POLISH FLAVOURS, TRADITION AND QUALITY

Polish producers are well aware, that the quality of food products are playing a bigger role and are becoming the deciding factor for consumers. That is why they are constantly striving to improve the quality of the offered assortment. A great benefit is the combination of experience with old Polish recipes and tradition with modernity. Modernity helps in keeping an eye on the quality of the products at each step of production – from the raw material to the finished goods, tradition is the response to the trend manifested by the fashion for traditional products, old Polish.

The list of Polish producers, who can be proud of excellent production quality and a lengthy tradition of production is quite long, it would be difficult to name them all, or even just the most important. But, it is definitely worth cooperating with all Polish manufacturers present at the fair!

Welcome to the latest issue of ‘Food from Poland’ Magazine where you can read about Polish companies and the excellent traditional food products they make. Enjoy reading!

40 THE 2022 SUMMARY ON THE POLISH FMCG MARKET

TRADE FAIRS

68 Is it worth participating in fairs?

TECHNOLOGY

76 Artificial Intelligence in the FMCG sector – is it worth investing in?

INTERVIEWS

14 Małgorzata Cebelińska, Vice President of the Board at SM Mlekpol

18 Karol Pilaciński, Export Director at Bogutti

24 Jakub Kępka, Key Account Manager at Transad.

38 Dr. Adam Mokrysz, the President of the Mokate Group and Dr. Katarzyna Mokrysz, CEO

66 Olgar Suner, Deputy General Manager at Turka

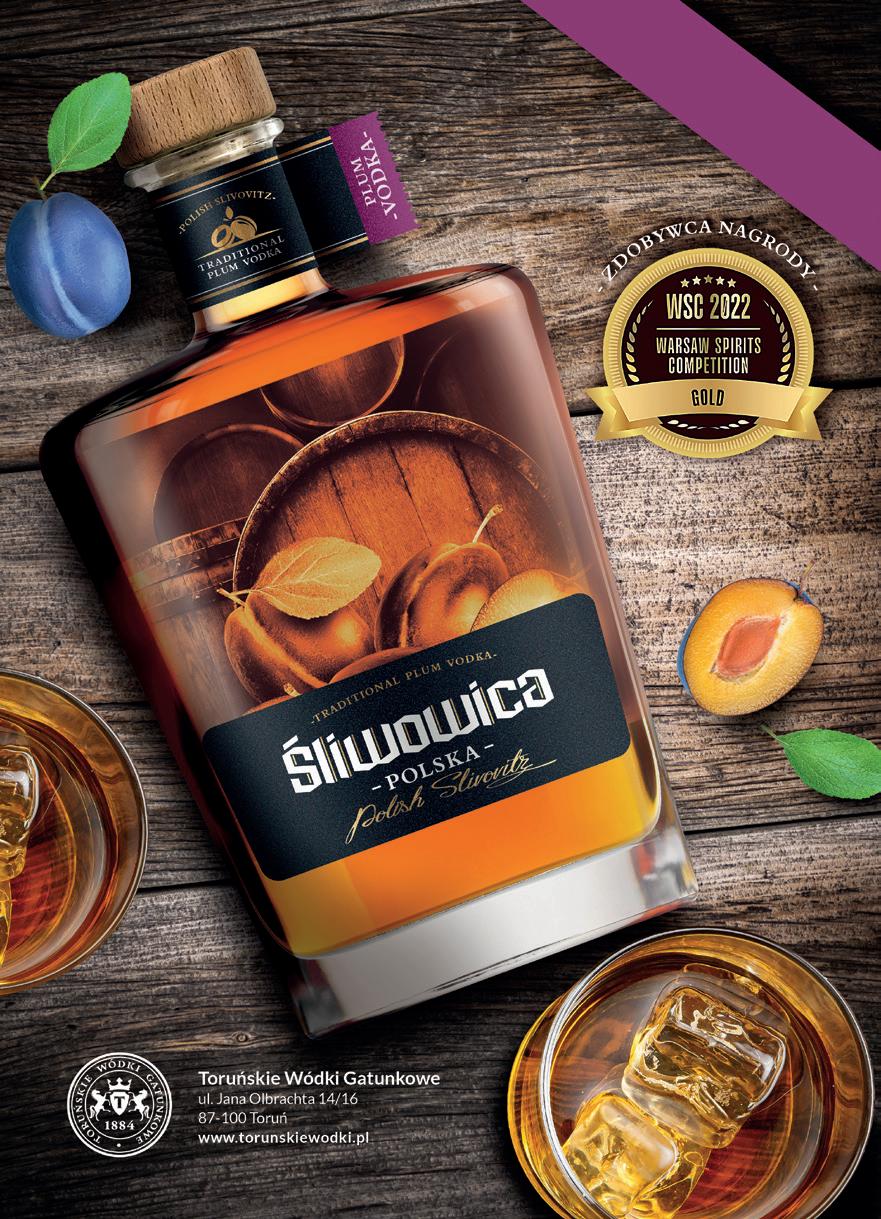

70 Grzegorz Grabowski Managing Director at Toruńskie Wódki Gatunkowe

74 Bogdan Łukasik, CEO at Modern Expo

90 LIST OF POLISH COMPANIES

97 DISCOVER POLISH PRODUCTS

Editor-In-Chief Tomasz Pańczyk t.panczyk@foodfrompoland.pl

Managing Editor Monika Górka m.gorka@foodfrompoland.pl

Advertisement Office Phone: +48 22 847 93 67

Sales & Marketing Departmet Katarzyna Paciorek k.paciorek@foodfrompoland.pl

Graphics studio

Printing house: ArtDruk Kobyłka www.artdruk.com

Editorial Office Bagno Street 2/218 00-112 Warsaw, Poland Phone: +48 22 828 93 66 redakcja@foodfrompoland.pl www.foodfrompoland.pl

Fischer Trading Group Ltd.

CEO: Tomasz Pańczyk t.panczyk@ftgroup.pl

MARKET INSIGHT 9 Increase in the value of Polish food exports in 2022 48 Promotion of Polish products on international markets 58 The energy crisis directly affects the functioning of the trade sector 64 Trade franchise just for the modern times FOOD SECTOR 22 30 Years With The Best. For The Best. 32 Polish People Love Sweets 52 Tradition with a pinch of the modern 80 RFID is the technological drive for trade in this decade 82 POLL: Polish people do not believe in a falling food prices scenario 87 Polish trade affected by war

Reliable partner in logistics

30 Predictions for confectionery market 84 Glovo predicts the trends for 2023

Social commerce – a trend that increasingly drives Polish companies

Tomasz Pańczyk, Editor-in-chef Food from Poland Magazine

LOGISTICS 26

TRENDS

86

Paweł Pańczyk

8 #editorial Spring 2023 CONTENTS

Increase in the value of Polish food exports in 2022

Marcin Wroński Deputy Director-General of the National Support Centre for Agriculture

Marcin Wroński Deputy Director-General of the National Support Centre for Agriculture

What significantly contributed to the increase in export value was the exchange rate of the Polish zloty against the euro which was favourable for exporters and supported the competitive prices of Polish agri-food products on the international market. What also had an effect on revenue on international sales by Polish exporters were high transaction prices of food internationally, resulting i.a. from the economic consequences of the military conflict in Ukraine.

The good results achieved in the export of agri-food products testify to the growing efforts of domestic entrepreneurs towards diversifying business relations on third-country markets and improving the quality of the products on offer. With product offerings adapted by Polish entrepreneurs to the varied

preferences of foreign consumers, a demand for Polish products on the international market is maintained.

The increase in revenue on international sales in the ten months of 2022, as well as the greater growth dynamics compared to 2021, confirm that Polish entrepreneurs operating in the agri-food industry are faring well on the international market. The export of agrifood products allows managing excess food produced in Poland, as well as is a significant source of revenue for the Polish agri-food industry, and has a positive effect on the country’s economy.

At the same time, the value of agri-food products imported was EUR 26.2bn (PLN 122 bn), and was 29.6% higher year over year. The positive trade balance amounts to EUR

13.0bn (PLN 61bn), 23.0% higher than in the period from January to October 2021.

Export of agri-food products from Poland by territory

As in previous years, agri-food products were exported from Poland largely to the market of the European Union. From January to October 2022, deliveries to EU-27 states generated over EUR 29bn (an increase of 30%), making up over 74% of total revenues on export of agri-food products from Poland.

