Are

asking

right questions?

Have you ever met a business owner who didn’t want to improve their business?

magazine The independent news source for users of accounting apps & their ecosystems ISSUE 34

you

the

Xero PLUS MORELOADS FROM Connected Apps TUTORIALS CASE STUDIES INTERVIEWS NEW APPS NEW RELEASES COVER STORY

2 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems Trial Wo r k flo w M ax f ree f o r 1 4 d ays w o r k flo wm a x .c o m /s t a r t S u p e rc h a rge y ou r clients’ profitability with WorkflowMax Tr y th e e n d -to - e nd j ob m an a ge m e nt s o f t w a re that ove r 1 0,000 b usin e s s e s love .

We emp ower our c lien ts wi th technol ogy tha t drives tangib le impac t in their b usiness pe rf ormance and rea l-time un ders tanding f or ou r adviso rs. So fo r us , W orkfl ow Max was an ob vi ous choice when it came to smal l business job and prac tice managemen t.

Issue 34 / 3 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Boost the va lue of you r a dv iso r y bu s ines s an d ge t c e rt ifie d wo rkflo wma x .c o m/a dv is o r

Juliet Hyatt-Brown from Lautrec Consulting Engineers work with WorkflowMax implementation partner Josh Licence from BlueRock Digital Juliet Hyatt-Brown Lautrec Consulting Engineers

J

os

h

Licenc e BlueRock D igi ta l

Issue 34

Main Contacts -

CEO: David Hassall (Co-Founder)

Managing Editor: Wesley Cornell (Co-Founder)

Director of Strategic Partnerships: Alex Newson

Design & Communications

Manager: Bethany Fulks

Creative Assistants: Hebe Vermeulen, Robyn Consterdine

Editorial/News Submissions:

If you have any editorial content (news, comment, tutorials etc.) that you would like us to consider for inclusion in the next edition of XU Magazine, please email us at editorial@xumagazine.com

Advertising: advertising@xumagazine.com

E: hello@xumagazine.com

W: www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2023. All rights reserved. No part of this magazine may be used or reproduced without the written permission of the publisher. XU Magazine is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, Merseyside, L3 4BN, United Kingdom. All information contained in this magazine is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine cannot accept any responsibility for errors or inaccuracies in such information. If you submit unsolicited material to us, you automatically grant XU Magazine a licence to publish your submission in whole or in part in all/ any editions of the magazine, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in XU Magazine are not necessarily the views of XU Magazine Ltd, its

4 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems magazine

editors or its contributors. The independent magazine for Xero users, by Xero users 8 COVER STORY Castaway Forecasting Are you asking the right questions? 12 Billhop The Business Case for Credit Cards 14 Appogee HR Is your company giving away too much ‘free’ work? 18 Circit Verified Analytics: The potential of automated data matching 22 SeedLegals Tired of saying, ‘We can’t help you with that’? 26 NextMinute 5 Things you should know about your Residential Construction Clients 28 ApprovalMax Streamline your audits with approval automation: how ApprovalMax can help 32 WhisperClaims Could there be a smarter way to prepare R&D tax claims? 34 Capitalise How to protect your clients balance sheets in 2023 38 FuseWorks Sign Here, There and Everywhere. FuseSign Takes Digital Signing for Accountants Global 42 GoProposal by Sage How to be the most valuable accountant 44 Bright What do your clients need right now? Welcome to issue 34... 48 INTERVIEW Futrli Q&A with Helen Cockle, Chief Operation Officer or Futrli 52 Accountex Australia Accountex Australia, a new type of finance event 56 HR Partner Make Recruiting Easy! 60 Dext 2023: The Year of Accounting Automation Join our newsletter for regular updates and also be one of the first to know when a new issue of XU Magazine is released. xumagazine.com STRAIGHT TO YOUR INBOX! 8 52

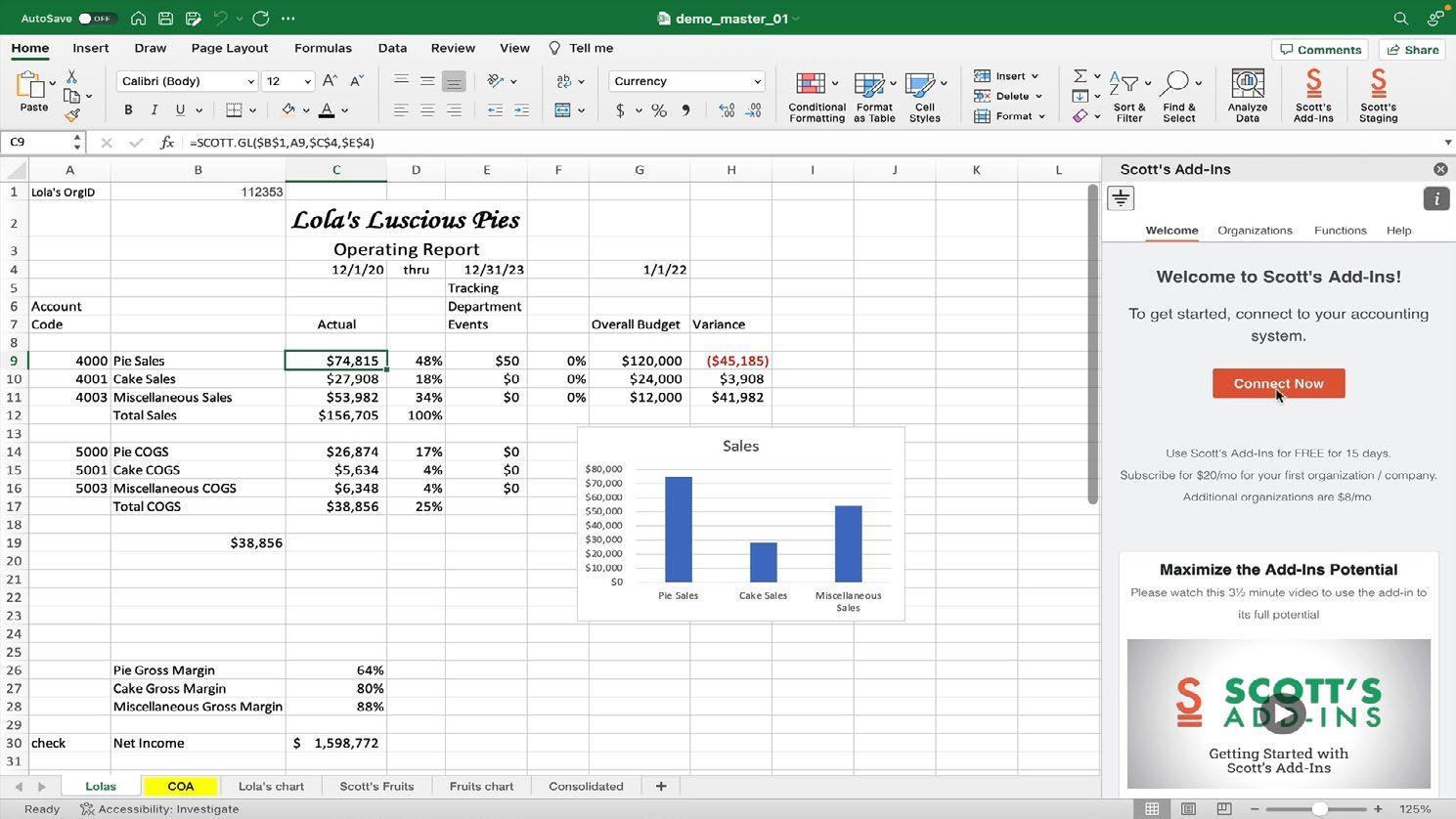

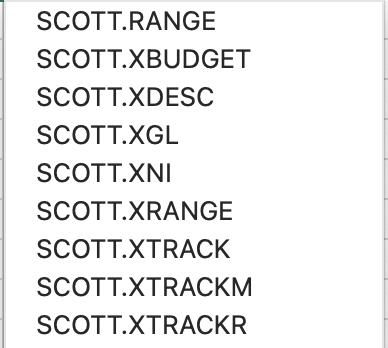

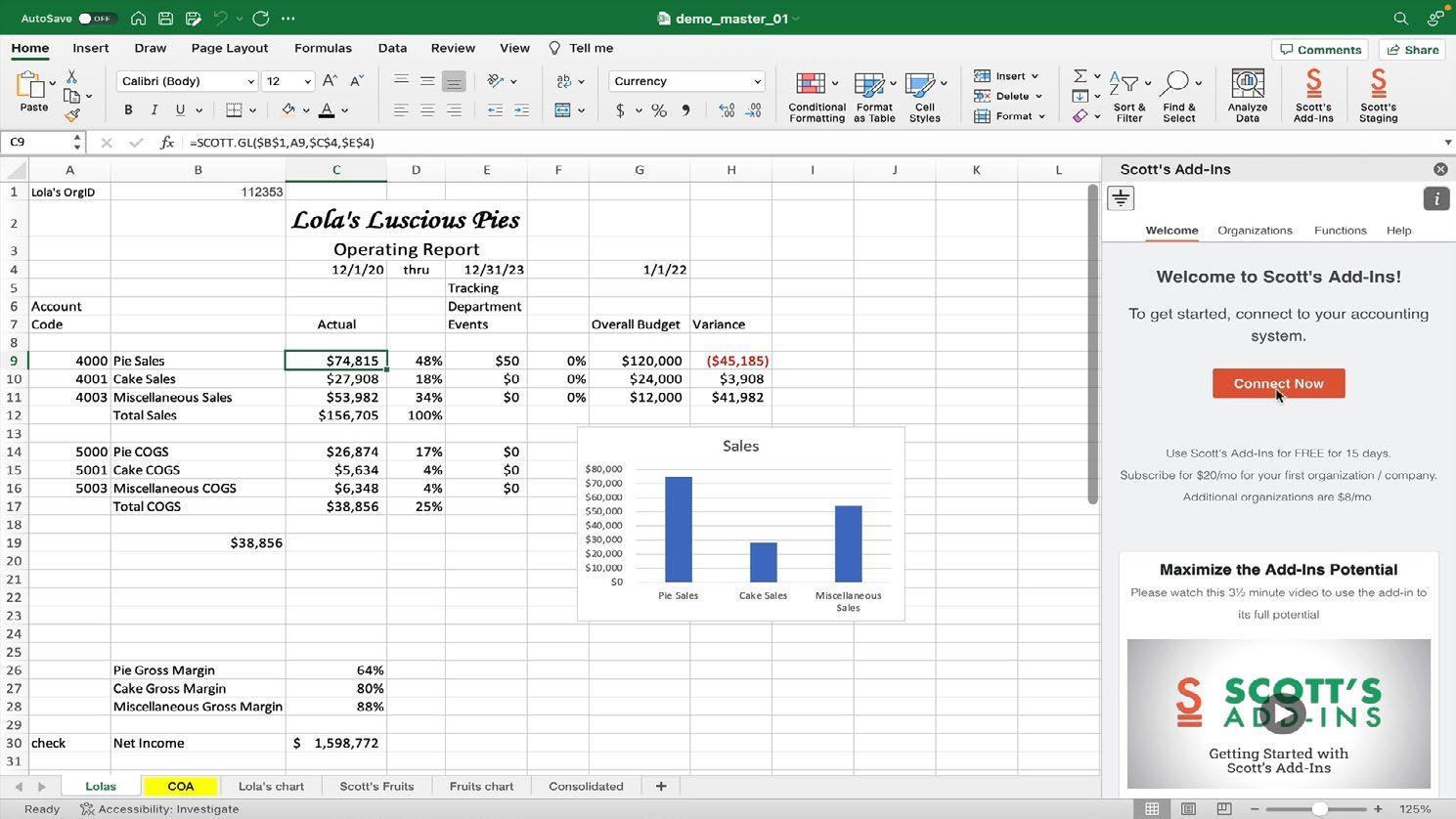

Issue 34 / 5 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine INTERVIEWS... 62 Spotlight Reporting How to choose a virtual CFO in 2023 68 Tidy How Sunshade Hadles the Head of Business 72 AutoEntry by Sage Making Tax Detail: What now? 76 Aider Aider Advisory Software - helping accountants simplify compliance & scale advisory 80 Datamolino Five reasons to help convince your paper-loving clients to digitise their bookkeeping 84 Joiin Expect more from your software 88 SuiteFiles Client collaboration 92 Tall Emu Automate, Integrate and Accelerate with Tall Emu + Xero 96 Wolters Kluwer Tax & Accounting UK Data Privacy Day: Modern accountancies reap the rewards of responsible data practice 98 AdvanceTrack Glancing backward, looking forward DID YOU KNOW? Look out for any article that shows the CPD Certified logo. It has been approved to count towards your CPD points! XU are now a CPD Corporate Member We have been working closely with the CPD Certification Service to have our articles CPD Certified. As you are reading through the magazine any article that shows the CPD Certified logo has been approved to count towards your CPD points. We are really excited to have been able to secure this for our readers as it means all approved articles can now be used towards your CPD points and building up your CPD register. 102 Wolters Kluwer AsiaPacific What’s the right practice management software for your firm? 106 INTERVIEW Institute for Certified Bookkeepers UK Q&A with Ami Copeland, Chief Executive Officer of ICB UK 112 ExpenseOnDemand How to maximise value from your business tech 118 Scott’s Add-ins The Riches in Niches Helen Cockle Futrli, Chief Operation Officer 48 Ami Copeland ICB UK, Chief Executive Officer Michael Ford Castaway Forecasting, Founder & CEO 98 92 106 134

116 ApprovalMax 10 expert tips for preventing Accounts Payable fraud

118 Institute for Certified Bookkeepers Australia Professionalism is Everybody’s Business

120 UPDATES FROM XERO

130 NEW TO THE XERO APP MARKETPLACE

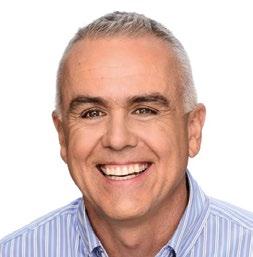

134 INTERVIEW Castaway Forecasting Q&A with Michael Ford, Founder & CEO of Castaway Forecasting

138 EVENTS Accountex Visitor registration opens for Accountex London 2023

142 FOCUS: MENTAL HEALTH Tips for Managing your Wellbeing in 2023

146 UPDATES & NEW RELEASES

148 EVENTS Accounting & Finance Show Asia Bigger and better in 2023!

150 CLASSIFIEDS

153 XERO APP PARTNER OF THE MONTH

154 WOMEN IN ACCOUNTING

2023 Women in Accounting awards open to recognise top 50 changemakers in the industry

156 AND FINALLY... A personal note to say hello from Sukhinder Singh Cassidy, CEO of Xero

6 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems

Upcoming...

138

118 156

Accountex London

Visitor registration opens for Accountex London 2023

Track all items in your inventory and reduce costs of replacing lost, damaged, stolen and out-of-date stock

Issue 34 / 7 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine LOST

1. Low Stock Alert 2. Purchase Order 3. Receipt of Stock 4. Automatic Stock Level Update 5. Sell Stock Batch & Assembly Tracking Real-Time Inventory Control Costs Track batches of materials and associated information for detailed traceability and control Real-time inventory Dashboard shows what’s ready to sell and parts and materials available to fulfil orders

Start your 21-day FREE trial today! tidyinternational.com/trial

STOCK End-to-End Visibility

= LOST PROFIT

Cover Story This article is

Are you asking the right questions?

Have you ever met a business owner who didn’t want to improve their business?

ntrepreneurs are driven by ‘the itch’. If you’ve felt it yourself, you know exactly what I mean. It’s that innate gnawing, discomforting feeling that comes from a deep, and often lifelong, conviction that there has to be a better way. The itch is never far away - it lives in your head, distracts your thoughts, nags at you. I’m no psychologist, but to me the itch is as deep as DNA. It’s not a learned behaviour, so it can’t be ‘unlearned’. There is no escape.

