Our commercial banking team can help you map the cash moving in, through and out of your business with next-level know-how. So, no matter which way it moves, you can be sure it’s moving you forward.

The Financial Stability Oversight Council voted unanimously to issue for public comment a proposed analytic framework for financial stability risks. This new framework is intended to provide greater transparency to the public about how the council identifies, assesses, and addresses potential risks to financial stability, regardless of whether the risk stems from activities or firms.

The council also voted unanimously to issue for public comment new proposed interpretative guidance on the Council’s procedures for designating nonbank financial companies for Federal Reserve supervision and enhanced prudential standards. This proposed guidance would replace the council’s existing guidance and describes the procedural steps the council would take in considering whether to designate a nonbank financial company.

The actions proposed by the council would:

Enhance the Council’s ability to address financial stability risks. The financial system continues to evolve, and past crises have shown the importance of being able to act decisively to address risks to financial stability before they destabilize the system. The new proposed guidance would help ensure that the Council can use all of its statutory authorities as appropriate to address risks to U.S. financial stability, regardless of the source of those risks.

Provide transparency to the public on how the Council performs its duties. For the first time, the Council is proposing to issue a framework broadly explaining how it identifies, evaluates, and responds to potential risks to U.S. financial stability, whether they come from activities, individual firms, or otherwise. This framework outlines common vulnerabilities and transmission channels through which shocks can arise and propagate through the financial system. It also explains how the Council considers the tools it will use to address these risks.

Ensure a rigorous and transparent designation process. The proposed nonbank financial company designations guidance would continue to provide strong processes, including significant two-way engagement with companies under review. These processes would minimize administrative burdens on companies under review while providing ample opportunities to be heard and to understand the Council’s analyses. Further, the separate proposed analytic framework explains how nonbank financial company designations fit into the Council’s broader approach to financial stability risk monitoring and mitigation.

The Consumer Financial Protection Bureau (CFPB) issued a policy statement that explains the legal prohibition on abusive conduct in consumer financial markets and summarizes over a decade of precedent. The CFPB leads enforcement and supervision efforts to identify and end abusive conduct against consumers. In 2010, in response to the financial crisis, Congress passed the Consumer Financial Protection Act and created the prohibition on abusive conduct. The act tasks the CFPB, federal banking regulators, and states with the responsibility to enforce the prohibition and puts the CFPB in charge of administering it. The policy statement will assist consumer financial protection enforcers in identifying wrongdoing and will help firms avoid committing abusive acts or practices.

“In response to the predatory mortgage lending practices that drove the financial crisis, Congress banned abusive conduct in consumer financial markets,” said CFPB Director Rohit Chopra. “The CFPB issued today’s guidance to provide an analytical framework to help federal and state agencies hold companies accountable when they violate the law and take advantage of families.”

Policy statements provide background information about laws the CFPB administers and articulate how the CFPB will exercise its authority, but they do not impose new legal requirements. In 1980 and 1983, respectively, the Federal Trade Commission issued policy statements on both the unfair and deceptive practices prohibitions. Similarly, today’s guidance summarizes precedent and establishes a framework to help federal and state enforcers identify when companies engage in abusive conduct.

In this policy statement, the CFPB sets forth how abusive conduct generally includes (1) obscuring important features of a product or service or (2) leveraging certain circumstances—including gaps in understanding, unequal bargaining power, or consumer reliance—to take unreasonable advantage. In particular, the statement describes how the use of dark patterns, set-up-to-fail business models like those observed before the mortgage crisis, profiteering off captive customers, and kickbacks and self-dealing can be abusive.

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart EDITORIAL DIRECTOR

David Krechevsky EDITOR

Keith Griffin SENIOR EDITOR

Mary Quinn

MULTIMEDIA PRODUCER

Katie Jensen, Sarah Wolak, Erica Drzewiecki, Ryan Kingsley STAFF WRITERS

Rob Chrisman CONTRIBUTING WRITER

Gary Rogo

SPECIAL SECTIONS EDITOR

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray

GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Lydia Griffin MARKETING INTERN

If you would like additional copies of Mortgage Banker Magazine call (860)719-1991 or email info@ambizmedia.com

Submit your news to editorial@ambizmedia.com

www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com

In the past, handling a borrower’s monthly payment was relatively straightforward. The servicer, more often than not the lender, would receive the check or bank transfer around the first of the month, hopefully by the 15th, deposit it in the correct account, and then possibly remit most of the payment to the investor. Servicing, and its ramifications and complications, has evolved, however, and as we enter the summer months of 2023, servicing is worth revisiting.

A mortgage servicing right (MSR) is the strip of interest from the loan. Based on the accounting rules, it becomes an asset when a mortgage loan is sold and servicing retained. Mortgage servicers are responsible for collecting payments on the mortgage loan and distributing these payments to appropriate authorities (including investors, tax authorities, and insurance companies).

The Consumer Finance Protection Bureau (CFPB) has taken an increased interest in ensuring all of this is done correctly, and that when servicing is bought or sold, the corporations handle it well, and that there is no confusion on the borrower’s part.

Speaking of which, the pace of blocks of servicing, large and small, being sold and bought has increased dramatically and should continue to the end of 2023, if not beyond. MIAC, Phoenix, Incenter, RAMS Mortgage Capital, Mountainview, to name a few companies, are actively involved in servicing transactions. “Why?” Smaller companies, which added servicing during the pandemic because aggregators weren’t paying for it, now need the cash to try to outlast their competitors with margins and volumes having declined.

For those companies who opt to retain their servicing, given that the value of the mortgage servicing rights represents the lion’s share of the value of a lender and servicer, protecting the value of the servicing is very important.

Like commodity prices, or a locked mortgage pipeline, the value of MSRs can be hedged but very few smaller companies do that.

Servicing is a numbers game. Simply put, if it costs a servicer $10 a month to service a loan and is paid $50 a month to do so, it is a source of revenue. The longer that situation exists, and the loan is “on the books,” the better. Originating or buying servicing and valuing it as if you’ll own it for years, only to have it pay off (prepaying) in four months, is a moneylosing situation. The value of servicing is the net present value of the servicing revenue components less expenses, adjusted for prepayment speeds. So, if expenses increase, or the income decreases, it is a problem. The servicer also can earn income from late fees, ancillary income, and float income.

(unique to scheduled / scheduled products), prepayments, voluntary payoffs through refinances, and involuntary payoffs through foreclosures.

The value of the servicing “book,” if held, is usually the primary source of value on the balance sheet. And prepayment speeds are the key driver behind servicing values: The longer a performing MSR is held in the portfolio, the more revenue will be received. And as interest rates rise, prepayment speeds will slow down. That increases the duration and resulting value of the MSR. And as interest rates drop, prepayment speeds will rise, which will decrease the life and the value of the MSR. As rates rise, voluntary speeds slow and the cash flows extend, increasing values, and as rates fall, voluntary speeds increase and the cash flows shorten, decreasing values.

Brokers see the results of all these calculations and forecasts in their daily mortgage pricing. They can read the borrower’s complaints in the CFPB’s published information and hear the occasional confusion from borrowers whose mailing address has changed for their monthly payments. They also see how some large companies with large amounts of MSRs place a value on the servicing that may be below or above the accepted market value.

Put another way, on the income side MSR valuation is composed of service fee revenue, escrow float earnings, principal and interest (P&I), and payoff float earnings, ancillary income (e.g., late fees, modification income, optional insurance, etc.). On the expense side, there are servicing costs, additional costs for delinquent loans and foreclosures, advances on delinquent P&I and escrow payments, interest owed on escrow accounts in some states, interest owed on early payoffs

However, the basic premise of servicing remains the same throughout all of this. A loan is given to a borrower who agrees to make their payments in a timely fashion. When the borrower does that, in the vast majority of cases, the “system” works. When the system doesn’t work, for whatever reason, brokers and LOs can step in to answer questions, once again adding value and further solidifying their relationship with the borrower.

The longer a performing MSR is held in the portfolio, the more revenue will be received.

Successful women are constantly looking to hone their skills, build relationships and better understand how to use and improve their abilities and talents. They want to be able to share their experiences and questions with colleagues who understand, and do it in an environment that helps build connections that last a lifetime. That’s why there’s the Mortgage Star Conference for women in the mortgage profession, a specially-designed hands-on immersion event centered around superior results.

There are apps for everything these days, including mortgages. But while we’re living life in an electronic landscape, not everyone prefers doing business behind a screen.

