SAFETY IS

ACCIDENT A look at the top fi ve severity exposures in the corrugated industry March/April 2023 Volume 27, No. 2 ALSO INSIDE Taking Responsibility: A Look at EPR Policy Boxmakers Beware: Cybersecurity Considerations Member Profile: Southern Carton Co. A PUBLICATION OF AICC, THE INDEPENDENT PACKAGING ASSOCIATION

NO

BOXSCORE www.AICCbox.org 1 TABLE OF CONTENTS March/April 2023 • Volume 27, No. 2 Visit www.AICCboxscore.org for Member News and even more great columns. Scan the QR code to check them out! COLUMNS 3 CHAIRWOMAN’S MESSAGE 4 SCORING BOXES 10 LEGISLATIVE REPORT 12 MEMBERS MEETING 16 ASK RALPH 18 ASK TOM 20 SELLING TODAY 24 LEADERSHIP 30 MEMBER PROFILE 56 THE ASSOCIATE ADVANTAGE 58 WHAT THE TECH? 60 STRENGTH IN NUMBERS 68 THE FINAL SCORE DEPARTMENTS 8 WELCOME, NEW & RETURNING MEMBERS 29 AICC INNOVATION 64 FOUNDATION FOR PACKAGING EDUCATION 66 INTERNATIONAL CORRUGATED PACKAGING FOUNDATION 36 44 48 BoxScore is published bimonthly by AICC, e Independent Packaging Association, PO Box 25708, Alexandria, VA 22313, USA. Rates for reprints and permissions of articles printed are available upon request. e statements and opinions expressed herein are those of the individual authors and do not necessarily represent the views of AICC. e publisher reserves the right to accept or reject any editorial or advertising matter at its discretion. e publisher is not responsible for claims made by advertisers. POSTMASTER: Send change of address to BoxScore, AICC, PO Box 25708, Alexandria, VA 22313, USA. ©2023 AICC. All rights reserved. FEATURES 36 SAFETY IS NO ACCIDENT A look at the top five severity exposures in the corrugated industry 44 TAKING RESPONSIBILITY New recycling laws for packagers are gaining acceptance across the U.S., but are they overreaching when it comes to boxmaking? 48 BOXMAKERS BEWARE Protecting your systems is more than smart security—nowadays, it’s essential to your business

OFFICERS

Chairwoman: Jana Harris, Harris Packaging/American Carton, Haltom City, Texas

First Vice Chairman: Matt Davis, Packaging Express, Colorado Springs, Colorado

Vice Chairs: Gary Brewer, Package Crafters, High Point, North Carolina Finn MacDonald, Independent II, Louisville, Kentucky

Terri-Lynn Levesque, Royal Containers Ltd., Brampton, Ontario, Canada

Immediate Past Chairman: Gene Marino, Akers Packaging Service Group, Chicago, Illinois

Chairman, Past Chairmen’s Council: Jay Carman, StandFast Packaging Group, Carol Stream, Illinois

President: Michael D’Angelo, AICC Headquarters, Alexandria, Virginia

Secretary/General Counsel: David Goch, Webster, Chamberlain & Bean, Washington, D.C.

AICC Canada: Lee Gould

DIRECTORS

West: Sahar Mehrabzadeh-Garcia, Bay Cities, Pico Rivera, Califormia

Southwest: Jenise Cox, Harris Packaging/American Carton, Haltom City, Texas

Southeast: Michael Drummond, Packrite, High Point, North Carolina

Midwest: Casey Shaw, Batavia Container Inc., Batavia, Illinois

Great Lakes: Josh Sobel, Jamestown Container Cos.

Macedonia, Ohio

Northeast: Stuart Fenkel, McLean Packaging Pennsauken, New Jersey

AICC Canada: Terri-Lynn Levesque, Royal Containers Ltd., Brampton, Ontario, Canada

AICC México: Sergio Menchaca, EKO Empaques de Cartón S.A. de C.V., Cortazar, Mexico

OVERSEAS DIRECTOR

Kim Nelson, Royal Containers Ltd., Brampton, Ontario, Canada

DIRECTORS AT LARGE

Kevin Ausburn, SMC Packaging Group, Springfield, Missouri

Eric Elgin, Oklahoma Interpack, Muscogee, Oklahoma

Guy Ockerlund, OxBox, Addison, Illinois

Mike Schaefer, Tavens Packaging & Display, Bedford Heights, Ohio

Ben DeSollar, Sumter Packaging, Sumter, South Carolina

Jack Fiterman, Liberty Diversifies, Minneapolis, Minnesota

EMERGING LEADER DELEGATES

Lauren Frisch, Wasatch Container, North Salt Lake, Utah

John McQueary, CST Systems, Atlanta, Georgia

Jordan Dawson, Harris Packaging, Haltom City, Texas

ASSOCIATE MEMBER DIRECTORS

Chairman: Greg Jones, SUN Automation Group

Glen Arm, Maryland

Vice Chairman: Tim Connell, A.G. Stacker Inc Weyers Cave, Virginia

Secretary: John Burgess, Pamarco/Absolute, Roselle Park, New Jersey

Director: Jeff Dietz, Kolbus America Inc., Cleveland, Ohio

Immediate Past Chairman, Associate Members: Joseph Morelli, Huston Patterson Printers/Lewisburg

Printing Co., Decatur, Illinois

ADVISORS TO THE CHAIRMAN

Al Hoodwin, Michigan City Paper Box, Michigan City, Indiana

Gene Marino, Akers Packaging Service Group

Chicago, Illinois

Greg Jones, SUN Automation, Glen Arm, Maryland

PUBLICATION STAFF

Publisher: Michael D’Angelo, mdangelo@AICCbox.org

Editor: Virginia Humphrey, vhumphrey@AICCbox.org

ABOUT AICC

EDITORIAL/DESIGN SERVICES

The YGS Group • www.theYGSgroup.com

Vice President: Serena L. Spiezio

Content & Copy Director: Craig Lauer

Managing Editor: Therese Umerlik

Senior Editor: Sam Hoffmeister

Copy Editor: Steve Kennedy

Art Director: Alex Straughan

Account Manager: Frankie Singleton

SUBMIT EDITORIAL IDEAS, NEWS, & LETTERS TO: BoxScore@theYGSgroup.com

CONTRIBUTORS

Maria Frustaci, Director of Administration and Director of Latin America

Cindy Huber, Director of Conventions & Meetings

Chelsea May, Education and Training Manager

Laura Mihalick, Senior Meeting Manager

Patrick Moore, Membership Services Manager

Taryn Pyle, Director of Training, Education & Professional Development

Alyce Ryan, Marketing Manager

Steve Young, Ambassador-at-Large

ADVERTISING

Taryn Pyle 703-535-1391 • tpyle@AICCbox.org

Patrick Moore 703-535-1394 • pmoore@AICCbox.org

AICC

PO Box 25708

Alexandria, VA 22313

Phone 703-836-2422

Toll-free 877-836-2422

Fax 703-836-2795 www.AICCbox.org

PROVIDING BOXMAKERS WITH THE KNOWLEDGE NEEDED TO THRIVE IN THE PAPER-BASED PACKAGING INDUSTRY SINCE 1974

We are a growing membership association that serves independent corrugated, folding carton, and rigid box manufacturers and suppliers with education and information in print, in person, and online. AICC membership is for the full company, and employees at all locations have access to member benefits. AICC o ers free online education to all members to help the individual maximize their potential and the member company maximize its profit.

WHEN YOU INVEST AND ENGAGE, AICC DELIVERS SUCCESS.

Education for Your People

Ahot topic of 2023, thus far, has been what our industry will look like after experiencing the past two unprecedented years of growth and chaos during the COVID-19 pandemic. Board Converting News covered this topic in Len Prazych’s article, “Converter Outlook, 2023, Part 1: Shrinking Demand Is Concerning,” showcased in January. I had the privilege of being one of the contributors, along with a handful of other independent converters. The consistent theme was that we as independents in our industry not only survived but thrived, despite one challenge and obstacle after another.

The consensus regarding 2023 was it should be a good year. However, we all are feeling softening in the market and expect that to remain the trend throughout 2023. This is the same concern that AICC’s Membership and Marketing Committee recently expressed at its past meeting. AICC President Mike D’Angelo reached out to me after this meeting and shared their sentiments. He said, “There was discussion that the softening in the market that converters are feeling at this time is a great time to double down on your commitment to your most important resource—your people. You do that by getting more education in front of them.”

This was music to my ears. What a great time for us as owners and managers of our independent box companies, as well as our incredible vendors, to utilize all that AICC has to offer in education. Below are some of the resources AICC has for its members:

• Free online education: More than 100 courses are offered online for all of our employees. There is training that supports all aspects of your business—production, sales, service, design, finance departments, human resources, and leadership training, to name a few. Currently, 18 online courses are offered in Spanish, with the commitment from AICC to continue translating more courses on a consistent basis.

• All Access Pass: More than 150 industry-specific live and prerecorded webinars and One Point Lessons allow employees to get quick tips and tools to enhance their skills. The one-time fee is minimal compared with the value your company will receive.

• AICC NOW (AICC’s new streaming website): AICC NOW brings all of AICC’s videos and online content to one easyto-navigate location. You can now access AICC’s vast media offerings, which include the Packaging University, webinars, podcasts, Ask the Experts, white papers, and more. Visit NOW.AICCbox.org for more information.

• Breaking Down Boxes podcast: Listen to Gene Marino and Joe Morelli converse with entrepreneurs in the independent packaging space. AICC members tell their compelling stories and the lessons they have learned along the way. Listen to past episodes anytime; new episodes are released the first Monday of every month. Tune in to hear what takeaways and valuable insights the podcast and our fellow AICC members have to offer.

So, as we slow down a bit, take advantage of this time and share this knowledge with your employees. As I like to say, “Better Minds, Better Boxes.” Invest in your company’s future through education.

Cheers to a happy, healthy, and prosperous 2023!