Entrepreneurs start businesses because the itch gets too much. They resist it, they damp it with logic, they try to ignore it, but it never goes away. As time goes on, it intensifies. Finally, they are compelled to do something about it.

The caricature view of the entrepreneur as a risk-taking, slick-talking hustler could not be further from the truth. The real entrepreneurs, the ones that you and I work with, are just people doing everything they can to scratch their itch. And no matter where they are in the world, no matter what industry their business serves, no matter what

age, sex, creed or colour, the itch, the belief, the drive to find a better way is exactly the same.

They can see the path ahead. They can see the forks in the road, the options, the decision points. And they need help to work out which way to go.

At Castaway, every day we talk to entrepreneurs and to the accountants who look after them. Our customer base is split evenly, so we get a healthy range of views from both perspectives.

The Entrepreneurs tell us they see the services their accountants provide on 3 levels:

1. They appreciate the compliance work that keeps their business on the right side of the law

2. They value the work that supports and sustains the business (bank loans, grants and the like)

3. They love the work that helps unlock the possibilities of the business (scratching the itch)

It should be no surprise that their level of ‘excitement’ about the fees they pay follows the same order.

Michael Ford, Founder & CEO, Castaway

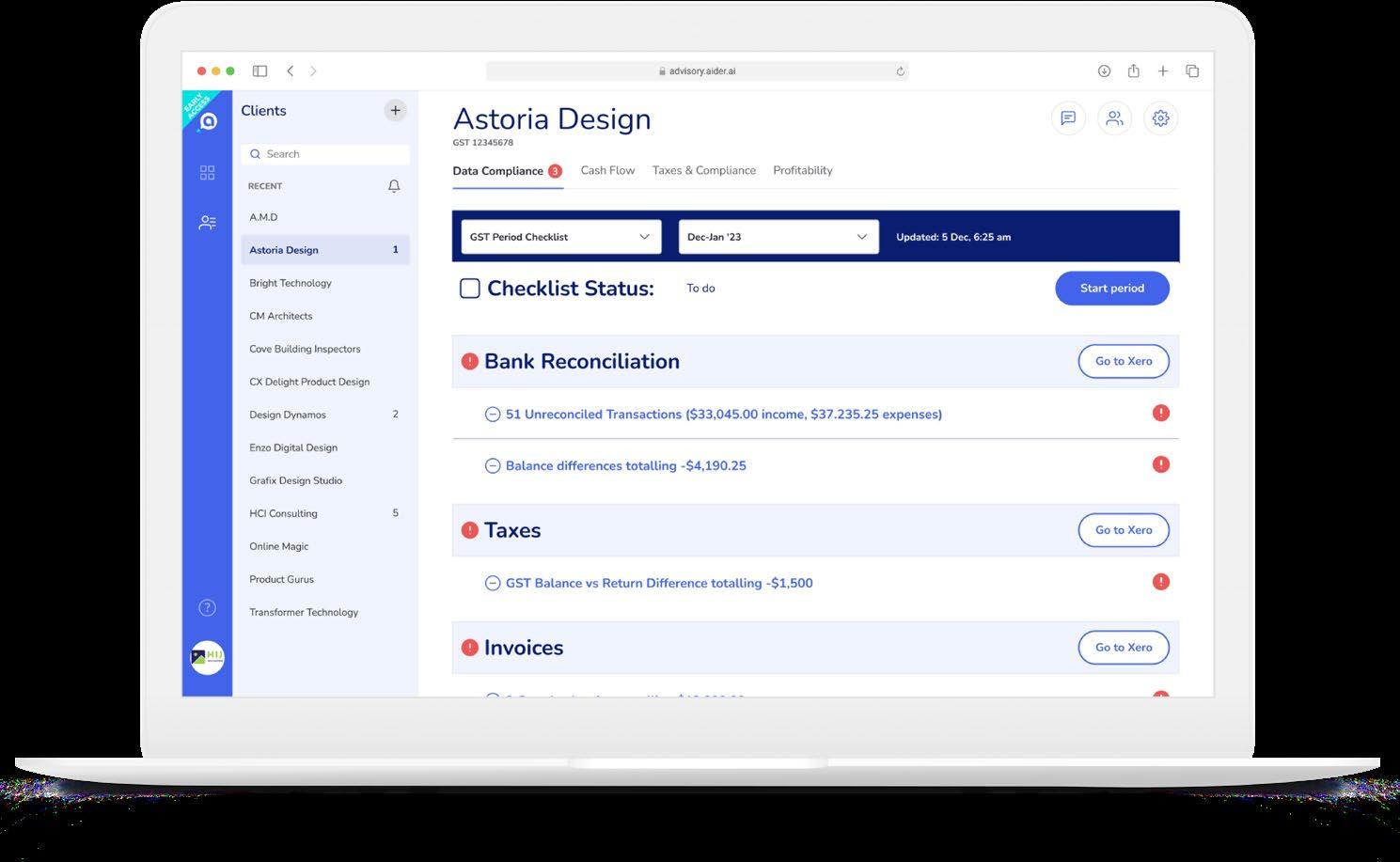

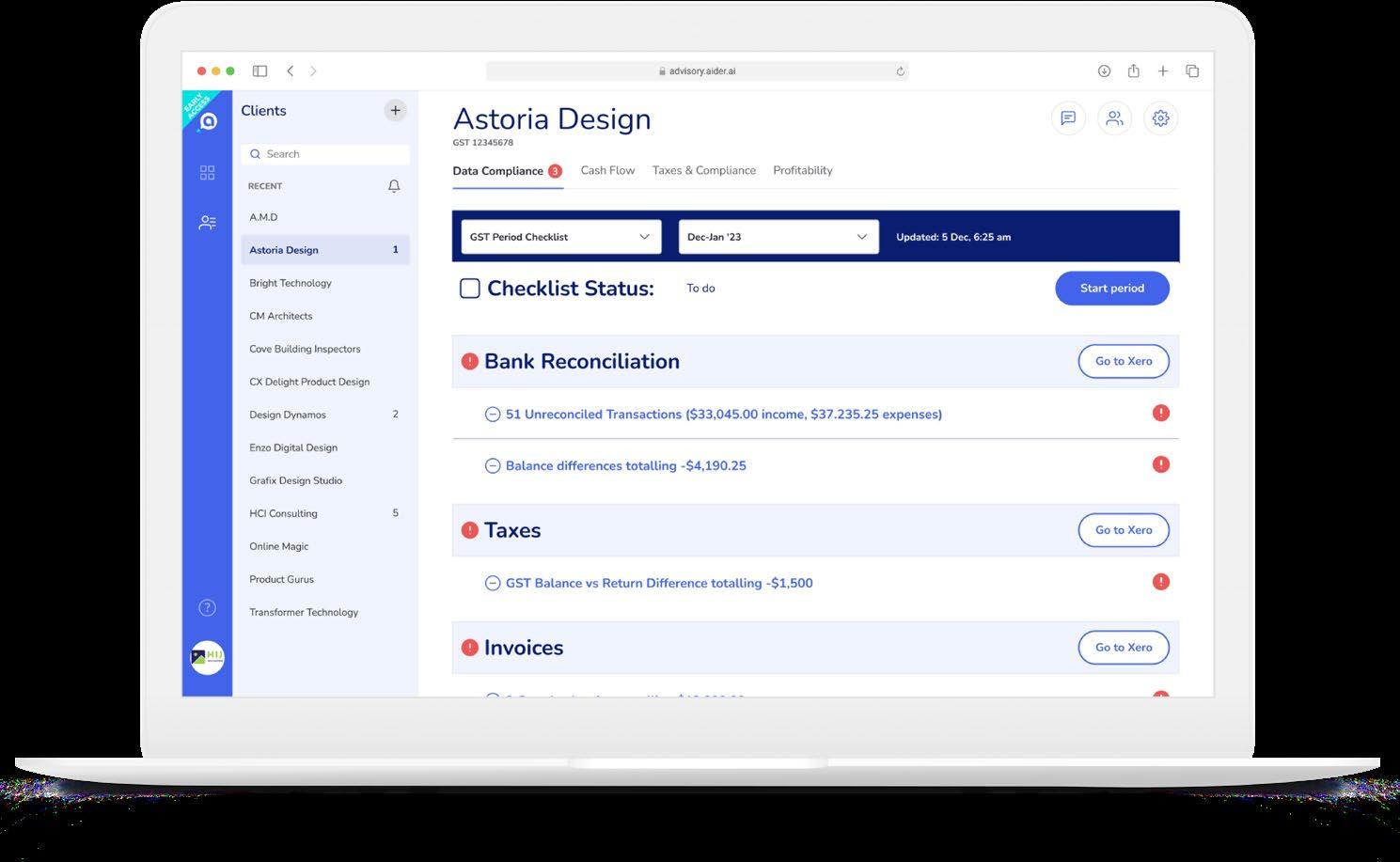

Forecasting

Michael Ford is a lifelong entrepreneur with the battle scars to prove it. After 12 years with KPMG & PwC, Michael started his first business. Since then, he’s worked with thousands of businesses, built his own businesses, & founded Castaway, the most powerful business forecasting & modelling software on the market. Michael is a soughtafter thought-leader on the art of growing businesses. Michael is a published author, currently writing his next book. A keen road cyclist, Michael rides more than 10,000km per year, training to support Tour de Cure Australia.

The Accountants we talk to tend to fit into one of 3 categories:

1. A few tell us “my clients just don’t need that sort of stuff”

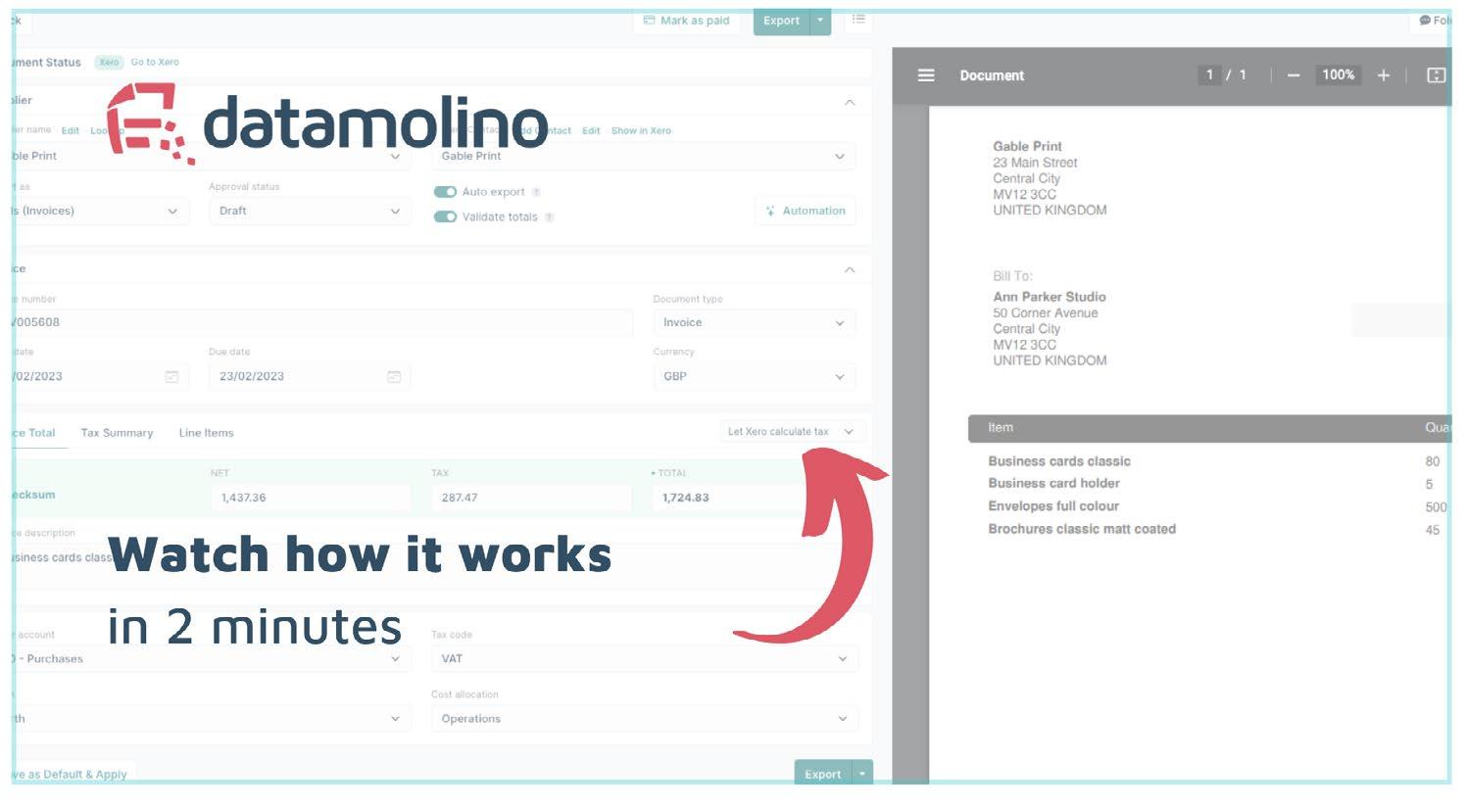

2. Some say they build budgets and forecasts when clients ask for them

3. For others, forecasting is the backbone of their advisory practice. Clients love the work they do and happily pay their fees

To the first group… who knows, they may well be correct. But if there’s even one entrepreneur on the client list, I guarantee that firm is not asking the right questions.

When we dig deeper with the second group, their focus is generally the entrepreneur’s second level of satisfaction, the sustaining and supporting work like applying for bank loans and grants, churning out annual budgets and the like. Although the demand generation is reactive, this work is useful for clients and can be readily systemised and productised into a profitable service… definitely a win-win.

The third group are different. They work differently, they think differently, they talk differently.

Issue 34 / 9 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine @CAForecasting

Cover Story

E

Cont...

And they get different results for clients. By different, I mean better… much better. Of course, the question of “how” they are different has a hundred answers.

One thing stands out for me. The third group have gone beyond forecasting as a maths exercise focused on putting numbers on a page. They’ve evolved to embrace the idea of forecasting as a framework for exploring what is possible. This is a big step, in both mindset and methodology. They’ve found the holy grail - a way to help their entrepreneur clients scratch the itch, a way to help those entrepreneurs unlock the possibilities in their business.

It’s a simple idea, but it’s counterintuitive, especially for firms with strong compliance-based business models, where efficiency and capacity utilisation are the traditional optimisation tools.

But it’s also entirely intuitive. Clients perceive the greatest value when you help solve their biggest, most annoying problems. And for an entrepreneur, the ‘itch’ is the most significant long term problem there is. And forecasting, the process of looking ahead, considering scenarios, facing realities, game-planning responses, making decisions, is the best framework I know for unlocking possibilities, for finding solutions to the itch.

So how do the third group of accountants start the conversations with their clients? How do they build the interest? How do they get the clients to happily agree to engage them?

Well, the good news is we’ve seen lots of different approaches… and they all work very well. It’s a matter of finding something that

works for you. If you’re looking for somewhere to start, here’s a simple 3-step approach that involves zero selling, but is highly effective at unlocking possibilities for both you and your client.

1. Find the itch

Here’s an idea. Find a client. Take them to coffee, or to lunch, or just have a call. With genuine interest, ask 3 questions:

1. Why did you start this business?

2. What were your dreams for the business back then?

3. How have those dreams changed?

You’re looking for the itch.

Given the chance, and an engaged audience, most entrepreneurs love talking about their business. Some will open up immediately, the ideas and stories will just start flowing. For others, the conversation might take some time to get rolling.

