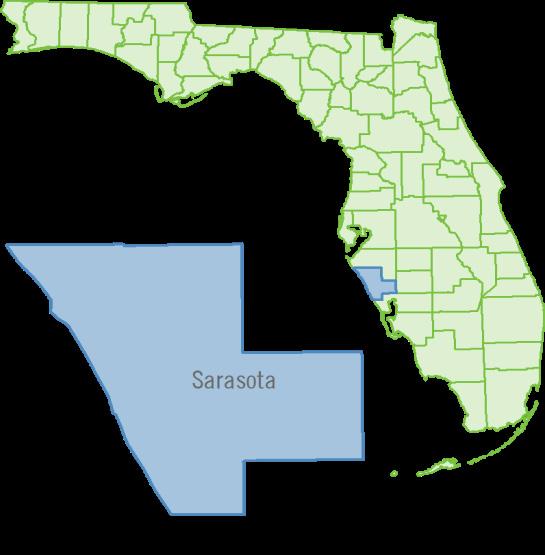

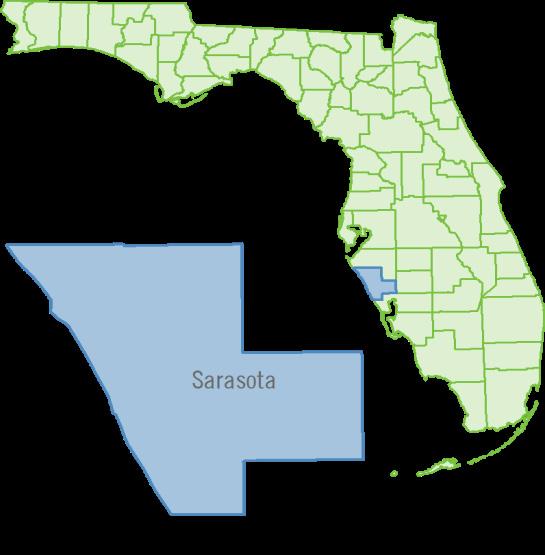

Wild Blue at Waterside has captivated homeowners with its Lakewood Ranch location, incomparable residences and resort-style amenities. This award-winning community by Stock Development features single-family homes by some of the area’s most notable builders and incredible lifestyle amenities, including the newly opened

13-acre Midway Sports Complex. Construction on the 30,000-square-foot social clubhouse begins this summer, with indoor and outdoor dining, two pools, a movie theater, fitness center and 9-hole premier putting course. Now’s the time to discover Sarasota’s most desirable nature-centric luxury community.

8396 Sea Glass Court, Lakewood Ranch, FL 34240 l 941.313.3852

From University Parkway turn south onto Lorraine Road and follow the signs to Wild Blue at Waterside

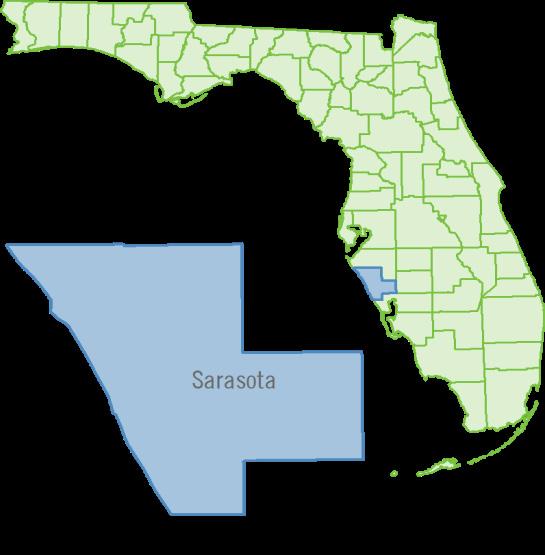

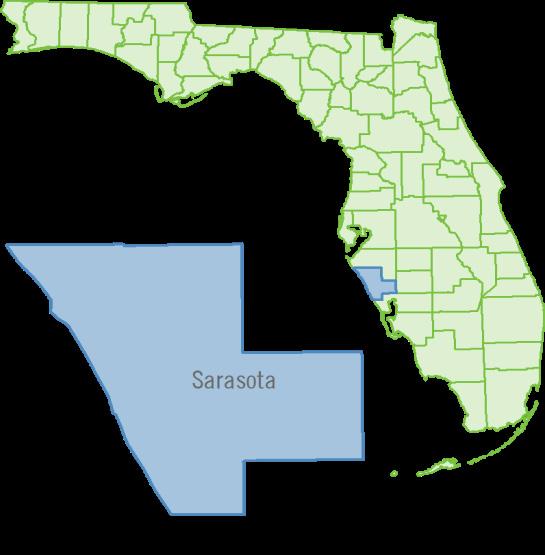

The Sarasota-Bradenton real estate market has undergone significant transformation in recent years. From pandemic-driven shifts to rising interest rates and a surge in new construction, the landscape of buying and selling homes continues to evolve. To gain insight into what 2025 may hold, RASM spoke with industry expert Dr. Brad O’Connor, Chief Economist for Florida REALTORS®, to explore the market’s current state, future projections, and the key factors shaping real estate in the region.

Just when you thought you wrapped your head around the document, form, and practice changes which were put into place in 2024, think again! Effective January 2025, three notable changes were made to the FAR/BAR as is and standard real estate contracts.

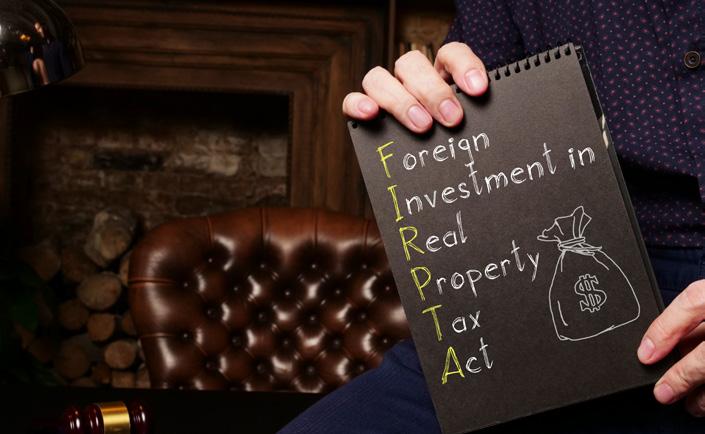

Now that your client has listed with you, obtained financing, and has currency exchange in place, it’s time to talk taxes. One of the most valuable resources, as a Realtor® working with foreign investors, is an experienced international accountant.

There are no shortage of associations in Florida. It feels like every other property is part of at least one association, and there are many that may have more than one. However, an association can add additional complications to your real estate transaction.

RASM South - 2320 Cattlemen Road

Sarasota, FL 34232

RASM North - 2901 Manatee Ave W Bradenton, FL 34205

Phone: 941-952-3400

FAX: 941-952-3401

www.MyRASM.com

Vice President of Operations & IT:

Jesse Sunday

Vice President of Advocacy & Member Programs: Maxwell Brandow

Communications Director :

Brandon Gay

Member Services Director : Jessica Montague

Professional Development Manager: Denise Ricciotti

Marketing and Communications Coordinator:

Amanda Freed

Magazine Editor: Beth Sunday

President:

Debi Reynolds, SaraBay Real Estate, Inc.

President-Elect:

David Crawford, Catalist Realty LLC

Vice President:

Anita Lambert, Sotheby’s International Realty

Treasurer:

Julia Montei, Coldwell Banker Realty

Immediate Past President:

Tony Barrett, Barrett Realty, Inc.

Chief Executive Officer: Jeff Arakelian

MISSION STATEMENT:

Empower and engage our Realtor® Community by delivering essential services, resources, education, and experiences that elevate member success and professionalism, while advocating for Realtor® initiatives and private property rights.

VISION STATEMENT:

We are an innovative and relevant association that elevates the standards of professional excellence, and are critical to our members’ success, while providing value to our community.

SUBSCRIPTIONS:

The annual dues of every member of the REALTOR ® Association of Sarasota and Manatee, Inc., includes a one-year digital subscription to ELEVATE Magazine. Editorial ideas and manuscripts are welcomed.

MAGAZINE DISCLAIMER:

Byline articles and columns express the opinions of the writers and do not necessarily reflect the policies or sentiments of the REALTOR® Association of Sarasota and Manatee, Inc., and its affiliates (together, the Association). All submitted copy is subject to editing. Copyright © 2025 REALTOR® Association of Sarasota and Manatee, Inc. All rights reserved. Reproduction in whole or in part without written permission is prohibited. Advertisements in the publication do not constitute an offer for sale in states where prohibited or restricted by law. Additionally, the Association makes no guarantee and takes no responsibility for the accuracy of any third-party advertisements in this publication. All liability with respect to actions taken or not taken based on the contents of this publication are hereby expressly disclaimed. The Association has provided the content of this publication “as is” and without warranty of any kind, express or implied, and as such, is not responsible or liable for the accuracy, content, completeness, legality, or reliability of the information.

