A rorrnlr rlinn:nr aIFt\/laled , ",^^.-l +^-l-'^^l^-' vvuuu LcLr il lulu6y

A rorrnlr rlinn:nr aIFt\/laled , ",^^.-l +^-l-'^^l^-' vvuuu LcLr il lulu6y

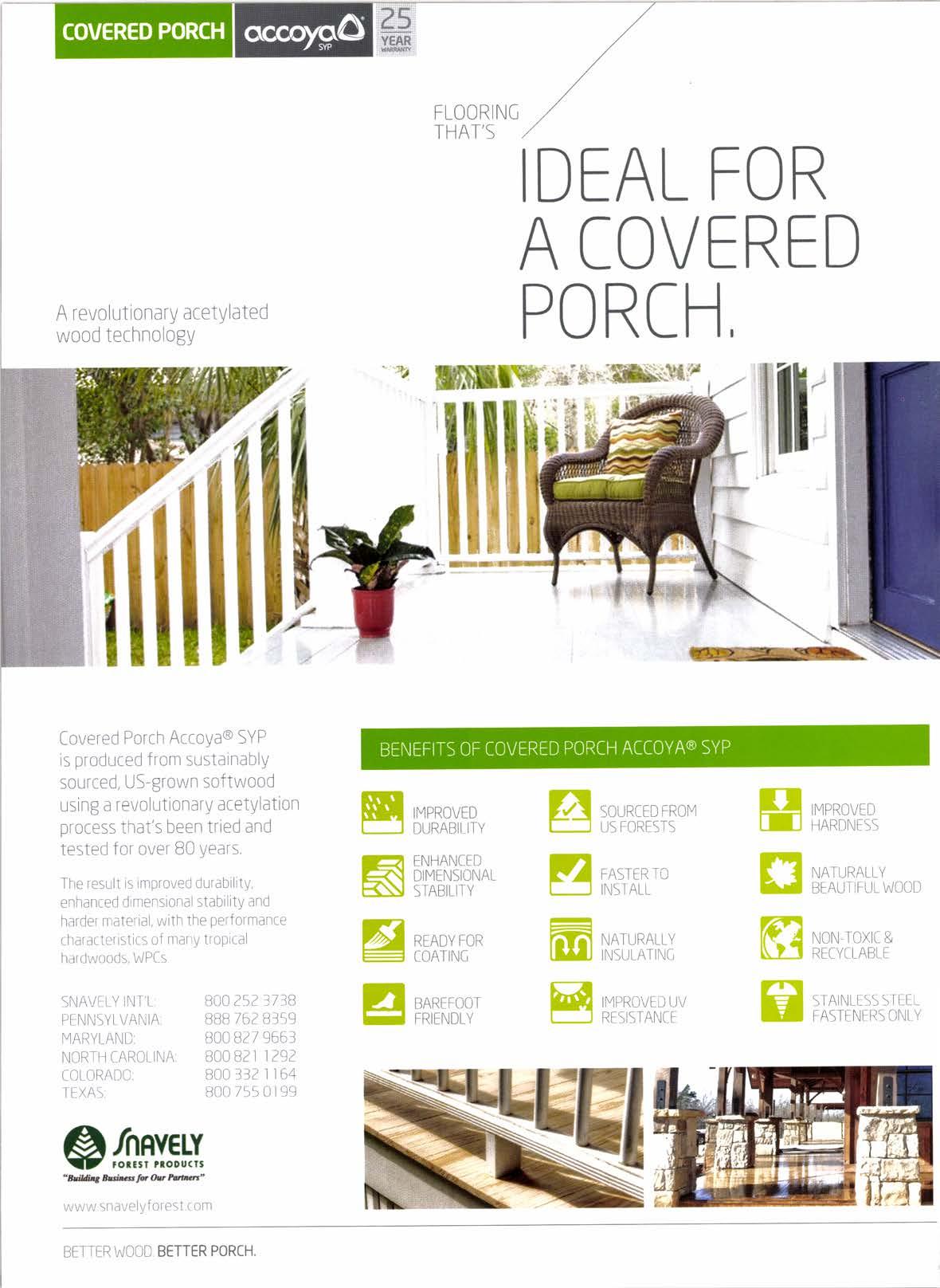

fovered Porch Accoya@ SYP rs produced from sustainablY sourced, US-grown softwo0d using a revoluti0nary atetylatl0n

n: nr pqq -r;1'<, hpen lrted af d tested for over B0 years

Tle result 1s imptoved durabilrty, enhanced d menstonal stability and harder m,-tte,lal, u;ith the pei-formance chararltristics of rnairV trop ral h,:rdwoods, WPCs

SNAVFI Y INT'L BAO 252 -7 3B

PI-'NNSYI VANIA BBB 762I]]';g

YIARYLANLI U00 t]2 / 966i

NORIi I IAROLINA: 800 BZI I 292

tOt ORADCT 800 332 I I 64

TFXA! 800 755 0 I gcl .t}' ) gI /NRVCLY !7 rorrsr rloou(lr^WttufuOsIw." vtwrr snavelyf orest t om

I14PROVED DURABII ITY

FNHANIFD DIMTNSIONAL S IABILI]Y

RTADY FOR t OAT|NI

BARFFOOT FRIENDLY

SOURTED FROYI iJS FORFSTS

FASTER-iO INS IALL

NATURALLY INSULATINT, II'4PROVEJ IJV RTSISTANTF

IMPRCV{:D HARI]I\F55

NATt]RALLY tsIAUiII_UL WOOD

NON TOXIT & REIYTLABI E

STAINLTSS S IIT. i:ASl {-N['RS 0Nt Y

SawTek'" automated Processing systems to integrate, oPtimize and cut EWP.

Maximize profitabiliv from EWP with most efficient job pick processing.

1 17 performance points constantly monltored remotely.

3 models size-matched to fit any dealer model.

Modular, so you can add features as your busrness grows.

9

10

12

14

20

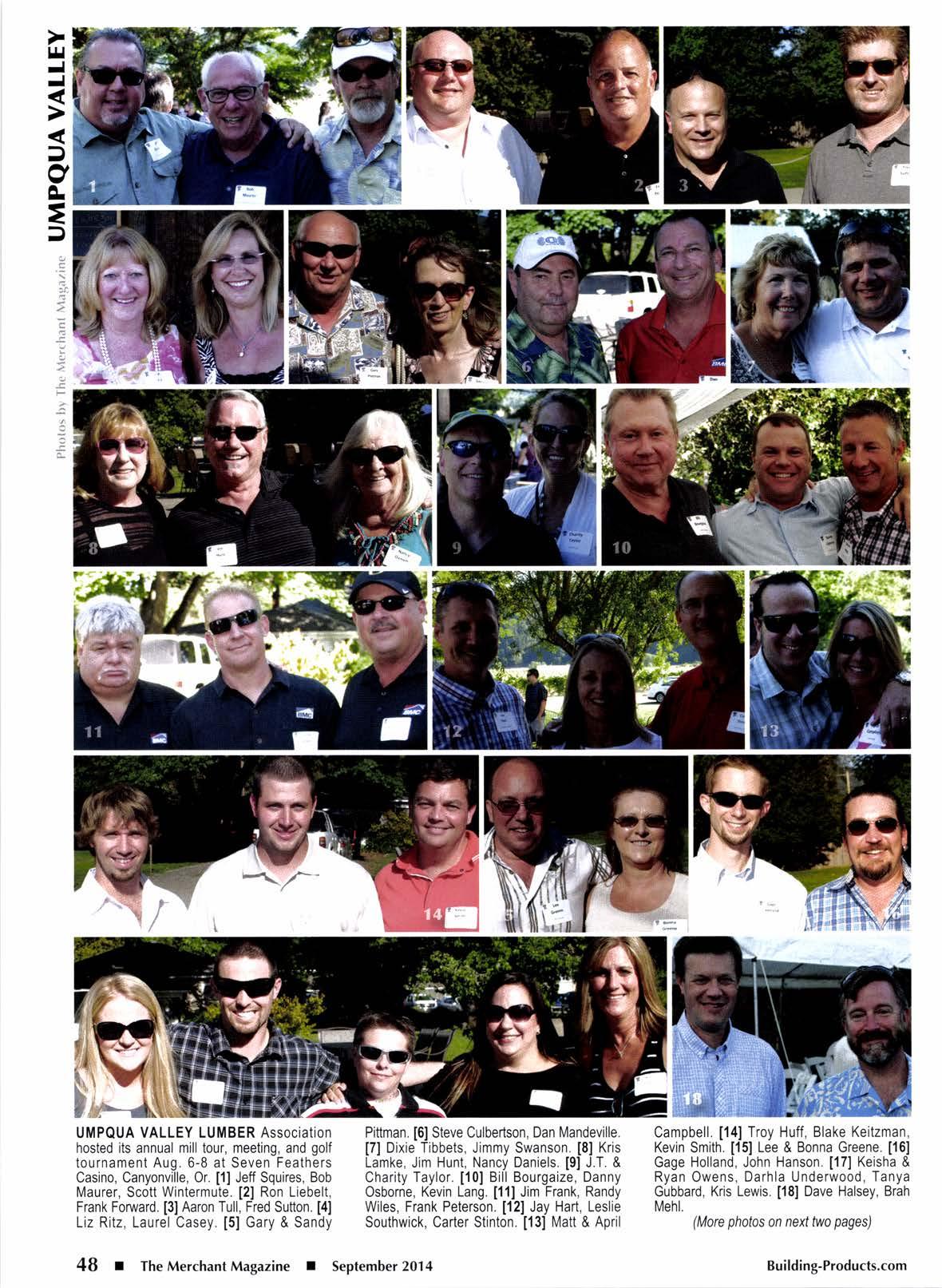

48 PHoro Recrp Uupeun VnllrY Mtt-L Wrrx

CHANGE OF ADDRESS Send address label from recent issue, new address, and 9{igit zip to address below.