Poland mostly sold the following to the EU Member States: poultrymeat (EUR 2.7bn), cigarettes (EUR 2.4bn), milk products (EUR 2.2bn), beef (EUR 1.5bn), breads and bakery products (EUR 1.5bn), petfood (EUR 1.3bn), and chocolate products (EUR 1.3bn).

In the period from January to October 2022, the sales of Polish agri-food products abroad reached a record-breaking value of EUR 39.2bn (PLN 183bn), 27.3% higher year over year.

Source: Elaboration of the Analysis and Strategy Office, the National Support Centre for Agriculture, based on the figures of the Polish Ministry of Finance; 2022 – preliminary figures. The balance is calculated based on the figures to several decimal places. 20,2 26,2 0,8 1,7 2,1 2,0 39,2 22,7 25,0 21,3 20,0 19,3 17,3 16,1 15,1 14,3 13,6 12,6 10,9 10,3 9,3 8,1 6,4 5,4 4,4 7,1 8,5 10,1 11,7 11,5 13,5 15,2 17,9 20,4 21,9 24,3 23,9 27,8 29,7 31,8 34,3 37,6 30,8 5,2 2004 0 10 20 30 40 export import balance 2009 2014 2005 2010 2015 2006 2011 2016 2007 2012 2017 2019 I-X 2021 I-X 2022 2008 2013 2018 2020 2021 1,4 2,2 2,6 2,6 4,3 6,1 6,7 7,8 7,0 8,5 9,7 10,5 11,6 12,6 13,0 10,6 bln EUR 9 #marketinsight

Polish international trade in agri-food products

Export of agri-food products from Poland by month

Polish agri-food export to the EU market is considerably concentrated geographically. Poland’s main trade partner is Germany. From January to October 2022, the value of exports to that country amounted to EUR 9.7bn, 26% higher than the year before. Exports to Germany mostly included cigarettes, poultrymeat, fish preparations, petfood, breads and bakery products, chocolate, and chocolate products. Other important recipients of Polish agri-food products also included the Netherlands (EUR 2.6bn, a 43% increase; export of mostly poultrymeat, cigarettes, grains of maize, beef, chocolate, chocolate products, as well as fruit and vegetable juices), France (EUR 2.4bn, a 34% increase; export of mostly poultrymeat, meat preparations, beef, chocolate and chocolate products, breads and bakery products, and petfood), Italy (EUR 1.9bn, a 20% increase; mostly cigarettes, beef, fish preparations, as well as cheese and quark, making up close to 50% of the export value), and the Czech Republic (EUR 1.8bn, an increase of 34%; export of mostly poultrymeat, breads and bakery products, as well as cheese and quark).

In total, export to the markets of the aforementioned five countries (Germany, the Netherlands, France, Italy and the Czech Republic) generated around EUR 18.4bn, which in value is over 63% of exports to EU-27 countries.

Poland exported over EUR 10.1bn worth of agri-food products to non-EU

Polish international trade in agri-food products from January to October 2022

Polish agri-food export by territory from January to October 2022

Source: Elaboration of the Analysis and Strategy Office, the National Support Centre for Agriculture, based on the figures of the Polish Ministry of Finance; 2022 – preliminary figures.

0 2,6 2,8 3,4 2,9 2,9 3,1 3,0 3,2 3,4 3,4 3,1 3,3 4,1 3,7 3,9 4,0 4,1 4,3 4,3 4,4 2,9 3,6 2,8 3,3 2,7 2,8 3,2 2,6 2,6 2,7 2,8 2,7 3,1 3,2 I II III IV V VI VII VIII IX X XI XII 2020 2021 2022 1.0 2.0 3.0 4.0 5.0 bln EUR

Source: Elaboration of the Analysis and Strategy Office, the National Support Centre for Agriculture, based on the preliminary figures of the Polish Ministry of Finance.

EUR 39,2 bn (PLN 183 bn) EUR 26,2 bn (PLN 122 bn) EUR 13,0 bn (PLN 61 bn) +27,3% +29,6% +23,0% export import balance France 6% Netherlands 7% Other countries 13% 39,2 bln EUR 29,0 bln EUR Saudi Arabia 1% USA 2% Ukraine 2% Great Britain 8% Italy 5% Czech Republic 4% Spain 3% Romania 2% Belgium 3% Hungary 3% Slovakia 2% Denmark 2% Lithuania 2% Sweden 2% Other EU countries 8% Germany 25% EU-27 74% 10 #marketinsight

Source: Elaboration of

the Analysis and Strategy Office, the National Support Centre for Agriculture, based on the preliminary figures of the Polish Ministry of Finance. The balance is calculated based on the figures to several decimal places.

Polish export of agri-food products by goods from January to October 2022

Others

EUR

Meat, meat preparations and livestock

EUR 8,0bn (+39%)

Alcohol

EUR 0,6bn (+16%)

Fruit and vegetable juices

EUR 0,7bn (+25%)

Tea, coffee, cocoa

EUR 0,9bn (+26%)

Oilseeds, vegetable fats

EUR 1,3bn (+77%)

Office,

Source:

Fruits and preparations

EUR 1,5bn (+8%)

states from January to October 2022, which is 20% more than in the comparable period in 2021. Poland’s exports to non-EU states included most of all: milk products (EUR 858mn), poultrymeat (EUR 806mn), wheat (EUR 648mn), chocolate products (EUR 605mn), breads and bakery products (EUR 590mn), and cigarettes (EUR 516mn).

Important non-EU recipients of Polish agri-food products, like in previous years, were largely the United Kingdom (EUR 3.0bn in revenue, a 26% increase in value; export of mostly poultrymeat, meat preparations, chocolate and chocolate products as well as breads and bakery products), Ukraine (EUR 786mn, a 20% increase; export of mostly cheese and quark, petfood, coffee, water, pigmeat, as well as chocolate and chocolate products), the United States (EUR 638mn, a 29% increase; export of mostly chocolate and chocolate products, pigmeat, fish and fish preparations, as well as meat preparations) and Saudi Arabia (EUR 435mn, an 8% decrease; export of mostly cigarettes, wheat, as well as breads and bakery products), and further down the line –Israel (EUR 334mn, a 43% increase; export of mostly beef, sugar and wheat), Norway (EUR 248mn, a 14% increase; export of mostly cigarettes, grains of maize, petfood and fruit preparations), as well as Algeria (EUR 219mn, a 42% decrease; export of mostly condensed milk and milk powder–65% in value, and tobacco – 27%).

Vegetables and preparations

EUR 1,9bn (+21%)

Fish and preparations

EUR 2,2bn (+13%)

Export of agri-food products from Poland by goods

In the breakdown by goods, meat and meat preparations dominated the Polish export of agri-food products. From January to October 2022, the revenue on the international sales of this product group rose by 39% compared to the previous year, amounting to EUR 8.0bn, constituting 20% of the total value of Polish agri-food product exports. The largest share in the value of exported meat and meat products was in poultrymeat (44% – EUR 3.5bn), meat preparations (23% – EUR 1.8bn), beef (22% – EUR 1.7bn) and pigmeat (8% – EUR 677mn). Export of livestock and other kinds of meat was relatively small in value, making up 2% and 1% respectively of the revenue on the export of meat products from Poland.

The second-highest item in value, with a 14% interest in export of agri-food products from Poland, was cereal grains and preparations, the total sales of which grew by 40% compared to the analogous period in 2021, to EUR 5.4bn.

Revenue on the export of cereal grains was EUR 2.5bn. 7.3mn tonnes of cereal grains exported were made up by maize in 41% (3.0mn tonnes, export volume increase by 92%), wheat in 41% (3.0mn tonnes, a 6% decrease), rye in 5% (381k tonnes, a 62% decrease) and barley in 4% (287k tonnes, a 31% decrease).

Cereal grains and preparations

EUR 5,4bn (+40%)

Tobacco and tobacco products

EUR 3,6bn (+5%)

Milk products

EUR 3,1bn (+42%)

Sugar and confectionery

EUR 2,6bn (+15%)

Exporters placed grains mostly on the Union market (5.2mn tonnes, 71% of exported grain). From January to October 2022, grains of maize were exported mostly to Germany (1.4mn tonnes, 48% of exports of the said grain), the Netherlands (498k tonnes, 17%) and the United Kingdom (243k tonnes, 8%). Largest recipients of wheat were primarily Germany (959k tonnes, 32% of exports of the said grain), Nigeria (353k tonnes, 12%) and South Africa (253k tonnes, 8%). The main destination for rye from Poland was Germany (330k tonnes, 87% of exports of the said grain), whereas for barley – Germany (189k tonnes, 66% of exports of the said grain), the Netherlands (35k tonnes, 12%) and Algeria (31k tonnes, 11%).

