26

Jennifer Gibson-Hebert, JSJ Productions, Inc. A growing and employee-owned company.

31

Meese Düsseldorf

The most international trade fair of the global plastics and rubber industries.

34

A. Michael Gellman, Fiscal Strategies “4” Nonprofits A call to action to spur change.

40

Michelle Rose, ARMA CEO

A back to basics, in-person conference with an exceptional business program and opportunities for connections.

52

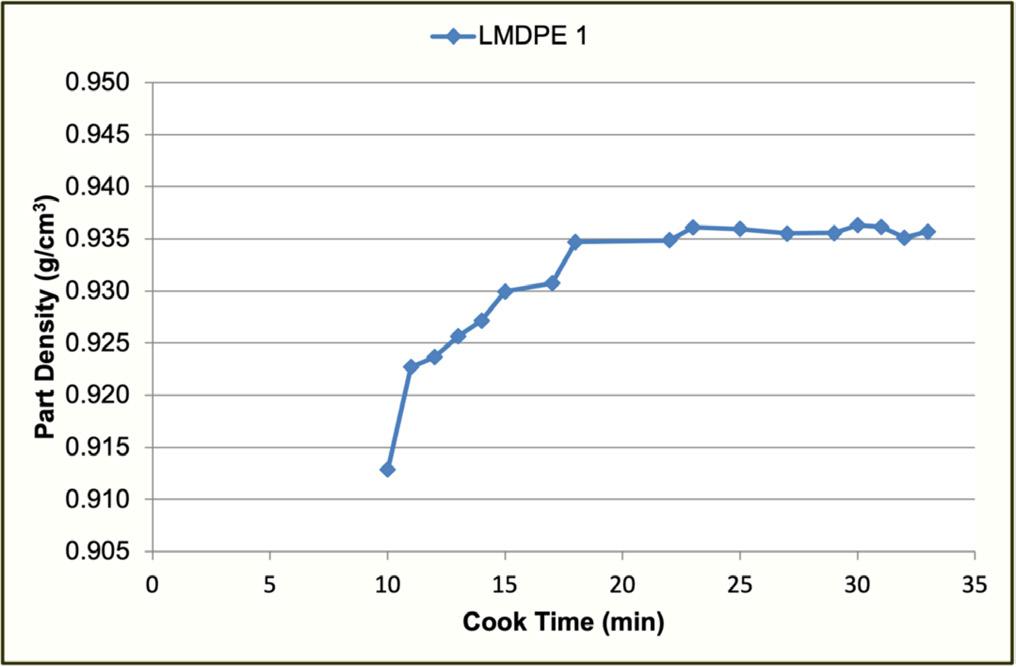

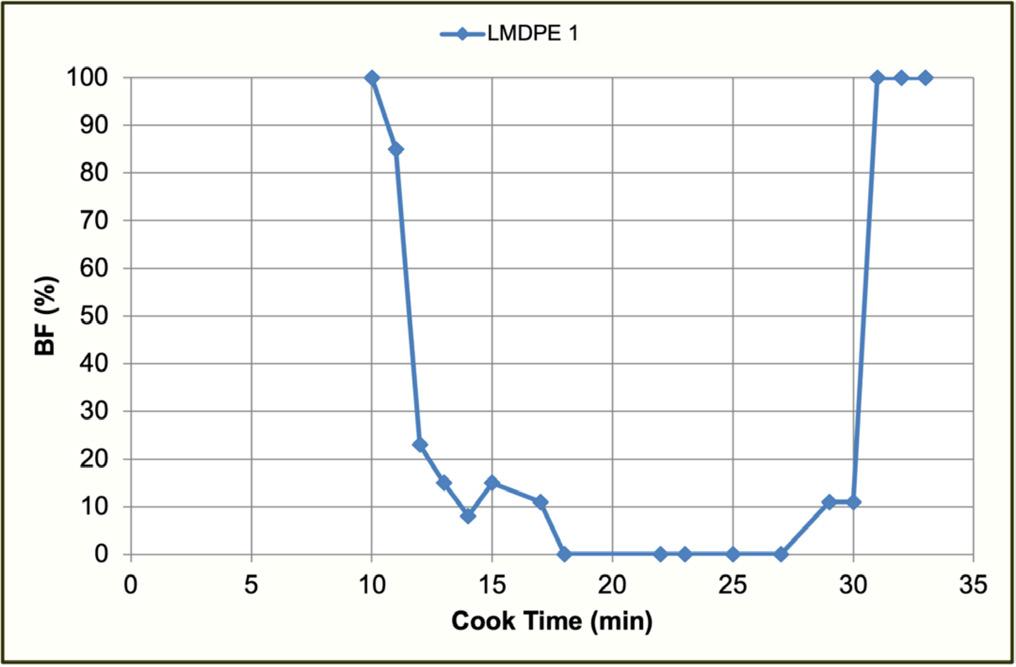

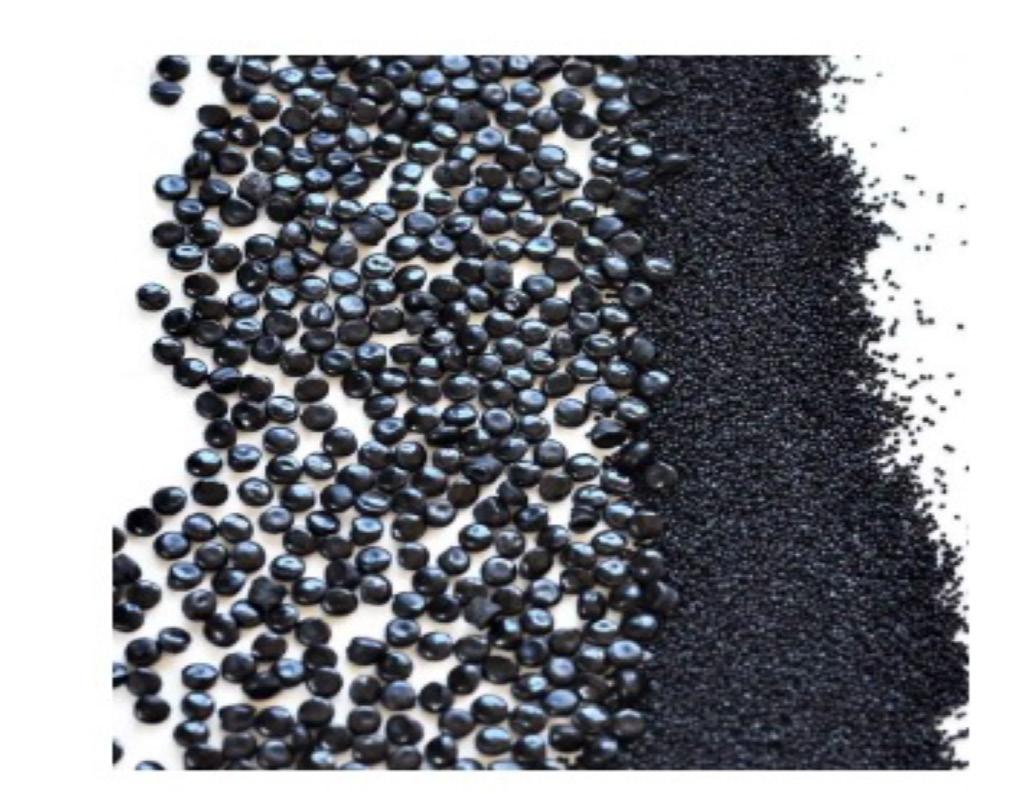

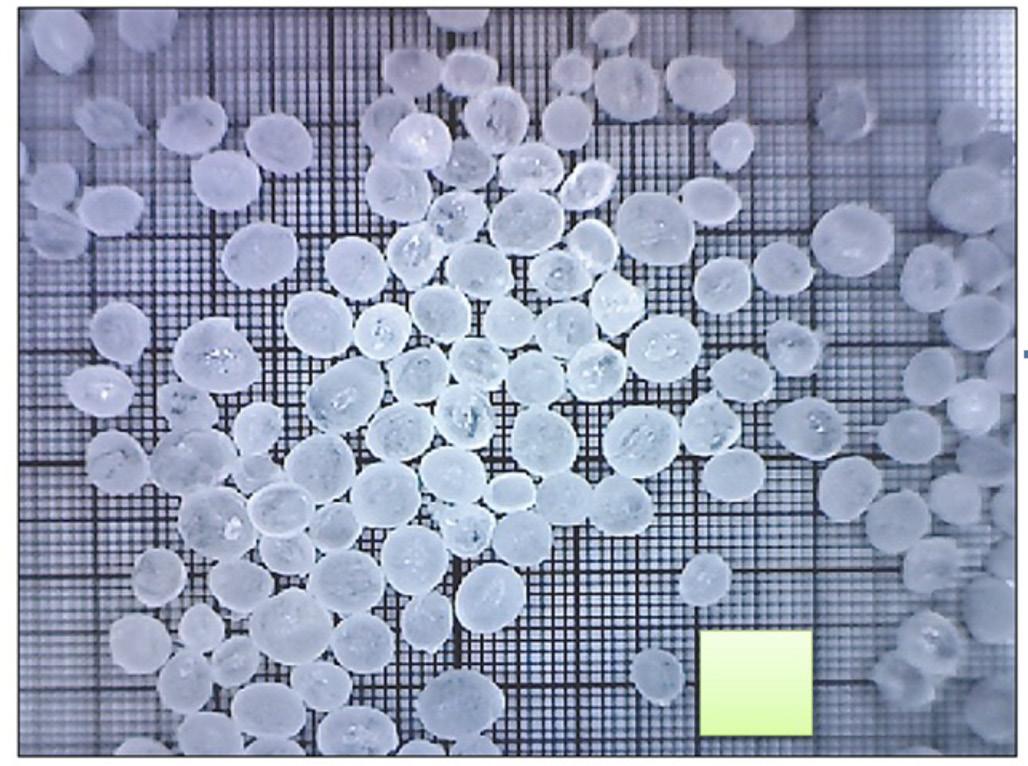

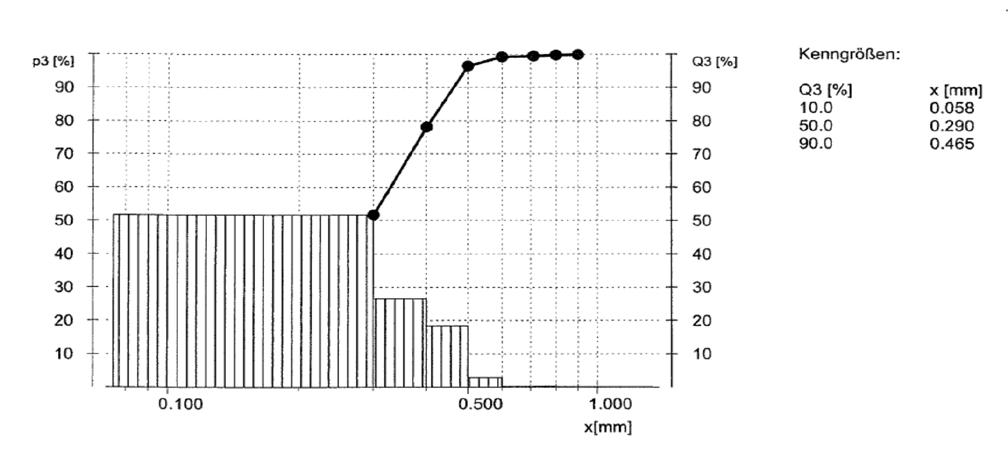

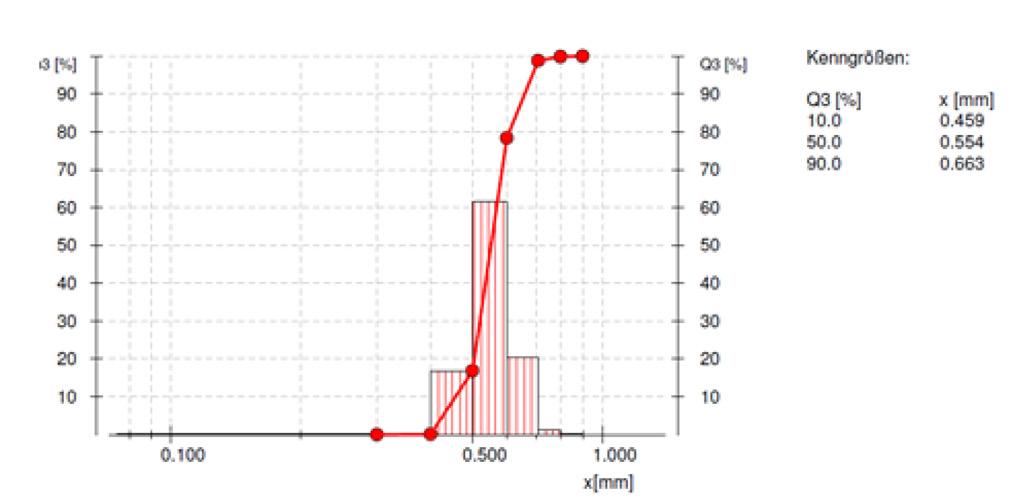

Dr. J Carlos Caro, PhD Polymer Chemistry, GRAFE Polymer Solutions

The benefits of using micropellets.

Industry is flooded with information addressing the hot topic of a circular economy. The simple definition is a model of production and consumption, which involves sharing, leasing, reusing, repairing, refurbishing, and recycling existing materials and products if possible. In this way, the life cycle of products is extended. In practice, it implies reducing waste to a minimum. There is a lot of mention about a circular economy inside this issue.