POSTMASTER Send address changes to The Merchant Maqazine, 4500 Campus Dr., Ste. 480' Newoort Beacli, Ca. 92660-1 872. The Merchant illaqazine (ISSN 7399723) (USPS 796-560) is oublished monthlv at t1500 Campus Dr.' Ste.480, Newport Beach, Ga.92660'1872 by Cutler Publishinq, InC. Periodicals Postage paid at Newport Beach. C-a., and additional post offices. lt is an indeoendentlv{wned publication for the letail, wholesale hnd distribution leriels of the lumber and building products markels in 13 western states. Copyright@2O14 by Cutler Publishing, Inc. Cover and entire contents are fullv orotected and must not be reproduced in any manner without written permission. All Rights Reserved. lt reserves the righl to accept 0r rejqg!qly editorial or advertising mafter, and assumes n0 liability for materials fumished to it.

6 Tornllv RnNooitt

1 6 Corraprrrrtvr lNtttl-lcENcE

18 OrsrN ON Snlrs

30 Movrns & Snnxrns

34 npp Wnrcn

35 MnNncurlrNr Tlps

3B Fnr"ulv BustNrss

40 Nrw Pnooucrs

51 AssocrnnoN Uponre

52 lN Mtmonrnpt

52 Cmssrrrro MnnxtrpLlcr

53 Dnrr Boor

f Hone Hrosr of you were able to get a break this summer and enjoy some time loff. I was fortunate to return to Europe to visit family. The EU economy still does not feel quite right or strong. coupled with the issues in Putinland and the Middle East, I am concerned about an impact here in the short- and mid-term. Certainly, other nations look to a strong U.S. economy to pull them through.

Being back in the Old World provides a perhaps appropriate opportunity to get a few things off my aging chest. Yes, sometimes it is no fun getting old. Yes' my doctor is my new best friend, my back aches, I nap after dinner, I forget things, the waist line gets bigger, and the elastic waist band is a relief, but I am still the bundle of joy I have always been. I may no longer love everything the young do, but I am pretty good with technology, still sing the latest hits on my way to work (badly), I still like to party (as some of you can attest), and I am often the last to leave at the end of the night!

So I recently read that there are 100 million of us over 50 in this country and that we possess more than 70Vo of the disposable income. We buy two-thirds of the cars, over half of the computers, and we pay the stars' exorbitant earnings by buying over a third of all movie tickets. We love to travel (about 80% of premium travel) and we have found the likes of Amazon by buying $7 billion online' Indeed, if we were a country, our age group would represent the world's third largest economy.

In my household, we fit all of the above profiles. We like to go out and eat. We continue to spend a small fortune remodeling the house. We also try to do our best to support the local economy.

So why the column? Well, according to most marketers, we do not exist. We do not count. We have been written off! And I am not going to take it anymorel

Everyone markets to the young, which is fair enough, but why forget us? Many of us will be living until our mid-80s (well, that is what I am planning for and hopefully longer) and there will be a lot of spending between then and now. Stats show that despite being a third of the economy, our age group is targeted by just 57o of market spending. What a mistake! Nielsen calls our generation "the most valuable generation in the history of marketing."

With a projection that our 50+ age group will grow by 34Vo between now and 2030, it appears that companies are missing out big time.

When the term "baby boomers" was coined back in the 1970s, we were the ones viewed as spenders who shunned the frugal life of our parents. Guess what, that has not changed. We still spend, we still travel, we still eat out, we still have our memberships to all types of organizations, we still use technology, we still buy cars, we still repair and improve our homes (I'm tiling two rooms now)' we still read newspapers, we still watch television, and now you find us on the web, too (and since we often have more free time, we are easily marketed to).

There is no reason I do not want to buy the latest headset or laptop. Have you ever seen our age group in an ad for a sports car? We may have 50 shades of gray, but in reality advertisers only have eyes for 18to 30-year-olds.

Admittedly, what we may buy might be different than other generations, but we can make an awful lot of money for those who recognize our value. Again, the 50- and 60-year-olds of today are the 40- and 50-year-olds of yesterday, with our improving longevity and longer active years. So enough, I argue, as I head off to physical therapy.

Alan Oakes. Publisher aioakes@aol.comwww. bu ld ng-prod ucts. com

A publication of Cutler Publishing 4500 Campus Dr., Ste.480, Newport Beach, CA 92660

Publisher Alan 0akes ajoakes@aol.com

Publisher Emeritus David Cutler

Director of Editorial & Production David Koenig

dkoenig@building-products.com

Contributing Editors

Dwight Curran James Olsen

Carla Waldemar

Advertising Sales Manager Chuck Casey ccasey@building-products.com

Administration Director/Secretary Marie Oakes mfpoakes@aol.com

Girculation Manager Heather Kelly hkelly@building-products.com

How to Advertise

Ghuck Gasey

Phone (949) 852-1 990 Fax 949-852-0231 ccasey@building-products.com

Alan Oakes www.building-products.com

Phone (949) 852-1990 Fax 949-852-0231 ajoakes@aol.com

CLASSIFIED David Koenig

Phone (949) 852-1990 Fax 949-852-0231 dkoenig@building-products.com

How to Subscribe

SUBSCRIPTI0NS Heather Kelly Phone (949) 852-1990 Fax 949-852-0231 hkelly@building-products.com or send a check to 4500 Campus Dr., Ste. 480, Newport Beach, CA 92660

U.S.A.: One year (12 issues), $22 Two years, $36 Three years, $50

FOREIGN (Per year, paid in advance in US funds): Surface-Canada or Mexico, $48 Other countries, $60 Air rates also available.

SINGLE COPIES $4 + shipping

BACK ISSUES $5 + shipping

UFP-Edge is made from the highest-grade lumber available, free of wane and with only small, tight knots that highlight the warm characteristics of natural wood. Hand-selected. Carefully cut with blades we sharpen and maintain ourselves. Manufactured near customer locations to eliminate the damage associated with storage and multiple transports. With UFP-Edge, you can offer the finest pattern, fascia and trim products on the market today.

fD uvs,ns ARE FTNDTNG it trickier to I-lprocure medium density fiberboard, as resurgent demand causes prices to rise, according to a new IBISWorld report.

"Growing demand for MDF has allowed suppliers to increase their prices, lowering buyer negotiation power," explains IBISWorld procurement analyst Jesse Chiang.

She gives MDF a buyer power score of 2.9 ortt of 5, reflecting moderate negotiating conditions for buyers. MDF price movements depend largely on residential and nonresidential expenditure levels, as well as private spending on home improve-

ments-all of which have grown sharply over the last three years.

Rising prices are restraining buyer power because buyers are less able to delay contractual decisions with prices increasing continuously. Instead, buyers must negotiate contracts to lock in lower prices. Prices are forecast to grow substantially over the three years to 2017, which will continue to reduce buyer power in the coming years.

Price increases for inputs such as lumber also led to price growth for MDF, limiting negotiation flexibility for suppliers that struggled to maintain profitability. Consequently, buy-

ers are left with fewer opportunities to arrange favorable deals and negotiate lower prices. Additionally, moderate market share concentration and product specialization have created a tougher purchasing environment for buyers.

"Large, vertically integrated operators have significant market power, while moderate product specialization reduces buyers' ability to locate suppliers capable of satisfying their specific product requirements," says Chiang.

Nevertheless, buyers do have some considerable advantages. The high availability of substitute goods ensures that buyers are not forced to accept major concessions in their contracts because of their ability to switch to other suppliers that distribute alternative building materials.

Secondly, low switching costs limit suppliers' ability to charge higher prices. Lastly, despite high demand driver volatility, volatility in prices for MDF products has been low. This factor has benefited buyers by making inventory planning and budget forecasts easier.

MDF is an engineered wood product made of a mixture of wood fibers, resin and wax. It does not have knots or grain patterns, making it easy to work with in many building applications. Due to its strength and comparatively low cost, furniture manufacturers use MDF as a substitute for hardwood products.

The top four MDF vendors are Louisiana-Pacific, Weyerhaeuser, West Fraser Timber, and Plum Creek Timber.

tTt"t Pnsr l2 months have seen I OSB manufacturers maintaining high production levels, gambling on a resurgent housing market.

According to Random Lengths, so far this year, North American OSB production is up 8.4Va compared to the first six months of 2013. Yet, without the expected spike in demand, over the last l8 months, the OSB Composite

Price has fallen nearly in half-from $438 at the start of 2Ol3 to $233 in early August. (During the same period, plywood prices rose.)

Industry leader LOUISIANAPACIFIC, Nashville, Tn., operates 11 OSB plants in the U.S. and Canada (plus one in Brazil and two in Chile), generating net OSB sales in 2013 of

$1.1 billion (representing over half the company's overall sales). LP appeared poised to grow even larger, with its planned acquistion of Ainsworth Engineered's four plants. The deal would have given LP a 63Vo share of the OSB market in the Pacific Northwest and a 55Vo share in the Upper Midwest. But in May, after eight months of wrangling with governmental antitrust concerns, LP abandoned its takeover bid.

"We believe this transaction would have led to positive outcomes for customers, employees and shareholders, and fundamentally disagree with the analysis by antitrust agencies of the competitive dynamics of our agency," said LP c.e.o. Curt Stevens.

In other OSB news, LP's Peace Valley mill in Fort St. John, B.C., hopes to gain approval by the end of this year to use a new type of wood resin-MDI (methylene diphenyl diisocynate) rather than formaldeyde.

NORBORD, Toronto, Ont., owns nine OSB facilities in North America, plus one each in Belgium and Scotland. In 2013, its OSB mills produced at approximately 75Vo of installed capacity, compared to 70Vo tn 2012. North Amerian OSB shipments rose 7 Vo , with 20 l4 expected to be even busier. Norbord restarted its OSB mill in Jefferson. Tx.. in mid-2013 and ramped up to full capacity by the fourth quarter.

It is also rebuilding the

its curtailed Huguley, Al., mill to prepare it for a possible restart in mid2015, if demand increases. The company is not planning to restart its mill in Val-d'Or, P.Q., this year, but will continue to monitor market conditions.

"In North America, homebuilding activity continues to improve," said president and c.e.o. Peter Wijnbergen. "But the pace has been held back by labor availability and a lack of entrylevel buyers, and OSB prices have been disappointing."

Way, Wa., saw its six North American OSB plants increase production by 8.44Vo last year, from 2.511 billion sq. ft. in 2012 to 2.723 billion in 2013, reaching 90Vo of capacity. Sales rose 10.5Vo, from $2.508 billion in 2012 to $2.772 billion in2013.