ADVERTISING:

For information on advertising and article submissions, contact Beth Sunday, Magazine Editor, at 941-952-3417 or email Beth@MyRASM.com

By: Jeff Arakelian, RASM CEO

It has been just over six months since the National Association of REALTORS® (NAR) settlement in the Sitzer/Burnett antitrust case was preliminarily approved. The residential real estate brokerage industry has undergone significant changes to implement the terms of the settlement. The settlement, officially finalized on November 26, 2024, addressed allegations that NAR and major brokerages conspired to inflate commissions paid by home sellers.

Previously, listing brokers were required to offer compensation to buyer’s agents when listing properties on Multiple Listing Services (MLS). This rule has been removed, allowing sellers and buyer’s agents to negotiate compensation independently. Further, all references to compensation have been removed from the MLS’s nationwide.

Buyers must now enter into written agreements with their agents before viewing homes. These agreements detail agent compensation and reinforce that commissions are negotiable.

Florida REALTORS® played a vital role creating new forms and revising numerous existing forms to support and protect REALTORS® implementation of practice changes required by the settlement. New forms included compensation agreements, and revised buyer broker agreements, sales contracts, listing agreements, and showing agreements.

NAR, for its part, even though unsuccessful, did the heavy lifting by defending the industry and subsequently negotiating the settlement. While NAR was unable to cover all members through the settlement, 1 million of the 1.5 million were covered, and the entire industry is protected from “copy-cat” lawsuits for the next seven years. Since then, NAR has engaged its resources to develop practice change guides for members and a host of consumer guides to help educate the consumer on purchasing, selling, and owning residential real estate.

Brokerages have adapted to the new rules by updating their operational procedures and training programs to ensure compliance and maintain service quality.

Only time will tell how these changes will affect commission structures and consumer behavior. Some data indicates slight decreases in commission rates. The real impact on commissions remains to be seen.

Overall, the industry is navigating a period of transition, aiming to balance transparency, competition, and consumer protection in the evolving real estate landscape. The industry has adapted, and we are still here! •

The Sarasota-Bradenton real estate market has undergone significant transformation in recent years. From pandemic-driven shifts to rising interest rates and a surge in new construction, the landscape of buying and selling homes continues to evolve. To gain insight into what 2025 may hold, RASM spoke with industry expert Dr. Brad O’Connor, Chief Economist for Florida REALTORS®, to explore the market’s current state, future projections, and the key factors shaping real estate in the region. The following is a paraphrased question-and-answer conversation, courtesy of Dr. O’Connor.

Q: WHAT IS THE CURRENT STATE OF THE RESIDENTIAL REAL ESTATE MARKET IN SARASOTA - BRADENTON?

A: The Sarasota-Bradenton area has undergone substantial changes in recent years. Leading up to the pandemic, there was a surge in building and excitement in the market. The pandemic initially disrupted real estate, but then the market exploded with record-low interest rates, leading to a surge

in home sales. We started to see more New York, California, and Midwest transplants to the Gulf Coast. However, as inflation rose and the Federal Reserve increased interest rates, affordability became a major concern. While home prices have remained relatively high, the volume of sales has slowed some in recent years. The affordability issue has really been the same story for the past several years from 2022-2024.

Q: HOW HAVE SINGLE-FAMILY HOME AND CONDO SALES BEEN AFFECTED?

A: Single-family home sales have remained relatively stable over the past three years, although they are lower than the peak seen during the pandemic boom. New inventory plays a part here because there is more competition and potential buyers have more time to weigh all their options. However, condo sales have seen more of a decline, primarily due to new reserve requirements that have been put in place across the state, aging condo stock, and increased competition from new construction. Buyers are more hesitant, and condos are taking longer to sell. The Sarasota and Bradenton area has

experienced a higher level of new condo listings, but that actually goes back to 2023, not just 2024, so it’s not necessarily due to the reserve requirements. Sales are cyclical and condo sales are down, and that can be attributed to all sorts of factors such as a buyer’s profile. For example, retirees will have different needs than families with young children. Another major contributing factor to slower condo sales is the competition from new construction.

A: Sarasota and Bradenton have seen a significant increase in new construction, your area is building a lot, particularly in multifamily housing. Looking back over the last four years, there’s been a lot of multifamily units permitted, and a good deal has been delivered. With so many developments coming online, there’s been increased competition, particularly for older properties. Many buyers now opt for new builds that don’t require immediate renovations, such as roof or shower replacements. This increased inventory has contributed to a slowdown in sales and a slight softening of prices. Historically, the SarasotaBradenton is more of a single-family market with a healthy condo inventory, but the level of permits and building has been sizeable, and that will lead to more options for buyers.

A: We anticipate a relative slowdown due to the sheer volume of new developments. This is a natural market adjustment. However, Florida’s real estate market tends to recover quickly, even after major disruptions like hurricanes. The long-term demand for Sarasota and Bradenton remains very strong due to their appeal as desirable living destinations. Rising housing costs are a nationwide issue, not just limited to the Florida market, and while inventory will differ from market to market, Florida offers a lifestyle that will continue to attract buyers despite hurdles like insurance, rising costs, and hurricanes.

Q: SPEAKING OF HURRICANES, HOW HAVE RECENT STORMS AFFECTED OUR MARKET?

A: Historically, hurricanes only cause temporary disruptions. If the damage is widespread, specific zip codes may see slower sales, but Florida’s housing market has always rebounded faster than expected. We look at data from all the major hurricanes dating back from 1995, and on a county-wide level, sometimes the hurricane data doesn’t even show up in our housing data, unless they were particularly devastating. If it’s concentrated in a few zip codes, then those areas will see sluggish activity where there is major property damage. But where there is superficial damage, the Florida housing market bounces back faster than you would think. Again, the factors that make Sarasota and Bradenton attractive - weather, lifestyle, and amenitiesremain unchanged post-hurricane.

A: Rising insurance costs remain a challenge. On the condo side, we have the added difficulties of reserve requirements for those communities, as well as those communities that weren’t prepared for an intense storm. However, the interest rates remain the biggest factor for keeping the market where it is right now. The rates were high before the hurricanes, and they remain high now, so that really hasn’t changed the trajectory of your market. The hurricanes also have not changed the trajectory of your market - so that’s very good news. From what I can see in the data, you may have more sales of damaged homes, where people would rather sell “as is” vs. investing in complete remediation, but that shouldn’t impact your total sales significantly.

It’s hard to get reliable data on rates because there is no central data source. However, we have different sources that we rely on and they do seem to point in the same direction. Recent legislative changes have introduced more insurers to Florida, which should help stabilize premiums. The hope is that added competition will result in competitive pricing, and the data shows at least a slowdown. However, we have yet to see significant decreases, but at least we’ve seen them stop growing at the rate they were. In addition, updated FEMA flood maps could influence property values and require further insurance assessments.

One of the indicators of a healthy market is days on market, which is not much different now than it was pre-pandemic. From around 2013-2020, your area was around 40-50 days on the market for a single-family home. Obviously that was higher than it was in 2021, when you averaged around 8 days on the market, and experienced bidding wars. That type of market is not sustainable and creates frustration on both sides of the sale. Back in 2008, your market area for single-family homes experienced more than 150 days on market for a typical sale. So you’re at around 50 days on the market for single-family homes now, and approximately 60 days for condos, so that is a lot healthier. Prices have weakened a little bit, but that is just reflecting the growth in inventory, and interest rates are still making it hard for demand to rise. So even though prices have lessened slightly, affordable housing is a big concern as prices are still much higher than they were in 20192020. There is more weakness in the condo market, as I mentioned, but we don’t currently have any data that would suggest a significant drop in housing prices.

A: Interestingly, cash sales have declined in the past year compared to the previous three years. This does seem odd, with rates being so high, you would think that there would be an increase in total cash buyers. I think investors have become more cautious, and price appreciation has slowed. However, the luxury market still sees higher levels of cash purchases, as affluent buyers are investing in homes they intend to live in long-term. We’re also seeing investors paying in cash, but not as much as we’re used to simply because we don’t have as many lower-priced homes on the market currently.

A: The challenges facing Sarasota-Bradentonhigh interest rates and affordability concerns - are felt statewide. However, there are some differences. Areas like Tampa have more job opportunities making high home prices and high rent more tolerable, while Sarasota-Bradenton has more residents who are retired, though there is a significant and growing young professional demographic. The hottest real estate activity is currently in the I-4 corridor between Tampa and Orlando, where affordability is driving strong demand. Housing in this area is extremely affordable, so we have seen a big increase in construction, growth, and home sales in the Lakeland area and stretching north to the Villages. However, these communities aren’t as established yet, so they present challenges of a long commute, or less access to amenities. But it does provide buyers with more options if they want to work in the Sarasota-Bradenton area but affordability remains an issue.

A: Since the pandemic, we have had a general increase of people moving from out west to Florida in greater numbers than they used to. We have seen an influx from the mountain states as well as an increased migration from Texas. This data pre-dates the recent fire devastation experienced in California so only time will tell if that disaster will have an impact on migration to Florida but I don’t think it would impact us much.

A: Overall, while 2024 was a challenging year, we could start to see relief later this year if rates can get down closer to 6%. However, there are too many economic shifts unfolding in our country to predict what will happen so we are in a period of uncertainty. We do need to get people used to the idea that rates really aren’t going to be back at 2% or 3%, and over time, life goes on. People will still migrate to Florida, they will still need homes, and the Sarasota-Bradenton area will continue to grow at a healthy rate.