If you’ve been in business a while, the daily grind, decision fatigue, pandemics and other challenges can wear you down … its all too easy to forget (or suppress) the original dreams for the business. In this situation, be patient and nurture the conversation. The memories will start to come back, a trickle at first and then more. Keep at it and you’ll see the imagination spring to life and the ideas start to flow. That’s the itch firing up again … it never goes away.

2. Run a Possibilities session

It’s not a strategy conversation. It’s not a business planning session. It’s not a SWOT session. It’s not even a forecasting discussion.

It doesn’t need to be complicated,

or deep, or detailed.

Grab a napkin or a sketchbook or a scrap of paper. Find a stack of post-it notes and some coloured markers. This is lo-fi design. We keep it plain and simple because the tactility, colour and physical movement all seem to help people access better ideas.

It’s a possibilities session. It’s about tapping into the itch, unlocking the possibilities that exist in the business and in the entrepreneurs’ mind. You don’t need to know all the answers, just the right open questions. Here’s a few ideas to get you started:

• If money were no issue, what would you change in the business?

• If you were a competitor, how would you compete against the business you run today?

• If someone gave you 50k to invest in your business (or pick an appropriate figure), what would you do with it?

• What stresses you or frustrates you about the business?

• If you could start this business again today, would it look any different?

• How would you double the size of this business? How would you halve it?

• What projects would you like to do in the business?

As the ideas come out, jot each one down on a sticky note. Use mind-maps, flow charts or create your own method to dig deeper or expand the thoughts into something more fully formed. Whatever it takes, capture the ideas and don’t interrupt the flow.

We do this at Castaway. Every time, we come away with enough ideas to fuel dozens of internal projects.

10 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems Cover Story

Join our newsletter for regular news updates and also be one of the first to know when a new issue of XU Magazine is released. xumagazine.com STRAIGHT TO YOUR INBOX!

3. Rough out a roadmap

On a whiteboard, a glass window, or a big sheet of paper, make a timeline. Create 8 columns along a line, one for each of the next 8 quarters. If it’s a fast-growth business, change that to 8 months. Or make it whatever time interval suits you best.

Now grab the sticky notes full of ideas from the Possibilities session and start adding them to the time that makes most sense. This process is iterative and will trigger discussion on priorities, constraints, dependencies. It will likely spark more ideas too, so keep some blank sticky notes handy.

You might find as you work through the process that several alternate paths open up. They might arise from different options for priorities, or be pointed at different objectives, or different resource and staffing needs. This is exactly what you want. These

are key decisions and you now have the chance to make them consciously, with intent. This is a much more powerful outcome than letting the business just keep rolling along.

Connecting the roadmap to the forecast

Once the roadmap is done, you can proceed to build a forecast. Or forecasts, if there are still several roadmaps on the table. Like all forecasts, this also ends up as a bunch of numbers on a screen. However, it is so much more than the ‘fun with maths’ forecasts we talked about earlier. This forecast is now built from the roadmap you helped design for the business. Every number is part of the story of the business. And the story of the business is now designed to scratch the itch. It matters.

And when you come to compare actual performance against the forecast, the variances mean

something. When the actual results are different to what you expected to happen, there’s great value in the discussion. What worked? What didn’t? What should we do more of, less of? How should we refine our approach? The variance discussion is now the heart of a learning loop for the business.

And the best thing? You never run out of things to talk about. And the conversation is always about how you are creating value by helping the entrepreneur unlock their possibilities. And that is what it takes to scratch the itch.

To find out more about Castaway Forecasting visit our website: castawayforecasting.com

Issue 34 / 11 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Cover Story

FIND OUT MORE...

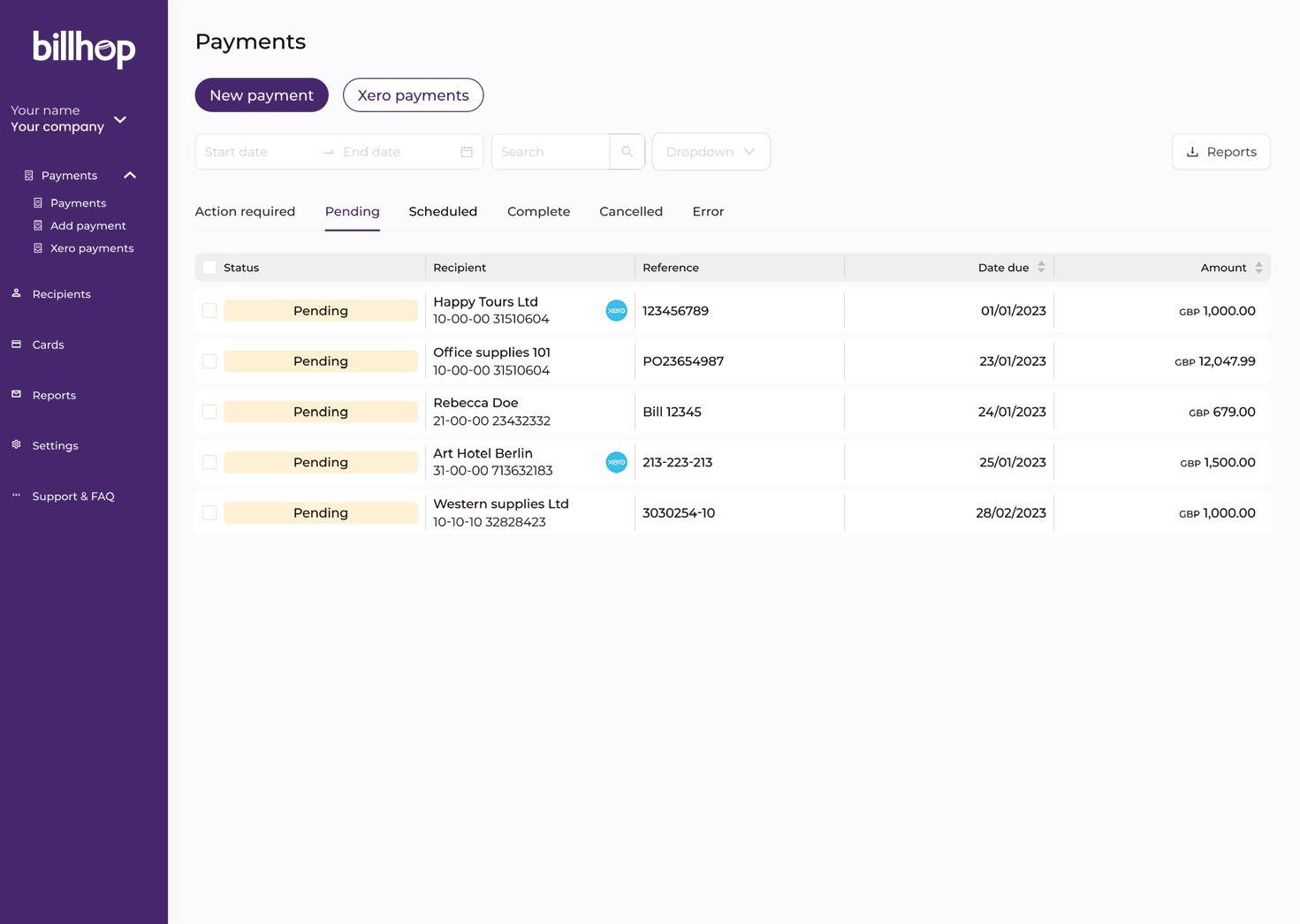

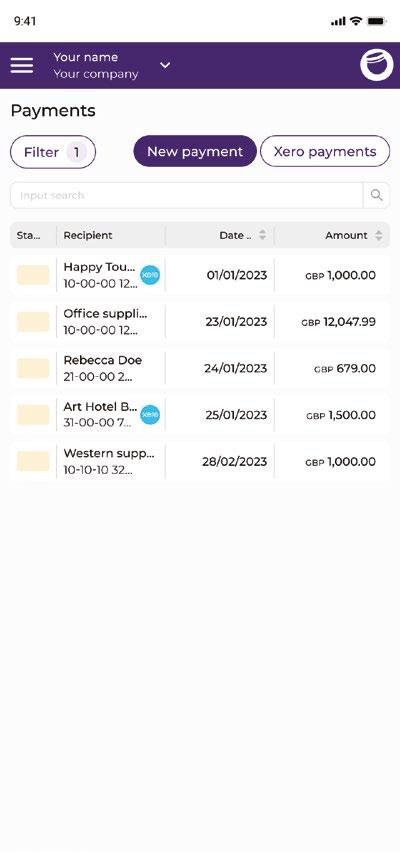

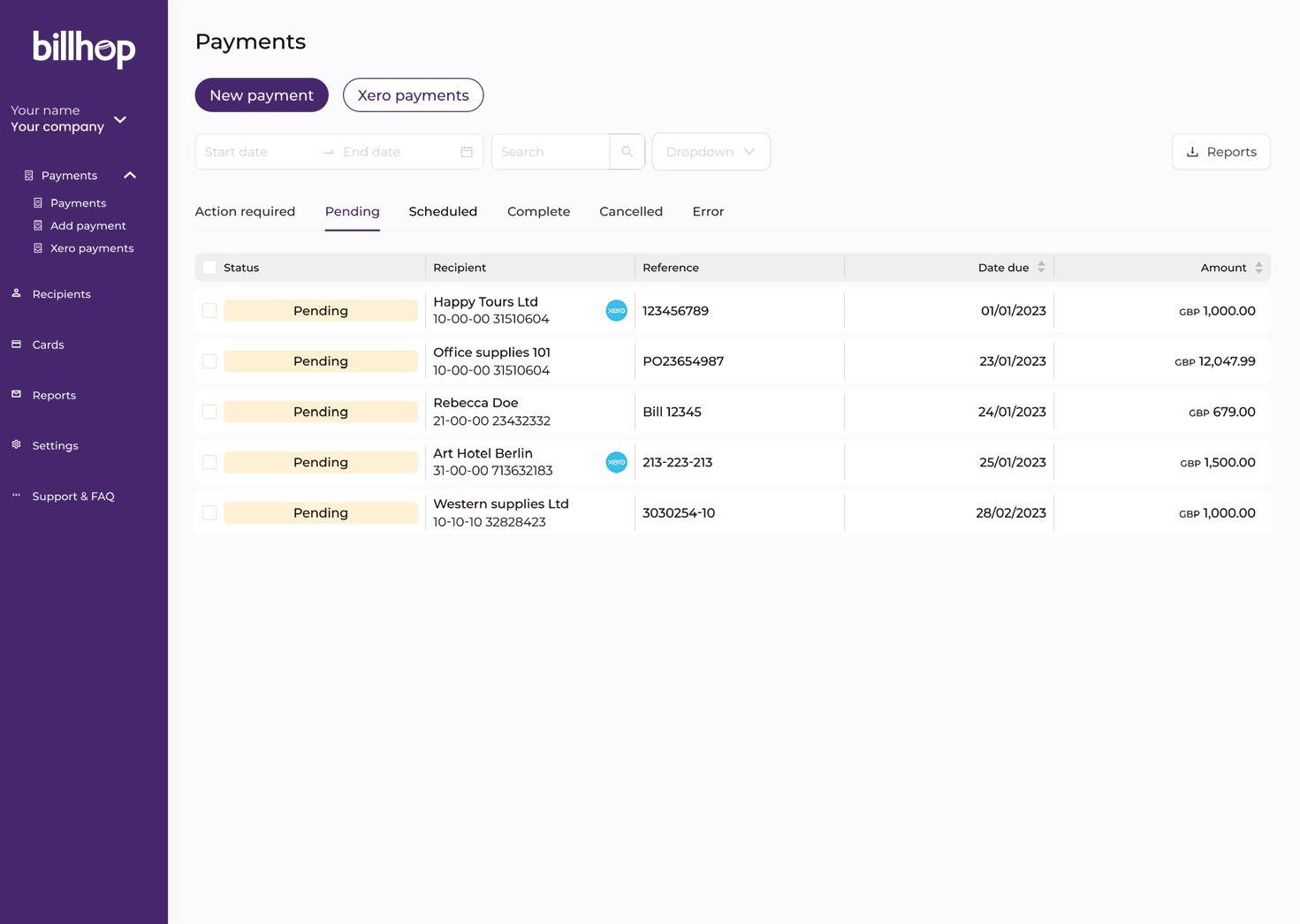

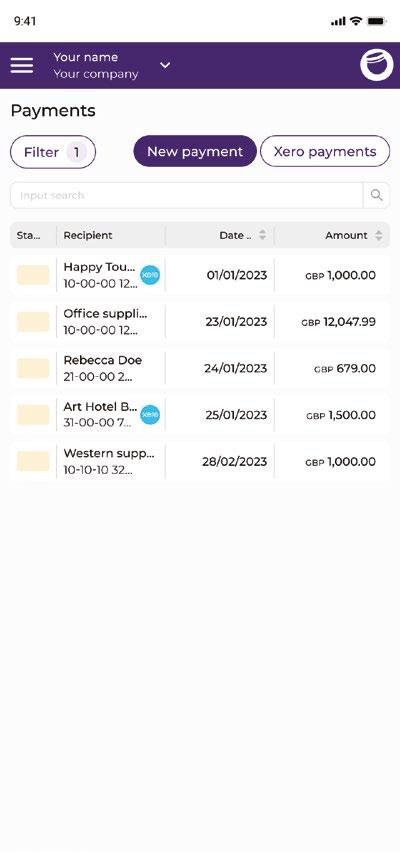

The Business Case for Credit Cards

When Staying Cash Positive is King

All business owners, regardless of their size and niche, know this: effective cash flow management is the cornerstone for the healthy growth of one’s company.

tarting a business is not for the faint-hearted. Let’s face it - the odds are unfavourably stacked against start-ups.

Unsurprisingly, the most cited reasons by business owners for seeing red on the balance sheet is the never-ending race to reduce the time between cash payables and receivables.

Without the resources and readily available working capital of larger corporations, small business owners are often left unmoored and isolated, with crushing debts and a mounting pile of unpaid bills.

The business case for credit cards

This is precisely where the use of corporate credit cards can provide an easy and elegant solution to help businesses improve their working capital and overcome liquidity shortages.

It essentially allows you to extend your payment time by syncing your bill payment dates with your card’s billing cycle.

Improving cash flow

A major rule of thumb for effective cash flow management is to preserve funds for as long as possible.

Thankfully, most major credit card issuers offer up to 55 days of interest-free payment period. This means that you can hold on to your cash longer without having to pay out of pocket to cover costs while waiting to get paid by your customers.

Paying by credit card is especially useful for unexpected expenses or larger tax bills. It is a convenient and readily available means to spread the cost of your financial strain over a longer period.

Plus, paying suppliers on time or even earlier with business credit cards can place you in their good graces. This can position you to negotiate more favourable payment terms.

Low card acceptance rates

Using credit cards to postpone payment dates seems like

Giorgio Giurdanella, Managing Director, Billhop UK

Giorgio is the managing director at Billhop UK. He has over 15 years of experience in various roles that span across card issuing, transaction processing and B2B payments. Giorgio’s rich background in seeing projects through from implementation to commercialisation gives him in-depth knowledge about consumer’s pain points within the B2B sphere and how best to tackle them.

the natural solution to many companies’ liquidity flow predicament. So why aren’t more businesses paying their suppliers with credit cards?

As it stands, there is £100 trillion worth of untapped cash within the B2B market for the sole reason that most vendors do not accept card payments.

Though unfortunate, it is easy to see where these vendors are coming from. Accepting credit cards comes with high processing fees and involves countless moving parts in order to fully integrate the system into their accounts receivable process.

According to a survey conducted by First Annapolis Consulting, 67% of suppliers cited high credit card processing fees as the largest deterrent to offering credit cards as a payment method.

Chances are that your B2B supplier may be reluctant to invest in a system that accepts credit card payments.

