.

Other aspects of the expansion project included constructing new offices in the main headquarters building and the addition of a new, state-of-the-art Research and Development laboratory for increased quality control and new product development. Once the production equipment is fully operational, the company expects to hire additional full-time employees.

According to Tony Reis, President, “We definitely had some setbacks with the current state of the supply chain, which caused some delays in the completion date. Now that we are finished, we are focused on meeting the needs of our customers and hope to be introducing several new waterproofing products to our portfolio. As an ESOP company, there is a lot of excitement among our employees as MFM continues to grow.”

www.floridaroof.com | FLORIDA ROOFING 11 PBR Panel 5V & Millennium-V Call 877-358-7663 for a list of distributors in your area Proud Member M-Seam/Standing Seam Visit www.mmi2000.net for all of our Florida Product Approvals Rib Panel

FRM

When You Think You Have Seen It All… Think Again

Approximately a month after Hurricane Ian made landfall on the southwest coast of Florida, I received a group email from the Roofing Industry Committee on Weather Issues (RICOWI). The email included some recent roof observation photos submitted by Ron Kough, RRO of Roof Assessment Specialists, Inc. Ron’s email had a picture attached that tested my ability to comprehend what I was seeing. A similar image is shown at the bottom of page 14.

It was from a mid-rise condominium on the Gulf Coast in Sarasota County. It is approximately 50 miles north of the location where Ian made landfall. The sustained wind speeds in this area were reported to have been between 70 to 80 mph. These wind speeds were substantially below design wind speeds required in recent versions of ASCE 7 for this structure. But what caught my attention was not that this roof covering was damaged but the particular way the fasteners had penetrated the roof covering. It was reminiscent of a bed of nails that we have all seen before. This condition was present in several roof areas.

I have seen many roof coverings in my time where fasteners have become disengaged from the roof deck after a high-wind event, particularly when they are installed over lightweight insulating concrete decks (LWIC). Usually, the fasteners can be felt under the roof covering where the fastener didn’t go back into the deck after experiencing roof covering uplift. Rarely, the head of the fastener will protrude through the covering. What made this situation different was that the point of the fasteners was pointing upward! That was something that I had never seen.

Ron is a very knowledgeable roof consultant and an FRSA associate member who I’ve known for some time now, so I reached out to him to discuss his

findings. He filled me in and asked if I would be interested in joining him to observe him making some roof cuts. With many of my questions still unanswered, I jumped at the chance to see for myself what had caused this very odd situation.

We knew that the roof assembly was a structural concrete deck with an LWIC fill placed over the structural concrete. The visible roof covering was a modified bitumen membrane with a white roof coating applied. Protruding through the roof were what appeared to be 16d smooth shank nails. The first cut revealed that the upper modified membrane was not bonded to the underlying membrane. That may have been due to the presence of aluminum coating on the underlying roof covering. What appeared to be a feeble attempt to torch-apply the upper membrane to the underlying roof covering made removal very easy. Between the two membranes were a number of threeinch plates with a 1/4-inch hole in the center and three evenly spaced 3/16-inch holes closer to the perimeter. Some were still placed over the underlying roof covering in their original location, with three of the 16d nails driven through the underlying roof covering and into the LWIC. Other plates and nails were lying loose between the membranes while others were upside down and protruding through the upper roof covering.

So, we now knew what the fasteners were, but still the question remained as to how the fasteners became disengaged from the deck and had the space to flip over 180 degrees. The underlying roof covering had an organic sheet mechanically attached with LWIC fasteners that were fairly sparce, at least in the test cut location. The organic base sheet which looked like #15 felt had pulled over the fasteners, leaving only the aforementioned plates and 16d nails attempting

12 FLORIDA ROOFING | February 2023

Mike Silvers, CPRC, Silvers Systems Inc. and FRSA Director of Technical Services

to hold the underlying roof covering to the deck. Since the 16d smooth shank nails offer little pull-out resistance in a LWIC deck, they had easily pulled out. That means that the underlying roof covering had to be up at least three inches above the deck during the high winds. But to allow enough space for the fasteners to pull out and then scatter and overturn between the two roof coverings, the upper roof covering had to have at least a similar space. Picture the two roofs floating independently above the deck as the wind exerted negative pressure on the roof coverings. The fasteners were being hurled into the void by the underlying roof covering as it buffeted or fluttered during the event. Some of them had landed plate down and point up (think of dropping a hand full of cap nails). When the wind decreased and gravity caused the roof coverings to lay back down, the fasteners penetrated the upper roof covering, causing the effect that had initially gotten my attention.