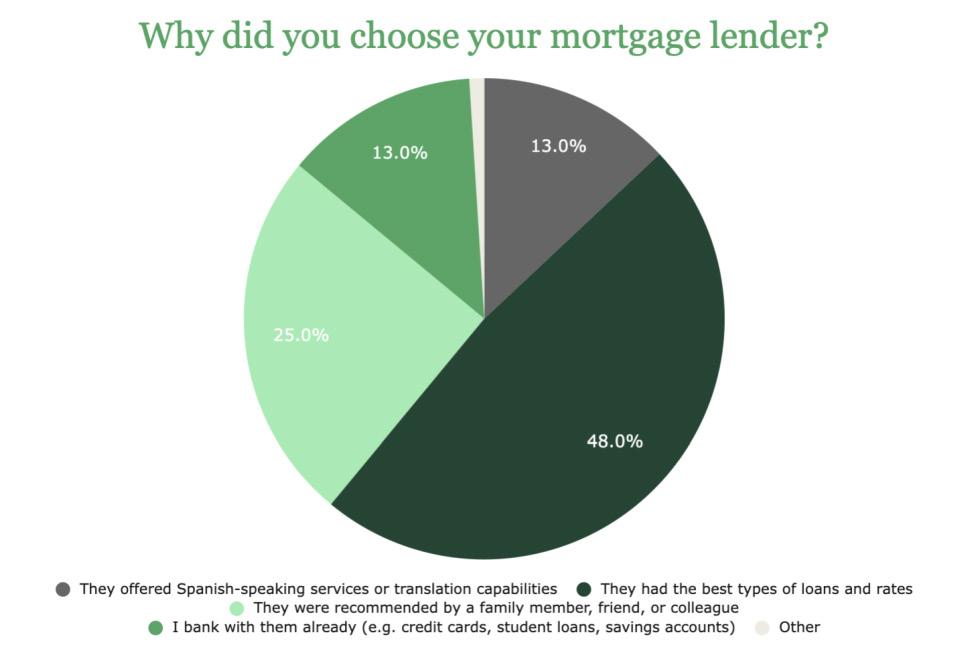

Maxwell, a digital mortgage platform that specializes in products for small to midsize lenders, found in its recently released 2023 Hispanic American Borrower Report that borrowers want to sit down and get into the nitty-gritty about their contracts. While the report also delves into the diversifying profile of American borrowers, one statistic shines through: 96% of HispanicAmerican borrowers are planning to choose a lender they can meet inperson in lieu of an online-based option.

While Hispanic-American borrowers are predicted to overtake the majority of borrowers’ demographic, they’re not so keen to jump into a digital mortgage experience. Instead, they’re gravitating toward local lenders known within the community.

Maxwell co-founder and CTO Rutul Davè says the reason is simple: They want genuine support.

Davè says there’s a definitive reason why over 40% of mortgages are originated by local small to midsize lenders: People crave the personal attention and guidance that comes along with working with a smaller lender. And, more specifically, underserved, minority borrowers want to make sure they’re making the best choices for their money..

“Part of the mortgage process is wanting to find someone trustworthy that can coach you through the transaction. It’s the biggest transaction of most people’s lives,” Davè said. “There are a lot of terms and concepts thrown at you [during the process.] They want someone they can connect with and who understands the local community as well.”

Small local lenders such as NorthStar Home Loans cater to their communities, and not just through mortgages. The Putnam, Conn.based company makes it a point to expand its outreach beyond the client level.

“In a small business like ours, we’re essentially helping out our neighbors. Locally owned businesses treat people like people, not transactions,” said Jason Verraneault, Northstar’s owner and founder. “What makes us different from a larger lender or online platform is that we’re in the business of building lifelong relationships where my clients will one day refer their kids to us.”

Verraneault’s company is in the northeast corner of Connecticut, known as the Quiet Corner. It’s in the state’s least populous county, Windham County, where the poverty rate sits around 11.5%, per 2020 records.

Verraneault says that the county allows USDA guidelines, meaning that no credit score is needed for a loan.

“We accept down to whatever is allowed by the FHA, which accepts as low as a 500 credit score and 10% down. Most lenders cap at a 620 or 640 score,” Verraneault said. “And with USDA guidelines, we have to work with our customers to help them find nontraditional tradelines for their payment history to prove that they’re fit to own a home.”

Denise Lanouette, a mortgage consultant at Hartford, Conn.based First World Mortgage, says that even though her company has multiple branches across the state, community is still at the core of its foundation.

“Because we’re a local lender, I have a whole network of local trusted financial experts, real estate agents, attorneys, inspectors, and contractors who have worked in these local areas in the past and who I feel confident recommending to customers,” she said. “Local lenders offer personalized service that extends outside of “bank hours” – they are often available evenings and weekends to keep momentum and maintain great communication.”

Like Northstar, Lanouette says that First World partners with local organizations such as the Connecticut Housing Finance Authority.

“We pair with these groups to run workshops and seminars designed to inform potential first-time homebuyers about the fundamentals of financial wellness and the mortgage qualification process,” she said.

And Lanouette says it’s not just customers who care about their lenders being local: it’s real estate agents, too.

“A huge reason why real estate agents prefer local lenders to online

“Part of the mortgage process is wanting to find someone trustworthy that can coach you through the transaction. It’s the biggest transaction of most people’s lives.”

– Rutul Davè

lenders is because of a combination of their local relationships, their reputation, and accountability,” she said. “People want to do business with people they know, like, and trust.”

Verraneault says that working with and being readily available to his clients is just half of the business. The other half is pushing out knowledge and support into the local community, using more ways

than just social media to do so.

“Me and my staff are out at events and sponsoring local sports,” he said. “We’re regulars on our town’s local radio show and we also deliver food to a pantry every Wednesday. That’s just the culture of the company.”

Verraneault added that the food deliveries aren’t to promote the company, they are to show clients and potential customers that Northstar cares about the communities in which they live.

“We’re not going to these events

and talking about the mortgage world, either,” he said. “We’re being a part of our community regardless of our work.”

Davè says that lenders can make themselves welcoming to customers by providing additional support, such as language help.

“For Spanish-speaking borrowers, it helps if there’s someone on staff to help them understand the process,” he said. “There are also specialized programs that lenders can use to help borrowers better grasp the mortgage process. Maxwell, for example, has a screen-sharing software where a borrower can see their originator’s screen and know exactly what their mortgage is.”

A sad truth about the mortgage process is that the support often doesn’t meet the needs of customers who may need extra guidance.

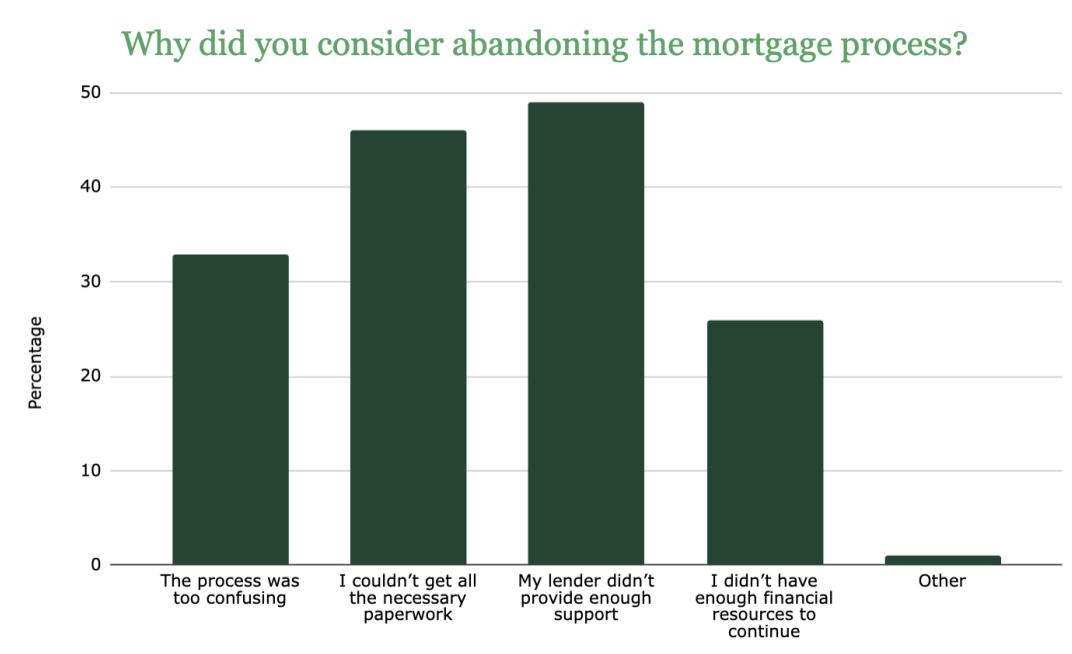

“Close to 50% of Hispanic borrowers who considered abandoning the homebuying process considered so because the lender didn’t provide enough support,” Davè said. “It’s not just underserved borrowers that want attention either. If you think about the largest sect of homebuyers, which is millennials, we see that they also want in-person experiences and conversations even though they’re usually proficient in technology and online transactions.”