Sales kicked off a notch behind in 2014. "Severe winter weather dampened the start of the spring building season," said Doyle Simons, who became president and c.e.o. last year.

The year has marked one milestone-Weyerhaeuser's OSB mill in Edson, Alb., is celebrating 30 years of operation, reportedly making it the first OSB plant in Canada to do so.

Vancouver, B.C., is regrouping, following the collapse of the proposed acquisition by LP.

In 2013 , Ainsworth's four Canadian OSB plants generated sales of $488 million- 19.2Vo higher than 2012, thanks to significantly higher OSB prices. Production was, however, slightly down (0.7Vo) compared to the year prior, due to maintenance downtime and transportation issues.

Late last year, the company restarted its OSB mill in High Level, Alb., which had been indefinitely curtailed six years ago.

The company also recently reintroduced two popular OSB products under its new OSC XL brand: OSB XL 9 ft. and 10 ft. panels in multiple thicknesses and custom lengths.

HUBER ENGINEERED WOOD, Charlotte. N.C.. owns five OSB mills.

GEORGIA-PACIFIC. Atlanta. Ga., has been operating six of its nine OSB plants. Its mill in Skippers, Va., was mothballed three years ago, while plants in Grenada, Ms., and Mt. Hope, W.V., were shut down three years ago.

TOLKO, Vernon, B.C., is back up to three operational OSB plants, with the restart of its Athabasca mill in Slave Lake, Alb. The huge facility, which opened in late 2008 before closing months later due to poor market conditions, restarted in December 2013 and is expected to reach full production capacity by the first quarter of next year.

Late last year, Tolko also acquired full ownership of the Meadow Lake OSB mill in Meadow Lake, Sask., per the terms of its original limited partnership contract signed in 2001 with the government of Saskatchewan and

several aboriginal stakeholders.

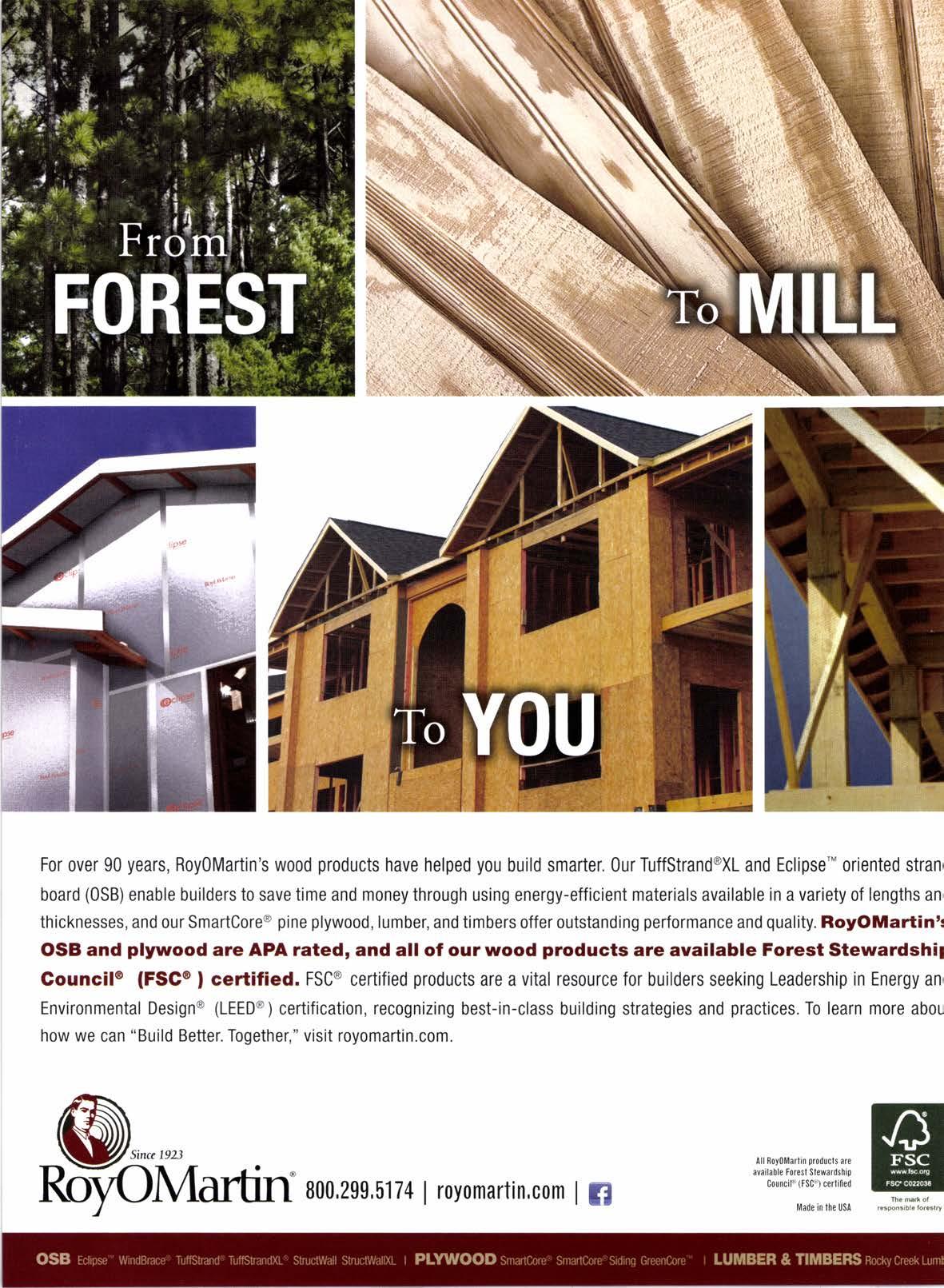

ROYOMARTIN, Alexandria, La., is moving into its seventh year of operation at its OSB facility in Oakdale, La.

The company has been FSC-certified by the Rainforest Alliance since 2002, and has completed 2014 FSC chain-of-custody and forest management annual audits with the alliance.

ARBEC

St.-Leonard, P.Q., operates an OSB mill in St. Georges de Champlain, P.Q., which was idled from Aug. 2-21.

Each member of the panel was given four questions prior to the session that covered areas on how western red cedar is faring relative to overall sales; changes in the role between retailer, distributor and supplier; resources that would help their sales force sell WRC, and steps needed to improve returns on WRC sales and capitalize on rising demand trends.

As would be expected given the breadth of retail locations and types of businesses, the answers covered a lot of ground, but the information that came from the discussion provided excellent insights into improving WRC sales, and created the foundation for an actionable plan-appropriately called the WRCLA Retailer Response Plan-for the association to move forward with.

Elo* Irs RECENT annual general .l-' meetins in Kelowna. B.C.. the Western Re-d Cedar Lumber Association invited six retailers with broad regional representation to an open panel session and discussion on evolving business trends. This group of industry experts responded to a list of prepared questions designed to explore the role of the retailer and identify areas of opportunities to impact western red cedar's competitiveness and facilitate sales on the

retail floor.

The panel consisted of Mike Dunn, president of Dunn Lumber, Seattle, Wa.; Skip Dierdorff, Northwest area manager for Alpine Lumber, Steamboat Springs, Co.; Rob Myckatyn, inventory manager and purchaser at Standard Building Supplies, Burnaby, B.C.; Tim Priddle, president of The WoodSource, Manotick, Ont.; Sean Stevens, owner of M&M Lumber, Tulsa, Ok., and Shane Smith, president of Speonk Lumber, Speonk, N.Y.

There was unanimous agreement from the panel (and members of the audience) that any plan to help sales at the retail level needs to reach the customer prior to them walking into the store.

As most of us in retail can attest, when a builder or d-i-y homeowner walks into a retail location, the majority will already have a shopping list of materials in hand, and aren't likely to change their decision over what they already have in mind.

Knowing this, WRCLA developed online surveys and research targeting three audiences -d-i-yers, custom home builders, and architects-to better understand each group's awareness

of WRC's range of uses and applications, the factors of greatest importance to them (e.g., natural beauty, affordability, etc.), and how to make it easier to specify and use in design and application.

The research results will be used to better develop messaging and programs "to put WRC on the shopping list" before the customer walks into the store.

As to the resources that directly engage the retailer, the WRCLA and its advertising agency, Bare Advertising & Communications, developed a host of tools that can be tailored to each retailer's or distributor's specific needs. Here's an example of what's available to service affiliate members:

WRCLA's website, RealCedar.com, has a wealth of information to help consumers choose WRC over other products and specify materials. This content is made available for integration into the retailer's website. It can be designed as a single page, added to existing materials, or even become its own microsite.

A short, consumer-friendly "Everything You Wanted to Know About Cedar" video is being developed for use on retailer sites to help specify WRC. It illustrates the difference between clear and knotty, shows popular dimensions and suggestions for decking and siding, provides a brief overview of cedar's green benefits, and can link the consumer to product-specific pages on the retailer's site.

WRCLA is releasing a pilot launch of its retail training application that will help retailers and consumers specify Real Cedar (WRCLA's branded products).

Short, FAQ-style quick-tip mini cards are available to retailers and staff for self-administered training and tests.

With the growing consumer interest in environmentally friendly products, WRCLA recently launched its Real Green program to address common misconceptions about western red cedar's green qualities against competitive composite products. Materials include educational handouts and video content backed by Life Cycle Assessments and Environmental Product Declarations highlighting WRC's position as king of green building materials.

Consumers can already use the retailer locator on RealCedar.com to find the member closest to them, but a number of new tactics are being employed, such as online editorial content with the retailer, case studies, and blog content to further connect the consumer with the retailer.

WRCLA has a growing collection of how-to, FAQ, and informative videos on RealCedar.com and its YouTube channel that can be linked to retailers' sites.

Downloadable retail resources on RealCedar.com, such as co-op ad mats, print-ready marketing materials, and training resources are available on demand.

It's a program that should be worthwhile following as WRCLA takes proactive steps to grow WRC's competitiveness and value position in an evolving market.

- To learn more about WRCLA's Retailer Response Plan and progress, attend the WRCLA-hosted session Nov. 14 at NAWLA's Trader Market in Chicago or contact realcedar.com/contact.

ff,tvr You, or any of your Ilfriends in the business, ever been approached by a customer who says, "That composite deck is just beautifuM can't wait to get some chairs or a garden bench made out of the same stuff."