Jana Harris CEO and Co-owner, Harris Packaging and American Carton Co. AICC Chairwoman

BOXSCORE www.AICCbox.org 3 Chairwoman’s Message

Manufacturing Slides Into Recession

BY DICK STORAT

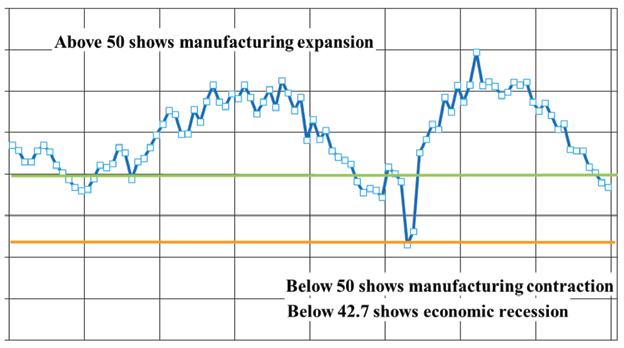

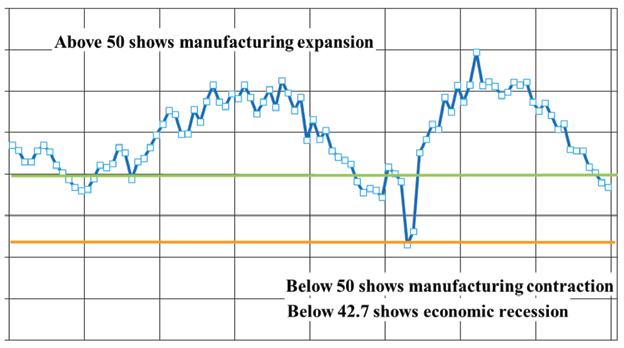

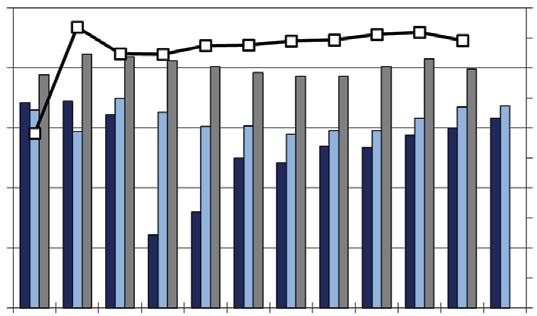

The Institute for Supply Management publishes a monthly report on economic activity in the manufacturing sector based on survey responses from several hundred supply chain managers across the full spectrum of manufacturing in the U.S. Recent reports show a faltering expansion in factory output, and many forecasters expect the slowdown to continue this year.

According to that survey, the manufacturing sector contracted for the second consecutive month in December, following 29 months of expansion. As shown in the top chart to the right, the overall index clocked in at 48.6% in December when only two of 18 industry sectors reported growth: petroleum and coal products, and primary metals. Thirteen sectors, including paper products, contracted in December, according to survey respondents.

Labor management sentiment continued to shift, with several panelists’ companies reducing employment levels through hiring freezes or attrition.

Demand, which had been bolstered by resilient consumer spending during the year, weakened in December. The New Orders Index fell to 45.2%, marking the third consecutive month of shrinking sales. Export orders also contracted markedly, reported at 46.2%, while backlogs were at historically low levels.

As the overall economy seems to be heading toward slower growth or perhaps a contraction later this year, demand for manufactured goods is not likely to grow at the pace experienced during the past two years.

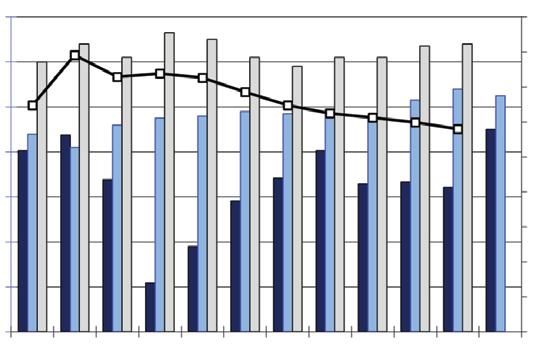

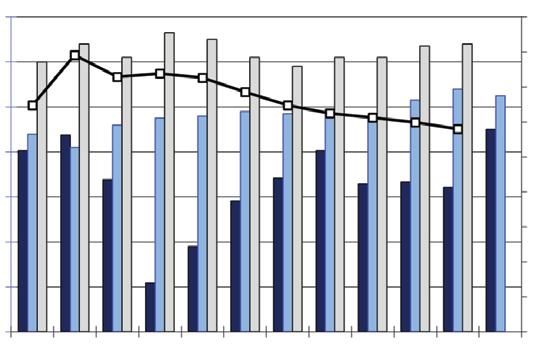

While overall manufacturing activity faltered, production of nondurable consumer goods, the largest consumer of boxes and related packaging, continued to

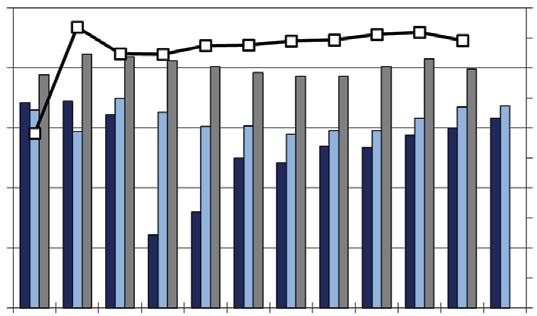

show monthly gains as the year came to a close. Th rough November, production of these fast-moving goods had risen by 2.9%. The details of 2022 food production statistics are summarized in the bottom chart on this page.

Food makes up one of the largest components of nondurable goods, and most food

products are intense consumers of paper packaging. Food production remained elevated throughout the past year and had grown by 4.5% during the year through November, as shown in the top chart on page 5. Total food production consistently outpaced its prior-year output for a total of 21 consecutive months ending in November.

Purchasing Managers’ Index

BOXSCORE March/April 2023 4 Scoring Boxes

Source: U.S. Census Source: Institute for Supply Management Industrial Production Nondurable Consumer Goods

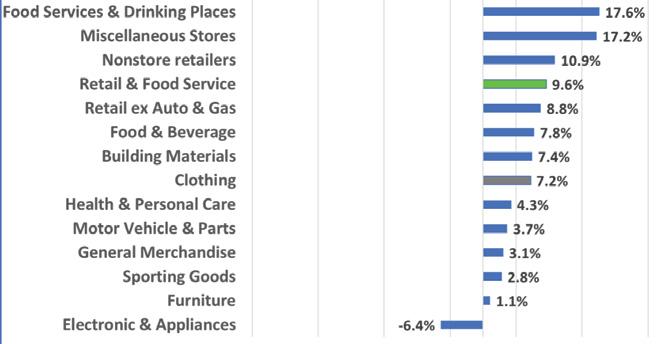

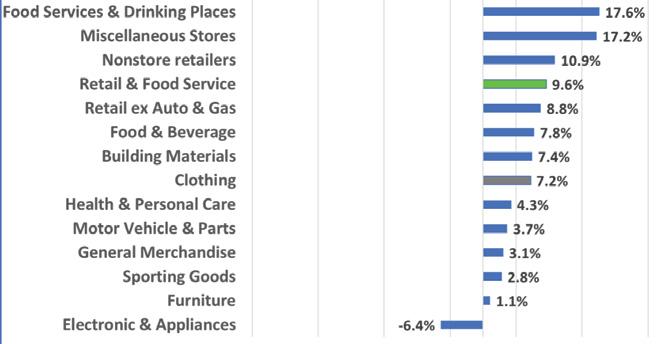

Sales by Business (2022 YTD Percent Change Through November)

Retail

U.S. Food Production Industrial Production Nondurable Consumer Goods Retail Sales by Business (2022 YTD Percent Change Through November)

Index U.S. Food Production 15 16 17 18 19 20 21 22 30 35 40 45 50 55 60 65 70 2021 2022 Percent C hange Year-to-Dat e 2020 J AN FEB MAR AP R MAY J UN J UL AUG S EP OC T NO V DEC Index (2017 = 100) 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 90 92 94 96 98 100 102 104

Purchasing Managers’

Truck. Loads . More.

Corrugated printing has gone from basic to beautiful in 10 year s. With the explosion of packaging demands and shor ter print runs, speed has become the #1 capacit y driver. One of our customers tells us automated complete plate cleaning in < 4 minutes adds 25% capacit y in a working week with FlexoCleanerBrush™

He calls it ‘Truckloads More Capacit y’. You can do your own math.

Scoring Boxes

Purchasing Managers’ Index

Even though total food production rose by 4.5% through November, individual food product categories showed a range of change. The table below shows the year-to-date

percentage production growth for a range of foods.

For those interested in exploring the range of products for which monthly growth indexes are published

Retail Sales by Business

by the Federal Reserve Board, visit www.federalreserve.gov and select Industrial Production and Capacity Utilization.

Inflation became a major economic factor during 2022. Between November 2021 and November 2022, the consumer price index rose by 7.1%. The bottom chart at left shows the breakdown of retail sales by business for the past year through November. However, those data are not adjusted for inflation, so they need to be discounted for inflation. The year-to-date growth rate of all retail and food service sales was 9.6% as initially reported, but after considering the impact of inflation, growth was more in the range of 2%–3%.

Managers’ Index

Food service accounts for some 13% of retail and food service sales and was hardest hit for the longest time during the COVID19 pandemic. Its recovery rate of 17.6% this past year just barely brings them out of the depression the pandemic placed them in.

The largest single channel of retail sales has become sales made by nonstore retailers—mostly e-commerce sales. These sales accounted for 15.8% of retail sales this past November, having unseated general merchandise and department stores as the largest retail sales channel. Growth of online sales remained in double digits this past year, measuring 10.2% through November.

Retail Sales by Business

Food and beverages sold for offpremises consumption at food and grocery stores accounted for 11.8% of sales during the same period and grew at 7.8% through November—relatively flat considering the impact of inflation.

Sales of building materials grew around the same rate as food and beverages this past year, and elevated growth will likely continue in the aftermath of destructive weather.

Dick Storat is president of Richard Storat & Associates. He can be reached at 610-282-6033 or storatre@aol.com

BOXSCORE March/April 2023 6

Sources: U.S. Census, RSA Inc.