Coast’s ultimate gathering for mortgage pros.

The mortgage industry is going through a significant change. For mortgage origination professionals, it’s a struggle to keep on top of all the changes, and to keep your sales strategies and marketing initiatives at their peak. You need to keep your pipeline filled, and you need the tools and directions to stay profitable, efficient, and effective. We’ve brought together the best in the business to create a top tier event specifically designed for mortgage origination pros.

Mortgage Banker Magazine readers like you can attend for free by using the code MBMFREE.

www.ultimatemortgageexpo.com

After years of soaring property prices and a red-hot real estate market, property investors are now facing a new reality: what goes up, must come down. As the global economy faces unprecedented challenges, property investors are seeing a shift in the market, with prices beginning to cool and demand starting to wane.

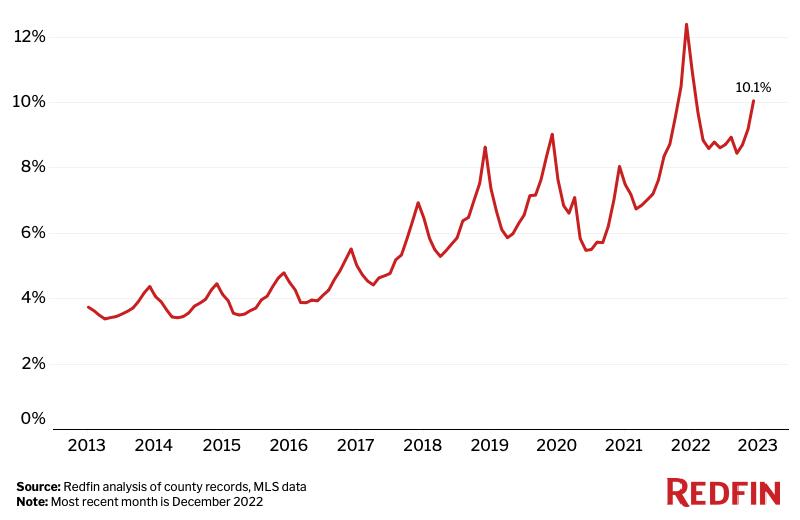

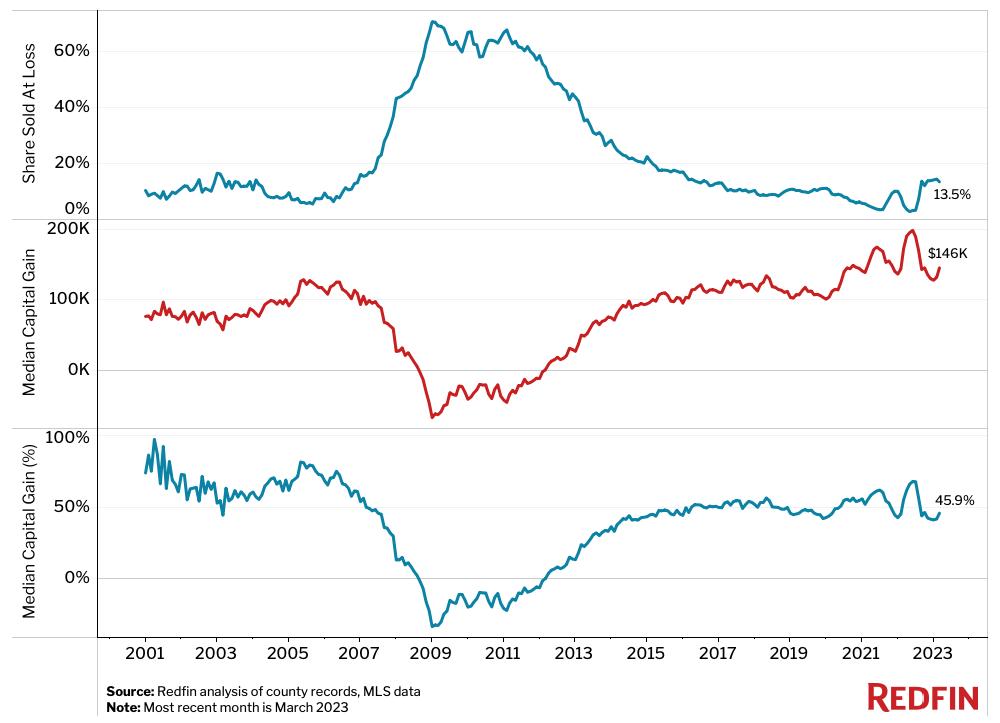

Following a record spike in the middle of the COVID-19 pandemic, investor purchases have fallen the most on record at 45.8% – which beats the 45.1% slump in the middle of the 2008 housing crash. A recent Redfin report showed that one out of every seven homes an investor sold was sold for less than paid for – causing many to lose out on any gain potential.

But it’s all about perspective. Redfin frames this data as being a red flag for the investor community, but others aren’t worried about the seemingly abrupt drop in purchases. Melissa Deal, head of sales at Haus Lending, says that the drop in activity is merely investor purchases leveling off following a period of rapid activity between mid-2020 and early 2022.

In 2021, investor home purchases grew by 64% over 2020 after being dampened by the onset of the pandemic but nevertheless grew by 39% compared to 2019, according to Realtor.com.

“While activity did drop, we have to look at that near-150% spike. But when you even out that huge spike with the gains and losses, it evens out,” Deal said. “While there still is a loss, there wasn’t a huge spike in 2006 or 2007 right before the 2008 investor activity crash.”

For Deal, this isn’t anything to be concerned about, and it certainly isn’t an indicator of a recession. After all, the too-good-tobe-true numbers needed to come down at some point.

“Trees can’t grow to the sky, the number couldn’t keep going up,” Deal laughed.

“For a while, [investor home purchases] hovered around an average of thirty or forty thousand units pre-pandemic, spiked up to 150,000, and now it’s down. But we’re still on a gradual, stable trajectory.”

“In terms of demand, we’re picking up but still seeing a somewhat healthy market. People are taking a bit longer to pay off loans and pay us back … I think a lot of [investors] are faking it until they make it.”

> Gregg Kennedy Haus Lending

Melissa Deal Haus Lending

Gregg Kennedy, Haus’ managing director of loan originations, says that investor activity is cyclical and that good, savvy investors know how to still be profitable.

“If anything, the market is finally normalizing after a frenzy during peak COVID times,” Kennedy said. “In terms of demand, we’re picking up but still seeing a somewhat healthy market. People are taking a bit longer to pay off loans and pay us back. … I think a lot of [investors] are faking it until they make it.”

Deal says that investors seemingly “pulling back” (according to the data) isn’t a message of panic. She pointed out that a lot of the market’s risk factors have dissipated, such as supply chain issues, labor shortages, and lumber prices.

“There will always be nervousness from

investors about whether they’ll be successful in their flips or make a profit,” Deal said. “But, we’ve seen that home flippers are still making a profit of between $65,000 to $70,000, which is steady. And, their market share has remained on par.”

For Deal and Kennedy, it makes sense that

markets and investor activity are cooling.

“Take a look at top pandemic spots like Scottsdale, Arizona, and Las Vegas. Those markets went crazy and so they’re bound to fall back as the market cools,” Deal said.

For experienced investors, this is just the correction that they’ve been expecting, according to Stephen Ballard, RCN Capital’s business development manager.

“While newer investors to the market are panicking, the experienced ones are looking at the bright side and noticing that today’s homes are more affordable than they were six months ago,” Ballard said. “We’re in a high interest rate environment, which you think would discourage investors. But the lower home prices are keeping them interested.”

Ballard says that as activity slows and investor purchases return to a normal level, RCN isn’t necessarily worried.

“The only concern that we have is whether our clients have the same level of data that we do about the market,” he said. “For this reason, we’re shifting our focus as to what we’re looking for from an investor… the market’s tighter, so we have to be more careful, and we want our clients to be protected. We want to see a higher credit score than we would have preferred a year or two ago, someone who has more equity and is a bit more conservative with their money.”

While investors could be alarmed about Redfin’s raw data, Deal and Kennedy both reiterated that they haven't experienced any investors expressing concern.

“They know that housing prices will only fall so far,” Deal said. “Yes, there was a crazy spike and a perfect storm for flippers last year, [which put them in] an entrepreneurial mindset. But despite a slowdown in the data, the percentages of houses that have been flipped keeps going up.”

Fred Matera, chief investment officer at Redwood Trust, says that the company’s subsidiary, CoreVest, hasn’t seen investors shy away.