I didn't think so.

Compared to redwood, which is naturally beautiful and durable, with a structural integrity that can't be replicated, composite lumber suffers. It's no wonder that redwood is used in a wide variety of home projects, while composite lumberjust is not.

In fact, redwood is the ideal wood product for just about any home project-indoors or out. With its natural resistance to shrinking, warping and checking, using redwood lumber on your project means you built it to last a long,long time.

Whether the project is furniture, cabinetry, planters, fences, trellises, pergolas, buildings, and, of course, decks, there are a wide variety of redwood boards, siding and timbers for almost any application suitable for wood. And since redwood is naturally durable, it is the ideal choice for use in garden beds, planter boxes and greenhouses for organic gardens.

For professionals working with redwood, they'll agree that redwood as a product provides greater flexibility of application than man-made products. It's a material that's easier to cut, won't bend or warp, and can be left natural or stained to complement a customer's chosen color palate. Over the years, redwood can be restored repeatedly with minimal effort and cost.

Not only is it beautiful to look at and beautiful to work with, redwood is also a beautiful thing for helping the envi-

ronment. You can't say the same thing about composite lumber. Compare the energy consumed to harvest and manufacture redwood (a renewable resource) to the process required to produce plastic/composite decking (consuming nonrenewable oil resources), and it's pretty clear that a natural product is far preferable. Consider:

Redwood trees need soil, sun and water to grow. No oil wells are drilled for raw materials that a plastic-composite deck needs.

As these trees grow, they capture and store carbon, essentially cleaning the air around them. That carbon is locked in; even after harvesting and milling, a redwood deck retains that carbon. A plastic-composite deck consumes 15 times more energy than a redwood deck- and 87Vo of that energy comes from nonrenewable fossil fuels, a major source of carbon emissions

Even when redwood lives out its usefulness, the lumber is biodegradable, returning to the earth to help make more trees. Composite decking is not recycled; it is often sent to the landfill.

Redwood can inspire great ideas, and then be the perfect material to make that idea reality. The versatility and durability of redwood is a quality that can't be matched in nature or a laboratory. For the project that may be just the beginning for a customer, recommending redwood ensures the look and feel of the project will be consistently harmonious, start to finish.

- Charlie Jourdain is president of the Califurnia Redwood Association. Reach him at charlie@calredwood.org or (888) CAL-REDWOOD. To learn more about redwood, visit www .calredwood.org

f r's ,r LUMBERMAN's version ol Buck f-.to rhc Ftttttre. In 1946. BennY Friedman opened a building center in Petaluma. Ca. In 197 l, he launched a second Friedman's Home ImProvement in nearby Sanla Rosa. shuttering the Pctaluma site when the building's dilapidated state and insurance hassles forced a decision upon htm.

By 1993, his son Bill-next uP at bat-had opened a store in Sonoma, then another in Ukiah in 1996. But a soft spot remained in everyone's heart Petaluma, where it all began.

Well, as they say in the movies, they're baaaack! After years of watching, scouting and waiting. a suitable location at last arose when a proposed Lowe's failed to materialize. Backed

by strong support from the town fathers. Friedman's in Petaluma's new Deer Creek Valley Shopping Center opened in May-in time to welcome Bill's son, Barry, as the companY's new president-cum-c.e.o. (Bill retains his seat on the board and post as premier mentor.) So, full circle: Store #4 re-blossoms in location #1.

Never mind that Barry is just 30something. He's been around the block a time or two. Just as his dad did beiore him. he grew up sweeping sawdust, bagging purchases, and corralling carts. But, after earning a business degree in college. wild oats prevailed over white pine. "I spent three years on the NASCAR team in North Carolina. then with a whitewater raft-

ing outfit in Montana. But I alwaYs knew I'd come back. When mY fblks called, in 2004, and said, 'No Pressure-but we'd love to have you,' that sealed it.

''I started from the ground uP, cashiering, then spent time in each department, including the suPPort functions," gaining more and more responsibilities, including assisting with the remodeling of the Sonoma store, Barry says. He earned a management position in 2008, then advanced to v.p. of operations the following year. So when the time came, with the blessing of his dad, he took the helm of the whole enchilada. "I'd been mentored by so many here, and they all believed in me, or I would not be in this position."

His management style is all his own. "My grandfather was a PeoPle person, loved the place. And Dad's a products guy, an amazing merchant." For Barry, it's all about the staff, 600strong by now. "I believe in the team concept (l was captain of my college football team)-doing things together, seeing people grow. We're in the relationship business," he denotes his line of work. "We've built a strong reputation in the community for honesty, treating the customer right, and people appreciate that. We do business like it used to be...."

That works, and works well, if the staff has absorbed the message. At Friedman's. that critical criterion is achieved "through modeling-how to handle situations. And," Barry is quick

to acknowledge, ensuring that the company's ethos is passed on and absorbed by its employees "gets harder and harder as you grow." With the addition of the Petaluma store, staff surged from 400 to 600-"so it came down to, how do you translate that to the new hires? (We hired in all our locations.) We looked for attitude, rather than skills or experience-the desire to be here! We decided to have one designated person screening all applicants before sending the best-qualified on to the managers, to find the right fit for the culture."

The new Petaluma complex has an 85,000-sq. ft. footprint, which includes a dry shed and greenhouse. In designing it, what lessons were addressed that had been learned in the three existing stores, arreporter queried. Says Barry, "We knew we wanted to go in with a full offering for our customers, to build that expectation. Having an outdoor lumberyard was a critical factor for us, because we serve a dual path-retail (6OTa) and pro (40Vo). We needed that [yard] for the contractors, to compete with the boxes: accessibility of product. But, we'd also learned, that very factor can be intimidating for retail consumers. So we located the dry shed closer to the main store than in our other locations. It's reached by a short path-really, just an

extension. But"-a savvy "but"-"we still have a contractor entrance, with special parking, for a quick in and out. ' "SKUs were enhanced in some departments, but some are displayed differently," including the new Express Yard on Display feature-a 68-ft. display corridor of products actually out there waiting in the lumberyard, planned with the aim creating a "less-intimidating feeling. The customer is inside, looking at it, before heading outside. Unique!" Barry exclaims.

Another innovation: a mezzanine level of 4,500 sq. ft. voted to kitchen and bath. "In our other locations. thev

not a maze. It's easy to navigate. Plus there's lots of bright signage and super-graphics, like the ones depicting scenes of Sonoma County. Others sell the 'dream,' like in our outdoor living section."

And customers love it. But, let's face it, what they're talking about most is Friedman's new Living Wall: four of them, actually, planted in greenery. They were planned to break up the building's concrete facade, but-bonus-pull their weight as a marketing tool, too. "They're beautiful, they're dramatic, and they've turned into a destination. People drive over to see them." And see what's within, of course. Plus, Petaluma is the poster town for uber-green California, "so it shows what we, as an organization, represent in environment-friendly products, too."

The recent grand opening party sounded just as Californian: 900 guests-staff, vendors, key community members-at the preview event. "Petaluma's been an under-served market, and we'd tried to come back to town for years." When that dream was finally realized, it represented an emotional moment for all the Friedman's clan.

So, what's next? Or, is there a next? "Having a fourth location definitely changed the organization to be more efficient in how we handle things. But"-short answer-"yes, we're always looking for opportunities to pursue farther out."

right on the retail floor. But we felt that, by changing And there'll probably be another at environment, it would offer a different experience-no generation of Friedmans being groomed to step in. Barry's istractions, more intimate, no shopping carts. Plus," he in a smart merchandising move. "we elevated the level fourth child was born two weeks before the fourth store opened. I'm just sayin'.... products up there-another move to improve the cus' experience"-and. ahem. profit. Adding to that experience, the whole layout is more n. "It's easy to clutter a store," Barry knows. "You want

to sell product, fill the space. But we were very disciplined. So you walk in, look left, look right, look ahead, and it's

Carla Waldemar cwaldemar@comcast.net C.E.O. Bill Friedman is transitioning leadership of the chain to son Barry. LIVING WALL of greenery at Friedman's new location in Petaluma, Ca., has quickly become the talk of the town.

f, s se,I-esreopI-E, we need to be confident. Confidence lLinspires confidence. If we are confident in what we say, our customers will feel and believe it. This will help them relax enough to listen to us.

So many sellers can't even get their (potential) customers to speak to them, much less listen, because their approach is too humble or nervous. The humble may inherit the earth, but they are going to inherit it from a salesperson who was bold enough to ask for it first. Humble salespeople confuse being humble with being respectful and suffer for it. Humble is easy to say no to.

Confidence alone is not enough. Great sellers are bold. They ask for things, even when they are told those things aren't available:

Us.' "May I speak to the buyer please?

Reception: "She is on the phone right now."

Us.' "That's fine, I can wait a little bit. How are you today?" (Friendly banter ensues-the rare and subtle art of the master seller.)

Reception: "Oh, she's free. Let me put you through."

Us.' "John, we just bought a block of 2x4 l6's out of Big Timber. We've already sold five to market-savvy customers. How many can you use?"

Customer: "I can't afford to pay the premium for l6's, but what's your price?" (This is where the Quotron gives the price and then says, "Okay.")

Us.' "The price is the good part. If you think you can't afford l6's now, wait until they run another $50/MBF. Let's put at least two of these on to protect you from this market andhelp you make money while we do it."

Customer: "Alright, give me one of those."

Customer: "Okay, I'll take one of those at $450."

Quotron: "Thanks for the order."

Us.' "John, I don't think one is going to be enough. You only buy great deals, so this must be one and since that is true, we should put on at least five."

Customer: "You're right, but five is too many. Give me an extra two for a total of three."

Salespeople who struggle are afraid of being pushy.

Master sellers don't even think about it. There are salespeople who are too pushy, but they are rare. Unless you are a statistical anomaly, you are not too pushy, probably the opposite.