Federal Reserve FOOD CATEGORY % CHANGE YTD, NOVEMBER 2022 Animal Foods 0.0% Sugary Products 4.5% Preserved Fruits & Vegetables 3.8% Dairy Products -1.4% Meat Processing 1.7% Poultry Processing 6.7% Beverages 4.0% Bakeries -0.4% Industrial Production Nondurable Consumer Goods

Source:

(2022 YTD Percent Change

Through November)

Food Production Industrial Production Nondurable Consumer Goods

U.S.

(2022 YTD Percent

U.S. Food Production -35.0% -25.0% -15.0% -5.0% 5.0% 15.0% 25.0% 2021 2022 Percent C hange Year-to-Dat e 2020 J AN FEB MAR AP R MAY J UN J UL AUG S EP OC T NO V DEC Index (2017 = 100) 0.0% 0.5% 1.0% 1.5% 2.5% 2.0% 3.0% 3.5% 4.0% 4.5% 5.0% 85 90 95 100 105 110

Change Through November) Purchasing

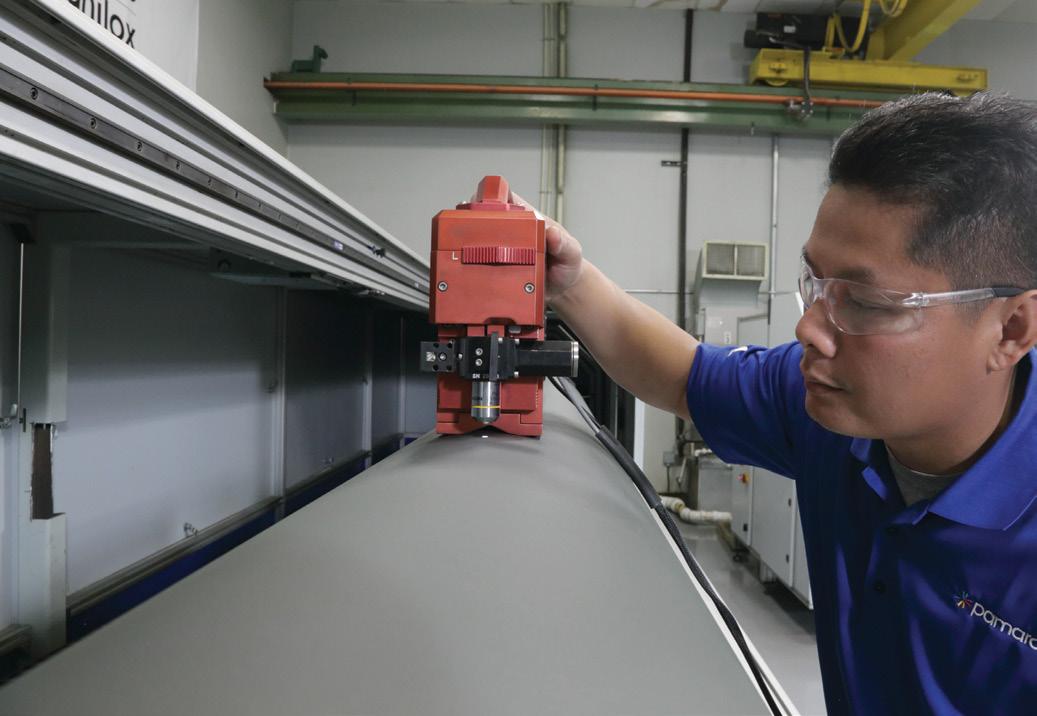

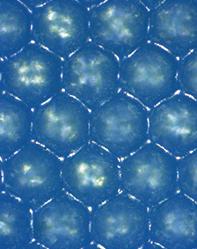

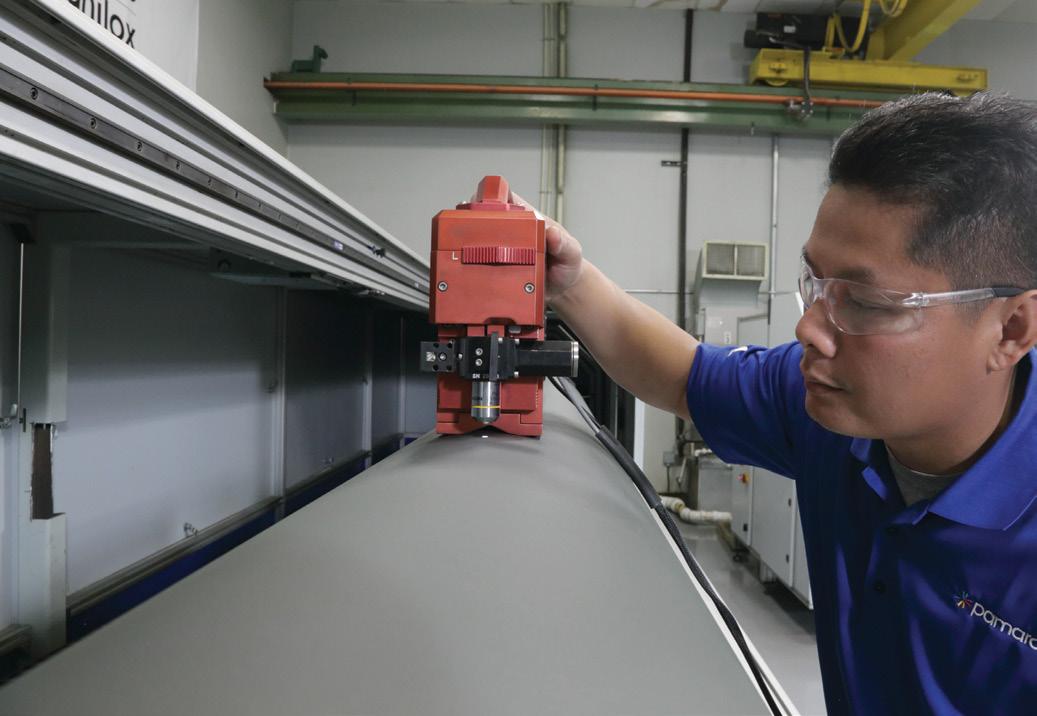

Quality & Consistency

Produce Better Quality Graphics

ThermaFlo™ Brings HD Graphics To Corrugated Printing

With a consistent cell geometry that promotes ef cient ink-release, atter cell walls for better ink metering and due to our multi-hit technology - you can get extended volume ranges.

Welcome, New & Returning Members

Welcome, AICC’s New Members!

WORKSTREAM CADE TWITTY

Demand Generation Senior Associate

2600 W. Executive Pkwy. Suite 200 Lehi, UT 84043

801-376-7620

www.workstream.us

PRAGATI PACK INDIA PVT., LTD.

ANANTH KUMAR G.

Chief Operating Officer

Plot No. B5 & 6, IDA Gandhinagar, Kukatpally, Hyderabad, Andhra Pradesh 500037

India

www.pragati.com

STAMBAUGH NESS

LEIGH ANN WILSON

Director of Manufacturing Strategy

220 St. Charles Way, Suite 150 York, PA 17402 717-757-6999

www.stambaughness.com

ePRODUCTIVITY SOFTWARE

ALEKS ZLATIC General Manager

11545 W. Bernardo Court, Suite 305 San Diego, CA 92127 412-456-1141

www.eproductivitysoftware.com

VEGA SRL

ROBERTA MASTRANGELO

Digital Media Manager

Viale Dell’Industria 6 20037 Paderno Dugnano, MI

Italy

+39 02 99046212

www.vegagroup.it/en

PROCURE ANALYTICS

MATT REDDINGTON

Vice President of Operations

3101 Towercreek Pkwy., Suite 500 Atlanta, GA 30339 404-723-0501

www.procureanalytics.com

BOXSCORE March/April 2023 8

What’s Ahead?

BY ERIC ELGIN

I’m writing this article in early 2023 just as Congress reconvened. Consequently, there’s a lot of speculation about what’s ahead for business-related legislation with a Republican-led House of Representatives.

AICC is a longtime member of the Small Business Legislative Council (SBLC), and AICC President Mike D’Angelo is a member of its board of directors. SBLC, in our view, has the best track record in keeping us apprised of issues and how they are likely to affect AICC members in their day-to-day business. So, with that in mind, let’s look at a few issues SBLC has brought to our attention for the fi rst session of this 118th Congress.

Taxes

For those of you who may have regularly attended our annual Washington Fly-Ins 10–12 years ago, you may recall our continual drumming for making the R&D tax credit permanent. It was typically renewed on a one- or two-year basis through various tax bills, but the business community wanted a permanent fi x. The Tax Cuts and Jobs Act of 2017 included a longer-range “fi x” to the question of the R&D tax credit, but it, too, set an expiration date of December 31, 2021. We see the restoration of this tax credit as an important priority for small and medium-sized businesses. Whether it can get passed in this new Congress remains to be seen.

FTC to Ban Noncompetes?

Th is one came out of the blue: The Federal Trade Commission (FTC) on January 5 issued a proposed rule that, if enacted in its current form, would prohibit

businesses from entering into or attempting to enforce noncompete agreements with their employees. Claiming that these agreements artificially depress wages because they prohibit workers from seeking more lucrative employment opportunities elsewhere, FTC says the rule will apply to contractual provisions such as “excessively broad nondisclosure agreements.” We don’t know exactly how many AICC members would be affected by this, but whether you’re a boxmaker or supplier, you likely have noncompetes in your agreements with your key employees—general managers, sales managers, and the like. These protect your proprietary information without, in my view, undue burden on the employee in their search of new employment. AICC is likely to issue comments on this proposed rule during the 60-day period, so stay tuned.

SEC Rules on ‘Climate Change’

The Securities and Exchange Commission (SEC) is also set to release fi nal rules in early 2023 on climate change disclosures.

The new rules are expected to require companies to report greenhouse gas emissions and other climate “risks” when they make fi lings with SEC. While this affects only public companies, it stands to reason that private companies such as AICC members will see another wave of “vendor certifications,” meaning boxmakers will have to satisfy their customers’ ongoing demands for corrugated packaging’s impact on the environment, which we all know is minimal.

Add to these issues the U.S. Department of Labor’s ongoing scratching into overtime rules and classifications for independent contractors, and you can see that our “what’s ahead” is likely to be very interesting.