Restorative and regenerative by design, a circular economy means materials constantly flow around a closed-loop system, rather than being used once and then discarded. In the case of plastics, this means simultaneously keeping the value of plastics in the economy, without leakage into the natural environment. We take materials from the Earth, make products from them, and eventually throw them away as waste – the process is linear. In a circular economy, by contrast, we stop waste from being produced in the first place.

In a circular economy, manufacturers design products to be reusable. For example, electrical devices are designed in such a way that they are easier to repair. Products and raw materials are also reused as much as possible. For example, by recycling plastic into pellets for making new plastic products.

This is underpinned by a transition to renewable energy and materials. A circular economy decouples economic activity from the consumption of finite resources. It is a resilient system that is good for businesses, people, and the environment. The circular economy is a systems solution framework that tackles global challenges like climate change, biodiversity loss, waste, and pollution.

Experts say this is how we will manage resources for the future, how we will make and use products, and what we will do with the materials afterward. Only then can we create a thriving circular economy that can benefit everyone within the limits of our planet.

One only must ask: What will it take to transform our throwaway economy into one where waste is eliminated, resources are circulated, and nature is regenerated? The circular economy gives us the tools to tackle climate change and biodiversity loss while addressing important social needs. It gives us the power to grow prosperity, jobs, and resilience while cutting greenhouse gas emissions, waste, and pollution.

We are so pleased to present an inside look at how Scott Seljan, Seljan Company, has engaged in a fast-growing employeeowned robotics manufacturing company, Rock Lake Robotics. His inspiring journey began due to a need for labor in his own rotomoulding company. Read all about the ideology behind this exciting USA innovative manufacturing story.

I also think you will enjoy reading noted economist Michael Gellman’s article on how inflation affects planning, budgets, and operating reserves, but more importantly perceptions. He says to “get out in from of inflation, we need to turn inflation-driven negative feelings into a positive driver for innovative planning and a wake-up call to action”.

Michelle Rose, ARMA CEO, contributes a great review of the 2022 ARMA Conference held recently in Melbourne, Australia. This was the first time ARMA has met in person in three years due to Covid. Their backto-basics programming along with great business and social opportunities drove a very successful conference. Ronny Ervik reports on the 2022 Nordic ARM Conference held earlier this year in Copenhagen. The focus of this conference was the circular economy, automation, and innovations.

Susan Gibson Publisher & EditorI hope you enjoy the issue!

In the case of plastics, this means simultaneously keeping the value of plastics in the economy, without leakage into the natural environment.

Publisher & Editor

Susan D. Gibson President - JSJ Productions, Inc. susan@jsjproductionsinc.com

Technical Editor

Alvin Spence PhD MEng aspence@centroinc.com

Process Editor

Paul Nugent PhD MEng paul@paulnugent.com

Design Editor

Michael Paloian President - Integrated Design Systems, Inc. paloian@idsys.com

Global Contributing Editors

Celal Beysel Chairman - Floteks Plastik beysel@superonline.com

Martin Coles Matrix Polymers martin.coles@matrixpolymers.com

Adam Covington Ferry Industries acovington@ferryindustries.com

Mark Kearns Moulding Research Manager m.kearns@qub.ac.uk

Ravi Mehra Managing Director - Norstar International LLC maramehra@aol.com

Advertising and Art Production

Marketing/Advertising Director Jennifer Gibson Hebert Vice President, JSJ Productions, Inc. jennifer@jsjproductionsinc.com

Chief Art Director Anya Wilcox JSJ Productions, Inc. awilcox@designintersection.com

Circulation & Distribution Administration

Sheryl Bjorn JSJ Productions, Inc. sheryl@jsjproductionsinc.com -

Editing & Translations

Suzanne Ketron | Oliver Wandres | Sheryl Bjorn

Website & Online Technology

Jason Cooper JSJ Productions, Inc. jason@bound.by

RotoWorld ® is a JSJ Productions, Inc. Trade Publication JSJ Productions, Inc. 625 West Market Street, Salinas, CA 93901 Phone: (512) 894.4106; Fax (512) 858.0486 Email: rotoworldmag@rotoworldmag.com and Website: www.rotoworldmag.com

Subscriptions One-year subscription (six issues), print or digital, $60 US, $90 Canada/Mexico, $135 All Other Countries. To subscribe or to submit change of address information, call us at (512) 894.4106; fax us at (512) 858.0486; visit us online at www.rotoworldmag.com; or email us at sheryl@jsjproductionsinc.com. You may also write to RotoWorld ® Subscriptions, JSJ Productions, Inc., 625 West Market Street, Salinas, CA 93901

Advertising For information on advertising, please contact Advertising Director Jennifer Gibson Hebert, JSJ Productions, Inc. Email Jennifer Gibson at jennifer@jsjproductionsinc.com

Letters We welcome letters about our contents. Write Letters to the Editor, JSJ Productions, Inc., 625 West Market Street, Salinas, CA 93901 512.894.4106 phone 512.858.0486 fax, or Email susan@jsjproductionsinc.com.

Editorial Queries We consider unsolicited contributions. Send manuscript submissions as email attachment to Susan Gibson at susan@jsjproductionsinc.com.

JSJ Productions, Inc. bears no responsibility for claim or factual data represented in contributed articles.

Postmaster Send changes of address to RotoWorld®, JSJ Productions, Inc., 625 West Market Street, Salinas, CA 93901

RotoWorld® is a JSJ Productions, Inc. independently owned, bi-monthly trade magazine for the international rotational molding and plastics design industries. JSJ Productions, Inc. owns all copyrights on articles published herein unless ownership is otherwise stated. Reproduction of this magazine, in whole or in part, without the express written permission of the publisher is not permitted.

Alvin Spence is Vice President Engineering at Centro, Inc., North Liberty, Iowa. He provides leadership for Centro’s product development team and quality resources. Alvin received his Bachelor’s degree in Mechanical & Industrial Engineering and PhD from Queen’s University Belfast. aspence@centroinc.com

Paul is a consultant who travels extensively across six continents assisting clients in many roles from training to expert witnessing. He received his Eng. degree in Aeronautical Engineering and Ph.D. in Mechanical Engineering from Queen’s University of Belfast. Paul developed the Rotolog system, the first complete computer simulation (RotoSim), and authored a book entitled Rotational Molding: A Practical Guide paul@paulnugent.com

Celal is Chairman of Floteks Plastik, the pioneer and innovative leader of the rotational molding industry in Turkey and a Global Contributing Editor for RotoWorld® magazine. Being an ARM member for more than 20 years, he has made many presentations at ARM meetings in various countries. He is also active in business and political organizations in his country. Celal has authored numerous articles published in various newspapers and magazines about politics, plastics, rotomolding, and innovation. beysel@superonline.com

Michael is President of Integrated Design Systems, Inc., Great Neck, New York. Over the past 25 years, Mike has developed a broad range of plastic products utilizing various processing methods including rotational molding. Mike’s B.S. degree in Plastics Engineering and Masters in Industrial Design, combined with his extensive experience, has formed the basis for his branded and unique insights into the field of plastics part design. paloian@idsys.com

Martin Coles, CEO of Matrix Polymers co-founded the business 30 years ago and is the company’s largest shareholder. Shortly after graduating from London University, he began his career in the plastics industry working for a major Italian petrochemical and soon became passionate about the unique world of rotomoulding. Matrix Polymers are experts in rotomoulding materials and have become a global supplier with compounding and grinding plants in the UK, Poland, Australia, New Zealand, and Malaysia. The company sells more than $150 million of rotomoulding materials each year and has 230 employees. martin.coles@matrixpolymers.com

Adam Covington is President of Ferry Industries, Inc. in Akron, Ohio U.S.A. Covington has been with Ferry Industries for over 11 years, advanced through the manufacturing, engineering, sales, and service positions within the company and was appointed President in 2019. Adam strives to find solutions for customer’s needs and advance machine technology for the rotomolding industry. He is a graduate of Ohio University’s Russ College of Engineering and Technology with a Bachelor’s degree in Industrial Technology. acovington@ferryindustries.com

Mark Kearns is the Rotational Moulding Research Manager of the Polymer Processing Research Centre at Queen’s University of Belfast. He is a Chartered Chemical Engineer with a M. Phil Degree in Rotational Moulding. Mark manages rotational moulding research and development projects for companies across Europe, Australasia, and North America. M.Kearns@qub.ac.uk

Rob Miller is Owner/President, Wittmann Battenfeld Canada Inc. Rotoload. Rob started in the plastics pneumatic conveying industry in 1986. He has spent his entire career developing, engineering, and designing all types of catalog, standard, and custom pneumatic conveying systems for the plastics industry. He started in the rotational molding industry in 2013, has enjoyed learning the idiosyncrasies of the industry and market, and most of all meeting the people and building relationships for the future. Rob.Miller@wittmann-group.ca

Ravi Mehra has been associated with the rotational molding industry since the early 1970’s. He is a Past President of ARM – Association of Rotational Molders, and has been inducted into the ARM Hall of Fame. He is the Founding Chairman of StAR – the rotational moulding Trade Association of India. He was the Chairman of ARMO – Affiliation of Rotational Moulding Organizations from 2012 to 2014. Ravi consults internationally with companies in the rotational moulding arena to help their global strategy, facilitate technology tie-ups, and business alliances. maramehra@aol.com

Ian Hansen has over 30 years of experience in the rotational moulding industry and has presented to conferences around the world on the subject of quality, safety, and tank design standards. Rotomoulders around the globe have problems from time to time. Rota Consult delivers production solutions so rotomoulders can improve productivity and profitability, without wasting more of their valuable time. ianhansenconsult@gmail.com, www.ianhansenconsult.com

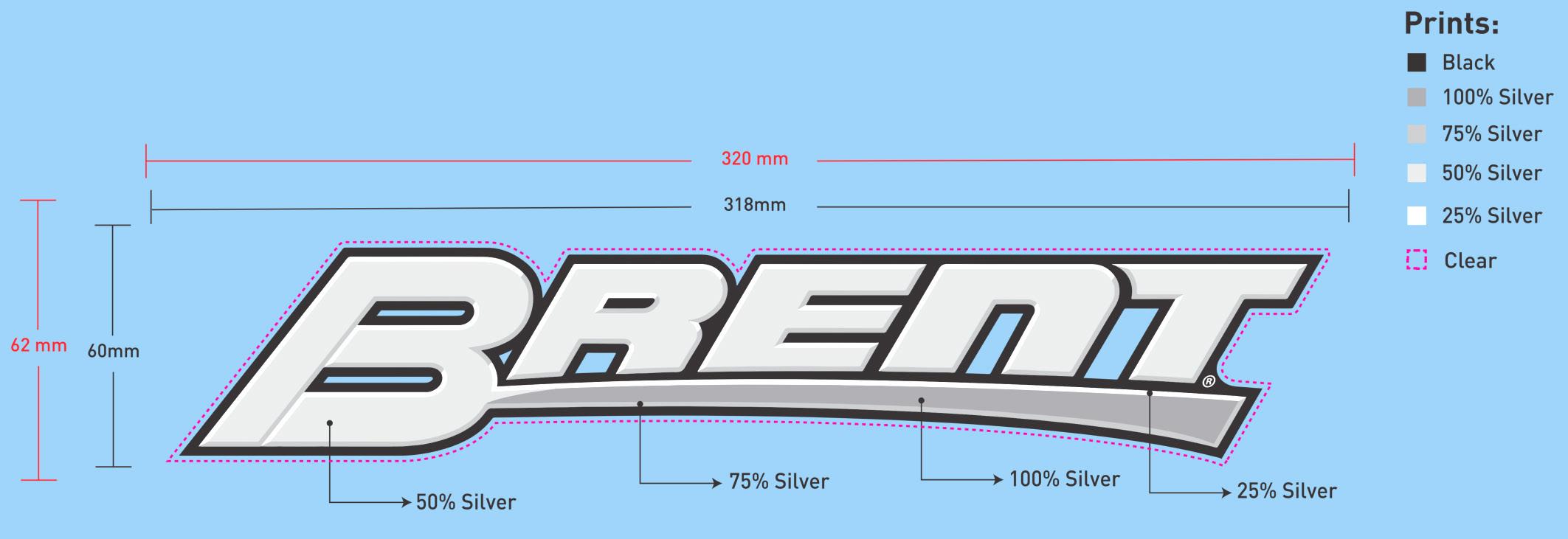

Jim is the General Manager of PSI Brand, the permanent graphics for plastics division of their family business, Polymer Systems International in New Zealand. Starting out as an engineer and rotomoulding operator, the past 20 years has involved leading a team, developing graphic systems to service global brands, and assisting rotomoulders decorate their plastic products to deliver long-lasting brand experiences. jim@psibrand.com

Jennifer Gibson is Vice-President and partner of JSJ Productions, Inc. with offices in Austin, Texas and Monterey County, California.

Jennifer serves as the Executive Director for the Culligan Dealers Association of North America and Publisher/Editor of Connection magazine, which is dedicated to the Independent Culligan Dealers of North America. In addition, Jennifer oversees marketing and advertising for RotoWorld ® magazine, the only magazine dedicated to the worldwide Rotational Molding Industry and Plastic Design Industry. Jennifer also collaborates on independent production/ marketing/event/fundraising projects for various clients worldwide.

Jennifer holds a BS and Masters degree in Macro Administrative Social Work/Fundraising for Non-profits, and following graduate school; she worked as a lobbyist/fundraiser on behalf of disadvantaged youth throughout the state of Indiana. Jennifer began working for JSJ Productions, Inc. in 2000 and became a partner in 2007. She has extensive experience in lobbying, event planning, project production, board management, association leadership, marketing, advertising, publishing, and online digital media.