We don't need to be pushy. We need to be persistent and consistent. We need to call on our customers and promote product to them in a persistent and consistent way. Many sellers only call their customers with deals. This makes them the deal supplier, not the main supplier. When we are in sync with our customers, we can sell into their need. When we call willy-nilly, all we can do is offer them deals. This is called chasing. Chasing orders/selling deals are part of what we do as market-driven sellers. But we also want the "relationship orders." These orders go to the salesperson who calls in a persistent and consistent way.

In many cases, "We have reached our conclusion" just means "We have stopped thinking." Too many sellers arq hiding behind the truth, Master sellers find a way. They usd creativity and imagination to structure the deal so it workd for everyone.

Sawmill/wholesaler/distribution organization has a carload of 2x4 14's that needs to be gone-todayl

Quotron: "I talked to my guy. He can't use l4's." (Thid is a truth, but a worthless one. This is like a Marine at war saying his tummy hurts. It may be true, but it doesn't help us win.)

Us; "My guy couldn't use l4's, so I sold them to him on a 12' count. It was a bit of a counter. but they're sold." :

The fact (master sellers ignore these annoying things sometimes) is that both customers above can't :use l4's.

It is also a fact that the second customer bought a load of l4's! Many sellers think they are in the fact business, while master sellers realize they are in the possible business.

It's just talking, right? Wrong. Salesmanship takes a certain spirit-the spirit of a salesman.

James Olsen Reality Sales Training (503), 544-3572:

ABUNDANI. RFNEWAIJLE REDWOOD Is one of nature's finest buildingl rraterials lt s strong, dr-irable, beautifu ernd easy to work with. That's why derrand Keeps grow r'rg antong rrorneowners, contractors and arch tects.

AND SUPPLY WILL STAY STBONG, TOO. \,Vhy are we so sure? Because every year trtore reciwood rs being grown than harvested in nearly I million acres of sustainably rranageci reclwocd forestlands in Nortfrern California

We believe STFIONG AND Gllofllt'iCi is a formu a for long-terln success. 1t 5tg1 1n;.k so too, contact Julie Wright at (707) 764-4450 or JWright@hrcllc.com

fN 2013, TRUCKS MovED 69.lVo of all domestic freight Itonnage, up from 68.5Vo the previous year. Over the past decade, moving this freight has become increasingly difficult. High driver turnover, a decrease in the number of owner-operators in the trucking industry, and elevated service demand have amplified existing problems such as increased government regulations, a current driver shortage, and increased costs of transportation.

The most significant changes in government regulations that went into effect July 2013 are adjustments in the legal hours of operations. The new rules include a 34hour restart period, which must include two periods from 1:00 a.m. to 5:00 a.m. home terminal time that may only be used once per week and are measured from the previous restart period.

Additionally, a driver may only drive eight hours after the last off-duty time or sleeper berth period of at least 30 minutes. If a driver is stopped at a delivery location and not in his sleeper berth, it is now considered on-duty time and will not count towards his 30-minute break. Longhaul drivers are typically paid by the mile, so the change in rules has meant that drivers are on the road longer without any extra pay. The regulations reduce the number of hours a driver can work, increase the number of required breaks, and add significant costs to the trucking industry.

Today there is also a truck driver shortage. According to the Bureau of Labor Statistics, the average age of a commercial driver is 55. Many younger would-be drivers are drawn to construction and other jobs that pay more. The Bureau of Labor Statistics list the median waqe of a

tractor-trailer driver at $38,200, which is 11.87o lower than the average U.S. wage, and drivers' wages are increasing more slowly than other wages. Drivers are typically away from home for long periods and are restricted by new regulations. This limits the amount of income a driver paid by the mile can earn.

Additionally, American Trucking Association (ATA) chief economist Bob Costello states, "At the moment, we already have 30000 unfilled jobs for drivers in the trucking industry. As the industry starts to haul more, because demand goes up, we'll need to add more drivers-nearly

100,000 annually over the next decade-in order to keep pace."

Because drivers are in such demand, the trucking industry is experiencing an extremely high turnover rate. ATA reported that turnover at large carriers is at9l%o and has been there or above for the past eight quarters. A large carrier that has 200 drivers will replace 180 ofthose drivers in the next l2 months.

Further complicating the search for qualified drivers are the Compliance, Safety, Accountability (CSA) regulations introduced in December 2010. Carriers that employ drivers with a history of safety violations or accidents are subject to increased inspections and a lower score. With fewer entrants into the trucking job market, the industry must change.

Many independent carriers and smaller trucking companies have gone out of business due to the increased costs associated with trucking. Diesel fuel has risen from $ 1 .8l/gallon in 2004 to $3 .9Zlgallon in 2013. During the recession, there was price pressure on all goods and carriers had a hard time implementing fuel surcharges for the freight they haul.

The government is proposing that all trucks be equipped with electronic logs. On August l, 2013, the Obama Administration announced a proposal to eliminate "the burdensome daily paperwork required for professional truck drivers." Unfortunately for small or independent carriers, retrofitting equipment with electronic logs will be expensive and add annual per unit monitoring fees.

Beyond fuel and regulation costs, truck operation costs are affected by regular repairs to damaged equipment caused by deteriorating roads; taxes and tolls to pay for

Next month's October issue of Building Products Digest will feature an in-depth Traders Market Preview promoting the NAWLA Traders Market Nov. 12-14 in Chicago.

The Traders Market is North America's premier lumber tradeshow, delivering access to the entire supply chain under one roof. Whether you want to sell your product, find new suppliers, or expand your network, you'll find the opportunities and visibility you need at the Traders Market.

The site is the newly renovated Hyatt Regency Chicago. Registration is now open. NAWLA members can receive discounted access to the event.

repair of infrastructure; and the insurance and equipment required to meet security, safety and environmental requirements. The additional costs associated with trucking are resulting in fewer independent and small carriers that are a viable source for moving freight.

Snavely International has responded to these challenges in recent years by increasing its driver fleet. We have found that by paying more than the median wage, turnover decreases and we have greater control.

In the past year, we also registered with the Federal Motor Carrier Safety Administration (FMCSA) and obtained a United States Department of Transportation (USDOT) number. This allows us to pick up and be paid for return freight. While it opens us up to increased regulations, we anticipate the benefits will outweigh the costs.

However, it is clear that the only foreseeable outcome to the increased government regulations, driver shortage, and increased cost of operations will be an increase in the cost of freight. Increased costs to carriers are reflected eventually in increased prices for freight paid for transportation.

If you would like to hear how other companies are responding to these freight challenges, please join me and other NAWLA members at the Leadership Summit, March 24-26,2015. at the The Westin Kierland in Scottsdale, Az.ln addition to numerous opportunities to connect with peers from across North America and hear their perspectives on transportation challenges, the program will include educational sessions on this topic. Additional details are available at www.nawla.org.

As it moves away from redwood lumber production, C alifornia Redwood Co., Arcata, Ca., has parted with two of its California remanufacturing plants and is evaluating the best use of its third.

Redwood Empire, Morgan Hill, Ca., has taken over CRC's Woodland, Ca., distribution center and reman facility.

Cerro Pacific Lumber, Redwood Valley, Ca., purchased the equipment at CRC's Ukiah, Ca., reman plant and assumed the lease at the facility.

CRC continues operating its large drying and reman facility in Brainard, Ca., located between Arcata and Eureka. According to president Doug Reed, "after the end of the year, we will evaluate the best use of our Brainard facility. Brainard has a great deal of capacity and flexibility, as well as a seasoned workforce, but our need for it will be reduced dramatically as we exit primary manufacturing of redwood lumber."

Calaveras Lumber, Angels Camp, Ca., acquired fellow Ace Hardware dealer J.S. West Lumber & Hardware, Sonora, Ca., effective Sept. 4.

J.S. West general manager David May called the deal "a perfect fit," explaining that the West family was looking to return to its core businesses of egg and propane production, while Calaveras Lumber has wanted to expand to Sonora ever since the local Andy's Home Center closed in 2011.

May noted there were no plans to enlarge the store, but the lumberyard will expand the quality and types of lumber it stocks.

Seneca Sawmill Co. has begun a two-to-three-year upgrade of its dimension sawmill in Eugene, Or., to significantly increase annual capacity.

The $50-million investment includes installing new milling equipment, sorting system, dry kilns and planer and improving its plus shipping and log yard.

Weyerhaeuser Co. will move its headquarters from Federal Way, Wa., to Seattle, Wa., in mid to late 2016, when construction of a new building is complete.

The new facility will cover seven stories and about 165,000 sq. ft.-

roughly half the size of its current quarters.

"There are two main drivers for this decision, which we made after thorough analysis of various options for the location of our headquarters," said president and c.e.o. Doyle R. Simons. "First, our 430-acre campus in Federal Way is costly and too large for our needs. Second, moving our headquarters to Seattle will give us access to a larger talent pool to meet future recruiting needs, not just in this region, but from across the country."

The company will divest the land and buildings it owns in Federal Way, where it moved to from Tacoma in l97l.It plans to retain its nearby tech center.

A former assistant store manager at Home Depot, Arrowhead, Az., who is legally blind has filed a discrimination suit, charging the company failed to accommodate his disability in requiring workers to use smartphones with small screens, and then firing him.

Leslie W. Gibson, who worked for the chain from 2000 to 201l, claims Home Depot would not provide him with a reasonable accommodation when it replaced larger computers with smartphones featuring small screens he had difficulty reading.

When Gibson complained, he was placed on a "performance improvement plan" and ultimately terminated. He is seeking compensatory and punitive damages for discrimination and retaliation under the American with Disabilities Act, alleging a "causal link" between his request for accommodation and his release.

Two years ago, Home Depot paid deaf workers $925.000 to settle a disability discrimination class action suit.

Roseburg Forest Products has filed a lawsuit to restore longstanding water rights it says were illegally taken from its Weed, Ca., veneer plant by the regional water districts.

The suit alleges that its water rights were reapportioned, without notification, to wood treater J.H. Baxter & Co., Weed.

Roseburg argued the issue is critical to its operations, which require water to process wood veneer and generate power used by the Weed facilitv. as well as commercial and

residential ratepayers.

According to the suit, the water rights were initially granted in 1932 and transferred to Roseburg when it purchased the land in 1982. Roseburg said it offers and continues to sell a portion of its water, and it has been providing free water to the city, persuant to a 50-year lease deal set to expire in 2016.