RASM sincerely appreciates Dr. Brad O’Connor for sharing his expertise and valuable insights on the state of our local real estate market. Brad O’Connor, Ph.D. is the Chief Economist for Florida REALTORS®.As the head of the research department he oversees the production of the association’s widely-cited monthly housing market statistics, as well as numerous other economic and statistical research projects. For the most recent market statistics from Florida REALTORS®, see pages 18-21, and 40-44. •

By: Julia Jones, Founder/Co-Owner, PuroClean of Bradenton, Lakewood Ranch & Siesta Key

When unexpected property damage happens, homeowners and businesses in the greater Manasota area know to turn to PuroClean, The Paramedics of Property Damage, for fast, reliable restoration. While PuroClean is best known for mold remediation, along with water and flood damage mitigation, many don’t realize that PuroClean’s services go beyond that. Whether it’s removing tough odors like cigarette smoke or restoring property after fire damage, disinfecting homes and businesses, or handling biohazard cleanup from trauma or crime scenes, PuroClean is ready to help - 24/7/365 days a year.

Julia Jones founded regional PuroClean franchises after recognizing a real need for a restoration company that puts integrity and compassion first, giving homeowners and businesses a trusted option in difficult times. She

started with PuroClean of Bradenton, then expanded with PuroClean of Lakewood Ranch & Siesta Key.

With years of experience in water, fire, mold, and biohazard restoration, Julia and her GM, Brenden Williams, have built a reputation for responding quickly, solving problems efficiently, and treating customers with care and respect.

Available 24/7, PuroClean uses professional-grade equipment to restore properties as quickly and thoroughly as possible. PuroClean also works directly with insurance providers, helping to simplify the claims process so homeowners and business owners can focus on getting back to normal.

PuroClean is very proud of its many 5-star Google Reviews! PuroClean is an IICRC and NORMI Certified firm, licensed by the state of Florida for Mold Remediation, and is recommended by several police agencies for trauma response.

If you seek restoration services from a trustworthy team that genuinely cares, please call PuroClean at 941-ADD-PURO (941-233-7876) or 941-877-2288. Find us online at www.purocleanofbradenton.com or www. puroclean-lwr-siestakey.com. Follow us on Facebook or Instagram. •

By: National

Association of REALTORS® Interpretations of the Code of Ethics Agreement Case 1-25: (Adopted November, 2000.)

Realtor® A had listed Seller S’s vintage home. Buyer B made a purchase offer that was contingent on a home inspection. The home inspection disclosed that the gas furnace was in need of replacement because unacceptable levels of carbon monoxide were being emitted.

Based on the home inspector’s report, Buyer B chose not to proceed with the purchase.

Realtor® A told Seller S that the condition of the furnace and the risk that it posed to the home’s inhabitants would need to be disclosed to other potential purchasers.

Seller S disagreed and instructed Realtor® A not to say anything about the furnace to other potential purchasers. Realtor® A replied that was an instruction he could not follow so Realtor® A and Seller S terminated the listing agreement.

Three months later, Realtor® A noticed that Seller S’s home was back on the market, this time listed with Realtor® Z. His curiosity piqued, Realtor® A phoned Realtor® Z and asked whether there was a new furnace in the home.

“Why no,” said Realtor® Z. “Why do you ask?” Realtor® A told Realtor® Z about the home inspector’s earlier findings and suggested that Realtor® Z check with the seller to see if repairs had been made.

When Realtor® Z raised the question with Seller S, Seller S was irate. “That’s none of his business,” said Seller S who became even angrier when Realtor® Z advised him that potential purchasers would have to be told about the condition of the furnace since it posed a serious potential health risk.

Seller S filed an ethics complaint against Realtor® A alleging that the physical condition of his property was confidential; that Realtor® A had an ongoing duty to respect confidential information gained in the course of their relationship; and that Realtor® A had breached Seller S’s confidence by sharing information about the furnace with Realtor® Z.

The Hearing Panel disagreed with Seller S’s contentions. It noted that while Realtors® do, in fact, have an obligation to preserve confidential information gained in the course of any relationship with the client, Standard of Practice 1-9 specifically

provides that latent material defects are not considered “confidential information” under the Code of Ethics. Consequently, Realtor® A’s disclosure did not violate Article 1 of the Code of Ethics. •

Published with the consent of the NATIONAL ASSOCIATION OF REALTORS®. Copyright NATIONAL ASSOCIATION OF REALTORS®-All Rights Reserved.

• $750 for vacant residential properties renting at

• $450 for vacant residential properties renting at $1000+ per month

• $250 for vacant residential properties renting for less than $1000 per month

• $250 for any property with existing tenants in place

By: Amy L. Concilio, Attorney at Law, Williams Parker

Just when you thought you wrapped your head around the document, form and practice changes which were put into place in 2024, think again! Effective January 2025, 3 notable changes were made to the FAR/BAR as is and standard real estate contracts. It is important that all Realtors® are aware of these changes and how they impact buyers and sellers throughout the closing process.

The most significant change to the contract is the change to Section 9, which identifies which party (Buyer or Seller) is responsible for paying certain closing costs. The addition of “Seller’s Closing Services” and “Buyer’s Closing Services” to Section 9(a) and 9(b) respectively, provides clarity that each party may be charged a fee for Closing Services even if that party did not select the Closing Agent. This addition to the contract allows the Closing Agent to charge a fee to both the Buyer and the Seller for preparing the documents necessary for Closing. The contract also now clarifies that the term “Closing Services” shall have the meaning ascribed in Section 627.7711(1)(a), Florida Statutes, which is “services performed by a licensed title insurer, title insurance agent or agency, or attorney agent in the agent’s or agency’s capacity as such, including, but not limited to, preparing documents necessary to close the transaction, conducting the closing, or handling the disbursing of funds related to the closing in a real estate closing transaction in which a title insurance commitment or policy is to be issued.” Keep your client fully informed and eliminate any last-minute closing cost surprises by asking the Closing Agent for a breakdown of fees at the beginning of the transaction.

The following sentence has been removed from Section 15: “The portion of the Deposit, if any, paid to Listing Broker upon default by Buyer, shall be split equally between the Listing Broker and Cooperating Broker; provided however, Cooperating Broker’s share shall not be greater than the commission amount

listing Broker had agreed to pay to Cooperating Broker.” This change should not be surprising as commissions are now governed by separate commission agreements.

There are now two additional addenda listed in Section 19. Addendum FF (Credit Related to Buyers Broker Compensation) and Addendum GG (Sellers Agreement with Respect to Buyers Broker Compensation) are now options to select and incorporate into the contract.

Should you have any questions regarding these contract changes and how they may affect you and your clients, please reach out to a real estate attorney for proper guidance throughout the transaction.

8902560.v1 •

This article is meant for educational purposes only. It is not intended to serve as legal advice and should not be used as a substitute for consultation with an attorney.

By: Kim Coffland, RASM Fundraising Programs Coordinator

Have you ever thought about leaving a lasting mark on the real estate community?

Now’s your chance! Brick orders are open through December 2nd , giving you the opportunity to showcase your legacy, honor a mentor, or support a great cause - all while securing a permanent spot at the REALTORS® Association of Sarasota and Manatee (RASM) offices

With 18 new bricks already on order, we’ll be celebrating their placement at RASM North and South in the coming months. A tax-deductible donation starting at $300 gets you a custom-engraved brick that will be seen and appreciated by fellow Realtors®, clients, and visitors for years to come.

An engraved brick isn’t just a name in stone - it’s a statement. It tells the world you’re committed to your profession, your community, and the future of real estate. Whether you want to celebrate a milestone, honor someone special, or promote your business, this is a meaningful and lasting way to make an impact.

Your engraved brick becomes a permanent part of the RASM office walkway, offering built-in marketing visibility. Many Realtors® use bricks to highlight their years in the industry, promote their brokerage, or recognize team achievements. Maybe you want to commemorate a big career milestone - like your first sale, 100th closing, or the grand opening of your own brokerage. Or perhaps it’s time to celebrate a wellearned retirement. Whatever the reason, this is a oneof-a-kind way to mark the moments that matter.

Beyond recognition, your brick purchase helps fund the RASM Charitable Foundation, which provides scholarships for local students, supports housingrelated charities, and RASM members in crisis. Your contribution does more than secure your place at RASM - it actively makes a difference in the lives of others.

Bricks are also a wonderful way to pay tribute to those who’ve made an impact on your life or career. Whether it’s a mentor, a family member, a past leader in the industry, or a dear friend, an engraved brick provides a lasting way to honor their legacy

Some members choose to celebrate a family legacy by including multiple generations in real estate on a single brick. Others dedicate bricks to colleagues who have made a meaningful difference in their professional journey.

Don’t miss this opportunity to cement your place in RASM history. Whether it’s for business, personal recognition, or charitable impact, purchasing a brick is an investment in your future, community, and your profession!