Increase in the value of export was observed practically in all agri-food product groups, i.e., tobacco and tobacco products (5%, up to EUR 3.6bn), milk products (42%, up to EUR 3.1bn), sugar and confectionery (15%, up to EUR 2.6bn), fish and preparations (13%, up to EUR 2.2bn), as well as vegetables and preparations (21%, up to EUR 1.9bn), and fruit and preparations (8%, up to EUR 1.5bn). There was also a rise in the value of exported oilseeds and vegetable fats – by 77% (EUR 1.3bn), tea, coffee and cocoa – by 26% (EUR 0.9bn), fruit and vegetable juice – by 25% (EUR 0.7bn), as well as alcohol – by 16% (EUR 0.6bn).

Elaboration of the Analysis and Strategy

the National Support Centre for Agriculture, based on the preliminary figures of the Polish Ministry of Finance.

7,4bn 20% 18% 14% 5% 6% 7% 8% 9% 2%2%2%3% 4% 39,2 bln EUR 11 #marketinsight

milk and ricegrain Sweet teddy bear

2023 will be a difficult year, for the dairy industry as well. How do you intend to face it?

The past year has brought negative phenomena that we will probably face in the coming years. High inflation, which has affected the whole world, portends many difficulties – also in the dairy industry. Mlekpol’s strength is multi-directional production, capable of being dynamically adapted to the needs of the market and the customer. We believe this flexibility will allow the Cooperative to survive the hardest times. If the situation improves and the market returns to the dynamics we have known, there are chances that the dairy industry will not suffer and dairy producers will still be interested in development of their farms.

In 2022, SM Mlekpol continued the previously launched investments, including pro-ecological ones. How important does the Cooperative find this aspect of development?

Systematic investment ensures Mlekpol’s development and efficient operation. The investments mainly relate to the implementation of milk processing technologies. They give, apart from innovative products and technical solutions, environmental benefits, very important to the Cooperative. Technical infrastructure and modern machinery are also pro-ecological investments that enable improvement of work efficiency and lower energy consumption. Individual plants modernize their sewage treatment units and implement cogeneration systems. Our business partners also appreciate our measures aimed at using environmentally friendly product packages compliant with the ideas of sustainable development.

Mlekpol’s Multidirectional Dairy Production

Does innovation go hand in hand with ecology?

It should. These are the consumer expectations and the changing consumption patterns. First of all, ecological innovation has a positive impact on the endangered natural environment, increases the competitive advantage on the market, but also it also reduces production costs (an extremely important role of state governments). This is not just about production technologies but entire technological systems, production processes, products, operation, equipment, as well as organizational and management procedures. In this aspect, of course, the knowledge and skills of employees involved in the production process, as well as development of the product quality policy, are necessary. Eco-innovation is obviously an additional cost for Mlekpol, yet there is no turning back from this direction.

People are the strength of every company – please tell us more about the “heart” of the company, important relations, and the consumers themselves.

We take care of people, naturally – this is obvious, as we have been doing itfor more than 40 years. Meeting the trends and needs, we provide consumers with high-quality milk products originating from the cleanest regions of Poland. We care about the surrounding environment and animal welfare. The heart of the company is created primarily by the people who are its greatest capital, strength and future. The Cooperative associates nearly 8,500 farmers and 2,800 people employed at 13 plants throughout Poland. Their knowledge of milk production is drawn mainly from their own experience – as they come from regions where the beautiful tradition of dairy farming are passed from generation to generation. We believe in the strength of tradition

14 #interview

Małgorzata Cebelińska, Vice President of the Board at SM Mlekpol talks on dairy sector in Poland, company’s investments, innovative products, portfolio development over last years, export offer and global trends.

and values, because whatever Mlekpol does, it does with people, for people and with people in mind.

Quality, tradition and… – what is the third crucial factor defining the cooperative itself and its offer?

Openness – to the needs of the customer, the market, and the foreign partners. This also means watching the consumer trends and keeping up with them, which results in innovative implementation of the dairy products. In cooperation with the Institute of Dairy Industry Innovation in Mrągowo, SM Mlekpol develops ideas and adapts its portfolio to the consumer and market requirements. The range of Mlekpol’s products already includes about 500 items characterized by high quality, a simple, clean composition, an excellent taste. They are under various brands in Poland and abroad.

How will the SM Mlekpol’s portfolio develop in the near future? Consumer behaviour has changed a little, will it affect your offer?

Mlekpol’s product offer is always adapted to the changing market situation. Therefore, we expect increased interest in drinking products, desserts, fermented beverages, as well as other products with high nutritional value and protein concentration. However, taking into account the pessimism connected with the economic situation, we have also introduced cheese in large, economic packages. Thus, we will satisfy the needs of those who have recently experienced substantial worsening of their financial standing.

What does the export offer look like? What do foreign consumers appreciate Mlekpol products for?

The export offer of SM Mlekpol is, mostly, products with longer shelf life, such as UHT milk, flavoured milk, and creams, as well as butter, cheese, and a wide range of powdered products that we have been able to expand upon construction of a modern powder plant in Mrągowo.

Foreign consumers value Mlekpol products mainly for their high quality, repeatability, and Polish origin. Through participation in foreign fairs in different parts of the world and talks with current and potential partners from abroad, we can learn their particular needs and preferences. Then we can adapt our offer to the requirements of individual countries, and develop new product categories. Our partners know and appreciate the production flexibility of Mlekpol, i.e. the constant availability of large product batches, as well as timely fulfilment of orders. Such cooperation is possible thanks to our own, stable raw material base and the production capability in 13 modern plants.

Your products reach almost 100 countries worldwide. Which markets are the most promising? How do consumer requirements differ between countries?

The most promising markets are those with insufficient milk production, forced to rely on import to satisfy their consumption needs. These include South-East Asian, African, and Middle Eastern countries. Other markets, equally important to Mlekpol, are China, South Korea, Mexico, Chile, the Dominican Republic, as well as Moldova and Serbia. Consumer needs differ between continents and regions. In developing countries, consumers replace cheaper prod-

ucts – such as rice or beans – with protein-rich goods like milk, cheese, and fermented products. Poorer countries focus on purchase of essential dairy products – e.g. liquid or powdered milk. On the other hand, countries with a high level of economic development show a definitely higher interest in premium products, including long-ripened cheese, butter, and high-protein powdered products for supplementation, such as WPC 85.

What are the current global trends in the dairy industry?

Nutrition trends worldwide are shaped by young people. Within the next five years, the market will increasingly appeal to niche identity needs of loyal customers/investors. A new era of social pressure will begin, as consumers will be increasingly concerned with the ethics of dairy brands, including animal welfare. New generations also want to be in the spotlight, and dairy producers can help them. Besides, we cannot ignore the digital innovations and ways of communication with customer. Over the next 24 months, we can expect that the change in conditions will change consumer habits and lifestyles, such as consumption of smaller amounts of food, buying products with shelf life that will soon expire, or choosing goods in simple packages – not so pretty but of local origin and at lower prices. Consumers will try to reduce food waste and pay much attention to product reuse and recycling. As for older generations, buyers will put much emphasis on health issues, yet innovative food products will also remain important to them. It is, among others, the result of their kitchen creativity and openness to diverse tastes, also from other regions of the world. Buying dairy products will become a way to protect the environment and mental wellbeing, giving the consumers a sense that, by eating dairy products, they are doing something good for their community.