Interfor has decided to make permanent the closure of its Beaver, Wa., sawmill and Forks, Wa., planer, consolidating production at its Port Angeles, Wa. The sawmill closed June 27,lhe planer soon after (see Aug., p.28).

Sierra Pacific Industries, Anderson, Ca., has completed its purchase of Hurd Windows & Doors and Superseal Windows & Doors, Medford, Wi., from Longroad Asset Management.

SPI will continue the Hurd and Superseal brands within its windows division.

Boise Cascade Co. curtailed operations at its Elgin, 0r., plywood mill and stud mill Aug. 30 to Sept. 6, as it installed new equipment at its log utilization center.

Pacific Western Wood Products, Los Angeles, Ca., is now distributing Trident Luxury Vinyl Flooring interlocking planks.

Weyerhaeuser Co., Federal Way, Wa., has launched a stock repurchase program of up to $700 million of its common shares.

Feeney Inc., oakland, ca., added an 87,000-sq. ft. DC in Cranbury, N.J., to service dealers east of the Mississippi River.

Kodiak Building Partners, Denver, Co., has purchased fabricators/distributors AO, Inc., Dallas, Tx., and Barnsco Inc., Dallas.

Gali Bamboo, San Diego, Ca., has been named to the /nc. 5000 list of the fastest growing private companies in America for the sixth straight year.

National Frame Building Association has revamped its website at www.postframeadvantage.com.

MacBeath Hardwood Co. will relocate its corporate headquarters from San Francisco, Ca., to Edinburgh,In., on Sept. 15.

For the first time in its 60-year history, MacBeath will have its production facility, c.e.o., c.f.o., and financial heart of the company all under one roof. While its four distribution centers in California are unaffected, the company cited "ongoing challenges in conducting business in the state" as factors contributing to the move.

MacBeath Hardwood was established in 1954. The company offers domestic hardwood lumber, imported lumber, panels, manufactured wood products, finishes, adhesives, hardware and tools.

Hayward Corp., Monterey, Ca., has relocated its Redwood City, Ca., operations from the former T&H Building Supply property to a larger, more accessible site with a better layout.

"Our new lumberyard and hardware store will expand Hayward's Bay Area presence and give us the opportunity to grow our business by better serving our local customers," said William E. Hayward, president, c'e.o. and chief sustainability officer. "It will also introduce our brand to a large group of new customers."

Later this year, the new facility will add a Hayward Design Center, stocking Kolbe & Kolbe, Marvin, Unilux, Jeld-Wen, Rogue Valley, and Lemieux doors and windows' Hayward, which operates seven lumberyards, six design centers, and a roof truss plant, acquired T&H last year.

Parr Lumber Co. opened an 8,500-sq. ft. Pan Design Center showroom in Aloha, 0r.

Basic American Supply has opened in Colorado City, Az. (Chuck Bradshaw, mgr.).

ABC Supply has opened its first location in Montana, in Billings (Adam Snavley, branch mgr.).

Habitat for Humanity nas opened a second ReStore discount LBM outlet in Boise, ld.; remodeled its branch in Newport, Or.;and is relocating its 15,000-sq. ft. unit in St. George, Ut., to a 40,000-sq. ft. building that formerly housed a grocery store.

Anderson Mouldinq Doors & Windows, culver City, Ca., has opened a neil Door Store America showroom in Gardena, Ca., and launched a new retail site for doors (doorstoreamerica.com).

True Value Hardware, Salida, Co., was honored as Business of the Month by the local Chamber of Commerce.

Anniversaries: Garr's Ace Hardw?rc, Marysville, Wa., 90th Shelly's True Value Hardware, sparks, Nv., 70th ... Timb6rline Ace Hardw?IO, Telluride, Co., 45th Cali Bamboo, San Diego, Ca., 1Oth

Roseburg Rigidlamo Key Advantages

Stronger, stiffet more consistent

Dimensionally stable

APA quality assured

FSC'certified LVL available

Longer spans than conventional lumber

Greater load carrying capacity than conventional lumber

Wide width (up to 7")

Product & Performance Warranty

A fior€st Pmducts Company -

The Roseburg Framing Systemo for Floors and Roofs

RFPI'Joists. RigidLam" LVL. RigidLam' LVL Studs

RigidLam' LVL (olumns. RigidRim' Rimboard

F5(' (ertifi ed Products Available

Distributed by:

PO Box 396 10761 S. Alameda Street Lynwood, CA9A262 (323\s67-1301 |

Since l9i I nc're l.ecn nrrrking .1rrirliry firrest pro.lucts usc(l hr',.listril.rttor:, tlerlcrs, l.rriltlcr., rcnroclelers, lrrrl tlo-if-tt)rr15rrllL.r:.

l;or ovcr \i\t) \'citrs rie hitvc tirlkxrc.l fhc santc lrrinciplcr: trrltc crrrc t;tl't',rl \,)tl; \lt'ir, t,,l'trtt'llt'llrt';rtt.l t'llltit'lrtt itr trtlrtrttl:ttfrrtiltg; cust()nrcrs thc u,rt vorr u,rrrl.l likc to hc trclrtctl.

oi'thc lrn,l ln.l it u.ill trikc

ill)il f rcilt itll stt1,.p.lig1. ;111.1

For sales call: 1,800,331.0831 www. swansongroupinc. corn

Koppers Inc.. Pittsburglr. Pa.. hls cotttplctcd the acquisition of thc Woocl Pre-sct'vittion ancl Rlrilrolcl Serviccs businesses of Osr.nosc Holclings lirr $i4t):l.l nrillion.

The Wood Preset'vation bttsincss has bccn rctlltnlecl Koppcrs Perfixntancc Chctniclrls. Thc Raillttacl Scrviccs br.rsiness is now Koppels Railroacl Strttcttrt'cs.

Rough & Rcacly Lumbcr Co. has rcstarlc(l its Clrvc .lunction. Or.. sawrnill. l-5 months aftel shutting cltlun clttc to an Llnccrtain tintbcr supply.

Follrlwing a li(r-rrillion up-tracle. the ntill rlo\\' IcillLrrcs a ncw rcsaw, high-spcccl rtang eclucr'. ancl tritrtrttct'stackcr softcf

Forty, crnploy'ccs \\'L-re rehirccl to get the litcility back on linc. with anothcr 30 crpcctccl to return by thc tirne thc companv rcsLlnrcs salcs this lttonth.

Pennsr'lvurtiit attcl lncl iltna l-rtrnhermens Mutttal Insrrrancc Conrpanics hitvc latttrchctl a new website at rvu"'ru .pI tri Inr.coltt. cttrttbi n i n g inlitrnration from thc tlvcl previous companl sitcs in a ttcw litrtttat that cnhances prc\ i()u) lL'iltu|.e \ lrtttl itttlltrrr c\ tl\t' l t' \l)t'ti1;111.

The rccent affiliation ol'PI-M lncl ILM has lctl to a r-rur-nbcl of improvcmcrrts lirr both cotnltanics irt tltc llursr-rit to prove that to-gether. thcy llc bcttcr. Accot'tling to Stcrc Firko. PLM/ILM senior v.p. ol'nrarkclittg & I'iclcl opcrlrtions. "PLM and ILM have consistcntll ntaintainccl lon!Istancling relationships with custonlcrs. stt'ir in,g t() l'ctllrlili

aheacl ol'clrangcs in thc intltrslr'ics wc scrvc and prtlvide the lrost Llp-1() clatc irtlitrnllrtiotr tlccclccl to llrotect oul' cLlstonrcrs. Thc ncr,r' $'cbsitc |cl'lccts lllis goal and ()nee ;.lgltill proves uhr' 'togcthcr. wc'rc bcttcf ."'

When entcring thc wcbsitc. visitors alc grcetcd b1 a scrolling banner that highlights ctlrrcltt collll)illll initiltir cr and pertinent custollcl' inlitrrttlrtion. Thc ttcrl laltlttt proviclcs lbr easiet' navigation thlotrgh both olcl rttltl nc* illfornralit'rn. creating an indir iclLrllizetl ttsct'crpe tie llcc.

According to Firko. thc ricbsitc tttot'c closclr' alisns witlr thc company's mission ttt bc rccttgltizccl rts thc prcnricr insulancc provider scrvins thc lLtntbcr. utltlcluot'kit.tg ancl bLrikling rraterial inclustries. "Thc ncu u cbsitc lircttscs orr provicline customcr scrvice thc uar ottr cLlst()tllcl's u'allt it." suirl Firko. The nerr forntat allo\\ s ctlstolllgl'5, t1r vic\\ inlirrnration rvhcn thel'\\'ant it. n'het'c thev u'attt it. attcl on any dcvicc- all u ithout losing an1' firnctionality.

Thc o',r'ncr-/nrlnllgcr ol' Cal i bcr Forest Products. Tttrrrcr. Or'.. hus bccn scntenccrl 1o lll ntotrths in prison and ttl pa1' S2. I nrillion rcstituti()n.

Willianr ClaLtssctt. 7 | conf'cssccl to se llin-u rnore than 60 cliscor.rnte cl inroiccs llont 2(X)(r to 2(X)tt to Middleman Northuest. Lakc Osrvcso. Or.. lirr ltrtlclucts that he clid not ship or lor funcls tltirt hc hacl llrcrttly collcctctl.

As a result ol'bcins unublc t0 c0llect otl tl'tc boglls inroices. Micldlcrnan Noltltwcst clcl'ar,r ltctl otl loalts. clestroy'cd thc creclit ol'owncr llt'iln Kinclitl. ancl clcplctccl thc savings of' Kincaicl's lathcr. u'ho ltlrcl pcrstlrtallv sLlaranteed a line of credit.

Steve Hagen, Western Woods Inc., Chico, Ca., and former co-owner of Unity Forest Products, Yuba City, Ca., has retired after 40 years in the industry.

Tony Carpenter, Ken Carter, and George Hammann, all exCalifornia Redwood Co., are new to sales at Western Woods Inc., Chico, Ca.

Jeff Wedge, ex-CertainTeed, has been named national director of window sales for BMC, Boise, Id. Thomas "Fritz" Shatlah is new to door and hardware sales in Belgrade, Mt.