We all know that roofs can blow off during high-wind events, but hopefully this situation helps one understand some of the dynamics at play. I don’t know the age of these roof coverings or what editions of the building codes were in place during their installation. For the purpose of this article that is not important, however, contractors need to be aware of current code requirements concerning recovering and replacement. Specifically, item 5 in the section on page 16 clarifies that if an existing roof is used for attachment of a new roof system, then the combined system must meet current uplift resistance requirements in ASCE 7. If it cannot, then it must be replaced not recovered. Using this approach could have prevented an issue that now, according to Ron (after further investigation), will require replacement of the deteriorated LWIC fill. Whether this is replaced with tapered insulation or new LWIC, it will clearly add increased complexity and cost in order to achieve a proper code-compliant roof replacement.

14 FLORIDA ROOFING | February 2023

2020 Florida Building Code, Existing Building, 7th Edition

CHAPTER 7 ALTERATIONS—LEVEL 1

SECTION 706 EXISTING ROOFING

706.3 Recovering versus replacement. New roof coverings shall not be installed without first removing all existing layers of roof coverings down to the roof deck where any of the following conditions occur:

1. Where the existing roof or roof covering is water soaked or has deteriorated to the point that the existing roof or roof covering is not adequate as a base for additional roofing.

2. Where the existing roof covering is wood shake, slate, clay, cement or asbestos-cement tile.

3. Where the existing roof has two or more applications of any type of roof covering.

4. When blisters exist in any roofing, unless blisters are cut or scraped open and remaining materials secured down before applying additional roofing.

5. Where the existing roof is to be used for attachment for a new roof system and compliance with the securement provisions of Section 1504.1 of the Florida Building Code, Building cannot be met.

Exceptions:

1. Building and structures located within the High-Velocity Hurricane Zone shall comply with the provisions of Sections 1512 through 1525 of the Florida Building Code, Building

2. Complete and separate roofing systems, such as standing-seam metal roof systems, that are designed to transmit the roof loads directly to the building’s structural system and that do not rely on existing roofs and roof coverings for support, shall not require the removal of existing roof coverings.

3. Reserved.

4. The application of a new protective coating over an existing spray polyurethane foam roofing system shall be permitted without tear-off of existing roof coverings.

5. Roof Coating. Application of elastomeric and or maintenance coating systems over existing asphalt shingles shall be in accordance with the shingle manufacturer’s approved installation instructions.

Mike Silvers, CPRC is owner of Silvers Systems Inc., and is consulting with FRSA as Director of Technical Services. Mike is an FRSA Past President, Life Member and Campanella Award recipient and brings over 40 years of industry knowledge and experience to FRSA’s team.

16 FLORIDA ROOFING | February 2023

FRM

C A L L A C E & L E T S W O R K T O G E T H E R ! ADD ACE FASTENERS TO YOUR FM NAV NUMBERS & YOUR SUPPLY CHAIN

NAV

Add our FM approved fasteners to your Generics, or simply let us private label for you!

DISTRIBUTORS MANUFACTURERS We are working with manufacturers to include Ace Fasteners in their FM

numbers

GREAT FASTENERS

GREAT PRICES GREAT SERVICE

TRAINING CENTER

Discounts

Let FRSA Cater Your Event

us take care of the food and beverages, so you can focus your limited time on training employees and interacting with valuable clients. Affordable, Convenient Solution

discounted training room rental rate for FRSA members is $500; conference room, $200. Rentals include AV equipment, staff support and promotional exposure.

Training Room, Conference Room and Outdoor Space

training room seats 48 and the conference room seats 16 (when distancing restrictions are not in

Outdoor space available for hands-on training.

FRSA ORLANDO FRSA Member

Available

Let

Full-day

The

effect).

3855 N Econlockhatchee Trl Orlando, FL 32817 800-767-3772 EXT 123 JOHN@FLORIDAROOF.COM BOOK NOW> Perfect for your next training seminar or meeting. Now Open

FRSA staff is very accommodating and even helped reserve and manage the catering for our group, which allowed us to concentrate fully on the training. ” “

— Todd Shannon CORE Roofing Systems

Multi-Pipe Penetrations: The Bane of Roofing

A Checklist Can Help Multiple Trades Coordinate Their Work on Pipe Curbs

Thomas W. Hutchinson, AIA, CSI, Fellow-IIBEC, RRC

It never ceases to amaze me the way pipe penetrations through the roof are flashed or integrated into a roof cover. It’s as if there is a contest to see if everyone can do it differently – roof cement, membrane pitch pans, pourable sealer, lead, sheet metal covers, pre-molded boots, roof curbs penetrated in every which way and on and on. Many leak within a few months, only to then be caulked, covered in roof cement or duct taped (see photos on page 22). Most of these conditions relate to roofs that have been reroofed. What’s a designer to do?