To place your order or learn more, visit myrasm. com/foundation. •

By: Max Brandow, RASM Vice President of Advocacy and Member Programs

Th is January, the Manatee County Commission proposed vacation rental regulations for all short-term rentals in Manatee County. Initial proposals include many common regulations we see in other municipalities: occupancy limits, registration fees, inspections and inspection fees, safety requirements, and a designated agent for every property. RASM has taken an initial stance of opposition to any regulations that would hurt property owners utilizing their property as they wish as long as they are following the rules. While some of these regulations on their face seem harmless, when added up they can act as a de facto ban on vacation rentals due to the cost to comply with all the requirements, which is what we want to avoid.

RASM’s position on vacation rental regulation has been consistent throughout the years. We have always advocated for safe neighborhoods, keeping harmony of the neighborhoods intact, and steadfast enforcement of current regulations on sound, open house parties, parking violations, and trash and garbage violations. The issue we run into is that municipalities that pass vacation rental regulations to address the above problems, already have ordinances and laws on the books prohibiting such actions. Enacting a whole new set of regulations negatively impacts the operators who are following the rules and the bad actors will still break the rules, and given the municipalities inability to enforce prior rules, we don’t have confidence a new regulatory scheme will improve their code enforcement capability. So, we’re now left with a situation where vacation rentals become more expensive to operate, the issues persist because the root cause of issues with vacation rentals doesn’t truly get addressed, and taxpayers and rental operators playing by the rules foot the bill.

As this issue progresses in Manatee County, we will be working with County staff to make sure any program proposed is the least burdensome on your clients. If you would like more information and how to get involved with this issue, please reach out to me at maxwell@myrasm.com.

Since 2022, Florida’s My Safe Florida Home grant program has helped about 29,000 homeowners fortify their homes with up to $10,000 for roof upgrades, impact-resistant doors, windows, and shutters.

However, the application portal has been closed since July 2024, leaving 45,000 homeowners stuck on a waiting list despite completing wind mitigation inspections. Governor Ron DeSantis is pushing the Legislature to fund these pending grants so new applicants can apply this year.

His 2025-26 budget includes a $590 million request - the largest since the program’s return. Of that, $480 million would cover the backlog, while $109 million would fund 10,000 new applicants. An additional $100 million annually would keep funding 10,000 grants per year moving forward.

DeSantis urged lawmakers to approve funding in a special session starting January 27, but they instead focused on immigration policies. “We wanted to get funding for the waiting list so homeowners could strengthen their homes before hurricane season,” he said.

First launched in the 2000s, the program was revived as part of efforts to stabilize Florida’s insurance market by reducing litigation and insurer failures. Strengthening homes not only lowers hurricane damage but can also help homeowners save on insurance premiums.

Program director Steven Fielder reported that half of grant recipients have seen premium reductions. However, recent law changes mean future applicants may face income restrictions unless policies are revised.

Florida REALTORS® and RASM members will be advocating for maximum funding of this and other homeownership incentive programs when we travel to Tallahassee for Great American REALTOR® Days in March. •

By: Brandon Gay, RASM Communications Director

The R EALTOR® Association of Sarasota and Manatee (RASM) has released its January 2025 real estate market report, providing an in-depth analysis of key trends across both counties. Based on data from Florida REALTORS®, the housing market in Sarasota and Manatee Counties for January 2025 reflects notable shifts, including increased inventory, longer sales timelines, and price adjustments across property types.

While closed sales have risen in some segments, median sale prices have generally declined, indicating a more balanced market compared to previous years. The rise in available listings has led to higher months of supply, giving buyers more options and greater negotiating power. Cash transactions remain a significant portion of sales, though they have slightly decreased in some areas compared to last year. The extended time to contract and sale suggests a cooling period in the market, particularly in the townhouse and condo sector.

Decrease in Median Sale Prices: Across all property types and both counties, median sale prices have generally decreased year-over-year. Sarasota County’s townhouse/condo market experienced the sharpest decline, while Manatee County’s single-family home prices also dropped notably.

Increase in Time to Sale & Contract: Homes are taking longer to sell across all segments, indicating a shift in market conditions.

Closed Sales Growth in Most Segments: Many property types experienced an increase in closed sales, with Manatee County’s single-family homes seeing the strongest growth year-over-year.

In Sarasota County, there were 520 single-family home sales in January 2025, reflecting a 6.8 percent increase from January 2024. The median sale price declined slightly by 1 percent year-over-year to $529,750, with nearly 49.4 percent of these transactions paid in cash.

Despite the increase in closed sales, inventory levels rose, with a 30.6 percent year-over-year increase, bringing the months’ supply to 6.4 months. The median time to contract and median time to sale also increased to 45 days and 85 days, respectively.

In Manatee County, there were 498 single-family home

sales, marking a 22.1 percent increase year-over-year. The median sale price dropped 8.6 percent to $480,000.

Manatee County ended January with 2,907 active listings, representing a 4.6-month supply of inventory. The median time to contract increased by 40 percent to 49 days, while the median time to sale rose 14 percent to 98 days.

“While closed sales have increased, inventory growth continues to outpace demand, leading to an extended months’ supply,” said Debi Reynolds, 2025 RASM President and Managing Broker of SaraBay Real Estate. “This shift presents opportunities for buyers while emphasizing the importance of strategic pricing for sellers.”

The townhouse and condo market in Sarasota County saw a 15.8 percent increase in closed sales, with 242 transactions in January 2025. The median sale price fell 17.4 percent to $347,000.

Inventory grew significantly, with 2,463 active listings and an 8.5-month supply, signaling a shift into a buyer’s market. The median time to contract increased by 51.4 percent to 53 days, while the median time to sale rose 8.9 percent to 86 days.

In Manatee County, townhouse and condo sales declined 7 percent year-over-year to 172 transactions, with 58.1 percent of sales being cash purchases. The median sale price dropped 6.1 percent to $335,990.

Manatee County ended the month with 1,714 active listings, equating to an 8-month supply of inventory, further strengthening buyers’ leverage. The median time to contract increased by 27.7 percent to 60 days, while the median time to sale rose 14.1 percent to 105 days.

“Median home prices have adjusted in response to increasing inventory, particularly in Sarasota’s condo market,” added Reynolds. “With townhomes and condos in both counties exceeding eight months of supply, market conditions now favor buyers.”

The January 2025 housing market highlights a transition, with increasing inventory and shifting price trends favoring buyers in many segments. While some property types have seen stronger sales activity, longer selling timelines and price adjustments indicate a move away from the highly competitive market of previous years.

In this evolving landscape, the expertise of a Realtor® is more essential than ever. Whether navigating price fluctuations, strategizing in negotiations, or understanding the impact of increased inventory, working with a Realtor® ensures that buyers and sellers make informed decisions in a changing market.

Monthly reports are provided by Florida Realtors® with data compiled from Stellar MLS. For comprehensive statistics dating back to 2015, visit www.MyRASM.com/statistics •

By: Brian McCrone, President/Inspector of Premier Inspections, RASM Platinum Sponsor

Sk ipping out on a home inspection puts the home buyer at significant risk. For many, buying a home will likely be the single largest purchase of their lifetime. A home inspector is an objective consultant acting on the buyer’s behalf, delivering a report about the home’s condition to provide the buyer with vital information to make an educated decision on their purchase.

Viewing the photos provided on the listing and visiting the home in person is only the tip of the iceberg when getting an understanding of the home. Cosmetic features play a part in determining whether the home is right for your buyer. However, cosmetic features are often renovated relatively cheaper than significant issues associated with the home’s “bones” hiding under the surface.

The average person can easily miss vital issues without the appropriate knowledge, expertise, and tools needed to identify them. Once the home is purchased, the responsibility to remedy problems and cover costs falls onto the new homeowner, costing thousands of dollars.

During the inspection, we methodically move through the home, conducting various tests, taking measurements, and assessing the various systems’ conditions and components. Throughout the inspection and further detailed in the home inspection report, your inspector will highlight any defects they come across, both minor and significant. Every home will have some defects found during the inspection, but many minor defects won’t impact the transaction, such as normal wear and tear.

However, major defects are a different story. A roof that needs replacing, severe foundation cracking, or old wiring in the electrical system are all examples of major defects and require invasive and expensive repair costs. In many cases, significant defects pose a dangerous risk to the health and safety of the residents and the property itself. If our inspector comes across any major defects like these, they alert the homebuyer to their severity. With this information, you can work to plan your buyer’s next move, whether renegotiating or not.

Whatever decision is made, it’s better to be aware of significant defects early to plan the next steps accordingly. Skipping a home inspection only to uncover a major defect after the home is purchased will not provide many options, and it will be the buyer’s responsibility to handle.

Defects and issues aren’t the only matters identified during a home inspection. The inspector will assess the condition of the structure’s systems and components, providing information about expected working lifespans. Even if they are in good shape at the inspection, almost all systems will wear out over time and need repairs or replacement at a certain point.

The inspection report will include the ages of different systems. The inspector could recommend repair or replacement. The buyer can then keep track of such expected life spans, plan out follow-up inspections, and prepare for repairs or renovation. Proper maintenance can extend the lifespan of the different systems and structures. The home inspection report is a valuable reference tool for tracking various home systems and planning out future maintenance.