Jennifer is a member of the ASAE (Association Society of Account Executives) and active and several non-profit charities geared towards autism awareness and education.

Dr. Herrero is the CEO and lead designer of products and services at The Chalfont Project Ltd, an international firm of organizational architects. He is also the Managing Partner of Viral Change Global LLP, which specializes in the application of organizational change. Dr. Herrero is a psychiatrist by background who, after medical practice and academia, spent many years in hands-on leadership positions in global companies. He is an international speaker on organizational challenges, has received the Grand Davos Award in a World Communication Forum, and is an accomplished TEDx speaker.

With a Degree in Hotel Management and a background in event organisation, Michelle started with the ARMA almost 15 years ago, in the role of Deputy Executive Officer. During her career so far, Michelle has organised conferences and study tours all over the world and gained extensive experience in membership management, stakeholder engagement, and administrative services, as well as business and project management. Due to her commitment, hard work, and wide range of expertise, as well as the value of her current industry relationships, Michelle was selected for the role of CEO starting January 2021.

Michael Gellman is an independent fiscal and financial strategist for nonprofit organizations and a founding principal partner for Fiscal Strategies “4” Nonprofits, LLC where the primary focus is helping legacy organizations and new organizations build and achieve a sustainable and financially healthy future. Gellman was a former 20-year Shareholder for Rubino & Company, Chartered, CPA’s and Consultants. He has more than 35 years’ experience in nonprofit fiscal, financial and accounting systems working as a chief financial, fiscal and management consultant where he has focused on specialized management and advisory services for trade and professional associations, public charities and endowment-based foundations. Gellman has also developed comprehensive budget and projection-based systems in support of senior management and organizational leadership.

Despite the significant challenges of the past few years, the rotational moulding market has continued to thrive – contributing to the continued rapid growth of Matrix Polymers and our parent company, Revolve Group.

The specialist rotomoulding raw material supplier launched a new regional website earlier this year and now has a shiny new product brochure to complement. It reflects the group’s local approach, providing our customers with the most relevant experience possible and showcasing our global product portfolio.

Customers worldwide can now browse the wide range of products and services offered, quickly and easily, no matter where they are. The new brochure is easy to navigate, interactive, and smartphone friendly, making it even easier to find the information you need.

CEO of Matrix Polymers, Martin Coles, commented: “We will continue to invest heavily in our manufacturing facilities and additional production capacity, whilst continually reviewing and improving our communication channels with our customers.”

For more information, go to www.matrixpolymers.com

• Anti-scratch additive for PP & TPO formulations boost reuse potential of plastics used in consumer applications

• Extend service life of agricultural mulch films with new light stabiliser solution

• Novel bio-based lubrication and nucleation additive for polyesters in E&E and transportation sectors

MUTTENZ, SWITZERLAND — K 2022 visitors looked forward to new Clariant additive solutions to progress more sustainable plastics and reduce resource use. New developments give applications greater resilience to support longer use and reuse on the path to circularity. Plus, solve production challenges while achieving better efficiency and a lower carbon footprint during compounding and processing.

“By extending a product’s service life and by boosting reuse potential, the plastics industry can contribute positively towards reducing wasteful consumption and increase circularity in key segments. Adopting ways to reduce material waste and energy use in production brings further sustainability advantages and improves product carbon footprint. With these new additives, including renewable-based solutions, in our portfolios, we’re excited to offer plastic processors and value chains more support to collaborate and further innovate together,” comments Martin John, Head of Advanced Surface Solutions at Clariant.

New anti-scratch additive to extend the service life of consumer goods

Surface aesthetics play a crucial role in the perceived quality of consumer goods. Clariant’s new renewable raw material-based anti-scratch additive for polypropylene (PP) and thermoplastic olefins (TPO) formulations – Licowax® AS 100 TP – enables molded plastic goods across a wide range of consumer applications to maintain their original look and feel for longer. This offers significant potential to extend service life and improve properties’ retention and parts’ reuse.

The new additive helps to prevent scratches and mars on the surface of goods during handling, transportation, and end-use. This is particularly beneficial for otherwise scuffprone applications such as interior automotive parts like dashboards and door panels, household appliance casings, cosmetics packaging, and lightweight luggage.

New light stabilizer supports more sustainable agricultural films

Mulch films perform an important role in optimizing crop growing conditions, by protecting both crops and soil from contamination and from the loss of moisture and nutrients

Clariant launches new additives at K 2022 to support plastics sustainable evolution

“With these new additives, including renewable-based solutions, in our portfolios, we’re excited to offer plastic processors and value chains more support to collaborate and further innovate together.”

— Martin John, Head of Advanced Surface Solutions at Clariant

that could jeopardize yields. New AddWorks® AGC 970, Clariant’s latest light stabilizer solution for polyethylene agricultural films, offers the mulch segment a step up in product durability. Addition of the additive enables converters to extend the service life of their products, by increasing UV resistance and resistance to high levels of agrochemicals. The granular additive can be dosed directly during conversion which supports more tailored use.

Benefit from a unique combination of lubrication and nucleation in engineering plastics for greater efficiency in compounding and processing. Compared to more conventional products, new biobased Licocare® RBW 560 TP Vita can withstand higher processing temperatures thanks to excellent thermal stability and low volatility and works more effectively at low dosage. It also has outstanding color stability. The combined benefits make it particularly attractive to formulators of polyester compounds for use in the E&E or transportation industries.

The new additive promotes easier mold release which improves the surface quality. Productivity-wise, it also means fewer polyester parts get stuck in the mold and therefore less molding downtime.

The risk of short shots and rejects is reduced too. It is possible to produce more parts per machine hour due to faster cycle times driven by shorter cooling cycles. As a result, energy consumption is reduced.

Licocare RBW 560 TP Vita is the latest extension to Clariant’s Licocare range of high-performing additives based on renewable, non-food-competing feedstock. They are derived from crude rice bran wax, a by-product from the production of rice bran oil. Vita designated products use real renewable content of at least 98% Renewable Carbon Index (RCI), thus offering the advantage of a lower carbon footprint compared to state-of-the-art alternatives.

Clariant has applied for FDA food contact approval for its entire range of Licocare RBW additives. This will open up their use by plastics compounders and masterbatch producers in an even wider range of plastics applications.

Clariant’s additive products and solutions offer exciting opportunities for the plastics industry to strengthen the links between efficiency and sustainability, safety, performance, value, and low carbon footprint.

For more information on these featured new additives, as well as Clariant’s wider support to meet sustainability and circular economy challenges, visit www.clariant.com/K-2022.

ROTTERDAM, NETHERLANDS — LyondellBasell and Shakti Plastic Industries, India’s largest plastic scrap recycler and waste collection company, have signed a Memorandum of Understanding (MoU) to form a joint venture to build and operate a fully-automated, mechanical recycling plant in India. The plant is intended to process rigid packaging post-consumer waste and produce 50.000 tonnes of recycled polyethylene (PE) and polypropylene (PP) per year, equivalent to the single-use plastic waste produced by 12.5 million citizens. It is envisaged that the new facility will become the largest mechanical recycling plant in India and is estimated to start at the end of 2024. LyondellBasell will market the recycled products produced by this joint venture adding volume to its Circulen Recover range of existing PE and PP materials to help meet the increasing demand by converters and brand owners in India for recycled polymer materials.

“The proposed joint venture will allow us to address the issue of plastic waste in the second most populated country in the world and expand our circular polymer product offering to India,” says Yvonne van der Laan, LyondellBasell Executive Vice President, Circular and

Low Carbon Solutions. “Combining our respective expertise with Shakti Plastic Industries will create an innovative system that can be scaled as the circular economy grows.”

Once established, the joint venture will leverage each partner’s strengths. With the development of a recycling infrastructure in India, Shakti Plastic Industries will provide structure and formality to the waste collection process to secure materials to be used at the new venture. LyondellBasell will apply its long-standing leadership in innovative plastic production technology, vast experience in product development, and strong knowledge of the polymer markets in India.

“The circular economy will increasingly develop into a critical part of the plastic value chain in India, requiring solutions across the value chain to develop a sustainable world of plastic recycling,” says Rahul V. Podaar, managing director of Shakti Plastic Industries. “As we move towards becoming a value player in the circular economy, we will continue to seek opportunities for future growth. Together with LyondellBasell, we will be on the forefront in India taking significant steps to recycle rigid plastic waste which supports the government initiative to reuse recycled plastic applications.”

» ROTOLOAD™ is the ONLY solution to ALL of your powder resin handling needs.

» ROTOLOAD™ is the ONLY comprehensive line of powder resin conveying and weighing equipment, specifically designed to meet the demands of the Rotational Molding Industry.

» ROTOLOAD™ uses vacuum to load your material, hold it above your process machine, and dispense, quickly and accurately. In addition it is the ONLY solution to the question of how to reduce under and overweight parts, mess, downtime and resin loss.

CALGARY, ALBERTA, CANADA — NOVA Chemicals Corporation (“NOVA Chemicals”), a leading producer of polyethylene resins, announced the launch of its new, mechanically recycled polyethylene resin: EX-PCR-NC4. Incorporating this product allows converters and brand owners to meet their sustainability goals, without compromising package performance in applications such as shrink, e-commerce, heavy-duty sacks, and protective packaging.

EX-PCR-NC4 contains 100 percent post-consumer recycled polyethylene (rPE) and offers highly versatile design flexibility making it an ideal solution to lower the carbon footprint of packaging and address climate change. NOVA Chemicals’ rPE is sourced from a distribution center flexible film, which includes a blend of back-of-store stretch and front-of-store consumer drop off. Source materials are processed with state-of-the-art technology resulting in a low odor, consistent, and stable product. NOVA Chemicals’ proven technical expertise can help guide customers to incorporate rPE and maintain the necessary level of performance while also creating recyclable flexible packaging that remains in the

PE stream through a design for recycling approach.

“Through customer trials and applications development at our Center for Performance Applications in Calgary, we have successfully incorporated our new rPE resin in various end-use formats,” said Anna Rajkovic, NOVA Chemicals Circular Economy Market Manager.

Commercial quantities of EX-PCR-NC4 are available today. “Our new rPE product line is the definition of a win-win. It provides converters and brand owners with a more sustainable packaging solution without compromising overall quality or strength. And, by utilizing rPE, we’re diverting plastic waste from landfills while also enabling a fully recyclable new product: a true demonstration of circularity,” said Alan Schrob, NOVA Chemicals Mechanical Recycling Director. “We aim to deliver commercial quantities of consistent high-quality rPE products to meet the needs of our customers and the desires of the brand owners and consumers. NOVA Chemicals continues to demonstrate leadership in providing sustainable polyethylene solutions, and we look forward to additional growth in this space.”

Rotoworld Magazin Issue 4/2022 AZ: 177,8x122,276 + 3mm Coated FOGRA39 PDF/X-1a:2003 hd-kunststoffe.com

MALMO, SWEEDEN — Perstorp is aligning with the new industry standard for product carbon footprint (PCF), developed by the industrial initiative Together for Sustainability. Perstorp can already provide product carbon footprint values for about 85% of its products (based on sales volume) and is continuously adding more products.

The focus on product carbon footprint is strongly increasing, in line with the emerging emphasis on reducing CO2 emissions and sharing carbon footprint at a product level. Swedish-based sustainable solutions provider Perstorp currently has product carbon footprint values for more than 80 products, which corresponds to about 85% of the sold volume. These values are updated annually, based on production plant-specific conditions. All the PCF values for Perstorp’s Pro-Environment products, contributing to the sustainable transformation of value chains by substituting fossil feedstock with renewable and recycled, are ISCC PLUS certified.

Carbon footprint data is central for companies working towards CO2 emission reduction targets, and for making informed decisions by comparing the footprint of different products. To enable companies further down the value chains including brand owners to make carbon footprint calculations of their individual products, it is crucial that the chemical industry can provide this data for their products, which in turn are raw materials used in thousands of end products.

“Transparently sharing this type of information with our customers is an important part of being a sustainable solutions

provider and serving value chain needs,” says Anna Berggren, VP Sustainability at Perstorp. “Product carbon footprint is an important way of providing value with our Pro-Environment products; it shows how they reduce CO2 emissions by substituting fossil feedstock with renewable or recycled alternatives, which gives an effect on all downstream parties and products in the value chain. We have products already today that are climate positive up to our gate when including biogenic CO2 uptake, and we will continuously reduce the carbon footprint of all our products along our reduction roadmaps towards reaching our Science-Based emission reduction targets in 2030.”

As part of the joint initiative Together for Sustainability, companies from the global chemical industry have agreed on a global guideline for calculating product carbon footprints. Perstorp was one of several companies who evaluated and tested the new methodology during spring 2022. Perstorp has been calculating and sharing product carbon footprint values with customers for many years but has now also developed a digital tool that makes it easy and accessible to share the values with customers.

Together for Sustainability is an industry-leading initiative driven by chemical procurement specialists. Each member is dedicated to building sustainable chemical supply chains, regulatory requirements, and responding to the needs and expectations of society.

For more information contact Perstorp, Perstorp Holding AB, Neptunigatan 1, SE-211 20 Malmö Sweden, +46 435 380 00, perstorp@perstorp.com, www.perstorp.com, @perstorpgroup

is a family-owned injection moulding company established in 1994 with the aim to supply quality injection moulded components to the rotational moulding industry, primarily the rotationally moulded tank market.

Over the last 28 years, through constant product development and innovation, we have expanded our range and now offer one of the most extensive product ranges for rotationally moulded tanks on the market. Our products are covered by over 10 patents and registered designs and are distributed to over 15 countries worldwide.