The Solution

To deal with these conditions, I decided long ago to isolate the pipes from the roofing by having the HVAC piping come up through a prefabricated roof curb with a pipe curb cap and horizontal sleeves out the sides of the copper cap for each pipe – making the pipes fully independent from the roof. As such, the pipes could then be replaced or removed and additional pipes added without affecting the roof membrane and, possibly, the warranty.

I would suggest that when multiple pipes all grouped together penetrate the roof cover, the standard of care for architects, roof consultants and engineers is not a pourable sealer pocket but a pipe curb.

Design items to consider when moving forward with a pipe curb to be replaced on an existing roof include:

■ Purpose: isolation of the pipes from the roofing.

■ How many and what type of penetrations are you dealing with?

■ Disconnection, rerouting and reconnection of the piping.

■ Understand that the work of these details will most likely require coordination with mechanical and electric contractors.

■ Let’s not forget the owner, who may be without air conditioning for several days.

■ Vapor drive from the exterior of the curb toward the interior: How to seal the interior of the curb?

■ What type of deck is there, how open is it to allow the pipes to pass and how can it be closed off?

■ Separation of the pipes placed close together.

■ Waterproofing of the interior of the curb.

■ Ability at some time in the future to gain access to the pipes.

■ Material that will not rust (copper and stainless steel).

The Detail

The proper detail will involve a roof curb and a sheet metal cover, horizontal sleeves out the side of the copper cap that are then sealed with a foam rod, primer and sealant. The height of the curb should be eight inches above the roof surface – remember the tapered insulation. This condition of course requires specific detailing.

Construction involves disconnecting the pipes (and recapturing Freon where it exists). The detail should encompass a vapor retarder, roof curb, insulation for the interior of the curb and a solderable sheet metal hood with horizontal pipe sleeves for the pipe(s) to pass and a removable top. The last steps of the construction process include reconnecting the piping and sealing the pipes to the horizontal sleeves with a foam rod, primer and sealant. A very specific detail should be created to convey what is required. The construction of the pipe curb requires coordination of several trades.

As with other details, the pipe curb detail can involve a complex set of steps. In addition to the contractors having difficulty being able to decipher the steps, our observers did too so we created the following quality assurance checklist.

The Checklist – Pipe Penetration Quality Assurance Compliance

1. Have the existing curbs been removed, pipes disconnected (and any Freon captured) and electrical disconnected?

o Yes o No

2. Has a new insulated roof curb of the correct height been installed and properly secured?

o Yes o No

20 FLORIDA ROOFING | February 2023

ADAMSANDREESE.COM // TRENT.COTNEY@ARLAW.COM // 866.303.5868 PROUDLYREPRESENTING THE ROOFING INDUSTRY MAIN OFFICE: TAMPA

3. Is the vapor retarder attached to the curb with an additional piece of vapor retarder material?

o Yes o No

4. Have the gaps between the pipe curb and roof insulation been filled with spray foam insulation?

o Yes o No

5. Has the roof deck on the interior of the roof curb been closed to the pipes to allow for the application of spray foam?

o Yes o No

6. Has the opening in the roof deck for the pipes to pass been closed off with a sheet metal plate and spray foam been installed to seal the bottom of the curb from air exfiltration and to support the concrete?

o Yes o No

7. Has the inside of the curb been filled with a minimum of two inches of concrete?

o Yes o No

8. Has the curb been filled with a minimum of 1-1/2 inches of pourable sealer over the hardened concrete base?

o Yes o No

9. Has the copper/stainless steel enclosure and sleeve(s) been fabricated with fully soldered joints?

o Yes o No

10. Has the copper/stainless steel metal enclosure cap been fabricated with fully soldered joints and have a cross break on top?

o Yes o No

11. Have the refrigeration pipes been modified to fit through the horizontal pipe curb sleeves?

o Yes o No

12. Have the proper stainless steel screws with EPDM washer fasteners been used to secure the metal cap?

o Yes o No

13. Have the pipe penetrations been centered in the horizontal pipe sleeves at the pipe curb cap and shimmed with a foam rod, to be centered in the sleeve?

o Yes o No

14. Have the primer, then foam rod, then polyurethane sealant been installed around the pipe to the metal sleeve?

o Yes o No

15. Has all sheet metal debris been removed from the roof surface?

o Yes o No

22 FLORIDA ROOFING | February 2023

Roof cement is not the roofer’s fix-it-all.