Proper maintenance can extend the lifespan of the different systems and structures, and a home inspector will often be able to identify if previous owners have completed such care. The home inspection report is a valuable reference tool for tracking various home systems and planning out future maintenance.

Premier Inspections has the knowledge and experience you demand for home or commercial inspections - serving families and businesses for over 40 years. Contact them today at 941-441-6606 or email at Brian@PremierInspectionsFLA.com •

By: Nena Mahlum Mills, MBA, Marketing & FIRPTA Manager, HBI

Now that your client has listed with you, obtained financing, and has currency exchange in place, it’s time to talk taxes. One of the most valuable resources, as a Realtor® working with foreign investors, that you can have in your toolbelt, is an accountant, but not just any accountant will do. You need to connect your clients with an accountant that has a thorough understanding about your client’s tax responsibilities as a non-U.S. owner of a U.S. property.

Why are they investing in the U.S.?

How long do they plan to hold their investment?

Are they going to rent out the property, or just use it personally?

What are their tax reporting requirements in the U.S.?

How do their investments in the U.S. affect their tax position at home?

Investors need to plan on disposing of their property in the US, from the day they plan to purchase it. They need to have an idea of what they plan to utilize the property for, and how long do they think they will hold on to it. Are they just wanting a single property, or they planning to be a serious investor? The answers to these questions can greatly impact not only their tax situation here in the U.S., but also in their home country, where they will be required to report their worldwide income.

An accountant can help your client determine the best way to invest in the U.S. that meets their investment goals/needs, and minimizes their tax obligations here in the U.S. An experienced accountant will be able to help your clients determine things such as the most tax advantageous way to take ownership of a property (entity or individual), what type of U.S. tax number they need (ITIN, EIN, or both), as well as what

type of tax return, they will need to file in the U.S., or if they will even have a requirement to file tax returns in the U.S. at all.

Another thing to consider prior to purchase is a succession plan. There are several factors that come into play to determine what happens if your client passes while owning a U.S. property. Part of the discussion with an accountant will include ways to protect any potential heirs from huge tax liabilities in the event of their passing. While some changes can be decided after purchase; Its always easier and more transparent to the IRS to assume ownership with an investment plan already in place.

Lastly, as a non-resident investor in a U.S. property, your clients will be subject to FIRPTA withholding when they sell their U.S. property. This withholding is much easier to navigate if your clients already know that it will be a part of their overall investment experience in the U.S. An experienced accountant will provide your investor with an overview of FIRPTA, including what items are deductible on US tax filings, and the burden of proof set forth by the IRS for those items to be usable in mitigating any tax bills.

As you can tell, there are lots of moving parts when it come to investing in the U.S. Contact your local RASM office for contact details for vetted accountants in your area.

To learn more, join us for the FIRPTA Fundamentals for Realtors® class on Thursday, March 27, at 10:00 a.m. at the RASM North office. •

By: Tess Scalise, Realtor®, Michael Saunders & Company

While much of our local area experienced and is still recovering from the impact of multiple hurricane impacts, Sarasota and Manatee counties have seen notable migration trends in recent years, reflecting both domestic and international movements.

Between 2010 and 2020, Sarasota County’s population increased by over 54,500 residents, averaging 15 new residents per day. The county’s decennial growth rate of 14.4% surpasses both the national rate of 7.4% and Florida’s rate of 14.6%. More than half of this growth occurred in the unincorporated areas. Per scgov.net, Manatee County experienced a net migration of 82,213 residents, indicating a significant influx of new residents during the period analyzed.

In 2023, Sarasota County saw a significant influx of new residents from various states according to ascendiagroup.com. The top 20 states contributing to this migration included New York, Georgia, New Jersey, California, Illinois, Pennsylvania, Virginia, Texas, Michigan, and Ohio.

The significant population growth and migration trends in Sarasota and Manatee counties present opportunities for real estate professionals to cater to a diverse and expanding market. Understanding the sources of new residents and demographic shifts can inform targeted marketing strategies and property offerings. Additionally, staying informed about future population projections can assist in anticipating market demands and identifying emerging areas of interest.

As seasonal swelling traffic patterns indicate, Florida continues to be a top destination for people escaping the cold to enjoy our sunny climate. Some of them may also be seeking vacation, retirement homes, or rentals. Naturally, you will want to arm yourself by being informed on regulation changes, rental restrictions, and new state and settlement-required disclosures to help your customers fully evaluate their options.

The downtown Sarasota area is undergoing a transformation with new condos, urban developments, and high-end amenities. Younger buyers and professionals are flocking to the downtown area for a vibrant, walkable lifestyle with access to restaurants, shopping, and cultural activities.

Lakewood Ranch is one of the fastest-growing master-planned communities in the country. It offers a variety of home styles, including single-family homes, townhomes, and luxury properties. It’s appealing to both younger populations and retirees due to its amenities and active lifestyle offerings.

Educate yourself on the nuances of selling to retirees, such as their preferences for accessibility, proximity to healthcare facilities, and social amenities. This market can be lucrative, especially with communities like The Meadows or Lakewood Ranch attracting older buyers.

As more buyers prioritize sustainability, Sarasota and Manatee counties are seeing an uptick in ecoconscious developments. Homes with energy-efficient features, energy-efficient appliances, and sustainable building materials, are in high demand. This is especially important for buyers who are looking for ways to reduce their carbon footprint while enjoying Florida’s natural beauty.

Only time will tell whether these migration trends will continue, yet there remains an opportunity for young professionals to study market shifts and adapt their strategy accordingly. Educate clients on current market conditions, whether they are buying or selling. Being informed about local trends and economic factors can help build trust with clients, especially when guiding them through their real estate decisions. •

By: Daniel Treiman, Realtor®, Michael Saunders & Company

Tucked away in the heart of Sarasota, Beneva Oaks is an exclusive gated community offering some of the largest lots in the area with unbeatable convenience to Siesta Key and downtown. Known for its peaceful, tree-lined streets and estate-sized homes, this sought-after neighborhood is a rare find for those seeking both space and accessibility.

Beneva Oaks stands out as one of Sarasota’s bestkept secrets, offering privacy and tranquility just minutes from the city’s best dining, shopping, and cultural attractions. With only 49 residences behind the gates, each property enjoys oversized lots, mature landscaping, and a distinct sense of seclusion while remaining centrally located. Residents in this small, tight-knit community participate in social events and are active in various committees that help govern the neighborhood; however, HOA fees remain relatively low for the quality of the area.

The neighborhood is home to some of Sarasota’s most impressive estates, including a stunning 7,023-square-foot residence currently available for sale at 3759 Beneva Oaks Blvd. Nestled on nearly an acre, this exquisitely designed 5-bed home features soaring vaulted ceilings, a show-stopping kitchen with sunken breakfast nook, and expansive indoor-outdoor living spaces that blend modern sophistication with Florida charm and provide the perfect setting for social events. With a saltwater pool, putting green, summer kitchen, and private gym, it epitomizes resort-style living in the heart of Sarasota.

One of Beneva Oaks’ greatest appeals is its unparalleled location. Residents enjoy a quick 15-minute drive to Siesta Key’s world-renowned beaches, while downtown Sarasota’s vibrant arts scene, boutique shopping, and fine dining are just a short trip away. The neighborhood also provides easy access to top-rated schools, golf courses, and Sarasota’s cultural landmarks, making it a premier choice for discerning homeowners.

For those seeking luxury, privacy, and convenience, Beneva Oaks offers a rare opportunity to enjoy estate living in one of Sarasota’s most desirable neighborhoods. •

By: Natasha Selvaraj, Esq., Partner, Berlin Patten Ebling PLLC

There are no shortage of a ssociations in Florida. It feels like every other property is part of at least one association, and there are many that may have more than one. While they certainly serve a purpose by providing homeowners with access to amenities they may not otherwise have, or ensuring consistent standards for property maintenance and appearances, nevertheless an association can add additional complications to your real estate transaction.

When preparing the sales contract it is essential to ensure all of the required information is provided by the seller to the buyer either within the body of the contract or on the appropriate rider to the contract. The required information will vary depending on what type of association the property is in, with the Homeowner’s Association Rider requiring the dues, capital contributions, and approval requirement be disclosed; while the Condominium Rider requires all of that plus the specific requirement for the seller to provide a laundry list of current condominium documents to the buyer, including the budget.

The Condominium Rider was revised (yes, again) at the beginning of the year to include additional information about Milestone Inspection Reports, Structural Integrity Reserve Study, and Turnover Reports. Keeping up with the changes and understanding the obligations the seller has to provide information and the buyer has to review and comply are essential to a smooth closing.

Some of the most common “deal breakers” when reviewing any rules and regulations or covenants and restrictions are related to parking and pets. Buyers need to understand what they are permitted to do once they move in to ensure they are not faced with difficult decisions when they find out their vehicles or beloved pets are violating the rules. Other common concerns for home buyers involve improvements they can make – whether it is a pool, shed, or patio, fence, landscaping, or the flamingo mailbox they have always wanted, ensuring a buyer understands what they can and cannot do on the property will ensure there are no unexpected surprises at the closing table, or worse, after the transaction has closed.