In addition to our own products, we offer product development and custom injection moulding services to customers. With the aid of CAD software (SolidWorks and MasterCam), 3D prototyping facilities, and a full in-house toolroom we can help bring our customers’ ideas to life.

Now on our second generation of family management, with key management roles being filled by non-family members. We are continually expanding into new markets and new locations all the while striving to enhance the overall customer experience.

For more information, go to https://rotoquip.co.za/2022/10/18/ roto-quip-who-we-are/

Perstorp makes product carbon footprint values available for 85% of its sales volume

Roto Quip, who we are…

BATANG-INDONESIA — As the largest economy in Southeast Asia, Indonesia is home to a rapidly growing urban population that is navigating pressing challenges surrounding sanitation and water supply. As the country’s water resources and infrastructure have continued to be put under pressure during the pandemic, the Indonesian government has introduced initiatives such as The National Rural Water Supply and Sanitation Project (PAMSIMAS) to provide millions with water and sanitation facilities.

In alignment with Indonesia’s sustainable development efforts, Orbia’s Building and Infrastructure business, Wavin, announced the opening of its new production plant in Batang, Indonesia to provide its expanding customer base in Indonesia and the Asia Pacific region with sustainable sanitation and water management solutions.

Said Sameer S. Bharadwaj, CEO of Orbia, “In Indonesia, 33.4 million people lack access to clean drinking water, and 99.7 million lack access to safely managed sanitation. We are solving this challenge by manufacturing Wavin UPVC and Wavin PPRbased pipes and fittings that deliver clean water and sanitation safety, cost-effectively and cleanly.” Continued Bharadwaj, “This

investment brings our business’ innovative water management solutions to a high-need market. It is a decisive step on our journey to advance life around the world.”

The Wavin production plant in new Grand Batang City will be built on a 20-hectare (49 acre) greenfield plot. When operational, the factory will employ approximately 200 people in production roles with room for further expansion in the coming years. Beyond manufacturing Wavin UPVC pipe and fittings, the space can accommodate the production of resilient city and energy-efficient building products like Wavin’s low-noise drainage systems and rainwater and stormwater management systems.

“We are very pleased to announce the opening of this new location,” said Maarten Roef, President of Orbia Building and Infrastructure (Wavin). “It allows us to further expand our solution offerings while bringing jobs and economic activity locally. With Wavin’s technology, innovation capabilities, and existing customer base, we are focusing on bringing more plumbers, engineers, contractors, installers, and municipal leaders complete solution systems for both above and below-ground water management and resilient urban development.”

The Solid Waste Infrastructure for Recycling grant program is a new grant program authorized by the Save Our Seas 2.0 Act and initially funded through the Infrastructure Investment and Jobs Act. The Infrastructure Investment and Jobs Act, also referred to as the Bipartisan Infrastructure Law, provides $275 million for Solid Waste Infrastructure for Recycling grants authorized by the Save Our Seas 2.0 Act. This is allocated as $55 million per year from Fiscal Years 2022 to 2026 to remain available until expended. EPA was provided an additional $2.5 million in the Fiscal Year 2022 funding to implement the program.

The Solid Waste Infrastructure for Recycling program provides grants for strategies to improve post-consumer materials management and infrastructure; support improvements to local post-consumer materials management and recycling programs; and assist local waste management authorities in making improvements to local waste management systems.

The entities eligible to apply for Solid Waste Infrastructure for Recycling grants are as follows:

• U.S. States and political subdivisions of states

• Puerto Rico, Virgin Islands, Guam, American Samoa, Commonwealth of Northern Mariana Islands

• District of Columbia

• Federally recognized tribal governments

• Former tribal reservations in Oklahoma (as determined by the Secretary of the Interior)

• Alaskan Native Villages as defined in Public Law 92-203

• Intertribal Consortia consistent with the requirements in Title 40 of the Code of Federal Regulations, Section 35.504(a)

EPA was interested in your needs and concerns to inform the development of the Solid Waste Infrastructure for Recycling grant program. EPA hosted a series of feedback sessions and issued a request for information to seek input on needed improvements to solid waste management systems (e.g., waste reduction, collection, sorting, processing, and end-markets for reuse and recycling). This input informed the Agency’s efforts to develop effective grant programs to improve solid waste prevention, management, and recycling infrastructure across the nation.

EPA accepted comments on through the docket on Regulations. The comment period was open until July 25, 2022. EPA anticipates the requests for applications will be released this fall. Prepare for grant applications now, before the Notice of Funding Opportunities is posted.

Provide input or submit questions about this program to SWIFR@epa.gov. Contact Us to ask a question, provide feedback, or report a problem.

Ferris State University Proud to Partner, Champion a ‘Once-in-a-Century’ Local

BELFAST, NORTHERN IRELAND — Queen’s has launched a new funding stream for academic staff interested in developing research links in Canada and the United States. The Research Mobility Fund was created by the North America Strategy Group and is being delivered in partnership with Research and Enterprise.

This exciting new funding opportunity represents one of many new initiatives being developed through the second phase of the University’s North America Strategy. First launched in 2018, the strategy spans three pillars – Research, Reputation & Education – and seeks to enhance the University’s success in engaging worldleading scholars, students, and institutions.

Professor Richard English, Chair of the North America Strategy Group, said: “The work of many colleagues has in recent years transformed the University’s relationship with the USA and Canada, and it has been very exciting to see that research and educational work develop so well. The Research Mobility Fund

offers another opportunity for QUB academics to develop and consolidate their research and partnerships. It will be excellent to see the important work that emerges as a result.”

The North America Strategy will provide funding for two Research Mobility calls. The first call opened in Spring of 2022 and, after a competitive review process, eight colleagues from across the University have received support to travel to North America in the academic year 2022-23.

The COVID-19 pandemic and other global events have forced companies to assess their fundamental operations. Chief among the considerations of U.S. companies in 2022 is how potentially relocating manufacturing can mitigate the risks of unstable international trade and supply chain management.

The COVID-19 pandemic affected 98% of global supply chains. Industries that invested significantly in offshoring to reduce costs saw dramatic risk increase, according to an article in The New York Times. Thus, U.S. executives are looking to “reshoring,” or the repatriation of industrial production and manufacturing to U.S. soil, as an attractive opportunity.

While relocating manufacturing may not be the “lowest cost” option, it may be the “best cost” option when weighed against supply chain resiliency and sustainability. According to the Kearney 2021 Reshoring Index, the primary reasons U.S. companies consider reshoring include labor cost, labor availability, delivery times, logistics costs, and reduced carbon footprint.

The common belief is that manufacturing jobs left the United States long ago for more cost-effective offshore labor. Recently, though, offshore manufacturing in countries like China has experienced wage inflation. Whereas, the Pew Research Center estimates the relative cost of U.S. labor has remained flat for over a decade. Reshoring could mitigate these costs and offer better service delivery, product quality, and brand perception.

The Kearney 2021 Reshoring Index found that 92% of the CEOs surveyed stated positive sentiments toward reshoring. Additionally, 79% of executives with manufacturing operations in China have already moved part of their operations to the United States or plan to do so in the next three years.

Reshoring efforts have occurred across many industrial sectors. Bloomberg highlights that the construction of new U.S. manufacturing facilities has increased by 116% over the past year and aluminum and steel manufacturers are building new plants across the Southeast. Semiconductor chip factories in New York have opened, according to a Vox article, to help alleviate supply chain disruption in the automotive and electronic industries. To meet further demand in the electronics industry, semiconductor companies have announced new facilities in the Midwest that are projected to support tens of thousands of long-term jobs.

Major U.S. retailers reportedly have vowed to spend hundreds

of billions of dollars over the next 10 years on domestically created goods. Finally, billion-dollar federal and state support aimed at encouraging domestic manufacturing underscores the impact that this trend will have on our economy.

Completely relocating manufacturing to the United States is not the only possibility — “near-shoring” or moving part of a company’s supply chain to the nearby countries of Mexico, Canada, or some countries in Central America are possible prospects for future investments. The Kearney Reshoring Index found that nearly 70% of the surveyed CEOs stated that they are evaluating near-shoring, have near-shored, or will near-shore to these regions.

Companies planning to move home or near home should consider several possible challenges. Manufacturers may face a shortage of supplies and skilled workers in their new locales. If a company cannot readily secure raw materials in the new location, importation costs of these materials may reduce profit margins. Moreover, some have pointed out that access to skilled domestic technicians may hinder relocation efforts unless a plan is in place to train new workers. Companies creating a transition plan should also think about tax implications, employment matters, real estate issues, and transportation availability.

Often, however, communities in the United States are eager to support relocating or expanding manufacturing by improving infrastructure, job credit, and outright grants. For example, Missouri offers incentive programs to eligible companies for financing public or private infrastructure on capital improvement projects. Similarly, unions supporting U.S.-based companies may prove to be supportive of moves that bring more stability to the workforce.

Rather than wait for circumstances to return to “normal,” companies instead can work to evolve their businesses to become even more agile and resilient in our “new normal.” They should consider taking advantage of the government or other programs that might support reshoring. Jackson Lewis attorneys can help manufacturers navigate the benefits and difficulties of reshoring and provide consultation services to make an effective plan. (Legal Clerk Kennedy E. Dickson contributed to this article.)

“Relocating manufacturing can mitigate the risks of unstable international trade and supply chain management.”

In an earlier “At Issue” article, I had flagged up my concerns about our industry’s dependence on gas, particularly in light of the recent NZ Gas Ban (NZ Gas Ban – a Wake-up Call for All Rotomoulders?).

With several countries proposing to ban any new installations of gas infrastructure, I saw this as a longterm problem.

I had no idea that only a few months later, rotomoulders in many parts of the world would pay a heavy price for their gas dependence. Some would have justifiable concerns about getting enough gas to run their factories.

We are experiencing an unprecedented energy crisis. The situation is particularly acute and worrisome here in Europe. Supplies from Russia have been drastically cut due to sanctions on Russia and Russia’s insistence on being paid in Russian Rubles.

Before the war in Ukraine, Germany received over 60% of its gas from Russia, as did many other western and southern European countries.

It is a real concern in Europe that if we get a particularly cold winter, the gas will run out and industry will suffer. Every government will prioritize the supply of heating, lighting, and cooking to domestic users, and everything else will be secondary and possibly rationed.

As a result, the rotomoulding industry faces a real threat in the coming weeks. Will gas supplies be sufficient to heat our industry’s ovens, and will moulders be able to pass on these significantly higher costs to their customers?

I saw a rotomoulder in the UK last week who said the cost of gas had more than tripled.

As gas becomes an increasingly global commodity, rotomoulders are not immune to cost increases, especially due to the surge in LNG that makes gas transportable around the globe.

The good news is that the current energy crisis should give our industry the extra motivation and impetus to become more energy

efficient and explore alternative energy sources.

Rotomoulding is a very energy-inefficient process (5-8% of energy is converted into making the mould), and we need to do better. Molders are increasingly interested in investigating technologies such as direct heating moulds (such as AMS Robomould and Persico’s SMART) and asking machine manufacturers like Reinhardt for information on conventional machines that run on renewable electricity rather than gas.

There are lots of other things moulders can do to reduce their energy usage, like improving oven seals to reduce heat loss, optimise the loading of arms, use materials requiring lower PIAT, using more efficient burners and finding ways to reuse exhaust heat.

As a result of this crisis, our industry should use this as an opportunity to become more innovative, and to move away from our dependency on gas. This will enable us to create a sustainable future that is much more energy efficient.

Jennifer Gibson Hebert, JSJ Productions, Inc.

Jennifer Gibson Hebert, JSJ Productions, Inc.

I recently had the honor of interviewing Scott Seljan, President/CEO of Seljan Company to discuss Seljan division Rock Lake Robotics, an employee-owned company located in Lake Mills, WI. After a long discussion, I was so impressed with this USA innovative manufacturing story, a growing company with so much potential and owned by employees. I asked for an interview to learn more about the company, its story, and the ideology behind being a company-owned business. I wanted to understand their successful journey. It is so exciting to share this story with our readers. Not only will you be inspired by the company, but I also think you will be super impressed with learning more about Scott Seljan’s drive, compassion, variety of gifts and talents, and how he gives to his companies and the world.