“We deal primarily with small to midsized investors,” Matera explained. “Investors did step up their presence in residential mortgages over the last few years, but a lot of the larger purchases were done by institutional investors. So smaller investors that we handle have stayed relatively stable.”

While other investors have decided to slow down, Matera assures that this is cyclical and

“For the investor market, the slowdown is a combination of higher borrowing costs, but similarly we haven’t seen valuation fall, per the capitalization rate, to offset the costs of borrowing. So I think some investors are saying ‘let’s wait’ for rates to come down.”

> Fred Matera Redwood Trust

isn’t anything to be concerned about in the meantime.

“For the investor market, the slowdown is a combination of higher borrowing costs, but similarly we haven’t seen valuation fall, per the capitalization rate, to offset the costs of borrowing,” he said. “So I think some investors are saying ‘let’s wait’ for rates to come down.”

Matera also says that in the meantime, he’s seen investors with CoreVest have extra capital to play with.

“There’s a tremendous amount of lending capacity and dry powder among our clients, meaning available capital, like accessible cash and stocks, that can be sold,” he said. “It was pretty busy out of the gate this year, but now they’re taking time to sit back and see what the best financial decisions are for them.”

When rates jumped up last year, it was normal for experienced investors to take a

step back and reevaluate what they wanted to spend their money on, Matera said. Charles Weinraub, a professional flipper, home investor, and owner of Handsome Homebuyer out of Long Island, N.Y., says that he’s not pulling back altogether.

“In June [2022] I pulled back heavily waiting for the market to adjust. Since that time prices locally have dropped 5 to 10% ... I have since ramped up my marketing efforts to take advantage of less competition, but I've changed what I buy and how I buy,” he said. “Many investors are taking losses from properties they purchased in 2022. Between interest rates almost tripling, construction costs through the roof, unstab-

le market conditions, and the building departments taking forever to issue building permits, it's nearly impossible to do business.”

However, Weinraub isn’t discouraged by the seemingly impossible ways to do business. He says that he’s been approaching first-time homebuyers for safe investment opportunities. “People will always buy houses. Interest rates at 2% or 20%, people will always buy houses. As a business owner you have to be willing and able to make adjustments to meet market demand,” he said. “For the near future I’ll concentrate on the first-time homebuyer market. That's where we see the biggest demand and the lowest supply. These are the safest investments.”

Veterans, when you’re struggling, soon becomes later becomes someday becomes ...when?

Don’t wait. Reach out .

Whatever you’re going through, you don’t have to do it alone. Find resources at VA.GOV / REACH

The CE Shop made waves in mortgage education since launching their courses last year. Why? Superior education content and instruction led by Michelle White. The CE Shop is proud to congratulate Michelle on her Legends of Lending designation!

White has had an admirable career as a mortgage professional since 1993 and has successfully navigated the ups and downs of the mortgage market over the years. Although Michelle is a legend in her own right, her rise to legendary status involves a diverse background in the mortgage industry and rather humble beginnings.

White began her career as an MLO Assistant and quickly transitioned to a Mortgage Loan Originator. Her zest for learning and variety also led her to explore careers that would allow her to experience all aspects of the mortgage process from underwriting to mortgage collections and insurance. Even when markets became volatile, she viewed what others would perceive as reasons to change their career instead as opportunities to strengthen her skills and knowledge within the industry.

Almost two years ago, White decided to take her passion for knowledge and join The CE Shop as a National Mortgage Expert and help launch NMLSapproved pre-licensing and CE courses for mortgage professionals. She came in with a razor-sharp focus on providing a quality curriculum that would set new MLOs up for success in the mortgage industry. She also brought a special interest in mortgage ethics.

White recounted the time that she experienced, what she calls, her “breaking point,” which only deepened her interest in mortgage ethics. She was expected to underwrite a loan where she had uncovered an attempt at fraud. After bringing the discrepancy to her supervisor, she found no support, and was still encouraged to go forward. She decided to take a stand against the decision of her supervisor, and although it cost her the position, she gained a new sense of purpose and dedication to ensuring that mortgage professionals are equipped and intent

on providing principled assistance to their clients.

In her work with instructional teams at The CE Shop, she infused some of these pivotal moments into the curriculum so that students get a real-world feel for what they may face at some point in their own careers. “Some of my own personal experiences were incorporated into the lessons,” White noted as she spoke of her process for designing The CE Shop mortgage courses.

The CE Shop’s mortgage education program had a formidable start with White at the helm. Her philosophy of variance in content delivery, making complex mortgage laws more digestible, and practical application of the duties of an MLO coupled with a well-designed curriculum and interface quickly moved the program forward. White is proud that students of different learning styles have been successfully navigating through the course and demonstrating content mastery.

“It’s encouraging to see how many people are able to get through the program successfully,” she said.

Fortunately for the mortgage industry, retirement is not in White’s plans. She plans to stay at The CE Shop as long as she can and feed her hunger for teaching and learning. Always the visionary, she has already begun formulating plans for new offerings that will further develop the program, including ongoing professional development courses.

Personally, she hopes to continue living out her belief that learning is a journey and not a destination by sharing her knowledge with other mortgage professionals as a motivational speaker.

As an industry veteran, now officially a “legend”, White has some valuable advice for aspiring and up-and-coming MLOs: “You can do a lot of good in the mortgage industry. You’re helping people realize the dream of homeownership; one of the great American dreams. If you can help someone achieve housing stability through purchasing their own home, you’re just making your community a better place to be.”

That may be the best commission any mortgage professional could ever earn.

“If you can help someone achieve housing stability through purchasing their own home, you’re just making your community a better place to be.”

MICHELLE WHITE

Investor interest may have leveled off in 2022, but when it returns they will want to start looking for those young investors.

Katie Jensen, staff writer for Mortgage Banker, says this younger generation sees themselves not as a first-time homebuyer, but more as an investor. Social media seems to be fueling the property investment craze among Gen Zers and Millennials.

They’re tech savvy, pragmatic, progressive, and very attached to their smartphones, meaning they can gather vast amounts of information within seconds and stay up to date on the latest news. Millennials and Gen Zers are born investors, and it’s only a matter of time before they enter the real estate market.

Those pesky smartphones their parents told them to put away at the dinner table are now making some millennials and Gen Zers a fortune. They can more easily access the stock market and other investments than any previous generation. Almost 60% of Gen Z and millennial investors own cryptocurrency and/or stocks. In 2022, 40% of Gen Z and millennial investors held meme stocks. What makes these particular generations ripe to invest in real estate? Gen Z and millennial investors prioritize the potential for longterm gains when picking stocks and reaping the benefits of property assets is a long-term game.

RCN Capital Chief Financial Officer Justin Parker says he thinks one of the reasons why millennials and Gen Zers are interested in investing is because it’s such a prevalent topic on social media.

“There’s a lot of social media presence around a lot of very successful entrepreneurs that have built their wealth around real estate,” Parker says. “I think that

has driven more interest because of the exposure kids get to that level of information that, historically, really wasn’t available.”

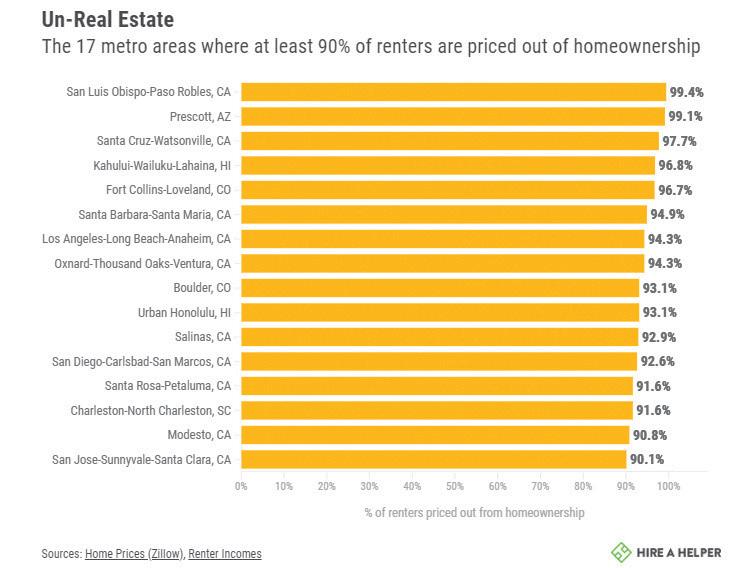

Although current price levels may have many cohorts of this generation feeling like homeownership is out of reach, the rapid increase in rents over the past two years is making them think twice.

“Gen Z is especially tuned into the idea that renting is ultimately a waste of money when compared to being able to build equity in your own property,” says Melanie Hanson, editor in chief of EDI Refinance.