The thinking here appears to be, “Let’s save time and goop up four penetrations at once.”

MOISTURE DEFENSE SYSTEM

The STINGER CN100B and NailPac are tested and approved for winds up to 180mph. That means you can confidently and efficiently install roof decks ensuring they are protected from whatever nature has in store.

Visit STINGER at booth #4501 at the International Roofing Expo to see the CN100B in action and to receive a free gift*.

*Limited to the first 500 visitors.

800-968-6245 | INFO@STINGERWORLD.COM |

The Result

By planning, properly illustrating the detail and working with a good quality set of contractors, long-term success can be achieved (see photos above).

With pipe curb details, as with so many other elements of sustainable and resilient roofing, assisting the crew in the field as well as your staff is the key to providing long-term benefits to your clients.

FRM

2023 Charity of Choice

Providing educational, vocational and mental health services to young adults who have aged out of foster care.

www.FloridaRoof.com

/charityofchoice

24 FLORIDA ROOFING | February 2023

Thomas W. Hutchinson, AIA, CSI, Fellow-IIBEC, RRC, is a principal of Hutchinson Design Group Ltd. in Barrington, Illinois. For more information about the company, visit hutchinsondesigngroup.com.

These photos show the right way to do it: clean, isolated from the roof and not a tripping hazard.

Extend Your Pipe Patent #8,752,344 www. TUBOS .biz 727.504.0633 info@TUBOS.biz The only Pre-fabricated Vent Pipe Extension for your short or broken plumbing stacks. Get them up to code height in less than 3 minutes, no clamps or couplings required. Works on cast iron or PVC and guaranteed to never leak! Available in 2, 3, 4” and NEW 5”

Ergonomic Guidelines – Using Four-Wheel Carts in Roofing, Part Three

Dr. Ken-Yu Lin and Dr. Zhenyu Zhang, SHARE Lab College of Built Environments, University of Washington

In last month’s issue, we discussed workplace setup and site pre-task planning. In this third and final article, we’ll focus on developing your ergonomic intervention program.

Developing Your Ergonomic Intervention Program

Ergonomic changes do not happen overnight. It happens little by little. Implementing an intervention program can help you incorporate solutions recommended in these guidelines into your company’s daily practice. Here are six steps you want to follow:

1. Have you obtained support from senior management? Implementing an intervention program requires resources and investment. This is particularly true for solutions like preventative replacement and tire selection. You need to make senior management aware of the important safety and financial benefits. Previous articles have provided reference information to communicate and convince senior managers. You can also use this information to develop a clear return on investment based on your own company’s situation. Tailored information will be more persuasive. By adjusting some parameters such as the number of carts you deployed, you can easily obtain your own return on investment data. Tip: You can use the ROI calculator offered by CPWR: https://www.safecalc.org/.

2. Are you ready to elevate workers’ motivation? Worker engagement is the key to a successful ergonomic program because the workers will be the ones making the necessary changes (e.g., workplace layout, team pulling/pushing). You should make employees aware of the prevalence of overexertion hazards caused by cart handling and the health consequences if no changes are made. For this purpose, awareness training is needed and previous articles have provided basic information to prepare that training.

3. Have you provided skill training to workers and site supervisors? Workers and site supervisors must be able to recognize the risk factors associated with cart handling. They must understand general control measures for reducing these risk factors before they can practically participate in the program. Again, refer to previous articles for training materials for the foreman’s meeting and toolbox talks.

4. Have you provided site-specific instructions? Training workers and site supervisors on the general risk control measures is not enough. As safety professionals, you should also offer them site-specific instructions. Consider revising your company’s template for job hazard analysis, safety planning and an inspection checklist to incorporate these guidelines. For example, you can add ergonomic hazards to your safety inspection checklist. This helps you identify and correct safety issues in a timely manner.

5. Have you redesigned the working environment to provide cues for action? Work with your warehouse manager and team members to remodel carts by installing a handle to enable easy team pushing from behind. You can also print warning signage and ask workers to attach them to carts and bundled material before they are sent to jobsites. These measures will remind workers and site supervisors to take action against overexertion injuries.