Eric Elgin is owner of Oklahoma Interpak and chairman of AICC’s Government Aff airs subcommittee. He can be reached at 918-687-1681 or eric@okinterpak.com

BOXSCORE March/April 2023 10 Legislative Report

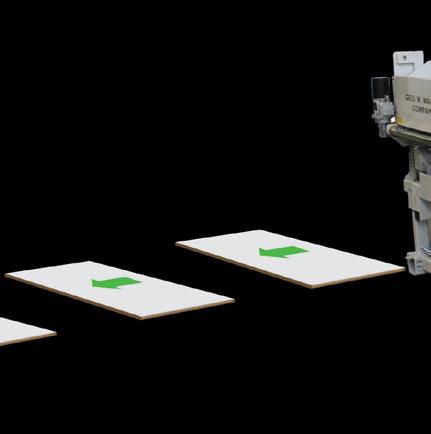

GEO. M. Martin Company • 1250 67th Street Emeryville, California 94608, United States 510.652.2200 • Fax 510.652.6447 • email info@geomartin.com The Martin logo and the word Scrubber are Registered Trademarks of the Geo. M. Martin Company. ROTARY DIE CUTTER STACKERS & PERIPHERALS SQC/SQX DIVERTER with optional SCRUBBER® TECHNOLOGY Q High-speed sampling Q Outstanding board control Q Automatic set-up Q Enhanced scrap removal Q LQC - Length Quality Control System LEARN MORE www.geomartin.com AUTOMATED SHEET SAMPLING

AICC México Meets in Guadalajara With 200-Plus Attendees

More than 200 AICC México members met November 15–17 in Guadalajara, Mexico, for the 2022 AICC México Annual Meeting and Trade Fair. The two-day event offered educational seminars, general session presentations, and a trade fair featuring 37 suppliers of corrugated machinery, equipment, and services. Also on the agenda was a tour of Cartographic, a corrugated and folding carton operation in the nearby town of El Salto.

The meeting began Tuesday, November 15, with a daylong seminar by R. Andrew Hurley, Ph.D., a professor of packaging science at Clemson University in South Carolina. Titled “Packaging Design Workflow Process Mapping,” the five-hour session looked at a seven-step process of design for customer-focused sustainable packaging (see sidebar, p. 14).

The meeting continued Wednesday, November 16, with general session presentations from several industry and

business management speakers. Sergio Menchaca, CEO of EKO Empaques, opened the session and welcomed attendees. Noting the growth of AICC México in the past two years,

he reported that the Association has 75 member companies, up from 40 in 2019. He then welcomed AICC President Mike D’Angelo, who reported on activities at AICC at large and urged members of AICC México to participate in the Association’s Spanish-language training programs and online courses. AICC Chairwoman Jana Harris, CEO of Harris Packaging and American Carton Co. in the Dallas-Fort Worth metro area, also gave welcoming remarks, noting the need for more education about our industry in colleges, universities, and trade schools.

The featured industry speaker of the morning was Mark Wilde, senior paper and packaging analyst with BMO Capital in New York, who gave an overview of the containerboard and corrugated markets in North America. He noted the recent months’ decline in box demand and the resulting softening

BOXSCORE March/April 2023 12

Members Meeting

AICC México members gather around Jose Agustin Diaz Pacheco (center) of EAM Mosca, who was inducted into AICC México’s Hall of Fame, at the 2022 AICC México Annual Meeting and Trade Fair in November in Guadalajara, Mexico.

Sergio Menchaca (left), CEO of EKO Empaques and AICC México, presents R. Andrew Hurley, Ph.D., professor of packaging science at Clemson University, with a token of appreciation for his presentation.

Photos courtesy of AICC

Members Meeting

of containerboard markets and predicted the major producers will soon be announcing the closure of older mill assets, adding that new capacity coming onstream in 2023 will also put downward pressure on paper prices.

Juan Javier Gonzalez, CEO of Cartró, a major independent supplier of sheets located in the Mexico City area, presented a leadership discussion on the qualities and characteristics of the chief executive. Saying that most management and leadership training focuses on the lower-level positions in the company and overlooks the CEO, Gonzalez outlined key characteristics needed for a successful company executive. They include mental and physical energy, a sound mind, emotional equilibrium, maturity, good work habits, and refi ned social skills. All these, he said, contribute to eff ective and ethical leadership.

Continuing in the program, Rodrigo de León González, a professor of political science and economics at the Instituto Panamericano de Alta Dirección de Empresa, spoke about the new geopolitical order in the postpandemic world and Mexico’s increasingly important role. He cited four factors that will influence the geopolitical structure into the mid-21st century: demographics, geopolitics, democracy, and sustainability.

Rounding out the day’s keynote presentations was Simon Cohen, CEO of global logistics company Henco, who discussed “The Secrets of an Entrepreneur Who, in Search of Success, Found Happiness.” Cohen described how in his early days of building his company he suffered a heart attack and, in rehabilitation, reordered his life priorities to family, faith, and friendship. His book, Pleno, tells the story of his journey.

The program also included AICC México’s annual Hall of Fame award presented this year to José Agustín Díaz Pacheco of EAM Mosca. He has been a member of AICC México’s board of directors since 2002 and has been instrumental in its growth over the past 20 years.

A trade fair featuring 37 key industry suppliers and a tour of graphic packaging company Carographic rounded out the meeting. Meeting sponsors were HP, PCM, SUN Automation Group, Alliance Machine Systems, Kolbus, SRC, Apex International, ALHU International, Grupo Gondi, EAM Mosca, BCM Inks, BIMAC, Policart, Macarbox, MATEC, ICASA, Erhardt+Leimer, and Carton.com.

For more information about AICC México and its annual meeting, contact AICC Latin America Director Maria Frustaci at mfrustaci@AICCbox.org.

DESIGNERS, CUSTOMER SERVICE, AND SALES REPS LEARN DESIGN PROCESS WORKFLOW IN GUADALAJARA

R. Andrew Hurley, Ph.D., a professor of packaging science at Clemson University in Clemson, South Carolina, and a frequent speaker at AICC-sponsored seminars and workshops, led a five-hour seminar on design process workflow at the 21st AICC México Annual Meeting and Trade Fair in November in Guadalajara, Mexico. More than 50 people attended, including designers, customer service and sales reps, and production schedulers and managers.

Hurley’s seminar focused on the seven-step workflow process necessary to ensure sustainable design in packaging. This includes defining the customer’s objectives, considering the product life cycle, and establishing simple and attainable goals chosen from the United Nations’ 17 objectives for sustainable development. Throughout the day, attendees worked in teams to brainstorm ideas, present concepts, and ultimately develop prototypes, which they then presented to the whole group.

Hurley is a regular presenter at AICC national and international meetings. For more information about his presentation or AICC México’s 2022 Annual Meeting and Trade Fair, contact AICC Latin America Director Maria Frustaci at mfrustaci@AICCbox.org

BOXSCORE March/April 2023 14

R. Andrew Hurley, Ph.D., professor of packaging science at Clemson University, presents a session on design workfl ow processes during the annual event in November.

Ask Ralph

Highlights From Recent Events

BY RALPH YOUNG

This article contains some pertinent highlights from the two recent conferences hosted by Fastmarkets: RISI and Pulp and Paper Week. We were honored to present on behalf of our industry and the independents. We have attended and delivered favorable messages on your behalf in 15 out of the 22 annual gatherings. In addition, we participate in a yearly Bank of America conference. The overriding theme throughout all of the presentations and conferences was based on how we are to live with and endure new uncertainties.

We are also often asked for our sources of information. Here are the basics:

• Scoring Boxes (monthly)

• BoxScore (bimonthly)

• Annual meetings

• Summit meetings

• National Association of Manufacturers

• Pulp and Paper Week

• Bank of America

• KeyBank

• Bank of Montreal

• Deutsche Bank

• American Forest & Paper Association public statistics (usually quarterly since 2022)

• Fibre Box Association public statistics (usually quarterly since 2022)

Capacity Changes

Internally, we track containerboard and boxboard capacity changes. Recently, we removed 550,000 tons of linerboard from WestRock because of machine closures and the shift in uncoated recycled boxboard to Sonoco and Ox Industries. We also follow the movements in other folding carton grades.

Transportation Issues

A slowing global economy, inflation, and reduced consumer spending have decreased ocean container shipments. Costs have decreased, except movements between the U.S. East Coast and the European Union. Trans-Pacific rates are down almost 75% from a year ago. Also, ocean container capacity is increasing and expected to rise 8.8% this year.

Problems with the Rhine River in Germany, much like our own watershed issues with the Mississippi River, have caused distribution challenges with materials that move by barge. A panel discussion moderated by Adam Josephson of KeyBanc Capital Markets stated there has been no backup of cargo ships at our ports since May, and there has been a 40% drop in outbound loadings.

Craig Fuller of FreightWaves said ocean rates between the U.S. East Coast and the European Union remain high. Ocean freight is dominated by a few players, and volatility always exists. New ships are being built. No one can forecast global demand. Port warehouses have been clogged. Railroad cars are expected to retire at the rate of 10,000 a year, and new rolling stock can be added at the rate of only 5,000 a year.

Macroeconomic Outlooks

There will be a drop in purchasing power, which historically has been shown to continue long after corrections in inflation rates via the Federal Reserve interest rate movements.

Even with reported “low” unemployment rates, labor supply shortages, energy disruptions, money supply, distribution logistics, government stimulus, interest rates, food shortages, shifts back from

accumulating durable and nondurable goods to services like going out to eat, inventory corrections, dollar strength, global trade disruptions, and reshoring movements are unknowns.

Global economic growth has stalled. The U.S. still appears somewhat positive in 2023, with maybe a 2.2% increase in 2024.

North American Containerboard

Manufacturing sales are good for converters, but drought conditions are creating challenges in domestic agriculture. When will inflation come under some control? The Fed raised the discount rate in December. Expect some containerboard capacity reductions, especially in high-cost kraftbased machines. We need a 3% average annual growth rate in corrugated shipments to consume all of the new containerboard coming on stream. It may be the year 2025 before a new balance is achieved.

Cost inflation has offset actual rapid containerboard price increases of the past few years.