Billhop: Disrupting the traditional B2B payments landscape

While credit cards have been a staple payment method in the

12 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems

S

This article is

“Simply put, there isn’t a solution as decidedly practical as Billhop when it comes to managing cash flow.”

B2C market for decades now, the concept of businesses paying one another by credit card is still relatively new.

That is why Billhop has been making waves in the B2B payment sphere. By combining existing credit card rails with proprietary technology, Billhop aims to address the low card acceptance rates within the B2B sector by allowing businesses to pay their bills with credit cards.

Traditionally, SMEs across Europe have mitigated the gap left by the time between paying suppliers and receiving payments from customers by taking out overdrafts, applying for loans and even resorting to invoice factoring.

Needless to say, these solutions are far from ideal and do not address the long-term, underlying problem that most small businesses are faced with - how to stop playing catch-up with their cash flow.

By using Billhop, you can make use of your existing credit-line without taking any additional steps to secure loans or funding. Simply put, there isn’t a solution as decidedly practical as Billhop when it comes to managing cash flow. No one else is offering what Billhop is doing in Europe.

Enhance your Accounts Payable

It might be hard to fathom that in this digitised work-from-home age, companies still process their Accounts Payable and Accounts Receivable manually. Yet, this is the case for businesses worldwide as they struggle to transition from their legacy systems and manual processes.

As a matter of fact, almost 1 in 5 organisations in the UK rely solely on manual data reconciliation.

Popular payment methods like cash, cheque and even bank transfer require a lot of time and manpower to monitor, record and track. The potential for human error is significantly increased and may even lead to huge fines when data is inaccurately reported.

Again, we see that by paying suppliers with credit card, businesses can streamline their inefficient processes and centralise their payments.

The data provided by credit card transactions can also be incorporated into enterprise resource planning (ERP) and accounting systems to further aid reconciliation.

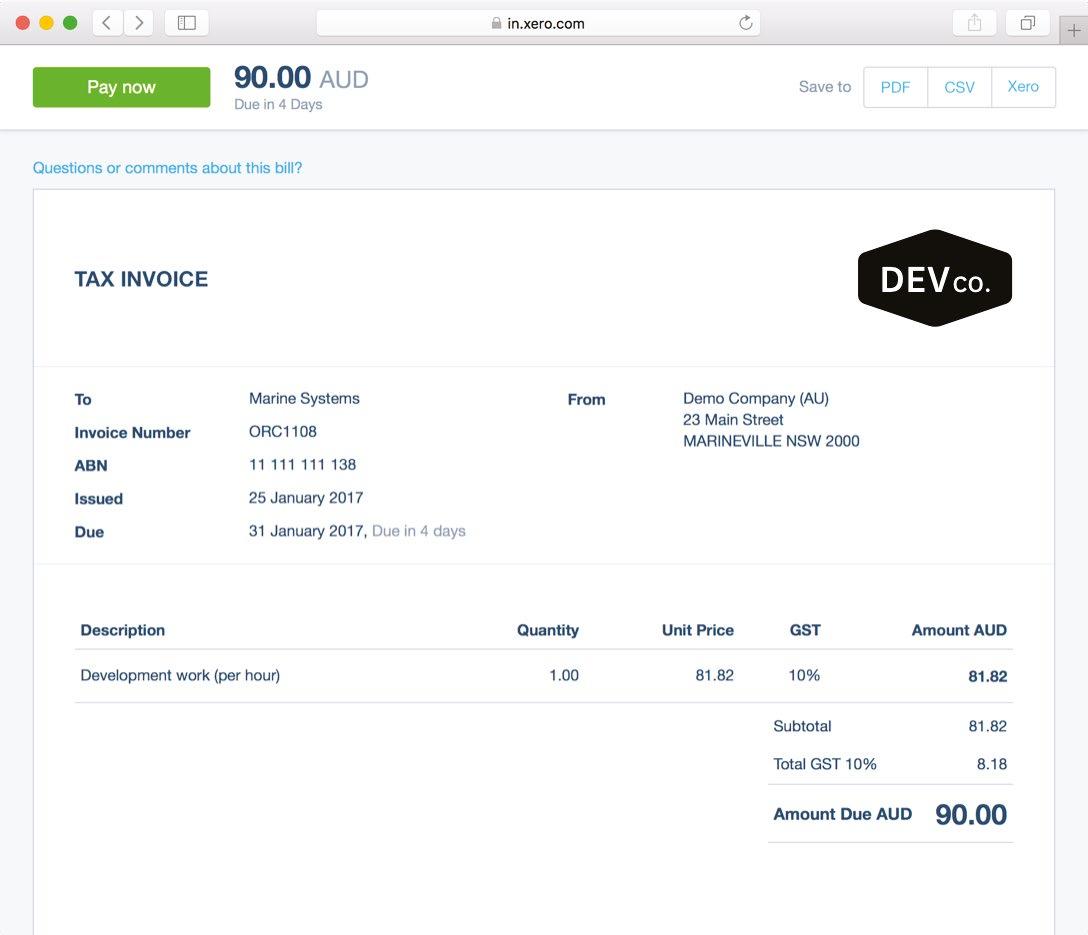

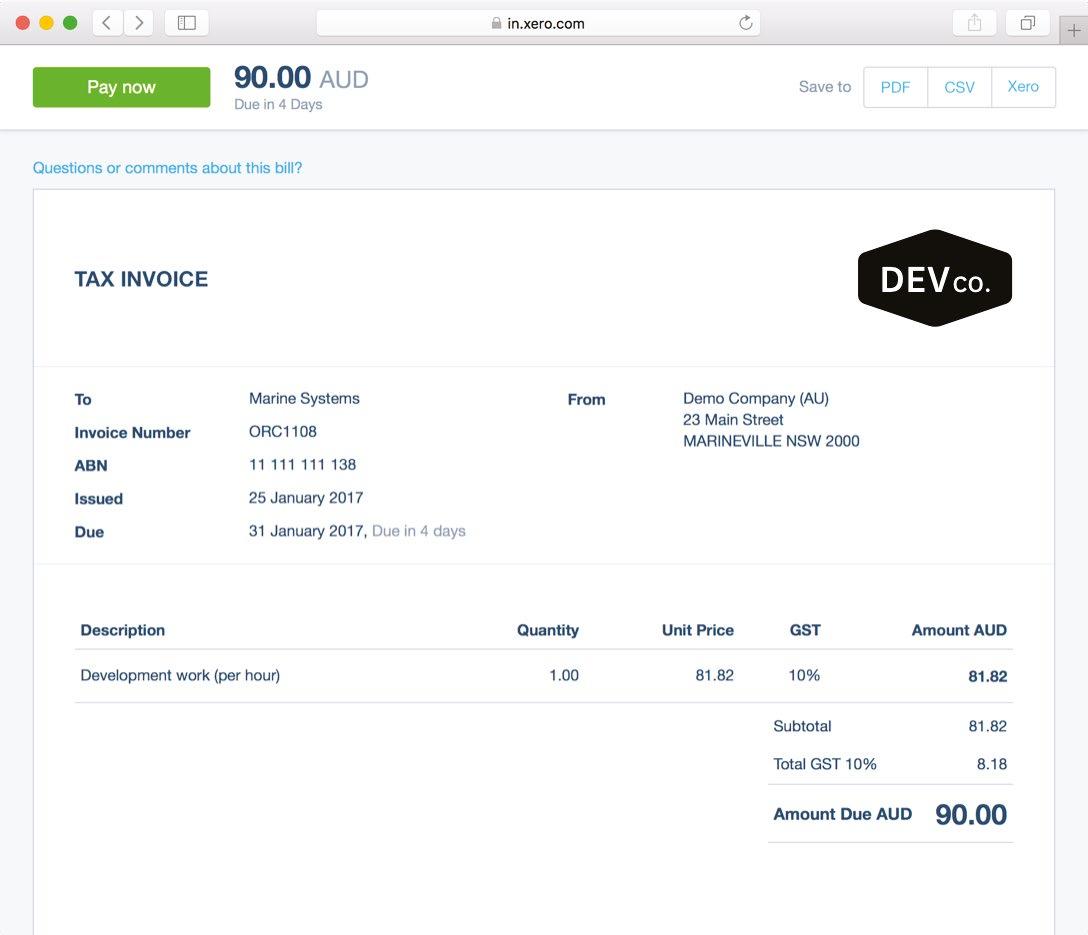

Keep on top of your bills with Billhop and Xero

Billhop has teamed up with Xero to help simplify payments for small business owners, sole traders and accountants.

Our automatic data sync means you do not need to input information into separate accounts or match bills to payments. Once a bill is paid on Billhop, its status will be updated in Xero so you can track your payments in real time.

Do better business with Billhop

With Billhop, you can pay any supplier invoice with your preferred credit card thus allowing the opportunity to get paid from customers before your card bill is due. Your bottom line remains intact without having to apply for loans with high interest rates. It truly is the easiest solution for small and mediumsized business owners to optimise their working capital and do better business.

Find out more about how your business might benefit from Billhop’s payment service by visiting: billhop.com

Issue 34 / 13 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

FIND OUT MORE...