6. How can you determine if the program is a success? Evaluation is the key to prove your efforts have paid off. Here are three signs you can watch out for during the program:

■ Reduced overexertion injuries. Review your company’s injury log before and after the program. Specifically, track claim numbers, total lost days and economic costs that are associated with cart handling.

■ Improved health status of workers. Deliver a health questionnaire to those workers who handle material carts and track the changes to their health status.

■ Changed practices by workers and site supervisors. When visiting jobsites, you can observe field workers’ practices of cart handling. Documenting the results will help you track if ergonomic hazards associated with cart handling are being increasingly addressed.

Dr. Ken-Yu Lin and Dr. Zhenyu Zhang, SHARE Lab College of Built Environments, University of Washington developed Ergonomic Guidelines, Using Four-Wheel Carts in the Roofing Trade with funding and support for this project provided by the State of Washington, Department of Labor and Industries, Safety and Health Investment Projects (grant number 2018ZH00361).

26 FLORIDA ROOFING | February 2023

FRM

Visit One of Our Locations for the Southeast’s Largest Selection of Roofing Materials and Equipment Roofing Tools Fasteners Drains & Parts Caulking & Sealants Safety Products & Apparel And More! www.crssupply.com 800-874-6152 We have Generators, Tarps and Fasteners in stock at all locations

COTNEY CONSULTING GROUP

Evaluating Contract Profitability, Part One

What is the language of business? The answer is accounting. Accounting speaks to owners and managers through numerous reports and financial statements, including a balance sheet, income statement and cash flow statements.

The procedures and methods regulating the preparation of financial statements for the construction industry are the Generally Accepted Accounting Principles commonly known as GAAP rules, allow some flexibility in reporting transactions within the accounting rules for construction companies. In our industry, contracts do not conveniently start and finish within our fiscal year, which can complicate the measurement of profits and allow room for error.

It is common for new contractors and managers coming up through the ranks or from construction schools to have never taken an accounting course, much less understand the finer points of construction accounting. Most contractors’ fundamental problem with evaluating contract profitability is leaving its calculation to the bookkeepers and accountants. Roofing contractors handle a lot of money that is not theirs. The company only gets to keep the profit, which most of us agree, is too small for the risks we take. Successful contractors and senior managers do not avoid accounting and do understand how to calculate contract profitability from work in progress. This requires accurate input of roofing installation information known only to the people engaged in the field.

The primary reason for being in business is to make a profit. You will not be able to survive long working at or below the breakeven point. One of the most challenging and misunderstood processes in contracting is capturing all of the data accurately, on time and knowing how to use it correctly to track interim profit or loss. Only then can you evaluate final profit or loss.

It can get complicated for roofing companies whose projects run through multiple monthly cycles. The first place to start is with your accounting system.

Selecting Your Accounting System

Begin by knowing what your business needs are. Prepare a complete list for your company, including what you will need to keep up with your projected growth over the next five to ten years. Depending on the type of projects you perform, some features to consider are:

■ Cash flow analysis by job

■ Work-in-progress (WIP) reports

■ Bonding reports

■ Purchase orders

■ Certified payroll

■ AIA billing.

The accounting software you will use should have all the tools you need to manage jobs effectively with a strong accounting core. It must be able to align with your business processes and be as integrated and automated as possible. The goal is to reduce manual work and spreadsheets as much as possible. Take the time and look for the system that fits your company’s needs and then you can get to the business of managing your profitability.

Percent of Completion

Allowing you to recognize the gain or loss related to your project in every accounting period in which the project remains active is essential. The percentage of completion method recognizes the ongoing revenue and expenses related to longer-term roofing projects based on the total work completed. The method works

28 FLORIDA ROOFING | February 2023

Project Name Contract Plus CO’s Billings to Date Total Cost to Date Estimated Cost Estimated Gross Job 1 $317,327.34 $397,017.34 $253,843.30 $260,000.00 $57,327.34 Job 2 $595,820.00 $448,135.00 $304,057.74 $385,000.00 $210,820.00 Job 3 $168,800.00 $168,800.00 $82,354.31 $90,000.00 $78,800.00 Job4 $141,590.00 $141,590.00 $100,509.26 $100,509.26 $41,080.74 Work in Progress Schedule

John Kenney, CPRC, CEO, Cotney Consulting Group

best when you estimate the stages of your project completion on an ongoing basis or at least estimate the remaining costs to complete your project. The steps you can use for the percentage of completion method are as follows:

■ Subtract the total estimated contract costs from the total estimated contract revenues to find the total estimated gross margin.