Evidence shows millennials and Gen Zers love to invest their money, but at the same time, they’re noted for having the most financial anxiety compared to other generations. Looking at the major events that occurred through their lives, that actually makes sense. They have extraordinarily high levels of student debt, lower levels of wealth and personal income, and lived through the Great Recession. Some watched their parents lose their homes or their jobs because of it. At the end of the day, debt can be a friend or an enemy depending on how you use it. So when these kids go shopping for a mortgage, it’s safe to bet they’re going to have questions and they’re going to be careful about who they trust.

Truthfully, it’s tough for anyone to qualify for a mortgage right now, especially if they have poor credit, stu-

dent debt, or don’t have the cash to afford a home. That’s why many have explored alternative ways to dip their feet in the real estate market, such as REITs, real estate mutual funds and companies with a real estate focus. A survey by GOBankingRates found that nearly one in four (24%) Gen Zers report being real estate investors.

RCN Capital has its fair share of Gen Zers and millennial clients.

“We see a tremendous amount of clients under the age of 30 and under 20 — call it younger, newer investors that have entered the marketplace,” Parker says. “They have their own different approaches to how they go about business.”

Bill Mervin, regional vice president of NJ Lenders Corp., has plenty of Gen Z and mil lennial clients and says the basis of his entire business is built on being a mortgage planner. As someone who began his real estate investing career at 21 years old, he’s the perfect authoritative figure to help young investors forge their path.

“We always frame it as a mortgage consultation, never just an application,” Mervin says. “We wanna usually sit down and spend a lot of time upfront building that trust.”

Loan officers and brokers should be more than debt salespeople. Being somewhat of a financial advisor, educator, and working creatively to help the toughest of borrowers is what makes your business valuable. Otherwise, you’re a commodity.

“We’re not debt salespeople,” Mervin says. “When individuals think of you as transactional, they’re gonna kind of put you in a box, and then it only comes down to price.”

Hand-holding is absolutely necessary for younger, inexperienced investors.

“The biggest piece of advice that we give to each and every one of them is find people that you can partner with and trust,” Parker says. “That doesn’t necessarily mean go in on the deal with you, but what it means is find a lender that has a wealth of knowledge to where they can kind of guide you and talk you through those deals and what to expect and what not to expect and what to be on the lookout for.”

So when these kids come knocking on your door, be prepared for questions like “How does DSCR work?” or “Can I put down less than 20% on an investment property?” or “Is it okay to rent out my home on Airbnb?”

What young investors really want to know

logistics, flexibilities, and functionalities they offer. This means knowing the ins and outs of all your products, including FHA, DSCR, Flip’n Fix, FHA 203(k), and whatever else is on the menu.

Typically, first-time investors and homebuyers will try to time the market for the “right time to buy,” but loan officers, brokers, and real estate agents know from experience that feeling is elusive.

“I was involved in real estate in Florida in 2004,” Mervin says. “A big major national builder bought a bunch of lots and stuff like that. And then six months later they’d marked them down 75% and I got swept up in that. At the end of the day, what I learned was these guys had all the money and all the smarts in the world to try to look at this stuff and they missed it.”

If Mervin had a client say this was a declining market or that now is not the time to buy, he’d likely tell them, “I just bought a duplex last week. I tell people I’m putting my money where my mouth is.”

Timing the market also isn’t necessary if the investor client plans on holding the property long term.

“Real estate, when stretched out over 5, 10, 15 years, there’s never been a period in history where that hasn’t produced tremendous returns,” Mervin says. “That’s why I’m not a real estate flipper. I mean, I’ve done like one of them in my lifetime, but I want to buy and hold everything that I can get my hands on.”

Buying while rates are still high may be a good strategy, because it allows investors to get in

before rates drop and the buying frenzy begins. Mortgage rates can be refinanced, but the price of the home is

So what are the best strategies and products for young investors looking to get into the market right

House hacking with an FHA loan is a great strategy for those young real estate investors who don’t have a lot of capital. They’ll use an FHA loan to buy a multi-family property and put down only 3.5% to 5%, depending on their credit scores.

“This is particularly good for the folks that don’t have children yet, and want to buy this as a way to start a real estate portfolio,” Mervin says. “They might also need a home to live in. Then one or two years down the road, they move out of that duplex or triplex and turn it into a full-on investment property.”

However, if a client doesn’t need a primary residence, the single-family rental market is probably their best bet. These small starter homes are manageable in terms of maintenance, and the investor and/or landlord only needs to find one tenant.

“I think a single family rental is a great way to dip your feet in the water,” Parker says. “If you find a rent-ready stabilized property where you just have to put a tenant in there that generates income to cover your mortgage payment, that’s pretty hands off.”

Another popular product for first-time investors are single-family fix-and-flip businesses, Parker says. They’ll need to find a home that is a little run down or distressed, get a decent price on it, and then throw a fresh coat of paint and do a light rehab. Later, they can sell it or refinance it into a rental loan.

There’s plenty of options to make real estate investing more affordable for young investors. Loan officers and real estate agents are the ones who can help these borrowers beat institutional investors that are pushing more and more people out of the market.

“You’re gonna have to execute violently and quickly when you see in this market,” Mervin says. “The key to being able to do that is to have all the information, to have all of your ducks in a row, and to have that planning done upfront so that when something checks those boxes, you can move on it quickly.”

Loan officers and brokers should be more than debt salespeople. Being somewhat of a financial advisor, educator, and working creatively to help the toughest of borrowers is what makes your business valuable.

It’s time to let your skills shine. Find resources for breaking through barriers like degree screens and stereotypes. It’s time to tear the paper ceiling limiting STARs: workers Skilled Through Alternative Routes rather than a bachelor’s degree.

I am more than who I am on paper.#HireSTARs

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions. When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com

(844) 851-3600

sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

The Carrington Advantage Series is a full suite of Non-QM Loan solutions that “Delivers More” for you and your borrowers. Ideal for borrowers, like the self-employed, that don’t fit Agency or Government Qualified Mortgage standards based on credit quality, property type, documentation type, income documentation, or other borrower situations.

• FICOs 550+

• Primary wage earners FICO

• DTIs up to 50%

• Bank Statements (personal or business) accepted

• We don’t require disputed tradelines to be removed

With the Carrington Investor Advantage (DCR)

• DCR down to .75

• First-time investors are ok

• Only 48 months seasoning for major credit events

• 1x30x12 mortgage history ok (866) 453-2400 carringtonwholesale.com

LICENSED IN: 47 States (excluding NH, MA & ND.)

Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors.

*Ease of use (Support staff, technology an other tools to support mortgage bankers) FirstFunding’s FlexClose Funding program allows our clients to fund outside the Fed wire restrictions. Same day and afterhours funding. Browser-based proprietary platform, customized reporting tools, and a dedicated customer service team.

Conventional Conforming, Jumbo, FHA, VA, USDA, Non-QM

(214) 8217800

firstfundingusa.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Be available when your clients go looking. Directory listings ensure your company is accessible when your clients are looking for you. Your listing includes:

• 6 or 12 month options

• Your active listing highlighted in the monthly special feature

Clear Capital is a national real estate valuation technology company with a simple purpose: build confidence in real estate decisions to strengthen communities and improve lives. Our commitment to excellence is embodied by nearly 800 team members and has remained steadfast since our first order in 2001.

clearcapital.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

West Hempstead, NY

DSCR Rental NO DOC Loans

Alpha Tech Lending is a trusted direct lender, with over a combined 30 years of experience in the private lending sector. We offer a variety of loan programs for non-owneroccupied residences that are customizable to suit your real estate investment needs. From fix and flips, long term rental, new construction, commercial bridge, and more. We lend to both new and experienced real estate professionals throughout the country. We value long term relationships built on trust. Our brokers are protected.

alphatechlending.com

(888) 276-6565 info@alphatechlending.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Pine Brook, NJ

Stratton Equities is the leading Nationwide Direct Hard Money & NON-QM Lender that specializes in fast and flexible lending processes. Our Hard Money and Direct Private Money loan programs support the following investment projects:

• Fix and Flip

• Soft Money Loans

• Cash Out — Refinance

• Fixed Commercial Loans

• Commercial Bridge Loans

• Bridge Loans

• Stated Income/ No-Income Verification Loans

• Rental Loans

• Foreclosure Bailout Loan

• NO-DOC

• Blanket Loans

• Fixed Rental Programs

• Multi-Family Loan

No Upfront fees! No Junk Fees! No Tax Returns!

strattonequities.com

(800) 962-6613

info@strattonequities.com

LICENSED IN: All States except for: AK, ND, NV, SD, UT

Your listing comes with an enhanced online profile, which includes:

• Company name, logo, & description

• Contact phone, email, social accounts, & location

• All directories your company is listed in

• Latest 3 mentions in articles on our site

• Latest 3 webinars hosted by your company (if applicable)

Prices are subject to change. Pricing is not guaranteed until a contract is formed.

ambizmedia.com/resource-guides

“If you haven’t yet realized your full potential, feel like you’re not worthy of success or think you’ve not made it, this book is dedicated to you, the underdogs of the world. Remember, it’s not how you start, it’s how you finish.”