Patti Wells, ex-Royal Plywood, is new to particleboard sales at Collins Products, Klamath Falls, Or.

Gary Powell has been named c.e.o. and Ben Powell is now president of Matheus Lumber Co.. Woodinville. Wa.

Jon Friesen is now mgr. of Parr Lumber, Tacoma, Wa.

Mike Morse has been named sales mgr. of the Contractor Direct division of Bridgewell Resources, Tigard, Or.

Cornelia Sprung, ex-Weyerhaeuser/ TrusJoist, has been named marketing mgr. for RedBuilt, Boise, Id. New regional mgrs. are Mike Hayley in the South Coast and Jason Weber in the Intermountain Region.

Mack Hogans, ex-Weyerhaeuser, and Kris Matula, ex-Buckeye Technologies, were elected to the board of Boise Cascade, Boise, Id. Director Samuel Mencoff has resigned.

Tom Takach has joined Sierra Pacific Industries, Anderson, Ca., as v.p. operations for the window division, overseeing SPI's Red Bluff, Ca., facility and two newly acquired Hurd and Superseal plants in Wisconsin. Also in the window division, Bob Taylor has been promoted to v.p. of business development & customer service. and former Hurd president/c.e.o. Dominic Truniger is now v.p. of sales & marketing.

Michelle Overbeck. ex-Orchard Supply Hardware, has joined Big Creek Lumber, Davenport, Ca., as marketing mgr.

Jon Ohlson, SDS Lumber Co., Bingen, Wa., has retired after 3'7 years in the business.

Jim Webb, ex-Orepac Building Products, has been named customer relations mgr. at Accent Windows, Denver, Co.

Jeff Ward is the new lean champion for Franklin Building Supply, Boise, Id., overseeing lean projects.

Alison Campbell, ex-Stimson Lumber, is now senior log accountant for GreenWood Resources, Portland, Or.

Erica Rocha is new to inside sales at Associated Building Supply, Oxnard, Ca.

Gene Richau has rejoined T&R Lumber Co., Rancho Cucamonga, Ca., as western division sales mgr.

Kristi L. Gall has joined the sales & marketing team at Distinguished Boards & Beams, Carbondale, Co.

Timothy Coutu is new to sales at KP Wood Ltd., Vancouver, B.C.

Wendy Canchola has joined Weather Shield Windows & Doors, Medford, Wi., as regional sales mgr. for the western U.S., covering California, Oregon, Washington, Idaho, Montana, Nevada, Arizona, Utah. Alaska and Hawaii.

Colleen Boyles has been promoted to store mgr. at Home Depot, Santa Fe, N.M. Brett Carli has transferred from Santa Fe to become store mgr. in Durango, Co.

Clarke Poos has been appointed mgr. of the Habitat for Humanity ReStore in Buena Vista, Co.

Ralph Goldman, ex-Milgard, is the new marketing mgr. for Cascade Windows, Valley, Wa.

Randy Nagle, ex-BMC, has been named v.p. of sales & marketing for Laloma Windows & Doors, Tucson, Az.

Eric Brown is now director of corporate communications for Johns Manville. Denver. Co.

Mary Rita Dominic has been appointed quality mgr. for Deceuninck North America. Monroe, Oh. Pat Dixon is a new technical services specialist.

Craig Menear will become c.e.o. of Home Depot, Atlanta, Ga., Nov. l, succeeding Frank Blake, who will remain chairman. Ted Decker has been promoted to executive v.p.merchandising.

Quent Ondricek, v.p. of lumber & building materials, Do it Best Corp., Fort Wayne, In., is retiring Oct. 24, to be succeeded by Gary Nackers. Nick Talarico has been promoted to divisional mgr., overseeing the hand tools, plumbing, cleaning, housewares and InCom departments. Betsy Hartman succeeds him as mgr. of internal audit.

Paul Drobnitch is now director of corporate development at ABC Supply, Beloit, Wi.

Kalvin Eden was promoted to national sales mgr. for the U.S. at BW Creative Railings Systems, Maple Ridge, B.C. James Webb is now national sales mgr. for Canada., and Scott Rolufs, regional sales mgr.

Rob Brown. c.f.o.. Hardwoods

Distribution, Langley, B.C., has been appointed acting c.e.o. while president/c.e.o. Lance Blanco recuperates after a cycling accident.

An Di Nguyen, ex-American Hardwood Export Council, has been named president of the Softwood Export Council, effective Sept. 15.

Stephen H. Meima has been appointed executive director of the Gypsum Association.

Chris P. Bacon now heads the employee cafeteria at MungusFungus Forest Products, Climax, Nv., report co-owners Hugh Mungus and Freddy Fungus.

Two Coat Exterior Prime

0ur two-coat process starts with an aLkyd sealer to btock tannin migration, fottowed by a high-performance acrylic primer. The resutt: RESERVE quatity, inside and out.

Made of quatity, ctear, finger-jointed Western Red Cedar or Redwood, these products are naturatl.y designed for exterior use-both species are ideaI for enduring extreme weather.

RESERVE products come in a wide range of sizes, [engths and finishes. Whether the project catls for S1S2E or S4S, we offer [engths ranging from 16'to 20'. Pattern stock is atso available.

Ix4 - 7x'),2 s/ayQ - s/ax!)

2x4 - 2x12

Our Siskiyou Forest Products RESERVE line is specially manufactured and treated to create the highest quality product available. Using state-of-the-art application and curing equipment, our premium Western Red Cedar and Redwood stock is made to last for many generations. We are proud to offer a beautiful, durable product that is ready for installation and final painting the moment it reaches the craftsmen.

Ply Gem, Cary, N.C., agreed to buy Simonton Windows from Foftune Brands Home & Security for $130 million.

Expected to close in October, the deal includes window plants in Pennsboro, Harrisville and Ellenboro, W.V.; Paris, Il.; and Vacaville, Ca., and the SimEx extrusion plant in West Virginia.

Simonton will operate as a stand-alone business unit.

A woman and her date are facing trespassing charges after she fell off the roof of a San Diego, Ca., Crown Ace Hardware and hit her head.

Police said they arrived on the scene Aug. 8 just after l:30 a.m. to discover the woman with head injuries and the man, also allegedly inebriated, still on the roof. She apparently had tried to climb down and fell through an awning. striking the ground l5 feet below.

An inventor from Show Low, Az., is pitching a new sheet design he says will allow OSB, plywood and drywall to be installed more securely during construction.

He says The Wave Joint provides a wider surface to anchor the sheets to a rafter or stud and allows use of the full width of the rafter or stud for mounting, improving the project's structural integrity.

In addition, improved placement of nails and screws reportedly results in a safer connection, despite accommodating standard fasteners. Because of its ease of installa-

tion, it also saves time and effort on the job..

The inventor retained InventHelp, Pittsburgh, Pa., in hopes of finding manufacturers or marketers who will license or purchase the design. "l feel this new style of panel will be beneficial to anyone in the construction industrv." he said.

Compared to redwood, which is naturally beautiful and durable, with a structural integrity that can't be replicated, composite lumber suffers. In fact, redwood is the ideal wood product for just about any home project-indoors or out. With its natural resistance to shrinking, warping and checking, using redwood lumber on your project means you built it to last a long, long time.

realstrongredwood. com - info@ calredwood. org

SIMPSON STRONG-TIE, Pleasanton, Ca., supplied 95% of the fasteners and 100% of the hangers for an environmentally friendly multifamily building constructed by Appalachian State University, Boone, N.C., and Universite d'Angers, Angers, France. Constructed as six modular units, the structure competed in Solar Decathlon Europe, held June 28-July 14 in Versailles, France.

SIMPSON STRONG-TIE, Pleasanton, Ca., supplied 95% of the fasteners and 100% of the hangers for an environmentally friendly multifamily building constructed by Appalachian State University, Boone, N.C., and Universite d'Angers, Angers, France. Constructed as six modular units, the structure competed in Solar Decathlon Europe, held June 28-July 14 in Versailles, France.

Global drywall demand is forecast to rise 5.8Vo annual through 2018 to 10.4 billion square meters, according to a new Freedonia Group report.

Rebounds in building construction spending, following years of declines in both North America and western Europe, will be the primary drivers of demand.

Growing sales in Africa and the Mideast, where drywall continues to gain popularity over more traditional building techniques and materials, will also contribute to demand gains.

While demand in both the Asia/ Pacific region and Central and South America is projected to slow from gains seen earlier in the decade, both regions will post solid growth through 2018.

Nearly three-fourths of new drywall demand from 2013 to 2018 will be due to China and the U.S. Drywall sales in the U.S. are forecast to advance nearly 8Vo, as the housing market recovers.

In China, demand for drywall is expected to post more than jqo annu'al growth, bolstered by significant gains in both residential and nonresidential construction spending. Drywall is also projected to be used more frequently in residential applications in China, as it gains popularity over traditional building materials.

Many industrializing countriessuch as Brazil,India, Mexico, Saudi Arabia, and Turkey-are also forecast to post solid growth in drywall demand through 2018.

Increasing demand for urban housing will drive residential building construction spending and related drywall sales. In addition, advances in office and commercial construction activity will contribute to demand gains.

Going forward, drywall demand will benefit from local construction companies increasing drywall usage at the expense of other products, such as building plaster.

The drywall market in western Europe is projected to expand over 2Vo annually through 2018 to over I billion square meters, a rate above the 2008-2013 pace, but the slowest internationally.

Many countries are expected to post rebounds in demand as their housing markets recover, with Spain registering the fastest growth and Italy and the U.K. also forecast to per-

form well.

Global demand for building plaster is projected to advance over 4Vo per year to approximately 35 million metric tons in 2018.

Construction firms in many countries are projected to gradually increase their usage of drywall-based construction techniques at the expense of wet construction methods, which require more building plaster per unit. A portion of these losses, however,

will be offset by growing use of building plaster as joint compound during drywall installation.

Thermo Pressed Laminates. Klamath Falls, Or., has been purchased by Panel Processing Inc., Alpena, Mi.

The acquistion allows Panel Processing to better provide wood components, coatings and custom flat panel fabrication services to the West Coast. TPL will operate as a subsiary of Panel Processine.