■ Field verify the amount of completed installation on the job as a percentage compared to 100 percent completion of installation labor. (Yes, if your project is behind in production, you will get percentages above 100 percent.)

■ Multiply the estimated contract revenue, including change orders, by the estimated completion percentage. This will provide you with the total revenue that can be recognized.

■ Subtract the previously recognized contract revenue from the total revenue that can be recognized in the current account period.

■ Calculating the cost of earned revenue, multiply the same completion percentage by the total estimated contract cost. Then subtract the cost already recognized to arrive at the cost of earned revenue to be recognized in the current accounting period.

An example of what your WIP schedule would look like is at the bottom of the page.

Revenue for a roofing company is a calculation that relies entirely on the accuracy of the contractor’s estimate of the cost to complete their work in progress. If one or more projects do not perform as well as expected, revenue will have been claimed that never existed and will have to be “paid back” in a subsequent accounting period.

Over and Under Billing

As shown in the example WIP schedule below, the amount a company has billed for work completed on a project during an accounting period is not considered in calculating revenue or total sales for that period. The entries “overbilling” and “underbilling” are used to balance the recognized revenue on your project. Over and underbilling is unique to the construction

and roofing industry and is a product of the work-inprogress schedule. It corrects the amount that should have been billed according to the work in progress calculations.

The amount earned to date has nothing to do with the amount billed to date. If the earned to date is less than the billed to date, it is recorded as billings in excess of costs, which is considered an accounting liability. If the earned to date exceeds the billed to date, it is recorded as a cost in excess of billings, which is considered an accounting asset.

Because of the effect on cash flow, a contractor should always avoid underbilling. Underbilling implies that the people billing the work are not communicating with those installing the work or that the cost estimate to complete the work is overly optimistic or in error.

Next month, we will discuss cost controls, tracking costs and the dangers of working without the correct information.

John Kenney, CPRC has over 45 years of experience in the roofing industry. He started his career by working as a roofing apprentice at a family business in the Northeast and worked his way up to operating multiple Top 100 Roofing Contractors. As CEO, John is intimately familiar with all aspects of roofing production, estimating and operations. During his tenure in the industry, John ran business units associated with delivering excellent workmanship and unparalleled customer service while ensuring his company’s strong net profits before joining Cotney Consulting Group. If you would like any further information on this or another subject, you can contact John at jkenney@cotneyconsulting.com.

Work in Progress Schedule (con’t)

www.floridaroof.com | FLORIDA ROOFING 29

FRM

Project Name Gross Percent Percent Complete Earned Profit Total Earned Revenue Billings in XS Cost + Est Earn Cost + Est Earn in XS Billings Job 1 18% 98% $55,969.85 $309,813.15 $87,204.19 –Job 2 35% 79% $166,497.28 $470,555.02 – $22,420.02 Job 3 47% 92% $72,105.77 $154,460.08 $14,339.92 –Job4 29% 100% $41,080.74 $141,590.00 – –

Five Myths About Payroll Taxes

Barbara Weltman, Attorney, Small Business Administration Contributor

If you want to grow your business, you probably need to hire employees to help you. Becoming an employer and expanding your staff entails many responsibilities, one of which is overseeing to payroll taxes. Unfortunately, there are many myths about these taxes. Here is the reality:

1. Myth: Transforming employees into independent contractors to save on payroll taxes is easy.

Reality: You probably know that it costs less to use an independent contractor than to have an employee on staff. The reason: the cost of payroll taxes, along with insurance and benefits apply only for employees. But don’t think you can simply reclassify a worker who’s been your employee as an independent contractor. The IRS, as well as other government agencies, are on the lookout for just such action.

The classification of a worker depends on many factors, most of which boil down to a matter of control. Essentially, if you have the right to say when, where and how work gets done, you’re likely dealing with an employee. The IRS uses three categories of factors to assess the degree of control: behavioral, financial and type of relationship. Many states use an ABC test:

■ The worker is free from the control and direction of the hirer in connection with performing the work.

■ The worker performs work outside of the usual course of the hiring entity’s business.

■ The worker is usually engaged in an independently established trade, occupation or business of the same nature as the work performed for the hiring entity.

2. Myth: All tax-free benefits are exempt from payroll taxes.

Reality: Receiving tax-free fringe benefits means that employees do not have to pay income tax on what they receive. However, it does not mean that employers are off the hook for payroll taxes. For example, 401(k) contributions made by employees through salary reductions are still subject to FICA. And adoption assistance is exempt from income tax withholding because the benefit is tax free to employees but is still subject to FICA and FUTA taxes. You can find a list of various fringe benefits and their tax treatment for employment tax purposes in Table 2-1 in IRS Publication 15B.