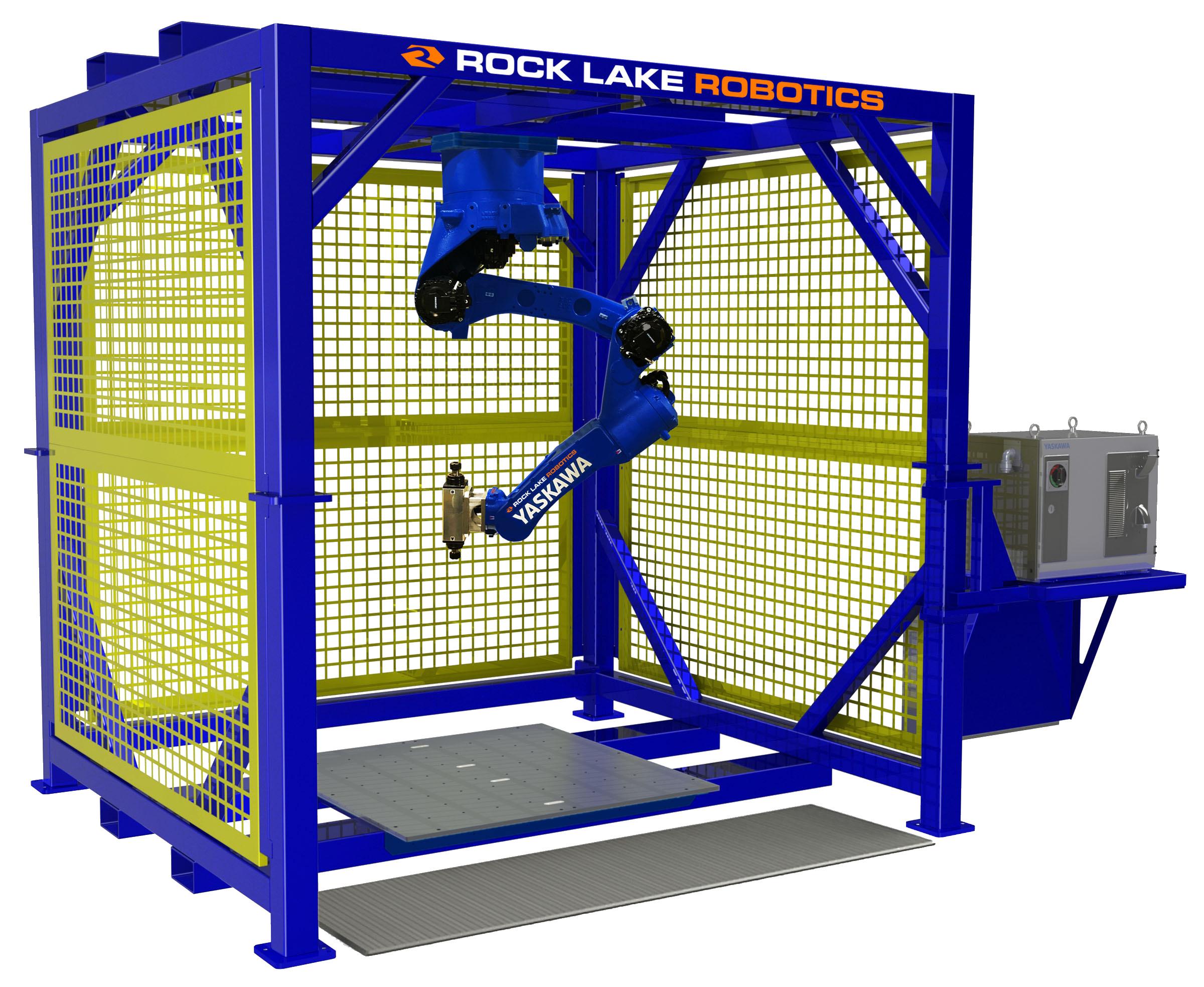

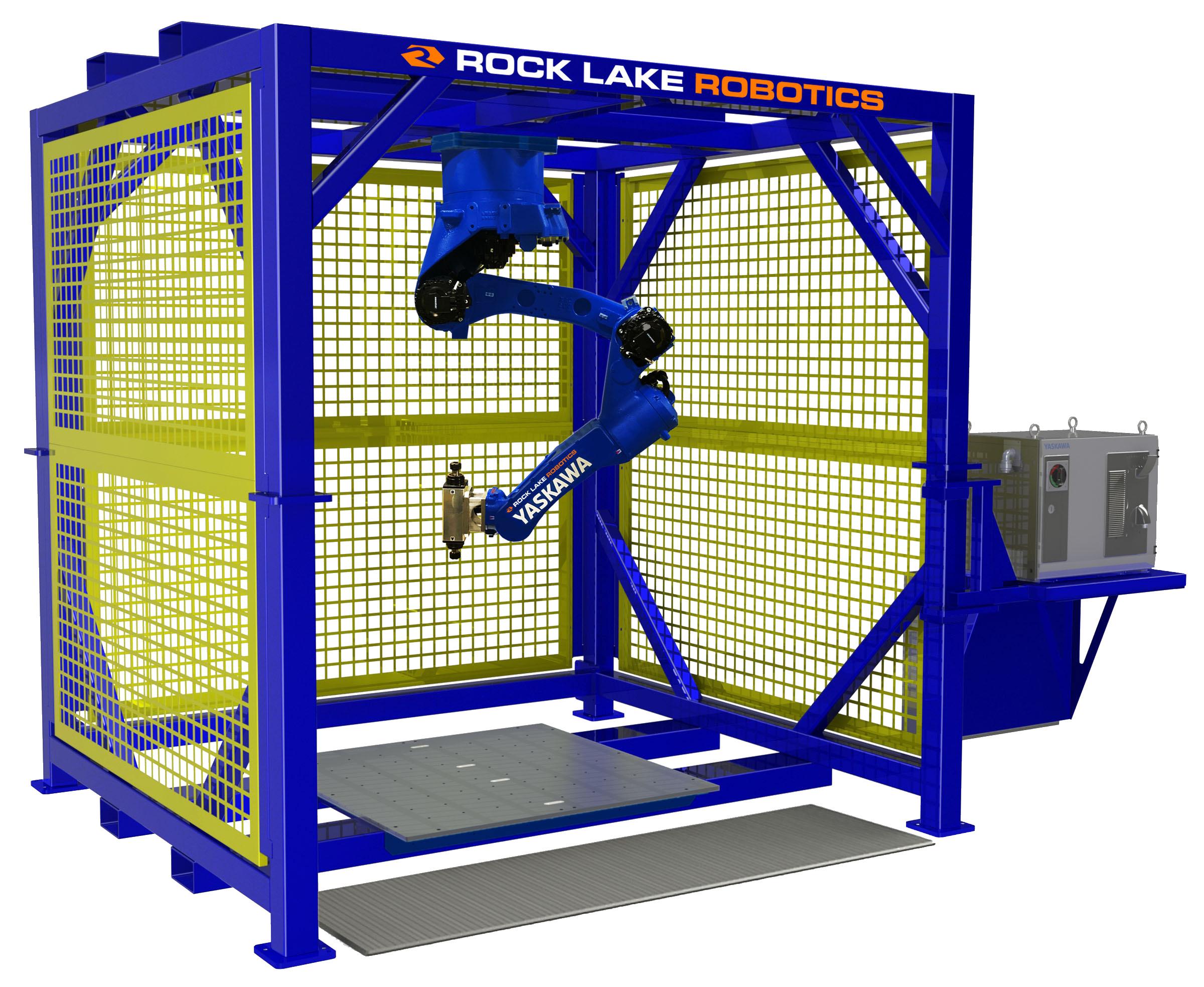

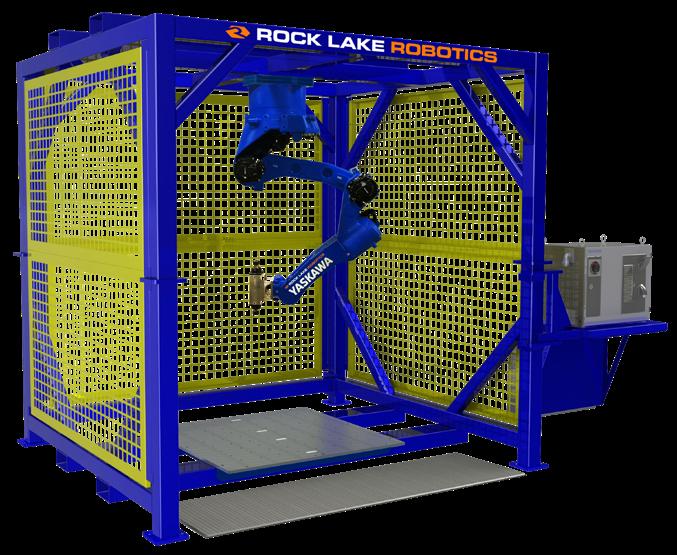

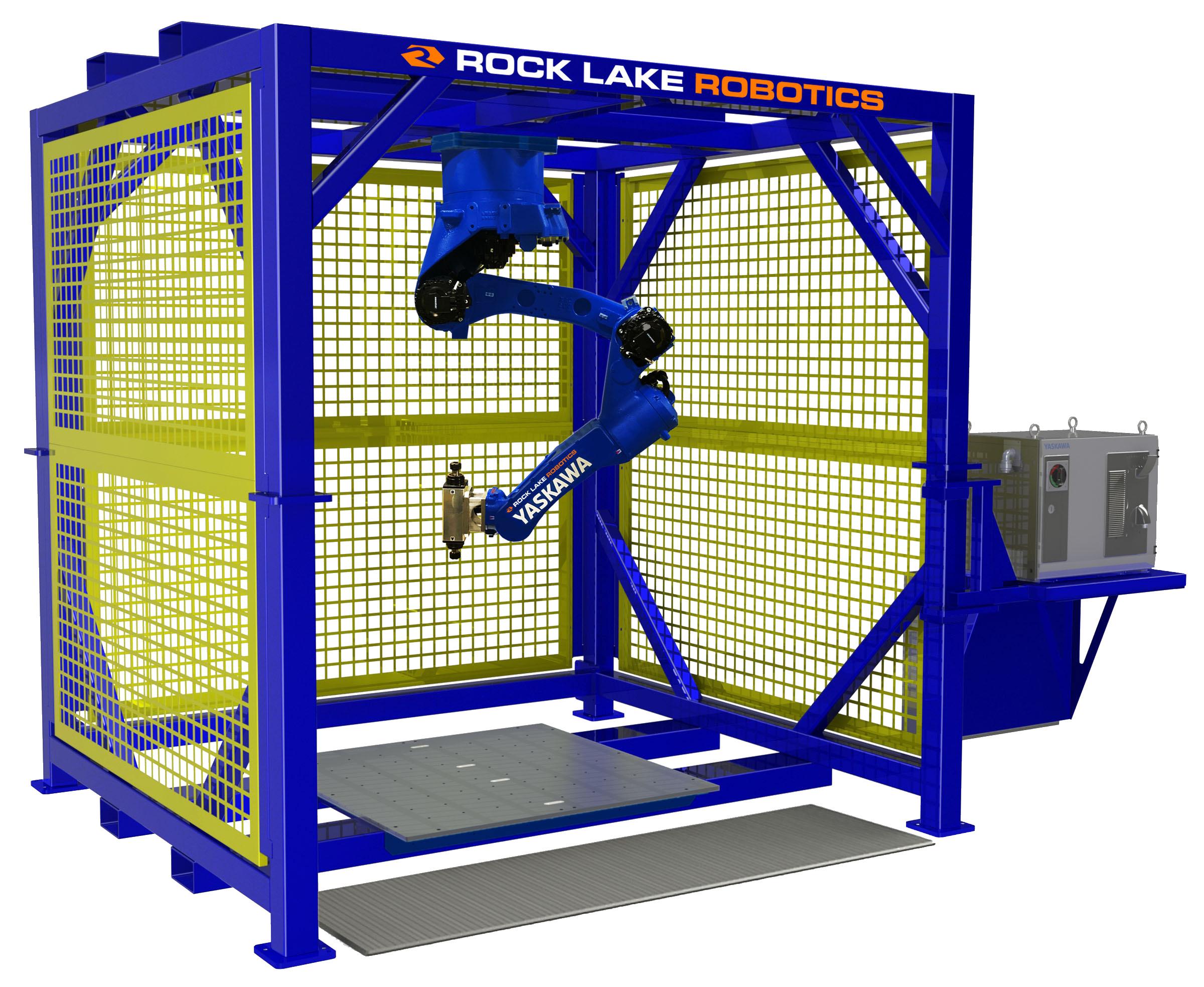

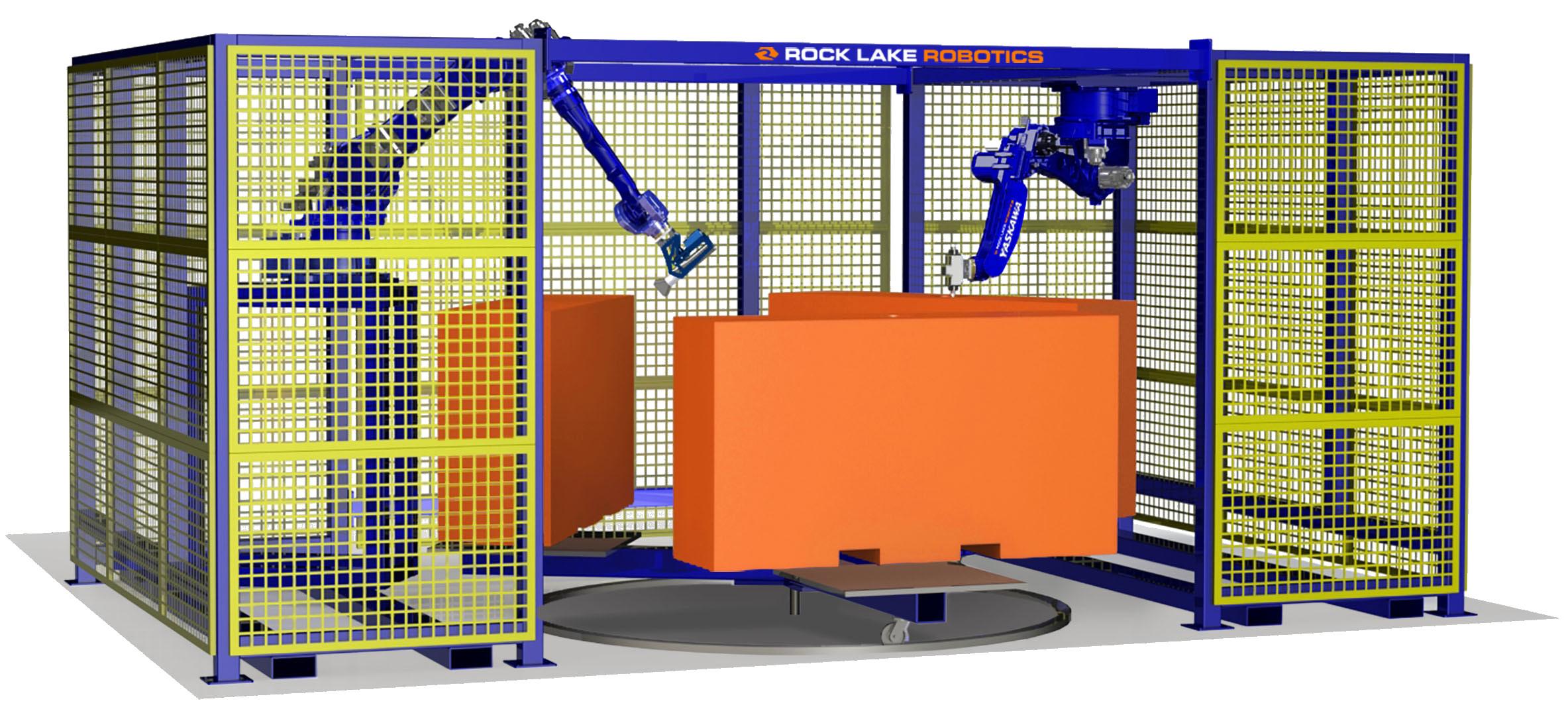

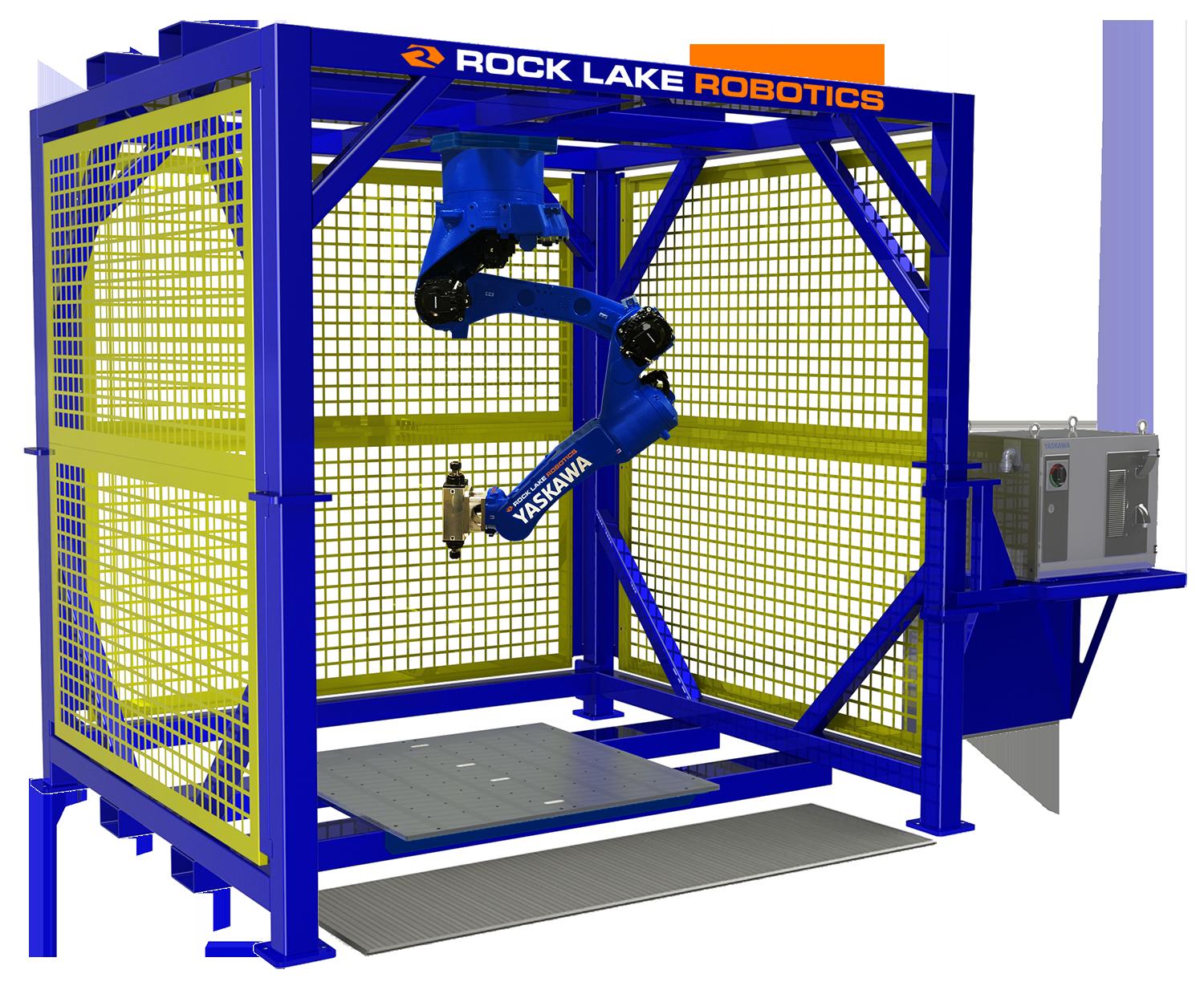

Per RockLake Robotics website: www.rocklakerobotics.com

Rock Lake Robotics is a division of Seljan Company, focusing on helping plastic manufacturing companies improve production, efficiency, and safety. With over 25 years in machine design and automation, Rock Lake Robotics can help with your most challenging integration needs. Experience in assembly, advanced fastening, fluid dispensing, and packaging as well as robotic cells.

Industries served include Rotational Molding – Blow Molding – Vacuum Forming – Injection Molding.

Rock Lake Robotics uses the latest engineering tools. Utilizing SolidWorks 3D design software, we can provide our customers with a complete design of their project, Mechanical Engineering, and Design · Electrical Engineering and Design. Controls and Robot Programming · Complete Project Management.

Q – Gibson Hebert: How would you best describe Rock Lake Robotics?

A – Seljan: We are a Robot Integrator for rotomolders. We understand the process.

Q – Gibson Hebert: What is the company structure, i.e., independent, a division of, corporately held?

A – Seljan: Rock Lake Robotics is an employee-owned LLC that is closely associated with Seljan Company. The 11 owners (so far) of Rock Lake Robotics are employees that have worked for Seljan Company for 20 years or more or managers at Seljan Company that fill key roles for Rock Lake Robotics.

Q – Gibson Hebert: Provide a background of the company, how, why, and when it came to be, and how it has grown and developed over the time of its existence (include any strategic/important stages of development for the company).

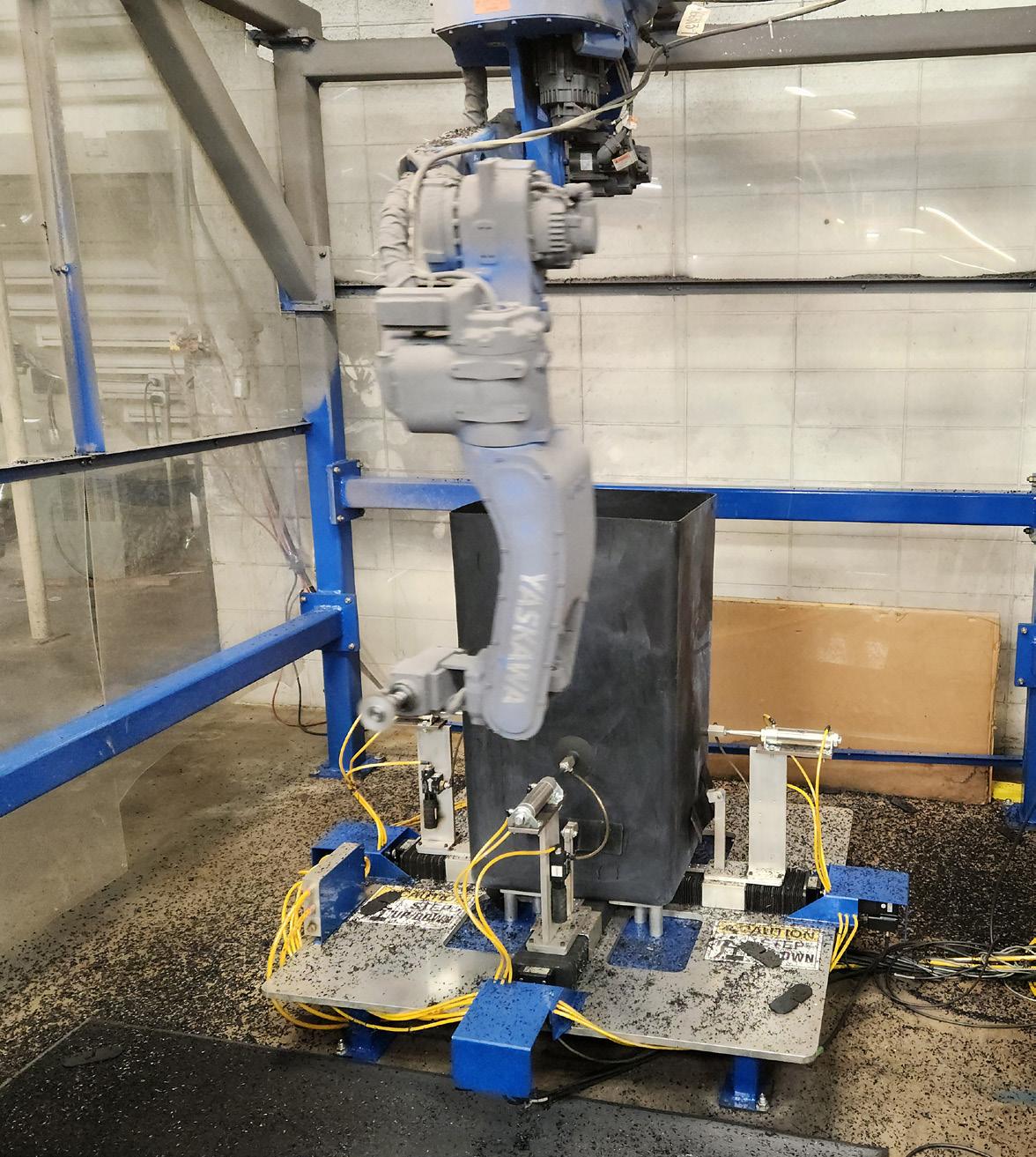

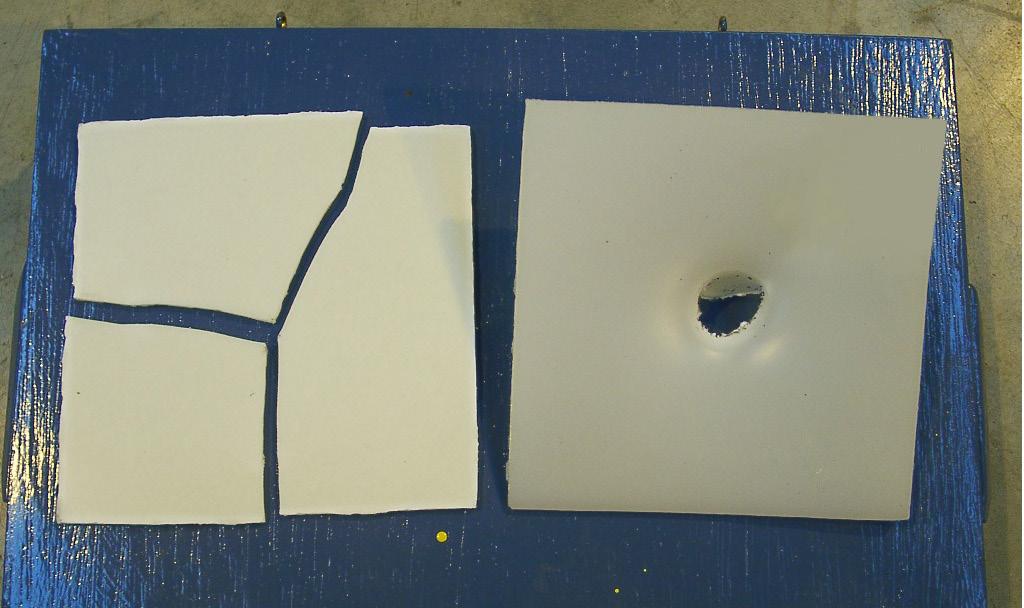