–Glenn Stearns

“Making hard decisions that require difficult changes is about learning to respect and honor your future self.” –Glenn Stearns

“The mindset that comes from adversity - from living through loss, fear, and pain can be a wonderful tool.”

–Glenn Stearns

Glenn Stearns, the founder and CEO of Kind Lending, is a well-known force in the mortgage industry and beyond thanks to his founding of Stearns Lending and his starring role in the television series, “Undercover Billionaire.”

Now he can add top-selling author to his biography. His new book, “InteGRITy,” debuted at the top of Amazon’s bestseller list when it debuted in mid-May.

According to information supplied by his publisher Simon & Schuster, the book is filled with anecdotes from Stearn’s roller-coaster life and career. He shares the lessons learned in his life, both personally and professionally, that helped him become the successful business leader he is. Through the book, he hopes to inspire others and leave a legacy built on kindness.

He spoke with Mortgage Banker Magazine staff writer Katie Jensen about his new book and the inspiration behind it.

Stearns: I’ve always led with my flaws, right? I’ve been very fortunate to have been able to grow a mortgage business through some tough times and come out in a very good place. I’ve had a lot of people say, how did you do it? By showing people the good, the bad, and the ugly, I think, and I hope it’ll motivate other people to know, when they’re ready to give up and when they think this is a dead end road, that they know everybody goes through that.

We all have very similar stories, and it’s just the power of persistence in not giving up. And so my goal is that if they are in our business, they realize we’re in a very small business and that they need to just keep their head down and live with integrity and try to surround themselves with good people and then it becomes a very rewarding business.

“When you’re in business, you’ve got to be willing to think outside the box and try new things, even if it makes you uncomfortable. It doesn’t matter if you’re a start-up or an established company - evolving is a never-ending pursuit.”

“Oftentimes, especially in business, you need to be chameleon-likemalleable and adaptable enough to your surroundings to survive. If you’re not, you’ll fall.

–Glenn Stearns

–Glenn Stearns

MB: Do you think aggression is an ingredient to success? And if so, what does healthy aggression look like within the business world?

Stearns: Of course a way to keep score is to watch your market share and how you rise above your next competitor and those kind of things. And, that’s OK. But when we turn and we say you are the enemy and we are going to try to destroy you or scorch the earth, and all those kind of things, we’ve missed the boat on what we are supposed to be doing when it comes to this industry.

We’re all in this together. When we don’t help each other, we do get into a place that we’re not helping each other. When I sold [Stearns Lending] to Blackstone, two years later, I was sitting in a board meeting. They were talking about … a 28% attrition rate and we had this and that. I said, wait, wait, back up. You said we had a 28% attrition rate? We’ve got 3,500 employees. When I sold the company to you guys, six people left that year. I knew their names. So 28%, you’re telling me over a thousand people leave our company and basically tell everybody else we suck.

That’s terrible. And so what happened? And the difference was that we’re kind and we knew our competitors, and we would call and go, “Hey, it looks like you got a few people that aren’t very happy over there. You might wanna talk to them because we are getting their resumes and maybe you can keep them.”

And when you put yourself in a position that allows you to be friendly and respectful of your competitors, then the next thing that happens is they honor you back. Right?

I’d rather go back to wanting to move the needle, wanting to be aggressive in our programs, in our marketing, in our ability to communicate to brokers or to our borrowers, our ability to have the best technology. I want to be aggressive in my ability to invest in my company and making sure we’re the best place to work so we can attract more people to come over here.

I don’t want to be aggressive in putting down the other lenders in saying why we’re better than them. I don’t have to do that. None of that matters. When people see happy people in your company, then that attracts other people.

I think I have a lot of respect for the other owners. I think they have respect for me and we just don’t get ourselves in a lot of pissing matches, you know?

competition between UWM and Rocket, it can get pretty vicious. Should you maintain that mentality of sticking to kindness and being a friendly competitor when your competitor is really trying to corner you?

Stearns: That wouldn’t happen with us. I’d call up [UWM CEO] Mat Ishbia and say, let’s go to lunch. I ran into Mat a while ago, and when we were talking, he said, “Glenn, I never had a better time in this industry then when we were number two and you were number one and we were fighting to try to beat you. We did that for a couple years and we sharpened each other. We made each other better. Everybody needs a very good competitor in order to get better. And I respect Mat for that. I loved that we went toe-to-toe and it was wonderful. When I got back in, I told him, hey, we’re coming after you in a joking way. Right? It was fun.

Now, I don’t want to get in a fight and say, you know, you can’t use another

You know, don’t get me wrong, don’t compare kindness for weakness, right? There’s a difference. I don’t mind standing up for myself, but I also don’t have a problem communicating with somebody else, another CEO that we need to. You know the problems happen when you stop communicating. There’s no reason why we can’t coexist. And hopefully in a space where we respect each other. I wouldn’t get into the fights that they did because I’d rather jump on a plane and try to solve the problems.

MB: A really great thing about this industry is that it seems to be populated by self-starters who succeed from difficult backgrounds. So it makes for a lot of great stories. Why do you think that happens? Why do people like that gravitate towards the mortgage industry?

Stearns: It’s an industry that has an unlimited upside and a very cruel

“The most important gift you can offer people is the encouragement to believe in themselves. Planting seeds of hope doesn’t require you to be bigger or more successful than others; you simply need to have enough confidence in yourself to build.” –Glenn Stearns

downside. Right? It’s a place where you can be very imaginative in your growth, and you can have your ideas and you can gain a lot of traction with people that believe in you and you can. Do some amazing things with a company very quickly and you can change a lot of lives.

So, there’s a lot to gain in getting into this industry. It’s a very cyclical world where if you only look a month ahead or at your present, you will fail. Drastically and fast and quickly. If you look at the cycles and you want to be in it for a career, then you realize you make a lot of money in this industry and you give at least half of it back during the down cycle. If you look far enough out, you understand that you need to always invest in the future and be prepared.

This has happened a few times where people have compared our company or myself to other owners that were living a real high life. I said that’s wonderful that they do that. I don’t feel it’s my money. It’s the company’s and I need to invest back in them. They’ll come a day and we see that today, right? They dividend out a lot of their money and now they need to have that money and it’s not there. You run into

some problems. You really have to look in the future if you want to have a strong business.

MB: You said in your book when you’re in business, you’ve got to be willing to think outside the box and try new things. Are there any examples that you can point to in your career where you thought outside the box and succeeded. Stearns: Right now we’re succeeding in Kind Lending in a world where everybody is struggling. And I’ll give you a couple examples of that and then I’ll tell you why I think it’s happening. If you look at our market share growth from all the reporting lenders, we were up 601% from last January to this January. We’re up over 200% just from January until [the end of April], and we are up a little bit more than that from last year this time to now when everybody else is down 60, 70, 80% from last year.

What’s different about us? Well, I’d say it’s because it isn’t our first rodeo, right? We’ve done this before and this time I’ve thought to myself, OK, what is it that I

want to do? Well, I want to be authentic. And an example of that is we had a wonderful software for the broker last time at Stearns, and it was called Snap. It was very quick, it was very efficient, and you could basically utilize that as a tool to help get you more business. And so when we sold the company, they changed that up and they wanted it to be a little bit different. And when they did that, we lost a lot of what was very special.

So when Kind came about, I said, I want to have the easiest software for the broker. I want to make it simple. I don’t want to make it perfect. I want it simple, and I want it fast. So we call our broker portal the Kwikie, right? And it’s the Kwikie because we have happy beginnings and happy endings. If it’s your first time, we’ll go easy on you. It doesn’t have to be hard. And we have all these puns that are very light and fun and make people go, did they just say that? Oh my God, a quickie, happy endings. Oh my goodness. And it makes people laugh and then they feel like, Hey, you know what? These guys are a fun company. They’re light. They make fun of themselves.

“Success isn’t a line you cross but the journey you take. If that’s true, then there is no finish line.” –Glenn Stearns

Nomination Deadline: July 28

By KATIE JENSEN, STAFF WRITER, MORTGAGE BANKER MAGAZINE

By KATIE JENSEN, STAFF WRITER, MORTGAGE BANKER MAGAZINE

hen OpenAI released ChatGPT to the public, entrepreneurs and people working in various industries were overwhelmed with the amount of possibilities this new technology could do to help increase efficiency in their business. As a large language model capable of generating human-like text, ChatGPT has the ability to converse with humans and answer questions within seconds.