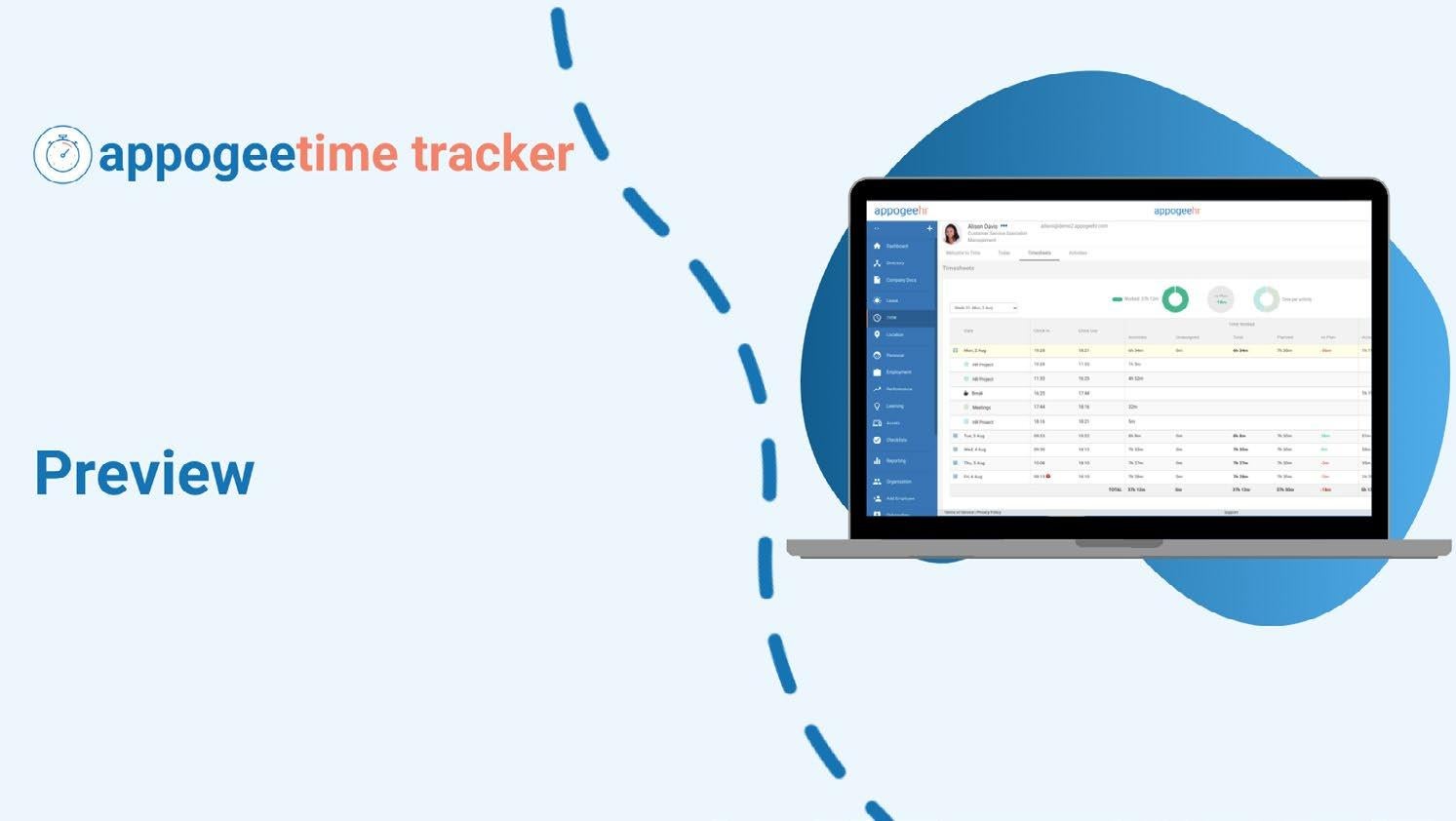

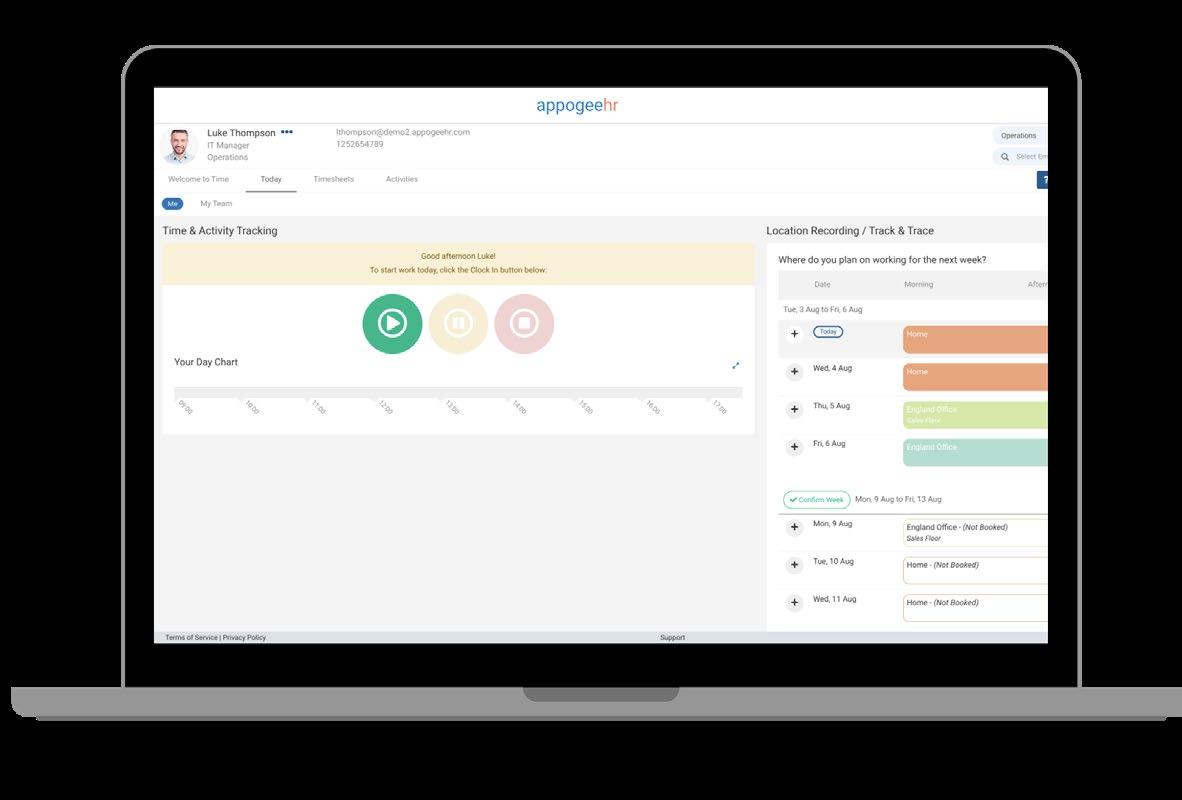

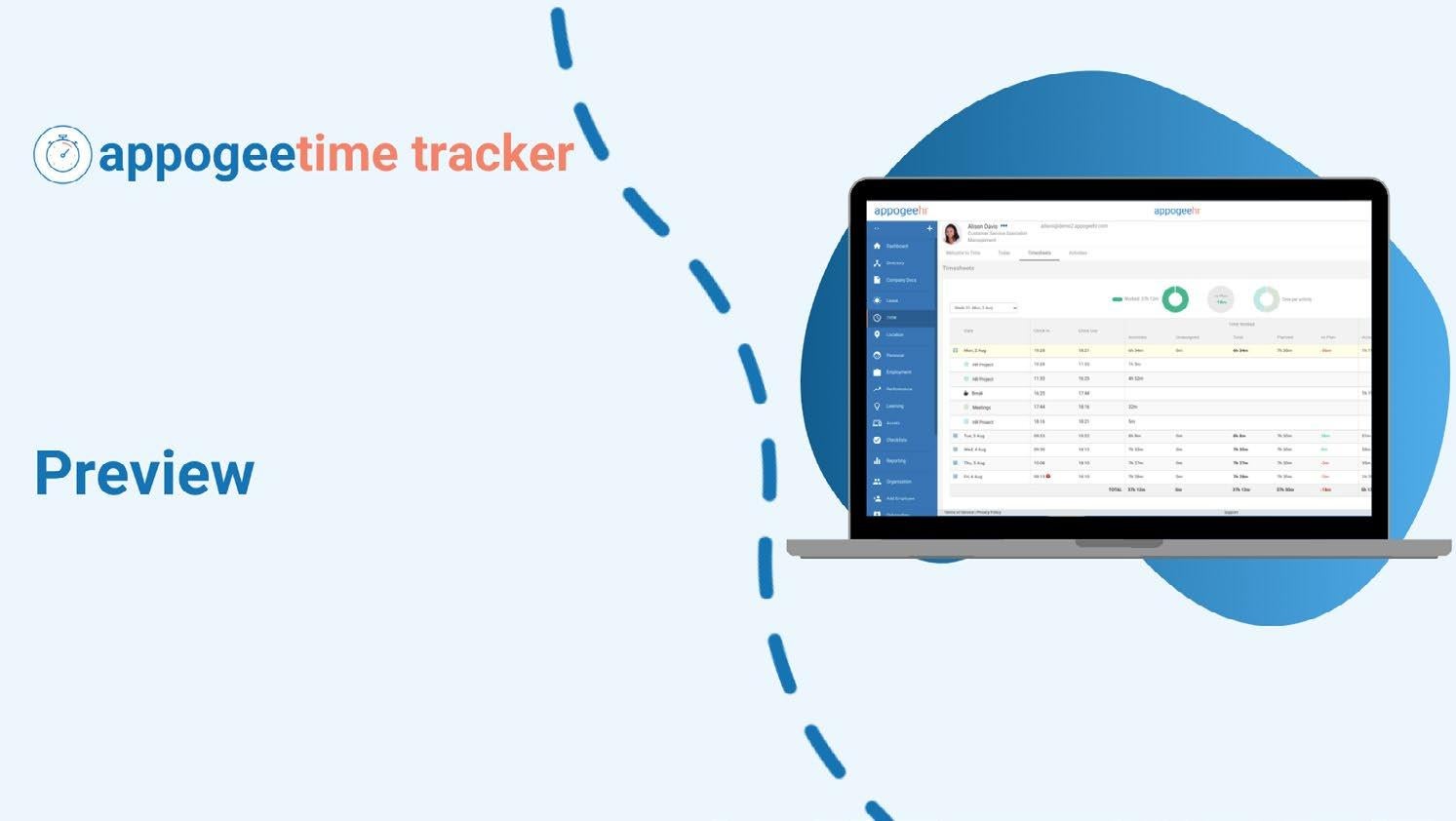

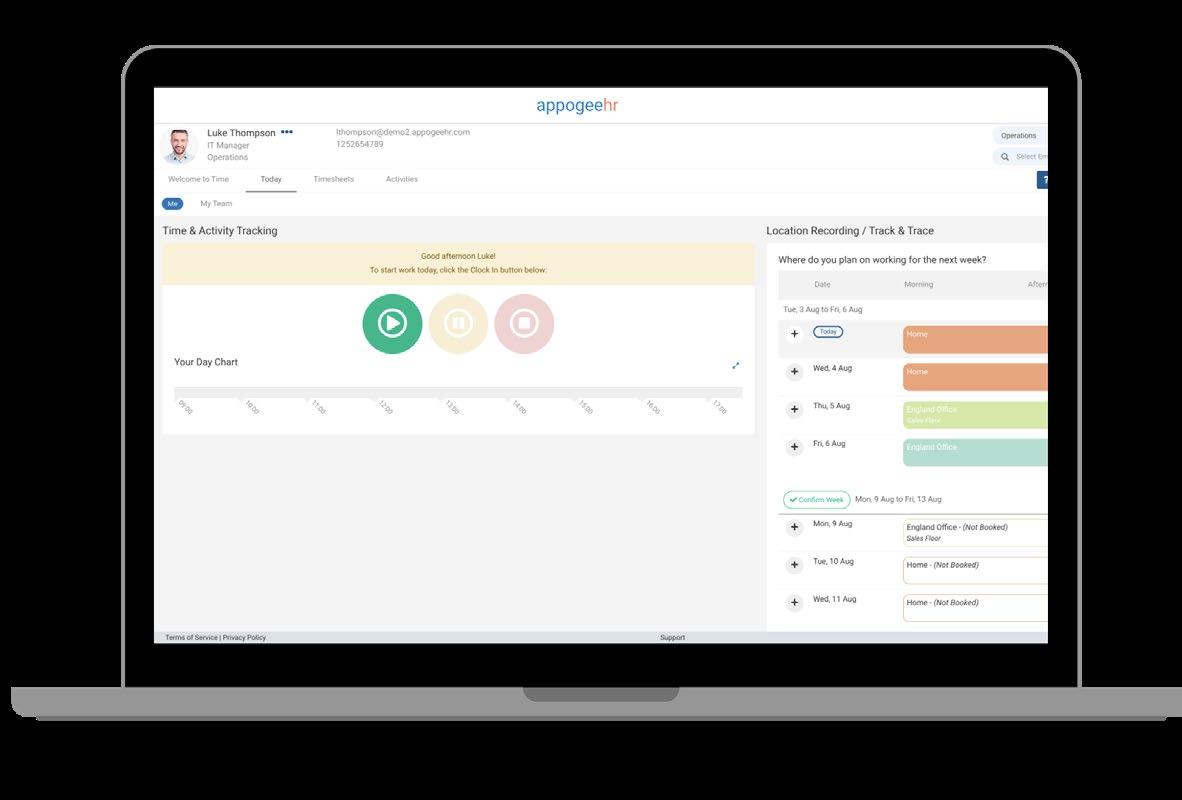

Is your company giving away too much ‘free’ work?

Charlotte Brown, Director of Business Operations, Appogee HR

Charlotte Brown is a Director of Business Operations who knows the power of HR and productivity solutions. A finalist at the Women In Tech Excellence Awards 2021, Charlotte has been helping SMBs drive their businesses forward for over a decade through innovative HR tech.

t’s great to be able to give time away for free – just make sure you know how much of it you can afford.

The idea of providing ‘free’ work to customers, i.e. additional work on a project or service that your customer doesn’t pay for, seems a senseless notion to some. After all, why would you give your time away for free? Customers will take advantage and it would be costly for your business to provide itwouldn’t it?

According to Finance Online a staggering $7billion is lost due to unrecorded work activities.

Business – as we all know –has long been dependent on ‘freebies’. So much so that it’s now part of many people’s expectations. Whether it’s giving out free samples to entice buyers to try something new; rewarding customers with something extra, or even offering interest-free payment terms for a set period of time. It’s just that what appears to the end recipient as being free simply has a planned cost to the provider at the other end – most usually in time.

There’s no such thing as a free lunch

The reality about free work, all comes down to perception. As the timeworn saying goes, “there’s no such thing as a free lunch” and whilst this adage is mostly true, “free” isn’t always a bad thing especially if you’re keeping track of both your billable and nonbillable utilisation in one place so you can see exactly what work is being done and calculate the exact costs alongside your budgets.

Many businesses habitually provide free – or so-called probono services – simply because it’s part of their mission to be more socially responsible. They’ll do so because giving their time has positive public awareness properties that make them seem like a good organisation to be doing business with. Put simply, a small amount of time given away here and there can result in more billable hours in the future from new or existing clients impressed by this altruism.

The only thing that stands in companies’ way is recording this time. Free can become costly very quickly if firms don’t keep tabs on their billable hours where costs

14

XU Magazine - The independent news source for users of accounting apps & their

/ Issue 34

ecosystems

The cost of unmanaged time is greater than you think.

@AppogeeHR

I This article is “According to Finance Online a staggering $7 billion is lost due to unrecorded

activities”

work

are attributed to them and those which they are willing to donate.

Knowing the interplay between the number of hours donated and the number of hours that are not is essential. It has obvious importance for being able to work out profit and loss, and even whether firms can really ‘afford’ to offer out free services at all.

Analysis of how much time is given away to who, how often, and by whom will determine whether certain projects are ‘worth it’. More in-depth analysis might even reveal which have gobbled up more time than managers might initially have thought, and what capacity employees have for being able to ‘give’ more of their time away to these pro-bono activities.

Time recording systems are essential for understanding just how much of your most precious resource can be apportioned to clients that may not generate any direct money. When done effectively time tracking can help you monitor employee time, manage projects, and track where your resources are going, however, it also goes beyond this, and can have a positive impact on many areas of your business.

Mitigate revenue leakage

Time tracking brings considerable success to organizations in the form of better results and better relationships. It gives

organisations the insight they need that enables them to reveal time losses, report errors, and identify revenue leakage. In doing so it helps reverse downward performance and productivity trends and brings in proper oversight.

Aid better and faster decision making

It’s highly likely that time tracking will increase billable hours by making project planning more efficient, and through easier timesheet management, time is better accounted for, meaning revenue lost due to billing errors is also eradicated. When organisations have better visibility around how staff are managing time, decision-making can be faster (and possibly more reactive and ‘better’), while problems can be spotted and managed, before they become larger.

Estimate costs for future projects

Understand exactly how much time a previous project activity took, especially if the activities are similar. Pinpoint areas where employees are spending too much time on non-productive low-value tasks. Equally, it will expose extra resources should one team be overachieving and have the capacity to take on additional tasks from another overloaded team. Time tracking data allows you to accurately estimate the costs of future projects. It can also help identify any variances and modify project costs before they get out of hand.

Maximise finance and productivity tool integrations

As with all good time tracking solutions they integrate with your existing productivity and finance tools to save you time and money. To help your teams to become even more productive, secure, and accurate in their day-to-day work. Keeping employees focused on deep work rather than jumping in and out of systems.

Identify areas for improvement

This can be tricky for many businesses as it’s likely you’ll need to have data available that you’re probably not already tracking. Make the most of your data and use it to take immediate action on areas that need improvements and more resources. Use the data Cont...

Issue 34 / 15 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

to assign the right tasks to the right people or allocate more staff to a project when deadlines are looming or assign staff to cover a period of employee absence.

Save valuable time and reduce error

Time tracking software saves time: according to Deloitte, 50% of professionals who do not have automated systems, (for example, time tracking) say manual data input and data adjustments are the most time-consuming parts of the process. Using leading time tracking solutions will ease the burden of manually tracking time in spreadsheets and reduce the risk of error in your reporting.

The true cost of not tracking time

Time is money and having no clear oversight of how or where your most precious resource is being spent will ultimately cost you. When taking a closer look at the statistics, the results uncover the current landscape for many businesses and it comes as no surprise that only 17% of employees are actively tracking their own time, according to research provided by TechJury.

This leaves the vast majority of employers with no clear indication of how their employees are managing their time on a daily basis and their productivity

rates. Poor time utilisation and untracked activities could have your business hemorrhaging money, put you way behind your competitors, and jeopardise customer relationships.

Future-proof your business with time tracking

It’s all about the bottom line. Streamlining your operations in any way will come with financial gains and time tracking is just one of the ways to do this. However, investing in time tracking technology is only as good as the strategy behind it. To ensure its effectiveness you’ll need to put the appropriate timetracking strategies in place to reinforce your chosen solution. In essence, with efficient time tracking and analysis smoothness is achieved, and better relationships result between both

employees and customers alike.

At a time when new business depends on the relationships, and what parties can bring to one another, having systems that automatically smooth things out has to be a bonus.

Not only will time tracking help you keep track of your costs, but it can uncover areas of your business where you can become more profitable and the potential for capitalisation - it’s a win, win!

16 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems

more about Appogee Time Tracker & our 40% discount

XU readers: appogeehr.com FIND OUT MORE...

Learn

for

Digital Signing, Done Simply Made

for Accountants by Accountants

Greater Control, Greater Flexibility, Greater Client Experience

Carefully crafted to suit the needs of accounting practices, big or small, FuseSign is a digital signing platform like no other.

Affordable, no hidden costs

Granular control over signing actions

100% mobile friendly

Purpose-built for the accounting industry

Secure with 2FA to mobile/email

No lock-in contracts

Highly customisable settings and features Intuitive, easy to use design for an outstanding client experience

Faster turnaround time

Less paper, less printing and less spent on stamps

Issue 34 / 17 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

LET’S CHAT!

Benefits www.fusesign.com

Scan the QR code to book in for a chat & secure your 14 day free trial! FuseSign

Verified Analytics: The potential of automated data matching

hat is Circit’s new product, Verified Analytics, all about?

Verified Analytics combines independent access to transactional data with data matching to the GL. With quick, secure and reliable access to bank transactions, tests like expenditure testing or debtors testing are made more efficient and 100% verification of ledger records comes within reach.

What are the use cases for accounting?

Matching transactional data to client records can help identify potentially erroneous, high-risk or unusual transactions and visualise or identify trends in cash balances at a glance.

Some specific examples:

• Cash to sales reconciliation: verification of income in the financial statements

• GL cash reconciliation: 100% verification of GL bank transactions

• Receivables/Payables testing: 100% verification of year end balances to post-date transactional records

• Payables omission testing: verification over completeness

of year end credit balances

• Cash control testing: verification of controls by mapping how cash postings are handled in the accounting system

Beyond audit, having easy access to transactional data across all your client’s banking providers allows an accountant to aggregate, analyse and gain complete insight into their client’s cash flow, within a platform that allows them to quickly and easily query those transactions by leveraging Circit’s other products.

There are also use cases for Forensic Accounting, where instant access to bank records via trusted, secure APIs can identify potentially fraudulent transactions or those requiring further investigation, and aid in the tracing of assets.

How does Verified Analytics tie in with other products?

Verified Analytics is a part of the Circit platform which provides a range of specialised products. In leveraging Circit’s products, accounts and auditors can query and collaborate on specific samples and transactions. Excel uploads mean data from any

accounting system can be easily uploaded into Verified Analytics to leverage its analytics functions.

On the platform, hundreds of Open Banking APIs allow seamless and secure integration into banking providers, with new providers being added regularly across different territories.

Finally, what ISAs are there around testing and sample sizes? What do they say?

There are a range of ISAs that cover testing, sample sizing, use of technology and risk identification, and more. ISA 315 covers identifying and assessing the risks of material misstatement and focuses on enhanced focus on controls, specifically IT controls and consideration of data analytics for risk assessment.

It references automated tools and techniques for analysis. This is where Verified Analytics comes in: it can be used for all of this from analytics, to reperformance of bank reconciliations and verification of the entirety of bank transactions in the ledger. Also covered: significant disclosures such as liquidity and debt covenants, distributions

18 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems

The FRC is increasingly encouraging the use of technology such as data analytics to enhance quality and increase sample sizes.