A – Seljan: In 2016, as Seljan Company was renewing our worker’s compensation insurance, the agency notified us that they were raising our premium. At that meeting, I learned we had eight very similar injuries in a 120-day period. All the injuries were caused by scraping parting lines on one of Seljan’s proprietary products. None were serious, mostly stitches.

I called a staff meeting and told the group we are going to buy our first robot. One of our VPs, Scott Woerpel, and I set up appointments with 3 different local integrators. We kept hearing the same thing, “It was going to take far too long to get a machine and entirely too much money to build.” None of the integrators were really listening to us, and a large part of the problem was they did not understand rotomolding. Therefore, I decided to go in a different direction and looked to find the right person to get us started in the business. The man we hired to help us had over 20 years in the industry and did a great job getting us set up with designs, pricing models, and the best suppliers. It helped that Seljan Company was Rock Lake Robotics’ first customer! Since Seljan installed that first robot

cell, we have had NO injuries. Our scrap ratio on that part is as close to zero as it will ever need to be. In addition, quality has been as good as the scrap ratio.

Q – Gibson Hebert: What is the company’s value proposition? Core Values? Strengths?

A – Seljan: Being teamed up with Seljan’s metal fab department and tool room is the key strength. We design, build, and test-run everything including the fixtures under the same roof as Rock Lake Robotics. Seljan’s metal department is very complete. Having this partnership eliminates a large layer of profit taking as we don’t have to go to outside companies to build everything we assemble.

We have a long history as Seljan Company as we started in the rotomolding industry in the early 1980s building fabricated tools for over 25 different rotomolders around the US. Seljan Company bought its first Ferry 220 in 2000.