Founder and CEO of Instamortgage Shashank Shekhar wasted no time getting to know the program and seeing what it could do for lenders, originators, and real estate

Wagents. Shekhar began playing with it to see how competent the technology was by having it write essays and poems.

His biggest frustration? The program sometimes shuts down because an overload of users are signing into it. Then, OpenAI launched the paid version, going for $20 a month, a couple of months later. Shekhar says the wonderful thing about ChatGPT is that anyone can use it. If high schoolers can get it to write their essays on The Odyssey, grown adults should have no trouble getting it to perform basic tasks such as writing an email.

“You don’t need any programming experience or coding experience,” Shekhar says. “It uses natural human language. And that’s what I mentioned in the ebook as well.

It’s like talking to Siri or Alexa or Google Assistant.”

This technology, valued over a billion dollars, is available to anyone at zero cost. In an attempt to help advance the mortgage industry that’s notably far behind other industries in terms of technology, Shekhar decided to write an ebook (also for free) instructing mortgage professionals on the various ways they can use ChatGPT for their businesses.

The more time spent playing with the technology, the better people will become at using it. Shekhar says that it’s a good idea to learn some prompts to ensure commands

or questions are understandable, and to get more accurate responses.

Here is a prompt provided in the ebook that works for marketing emails: “Write an email to a prospect for using me as a loan officer to get a mortgage for buying a home in Las Vegas, Nev., using the four Ps persuasive framework — promise, picture, proof, and push.”

ChatGPT then spit out an email Shekhar could copy, paste and send to his prospect, or he could make edits and craft it to reflect his voice.

For those who struggle with using social media to market themselves effectively, ChatGPT can be a helpful guide. In Shekhar’s ebook, he says it can create a content calendar to help plan what works best for you and writes the content. If you already have a written draft, ChatGPT can revise it to a specific tone, even adding a touch of humor. For videos, it can suggest just the title and the description, or it can write an entire script.

The most useful way to use ChatGPT is by having it help build relationships with referral sources, especially real estate agents.

Mortgage veterans will say the best way to get your foot in the door is by providing these Realtors value. Shekhar says this is typically accomplished by solving their problems, or by helping them create more opportunities and close more business. ChatGPT can do both.

Ask it to write listing descriptions for a three-bedroom, one-and-a-half bathroom house set in a quiet cul-de-sac. Obviously, the more detail added, the better the listing description will be. Then, ask it to shorten the description for flyers or social media posts.

In Shekhar’s book he says that the use cases for real estate agents far exceed that of a loan officer. If a loan officer were to teach classes on this topic to local real estate boards or officers, they would be building relationships with plenty of referral sources. Shekhar used the same strategy to build referral sources when he got started in the mortgage industry around 2008.

“I started teaching Realtors on using social media and video marketing in 2009 when it was a very new technology,” Shekhar says. “Very few people were using it so I could get in front of hundreds of real estate agents … and I think the same opportunity is there for loan officers now with ChatGPT.”

ChatGPT can also calculate mortgage payments and even run amortization

scenarios and pre-qualifications for loan officers’ clients. Here is a prompt that Shekhar used: “What is the mortgage payment on a $425K loan at 6% for a 30-year fixed loan?”

ChatGPT’s response: “The monthly mortgage payment on a $425K loan at 6% interest for a 30-year fixed loan would be approximately $2,548.90.”

Although this is an advanced supercomputer machine, ChatGPT can make mistakes from time to time. Shekhar says it can calculate basic pre-qualification when provided the debt-to-income ratio, even for more complicated pre-qualifications, but doublechecking answers is recommended.

“I have tested it on a few numbers where it’s not too far off the correct answer, but it’s not the correct answer,” Shekhar says. “And so those are the things that we need to wait on. And we need to be giving it a thumbs down. That’s one of the ways ChatGPT learns is that if you give it a thumbs up, it knows that it’s the right answer. If you give it a thumbs down, then it knows it’s the wrong answer and maybe tries to figure it out by itself. Maybe you can teach it by saying, ‘OK, this is how you calculate debt-to-income ratio. How you’re calculating it is wrong.’”

Most of the cases that Shekhar provides in the ebook revolve around marketing, education, and content creation. But as newer versions of ChatGPT come out and improvements are made, it has the potential to make more accurate calculations and perform more complicated tasks.

In Shekhar’s ebook he notes how quickly the internet became obsessed with ChatGPT. An infographic shows that Netflix took 3 ½ years to reach a million users, Twitter took 2 years, Spotify took 5 months, and ChatGPT took only 5 days. Newer versions are already being made too. It was originally launched in November 2022 as GPT-3.5, then GPT-4 was launched March 14.

However, it will take time to enable ChatGPT to perform more advanced mortgage-related tasks, such as risk management, but Shekhar says it is theoretically possible. Unlike artificially intelligent platforms, ChatGPT uses machine learning technology so it can improve on tasks the more it is used. It does have the potential to detect fraud if it was trained to do so. Shekhar provides an easyto-understand example of how this works:

“Through learning millions of intakes, it can help with risk management for lenders.”

“Let’s say that you want a platform to understand or be able to recognize what a cat looks like,” Shekhar says. “Now that machine will be fed hundreds and thousands of pictures of a cat and will be told what the basic features of what a cat is. They have four legs, whiskers, they’re small, and so on. ChatGPT will be shown a lot of other pictures that may look like a cat, but it’s not a cat. Maybe a baby tiger or lion or whatever. And then after that, it comes to a point where the machine has learned on its own and now it’s able to figure out which one is a cat and which one is not.”

In the mortgage world it can do the same to detect fraud.

“You can use the same machine learning to teach a platform like ChatGPT to understand, for example, which one is the correct pay stub and which one is not, or which one is the right W-2 and which one is not,” Shekhar continued. “And through learning millions of intakes, it can help with risk management for lenders where it’s able to figure out, ‘This pay stub is not correct, it’s a fraud.’”

Is it competent enough to replace experienced staff members such as underwriters, loan officers, processors, or

risk managers? Shekhar says “no,” because it can make mistakes. It requires oversight on the tasks it performs, like an intern would. ChatGPT is not necessarily your best employee, but it can do some things for you and make completing your daily tasks easier.

Time is another currency that loan officers, lenders, and other mortgage professionals can never get enough of. Broker owners who don’t have a large support system around them or need to scale back on staff in a down market need help handling marketing, client management, and relations with referral sources. Interns are a great solution, but it’s also likely they would want to be paid more than $20 a month for assisting with all these tasks. They’re also not available 24/7 and aren’t talented in all of these areas.

“One of the challenges that I have always faced is the fact that you can’t find one person with all the talent,” Shekhar says. “If you’re looking for somebody who can write video scripts, write blogs, write social media content, research for me to figure out which content will actually rank and do better … you are probably looking at three, four different interns because not all of them

have the talent to be able to do all of this.”

However, having ChatGPT do the initial heavy lifting makes it easier for one person to complete all of these tasks.

“I mean, 50%, 60%, 70% of the work is done for you,” Shekhar says. “Now you can have an intern who can possibly then go and finish the rest of the task, or you can do it if you’re a one person shop.”

Users can measure the success of ChatGPT for their business the same way they normally would. For example, if the open rate on a marketing email was 15%, and after using ChatGPT it ticked up to 20%, then it’s working. You can measure success the same way with tracking likes on social media posts or visits to a blog web page.

Shekhar’s ebook ChatGPT For Lenders is free. Downloads are available at chatgptforlenders.com. Plug in your email, phone number, and NMLS ID and a free copy will be sent to you.

“It’s just my way of giving back or paying forward to the industry that has helped me quite a lot over the last decade,” Shekhar says.

Picture your dream home. Now look down. There’s a bright red line keeping you out. Join host Katie Jensen as we dive into redlining and the legacy of discrimination. You’ll hear first-hand accounts from those who’ve had to fight back to achieve their dreams. And we’ll challenge industry leaders on how to rewrite this legacy.

Silencing your notifications and ignoring your email at the end of the workday could make you a better leader at your job, according to new research.

Managers who disconnected from their jobs at home felt more refreshed the next day, identified as effective leaders, and helped their employees stay on target better than bosses who spent their off hours worrying about work.

Less-experienced leaders were especially prone to becoming ineffective if they spent their time focusing on their jobs at home.

