NEWS

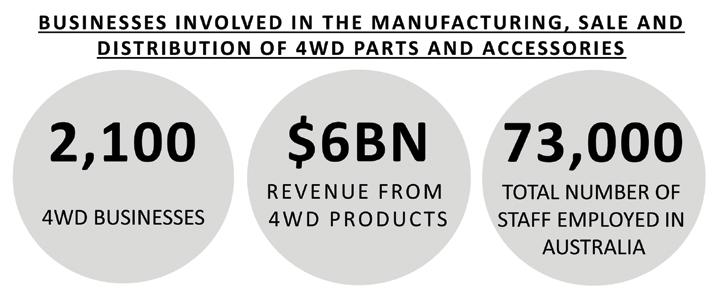

AUSTRALIAN 4WD PARTS & ACCESSORY MANUFACTURING In this article, ACA Research takes a deeper look at the learnings gathered from the AAAA 4WD Industry Council Market Study The popularity of 4WD utes and SUVs has risen steadily over the past decade. This trend only accelerated in 2020, with restrictions on overseas travel making the prospect of local road trips more appealing than ever, and leading to SUVs making up seven of the ten most popular new vehicles. It is natural then, for this growth to carry through to the 4WD parts and accessories market, which is well illustrated by ARB’s recently released halfyearly financial results. The company posted an after-tax profit of $54m, more than doubling its profit from the same period in FY20. Based on this, it is safe to say the 4WD aftermarket is big business, but just how big is it? According to our latest study on the 4WD market, conducted on behalf of the AAAA, the manufacturing, sale, and distribution of 4WD parts and accessories generates annual revenues within Australia of $6bn. This is direct revenue, with manufacturers then also sourcing two thirds of their raw materials from local suppliers, which sits outside of this figure. Additionally, these 2,100 businesses employ more than 70,000 staff within their Australian operations, further highlighting the scale of their impact on the broader community.

While the current results already position 4WD as a key component within the Australian automotive aftermarket, the industry is predicting a 17.5 percent increase in 4WD revenue over the next two to three years. Should this growth be realised, it will naturally have flow-on effects to other aspects of the economy. While many businesses are already sourcing parts locally, the research identified an increasing appetite to distribute, sell, or fit Australian made parts and accessories. Businesses do however recognise that this growth will not be achieved by resting on their laurels, with a range of strategies in place to drive change. These are grounded in a combination of innovation in terms of their product offering, increased operational efficiency, and improved sales and marketing activities. Ultimately though, the positivity and level of activity both speak to the confidence manufacturers have around the growing demand for these parts in years ahead.

Chart three: Top concerns impacting the future of the 4WD parts and accessories market Source: 2020 AAAA 4WD Industry Council Market Study

environment and potential future legislation (eg. relating to post-sale modifications) is creating a level of uncertainty for manufacturers, and others within the 4WD supply chain. While they are willing to invest in the development of new products, they recognise that unexpected changes could legislate them out of a market, despite high levels of unmet consumer demand. Beyond regulatory issues, the sector also recognises the work required to stay up to date with advances in vehicle technology, and the risk of poor-quality copies or counterfeit products (although this could be an opportunity to further leverage the good name of ‘Australian-made.’) In the broader context of an increasing market for 4WD vehicles both within Australia and overseas, this latest study shows the Australian aftermarket is well positioned to capitalise on the growing demand for parts and accessories, including opportunities to grow local production and further support the Australian economy. For further insights from the AAAA 4WD Industry Council Market Study, or to access your copy of the report, get in touch with info@aaaa.com.au

Chart two: Top 5 strategies for revenue growth. Source: 2020 AAAA 4WD Industry Council Market Study

Chart one: The business landscape for Australian 4WD aftermarket parts. Source: 2020 AAAA 4WD Industry Council Market Study

Despite this confidence, a number of challenges do exist. In particular, uncertainty regarding the regulatory

This column was prepared for AAA Magazine by ACA Research, our partners in the AAAA Aftermarket Dashboard which is delivered to AAAA members each quarter. For more information, visit www.acaresearch.com.au or contact Ben Selwyn on bselwyn@acaresearch.com.au

Australian Automotive Aftermarket Magazine March 2021

13