It was said European mills can exist only with fossil fuels and may take 10 years to make the switch to other sources such as biomass.

AICC can provide some slides if you request them and can assist you in communications with your suppliers and customers.

Ralph Young is the principal of Alternative Paper Solutions and is AICC’s technical advisor. Contact Ralph directly about technical issues that impact our industry at askralph@AICCbox.org

BOXSCORE March/April 2023 16

Operational Value Analysis Focuses on Cost Takeouts for Your Business and Key Clients

BY TOM WEBER

With each new year comes the trepidation of what may be ahead for many of us as our businesses revert to what they were before the COVID-19 pandemic (possibly). Two things are certain: Nothing will remain the same, and if we apply the correct resources toward our clients, better days will be ahead. This is the foundation for my following suggestion: to capitalize on the available human capital we have on hand who may, for the first time in a few years, have some time to focus on cost takeouts for your businesses and key clients.

The use of this approach is certainly not new, but it does require willing participants, some scheduled time, discipline, and the right mix of team members to ensure success for both parties. It is important to note that cost takeouts manifest themselves in unique ways, and possibly, cost-sharing may ultimately need to be established.

The following is an operational value analysis template that I was trained in from my days with Tenneco Packaging in the 1990s. I am happy to share it, and if any further explanation is necessary, please reach out to me.

Note: A suggested question to ask after you possibly identify your top five clients to discuss this approach with depending on your internal and external available resources is, How do we get started, and when?

Let’s make it another great year together.

Tom Weber is president of WeberSource LLC and is AICC’s folding carton and rigid box technical advisor. Contact Tom directly at asktom@AICCbox.org

Example Operational Value Analysis (OVA)

Jointly Developed OVA Team for Major Cost Takeouts

Objective:

$300,000 cost takeout initiative—targeting a minimum of $15,000/quarter and/or $60,000/year.

Term:

Supply agreement for three years in place, effective Jan. 1, 2023, through Jan. 1, 2026.

Team Dynamic:

Two to three rotational team members from each company meeting on predetermined quarterly dates and times, publishing meeting minutes to senior leadership, and developing specifi c action plans to implement with costouts associated. Meetings are intended to be rotational in nature between customer and supplier facilities. No single facility contributes alone.

Initial Suggested Team Leaders:

• Supplier OVA team: rotational with plant, sales, engineering, and maintenance leadership.

• Customer OVA team: TBD.

• Possibly request key outside suppliers to participate.

Documented Savings: Agreed upon in writing by all team members/leaders with details, responsibilities, and materials/process steps needed to implement. (Objectives should be low to no capital required.)

OVA KEY DISCUSSION POINTS

Defi nitions:

• OVA is an orderly and creative method to increase the cost-effectiveness of a manufacturing operation.

• An operation that performs better than another provides more value to the company.

• The lowest-cost item that performs equally well as another has more value to the company.

How It Is Accomplished:

• Component cost takeouts.

• Reduction of redundant processes.

• Reduction of secondary processes.

• Facilitation of flexibility in thinking and exploring multiple concepts.

• Focusing on essential functions to meet end-use product requirements.

• Identification of “low-hanging fruit” to drive a change culture.

• Utilization of a capital “lite” mentality.

Why Us:

• Proper assessment of the customer’s needs.

• Appropriate acknowledgment of customer priorities.

• Obtaining and utilizing 100% of customer feedback.

• Focusing on material usage, reduced waste, and significant operating costs.

• Reduced shipping, handling, and distribution costs.

• Increased customer satisfaction.

• Increased employee morale from being part of the solution.

BOXSCORE March/April 2023 18 Ask Tom

JB MACHINERY ® Productivity — Quality — Profitability JB Machinery Inc., | +1-203-544-0101 | jbmachinery.com INCREASE your profitability with all JB products. MAXIMIZE your profitability when you bundle one or more on new or existing converting lines. Save Labor/Energy Save Labor/Materials Save Labor/Time ® InKomand® This Ad Maximizes PROFITS

Strategies for Selling in Challenging Times

BY TODD M. ZIELINSKI AND LISA BENSON

The paper-based packaging industry is facing challenging times. High inflation and rising prices have consumers and businesses cutting back on spending. Recent years have seen a boom in the corrugated market as prominent e-commerce companies such as Amazon significantly increased their corrugated packaging use. At the end of 2022, retail sales were down in many categories, which, in turn, reduced the demand for corrugated. As the situation changes, corrugated companies must plan strategically to remain competitive.

A large key account can be demanding and often get preferential treatment, and as a result, smaller accounts see longer lead times as their orders get pushed back to accommodate the increased demand. The supply chain disruptions made the situation worse. Over the past few years, these smaller accounts could often fi nd

relief from small independent corrugators that could meet the required lead times. However, as the economy continues to struggle, large retailers are pulling back, opening capacity for large integrated companies that have the advantage of lower unit pricing. Th is makes the market much more competitive for small independents.

To remain viable, corrugated manufacturers must continue to deliver value to their customers. This means understanding who your customers are and providing them with solutions that alleviate or mitigate their pains or challenges. The goal isn’t to close a sale. It is to develop a relationship with your customer in which you are seen as a solution provider and not the boxmaker.

Know Your Target Market

Before selling value, you must ensure your customers are a good fit. Start with your current customer accounts. Evaluate

each individually and determine whether you would like more that are exactly like them. For the accounts you want more of, determine what makes them a good account—industries, spend, margin, type of purchase, location, etc. Do the same with your less desirable accounts.

In challenging times, it becomes difficult to turn work away, but accounts and personalities that don’t fit with your company can waste resources and be exhausting. Don’t be afraid to turn away business that doesn’t match your positioning. Saying no to those companies strengthens your position. It frees your sales and account management teams to concentrate on prospects and clients that will develop long-term relationships with you and continue to add to your profitability. Put your energy into fi nding and keeping customers that fit what your company does best. If in your area of

BOXSCORE March/April 2023 20 Selling Today

expertise, consider pivoting more heavily toward more recession-resistant industries, such as food and pharmaceuticals.

How Will You Differentiate Yourself?

How do you close the sale in a crowded market? Differentiation. Before you can sell, you need to know what you are selling. The brown boxes, primary packaging, or retail displays are only part of it. All your competitors sell those same things. Most take great care to meet quality expectations and have hired talented people. So, with the typical products, quality, and people off the table, what is left?

There are several ways to differentiate yourself. You can do something different than anyone else or do something better than anyone else. A third option is to expand your services, offering more so it is harder for customers to leave. In a mature industry, any of these may involve technology, artificial intelligence, or automation.

Differentiation can be found in the whole experience of working with your company. Looking holistically at what you offer allows you to compound the value. What value-added services are you offering, or what should you start offering, such as vendor-managed inventory, fulfi llment, or direct shipping?

To understand your differentiators, you must know your competitors’ strengths and weaknesses. Some say they don’t need to know what their competitors are doing; they only need to focus on what they are doing. You can’t create differentiation by ignoring what your competitors are doing. To be different means you are not the same as another, so you need to know the other you are comparing yourself with.

Asking your current customers why they choose you may provide insight into how you are different. Take that information and develop it into a compelling story of the value your company offers.

Value-driven Selling vs. Price-driven Selling

For most prospects and customers, price is a top priority. If you are in the position to offer low unit pricing, you will have an advantage in soliciting customers who are purchasing solely on price. Everyone else will need to focus on selling the value of their total solution. Th is is where having a differentiator becomes essential.

With pricing as a differentiator, the only thing that matters at the qualification stage is if they are willing to pay the price you are offering. With value selling, communication will be critical. The salesperson will have to ask probing questions to learn the pains the prospect is feeling.

Th is begins during the qualification stage of the sales process. The salesperson should ask open-ended questions that will give them insight into the prospect’s operations and fi nd the root of their challenges. It will also help determine how to present the value. They should let the prospect talk as much as possible without being interrupted and not be afraid to allow for “dead air.” It is human nature to avoid what is perceived as awkward silence in a conversation, so the prospect may talk to prevent it and then fi ll that space with valuable information the salesperson can use to help the prospect see the value. Listening is critical. The salesperson should ask additional open-ended questions as necessary to probe deeper to help the prospect see the value your company brings.

Example questions include:

• What brings you the greatest amount of frustration every day?

• How does your current lead time on boxes impact your business?

• How important is consistent delivery to you?

• When you have a late shipment, whom does that impact? What is the cost in lost productivity and dollars?

• How much time does your team spend scrambling to change

production and smoothing things over with your customers when shipments are late? Or how many resources are going into keeping an inventory of boxes for every SKU so this doesn’t happen?

By keeping the prospect talking, you may be able to help them uncover a pain point they didn’t know was solvable. Understanding the prospect’s goals and pains allows the salesperson to focus the solution on achieving those goals and relieving their pains. The solution may also improve the prospect’s job satisfaction and team morale and bring other nonmeasurable value.

Stay the Course

Targeting the right prospects, understanding your differentiators, uncovering prospects’ pains, matching the pains to your solutions, and demonstrating the value to your prospects will help prospects see the value your company offers. It is easy to lose momentum when all the news you hear is gloomy. But to keep a consistent flow of leads in your sales pipeline, remaining consistent with executing your sales process is imperative. Be consistent in calling, emailing, or texting prospects. They are also facing challenges, and with perseverance and communication, you may fi nd you have a solution that can help them.

Todd M. Zielinski is managing director and CEO at Athena SWC LLC. He can be reached at 716-250-5547 or tzielinski@athenaswc.com

Lisa Benson is senior marketing content consultant at Athena SWC LLC. She can be reached at lbenson@athenaswc.com

BOXSCORE March/April 2023 22 Selling Today

Two

The best of two worlds

companies team up for your success! Koenig & Bauer Celmacch’s expertise with converters have enabled us to develop machines for you with the highest technological standards in the industry. This supports maximum reliability, quality and flexibility. Our range of products meet different investment strategies and productivity requirements, ranging from entry-level models to machines that are equipped with the highest levels of automation, sophistication and the highest throughput. Contact us for information on how you can become the next success story. tom.fitzgerald@koenig-bauer.com

Supervisor Development Must Be Consistent to Be Effective

BY SCOTT ELLIS, ED.D.