The upshot is that the key to effective leadership in the office might be a better work-li-

“The simple message of this study is that if you want to be an effective leader at work, leave work at work,” said Klodiana Lanaj, a professor in UF’s Warrington College of Business who led the research. “This is particularly important for inexperienced leaders, as they seem to benefit the most from recovery experiences when at home. Leaders have challenging jobs as they juggle their own role responsibilities with the needs of their followers, and they need to recover from the demands of the leadership role.”

The study surveyed managers and their employees at U.S. businesses in 2019 and 2022. The researchers assessed leaders’ ability to disconnect from

Less-experienced leaders were especially prone to becoming ineffective if they spent their time focusing on their jobs at home.

“What we found is that on nights when leaders were able to completely turn off and not think about work, they were more energized the next day, and they felt better connected to their leadership role at work. On those same days, their followers reported that these leaders were more effective in motivating them and in guiding their work,” Lanaj said.

“But on nights when leaders reported that they were thinking about the negative aspects of work, they couldn’t really recuperate their energy by the morning,” she said. “They saw themselves as less leader-like and they weren’t as effective, as rated by their followers.”

So how can leaders – and businesses – promote this kind of work-life balance to build effective leaders?

“My hope is that this study will give managers data to support their decision to be present

at home and to disconnect from work,” Lanaj said.

While Lanaj’s study didn’t ask managers how they relaxed at home, other research points to well-known ways to unwind and reset: Exercise, socialize with friends, spend quality time with family, or engage with TV shows, books or hobbies. What helps one person leave work at the office might not help another. The key, Lanaj says, is to find the methods that let you decompress from work as much as possible.

And businesses that want the best out of their leaders on the job should help them recharge at home. Reducing after-hours emailing and expectations for on-call work is one way to do that.

Tech fuels a lot of this after-hours work, but also might offer a solution. You can set your phone to disable notifications after a certain hour or leave work devices in a dedicated office.

“You can start small,” Lanaj said. “Say, ‘After this time in the evening, I won’t check my work email.’ See where that takes you.”

sluna@ravdocs.com

469-730-4607

Scott Luna’s practice is focused on real estate law with an emphasis on mortgage document preparation and land title issues. Scott managed a successful multistate highvolume title and document preparation business for over 20 years before joining RAV and is recognized throughout the real estate legal community for his expertise. As a past President of the Oklahoma Land Title Association, Scott’s ongoing involvement in the industry adds to his wealth of title-related knowledge. Scott received his Juris Doctor degree from the University of Tulsa College of Law in 1991 after receiving his Bachelor of Science degree from Texas A&M University. Scott is currently licensed in Texas, Oklahoma, Missouri, Minnesota, Nebraska, and Kentucky.

Mitchel H. Kider Managing Partner

kider@thewbkfirm.com

202-557-3511

Mitch Kider is the Chairman and Managing Partner of Weiner Brodsky Kider PC, a national law firm specializing in the representation of financial institutions, residential homebuilders, and real estate settlement service providers. Mitch represents banks, mortgage companies, homebuilders, credit card issuers, and other financial service companies in a broad range of litigation and regulatory and compliance matters. He defends clients in investigations and enforcement actions before the Consumer Financial Protection Bureau, Department of Housing and Urban Development, Department of Justice, Department of Veterans Affairs, Federal Trade Commission, Fannie Mae, Freddie Mac, Ginnie Mae, and various state and local regulatory authorities and Attorneys General offices. In addition, Mitch acts as outside general counsel to smaller companies and special regulatory and litigation counsel to Fortune 500 companies.

Gregory S. Graham Co-Managing Partnerggraham@bmandg.com

972-353-4174

Black, Mann & Graham CoManaging Partner Gregory S. Graham has practiced in the areas of real estate, litigation, and bankruptcy law since 1989, and is currently licensed in Texas and admitted to practice before the United States District Courts for the Northern and Eastern Districts of Texas.

Mr. Graham is also currently licensed to practice law in Georgia and has been since 2017. He received his Juris Doctor degree from Southern Methodist University School of Law in 1989 after receiving a Bachelor of Arts cum laude from UT Dallas.

Mr. Graham’s affiliations include the Dallas MBA, where he previously served as a Director & Chairperson of the Legislative Committee; DFW Mortgage Brokers Association, where he previously served as Legal Counsel; MBA; NAMB; Texas AMB prior to its closure; and Texas MBA.

James W. Brody, Esq. Mortgage Banking Practice Group Chair

James W. Brody, Esq. Mortgage Banking Practice Group Chair

jbrody@johnstonthomas.com

415-246-3995

James Brody actively manages all the complex mortgage banking litigation, mitigation, and compliance matters for Johnston Thomas. Mr. Brody’s experience centers on those legal issues that arise during loan originations, loan purchase sales, loan securitizations, foreclosures, bankruptcy, and repurchase & indemnification claims. He received his B.A. in International Relations from Drake University and received his J.D., with a certified concentration in Advocacy, from the University of the Pacific, McGeorge School of Law. He was a recipient of the American Jurisprudence BancroftWhitney Award. He is licensed to practice law in California and has been admitted to practice in front of the United States District Courts for the Central, Eastern, Northern, and Southern Districts of California. In addition, Mr. Brody has served as lead litigation counsel for numerous mortgage banking and commercial related disputes venued in both state and federal courts, in a direct capacity or on a pro hac vice basis, in AZ, CA, FL, MD, MI, MN, MO, OR, NJ, NY, PA, TN, and TX.

Attorney

marty.green@ mortgagelaw.com 214-691-4488 ext 203

Marty Green leads the Dallas office of Polunsky Beitel Green, one of the country's top residential mortgage law firms. Mr. Green is an accomplished attorney with more than 20 years of experience in the legal, banking and financial services industries. He is the former Executive Vice President and General Counsel for Dallas’ CTX Mortgage Co. and previously worked with the Baker Botts law firm in Dallas as Special Counsel. In his role as leader of the firm’s Dallas office, Mr. Green advises clients on the latest rules and regulations covering residential lending, in addition to building on Polunsky Beitel Green’s long tradition of delivering loan closing documents with speed and accuracy. Mr. Green is admitted to practice before all Texas state and federal district courts in addition to the U.S. Court of Appeals for the Fifth Circuit. An honors graduate of the University of Texas School of Law, he earned his undergraduate degree at Southern Utah University. Texas Monthly has selected him as a Super Lawyer multiple years.

These attorneys are universally recognized by their peers as setting the highest standard for the legal profession, excelling in all fields — knowledge, analytical ability, judgment, communication, and ethics.Marty Green

When looking at the appraisal process, there are two variables that create the biggest variance. How fast an appraisal is paid for and how fast it is scheduled. To set up a borrower for a better experience, make sure they understand the need to pay for their appraisal and be available to allow an appraiser to come to the property. It is critical to set the best expectations and have good transparency throughout the process to ensure you and the borrower are on the same page. Here are the 5 ways to create a better appraisal experience for your borrower:

While analyzing thousands of appraisals we found orders that were required to be paid for up front, averaged almost ¾ of a day longer in turn time than those that were not paid-up front. This is adjusted for the time the order is on hold waiting for that payment.

The process of waiting for the payment causes operational challenges for appraisal desks and Appraisal Management Companies (AMCs).

The scheduling of an appointment is another bottleneck in the process. Most appraisers accept assignments in the current market under the assumption they will be able to get into the property within the next 24-48 hours. Especially when turn times become very competitive, appraisers are worried about scheduling issues and being able to get into the property. When an appraiser cannot get access to a property within that timeframe, they usually end up putting the appraisal back onto the back of their queue because they’ve already committed to delivering several other appraisals in that timeframe.

Appraisers do not need to spend very much time at a property. The percentage of time spent inspecting a property compared to the overall completion of the appraisal report is very minimal. The majority of the time is not spent in a home, it is spent researching, adjusting, and analyzing property data and market trends. Their main role at the property is to gather an accurate measurement and evaluate the condition and quality of the property. They will have to get a photo of every room in the house. Some important things that may be good to mention to the appraiser are any additions of square footage, recently finished basements, or recently updated kitchens and bathrooms. Additionally, anything specific about the market that might be unknown to the general public, such as a new park going up, FSBO sales not listed publicly, etc.

The appraisal is not meant to be a value for the best possible price of a home. An appraisal is meant to be a snapshot in time view of the value of the home. Appraisers use recently closed sales to form a view of the value of the property. Houses under contract or for sale can slightly adjust prices, but the majority of the value comes from closed sales. The appraiser takes a fairly conservative approach to getting to the value and is meant to help the bank evaluate the risk of the loan.

As a lender or AMC, you are only as good as the information you have on your vendor pool when it comes to assigning appraisals. You want to ensure you are staying compliant with selection processes but also select the best vendor for the property. The best way to do this is through robust reporting and comparison analysis through KPI’s.