Q - Gibson Hebert: What do you consider to be unique about this business – what sets it apart from others in the market?

A – Seljan: All the people that work for Rock Lake Robotics know rotomolding and they know it from hands-on experience. We can try things that other companies would never try. First - drilling, sawing, and routing, which we found was the easy part. We believed we could come up with a solution to spin-weld fittings on rotomolded parts. We saw the robot as being a superior way to flame parts. Scraping parting lines is another process we have developed successfully. We are currently working out a tool changer for our standard system with the goal of completely finishing a part with just one handling. The tool changer is expected to be fully tested late this year. What we are doing is applying robotic technology to our specific industry at a much lower cost than any of the mainstream integrators.

Q – Gibson Hebert: Can you tell us more about being an employee-owned company?

A – Seljan: When Rock Lake Robotics started, it was the perfect vehicle to give back to the people that built Seljan Company. When an employee hits the 20-year mark they get free shares in Rock Lake Robotics. The catch is they must work to build it. If we have a robot cell that needs to ship Monday, the owners will be working all weekend if that is what it takes. The payoff is that they all get annual dividend checks and when they retire at age 65, they take their shares with them and will receive those dividends as a very good retirement supplement. We have 2 more people that will be joining the Rock Lake Robotics ownership group this December.

Q – Gibson Hebert: How many employees and plant locations does Rock Lake Robotics have?

A – Seljan: Rock Lake Robotics currently has 11 employees and one location – 100 South CP Avenue, Lake Mills, Wisconsin.

Q – Gibson Hebert: What is the management structure?

A – Seljan: I am the managing partner. Scott Woerpel is the V.P.; and Eric Seaman is the Operations Manager. Eric oversees day-today operations of the company.

Q – Gibson Hebert: What are the trending growth sectors for robotics products throughout the world?

A. Seljan: We are specifically working with rotomolders at this time. We see a bright future for Rock Lake Robotics. Seljan Company shares the same problems as every other rotomolder so our focus for at least the next few years is to stay with what we really do well. Robots are the clear solution for labor shortages.

Q – Gibson Hebert: How does Rotomolding fit in? How does the process serve the company?

A – Seljan: Our customers report back to us that they are seeing solutions to difficult problems. Robots don’t take time off; they

make better quality parts that they can sell all the time. And we can take dangerous and expensive risks to operate hand tools like routers, saws, and grinders out of the hands of humans. Compressed air is not inexpensive to create. Every year since Seljan Company installed our first robot cell, our lost time injury rate has dropped dramatically. Since COVID, we have grown Seljan Company’s rotomolding division by over 20% and we are doing it without having any additional employees.

Seljan Company has 4 robotic cells now, and when resin prices started to increase the importance of reducing scrap and increasing quality and productivity became obvious.

Q – Gibson Hebert: What concerns you the most …. what keeps you awake at night?

A – Seljan: Potential supply chain issues. Our strength has been staying loyal to the vendors for the safety devices and most importantly the robot and controls. To date, our two main vendors have been flawless. Yaskawa is a world-class robot manufacturer and all these years later, they have been perfect on all marks. They make every delivery date on time, and we have not had any warranty claims on over twenty robotic cells that Rock Lake Robotics has sold.

Q – Gibson Hebert: What are some of the greatest challenges that your business faces?

A – Seljan: Internally, it is training more technicians to assemble and program robots. Externally, it is educating customers to design new rotomolded parts to work better with robotic technology. We can install vision systems on our robotic cells, but those add a lot of cost. Designing parts to work with robots is the best value for our customers. Keeping it simple is our motto.

Q – Gibson Hebert: What are your hopes for the future?

A – Seljan: That more rotomolders find the benefits and success that Seljan Company has experienced. Since Seljan started using robots in our secondary operations, our success is measurable, and we know we will only get better. The biggest change Seljan Company has seen is that we can now easily finish more parts in a 24-hour day than we can mold.

Q – Gibson Hebert: Does the company have strategic partnerships with suppliers/vendors that are core to the company’s success? If so, whom and why?

A – Seljan: Definitely it’s Yaskawa. We entered a distributor relationship on day one. It’s a relationship that has been excellent. They continue to innovate their products and offer the best school for training we thought possible. Several of the owners of Rock Lake Robotics have gone to the school and they all can do the basic operations of a robotic cell.

Q – Gibson Hebert: Scott, explain more about your direct affiliation with Rock Lake Robotics?

A – Seljan: I am the Managing partner. I oversee finances and consult with the design team on new systems. I am also a part of the advertising and tradeshow decision process.

Q – Gibson Hebert: What is your background, education, and experience?

A – Seljan: After coming out of the US Army in 1975, I started with Seljan Company, which was only in the metals business, as a punch press operator. From there, I took a 5-year Tool & Die Maker apprenticeship and went to Madison Area Technical College to learn to engineer. After 10 years in the shop and really learning the business, it was time to grow the company. I traded in my toolmaker career and went into sales and tool design. I worked in that position until my father passed away in 1998. That same year, I became President of the company. After a few years, it became clear that metal stamping was losing ground to Chinese companies. In 2000, we bought our first Ferry rotational molding machine. We were in a 30,000-square-foot building at the time. We added our second Ferry in 2002 and it quickly became apparent we were going to need more space. We leased an old factory down the street and relocated the metals shop. We added another Ferry and after a few years our parking lot got too small. In 2012, we purchased the building we now call home. This building is 502,000 square feet sitting on a 45-acre lot. Since then, our metals division has come back strong. We have added injection molding, blow molding, roll forming, powder coating, and laser cutting and now have a press capacity of up to 750 tons. The strange part of this process to this day is that I remember looking at this building when it was empty and it seemed absolutely enormous! Today, it is completely filled. We have added several proprietary product lines to complement our custom molding operations.

Q – Gibson Hebert: What led you to become involved in the robotics industry?

A – Seljan: It was the need to improve safety foremost. But as the production teams began to embrace rather than fear the robot everyone got excited about it! The goal of working smarter rather than harder is being achieved.

Q – Gibson Hebert: What industry and professional affiliations do you have? Why?

A – Seljan: First off, by default, I am a member of ARM (Association of Rotational Molding.) Ken Bather is our VP of Plastics and is quite involved. I am a member of ESGR, it’s a group that works between employers and active National Guard and Army Reserve units. Being an Army veteran, I know firsthand the training men and women receive in the military are skills that any business would find valuable. Locally, I belong to the Lake Mills Chamber of Commerce and the Main Street Program. Years ago, I was a member of the State of Wisconsin Apprenticeship Advisory Board. The mission was to keep apprenticeship training in line with current manufacturing trends and technology. We are also

involved with PPAI and ASI, which are groups that oversee the sales and marketing of promotional products.

Q – Gibson Hebert: How would you describe your leadership style?

A – Seljan: I have had the pleasure of working with so many very talented and dedicated people over the years. I have been a hands-off manager since I started. When someone asks me for an opinion, I will take the time to give my honest assessment. My philosophy has been to hire good people, treat them fairly, and with respect. I let them do their jobs.

Q – Gibson-Hebert: What would you say is your primary passion in business, and in life?

A – Seljan: I have always enjoyed adding new processes, taking on new challenges, and turning them into something profitable. Even after nearly 50 years on the job, it’s still fun. Back in the 90s when we started to grow the business, we hired new engineers. They really didn’t need me that involved anymore so I learned HTML and designed our company’s first website. I still do that today. I build and maintain all the websites that we have. Everything from coding to designing the graphics.

Personally, I play guitar. I started when I was nine and have never stopped. I played in rock bands, sat in with just about every genre of music, and finally found I really preferred jazz. A few years ago, I had the music highlight of my life. I played on stage with Grammy award-winning guitar player Eric Johnson (Cliffs of Dover). Along with that, I have a passion for sports cars. The list is too long for this article. Last on the list is working outdoors. My wife and I live on a 20-acre heavily wooded country parcel. Together, my wife and I are a team and maintain all the land. These days the tractor gets a lot more seat time than the sports cars!

For more info go to www.rocklakerobotics.com

Meese Düsseldorf

Meese Düsseldorf

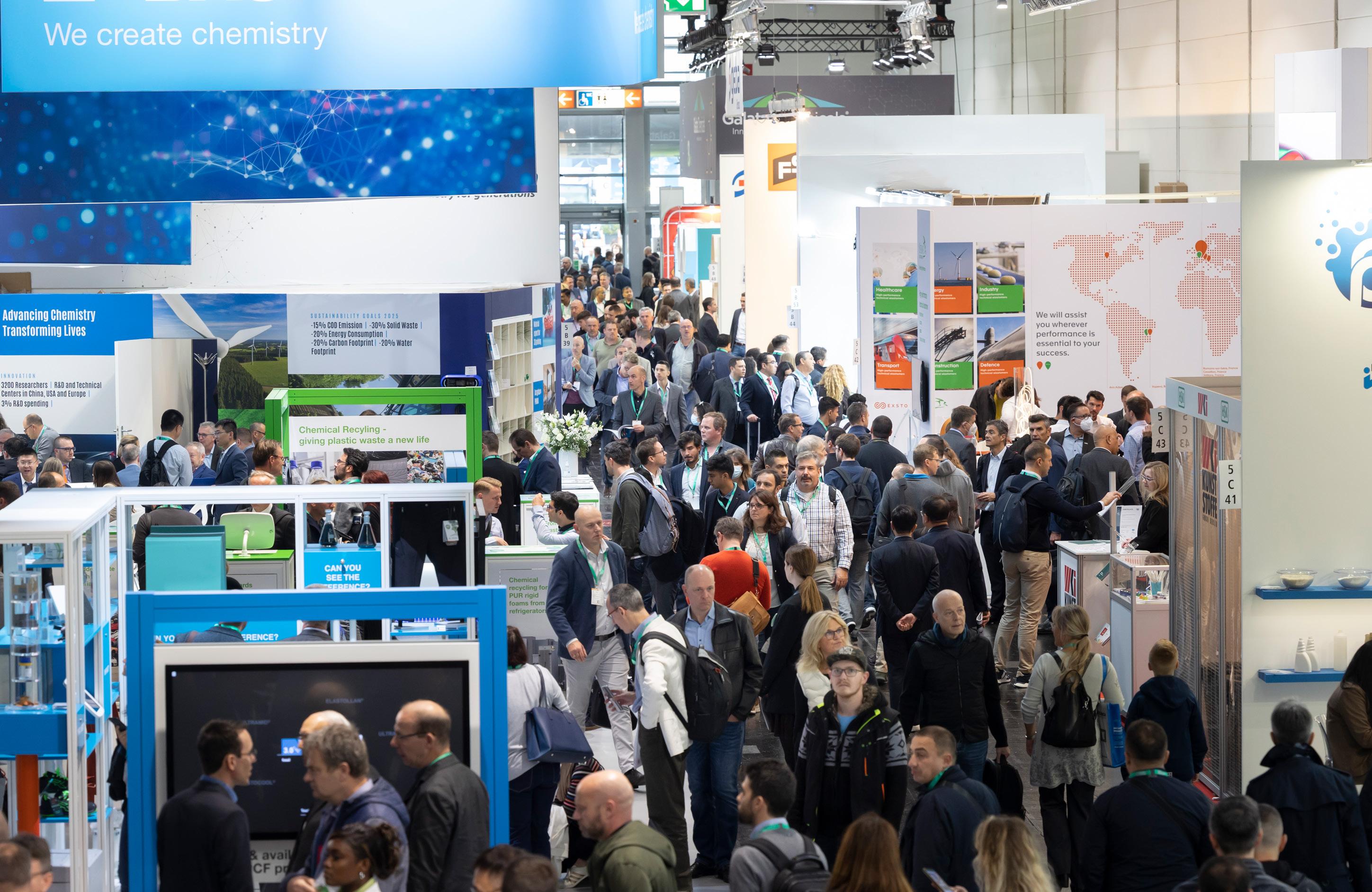

Innovation driver for the global plastics and rubber industry —Many concrete solutions, machinery, and products for the transformation to a circular economy.

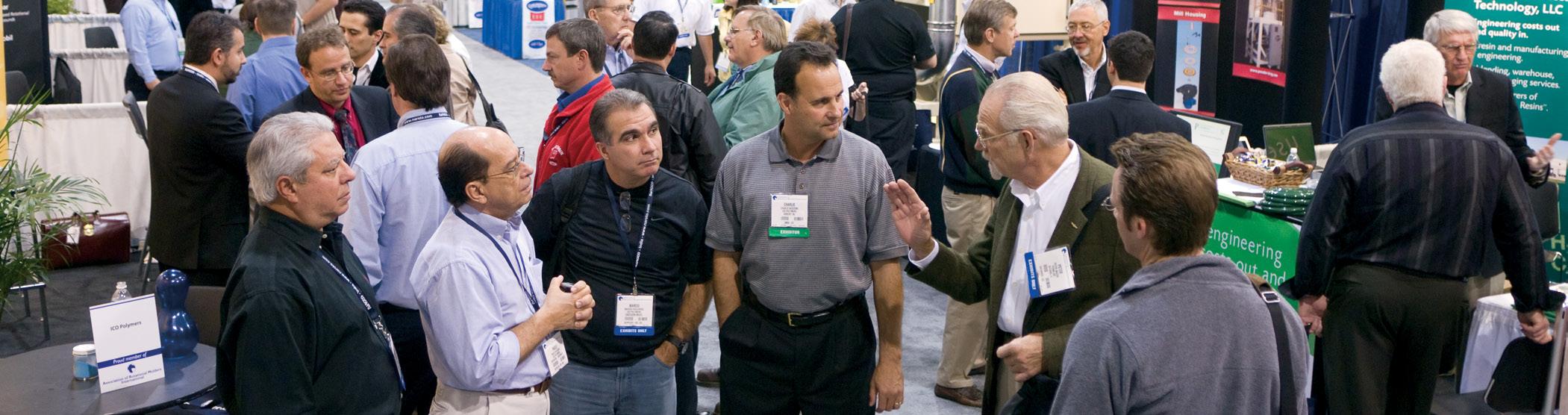

The joy of the plastics and rubber industry to finally be able to exchange ideas in person on a global level again after three years was characterized the K 2022 trade fair in Düsseldorf, Germany. The 3,037 exhibitors reported extremely good leads and a marked willingness of the trade visitors to invest, promising new customer relationships, and numerous business deals – some of them spontaneous.