BY SCOTT ELLIS, ED.D.

Remember when your dad threw you in the deep end and called it “learning to swim”? This is the everyday experience of many production supervisors. The purpose of this article is to outline a process that equips supervisors to lead the part of the business assigned with keeping promises to your customers. Those who would pursue this further may follow the steps described here using the Individual Development Plan course in AICC’s Packaging University.

Most supervisor training would be best described as “drowning avoidance.” Most supervisors rise from the ranks of machine operators. In the past, a machine operator was expected to possess the technical skills to produce quality products consistently and on schedule and to direct the crew toward that objective. Today, the model operator is also expected to lead and train the crew, often on multiple machines. Entering the deep end as a supervisor, the typical operator is expected to manage attendance, triage human resources issues, expedite orders with incomplete information, and liaise with the maintenance department, while training, motivating, and holding people to account. Only a small number of these skills are gained as an operator. Is it any wonder they flail and gasp?

The responsibility of equipping supervisors is one of the most influential investments in the culture of the company. These people represent management to the bulk of the employees. Their professionalism, including their technical and interpersonal know-how, is the hinge pin of company culture. It is a big job, and you have a lot to do. So, I suggest you start small.

You could launch a training program for all supervisors in the company. To do so, you will need to overcome the resistance of incumbent supervisors who may be capable and are yet unwilling to embrace professional improvement. I usually start with the willing, regardless of capability. I inform the team that the standards and performance measures are changing, and then I invest my time with the early adopters. When the increased capability of the willing results in an opportunity for advancement, you will have everyone’s attention. Then some will become willing, and others will self-select out of the role. My patience is long for the willing learner of any level of experience or even capacity. I will waste very little time on a person in possession of technical and interpersonal skills who chooses not to employ them.

The primary ingredient for success is consistency. Your way may not include online resources or one-on-one application meetings, but until there is a better “your way,” I invite you to try mine below:

1. Revisit the job description and assess its applicability to your current expectations.

2. List your expectations for the technical and interpersonal skills of a model supervisor in your culture.

3. Download the Supervisor Professional Development sheet provided in the Individual Development Plan course in AICC’s Packaging University.

4. Customize the list of Packaging University courses to fit the supervisor. You may choose not to require some of the more basic courses, or you may add those that are a better fit for your mix of business.

BOXSCORE March/April 2023 24 Leadership

CorrWhite is our waxable white coating created to minimize rod wear while maintaining the necessary after-wax brightness and opacity. Frequently used as a base coat on kraft liners for color applications, CorrWhite offers exceptional brilliance and a light coat weight providing the best value in the market. Responsive and agile, Magnum Inks & Coatings offers excellent technical expertise and outstanding service. Contact us and learn how the right partner can make all the difference in your printing/coating processes. MagnumInks.com | sales@magnuminks.com | 877.460.8406 ©2023 Magnum Inks & Coatings. All rights reserved. The Corr of your printing success.

5. Add any destination courses you believe would be relevant. You may choose to add an internal experience (e.g., spend a week in scheduling or customer service) or another local offering (e.g., courses at Dale Carnegie or tech schools and community colleges).

6. Discuss the pace of learning that will fit the current workload and agree to target dates for the fi rst few courses.

7. Meet regularly to check in with questions such as:

• “What did you learn from that course?”

• “How do you suggest we apply that knowledge in our plant?”

• “What obstacles would we need to overcome to make that best practice a habit?”

8. Favor the person who proves to be willing and capable with advancement in compensation and responsibility. Concurrently, stop offering advancement to the unwilling, regardless of their capability.

9. Model willingness to gain professional and interpersonal awareness.

Your initial investment will take some time and effort, but once you have an equipped supervisor, there will be two of you to train the rest of the willing team members. Whether you model your process after the one I have provided or adopt your own, there is no alternative to investing in the capability of your supervisors. Consistency: Th is is the way.

Scott Ellis, Ed.D., delivers training, coaching, and resources that develop the ability to eliminate obstacles and sustain more eff ective and profitable results. He recently published Dammit: Learning Judgment Th rough Experience. His books and process improvement resources are available at workingwell.bz . AICC members enjoy a 20% discount with code AICC21.

BOXSCORE March/April 2023 26 Leadership

J&L C O N T A C T U S O R S C A N T H E Q R C O D E T O L E A R N M O R E Phone: 509-535-0356 Fax: 509-535-0399 info@alliancellc.com W i t h w i d t h s u p t o 2 1 0 " t h e J & L i s t h e m o s t v e r s a t i l e s p e c i a l t y f o l d e r g l u e r i n t h e c o r r u g a t e d m a r k e t ! Mark 5

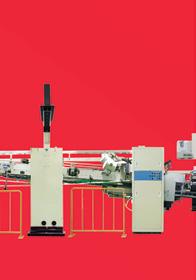

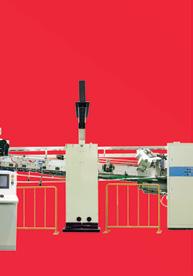

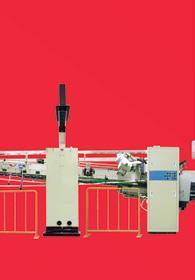

Full Throttle with Full Servo

Full Servo Inline Set While Run FFG improves speed rating by up to 12.5%

The latest innovation from Latitude Machinery Corp. (LMC) features full servo, Set While Run operation providing improved accuracy and an improved speed rating across multiple sizes:

660mm x 1800mm: 450 sheets/min 1000mm x 2500mm: 350 sheets/min

1200mm x 2700mm: 300 sheets/min

1200mm x 3000mm: 300 sheets/min

Full Servo can Reduce Noise Levels by 15%

Machinery and Handling for the Corrugated Board Industry EVERYTHING CORRUGATED UNDER SUN IS THE OFFICIAL REPRESENTATIVE FOR TAIWAN-BASED LATITUDE MACHINERY CORPORATION, ITALY-BASED PARA, AND ISRAEL-BASED HIGHCON 1-410-472-2900 sunautomation.com

EVERYTHING CORRUGATED UNDER powered by Latitude Machinery Corp. (LMC) is a world-class

of Corrugated Converting Equipment, specializing in Flexo Folder Gluers and Rotary Die Cutters. SUN is proud to be the exclusive representative for LMC equipment, parts and service in North and Central America.

manufacturer

STILL the Industry Experts 580 Sylvan Avenue, Suite M-A Englewood Cli s, NJ 07632 (201) 731-3025 • Fax: (201) 731-3026 info@klinghernadler.com Planning for the future is one of your most important jobs. Selling your business, succession planning, equipment decisions and expansions require the best advice and strategy. We’ve been providing Business Planning Services to the independent converter for over 30 years. Need to make a big decision? Call us now.

Headline

BYLINE

Member Benefi ts

New Savings Program for AICC Members

AICC is bringing members savings through a new affi nity partnership with AICC member Procure Analytics.

Procure Analytics, a group purchasing consultancy that manages indirect categories for over 1,000 member companies with $1.5 billion in controlled spend, can off er members strategic sourcing, cost reduction, and tail spend management.

“Th is is a great opportunity for AICC members, both box converters and suppliers,” says AICC President Mike D’Angelo. “Procure Analytics can bring great savings and efficiencies, especially in today’s rising cost environment, all of which fall right to the bottom line.”

Procure Analytics was founded to address the complex challenges of a frequently ignored indirect spend category: maintenance, repair, and operations supplies (MRO). The nature of MRO supplies (millions of stock keeping units, thousands of individual transactions, hundreds of potential suppliers, and the relatively small cost for individual products) make MRO an under-managed category within most organizations.

Procure Analytics has since broadened its portfolio of savings programs to address several other under-managed indirect spend categories, including freight services, pallets, uniforms and rental garments, corporate travel, and many others.

“Procure Analytics is thrilled to partner with AICC,” says Billy Medof, CEO of Procure Analytics. “Leveraging $1.5 billion of group spending and a team

of 100-plus data-focused procurement experts, Procure Analytics enables independent boxmakers to buy critical items at pricing and terms on par— and often even better—than Fortune 100 companies.”

More information about Procure Analytics and other AICC money saving programs can be found at www.AICCbox.org/savings.

BOXSCORE www.AICCbox.org 29

Southern Carton Co.: Integrity, Quality, and Service

BY STEVE YOUNG

COMPANY: Southern Carton Co.

ESTABLISHED: 1977

JOINED AICC: 1985

PHONE: 931-359-6285

WEBSITE: www.southerncarton.com

HEADQUARTERS : Lewisburg, Tennessee

CEO: David Kennedy

Jim Kennedy knew nothing about the corrugated box business when, in 1977, he and his wife, Kate, founded Southern Carton Co. in Lewisburg, Tennessee. At the time, he was general manager of the Heil-Quaker plant there, overseeing 1,300 people manufacturing commercial and residential heating and air conditioning systems. Yet, as successful as he was at Heil-Quaker, Kennedy’s entrepreneurial instinct told him an opportunity to sell small quantities of corrugated boxes to customers had been long overlooked by the bigger integrateds.

“He always wanted to start his own business, and wherever he worked, he excelled,” explains his son David Kennedy, now CEO of the company. “He’s getting to the end of his career; he’s

56, 57 years old, and he saw a niche here where if you wanted 500 or 1,000 boxes, you couldn’t get them from the big guys, let alone 250 or 300.” This, as David tells it, was the genesis of Southern Carton, a story that reads like that of many independent sheet plants in AICC’s membership today.

“He started with a Rite-Size boxmaker,” David continues. “He, my mother, and brother Rick started cranking out orders for 100, 200 boxes at a time. They rolled the cert stamp by hand with a little stamp pad and then glued or taped them shut.”

David explains that the little company’s immediate success soon forced the acquisition of faster equipment. “Like everybody in this business, one thing leads to another, and pretty soon he says,

‘I need to find a taper or a gluer or a slitter.’ That leads to printer slotters, which leads to flexos, which leads to rotary die cutters—all of which we now have.”

Expansion, Extension, Equipment

Today, Southern Carton is a $20 million company producing 200 million square feet annually. Its 55 employees work a single shift in an 85,000-square-foot manufacturing facility with an additional 53,000 square feet of off-site finished-goods warehousing.