A buyer needs to understand the associations finances and factor their financial state into their decision to purchase. Special Assessments are more common in condominiums than single family-homes, but villas or townhomes may have more expensive common elements that could also result in special assessments if there are not adequate funds in reserves or if regular maintenance has been neglected. Understanding the association’s financial position will help ensure a homeowner’s investment into their home is protected in the long run, and post-closing surprises are minimized.

Both the Condominium Rider and the Homeowners Rider provide for closing to be contingent upon the buyer being approved for the purchase, in the event that the association has an approval process. Knowing this early in the process can ensure both parties are working to release this contingency to ensure the contract doesn’t fall apart at closing based on a buyer not timely receiving approval.

Last but certainly not least, an “estoppel letter” is required when a property is in an association. This can cause a plethora of issues for the closing process if accurate association information is not available so it can be ordered timely. The letters are only valid for 30 days, and the current cost is statutorily set at a maximum of $299 per letter, with the option for additional fees to be charged on delinquent accounts or for expedited requests. The estoppel should confirm the current dues, any capital contributions, violations of rules, special assessments, as well as the status of buyer approval to ensure both parties have the most current information and to allow the buyer to verify the information provided by the seller is accurate.

There are many issues to consider and navigate when working with a property in an association, and understanding the intricacies, deadlines, and implications of a sale or purchase will ensure a smooth closing for everyone involved.

Join the professional development committee on March 24, 2025, for an interactive panel that discusses Homeowner’s Associations and Condominium Associations and their involvement and impact on your real estate transactions. Hear from various industry professionals about how they handle association-related matters ranging from obtaining documents, complying with the requirements of the HOA and Condo Rider, buyer approvals, and much more to ensure smooth transactions and efficient closings for their clients. Register today at www.myrasm.com/calendar •

This article is meant for educational purposes only. It is not intended to serve as legal advice and should not be used as a substitute for consultation with an attorney.

RASM happily recognizes the workplace anniversaries of our professional staff. Samantha L’Italien, Administrative Assistant to the CEO and Professional Standards Administrator, celebrates her first anniversary with RASM.

Samantha is a Florida native, born and raised in Boca Raton and a graduate of Florida Atlantic University. She and her family relocated to Lakewood Ranch in 2022.

In addition to her administrative responsibilities, Samantha is in charge of processing the RASM ethics and arbitration cases.

Samantha takes pride in being a devoted mother to her two children, finding joy in cheering them on during their softball and baseball games.

Samantha and her family enjoy spending time outdoors, whether it’s lounging by the pool or soaking up the sun at the beach. Their fun moments are often shared with their two beloved dogs, Spot and Sadie.

Tiffany Chamberlain, Financial Administration Coordinator, celebrates ten years with the association this month.

Tiffany works with the many day-to-day accounting functions and responsibilities at RASM and helps to ensure that accounting services run smoothly and efficiently.

Tiffany loves the family atmosphere that RASM embodies. She also loves the members and RASM staff and genuinely feels appreciated.

When not at the office, Tiffany enjoys spending her free time with her husband and their three amazing kids (daughter Zoey, age 9; son Blaze, age 6; and fouryear-old daughter Skylar).

She also enjoys going to the beach, relaxing outdoors, reading, and spending quality time with her family and friends.

Jessica Montague, Membership Director, celebrates her tenth anniversary with RASM this March. She manages all aspects of Realtors® memberships, ensuring accurate record-keeping, processing applications and transfers, and providing support to members. Jessica also serves as the Staff Liaison for the RASM Business Partners, Scholarship, and Diversity Committees.

Passionate about member engagement, Jessica enjoys the dynamic nature of her role and the connections she builds each day. She also values the camaraderie of her RASM colleagues. Outside of work, she finds joy in reading, attending concerts, and making memories with her family and friends.

Denise Ricciotti, Professional Development Manager, celebrates her fifth-year anniversary with the association this month.

Denise works to bring new and exciting education, training, and programming to our members.

She also works as the liaison to several committees, including Professional Development, the Leadership Academy, the Global Business Council, and the Realtor® Attorney Joint Committee. During her four years at the association, she is proud to have earned her CIPS, AHWD, and GREEN designations.

In her free time, Denise enjoys exploring local restaurants, bike riding on the Legacy Trail, reading, and working with charities. She also enjoys spending time with her husband, two daughters, and their rescue dog, Jaxson. •

By: Denise Ricciotti, RASM Professional Development Manager

Attending industry conferences isn’t just about learning—it’s about unlocking new opportunities, expanding your network, and staying ahead in an everevolving market. The right conference can equip you with the latest industry insights, innovative strategies, and valuable connections that propel your business forward.

That’s exactly what you’ll find at the RASM FIRE Conference & Expo on April 25, from 9 AM to 5 PM, at the Marriott Palmetto Resort & Spa. This full-day event is designed to ignite your success with sessions covering critical topics such as luxury real estate, condo law, property management, AI, and more.

The conference features an esteemed Broker Panel with David Crawford, Budge Huskey, Brandy Loebker, Ellen O’Day, and Victoria Stultz, moderated by Drayton Saunders. Gain insights into Florida’s real estate landscape with Margy Grant, CEO of Florida REALTORS®, and an Economic State of the Market update from Dr. Brad O’Connor, Chief Economist at Florida REALTORS®.

Beyond the sessions, enjoy a Business Partner Expo, where you can connect with industry leaders and potential collaborators. Plus, your $150 registration includes a reception and continental breakfast and lunch, making it both a valuable and convenient investment in your professional growth. Don’t miss this opportunity to sharpen your skills, gain insider knowledge, and expand your network. Secure your spot today! Register at https://www. myrasm.com/Conference.

CERTIFIED

Accredited Buyer’s Representative (ABR®)

Ashley Battle, Exit King Realty

Carla Michele Blethen, Leslie Wells Realty, Inc.

Mary Lynette Breedlove, EXP Realty LLC

Elena Durez, Medway Realty

Susan L. Dworsky PA, Engel & Voelkers Venice Downtown

Helen Jaquith, RE/MAX Platinum Realty

Anita Lambert, Premier Sothebys Intl Realty

Christopher Lincoln, Trend Realty

Gina Love, Better Homes & Gardens Real Estate

Daria Luczkowski, New Haus Group LLC

Oleg Shepherd, We Sell Biz LLC

Gregory Wood, Keller Williams On The Water Sarasota

At Home With Diversity (AHWD)

Kendel Leigh Sailer, Exit King Realty Certified Waterfront Specialist (CWS)

Alexandra Winsler Chau, Coldwell Banker Realty

Cindy Furtado, Waterside Realty LLC

Jozefina Wells, KW Coastal Living II e-PRO®

Cindy Furtado, Waterside Realty LLC Pricing Strategy Advisor (PSA)

Bianca Dwyer, Michael Saunders & Company

Cindy Furtado, Waterside Realty LLC

Arlene Ladell, Fine Properties

Short Sales and Foreclosure Resource (SFR®)

Daria Luczkowski, New Haus Group LLC Seniors Real Estate Specialist® (SRES®)

Deanna Marie Kennedy, Michael Saunders & Company •

MONDAY, MARCH 4

9:00 a.m. 14 HR CE (Day 1 of 2) tSouth

TUESDAY, MARCH 5

9:00 a.m. 14 HR CE (Day 2 of 2) tSouth

THURSDAY, MARCH 6

8:45 a.m. YPN Trolley Tour: Barrier Islands tSouth

10:00 a.m. FOREWARN Training Online

1:30 p.m. Storm Damage & Property Law: What Realtors® Need to Know tSouth

FRIDAY, MARCH 7

8:30 a.m. CREA Marketplace Meeting tSouth

TUESDAY, MARCH 11

1:30 p.m. Fair Housing: Be the Change tSouth

WEDNESDAY, MARCH 12

9:00 a.m. Intro to Contracts tSouth

THURSDAY, MARCH 13

8:30 a.m. CREA Sporting Clays Tournament 2025 Sarasota Trap-Skeet & Clays

1:00 p.m. iCE: Mastering Buyer Brokerage iOnline

FRIDAY, MARCH 16

8:30 a.m. CREA Marketplace Meeting tSouth

WEDNESDAY, MARCH 19

10:00 a.m. Stellar MLS Classes Assembling a Professional CMA tSouth

THURSDAY, MARCH 20

2:00 p.m. FOREWARN Training Online

FRIDAY, MARCH 21

8:30 a.m. CREA Marketplace Meeting tSouth

MONDAY, MARCH 24

2:00 p.m. HOA Panel tSouth

TUESDAY, MARCH 25

4:00 p.m. RASM After Hours tTBD

WEDNESDAY, MARCH 26

2:00 p.m. Spotlight on Dominican Republic tSouth

THURSDAY, MARCH 27

10:00 a.m. FIRPTA Fundamental for Realtors® NNorth

FRIDAY, MARCH 28

8:30 a.m. CREA Marketplace Meeting tSouth

MONDAY, MARCH 31

9:00 a.m. Home Sweet Homestead Exemption: All the Beautiful Benefits tSouth

FRIDAY, APRIL 4

8:30 a.m. CREA Marketplace Meeting tSouth

9:30 a.m. iCE: Preparing a Listing Contract iOnline

WEDNESDAY, APRIL 9

1:30 p.m. Fair Housing: Be the Change NNorth

FRIDAY, APRIL 11

8:30 a.m. CREA Marketplace Meeting tSouth

MONDAY, APRIL 14

8:00 a.m. GRI 201 (Day 1 of 2) NNorth

TUESDAY, APRIL 15

8:00 a.m. GRI 201 (Day 2 of 2) NNorth

FRIDAY, APRIL 18

8:30 a.m. CREA Marketplace Meeting tSouth

FRIDAY, APRIL 25

9:00 a.m. 2025 RASM FIRE Conference & Expo Marriott Palmetto Resort & Spa

MONDAY, APRIL 28

9:00 a.m. Commercial Core Law tSouth 1:30 p.m. Power Investing tSouth

WEDNESDAY, APRIL 30

8:30 a.m. GRI 202, (Day 1 of 2) tSouth

THURSDAY, MAY 1

8:30 a.m. GRI 202, (Day 2 of 2) tSouth

Registration is requested. See event calendar at: myrasm.com/calendar

CALENDAR KEY:

South 2320 Cattlemen Road, Sarasota, FL 34232 North 2901 Manatee Ave W, Bradenton, FL 34205 Hybrid Class offered online or at specified location. Online Class is only offered through webinar. Other Class or event is offered off site.