The export hits of SM MLEKPOL are…

Mlekpol’s export hits are UHT milk, powdered products, cheeses, butter, flavoured milk and creams. In view of deep-sea transport and the importers’ distribution capabilities, Mlekpol focuses primarily on products with long shelf life. Globally, the best-known product is Łaciate UHT milk in an environmentally friendly one-litre package. Furthermore, the Cooperative has created such international brands as Milcasa and Happy Barn, which are already well known to consumers in different countries. High-quality raw material and innovative packaging technology ensure that the milk retains its freshness and taste for a long time, without losing its nutritional value. In the cheese category, bestsellers are semi-hard cheeses, including Gouda, Edam, and Maasdamm in blocks, as well as in slices and portions. Mlekpol’s Mozzarella perfectly fits in with the preferences of foreign consumers, including the 2 kg grated version – for the purposes of the catering business. The category of spreads is dominated by Łaciate butter, processed cheeses, as well as Łaciate cream cheeses. For many years, Mlekpol has also exported powdered products, such as milk, whey, buttermilk, and, recently, specialized products, like concentrated whey proteins, e.g. WPC 80 and 85. Specialization of production and modern technologies implemented in production plants ensure more flexibility and possibility of manufacturing dairy products specially customers’ needs. Mlekpol is open to every cooperation and willingly takes on new challenges.

Thank you for the interview.

15 #interview

What export results may Bogutti boast? Is the pandemic-related slowdown of growth returning to its previous pace?

The main goal of the founders of Bogutti was international development. In the first period of our operations, sales focused on European markets, mainly Italy, the UK, and Germany. Several years ago, the company decided to start its expansion to non-European markets. Ever since, we have managed to reach more than 20 new markets, from South America to Africa to Asia. The diversification of direction of sales helped the company pass smoothly through the pandemic period. After a time, when the whole world had made a decision to introduce lockdowns, the customers returned to standard functioning. This allowed the company to manufacture without downtimes and to avoid the adverse effects of the pandemic.

International development

The growth of prices of raw materials, packaging, energy, gas, or costs of transport, directly affect the manufacturing cost of products –how do you take on the challenges that manufacturers currently face?

Over the last year, we have seen an unprecedented growth of production costs. The coincidence of such events as COVID, the Russian aggression in Ukraine, maritime transport difficulties, or high inflation, put the manufacturers under an immense cost pressure. On the one hand, the company was pressured by suppliers, and on the other hand, enormous resistance occurred on the part of customers. For a long time, traders would not admit to the thought it was necessary to introduce price adjustment. Starting this process was the most difficult thing. One had to change the customers’ perception. At a moment when the subject of price adjustment reached global proportions, the talks became easier. Tolerance for such measures increased.

Simultaneously, with the process of increases, our company has taken a range of actions aimed at optimizing purchases and production. We have eliminated unnecessary costs connected e.g. with the kind of packages used or the manner of production organization, in order to limit the scale of increases.

Please tell us more about the export offer. What makes the Bogutti products stand out against their competitors on the global market? What do foreign consumers appreciate your sweets for?

As I have said, international development of sales is the driving force behind the company. The production started from typically Italian cookies with delicious creams and from the traditional Polish fudge. We would like Bogutti products to be appreciated for their high quality, taste, and attractive price level.

18 #interview

An interview with Karol Pilaciński, Export Director at Bogutti on export directions, market challanges, innovations, company’s offer and development plans.

How do you adapt your offer to consumer requirements worldwide?

Bogutti has been active on the market for 10 years and we have strived all the time to develop and to introduce new solutions. We do not close within the limits of the existing offer. One of our development methods is focus on ideas submitted by our contractors. We always treat such a submission as a challenge to improve our offer.

Are innovations implemented in the offer? What does a foreign consumer expect and do those expectations differ between markets?

According to the adage that standing still means falling behind, we have constantly searched for new solutions, new recipes, new packages. Manufacturers try to surprise customers with new products. Consumers are bombarded from all sides with different offers, new trends and ideas. Thus, we develop sugar-free product lines or those free of palm oil.

Acting globally, we face different customer expectations on an everyday basis, concerning the recipes used, packaging standards, quality issues, or the price policy in the given area.

Which foreign markets are the most strategic to you and why? Will you appear on new markets?

The company’s history is connected with the European mar ket which still remains a strategic area of our operation. For five years, the company has strongly focused on development of sales on other continents. It is worth mentioning Middle Eastern countries where the traditional Polish milk fudge reigns invariably. For many years, the demand has been maintained on a very high level.

We strive to constantly expand the scope of our distribution. Recently, we have visited several industry fairs in Asia, resulting in new contracts. Especially in East Asia, we observe growing interest in Bogutti products and we will surely plan appropriate measures to increase the company’s presence on this market.

What new will appear in Bogutti’s portfolio in the near future?

All the time, we observe the changes occurring on the market and we listen to customer suggestions, which allows us to successfully develop our offer. We have recently focused on sugar-free cookies, since there is a global trend for such products. We have introduced doypack as a new packaging type for our cookies. The string package preserves the cookie’s freshness and enables longer storage. This is particularly important on Asian markets where high humidity and temperature do not favour open products. The next step will be expansion of the offer by single-packed cookies.

The development plans of the company for 2023 and the next years are…

The company has been developing dynamically for 10 years and each year brings something new. The next stage will be expansion of the production and storage areas. This investment will result in increased production and the company will expand its offer by new product categories. I hope we will be able to give more details in the several months to come.

Thank you for the interview.

19 #interview

30 Years With The Best. For The Best.

5 Steps To Success In Global FMCG

The origin of the Brand Distribution Group dates back to 1992 and is rooted in Białystok, north-eastern Poland. The past decades have been for the small trading company an inspiring journey to an international distribution group active in 100 markets. The company has been redefining global trade standards every day for 30 years. Milena Galas, Commercial Director, and the managers of commercial and purchasing departments at Brand Distribution Group reveal the secrets of its success.

2 1

BRAND is All You Need

The Greatest Assets are People

The greatest success in business is achieved by companies that understand that people are the greatest asset. „Our goal is to support the ambitions and creativity of our employees, improve their competences and reward performance. We are not afraid of structural changes and we’re actively seeking new experts” explains Milena Galas, Commercial Director. Lots of employees have been with the company almost from the beginning, others started cooperation in 2022 and are creating a new chapter in the history of the Brand Distribution Group. “Last year’s biggest challenge was to put the commercial structures in order. We have created 3 operating regions responsible for different geographic areas. Thus, our teams can focus on specific markets and develop their competences and the knowledge about the particular countries’ needs”.

„To enter a market, you must understand the local culture and adapt your work style and the product offer” adds Laura Rizescu, Head of Export-South. „What matters in Asia is the speed of response – our Contractors work 24/7, they expect an instant response, attractive prices, and the fastest possible delivery. In Arab countries, merchants love long-lasting negotiations, Europe, on the other hand, demands a creative approach to orders – Contractors are looking not only for attractive prices but above all, for products that will make their offer stand out on the market. Therefore, our work requires not only commercial experience but also being curious about the world, and flexibility”.

The world abounds in companies specializing in FMCG distribution. How to ensure your company’s success? The secret is systematic review of the portfolio, careful monitoring of the markets and local trends. „Trading in recognizable brands is no longer a challenge. Consumers have diversified expectations and hunger for novelties. We regularly evaluate distribution brands – we verify the sales and market potential, price positioning and marketing strategy” – explains Milena Galas

“Last year showed that smaller manufacturers have become a serious competition for the renowned global brands. Due to the economic and political crisis in the east, the demand for cheaper products that still guarantee high quality is growing”, says Alena Cimoch, Head of Export-East. Asian and European markets differ in their specificities. „Asian markets are greatly attached to love brands – original, recognizable products. On the Iberian Peninsula and in French-speaking countries the importance of healthy foods, dietary supplements and products with organic certificates is growing”, lists Laura Rizescu

„There is a huge Muslim diaspora in France, Sweden and in the Balkans, which is why Halal certified products are in great demand. Meanwhile, in the Arab countries, there is a growing popularity of European ice cream, drinks and non-alcoholic beers. An interesting trend is also the growing popularity of the pet food category: premium foods and delicacies which can be used to spoil your pet” – explains Eliza Solecka-Boczkowska, Head of Export-West

The product portfolio is kept attractive for customers by purchasing department run by Urszula Susoł. „We are constantly looking for innovations around the world, we monitor prices of hundreds of suppliers and anticipate trends. Our regular offer includes only proven brands. We also create seasonal catalogs, develop the impulse and premium products offer and build individual offers based on our Contractors’ briefs”.