A family enterprise from the start, Southern Carton is now in its third generation of ownership. Barbara Kennedy, David’s wife of 35 years, has been an integral part of the company’s growth and history as confidante, sounding board,

BOXSCORE March/April 2023 30 Member Profile

Southern Carton’s management team (from left): Angie Norman, plant manager; Eugene Peek, digital print manager; Diane Sharp, customer service manager; Angela Newman, customer service representative; David Kennedy; Connor Kennedy; and Zoe, director of plant security.

Photos courtesy of Southern Carton Co.

O u r j o b i s

u l l

s t

y o

r f

c i l i t i e s ' e n e r g y n e e d s , b u i l d a c u s t o m , c l i e n t - s p e c i f i c e l e c t r i c i t y o r n a t u r a l g a s p r o c u r e m e n t s t r a t e g y ,

P R O V I D E A R E A L - T I M E , A P P L E S - T O - A P P L E S C O M P A R I S O N O F S U P P L I E R P R I C I N G N E G O T I A T E O N Y O U R B E H A L F

a

y

y

u . A S A N E X T E N S I O N O F Y O U R T E A M , W E C A N : M I N I M I Z E B U D G E T A R Y R I S K P R O V I D E C U S T O M I Z E D E N E R G Y M A N A G E M E N T S O L U T I O N S S E T & M E E T E N E R G Y E F F I C I E N C Y & S U S T A I N A B I L I T Y G O A L S Endorsed By Since 2003 667.330.1159 ntemple@appienergy.com appienergy.com C o n t a c t y o u r d e d i c a t e d S e n i o r E n e r g y C o n s u l t a n t , N o e l T e m p l e , f o r m o r e i n f o r m a t i o n :

t o f

y u n d e r

a n d

u

a

a n d d o t h e h e

v

l i f t i n g f o r

o

and cheerleader. “Barbara and I discussed Southern Carton business almost nightly at the dinner table,” says David, adding that because of those discussions, two of the Kennedy sons—Connor and Sean—said, “I want to do that,” and they now work in the business, with Connor serving as president and Sean in production. (The Kennedys’ daughter, Meredith, is a nurse practitioner, and their other son, Patrick, is an engineer.)

The company’s values, as described by all the Kennedys, are “best in integrity, quality, and service.”

“Everybody here is so focused on the customer, whatever the customer needs,” David says. “Our unwritten motto is underpromise and overdeliver. Once a customer comes on board with us, they seldom leave.”

Connor adds that Southern Carton’s service ethos is grounded in what he calls a “servant” mentality. “We have a great sales team, and they’re all servants at heart,” he says. “They have a job to do, it’s true, but at the same time, they really just enjoy helping people. And I would say that about all our employees.”

The geographic reach of Southern Carton’s servant philosophy extends in a 130-mile arc from southern Kentucky in the north to northern Alabama in the south. Located about 45 miles south of Nashville off Interstate 65, Southern Carton’s central Tennessee location makes all these market areas an easy reach. Historically, David says, the pencil business dominated the local economies in the 1970s. “There were, like, nine pencil companies because cedar is so plentiful here and that’s what they were made of; there were pencil factories everywhere. Now, there are two,” he says.

The biggest economic shift to occur in the mid-South states since that time is the arrival of the auto industry. Beginning in the early 2000s, the region saw more than $10 billion in direct investment not only from legacy carmakers such as Ford and

GM but also newcomers such as Toyota, Hyundai, Volkswagen, and BMW. More recently, the region has seen a renewed investment wave to support production of electric vehicles—upward of $33 billion across the Southeast, according to online publication Electrek.

Southern Carton has been a beneficiary of this shift because with automotive manufacturing come the parts and systems suppliers that support it. “The economy here has changed so much that it’s probably one-third automotive,” says Connor, “and of our top 10 customers, four are automotive.”

The balance of Southern Carton’s business mix is made up of smaller yet thriving industry segments such as retail packaging firms, consumer and commercial cookware manufacturers, and food and beverage companies.

Serving this demanding market mix has required constant reinvestment in the production capability of the plant. Southern Carton’s equipment roster upgrades in 2022 alone totaled more than $8 million, and in 2023 and 2024, the Kennedy family is expected to invest an additional $4 million to $5 million. Before the 2022–2023 upgrades, Southern Carton’s equipment list was that of a typical service-oriented sheet plant: a Ward 66" x 125" two-color flexo-folder gluer, a Ward 66" x 115" rotary die cutter, a Lian Tee 26" x 78" two-color mini flexo, and a Marumatsu 86" x 205" jumbo printer slotter. In addition, the company has an Automatan labeler, a Fuji X3 digital printer, and a Zünd sample table.

The 2022 retooling of the company’s converting and finishing capability saw the addition of an Apstar 66" x 110" two-color rotary die cutter with an Alliance pre-feeder and A.G. Stacker, a J&L specialty gluer, a Baysek 170 die cutter with load turner, two Mosca unitizers, and three Mosca strappers. The upgrades went beyond converting and finishing operations to include such plant infrastructure as 400 feet of new conveyer

from Bay Machinery, two Bay Machinery load formers, a new Balemaster baler, and new cyclone. This March, Southern will take delivery of a new Apstar 66" x 126" two-color flexo folder gluer with an Alliance pre-feeder.

“We have basically retooled the plant with new or updated equipment in the past year so we are poised for growth,” David says. “Our region is growing; industry is moving to business-friendly Tennessee, and we now have a lot of fi repower to meet new customers’ needs.”

Scott Fray, general manager, agrees. “We now have a broader capability to supply many types of business segments—digital wide-format labels, flexo print—and we can run small boxes up to jumbo in-house.” Fray came to Southern Carton seven years ago after spending 24 years in the industry, predominantly at WestRock and Menasha.

‘Servants at Heart’

The box industry being a service business, all of the mechanical capability in the world will not sell a single item. Southern Carton’s market approach recognizes this; thus, exemplary customer service is enshrined as a principal company value. “The whole organization works with a sense of urgency whose only focus is on the customer,” says Fray, echoing Connor’s earlier description of Southern Carton’s employees as “servants at heart.”

“Our strengths have always been in our loyal customers and our loyal employees,” David says. “Many of our customers have been with us for over 20 years, and many of our employees have been with us more than 20. I believe the secret is to never take either for granted. [The adage,] ‘treat people like you would like to be treated,’ still holds true today.”

The roster of Southern Carton’s longtime loyal employees begins with Diane Sharp, who at 43 years of service holds a one-year seniority edge even over David, who just passed the 42-year mark. Sharp speaks

BOXSCORE March/April 2023 32

Member Profile

Unbox faster turnarounds

Make the move to digital – and unbox your business with the flexibility to accommodate fast turns, versioning requests, last minute edits, and changing buying decisions.

With the new EFITM Nozomi 14000 LED digital press for corrugated packaging and POS, you can reduce process steps from weeks and days to hours and minutes. And personalize runs from one to infinity at higher margins and with lower costs – all in a single pass.

Let’s build your brilliant future. Together. Scan to learn how corrugated converters and packaging printers are opening up new ways to say, “Yes!”

©

ALL

| WWW.EFI.COM

2023 ELECTRONICS FOR IMAGING, INC.

RIGHTS RESERVED.

Member Profile

of Southern Carton’s customers almost maternally. “It’s nice to be able to take care of customers. We know a lot of them; we’ve been doing business with most of them for lots of years,” she says. “We exchange grandkid photos. We talk about who’s getting married. It’s a lot of fun.”

Assisting Sharp is Angela Newman, whose 23 years at Southern Carton have been devoted entirely to serving customers. Yet, she says, she is still motivated by the diverse nature of the business and the creativity in meeting customers’ needs.

“What I find rewarding is being able to take care of the customers,” she says. “When I started, I thought a box was a box. I didn’t realize there were thousands of different styles of boxes and partitions. So, for me, it’s always a learning experience because I’m still learning, and I’ve been here 22, 23 years. Every day, there’s something different that goes on.”

Eugene Peek is supervisor of Southern Carton’s Fuji X3 digital press, a position he’s held for the past five years. But his experience in the company goes back 26 years beyond that, predominantly in plant supervision. “He’s the jack of all trades,” says David.

Peek has been steeped in Southern Carton’s history of growth, and he recognizes that history as a key part of the company’s success today. “I started when I was 18 so I’ve seen all of [the Kennedy] family grow up together,” says Peek. “I’ve seen it from a letter press, and I’ve been here since the first flexo we got. So yeah, I’ve seen every machine coming in as we grew over the years.”

Plant manager Angie Norman, like her coworkers, is devoted to the company and to the service of its customers. Even before she was employed there, she understood the company’s promise of reliability working in the shipping department for Sanford, then one of Southern Carton’s customers. “I was working part time at Sanford and unloading a truck from Southern,” she recalls. “Rick [Kennedy] asked me, ‘Are you happy

here? Do you want a full-time job? Why don’t you come over to Southern Carton and work for us?’”

Norman worked 21 of her 24 years at Southern Carton in shipping. “I was in shipping for 21 years, and the other plant manager retired,” she says. “So, they asked me to take the job. They trusted me. They had more trust in me than I had in myself to run it.” Norman credits her co-workers for much of her success, saying, “I keep smart people around me because I don’t know all the answers.”

Like her colleagues at Southern Carton, Norman has an unflinching commitment to serving the customer, no matter how big or small. “Yeah, everybody knows who our top five customers are, but we don’t treat them any differently than our lowest one,” she says. “If they call and say, ‘Hey, I’m out of boxes! I gotta have boxes,’ we’ll do whatever we can to get them.”

Looking Toward the Future

Southern Carton has had its share of challenges as have many other independent manufacturers, particularly in finding people. “I believe the major challenge facing our industry is labor— competent labor,” David says. “We have not faced the shortages many of my colleagues have experienced, but we have felt the pinch.”

Yet, the Kennedy family has positioned the company to take advantage of expected growth in the coming years. A third generation is now smoothly in place with Connor, the market is growing, and the family is actively reinvesting to take advantage of future opportunities. “My goal is to leave the plant in the best condition possible before I fade off into the sunset,” David says. “I didn’t want to leave Connor in a position where he’s having to replace equipment so I think he’s in really good shape for the next eight to 10 years.”