Dudley Gould, VP Business Development, Circit

This article is

Dudley Gould trained as an Auditor and worked at Moore Kingston Smith and KPMG. This experience made him realise the challenges being faced by accountants and auditors today: manual matching, small sample sizes and a lack of technology usage. He joined Circit in February 2021 to work on a product to address them: Verified Analytics.

W

and related party transactions, which can be easily accessed and reviewed against actual thirdparty bank data using Verified Analytics.

There is also ISA 500: Audit Evidence. This focusses on the source and reliability of evidence acquired, and corroboration of client obtained information. Verified Analytics enables simple access to third party data inplatform that can be used to corroborate client records.

Another example is ISA 560: Subsequent Events. This covers verification of after date balances, transactions related to disclosures in the accounts and identification of significant after-date transactions that may

require disclosure. All of this can be made easier and more efficient with direct access to data and a matching engine.

ISA 570: Going Concern is also applicable. A repeatable extraction of after date cash balances can provide ongoing review of going concern and an overview of accuracy of any forecasting and budgeting procedures the entity undertakes while also allowing post year end cash flows and trends to be viewed.

In conclusion, what can accountants gain from using Verified Analytics?

Companies are increasingly looking for more efficient, higher

quality accounting work and audits, while also providing more value. Leveraging a product like Verified Analytics brings more complete testing and automated matching within reach. This brings many advantages: adherence to ISAs and security standards, decreased risk and more efficient time usage for accountants and auditors.

Issue 34 / 19 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Learn more about Verified Analytics: circit.io/request-a-demo FIND OUT MORE...

20 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems Xero Marketplace

Issue 34 / 21 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Tired of saying, ‘We

help you with that’?

@seedlegals

Danny Bateman, Senior Business Development Manager, SeedLegals

Danny is Senior Business Development Manager for SeedLegals. With over a decade working with companies in the UK and Middle East, he loves empowering startups to grow and scale faster. Danny currently works with UK-based accountants to help them use SeedLegals to offer a more holistic, affordable and seamless service for their startup and SME clients.

Danny Bateman of SeedLegals explains how accountants can use legal-tech software-as-a-service to offer more value to clients.

Want to make your accountancy practice more attractive to new and existing clients? Add more services and become a one-stop shop for startups and small

But how do you do that without hiring specialist staff?

uses SeedLegals for extras. You can choose to add SeedLegals as white label software to your existing digital services, or give your clients discounts for SeedLegals and claim a referral

Offer more with innovative

Established in 2016, SeedLegals is an online platform which combines automated legal documents with friendly, personalised help from a team of experts. Since 2020, the company has worked alongside accountants to provide clients with a seamless, affordable

Hilda Henderson

Benjamin Sanders

Antonio Simpson

Lucinda Becker

Over 50,000 companies have used SeedLegals to grow and scale faster. As well as straightforward business legals such as employment contracts, company policies and board management, the legal-tech service helps founders and business owners with the pivotal moments that matter:

• Secure S/EIS Advance Assurance

XU Magazine - The independent news source for users of accounting apps & their ecosystems

can’t

This article is

New user

Search users…

Do S/EIS compliance

Two thirds of all SEIS and over half of all EIS Advance Assurance applications are done on SeedLegals

• Claim R&D tax relief

In 2022, SeedLegals helped clients successfully claim an average of £43,000

• Set up option schemes Get an EMI valuation

One quarter of all UK EMI schemes are designed and managed on SeedLegals

• Do a funding round

Take an investment

SeedLegals is the UK’s number one closer of early-stage rounds in the UK with over £1 billion raised to date. The company

pioneered ‘agile funding’ to help companies take one-off investments outside funding rounds.

Make clients happy - and boost profits

By partnering with SeedLegals, you have the reassurance of offering extra services via a market leader. And with a more extensive set of services, even small practices can build a reputation as go-to accountants. One early adopter of SeedLegals is Peter Jarman, Partner at PJCO:

‘We’re now a one-stop shop for EMI, S/EIS and R&D tax relief. If we had to say to clients that we can’t do these services, it would feel like

we’re letting them down by not providing a proper service. We rely on SeedLegals to be our specialist in the background. With the volume and speed that SeedLegals processes tasks for us, we’re offering more services to our small and micro-business owners, with fasterthan-ever turnaround times.’

To find out more and book a call to explore partnering with SeedLegals, go to seedlegals.com/ for-accountants. After that, get ready to stop saying ‘Sorry, we can’t do that’ and instead, ‘Sure! We’d love to help.’

Visit our website: seedlegals.com/foraccountants FIND OUT MORE...

“Add capacity without adding headcount”

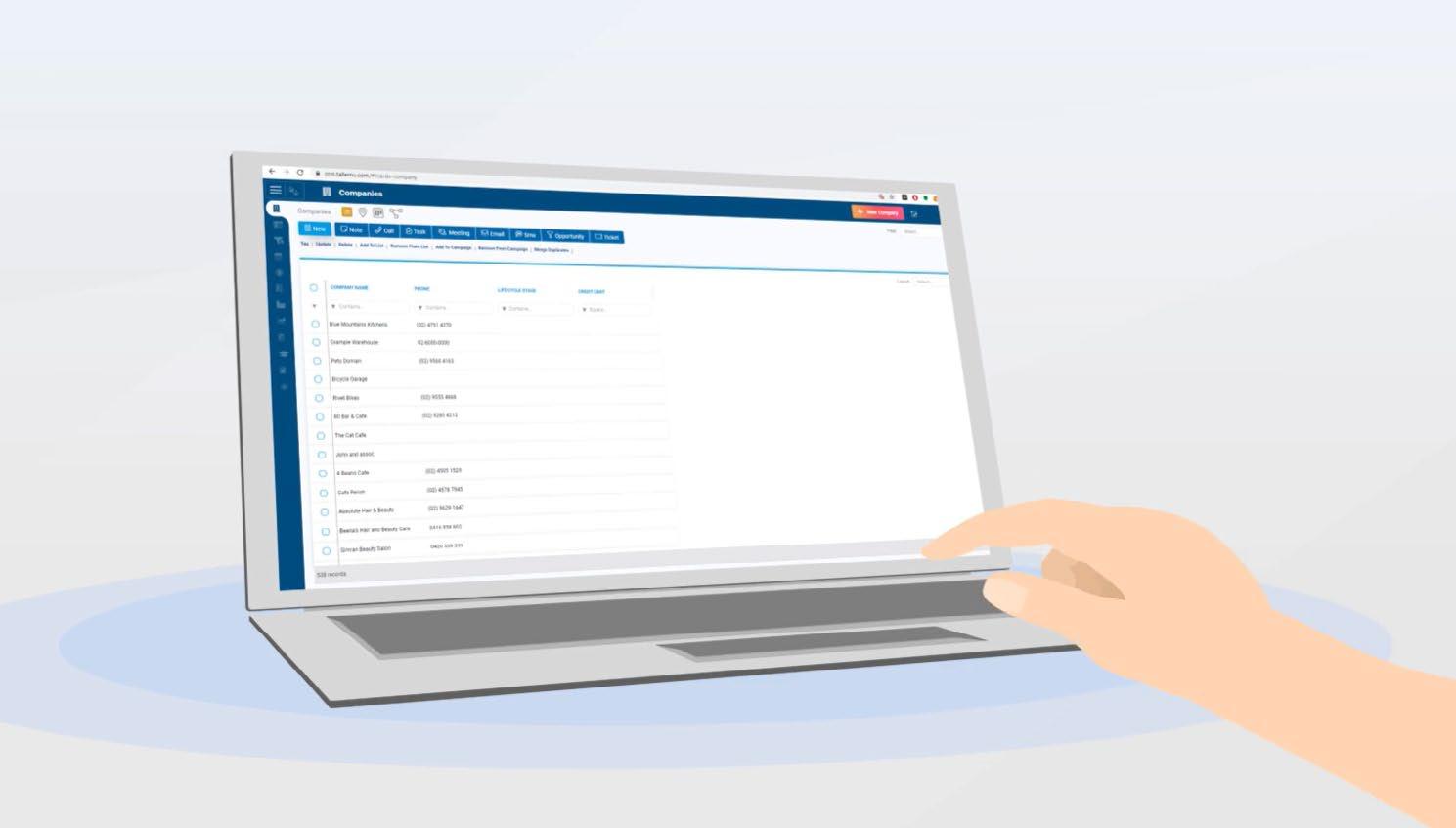

24 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems Wasting valuable time on manual tasks? Combining Tall Emu CRM + Xero helps businesses reclaim hours spent on unnecessary processes. Tall Emu connects with Xero to automate, integrate, and streamline your day-to-day business operations. Locally managed, locally owned and local support from our Aussie team. Visit tallemucrm.com for more information

Access Xero data in Tall Emu CRM–an all-in-one system

Manage customers, leads, stock, orders, fulfillment, and jobs

Send branded quotes instantly & take payment online

Manage inventory in real-time

Visualise sales pipelines –one source of truth for all data

Eliminate double data entry

Tall Emu has been helping businesses in Australia and New Zealand for 20+ years, providing a smarter way to manage sales and operations.

Start a FREE TRIAL

Issue 34 / 25 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

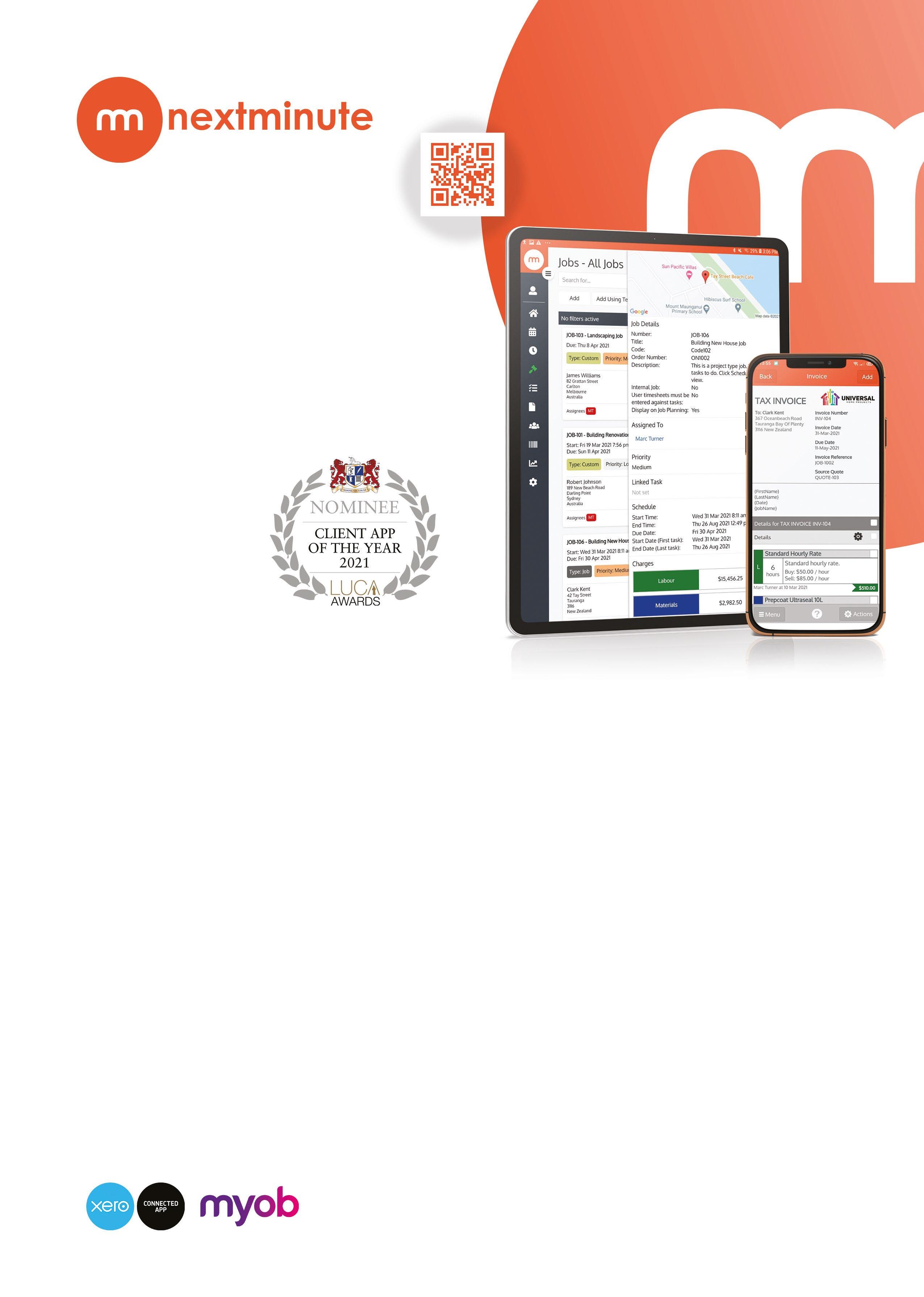

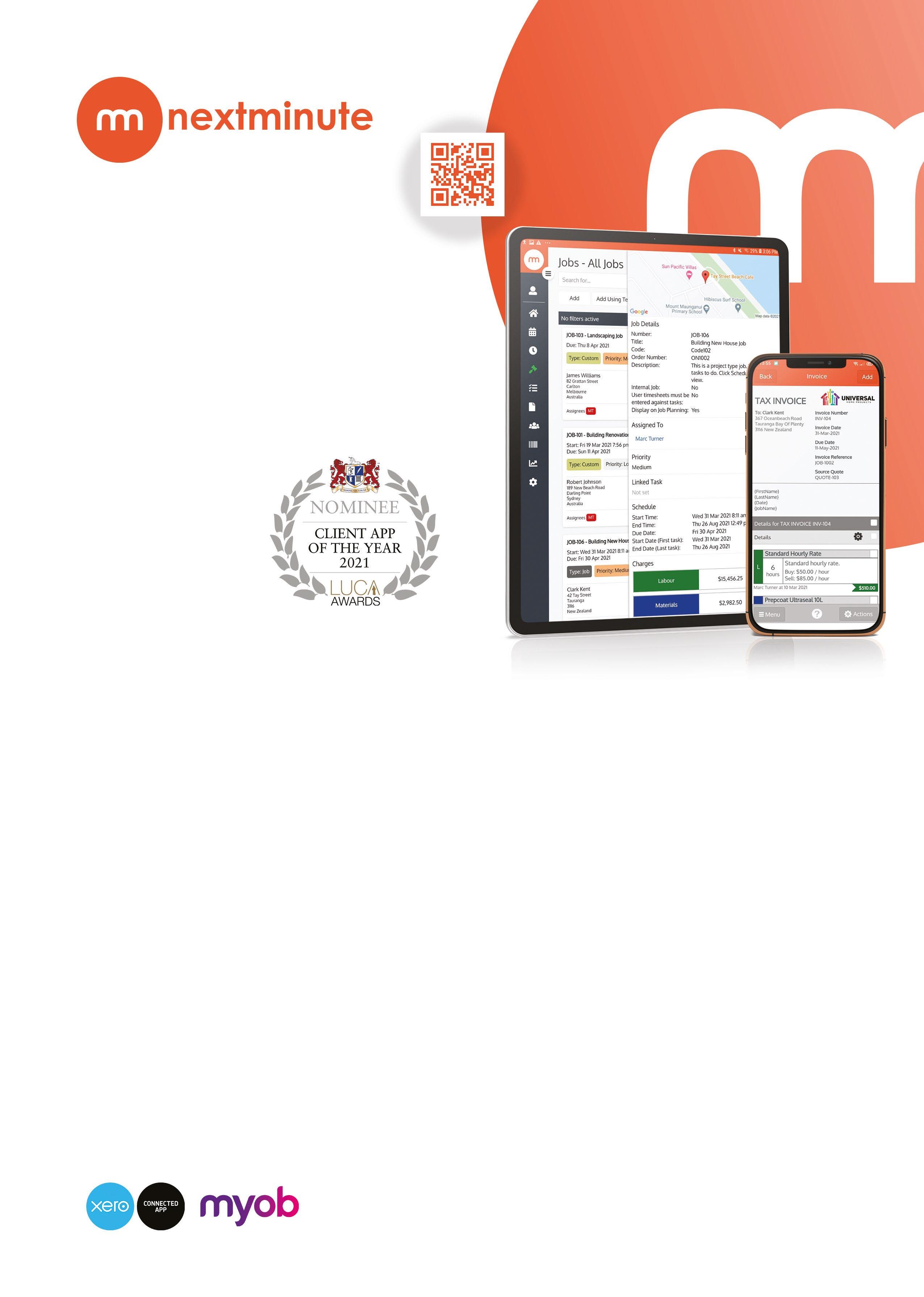

5 things you should know about your Residential Construction Clients

s a company, we want to make sure that our customers succeed, and that our product plays an important role in helping our customers achieve their goals.