3. Myth: You can pay employment taxes with your quarterly employer tax return.

Reality: In general, you must deposit federal income taxes withheld and both the employer and employee share of FICA with the US Treasury using the Electronic Federal Tax Payment System (EFTPS). Also, deposits are required for FUTA tax for the quarter

within which the tax due is more than $500.

4. Myth: Outsourcing to a payroll service provider relieves you of liability.

Reality: Rather than handling payroll in-house, many businesses use an outside payroll service provider to handle the chore of computing payroll taxes, withholding them from employees’ paychecks, remitting payroll taxes to the government and filing employment tax returns. What happens if a payroll provider fails to remit your money to the government? Or it fails to timely file employment tax returns? Unfortunately, you’re still on the hook for these obligations. You may have a lawsuit against the payroll service provider for theft, breach of contract or other bad action. You can even file a complaint with the IRS if you suspect your payroll service provider of improper or fraudulent activities regarding the deposit of your taxes or the filing of your returns. But it doesn’t relieve you of your obligations to the government.

5. Myth: Incorporating relieves you of liability for unpaid employment taxes.

Reality: You may think that having incorporated your business or formed a limited liability company (LLC), you have complete personal liability protection. You don’t. If you are a person responsible for withholding, accounting for or depositing withheld employee taxes (their income tax withholding and their share of FICA) and you willfully fail to do so, you can be held personally liable for all of these taxes, plus interest. This is called a trust fund recovery penalty and it can be applied to business owners even if they have corporations or LLCs.

Final Thought

In addition to any federal payroll tax obligations, you may also have state-level employment taxes to consider. Find out more about federal employment taxes from the IRS. Check with your state tax or revenue department to learn about your obligations on the state and local levels.

Barbara Weltman is an attorney, prolific author with such titles as J.K. Lasser’s Small Business Taxes, J.K. Lasser’s Guide to Self-Employment and Smooth Failing as well as a trusted professional advocate for small businesses and entrepreneurs. She is also a blog contributor for the SBA.

30 FLORIDA ROOFING | February 2023

FRM

Everyone pays the same workers' comp rate, but does your workers' comp insurance carrier provide you with the potential for a yearly dividend for operating safely? If not, you need to consider the FRSA Self Insurers Fund. These members received their share of $3 million during FRSA's Convention. For more information about joining the Self Insurers Fund, contact Alexis at 800-767-3772 ext. 206 or by email: alexis@frsasif.com

32 FLORIDA ROOFING | February 2023 ROO FRSA Self Insurers Fund JOIN FRSA T H E A S S O C I A T I O N T H A T W O R K S F O R T H E I N D U S T R Y WWW.FLORIDAROOF.COM 800-767-3772 ext. 142. ANNA@FLORIDAROOF.COM Access to Workers' Comp with an unmatched safety and training program FRSA Credit Union Discounts on seminars Discounts on Expo booths Sponsorship opportunities Access to the residential roof loan program. FRSA CU can assist with auto and equipment loans and all your banking needs Convention & Expo Technical Building Code support Human Resources & Legal Services Discounts on advertising Member Benefits FRSA Member Perk! Get your first month of R-Club membership for free. Email aj@rooferscoffeeshop.com to get your discount code.

ROOFING DAY in D.C. 2023 APRIL 18-19 YOUR VOICE MATTERS nrca.net/roofingday REGISTER NOW!

Accident Investigation

Jorge Castanon, Safety Consultant, FRSA Self Insurer’s Fund

An accident investigation is a detailed analysis aimed at discovering the factors that led to an accident that caused a potential injury or injuries and property damage. An accident investigation is also an effective safety measure in helping to identify causal factors connected to accidents, incidents and near-miss scenarios.

Although the Occupational Safety and Health Administration (OSHA) does not have a specific standard for accident investigations as a best practice, all accidents and incidents should be investigated, regardless of severity. Near-miss incidents in which no harm resulted should also be included. Some employers create an accident investigation checklist to ensure that all areas are covered. Completing an accident investigation will be beneficial in determining safety hazards or safety training that will need to be addressed to reduce the risk of future injuries.

Accident investigations can help pinpoint underlying causes and reasons that can deter future accidents. Supervisors and safety management personnel must be notified promptly following the occurrence of an accident. The accident investigation report follows set criteria that account for different variables including date and time of accident, possible defective equipment, witnesses present, job-related duties and tasks and a comprehensive summary of all related events.