22

Milena Galas, Commercial Director, Brand Distribution Group

3

Get Ready for the Worst, Expect the Best

Over the past 30 years the markets have experienced many crises. Current crisis caused by the armed conflict in Ukraine is therefore not the first faced by Brand Distribution. „Immediate adaptation to the current situation is the trait our contractors value most. Already during the pandemic and the related challenges, such as broken supply chains, we supported our Clients in production, logistics and even marketing, delivering millions of necessary products from every part of the world” – says Milena Galas

Experience and flexibility of the experts from Brand Distribution have allowed to successfully rise up to all the challenges of the current situation in the East. „World economy is one integrated organism. You cannot eliminate one link without losses on the part of the others. Russia was the main source of supply for numerous eastern markets – our goal was to secure the needs of those countries”, explains Alena

Cimoch

Think Local, Act Global

Brand Distribution Group never forgets about its roots. „We are from Poland, and we proudly support Polish manufacturers in achieving global success”, declares Milena Galas.

Brand Distribution Group employees frequently repeat their favorite motto: „With us, anything is possible!” and there, probably, is the key to the company’s success. 4

Polish products are renowned for their excellent quality and attractive prices. „We don’t even need to advertise Polish sweets and household chemicals, their quality speaks for itself”, emphasizes Alena Cimoch. „Poland is a huge exporter of meat and agricultural products to Arab countries”, adds Eliza Solecka-Boczkowska. „There is a lot of interest in Polish vodka and beer - not only the leading brands but also craft products manufactured from the grain to the bottle”, says Maciej Małecki, Business Development Manager

The purchasing department forecast a further increase of the interest in Polish products around the world. „Last year was a breakthrough for us in terms of the sales of Polish products of smaller brands. Polish sweets, snacks and drinks have had excellent reviews abroad, which is why we are opening up to new categories: cosmetics, pet food, etc.”, says Urszula Susoł

„Can-do” attitude

Lack of readiness to make changes is one of the biggest problems faced by companies with many years of experience. Brand Distribution Group employees, though, are certainly in no risk of falling into a routine. „We are a team raising the bar higher every day. We improve processes, expand the portfolio and the range of the provided services. We open new branches, markets and channels, including e-commerce. 2023 is all about the quality – a trade marketing unit is being launched; product marketing has been transformed into trade marketing. We are also building a unit that will work directly with key account managers of retail chains at international level”, explains Milena Galas

Relations with customers and their satisfaction are of utmost importance for Brand Distribution Group. „Our goal is short lead time. We offer comprehensive services: work on a ready-made portfolio, search for special order products, customs clearance, logistics... Everything is on us!”, enumerates Eliza Solecka-Boczkowska. „Purchasing department effectuate custom orders, ones that even go beyond the FMCG products portfolio. We solve crises, organize complicated transports. We are open to any topic, even difficult categories such as frozen food or fresh products” says Urszula Susoł

In 2022, Brand Distribution Group has been licensed for spirits, which allowed for a new project managed by Maciej Małecki. „We are creating an autonomous business unit with our own marketing plan and commercial structures. We intend to build a strong portfolio of alcohols for large customers and the HoReCa sector. We carefully select products, partake in alcohol and bartending trade fairs, source interesting contacts with manufacturers of brands that are worth presenting to consumers”.

One of the services provided by the Brand Distribution Group is the consolidation of goods. „We build multi-category orders to relieve buyers and to reduce transport costs and the carbon footprint. Thus, we send a mixed container to the end of the world and secure the needs for all categories.” – explains Alena Cimoch

„We help organizations around the world to save time for things that matters. Our mission is pursued through comprehensive commercial, marketing and logistic solutions provided by a team of professionals. 2022 was a challenging year for the world, yet we closed it with a record-high financial result. This year, on the occasion of the company’s 30th anniversary, we are planning special campaigns and offers for current and new contractors. You will definitely hear about us in future!”, concludes Milena Galas.

5

Alena Cimoch, Head of Export-East

Eliza Solecka-Boczkowska, Head of Export-West

Laura Rizescu, Head of Export-South

Maciej Małecki, Business Development Manager Urszula Susoł, Purchasing Director

23 #foodsector

Logistic of the future in professional release

Logistic of the future – how has the logistics market changed over the recent years? What has become the priority in the services of this segment?

The logistics market is one of the most actively developing sectors of the economy. One can easily see new warehouses sprouting around the largest agglomerations. In view of opening up to new product searches, the demand for innovative logistics and transport solutions has increased. Currently, of great importance is flexibility in relation to customers – services provided on the highest level, as well as consulting in the area of proper storage, warehousing, and transportation. A major role is played here by partnership in relations between partners – highlighting potential problems which might be encountered, as well as presenting ways to solve them. Appropriate personnel, numerous training, experience amassed over the years, all become an invaluable source to overcome difficulties posed by the requirements of a market expecting professional and reliable service.

Innovativeness is a key area of operation on many markets, in logistics as well. What technologies and innovative solutions do you use?

We are able to find a solution for virtually every customer. It is not a problem for us to carry both frozen and fresh goods at the same time; whether it is 2 pallets of frozen fish or a whole truckload of fruit, we can deliver on time. Each time, we approach every order individually, adapting to the needs required by the contractor. An extensive fleet, storage facilities – it is mainly due to this that we can store,

repackage and reload goods as well, while preserving the cold chain all the time. Our employees take care to satisfy the customer to the full extent and also to make proper use of our fleet and capabilities, such as double-chamber refrigerators enabling simultaneous transportation of fresh and frozen goods, or double-floored refrigerators for transportation of increased batches of goods, e.g. 66 pallets. The only limit is our imagination.

What kind of services are your specialty? What makes your offer stand out?

The leitmotiv of our company is refrigerated transport – products that need to be carried under a controlled temperature; from foods to components to medical products. It is due to customers to whom we have been providing services for years that we are developing, expanding and improving our fleet every year. Currently, we own every semitrailer type available on the global market, as far as refrigerating equipment is concerned. Our fleet includes standard semitrailers, as well as double-floored ones, floral refrigerators, multi-chamber ones with partition walls to transport goods at different temperatures; some of them have lifts. Most of our units are semitrailers with room for 33/66 pallets, but we also have smaller ones, accommodating between 1 and 18 pallets, which allows us to distribute even to very hard-toreach places. Additionally, apart from our vehicle fleet, we have a cadre of perfectly trained personnel fully involved in customer assistance and consulting. They oversee the entire process of transportation from

24

Interview with Jakub Kępka – Key Account Manager at Transad.

point A to point B. This process is more than just pulling up to be loaded and reaching the unloading site; there is a whole range of relations to be fulfilled if the entire operation is to have a happy ending. Through commitment and passion, they prove their dedication to the company which is not just corporation but also the very friendly relations we have here. Everyone is involved in the works and development of the company, as evidenced by the expanding fleet and the new challenges posed by cooperating companies, which is proof of their confidence in us.

Is a logistics partner able to affect savings, or even increase profits, of manufacturers in the FMCG sector?

The term “logistics partner” may denote companies specializing in a given branch for many years – no company specializes in all branches of the sector of logistic services – which know all inner workings of the given area inside out. Learning, many times, from their own experiences and errors, they are able to nullify and prevent any future problems which might arise in cooperation with a new contractor and a long-time partner alike. Additionally, what matters is reliable and transparent cooperation, as well as explanation of cost-related details: what they result from and what consequences they entail.

Analysis of the given needs and expectations will minimize the risk of, first of all, failure, and secondly, potential losses due to inexperience and wrong decisions. There are tools allowing one to minimize the costs; it is a matter of finding them, implementing them and using them correctly, as well as conversations with experienced people willing to share their knowledge and expertise.

In view of the drastically growing prices or the unstable geopolitical situation, it is a challenge nowadays to maintain the continuity of business. How do you provide your contractors with a stable supply chain?

The lack of stability in the world, with regard to both prices and geopolitical problems, affects us all, and entrepreneurs indeed bear the brunt of it. However, this affects not just the logistics sector but all areas of the economy. First of all, the situation impacts the first link of the chain; an increase in transportation costs affects the increase of prices in the final effect. However, many conversations with our contractors allowed us to realize the problems we are all facing, hence full comprehension thereof and the will to cooperate further. Nowadays, as I have already mentioned, it is not only price that matters but flexibility, the will to cooperate, actions based on the “win to win” principle, consulting, availability, timeliness, as well as openness in solving problems and searching for solutions. Also with price increases, especially of fuel, our partners fully understand the lack of stability and our models of cooperation are elaborated in such a way as to avoid any disruptions to the supply chain at any moment.

How do you adapt your offer to the individual needs of contractors from different countries? Are you able to react to all variables? What stands out in your fleet ?