One of our team values at NextMinute is to sit alongside our customers and partners. We also have the value proposition that we “make life easier by managing pricing, planning, people and profits.” So, we recently put together a Customer Survey in order to get a better understanding of the needs and preferences of our customers, and to question are we delivering on what we promise?

‘They’ also say success is in the eye of the beholder, and our beholders are our customerswho are also your customers!

If you are a Trusted Advisor with clients in the Trade & Construction industry, here are some results from our Customer Survey that might help you understand the industry better.

Who are they?

Our average client is a 39 year old male builder, business owner, married with more than one child and has completed some form of tertiary education like trade school, college or university.

What do they need?

We asked our clients, on a scale of 1 to 10 how important are the below items to their business (answers in order based on the average response.)

1. Profit

2. Managing their team

3. Save time

4. Consistent work

5. Scheduling work

6. More clients

This re-confirms for us that our value proposition of pricing, planning, people and profits aligns with what our customers consider important in their businesses.

What do they want?

Emily Ossington, Global Partnerships & Strategic Alliances, NextMinute

I have worked in the cloud accounting space for the past 10+ years, in both an accounting & bookkeeping firm and within the Xero Ecosystem. I now have a great role at NextMinute where I lead our Partnerships channel which includes working closely with the Accounting & Bookkeeping community.

When do they want it?

NOW!

No, not really. This was not actually a question asked in this survey. The fact remains though, that there is never a wrong time to make improvements in your life.

What can you do to help?

Get to know them

The information we provided above is based on the average responses.

“Our average client is a 39 year old male builder, business owner, married with children”

We asked them to rank the importance of family time on a scale of 1 - 10. It was number one.

Other questions around ‘hobbies and freetime’ had a variety of answers, all of which included outdoor activities such as fishing, board sports, or playing sports with their family & friends.

These responses indicate that our clients value and want more time to spend outdoors with their family.

Spend some time understanding each individual client, what is important to them, what their personal life looks like and why they chose to start their own business.

This will help you base your services on the individual client needs and what they will value from you, all while having their best interest at heart.

Plus, it will give you something to talk about with them next time you catch-up.

Learn about their day-to-day

Learn about their daily routine, the best time to reach them,

26 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems

@NextMinuteApp

We like to think we know our clients pretty well, but you know what ‘they’ say about assuming…

A This article is

office preferences, work hours, meetings, onsite times, who does the invoicing & payroll, do they have admin staff. The list goes on.

This is going to help you understand where & when you fit in and if they prioritize the “back end” work.

Learn about the industry

Trade & Construction complex with differing laws, education requirements, certificates & license requirements. For example, a cabinet maker is a carpenter, but a carpenter is not necessarily a cabinet maker - so what differentiates them?

Knowing industry requirements puts you in the best position to give advice & market yourself as an industry expert. If you are looking to create a niche in your business that sets you apart, having this expertise helps you attract the right clients.

If you already have a few like trade businesses, start there. For example, if you have a carpentry client and a cabinet maker, you probably have a good grasp on the industry and market yourself to that specific industry only.

Set the expectations

Set your expectations with them - what will you need from them to make the relationship work, and in turn, what can they expect from you?

If you spent time learning about their day-to-day, you might learn that Wednesday at 9pm, after the kids are in bed, is the time they allocate for admin. This is the time you will most likely receive a response to an email.

learn about it or how to integrate it with their accounting software and existing processes.

“Our clients value and want more time to spend outdoors with their family. ”

You can partner with apps from the Xero Ecosystem, like NextMinute and incorporate these into your service offering. It is definitely a valueadd that your clients want & need.

Don’t forget, if your clients succeed, so will you.

Or you might learn, they have no plan or priority for the bits of the business you need, which will mean you need to consider how viable this relationship will be or if there is a way for you to help them prioritize the business finances.

Be their eyes and ears

These guys want time back in their life to spend with their families, but they are prioritizing their businesses instead.

The digital landscape is everevolving and technology can be a game-changer for these clients but they won’t give it the time to

If you’re looking to improve your relationships with your Trade & Construction clients, start by learning more about them and then consider partnering with an industry specific software like NextMinute.

Our dedicated team can help you build strong and effective relationships with your Residential Construction clients, reach out to emily.ossignton@nextminute.com and start the discussion on how to achieve greater success with these clients in your practice.

Issue 34 / 27 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

Become a NextMinute Partner free of charge today: nextminute.com/partnerregistration FIND OUT MORE...

“Family time is ranked #1 for importance to Tradespeople”

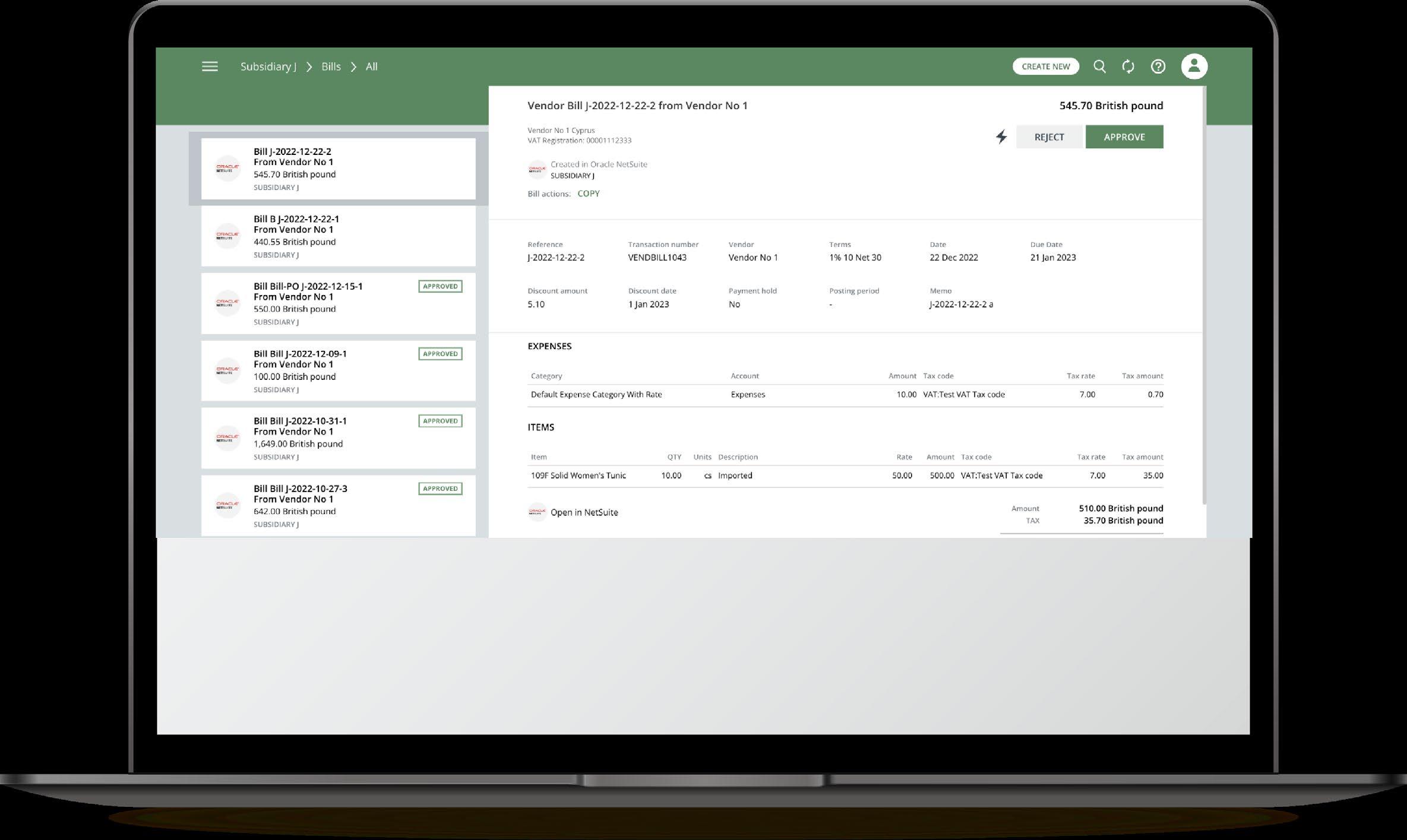

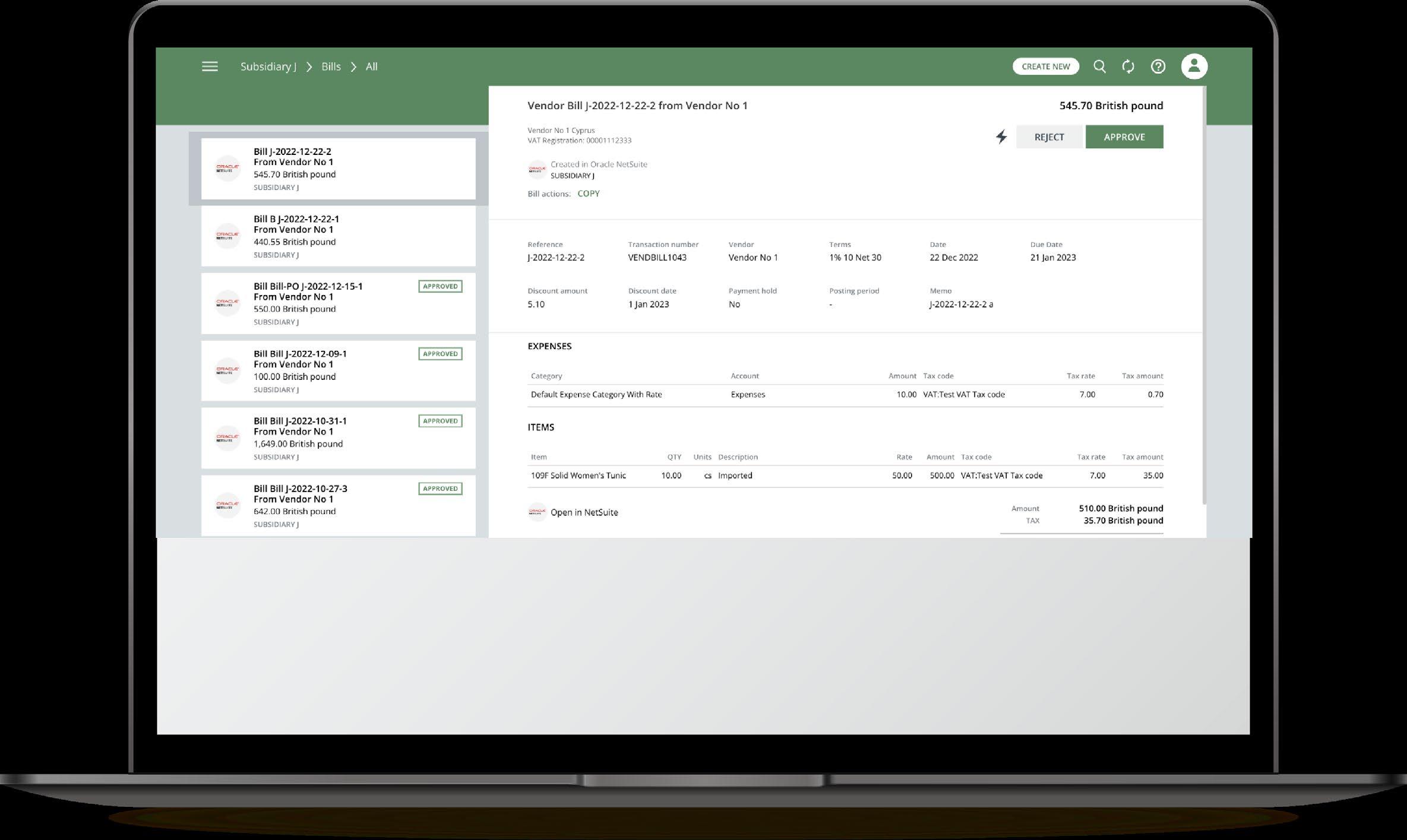

Streamline your audits with approval automation: how ApprovalMax can help

@ApprovalMax

Konstantin Bredyuk, Director of Product, ApprovalMax

With roots in business process management and optimisation software development, Konstantin has undertaken hundreds of product implementations for ApprovalMax clients worldwide.

Konstantin has been advising numerous organisations on implementing automation, financial controls, and client collaboration capabilities using Xero-based trusted app stacks, with business profiles ranging from SMEs to large accounting and advisory practices.

pproval automation apps are changing business processes for financial approvals and businesses who are regularly audited.

Approval automation apps are designed to save time, streamline the approval process, and improve the overall efficiency of AP operations. By sending notifications and reminders to approvers, approval automation apps become valuable as it reduces the administrative workload for bookkeepers and accountants, freeing up time to focus on more important tasks.

If your client is regularly audited, you’ll want to make sure they have a comprehensive and organised way of making and logging their financial approvals. A huge bonus of using a cloudbased app is having an audit trail that’s automatically generated, as this means auditors get a clear understanding of the approval process. It’s also a win for your client as it helps ensure they stay compliant, while reducing their risk of fraudulent activities at the same time. During an audit, the ability to invite auditors to view workflows and audit trails with read-only access is helpful, as it streamlines the evaluation process and makes

audits easier to get through. Approval automation becomes an investment that pays off for clients who get audited regularly due to the reliability, transparency, and efficiency it provides when recording and tracking financial approvals.

ApprovalMax is a cloud-based approval automation platform that helps accountants prepare for audits by streamlining the approval processes and providing an organised and comprehensive overview of financial data. Read on to learn how our features simplify the audit preparation process for auditors.

5 ways ApprovalMax simplifies audits:

1. A delegation of authority policy is built into your workflows

It’s good to have a separate document for your delegation of authority, but how do you make sure it’s not just a piece of paper in a filing cabinet or an online document saved in a folder? If your clients are still doing approvals on paper, their files will need to be organised and stored so they’re easy to retrieve. Keep in mind that human error can still come back to haunt

your client during an audit if they are doing this manually! . Alternatively, if your client issuing email to grant approvals, during an audit they will need to search through inboxes to find the approval history for all approved documents. This can take up a lot of their time, effort, and result in missing information that’s been deleted.

With ApprovalMax, you can create your delegation of authority policy in an approval workflow, so authorisation rules are followed consistently each time. You can also show auditors quickly and easily how your approval process works based on the authorisation rules you have set up in ApprovalMax.

You can create a simple or complex approval matrix, set up approvals that happen one after the other or at the same time, and add rules based on cost limits, GL codes, and tracking categories.