It is imperative that employers and safety staff members conduct personal interviews with the affected parties coupled with witnesses to gather comparatively reliable documentation. Interviews are not designed to assign blame or fault but rather

identify the precise cause and the successive events prior to the accident. The accident investigation should focus on identifying and correcting the cause of the incident and can improve your workplace morale by demonstrating the employer’s commitment to a safe workplace for all.

The employer should follow up with the affected employee after the accident investigation has concluded to see how they are doing. If someone has been hospitalized, someone from the organization should visit the employee in the hospital. A get-well card signed by co-workers, a fruit basket or flowers will send a message that the company really cares about its employees and will encourage the employee to return to work when able.

An accident investigation is a proactive approach in preventing future similar accidents that can have dangerous consequences.

There are many websites that can assist you in putting together a good accident investigation review and provide steps in the investigation process. If you are insured with the FRSA Self Insurers Fund, your dedicated safety consultant can assist you with the actions you should take for a good safety investigation.

The FRSA Self Insurer’s Fund (FRSA-SIF) has professional safety consultants throughout the state who are willing to provide SIF members with safety training at no additional cost. To find out if you qualify for FRSASIF membership, please contact us at 800-767-3772, ext. 206 or email alexis@frsasif.com. To learn more about the FRSA Self Insurers Fund, please visit www.frsasif.com.

What’s Wrong With These Pictures?

34 FLORIDA ROOFING | February 2023

FRM

the power of INNOVATION

THREE DECADES STRONG

Double Down on Your Protection! Offer homeowners the assurance of long-term waterproofing with exposure ratings available up to 365 days when using Polystick ® self-adhered roof underlayments in a 2-ply system.

Imagine what’s next! Polyglass.us/polystick2ply

Stay Connected

polyglass.us

SAVE TIME AND BE MORE EFFICIENT

28 Fully stocked locations throughout Florida to service your building material needs.

Homestead, FL 33032

(786) 829-2761

Jacksonville, FL 32209

(904) 503-9400

Tallahassee, FL 32304

(850) 574-7600

Odessa, FL 33556

(813) 749-5354

Orlando, FL 32804

(407) 291-7244

Tampa, FL 33619

(813) 740-8790

Fort Myers, FL 33916

(239) 935-5077

Deerfield Beach, FL 33442

(954) 969-8000

Miami, FL 33142

(305) 635-7177

Orlando, FL 32809

(407) 367-6246

Ocala, FL 34474

(352) 622-3933

Melbourne, FL 32904

(321) 369-7892

Ormond Beach, FL 32174

(386) 301-4471

Palmetto, FL 34221

(941) 722-6800

Leesburg, FL 34748

(352) 818-6120

Orlando, FL 32804

(407) 859-9997

Winter Haven, FL 33880

(863) 293-1555

St. Petersburg, FL 33716

(727) 565-4630

Sarasota, FL 34243

(941) 203-6320

Fort Pierce, FL 34982

(772) 466-3461

Stuart, FL 34997

(772) 223-8881

Vero Beach, FL 32960

(772) 778-0549

Orlando, FL 32810

(321) 442-0061

Fort Lauderdale, FL 33315

(954) 525-1158

Riviera Beach, FL 33407

(561) 863-9899

Clearwater, FL 33762

(727) 573-6075

North Port, FL34289

(941) 732-1029

Panama City, FL 32405

(850) 763-0851

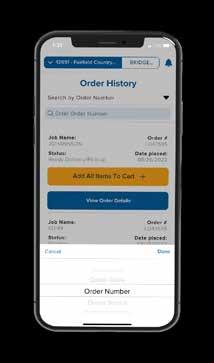

Find your local branch with the Beacon PRO+ Mobile App. Download the Mobile App today!

BECN.COM

Sandra Stetson Aquatic Center, DeLand, FL Installing contr.: Quality Metals Inc. Architect: Preston T. Phillips GC: Charles Perry Partners Inc. Profile: PAC-150 Color: Custom Stetson Green Photo: hortonphotoinc.com

Snap-Clad

Tite-Loc Plus

PAC-150

Sandra Stetson Aquatic Center, DeLand, FL Installing contr.: Quality Metals Inc. Architect: Preston T. Phillips GC: Charles Perry Partners Inc. Profile: PAC-150 Color: Custom Stetson Green Photo: hortonphotoinc.com

Snap-Clad

Tite-Loc Plus

PAC-150