The answer is in the question – this is individual. It is the basis of action in the current times and situation, not just on the market of logistics services but mainly based on the best possible relations

with partners. We cooperate differently with each one of them, as each customer is different, with individual needs, requirements, standards, or norms. However, since we know our partners and constantly remain in touch with them, we can respond on an ongoing basis and monitor all variables appearing during the implementation of individual tasks, virtually in real time. As I have said before, we own every semitrailer type currently available on the market. We put much emphasis on proper servicing, appropriate equipment, regular maintenance, and systematic inspection of the correctness of operation of individual components. Of tremendous importance to us is the proper operation of our equipment, worth several hundred thousand euros and often used to transport goods exceeding its value; simultaneously, we are able to ensure the safety of the property entrusted to us and, above all, to the drivers. Additionally, our semitrailers are equipped with many more options of cargo securing than in other companies of a similar nature have. Our stock is no older than 3 years, we systematically replace it with newer equipment, allowing no shortcomings on our part. We use all innovative solutions available on the market, and we search for them ourselves, to strengthen our position even more, expand the offer, and increase our competitiveness.

How do the forwarding services you offer optimize the transport processes?

Above all, through using our own fleet, we know the real costs borne by transport companies, especially by forwarding ones. Based on our own example, we have experienced what most service-selling companies have only read about in industry magazines; we now have real costs we are able to document and present to our contractors. In addition to the numbers, immediately visible when the concept of optimization is concerned, one should not forget timeliness. Aware of the transported cargo, especially foods, we allow no delays. We adapt our cadre of drivers to perform the entire operation flawlessly. We know that the cargo loses quality with each delay, and thus the quality is reduced when it reaches the end recipient – and, in fact, we are such recipients too every day.

Our greatest benefit is customer satisfaction and orders for new transports, as well as new challenges being posed to us. This motivates us to act and develop even more dynamically.

What goals do you set for yourself for the years to come?

Development, development, development, and more development. Of course, as every entrepreneur, we have assumed a certain business plan we are implementing step by step. We are unable to foresee the geopolitical situation and the extent to which it would impact us, but we surely intend to significantly increase our vehicle fleet, to develop even more with regard to less-than-truckload transportation, as well as to expand the scope of storage services. We can see potential in each of these areas. Few companies are willing and able to develop in all of the mentioned areas, while we can see a future in them. We will surely be able to repeatedly prove our experience to the customers who work and will work with us.

Thank you for the interview.

25 #interview

Reliable partner in logistics

The TRANSAD company was established in 2006; ever since, we have met the requirements of our Customers to the greatest care and extent possible. With the experience we have gained over all those years in the TSL industry, we can say with full responsibility that we focus on quality and professionalism. For many years, we have worked for the effects that are now plain to see.

Currently, we are able to adapt to almost every Customer, offering top-quality services and an individual approach to needs and requirements.

We care for our fleet to be state-of-the-art all the time and to meet the highest standards. We complement and improve our team on an ongoing basis so they can always be fully flexible and self-contained in the fulfillment of the tasks they have been entrusted with. We can offer top-level cooling transport, adapting to individual requirements. Our offer includes specialist types of cooling semi-trailers, from standard ones to multi-temperature or double-floor semitrailers.

Since the inception of our operations, we have been setting new goals for ourselves, setting the bar higher and higher, to motivate ourselves for constant development and search

for new solutions. Closely watching the market and the realities set for us by our customers, we have started dynamic development of one of the transportation branches, namely, groupage transport. There are just a handful of companies which take on the challenge of organizing such special kinds of shipments, especially as far as part of the load at a controlled temperature are concerned.

Facing the prospects of a new challenge, we have decided to improve the tools we have been working with so far. At a very quick rate, we have adapted storage areas for handling and confectioning of products, with simultaneous continued preservation of the cold chain that will in no way affect the product quality. Watching the world, our competitors, and the experience of our employees, we have balanced the entire system to adapt and select the best

options to fully satisfy the expectations of our customers. A modern warehouse furnished with ramps, insulated sleeves, specialist loading equipment for all kinds of goods, as well as different forms of cargo protection – from standard locking rods to anti-slip mats to heatshrink films, edge protectors, protective liners. Each time when a new way to secure transported materials appears, we strive to test it with our own fleet in order to introduce it into a wider circulation and to propose additional solutions to our customers.

Although we set the bars high for ourselves with regard to development, our contractors motivate us additionally, by searching for solutions together and with their trust in a company providing the highest value available on the market. We never shy away from problems or challenges; quite the opposite, we always

26 #logistics

strive to seek solutions together. Conducting a “win-win” corporate policy from the very beginning, we have never been oriented exclusively to our own good or the satisfaction of our needs. It is worth bending your everyday principles in order to work for the sake of common satisfaction. With our search for solutions, we broaden our knowledge and experience, to share with our customers and to be even more competitive.

Today, it is not hard to buy a car, to hire a driver, to take up an order and to drive ahead; yet there are few “ambitious” companies, setting themselves new challenges and willing to continue their development. In our small employee team, there is surely no lack of commitment or desire for development, both personal and of the entire company. We are aware that we act for the sake of a common future. Both in contact with customers and between each other, we focus on friendly, almost family-like relations. Time spent together, not only within the limits of professional contact, helps us strengthen the ties, consolidate the attachment, stability and conviction, and boost the confidence that nothing is impossible and the sky is the limit.

We do not give in to principles prevailing at corporations where every person becomes a robot, ceasing to be a human being, empathic and helpful. With our openness, devotion and intentions, we largely focus on relations. The relations with our customers have been developed for years; at some point, the business vs. business limits blur and we transcend to the level of friends, which helps us deepen the mutual trust. When we are able to count

on each other in every situation, the customer is certain we will always provide advice and a common solution to a problem. We also often participate in problems as consultants, even if we have not been involved in any of the logistic components. Such joint action strengthens the ties even tighter and allows us to spread our wings.

We can boast a list of customers who have cooperated with us for many years, have never been disappointed with us and wish to continue the cooperation, involving us in new projects and recommending our services to their own contractors. We are surely open to new experiences and further development in the transport and logistic industry.

27 #logistics

Predictions for confectionery market

The economic situation on the international trade and the food sector.

So far, worldwide reports and predictions have presented the growth of the confectionery category in global terms. Today, we know this is probably a growth in terms of value. One should be prepared for a possibility of reduced consumption in the confectionery category, due to the limited consumer incomes in 2023.

Tetiana Gurnevych, International Sales Director

Tetiana Gurnevych, International Sales Director

Nowadays, making a choice from the rich assortment available on the shelves, a consumer will approach the purchase more consciously. The composition will be the key factor when comparing products on the shelf. For many years, Wawel elaborated the “Good Ingredients” strategy which allows for building of competitive advantage and responds to consumer expectations, all of this with a simple

and brief composition of the product. Wawel confectionery contains no artificial flavours, preservatives, or colourings. Our Cream Fudge may serve as an example, with only 6 months of shelf life and a composition made up by just 4 ingredients: butter, milk, sugar, and glucose syrup.

In 2023, brand recognizability as well as the composition and quality of the offered products will continue to have the greatest importance, among new products on the market as well.

Unfortunately, the rising costs of raw materials and energy, as well as the inflation on different levels in different countries, has turned

out to be significant to manufacturers, and thus to consumers. The costs of transport have grown as well, which, in the case of exports, is important for the development of the shelf price at the level of local competition.

This year will thus be a year of challenges for everyone: manufacturers as well as the traditional and modern channels. After all, it is the consumer who will decide which strategy or action is proper in view of the current situation. The success of 2023 will involve, in particular, close cooperation between manufacturers and distribution channels, as well as the ability to quickly respond to changes and adaptation to market expectations. This is par-

30 #trends

ticularly significant in the area of exports and imports, due to the disparate economic situation and the changes occurring in individual countries. This will also be a year of investment, both on the part of the manufacturer and of the sale channels, as well as of substantially lower margins on both sides.

Speaking of trends in the confectionery category, one should take account of the trends for confectionery with functional additives affecting the immune system, increased activity, etc. More and more vegetarian and vegan products are appearing on markets. In this regard, Wawel has created the Vege Friendly family, combining filled chocolates, candy bars and chocolate bars with peanut butter filling.