Learn more at myrasm.com/calendar to register.

Tues., Mar 4 - Wed., Mar 5 9:00 a.m. - 5:00 p.m. [ South ]

Complete your 14 hours of continuing education for license renewal in this two-day class. The session includes 3 hours of Core Law, 3 hours of Business Ethics, and 8 hours of Specialty Credit. Attendance on both days, September 4 and 5, from 9 a.m. to 5 p.m., is required to receive credit. Members $89. 14 CE HRS.

DAMAGE & PROPERTY LAW: WHAT REALTORS® NEED TO KNOW

Thursday, March 6 1:30 p.m. - 3:00 p.m. [ South ]

Join us for a panel discussion on key legal issues following hurricanes in Florida, including property insurance claims, contract disputes, landlord-tenant matters, and real estate professionals’ responsibilities during recovery. Hear from legal experts and industry leaders as they share strategies to navigate poststorm challenges and support your clients effectively. Members free. Non-CE.

Tuesday, March 11 9:00 a.m. - 12:00 p.m. [ South ]

Wednesday, April 9 9:00 a.m. - 12:00 p.m. [ North ]

This New Member Orientation session is REQUIRED for new Realtor® members and serves as an introduction to the REALTOR® Association of Sarasota and Manatee. This 3-hour class covers key membership benefits and useful resources! Members free. Non-CE.

Tuesday, March 11 1:30 p.m. - 3:30 p.m. [ South ]

Wednesday, April 9 1:30 p.m. - 3:30 p.m. [ North ]

This class provides real estate professionals working in today’s diverse real estate environment with the knowledge and information they need to understand the importance of fair housing laws and ensure they are responsibly practicing real estate in a nondiscriminatory fashion. Members $10. 2 CE HRS.

Wednesday, March 12 9:00 a.m. - 12:00 p.m. [ South ]

A real estate contract, by definition, is a legally binding document between parties, that states the terms and conditions of the purchase and sale of real property. A real estate contract is also known as a real estate purchase and sale agreement, and standardized documents that have been approved by the Florida Association of Realtors and the Florida Bar, are generally used. In this class students will be introduced to the basic elements of a real estate contract. Members free. Non-CE.

Thursday, March 13 1:00 p.m. - 5:00 p.m. [ Online ]

This course teaches real estate professionals how to advocate effectively for buyer clients. It covers how to communicate your value, understand legal and ethical duties, align client goals with yours, and provide customer service standards. It also explores compensation options and post-settlement protections, helping you become a trusted buyer’s broker. Members $15. 4 CE HRS.

Monday, March 24 2:00 p.m. - 4:00 p.m. [ South ]

Join us for an interactive panel discussing Homeowner’s Associations and Condominium Associations and their involvement and impact on your real estate transactions. Hear from industry professionals about how they handle association related matters ranging from obtaining documents, complying with the requirements of the HOA and Condo Rider, buyer approvals to ensure smooth transactions and efficient closings. Learn the best practices and gain guidance on how best to advise buyers and sellers as they navigate the contract and closing process when an association is involved. Members free. Non-CE.

Wednesday, March 26 2:00 p.m. - 4:00 p.m. [ South ]

Explore the Dominican Republic’s history, traditions, and real estate market in this insightful session. Learn how to collaborate effectively with Dominican Republic agents and clients, and hear from a panel of international experts. The event will conclude with a wine and cheese networking session. Free for GBC Members and Webinar / $25 Non GBC Members (includes membership for the remainder of 2025). Non CE.

UPCOMING CLASSES CONTINUED

Learn more at myrasm.com/calendar to register.

Thursday, March 27 10:00 a.m. - 12:00 p.m. [ North ]

Join us for an essential class on the Foreign Investment in Real Property Tax Act (FIRPTA) tailored specifically for realtors. This course covers everything you need to know, including obtaining ITINs, completing buyers’ affidavits, understanding the responsibilities of both buyers and sellers, navigating IRS timelines, and much more. Gain the confidence to guide your clients through FIRPTA transactions with ease. Members $5. 2 CE HRS.

Monday, March 31 9:00 a.m. - 11:00 a.m. [ South ]

In this one-of-a-kind seminar, Board-Certified Real Estate Attorney Ned Hale will break down the homestead tax benefit, covering everything from initial qualification to Save Our Homes and portability. He will also explain how homestead protection shields homeowners from forced sales by outside creditors, a key factor in Florida’s reputation as a debtor-friendly state. Members $10. 2 CE HRS.

Mon., Apr 14 - Tues., Apr 15 8:00 a.m. - 5:30 p.m. [ North ]

With over a million real estate licensees in the U.S., effective personal promotion is a necessity. In GRI 201, you’ll learn to create a lasting promotion plan, master sales and marketing strategies, and refine listing presentations. The course also covers key tax considerations in real estate. Members $66. 15 Hours of Broker Post Licensing(PL) credit for broker licensees in their first license cycle, or 8 hours of Continuing Education(CE) Specialty credit.

Monday, April 28 9:00 a.m. - 12:00 p.m. [ South ]

This class fulfills the Core Law FREC State requirement. The Florida Legislature passes and amends real estate laws and rules each year. Learn the changes to state and federal real estate license laws asnd rules. Gain a brief overview of commercial transactions vs. residential; discuss both commercial real estate agreements, and legal issues unique to commercial transactions. Members $15. 3 CE HRS.

Wed., Apr 30 - Thurs., May 1 8:00 a.m. - 5:30 p.m. [ South ] In GRI 202, Technology Tools and Resources will provide you with the technology knowledge and services that will make you stand out from the competition. The Investment portion provides an introduction to investment real estate, real estate terminology, taxation, and principles of investing. Members $66. 15 Hours of Broker Post Licensing(PL) credit for broker licensees in their first license cycle, or 8 hours of Continuing Education(CE) Specialty credit.

These MLS required classes will now be available exclusively online: MLS Basic, MLS Compliance 101, and MLS Adding & Editing Listings. These are self-paced online classes avaialable at learn.stellarmls.com

We’re excited to introduce a new opportunity to make the most of your Stellar learning experience at RASM: “Open Door Q&A” – a dedicated time for personalized guidance and answers to all your questions after class!

After select classes, we’re opening up the floor for an informal and interactive Q&A session. Think of it as a modern twist on “office hours.”

Get personalized help with class concepts

Ask questions about tools and resources

Learn which Stellar classes and training programs can take your skills to the next level

No registration required - just show up with your questions and curiosity! We can’t wait to see you there!

WEDNESDAY, MARCH 19

10:00 a.m. New Subscriber Series 1 & 2 NSouth 1:00 p.m. New Subscriber Series 3 & 4 NSouth 2-4:00 p.m. Open Door Q&A NSouth

WEDNESDAY, APRIL 16

10:00 a.m. New Subscriber Series 1 & 2 NNorth 1:00 p.m. New Subscriber Series 3 & 4 NNorth 2-4:00 p.m. Open Door Q&A NNorth

WEDNESDAY, MAY 21

10:00 a.m. Realist: Public Records and Reports South 12-2:00 p.m. Open Door Q&A South

WEDNESDAY, JUNE 18

10:00 a.m. Realist: Public Records and Reports NNorth 12-2:00 p.m. Open Door Q&A NNorth

WEDNESDAY, JULY 16

9:30 a.m. Buyer Agent Series 1 & 2 South 11:00 a.m. Buyer Agent Series 3 & 4 South 12-2:00 p.m. Open Door Q&A South

WEDNESDAY, AUGUST 20

9:30 a.m. Buyer Agent Series 1 & 2 NNorth 11:00 a.m. Buyer Agent Series 3 & 4 NNorth 12-2:00 p.m. Open Door Q&A NNorth •

By: Jessica Montague, Member Services Director

Lisa Hendrix, Fine Properties

Jessica Dawn Hoeper, LPT Realty

Catherine Aganmayo, Keller Williams On The Water

Andrew Brett Augenstein, EXP Realty LLC

Jeffrey Paul Aumiller, Realty One Group MVP

Alexandra Patricia Azar, Fine Properties

Roxanne Baliman, Marcus & Company Realty

Roger Peter Barnaby, Realty One Group MVP

David Peter Barr, Berkshire Hathaway HomeService

Bassil L. Bassil, RoseBay International Realty, Inc.