“K in Düsseldorf has once again fulfilled the highest expectations. It continues to be the most international, complete, and innovative trade fair of the global plastics and rubber industry,” said Erhard Wienkamp, Managing Director of Messe Düsseldorf. “The trade fair has impressively demonstrated just how valuable face-to-face networking, chance meetings, and physical brand and product experiences are. We are very satisfied to see that K 2022 succeeded in sending out strong signals as an innovation driver of the industry and that our exhibitors did business with a high number of international customers with strong decision-making authority.”

A total of 176,000 trade visitors from all continents traveled to

K 2022. At over 70%, the proportion of international attendees at K 2022 remained at a consistently high level.

Ulrich Reifenhäuser, Chairman of the K 2022 Exhibitor Advisory Board, is also very pleased about the show: “After hardly any trade fairs could take place worldwide also on a national level over the past three years, K 2022 was even more eagerly anticipated as the world’s No. 1 trade fair of the plastics and rubber industry and succeeded in providing fresh impetus in all sectors of our industry. The many, in part, unexpected concrete contract negotiations held at the trade fair speak for themselves!”

The current unpredictability and uncertainty of events make for a tense situation in the sector overall, but this did not dampen the exhibitors’ commitment and visitors’ interest, quite the opposite: “Especially now in turbulent times and where the plastics industry is undergoing a transformation towards the circular economy, K 2022 was the ideal place to jointly and actively chart the course for the future,” stated Ulrich Reifenhäuser.

The trade visitors were especially inspired by the wealth of new technology developments presented by raw materials producers, machinery manufacturers, and plastics processors for the realization of the circular economy, resource conservation, and climate protection. Ulrich Reifenhäuser commented: “It can be clearly felt that all companies have embraced the need to take on social responsibility and think about plastics in a sustainable way

from the beginning of the process chain. The variety of solutions, machinery, and products for transformation towards a circular economy presented at K 2022 was incredible.”

The trade visitors at this year’s K came from 157 nations. In addition to Germany, European countries strongly represented included the Netherlands, Italy, Turkey, France, Belgium, Poland, and Spain. With 42% of the visitors coming from overseas, the international reach of K was as strong as usual. While less visitors from the East Asian region were at K 2022 compared to three years ago due to the currently more difficult conditions in those countries because of quarantine regulations, many visitors from the U.S., Brazil, and India attended K 2022.

According to a survey, about two-thirds of all visitors were primarily interested in machinery and plant construction. 57% (5% more than at K 2019) were interested in raw and auxiliary materials, with recyclates and bioplastics being particularly popular. For 28%, semi-finished products and technical parts made of plastics and rubber were the main reason for coming to the show (multiple answers possible). Over 70% of all visitors were from top and middle management.

Visitors gave K 2022 top marks for the completeness of the ranges and the presentation of the entire supply chain. 98% of all professionals stated they had fully achieved the goals associated with their visit.

During the eight trade fair days, it became evident that this year’s K was right on target with its selection of hot topics: circular economy, climate protection, and digitalization. In terms of investment intentions, machinery and equipment for processing and recycling stood out at 43%. The focus was particularly on sustainability, but also on circular economy and energy/resource efficiency in production. Around 40% of decision-makers said they are dealing with the topic of decarbonization.

K 2022 again featured two U.S. Pavilions with 35 exhibitors, organized by Messe Düsseldorf North America (MDNA) and co-sponsored by PLASTICS, The Plastics Industry Association. Overall, 105 U.S. companies showcased their products at K.

The K specials, which also focused on the three hot topics, were also very well received. The official special show, ‘Plastics Shape the Future, addressed the economic, social, and ecological challenges and potential solutions around the K key themes during high-caliber discussions and lectures and was well

attended throughout. The Circular Economy Forum, where the VDMA (German Engineering Federation) and 13 of its member companies impressively demonstrated the importance of technology in the implementation of the circular economy in the plastics industry was also popular with the international audience.

Also, much discussed at this year’s K was the global production language, OPC UA. This standard allows the processing parameters of the machinery and equipment involved to be coordinated more precisely and in a more targeted manner. This, in turn, is considered an important prerequisite for optimized circular management. 40 companies from eight countries participated in an OPC UA demonstration project at the trade show.

At the Science Campus, both exhibitors and visitors were provided with a concentrated overview of scientific activities and findings in the plastics and rubber sector. Numerous universities,

institutes, and funding organizations offered opportunities for direct dialogue.

Many trainees and students took advantage of the Plastics Training Initiative’s (KAI) offer to get information about career opportunities in the plastics industry.

The next K will be held in Düsseldorf, Germany from October 8 – 15, 2025. For further information on visiting or exhibiting at K 2025, contact Messe Düsseldorf North America; Telephone: (312) 781-5180; E-mail: info@mdna.com; Visit www.k-online.com and www.mdna.com; Follow us on twitter at http://twitter.com/mdnachicago

For hotel and travel information, contact TTI Travel, Inc. at (866) 674-3476; Fax: (212) 674-3477; E-mail: info@ttitravel.net; www.ttitravel.net

With proper anticipation and planning, inflation can be a call to action to spur change and innovation and stimulate “out-of-the-box” thinking. Avoid inflation’s potential negative impact on operations and service capacity by responding with new thinking and moving away from old legacy programs and operating platforms.

Inflation has always been present at some level. When inflation is low, it lurks quietly in the corner of our minds. But when inflation is revving, the ringing in our ears will not go away. During periods of uncertainty and economic volatility, inflation tends to draw attention, often triggering regressive non-thinking reactions. Inflation needs to be treated as an economic reality to be confronted and a challenging obstacle to be solved, not as a call to action by itself.

Don’t wait for inflation to drive change. This only causes narrow reactive responses that will be too late to be truly impactful and game changing. Typical kneejerk responses include raising fees, scrambling to search for additional funding, and as a last resort, instituting general, across-the-board cost-cutting measures. These

can be somewhat effective in the short run, however, in the long run, delivery on the business organization’s value proposition will suffer.

Instead, we must learn to treat inflation as a constant but everchanging factor to consider. Anticipation and planning are the keys to getting ahead of inflation and responding to it in a way that helps to drive assertive positive change.

When it comes to inflation, human nature frequently has us in a denial mindset. During periods of low inflation, we adopted a mindset that subnormal inflation will continue forever. However, during periods of high inflation, we first try to ignore the consequences. We then shift to overreaction mode, especially when the bottom line turns ugly with large deficits.

From a financial perspective, incorporating inflation factors into strategic and tactical planning and related key financial assumptions below must be part of the anticipation process.

This will help temper the tendency to count on overly optimistic outcomes. It will also force us to confront raising costs and hopefully trigger different thought patterns and consideration of new pathways and options.

“The nest egg must continue to grow to ensure future financial health.” Anticipation cannot happen if inflation awareness levels are out of balance. Balancing our awareness of inflation is as much art as science. Finding the right balance can be elusive. Aim for the middle, keeping inflation on staff’s consciousness but not making it the main, and especially not the only, factor for consideration. When inflation is low, we must work to raise awareness levels to anticipate that inflation will eventually accelerate. During periods of changing and/or high inflation we must do the opposite, attempting to temper overreaction. However, it is never too early to encourage early consideration of new strategies and tactics.

Case in point: price sensitivity vs. perceived value. At some point, if your main strategy to stay ahead of inflation is to raise fees, the price compared to return on value proposition will turn negative quickly. Paying more for the same experience will not go over well.

My favorite “go-to” tactic for working through complex planning challenges is to develop a short list of “key assumptions” that focuses on strategic objectives and desired results. This approach helps to simplify messaging and fast-track consensus and approval by diminishing feelings of negativity and confusion.

Building consensus and confidence is the main pathway to breaking down the negative barriers in any planning process. Using an approach that emphasizes a small number of key assumptions will bring clarity to planning while keeping the focus on the big picture and desired results.

It is best to view key assumptions as a short list of the most significant strategic objectives and desired outcomes for a planning effort (building next year’s budget), an unexpected challenge (reacting to non-renewal of a large grant), or a new project (acquiring a new program).

For example, when developing a new budget, the short list of key assumptions could be:

• Increasing fees (last increase was 5 years ago).

• Expand service hours at a medical clinic (due to increasing demand and new funding commitments).

• Adding a new income center.

Strive to have at least three, but no more than five, key assumptions on the list. Less than three makes the list too narrow in scope, and more than five will cause the list to be too broad and hard to remember.

To get out in front of inflation, we need to turn inflation-driven negative feelings into positive drivers for innovative planning and a wake-up call to action.

I recently reached out to a few to a few business organizations and asked them how they are reacting to inflation. Some of their responses surprised me and affected my thinking. A few comments that changed my thinking the most included: “I am not going to let fear creep into inflation discussions”; “Inflation is not going to beat us”; and my favorite inspirational takeaway; “Let’s use inflation to end R&R” (rinse and repeat).

These reactions provided a clear tactical path forward. Business organizations must constantly innovate and evolve to deliver on a strong value proposition. They must use whatever means available to encourage new thinking and innovation. The pandemic triggered a call to action and change. Inflation can do the same. It’s not about adjusting to meet inflation; it’s about doing things differently. If current programs

Focusing on a short list of key assumptions has numerous benefits. First, this approach will help management and staff to frame and focus their internal planning. Management and staff must consider all elements of planning down to the smallest detail. However, a thoughtful list of key assumptions will help management and staff remember the big picture. When done well, key assumptions convey the urgency of the organization’s needs and the benefits of success. Minor details can be distracting and disheartening, causing momentum to be lost. Keeping the focus on key assumptions will remind staff of the essential goals and help them to find solutions to meet those goals.

Additionally, key assumptions will help with external messaging others involved with the organization’s planning efforts. Board members and owners can be easily distracted, feel uncertain or afraid of new efforts, and sometimes overwhelmed by the details of a project. Sticking to consistent messaging though the framework of key assumptions will enhance focus, allowing them to confidently monitor progress, make inquiries, and ultimately provide approval when necessary.

Using an annual budget building process as an example, key assumptions help management and staff to define significant strategic budget modifications and goals while providing key insights to consider for approving the budget.

“Balancing our awareness of inflation is as much art as science.”

and activities are succumbing to inflationary pressures, then reconfigure, reposition, and change methods. Do not just raise fees and look for quick cost-cutting solutions. Throw R&R out the window and embrace innovation and change. Fears of inflation and change are not options anymore.

Operating reserves and inflation have a special symbiotic relationship. For me, no operating reserve is ever large enough. Inflation presents another vivid illustration of the importance of building operating reserves. The nest egg must continue to grow to ensure future financial health. Inflation is just another compelling reason to stay the course: keep adding to operating reserves, budgeting for surpluses, and building financial security.

With proper anticipation and planning, inflation can be a call to action to spur change and innovation and stimulate “out-of-the-box” thinking. Avoid inflation’s potential negative impact on operations and service capacity and return on value proposition. Remember that innovative business organizations are not succumbing to inflation. Rather, they are responding with new thinking and moving away from old legacy programs and operating platforms.

Planning Tip – Begin the next year’s budget building process with a short survey of questions related to current year budget performance and expectations for the next budget year. Design one short set of survey questions to be answered by owners, management, and staff. Track the results anonymously for each group and designate an inclusive working group to compile and analyze the results. This process will yield important insights that will help set the key assumptions for next year’s budget.

The process of identifying key assumptions also provides a great opportunity to pencil out initial thoughts around a new project or challenge. Some of my best key assumption lists have come from sketching a few quick notes while waiting at an airport or in an Uber. It is very comforting and calming to sit back and focus on the big picture and temporarily forget the many small details.

Dr. Leonardo Herrero, international change management consultant

Dr. Leonardo Herrero, international change management consultant

Framing messages is essential for strong leadership. Frames provide people with a quick and easy way to process information. They are cognitive shortcuts we use to help make sense of complex information, enabling us to interpret the world around us and represent that world to others.

Through framing, complex phenomena can be organized into coherent, understandable concepts. The most striking examples of modern-day framing were the different viewpoints expressed by Donald Trump and Joe Biden about the same issues during their televised debates in 2020.

Dr. Leandro Herrero is an internationally recognized speaker, author, and change management consultant with a penetrating understanding of organizational issues. He writes a short Daily Thoughts blog about these issues. This article comprises key extracts from three daily blogs Dr. Herrero has written about the importance of leadership framing. Especially relevant are his comments on ‘Intention and outcome – framing the use of data or insights,’ below.

I put framing at the top of the list of ‘leadership tasks’ because the framing of messages is essential for strong leadership. One of those non-rocket sciences around us that we refuse to pay attention to. Yes, I think we in business organizations completely underestimate the power of (mental and behavioral) framing to trigger and sustain behaviors, emotions, ways of doing, etc. Framing of messages is especially essential for strong leadership communication.

For me, there are three aspects of framing that are very simple,