The category of sugar-free confectionery is developing dynamically as well. For instance, as much as 65% of British confectionery consumers pay attention to the sugar content (source: Mintel). In Hungary, new government regulations concerning the Public Health Product Tax (NETA) came into force in 2022, aimed at reduction of unhealthy products in favour of a healthy lifestyle (including a classification of confectionery by sugar and cocoa content). In the USA, sugar-free products are present in all categories of confectionery and snacks: gummies, jellies, chocolates, candy, chips, etc. This year, we have relaunched our

packages, in the sugar-free category as well, and improved our recipe of sugar-free milk chocolates, reducing the content of natural sugars. We hope the modernized Wawel No Added Sugar line will appeal to our consumers and will be noticed on shelves in many countries.

Consumption of dark chocolates, as well as dark chocolates with nuts, dried fruit, raisins, is growing. This is a golden time for the categories of nuts and healthy snacks. In the category of dark chocolates, we have introduced new products: Premium Dark 70% Sea Salt & Caramel as well as Premium Dark 70% Mint

On the global scale, ecological actions among manufacturers, both on the level of production and of product packaging, will be of key importance as well. Care for the environment is another conscious choice of a consumer. This could bring a return of weight sale of products. In leading countries, such as the UK, Germany, or France, sales by package are prevailing. In Eastern Europe, on the other hand, sale by weight is still practiced. In the former

case, a return to sale by weight may take place due to environmentally-friendly actions and to minimize the amount of packages; in the latter – due to more acutely perceived inflation and growth of prices. Wawel is a leader in the category of weight sale of confectionery on the Polish market. For many years, we have maintained the concept Pick&Mix: Choose Your Royal Quality which allows the consumers to choose their favourite flavours individually, giving them a possibility to mix products and weigh all indexes together. In this regard, a consumer makes a purchase in the form of a game, and a given store has a beautiful, highlighted display with different Wawel product categories, increasing the product rotation in a given space and complying with the FIFO principles. This is a modern way of sale by weight of products we know well. In the Middle East, purchase by weight is not common. A 1 kg package is a standard purchase unit due to the size of families and the customs in those countries. In this area, we may expect reduction of weights or less frequent shopping, yet we should keep in mind that confectionery is a category associated, above all, with pleasure all of us deserve in our everyday lives.

s ince 1898 31 #trends

More and more vegetarian and vegan products are appearing on markets. In this regard, Wawel has created the Vege Friendly family, combining filled chocolates, candy bars and chocolate bars with peanut butter filling.

Polish People Love Sweets

Sweets are not just a perfect idea for a gift, an expression of feelings, or to share with your loved ones, but also a way to get into a good mood and have a little selfish moment of pleasure – just for yourself. For an occasion and with no occasion – what do confectionery manufacturers propose?

category of chocolate confectionery – cocoa is under scrutiny.

Ethical Values

Monika Górka, Deputy Editor-in-Chief

Consumer behaviour in sweet categories is characterized by high dynamics. On the one hand, we bet on traditional delicacies, such as chocolates or cookies; on the other hand, we are willing to taste innovative products. Most respondents declaring consumption of confectionery usually choose such products as chocolates (91.3%), cookies (89.0%), candy bars (81.7%), chocolate sweets (79.7%), and wafers (78.1%)1. According to a survey conducted by SW Research, a high percentage of respondents eat confectionery at least from time to time (83.6%). Low-sugar confectionery, in turn, is consumed by almost a half of the survey (47.8%). Therefore, a significant difference between the percentage of people consuming “conventional” sweets and low-sugar ones can still be seen (at a level of 36 pp.).

Growing Requirements

Above all, confectionery means pleasure in consumption. However, in view of the growing awareness of Polish consumers, increasing attention is paid to simple product composition. The so-called clean label is becoming a reality and “unnecessary” additives are less and less often encountered on confectionery packages.

The origin and manner of acquisition of the ingredients are also becoming important to the consumer, especially in the

In spite of the obvious reason we buy sweets, more and more consumers still look for healthier variants: with a simple composition, no sugar additives or preservatives. The confectionery categories are also affected by vegan and vegetarian trends. Consumers are interested in such products as vegan milk chocolate, there are also more and more soft sweets based on gelatin made from ingredients of plant origin.

The category of chocolate confectionery is constantly undergoing transformation in response to consumer needs and expectations. The analysis of data from the Global New Products Database (GNPD) kept by Mintel shows that over the last three years until October 2022, the leading statements among global new products were those from the group of ethical and environmental ones, with emphasis on sustainable resources/living environment (33%) and wellbeing of the human factor (33% as well). The next place was held by environmentally friendly products (30%). Honorata Jarocka, Senior Food and Drink Analyst at Mintel, stresses that this kind of positioning is consistent with the trends perceivable comprehensively in the category of food and beverages, and also responds to the growing consumer awareness in business ethics and environmental responsibility.

Consumer data for the Polish market show that the ethical dimension has become an important topic for the category of chocolate confectionery. In spite of high confidence in leading producers, many consumers are inclined to change their shopping preferences in view of unethical actions by their favourite brands.

Another trend observed on the confectionery market is interesting taste combinations, especially sweet with salty. A trend already noticed some time ago is the so-called multi-sensory sensations during consumption, which means a product should include several different consistencies.

“Packaging remains a noteworthy issue in terms of environmental responsibility. The Mintel data show that 53% respondents in Poland demonstrate readiness to pay more for chocolate in environmentally friendly packaging. Thus, both ethical and pro-environmental actions are an important direction in building the added value which, apart from the price advantage itself – extremely

A trend already noticed some time ago is the so-called multi-sensory sensations during consumption.

32 #foodsector

important in the context of the growing costs of living – also applies to non-price advantages fitting in with the code of the consumers’ personal convictions. This also means a significant possibility of growth for private labels which, as a rule, offer greater affordability and, as a part of competitive advantage, may engage with increasing intensity in campaigns regarding ethics and sustainable development. Importantly, more than one third (34%) of Polish consumers reveal they will buy more private-label products in view of the growing prices,” – summarizes Honorata Jarocka, Mintel.

A Time Full of Challenges

The times of the pandemic are certainly what everyone would rather like to forget, especially that there are new considerable

challenges ahead; yet, summing up the confectionery market in 2022, the pandemic cannot be omitted, as it has also significantly affected the last twelve months. In the pandemic periods, consumers tended to choose well-known products under proven brands, limiting their openness to experimenting and purchasing of new goods. Under the new shopping model, customers would do bigger shopping, for the future, buying confectionery in larger, family and economic packages, whereas impulse confectionery slightly declined in importance. But as soon as we observed no significant pandemic restrictions, in 2022, consumers returned to the impulse offer, and their interest in new products and single formats increased as well.

After the pandemic-related difficulties on the market, the industry had to face new

challenges. Positive market predictions currently clash with a range of economic difficulties both local and global in nature. Only over the last year, dairy products have gone up by almost 80%, and sugar today is twice as expensive as the year before.

A Sweet Future

The difficulties connected with the current economic situation omit no branch of business – according to analysts’ predictions, the global chocolate confectionery market will continue its stable development, growing by several percent annually. In Poland, it is predicted that chocolate confectionery consumption will increase by 0.5 kg per capita over the next 5 years. Domestic producers are still appreciated abroad – this year, Poland has maintained the 4th position worldwide among the greatest chocolate exporters – as we can read in this year’s “Global and Polish Chocolate Market” report published by Wedel.

What is the future of the chocolate industry? Do Polish sweets have their enthusiasts in the farthest corners of the world as well? As shown by the “Global and Polish Chocolate Market” report, Euromonitor predicts a stable growth

Consumer data for the Polish market show that the ethical dimension has become an important topic for the category of chocolate confectionery.

33

in the value of the global chocolate confectionery market by approx. 5-6% annually during 2023-20272. Apart from the obvious effect of the inflation, a major driving force behind this category will be, among other things, new goods introduced by producers, as well as the forecasted increase (year-on-year) in consumption of chocolate confectionery. Euromonitor estimates that Polish people currently consume an average of 5.7 kg of chocolate confectionery per capita, yet this value is supposed to rise to 6.2 kg by 20273. The ceiling of 6 kilograms per capita will be exceeded in 2025. Despite the decrease in the purchasing power of Poles and the lesser inclination for purchases, confectionery still remains an important part of the shopping basket. Simultaneously, it is worth stressing that the Polish chocolate market is mature and saturated – in this context, export provide an opportunity for development of the market players. The more pleasing is the fact that Poland has maintained its previous year’s high 4th position in the ranking of the world’s greatest chocolate exporters. This evidence of the perfect quality of Polish chocolate products and the producers’ accurate response to diverse consumer needs and preferences in the farthest corners of the world.