2. Automatic audit reports and trails mean less manual work

With ApprovalMax, when a document is approved, a report showing all the details of the approval process is automatically created and added to it in Xero. This includes all decisions made,

28 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems

A This article is

Audits can be stressful for accountants. However, with the right tools, the process can become much smoother. Learn how ApprovalMax can help.

exceptions, comments, and more. If you want more information, you can find a full record of the approval process in ApprovalMax.

3. Create easier access for auditors

With ApprovalMax, you can invite auditors to view your workflows and audit reports. The auditors will have read-only access, so they can evaluate things safely without the risk of making changes. They can see all reports and requests for your organisation and add comments. To invite an auditor, go to the “Users” page, add a new user and choose the “Auditor” role from the drop-down menu.

4. Using built-in reporting to extract more information during an audit

ApprovalMax provides comprehensive reporting to help evaluate the compliance of approval processes. Auditors can see how approvals were granted and get a complete picture with searchable reports. You can also get an overview or dive into specific details by downloading reports in Excel. These reports help identify exceptions to the approval process, such as approvals delegated to someone else, requests that were

automatically approved, requests that were not finished, and approvals made by administrators instead of the person who was supposed to approve.

5. Want to show off your approval workflow? Just export it.

Alternatively, you can share information about your approval workflows without inviting auditors to ApprovalMax. Simply open the workflow and press the “Export workflow” button to produce a PDF document with a written description of the flow. For example, if it’s a purchase order workflow, the document will include a list of individuals who are authorised to create purchase orders, the rules for each request maker, and for every stage, a list of those who approve them, with the rules for each approver.

Take the pain out of audits with ApprovalMax

If you have clients who are regularly audited, getting them onto an approval automation tool that’s built with the audit process in mind can help them feel more positive and confident during an audit. It also provides confidence to board directors who are demanding to have financial

controls in place. ApprovalMax is a game-changer as its features allow auditors to easily and comprehensively analyse any approval process, without you or your client having to compile audit reports manually. We have accounting firms all over the world that say that their clients and auditors are pleased with the way ApprovalMax has changed their audit process, with several of them citing that it is a no-brainer if your client is regularly audited.

To summarise, here’s how ApprovalMax makes audits a breeze:

• Business critical processes are fully visible and traceable.

• Auditors have easy access to any document they need and find all the relevant authorisation data.

• Audit trails and reports facilitate data and process accuracy, which is the base for informed decision-making.

• Accountants benefit from time savings because the manual effort is minimal.

Issue 34 / 29 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

approvalmax.com FIND OUT MORE...

Start your 14-day free trial:

30 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems appogeetime tracker Intelligent project tracking for forward-thinking companies. It’s about Time www.appogeehr.com l sales@appogeehr.com Track time against customers, projects, tasks and teams Secure project management roles and employee rates Analyse billable vs. non billable utilisation and project actuals Accurate pre-project planning and budgetting

Issue 34 / 31 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine START YOUR 14 DAY FREE TRIAL TODAY 40% off limitedtime offer mention XU magazine appogeehr sales@appogeehr.com l +44 (0)345 262 3003 app.appogeehr.com/trial

Could there be a smarter way to prepare R&D tax claims?

Mike Dean, Managing Director, WhisperClaims

Mike Dean is the MD and co-founder of WhisperClaims an award-winning UK-based fintech company delivering R&D tax claim preparation software and expert-led wraparound support services to accountants.

To date over 2,800 claims have been prepared by accountants using WhisperClaims to deliver an in-house R&D tax service for their clients, representing over £400 million of eligible spend.

Passionate about the digitisation of business processes, especially advisory services, Mike is your go-to for questions on the R&D tax scheme and how to get the most out of using our technology.

any are asking themselves if their clients’ claims will pass muster, and whether there’s more they could be doing to ensure that their processes are good enough to withstand scrutiny from HMRC.

Alongside this looms the spectre of April 2023 changes to R&D tax legislation kicking in, company year-ends, personal tax returns,

and R&D claims with hard deadlines all piling up. Times like these make it difficult to find the time to dot the ‘i’s and cross the ‘t’s; even with the most robust of manual or outsourced processes, errors can creep in.

Controlling the process

Having a robust process that is applied in the same way every time, for every claim, is key to

preventing errors. This could be achieved through manual processes, however experience tells us that in any process the weak point is people. People can be inconsistent, rushed and forgetful—often convincing themselves there’s no need to follow processes, especially given the other pressures of running a busy firm.

So, how can accountants ensure that claims are produced consistently, even during the busiest times of the year? In short, software automation! WhisperClaims’ R&D tax claim preparation software is designed to ensure consistency of process and output. The question set is dynamic and flexes depending on the data being input, providing a structure to help guide the conversations between accountant and client. Questions can’t be forgotten or skipped over, so accountants can be certain that the data has been reliably gathered.

XU Magazine - The independent news source for users of accounting apps & their ecosystems

M This article is @whisperclaims

The recent reforms to R&D tax legislation and HMRC’s ramping up of enquiries has even the most battle-hardened accountants feeling a little rattled.

Owning the relationship

Another important factor to an efficient claims process is the relationship between the accountant and client. As an accountant you have a unique indepth knowledge of all aspects of the client’s business, including:

to go back to the client to get information or ask questions that were missed the first time around.

Report production through WhisperClaims is completely automated and reduces the time taken to prepare the technical narrative and costs breakdown for submission to HMRC. This saves the accountant hours, if not days, of report writing.

The client, on the other hand, is the competent professional in HMRC’s eyes, and are the only ones who can judge—with the accountant’s guidance— whether the work they have done constitutes an advance in science or technology.

With the right technology, training and support, it is absolutely feasible for the accountant to deliver an in-house service and collaborate with clients in a credible and efficient way. Just as technology has transformed every other aspect of the accountant’s role over the past decade, dedicated R&D tax claims software can empower accountants with a framework and structure that enables them to deliver a high quality service that is robust, compliant and — most importantly— smart.

Optimising time

WhisperClaims software introduces efficiencies in two main areas—data capture and report writing—and ensures all claims are produced consistently and to the same standard, reducing the need for checking and reworking.

Software doesn’t replace the need for a conversation with the client to a) educate them about HMRC’s eligibility criteria and b) talk through their projects to ensure they correctly identify which qualify. What software does do is provide the accountant with a robust set of questions, and a structure for the conversation. This reduces the risk of having

What difference does this all make? Fundamentally, it means the accountant can spend more time on the important parts—talking to their client, understanding eligibility and building the relationship—and less on the highly repeatable processes like writing a technical narrative. This in turn means they can process more claims at the same time without compromising on quality, consistency or customer service—a win all round!

Remaining compliant

The R&D tax relief scheme is less prescriptive than any other area of tax regulation. It is not, however, beyond the comprehension of a qualified accountant. Fundamental to helping clients reap the benefits of the R&D tax scheme is understanding what HMRC’s definition of ‘eligibility’ is, how to apply that knowledge when talking to clients about the R&D work they have been carrying out, and being able to determine where eligibility does or does not sit.

When an accountant adopts WhisperClaims they gain access to both software and a comprehensive suite of expertled services to bolster their confidence and understanding of the scheme. Our advice line—a variety of live chat and 1-1 channels—gives them direct access to a team of R&D tax experts who they can lean on for advice at any point in the claims process. On top of that, they can register for back-to-basics

training and immerse themselves in our extensive video and online learning materials.

A common challenge faced by accountants is identifying eligibility within their current client base. If advice is needed, our ‘Portfolio Review Service’ helps them uncover low-hanging fruit and potentially overlooked companies, while also flagging clients who are unlikely to be eligible. This allows the accountant to focus their time in the right places.

Once a claim has been prepared within the app, our built-in risk mitigation features will flag areas of weakness that should be reviewed, and our optional ‘Claim Review Service’ provides an additional layer of reassurance that the claim has been thoroughly reviewed by an R&D tax expert prior to submission.

High quality service

All of this can be done without compromising on consistency or quality. Accountants can be sure that all claims are being prepared in the same way every time, and that their clients are receiving a robust and high-quality service from them as their trusted advisor.

Critically, accountants can be confident that they are minimising the likelihood of prompting an HMRC investigation. Even in the event of one being launched, the structured and consistent process of WhisperClaims software ensures an accountant can remain confident when responding to any additional questions HMRC may raise, with the added back-up of advice, guidance and support offered by our ‘Enquiry Support Service’.

For more information and to book your demo visit: whisperclaims.co.uk

Issue 34 / 33 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

1. Finances

2. Company structure

3. Pain points/problems

4. Plans for the future

FIND OUT MORE...

How to protect your clients balance sheets in 2023

Paul Surtees, CEO & Cofounder, Capitalise

During his 13 years in investment banking, Paul started investing in and mentoring early-stage businesses. The more involved he became in their stories, the more he saw how hard it was for them to raise funds. And yet he knew money was available. He was determined to make it as simple as possible for small businesses to grow. Out of these realisations came Capitalise. He’s led the direction and culture of the company since it was founded in 2016.

mall businesses are the backbone of our economy. With 61% of the working population being employed by smaller companies, we rely heavily on their resilience. Yet, with economic changes such as Brexit and the pandemic, high inflation, supply chain issues and a rising rate of insolvency (the highest it’s been since the 2009 financial crisis), there’s a lot to manage and control.

Fortunately, accountants have risen above these challenges and have continued to step up, supporting their business clients

in their time of need. As we enter further into 2023, a different set of challenges will come into play, and clients will need access to continued support.

We know from the Bank of England data that typically small businesses are slow to react when there is a potential cashflow risk. Taking a more reactive approach, small businesses are behind the curve when it comes to borrowing compared to larger businesses.

If the proactive approach from larger businesses can trickle down to the UKs smaller enterprises, we can expect to see our small businesses better protected in 2023 as they start to react to changes in a more productive way. In fact, according to Bain & Company (2019) businesses that take action in crisis, outperform over the medium term.

What are the current key challenges small businesses are facing?

• Staff shortages

• Increased material costs

• Supply chain disruption

• Higher energy and fuel costs

• Rising overhead costs including rents and interest rates

How can you ensure that your small business clients are staying proactive?

As accountants, time again, you have advised small businesses on what actions to take to remain resilient, and this recession will

34 / Issue 34 XU Magazine - The independent news source for users of accounting apps & their ecosystems

This article is

Paul Surtees discusses the macroeconomic impact on small businesses and the link between credit scores, funding and business’ balance sheets.

@Capitalisers

S

“70% of small businesses believe rising costs are their biggest challenge currently”

be no different. With regular client meetings, you can assess the business’ stability, forecast cashflow risk and opportunities and review business plans. This can be made easier with the use of credit information to see the health of your clients balance sheets.

Glen Collins, Head of policy at ACCA, describes how accountants and advisers can make an impact on the health and growth of businesses with their ongoing support:

“When you look at the work that accountants and advisers do, a lot of that is working through the options that will allow businesses to survive and prosper on the cash it’s got coming through. This is about providing the appropriate service, tailoring to a particular business’s needs and enabling them to plan, recover and grow.”

What actions could small businesses be taking?

There are a number of actions you can help your clients start taking to ensure they’re best protected in 2023. Below are a couple of key steps:

1. Reviewing job costing and pricing

Between inflation and continuous supply chain issues, the cost of materials is continuing to rise. Help your clients to price their materials accurately, and consider the importance of doing so on their profit margins and cashflow.

2. Help them negotiate better terms with credit profile

Credit scores impact a business’ access to finance, whether that’s looking for a loan with the best interest rates, tendering for new work, or looking to negotiate better supplier terms. A good credit score can set a business up for success. Research from Capitalises’ Get Fit For Business report found that only 29% of businesses even know their credit score. With Capitalise for Business, your clients can take

control of their credit profile and receive alerts on any changes to their credit profile, so they can get ahead.

3. Help them identify which companies to work with to minimise external risk

Encouraging your clients to credit check the companies they work with can help them to understand external risks. With Capitalise for Business, clients have the

ability to track the payment performance and credit profiles of other companies. So your clients can be prepared to know which terms to offer and which companies to work with. They can also feel more secure by checking the credit profiles of suppliers, identifying any potential issues in their supply chain early on.

4. Help them access funding when needed

Issue 34 / 35 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine

THOUGHTS FROM ACCA

“When you look at the work that accountants and advisers do, a lot of that is working through the options that will allow businesses to surivive and prosper on the cash it’s got coming through.

This is about providing the appropriate service, tailoring to a particular businesses needs and enabling them to plan, recover and grow.”

70% of small businesses believe rising costs are their biggest challenge currently, so being able to access business finance can make a real difference in a difficult period. Whether your clients are looking to bridge a cashflow gap, or grow and purchase new assets, funding could bring a positive impact. The ability to access the right loan from the most suitable lender, without spending hours on multiple applications, can be a big help.

With Capitalise’s funding marketplace, your clients can access 100+ lenders, get specialist advice and apply to up to 4 lenders in one application.

However, with time and resources being a challenge when trying to offer more support and advice to clients, ‘Client Tools’ allows you to provide your clients with a 360 view of their cashflow in

a completely self-serve format. They will be able to access their Experian credit profile, check the profiles of companies they work with and apply for funding with a carefully selected marketplace of lenders.

Start 2023 by empowering your clients with the right tools for them to grow, without having to put in extra resources. Capitalise and the ACCA, have developed a complete guide on the predictions for 2023 and how to protect your clients against these challenges. To read more, you can download the full guide here

Payroll solutions for successful businesses

Set-up, training and free ongoing support via phone and email

Comprehensive Reporting Suite with 50+ reports including HR

Suitable for all business sizes (1 to 1000 employees)

ipayroll.co.nz cloudpayroll.com.au

Get started for free today: capitalise.com FIND OUT MORE...

- Glen Collins, Head of Policy, Technical and Strategic Engagement at ACCA.

Sign Here, There and Everywhere. FuseSign Takes Digital Signing for Accountants Global

useWorks is proud to announce that their Innovative and Industry focused digital signing platform, FuseSign is spreading across the globe with the official launch in the UK at Accountex London, May 2023.

With FuseSign, accountants have access to a cutting-edge platform built specifically for the industry to provide a user-friendly, secure, and customisable platform that streamlines document signing processes, enhancing overall productivity and creating a seamless client experience.

FuseSign has already established a strong user base among Australian and New Zealand firms with large mid-tier networks like Accru, Bentleys, DFK, MGI, Pitcher Partners and many more jumping on the Fuse-train. Flexibility from small to extremely large firms makes FuseSign a perfect

fit for global expansion and the company is excited to bring its cutting-edge technology to the UK market.

Co-founded by Melissa Voss and Scott Barber, their Chartered Accounting background brings deep insight to the frustrations accountants have and has contributed to the success of the growth of FuseSign. “Solving key pain points and delivering tailored and targeted solutions to real-life problems is at the core of our success” says Scott Barber.

The past few years has seen FuseSign achieve exponential growth & tremendous success in the Australian and New Zealand markets, where it has been praised for its intuitive interface, advanced customisation options, and robust security features. FuseSign allows documents to be signed and returned in a matter of minutes, being the accountants choice and a highly sought-after alternative to many expensive traditional electronic signing tools.

The launch of FuseSign in the United Kingdom is an exciting

Melissa

From a background in Chartered Accounting, Melissa understands the frustrations accountants have when dealing with technology in practice. Co-founding FuseWorks 10 years ago, Melissa enjoys the challenges of working within the accounting industry to deliver best practice on a global scale with a specific focus on streamlining digital signing and document delivery, striving for the ultimate client experience through technology adoption.

development for the accounting industry, and the platform is poised to disrupt the market by offering a solution that specifically addresses the needs of accountants.

“We are thrilled to bring FuseSign to the UK market, and we believe that our purpose-built platform will be a game-changer for the accounting industry there,” says Melissa. “As a Chartered Accountant myself I understand the specific challenges faced by accountants, and our platform has been designed to address these challenges head-on. With FuseSign, accountants can focus on delivering value to their clients, rather than wasting time on manual document processes.”