Karen Ann Baumgardner, Vue Realty, LLC

Christina Bernhart, Regal Touch Realty Inc.

Courtney Bishop, Preferred Shore LLC

Eric Thomas Bolen, EXP Realty LLC

Traci Bolen, EXP Realty LLC

Jessica Brown, Dalton Wade Inc.

John Castanio, KW Coastal Living II

Jordan D. Chancey, Matthew Guthrie and Associates Realty LLC

Malcolm Chase, Michael Saunders & Company

Stephenie H. Chopek, Charles Rutenberg Realty Inc.

Christine Claxton, Marcus & Company Realty

Carolyn A. Codella, Wagner Realty

Thomas Frank Crone, White Sands Realty Group FL

William Thomas Cunningham, Realty One Group MVP

Keith M. Curtis, Serhant

Amber Blue Delbaugh, Florida Life Team LLC

Richard J. DeVita, The Keyes Company

Patrice DiZebba, McWilliams/Ballard Inc

Jennifer Dobreff, Coldwell Banker Realty

Chris Ekeberg, Marcus & Company Realty

Tina Ellis, Compass Florida LLC

Carminia Lim Escueta, EXP Realty LLC

Rebecca Anne Ferrando, The Keyes Company

Timothy C. Fink, Platinum Real Estate

Jennifer P. Flanders, Serhant

Brenda Selene Garcia Aguilar, HomeLife Realty

Coastal Proper

Oliver Giesser, Fine Properties

Caroline Fajstner Greenly, Nexthome Casa Bella Elite

Stacy Grillo, Preferred Shore LLC

Donna Marie Hartzler, RE/MAX Alliance Group

Kristina Hayden, Exit King Realty

Nicole Marie Hayden, Private Real Estate Collection

Mona C. Haymore, Alliance Group Limited

Brian Leigh Heavrin, Alliance Group Limited

Natalie Victoria Heil, Preferred Shore LLC

Stanley Heinlein, EXP Realty LLC

Pamela A. Hoidge, EXP Realty LLC

Michael Ryan Holt, Robert Slack LLC

Charlotte A. Humphrey, Corcoran Dwellings Realty

Sabrina Hurt, Fine Properties

Elise Monet Jakub, Marcus & Company Realty

Morgan T. Jones, Preferred Shore LLC

Megan Keilson, Preferred Shore LLC

Julie A. Kell, Coldwell Banker Realty

Joseph Kesslak, Coldwell Banker Realty

Wendy Lu Kesslak, Coldwell Banker Realty

Karinna Khokhlan, Preferred Shore LLC

Sonya Kis, Harbour Shores Realty

Roger Lee Konicke III, Real Broker, LLC

Svetlana Kraguljac, Florida Internet Realty LLC

Mark Labbato, EXP Realty LLC

Stephanie Lamb, LoKation

Jeannette Leon, Fine Properties

Patricia B. Leuallen, Wagner Realty

Daniel Vincenzo Lustro, EXP Realty LLC

Nola Christine Lyons, Coldwell Banker Realty

Olga Machefert, Preferred Shore LLC

Shana Kathleen Macri, Florida Attorney Realty Inc

Logan S. Malloy, Marcus & Company Realty

Melissa Mariano, Marcus & Company Realty

Christine Marion, Fine Properties

Natasha Lynn McCorley, Coldwell Banker Realty

Isabelle Glynn McHugh, Preferred Shore LLC

Tyrone Mclean, Dalton Wade Inc.

Greg Kirk McNeice, Coldwell Banker Realty

Manuel Mendez, The Real Estate Store

Mark Miller, Marcus & Company Realty

John C. Mooney, RE/MAX Alliance Group

Dylan Joseph Moore, Coldwell Banker Sarasota Cent.

Jason Moore, Michael Saunders & Company

Alexander M. Morel PA, Medway Realty

Javier E. Moret, EXP Realty LLC

Emme Morris, The Keyes Company

Kelli Kaye Movalson, Fine Properties

Alven Nguyen, Fine Properties

Ricardo S. Ortiz, Real Broker, LLC

Amy Lynn Palladino, Compass Florida LLC

Michael Anthony Panichelli, Preferred Shore LLC

Veronica Patti, EXP Realty LLC

Francisco J. Pena, Marcus & Company Realty

Luis Angel Piamba, Keller Williams On The Water S

RASM MEMBERS NOW WITH CONTINUED

Christine Pope, Michael Saunders & Company

Thomas R. Potter, Compass Florida LLC

Jeffrey Prater, Alliance Group Limited

Lydiette Quinones, Florida Life Team LLC

Anthony David Quirke, Dalton Wade Inc.

Sarah Reedy, Coldwell Banker Realty

Sara Rengifo Skopal, Beyond Realty LLC

Kendra Richardson, Preferred Shore LLC

Khory Richardson, RE/MAX Alliance Group

Brian Riggs, Fine Properties

Amy Rogers, Serhant

Cassandra Roznos, Marcus & Company Realty

Shauna Ruby, BlueSRQ Real Estate INC

Humdaan B. Saeed, KW Coastal Living II

Carlo Anthony Salerno, EXP Realty LLC

James P. Schmitt, Realty Hub

Cheri Scicchitano, Acropolis Realty Group LLC

Fred W. Sieger Jr, Compass Florida LLC

Whitney Silfies, Homes By Towne Realty Inc

Philippe Markes Sincere, Realty One Group MVP

Noreen Kathleen Slaalien, Compass Florida LLC

Shrvette Lechelle Small, EXP Realty LLC

Robert Sowul, Dalton Wade Inc.

Constantine Steve Stratos, Coldwell Banker Realty

Joseph M. Suarez, Compass Florida LLC

Rita L. Suarez, Compass Florida LLC

Sally Sweeney, Premier Sothebys Intl Realty

Angelic Tassos, Corcoran Dwellings Realty

Jason Torres, EXP Realty LLC

Gina Lee Treadway, Preferred Shore LLC

Aaron Van Hunt, Real Broker, LLC

Melissa Velez, LPT Realty

Christine Walker, Better Homes & Gardens Real Estate

Kasandra E. Wasylak, EXP Realty LLC

Sarah R. Whisnant, Matthew Guthrie and Associates Realty LLC

Coreen Wilde, Michael Saunders & Company

Dara Elizabeth Winters, EXP Realty LLC

Nadia Anac, 1ST Class Real Estate Gulf to Nina Becker, MavRealty

Griffin Michael Curtis, Curtis, Griffin Certified Appraiser

Brian Robert Govoni, HALLIDAY PROPERTIES (FLORIDA), LLC

Marcus Larrea, Palm Paradise Realty Group

Terry L. Millett, Gulf Shores Realty & Rentals

George Mitchell, Elliott Mitchell Real Estate

Annette Newkirk, HomeLife Realty Coastal Proper

Troy Nowak, Mangrove Bay Realty LLC

Patrick J. Quinlan, Harbour Shores Realty

Alex Eugene Rinehart, Barr Agency Real Estate

Peter C. Spinella, Peter C Spinella Licensed Real Estate Broker

Lawrence J. Vecchio, VRI Homes

Sallie Colaco Wagner, Keller Williams On The Water Sarasota

Paul Young, Young Real Estate

Sam Akmakjian, Anna Maria Island Beaches RE

Maria Baker Ballinger, KW Suncoast

Shelley Beauchemin, EXP Realty LLC

Jerome Begoske, KW Coastal Living II

Christopher Jordan Bolsinger, EXP Realty LLC

Shannon Book, Keller Williams On The Water S

Danielle Brown, Coldwell Banker Realty

Phillipa Jane Cannon, ELITE Properties LLC

Lesley Carpenter, Coldwell Banker Realty

John Westley Clayton, Preferred Shore LLC

Noah Collins, Coldwell Banker Realty

Stanley W. Colwell, Alliance Group Limited

Michele Lynn Conn, KW Coastal Living II

Ashley Louise Crawford, Epique Realty Inc

Keith E. Croteau, RE/MAX Trend

Eva Diana Daniel, Florida Capital Realty

Lawrence William Darby, Turner Real Estate Network

Sydney Davis, Real Broker, LLC

Kristen Dibella, Medway Realty

Erica Didiego, Preferred Shore LLC

Shaun Dove, Equity Central Florida RE. LLC

Angela Renee DuCharme, Marcus & Company Realty

Patrick Dunn, Michael Saunders & Company

Gina Ewan, INNOVATE Real Estate, LLC

Blade Joseph Feliciano, Fine Properties

Laura Ferrara, Michael Saunders & Company

James Austin Ford, Keller Williams On The Water

Brenda D. Fox, EXP Realty LLC

Erich Fuerbeck, Berkshire Hathaway HomeService

Luca Ghezzi, Keller Williams On The Water S

Oksana Glushko, Tamm Real Estate