Holiday Choices

The best occasion to give presents to your loved ones is, of course, holidays. They begin with the search for gifts. Among them, miscellaneous sweets can surely be a perfect present, capable of giving the recipient a moment of pleasure and joy.

The category of packaged confectionery includes, among other things, chocolate bars, pralines, cookies, candy and cooled bars, croissants, muffins and cakes, as well as candy, chewing gums, gummies and foams, or all kinds of confectionery with toys. “We can find them in smaller and larger stores alike, but of most importance here is the channel of discount stores, accounting for more than half of purchased packages in the category. Almost every third package is bought at small-format stores with an area up to 300 m2 (approx. 13%), whereas the least packages are purchased in supermarkets of 301-2500 m2 or hypermarkets (approx. 6%).

In small-format stores, the category of packaged confectionery has recorded a 16% growth

in the value of sales over the last 12 months (MAT 09/2022) in comparison with the previous period. Apart from the increase of the value of sales, an increase in the number of sold packages by approx. 9% can be noticed as well,” says Ilona Mazurek, Data Analyst at CMR.

In the Christmas period, products particularly gaining on the value of sales include pralines, chocolates, gingerbread, and chocolate figurines. A consumer reaching for chocolate in December can choose from an average of 30 variants at a price of approx. PLN 4.8 per packaging. “The most frequently chosen chocolates are those under the Milka brand manufactured by Mondelez, as well as Wedel. Chocolate in bars prove to be not just a perfect gift to loved ones but also an excellent ingredient of holiday baking. The most popular options with a weight of up to 100 g include the Kinder Chocolate Milk variant in 50 g and 100 g cardboard packages, as well as 100 g Milka Alpine Milk, whereas the larger version, above 100 g, is represented by Milka Oreo at 300 g, Alpen Gold Nussbeisser in a 220 g package, or Milka Toffe Wholenut at 300 g,” Ilona Mazurek stresses.

Particularly noteworthy in this period is gingerbread: the number of packages sold can be more than 2.5 times higher than in the spring and summer season. However, this category is not available in all small-format stores up to 300 m2, only in 3/4 of them. In December, such stores offered approx. 5 variants to choose from, at an average price of PLN 4.1 per package.

34

Poland has maintained 4th position in the ranking of the world’s greatest chocolate exporters.

Some of the confectionery types mentioned above are particularly prevalent in the gift categories. Pralines record peak sales by packaging in December, surpassing the level achieved in the months of St. Valentine’s Day or Mother’s Day. As CMR states, the offer of pralines is definitely richer in comparison with gingerbread; in December, we will find an average of 18 different variants in small-format stores, of which 7 belong to the chocolate box subcategory. “Deciding to buy pralines, a consumer incurs an average cost of PLN 13.1 per packaging, and the most frequent choices include the brands: E.Wedel Ptasie Mleczko, Ferrero Raffaello, and Toffifee (Storck),” the Data Analyst adds.

In the holiday context, it is also worth mentioning chocolate figurines, particularly enjoyed by the youngest consumers. They gain on popularity twice a year; in the form of Santa Claus, a snowman, or a bear in the Christmas period, and shaped like bunnies, lambs, chicks or eggs around Easter. As in the case of gingerbread, we can encounter the category of chocolate figurines in December in 3/4 of small-format stores up to 300 m2, and we can choose from an average of 5 different available products. The average price of

a figurine is PLN 2.2 per package and usually applies to the lower weight of 30-60 g.

“The last 12 months have served us a lot of interesting new products. On store shelves, we find such things as new chocolate bar variants of standard weight: Milka Oreo Strawberry 92 g, but also higher-weight versions: Milka Mmmax Nutty Choco Wafer 270 g and E.Wedel – strawberry-filled milk chocolate at 290 g. The offer of pralines has expanded as well to include a new variant of Toffifee; White Chocolate 125 g,” sums up Ilona Mazurek from CMR.

An important occasion

Although we need not look at the calendar to find reasons to please ourselves with a sweet delicacy, the calendar often defines dates special to the Polish people. The most important occasions, following the holidays, are Grandmother’s and Grandfather’s Day, St. Valentine’s Day, International Women’s Day, Men’s Day, and many others, only available in Polish calendars. There are also occasions that cannot be planned: a first date, an apology, a visit to friends – each of these moments are a perfect pretext to present some sweets that will improve special moments.

An important category in stores

Confectionery is a large category in small-format stores up to 300 m2. In terms of sales value, it occupies the fourth position after alcohol, tobacco products, and beverages.

Such a considerable number of products are due to the fact that confectionery is a large and extensive category. It includes products for children, for special occasions, for holidays, or for presents. There are chocolate and grain products, those which can be eaten right after exiting the store, and those better suited for a meeting with friends. A consumer will encounter the largest selection among cookies: about 50 types. More than 20 types will be found among chocolates and candy bars, and more than 10 may be chosen among impulse wafers, chewing gums, jellies and foams, as well as pralines. At the other extreme, there are such categories as fudge, flavoured jellies, or sesame seed bars. Here, on average, a consumer will find less than 2 variants.

The categories with the highest number of available variants coincide with those with the highest sales value. In this regard, the top 3 confectionery types are cookies, candy bars, and chocolates, with share values amounting to 18%, 13%, and 12%, respectively (in the first half of 2022). Regarding the number of packages sold, the ranking of the largest categories will change. The highest number of packages sold is accounted for by chocolate candy bars (17%), cookies dropped to the second position (15%), third is occupied by impulse wafers (15%). The following places are held by chocolates (8%) and chewing gums (7%).

As important occasions approach, shop shelves definitely have a wider offer of confectionery in occasional packages. The nearest occasions determine the selection of the appropriate assortment, with a view to general preferences of a wide range of consumers, but also taking into account the preferences of regular customers of a given trade establishment. A necessary element affecting the product rotation is proper exposure related to the approaching holidays, be it Christmas or other dates important to the Polish people. It is also worth paying attention to the impulse zone and to single-type packages which have made a comeback after the times of the pandemic.

35 #foodsector

The highest number of packages sold is accounted for by chocolate candy bars (17%), cookies dropped to the second position (15%), third is occupied by impulse wafers (15%).

GRUPA MOKATE STRATEGIA NA PRZYSZŁOŚĆ

Mokate Group A Strategy for the Future

Rozmowa

Jak w zmieniających się realiach rynkowych odnajduje się firma Mokate? Jaką strategię dalszego rozwoju biznesu przyjęliście na najbliższe miesiące, może lata?

How does Mokate fare in the changing realities of the market? What strategy of further business development have you assumed for the months or maybe years to come?

Adam Mokrysz: We like challenges that require bold and visionary action. With our experience and persistence, we are able to meet such challenges and expand successfully on international markets. Our exports comprise more than 70% of the Group’s revenues. Its further development is possible because we have focused on the innovativeness and quality of our offer, as well as on consistent building of durable business relations.

Adam Mokrysz: Lubimy wyzwania, które wymagają odważnych i wizjonerskich działań. Dzięki naszemu doświadczeniu i wytrwałości udaje się im sprostać i z powodzeniem prowadzić ekspansję na międzynarodowych rynkach. Nasza działalność eksportowa stanowi ponad 70 procent przychodów Grupy. Dalszy jej rozwój jest możliwy dzięki temu, że postawiliśmy na innowacyjność i jakość naszej oferty oraz konsekwentne budowanie trwałych relacji biznesowych.

Being true to tradition and to family values has been the basis for the hitherto development of the Mokate business. Can the family character of the company help in the management and further development of such an immense enterprise as the Mokate Group?

Wierność tradycji i rodzinnym wartościom to podstawa dotychczasowego rozwoju biznesu Mokate. Czy rodzinny charakter firmy pomaga w prowadzeniu i dalszym rozwoju tak potężnego obecnie biznesu, jakim jest Grupa Mokate?

Katarzyna Mokrysz: We have already operated under the Mokate brand for 32 years. Currently, we are an international enterprise, with a turnover exceeding one billion zlotys, and yet we have managed to remain a family company. For many years, we have been building a corporate culture based on respect for family values and traditions, as well as on the work ethos. At the Mokate factories in Poland and the Czech Republic, we employ more than 1,500 people, including entire families.