Woodbrowser Inc.. Grantham, N.H., has officially launched the building industry's only transparent purchasing platform for lumber and panel products. Woodbrowser currently provides truckload quantity purchasers with direct access to lumber at over 145 mills and growing in North America via phone, email and online, as well as products from traditional wholesalers and distribution channels.

"Woodbrowser's platform and sales process provide buyers and sellers of lumber products with a much more efficient method of price discovery on the open market, really as easy as sending an email," said president Chuck Gaede. "Our True Price Finder platform replicates the current sales cycle that can take hours when conducted traditionally via phone and email. We've transferred that process to an easy-to-use web platform that allows buyers to view bids from multiple mills and sellers simultaneously, negotiate, and then purchase all in the same place, which saves an enorrnous amount of time."

In May 2013, its beta site was test-

ed with select customers and mills, and the newly updated platform went live this past June.

Unlike past trading platforms, Woodbrowser recreates the current sales process, allowing a buyer to simply choose the products they are looking to purchase, and instantly send that quote request to multiple mills and brokers. The user interface allows for both sides of the transaction to offer, receive, and negotiate pricing all on one screen, with the buyer seeing the actual cost from the mill or seller plus a flat fee based on the per-1,000-bd.-ft. cost of the lumber.

The platform also provides valuable feedback including current market data, the rank of the offer, and average offer price, which is information that has never been offered to either party in the current marketplace. Purchasers and sellers can also find all of their purchase orders and past quotes all in the same place.

"Our team also understands that the industry thrives on information about movements within the market, which is why we share real-time

updates on the market via our website, through customer emails, and by multiple daily conversations with producers and purchasers," Gaede added. "More importantly, we work with all of our customers the way they want to do business. While some purchasers are interested in sourcing their lumber online, others are not which is why we will continue to trade traditionally via phone and email for as long as our customers request."

Benjamin Moore & Co. will open a new 375000-sq. ft. distribution center early next year in Oakland, Ca. The company's first Silver LEEDcertified operation, the DC will serve retailers and distributors in the western U.S. and-in time-the Asia Pacific region.

App: Srmrsox SrnoHc-Tu

Produced by: Josr HmcrR SeucroR

Price: Free

Platforms: Web

Users can quickly and easily select the most appropriate and costeffective joist hanger for their projects based on the type of installation, type and size of lumber and loads using a new web app from Simpson StrongTie.

The easy-to-use interface enables users to quickly select the members and configuration for their desired connection, and print the results. The app is accessible from any web browser and doesn't require downloading or installing special software. It was developed after receiving feedback from engineers who appreciated the functionality of SST's Connector Selector software, but asked for an easily accessible, webbased version.

htn You KNow that only a fraction Llof your staff brings their "A game" to work every day? According to companies like Aon Hewitt and the Gallup Organization, this number is about one in five.

The rest? At best they are bringing their B or C games to work. At worst, their main goal is to keep from getting fired.

This is the employee engagement

crisis we now find ourselves in. Countless companies dedicate a sizeable chunk of their annual budgets to solving their employee engagement issues, when in reality most engagement issues (as well as performance and behavioral problems) can be solved through conversation. Five conversations to be precise.

But most managers don't talk to their staff frequently enough, or don't

know how to talk to them or what to talk about! Managers are unaware as to how to plug into their employees' minds and figure out what they really want, and what they need to be fully engaged- and productive.

There are no psychic forces at work: getting into the minds of your employees to glean the information needed to increase not only engagement, but productivity in your work-

force can be as simple as conducting the following five FOCUSed conversations.

There are two types of feedback that fall under this conversation. First, give praise where praise is due. Studies have shown that a vast majority of employees do not feel appreciated enough for the job they do. Praise, it seems, is a scarce commodity in the workplace. So if your staff is doing a good job, be sure to let them know.

Conversely, one of the key factors in employee engagement is the ability to have your say. Be receptive to your staff's feedback. Who knows, they may just come up with a brilliant idea that makes a huge difference for the company.

Most performance issues stem from a disconnect between what the manager perceives as meeting objectives and what the staff member perceives as meeting them. To drastically reduce performance issues, managers must both clearly define and articulate expectations. Yet few do.

Your employees need to know what they must do to be successful in their jobs, and how that success will be measured. And you need to have a clearly defined yardstick by which to objectively measure performance. Aligning their expectations with yours will result in less frustration and anxiety-on both your parts.

Many studies list career development within the top three factors that employees gauge to determine whether to

stay with their current employer or look for another job. Yet, many managers avoid this topic like the plague for one of three reasons:

. They don't understand how to manage their own careers.

They are afraid that if they help their staff manage their career better they will surpass them on the cotporate ladder.

. They are afraid to talk about career development because they don't feel they can meet the employee's expectations. This is especially true in smaller companies or niche functions where there is not a lot of vertical career opportunity available.

Helping staff manage their careers makes good business sense. Ensuring that they understand what opportunities exist within your company (something they may not recognize without your help) will inhibit them looking outside of it.

Find out what your employees' priorities are and have open, honest conversations around how your company can help them achieve them-even with any constraints you may have. Suggest and recommend internal opportunities to learn, grow and develop and they will at least delay-if not avoid-looking for external ones.

The Underlying Motivators conversation helps to uncover those intrinsic factors-currencies of choice-that science has shown to be much more highly motivating than extrinsic ones such as pay and benefits. By tapping into each individual's currencies of choice you will help uncov-

cl'what thev ncctl to go thc extra rrilc. Conr.er-sclr'. oncc they clo. thcv ncccl tcr bc rccognizcd appropriatelv for it. Thc olcl adagc "Pllrisc in prrhlic. e()rreel in qrrirlrlc" is orrll hlrll- lrur.. Manv pcoplc don't respond 'F r'''cll to public recognition.

lclcntify the drivels of each individual staff memlre l to unloe k ploductir ity lnd unlcash potential. Then Icr'()qnizc thenr lrppIopIiatclv rvhcn the1,' clo go that ertra mile.

According to Gallup. tcanrs u,hosc nrenrbcrs play tct their strengths nrost ol tl-rc tirnc ar-c:

-50%, nrorc likclv to huvc lo* cnrplot'ee tul'nover

o l$fl: nrr)re likclv to bc highll' procluctir,e

4zl% rnorc likcl_v- to earn high custonel' satisfaction sc0res

Strengths can bc definecl as the innate abilities or bchav ioral pattcrns tlrut arc ncurologicalll'hard-r','iled into our brains bctwccn thc a-rrcs of 3 ancl 15. The conte\t tll'the behavior will change over time. but the patterns rernain thc same So thosc children who share their toy's in the sandbor at the age of -5 rnay very well become l5-i'ear-olds u'ho volunteer at the local charity. Ancl 20 yeal's on. thcr,rnal'

bccome the 35-year-olds u'ho are the most collaborative in the rvorkplacc.

Stre n-sth- identil'icat i0n ll:o fequ i fes u \ cr) m in( |l' time comnitrnent: ls Iittlc

its two hours per we'ck can makc a u'orld of diffbrcncc.

If vou cun help vour staff cletermine behaviors that comc naturallv to them. yoLr u"ill fincl that thcir stlcss is clccrcascd. lhcy becorne nrore cngagccl ancl. of course. ,r. _ t nrorc procluctivc.

Therc is n() reirson tL) spencl mass am0unts of tirne and money on "en-gagcnrcnt' proqran'ls w hcn all it takes is tapping into the niincls of voLrr pcrsonncl. B1' l'irst hirin-g the right staff and then cmployins thc l'irc FOCUSecI conversations, mrinagers will signif icantly' incrcasc ovcrall employee engagement.

Comrnunicate with 1'our statf frequently. effectively and lbout thc things that lcallv matter to thcm.

Kirn Scclitt,q ,!nrltlr i.i u ltturturt rcsottrccs c.rpcrt utttt autlutr ol tltc trt'rt'br.,afr Mind Reading for Managers: 5 FOCt-lScd Convcrsations I'or Greater Emplotee Enqagenrent and Ploductivity. Reuclt hcr viu igriteglobul .t'orn.

ll rfv oLDEST cHILD recently got his learner's permit. a IVlright of passage for all teenagers and a different sort of right of passage for parents. As he learns to drive, I find myself slamming repeatedly on imaginary brakes and trying, usually in vain, to use moderately toned coaching instead of screaming at the top of my lungs.

As with so many experiences, trying to teach my son to be a responsible driver has made me mindful of families in business together and intergenerational relationships. On a recent business trip, I rode in cars with members of our client's family business: the husband, the wife, the daughter, and one of their employees. In none of those occasions did I feel tense, slam on the imaginary brakes, or shout

intemperately at the driver. What makes me (along with most other parents of teenagers) so much worse a passenger when riding with my own dear son versus when riding with comparative strangers? And what makes business families less tolerant of each other than they are of "outsiders"?

First, we have a desire for our children to be perfect. I critique every aspect of my son's driving: every lane change, failure to use a turn signal, or one mile per hour over the speed limit elicits a comment. When riding with friends, clients, or anyone else, these things aren't even worth a mention. Perfection-never a realistic goal-is something we both expect and demand from our children, especially as we coach them to take on responsibilities for things about which we care the most.

Next, part of our anxiety is related to imaginary fears. We fear the heartache that would come if our children were in accidents and were injured. Even where no injury is involved, we worry about how they'd cope dealing with strangers in high-stress situations like rush hour fender benders. Again, when thinking of our employees or peers, these imaginary fears rarely come to mind.

Third, it's a little unnatural for go-go entrepreneurs like me to teach. We'd rather jump into the driver's seat and take charge of the wheel ourselves. Having someone else steer the car makes us feel vulnerable and afraid-especially if that person is our child. Having another competent peer chart the course doesn't seem to bother us nearly the same way.

Finally, deep down inside there is a lack of trust in our children. We remember the sloppy homework, the laziness when it came to working on school projects, the inclination to put friends and social activities ahead of work and scholarship, and other shortsighted, child-like decisions. It's hard for us to see that now they're driving their own cars or, in the case of many family businesses, steering the

company that dad and granddad helped create.

Eventually, I suppose, I'll grow more comfortable with my son driving the car and my foot won't reflexively jump on the invisible brake quite so often. For families in business together, here are some tips for helping their children earn their "Family Business Learner's Permits":