For his part, Connor credits his successful transition into the company

BOXSCORE March/April 2023 34

David and Barbara Kennedy, owners of Southern Carton Co.

to the family culture his father and grandfather established early on. “AICC has a lot of family businesses, and a lot of them have more family members involved than we have here. And you know, there’s some conflict in some of them,” he says. Pointing to David, he adds, “He and I talk every day, and yeah, we disagree on stuff all the time. But I thoroughly enjoy working with him and looking to grow what his life’s work has been—and his father’s life’s work. This is our livelihood, this is family, and now I look at all our employees that way, too.”

David’s optimism in his own company’s prospects extends to the corrugated industry at large. A member of AICC since 1985, Kennedy is now in his ninth year as part of a CEO Advisory Group, a group he calls his “corrugated brothers.” He sees a new era of opportunity for independent entrepreneurs in the box business. In his opinion, as companies further consolidate—even among independents—there will naturally be those customers whose mix just doesn’t fit into a bigger company’s higher-speed, higher-volume runs. He maintains a unique point of view that sees a renaissance of sorts in independent sheet plant startups. “I think there’s going to be a few more mergers and acquisitions, and then we’ll see a 1970s-style resurgence of independents starting again,” he predicts. “The more the industry consolidates, the more gaps there will be in the industry to fill, and independents will resurface always and fill that void. They will be box plant guys selling or producing for another, and they’ll want to start their own little sheet plant.”

Just like Jim Kennedy did in 1977.

Steve Young is AICC’s ambassador-at-large. He can be reached at 202-297-0583 or syoung@AICCbox.org

The innovative Hycorr Flexo Rotary Die Cutter Series has an updated KOLBUS feed section with servo-controlled drive technology, the latest operator-machine control interface, and KOLBUS 360 remote diagnostics. It also features a slit and score section and Serrapid quick change die-mount cylinder.

BOXSCORE www.AICCbox.org 35 Member Profile

I De Ile IIC . � �: : . 8 KOLBUS Hycorr Rotary

Reliability

Die Cutter Series Reputation of

Reliability, quality, and productivity. Learn More kolbusamerica.com �KOLBUS ' AMERICA INC. KOLBUS America Inc. T 216 931 5100 sales@kolbus.com service@kolbus.com parts@kolbus.com

SAFETY IS NO ACCIDENT

A look at the top fi ve severity exposures in the corrugated industry

March/April 2023 36

By John Kiefner

For those who have never stepped foot into a corrugated plant, it’s quite an eye-opening experience once past the front office. If I could turn back time, I would seek a safety consultant internship in a corrugated plant because no other industry offers anywhere near the variety of severe risk exposures.

While the frequency of injuries in the corrugated industry is often led by sprains or strains, trips, and cuts, the severe exposures are what keep me up at night. Rather than go through the Occupational Safety and Health Administration (OSHA) standards word for word, let’s look at some practical considerations for addressing fi ve severity exposures in the corrugated industry.

BOXSCORE www.AICCbox.org 37

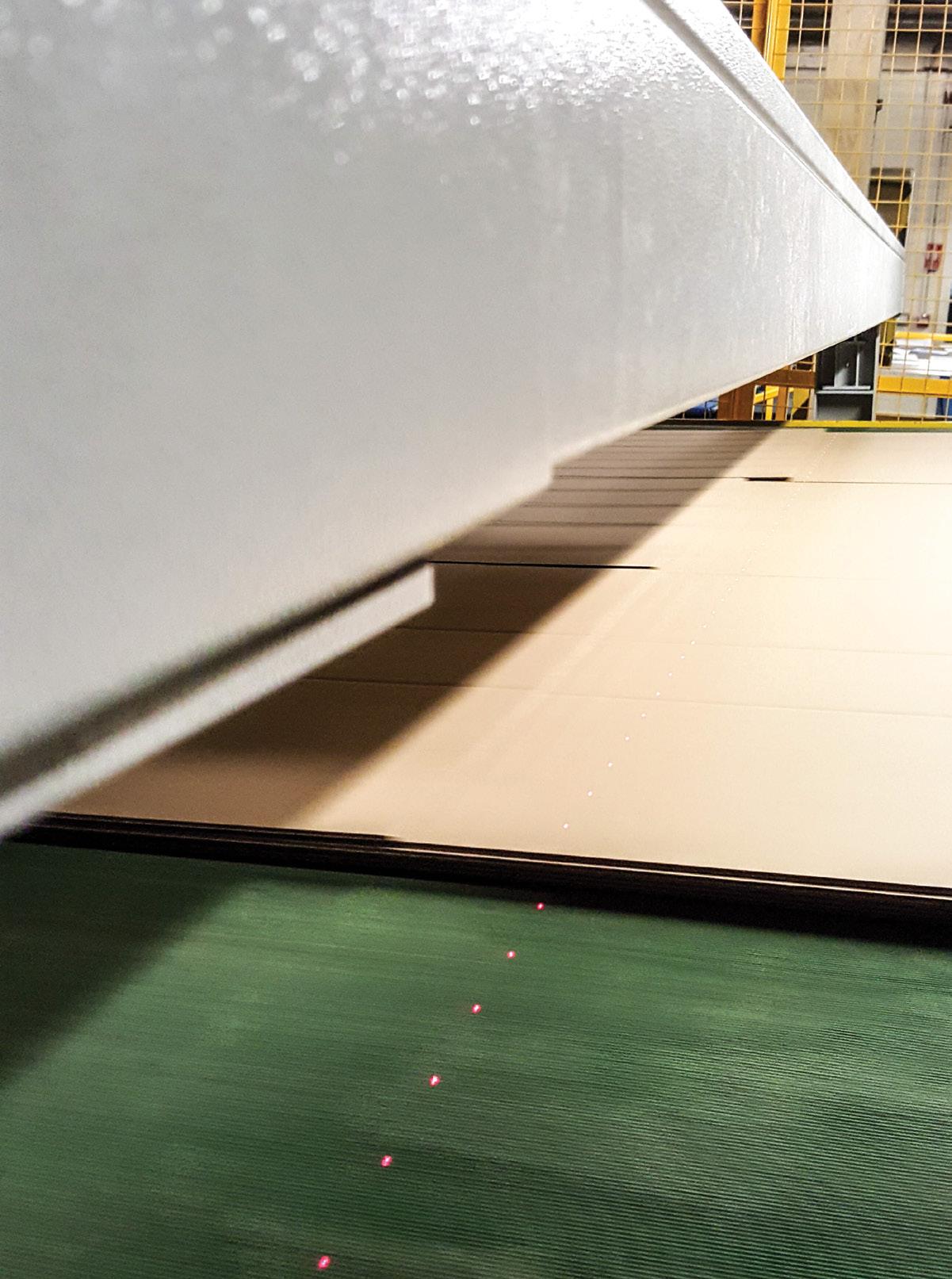

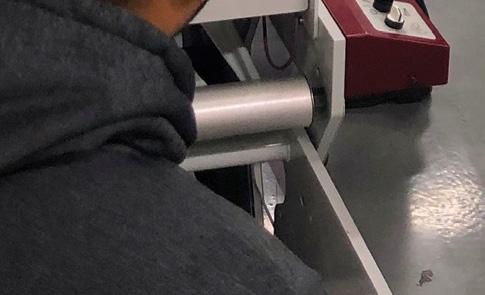

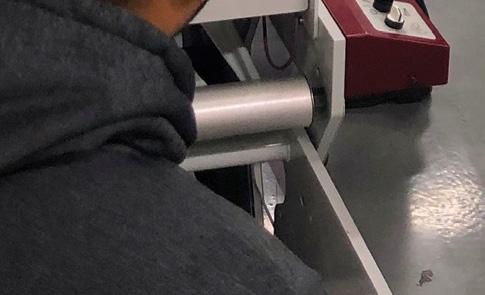

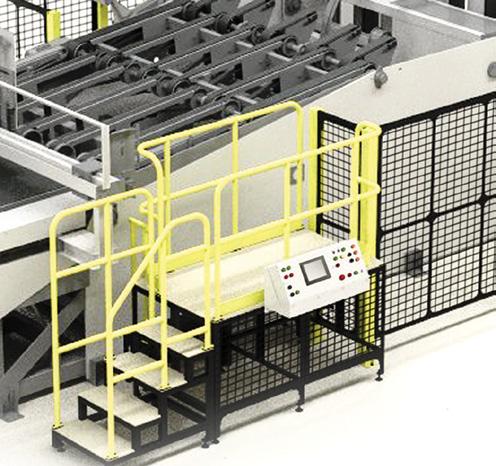

1. Caught in Machinery

Entanglement within machinery can occur in a split second when allowing any of the following items to be brought onto the plant floor: hooded sweatshirts, loose jewelry, long hair, lanyards without breakaway straps, and rags wrapped around the hand. A written policy should be in place prohibiting all of the above, and managers should strictly enforce the policy with employees and temps.

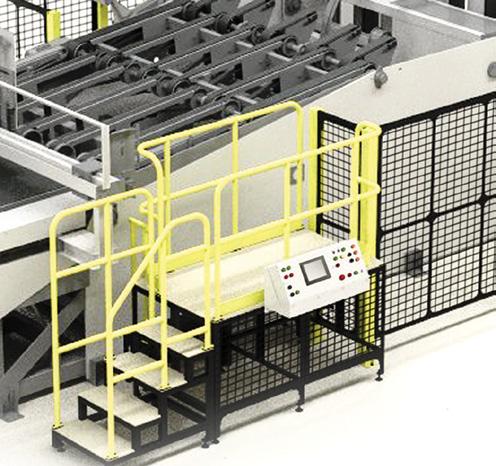

When assessing machine guarding, keep it simple. Anything beneath 7 feet that can catch clothing, hair, body parts, etc., should be guarded. Where physical guarding is used, it must be fi xed (tool used for securing) or interlocked. Other types of guards may include light curtains, pressure-sensitive matting, pull cords, etc. Although not required by OSHA, it is strongly recommended that interlocks and

BOXSCORE March/April 2023 38

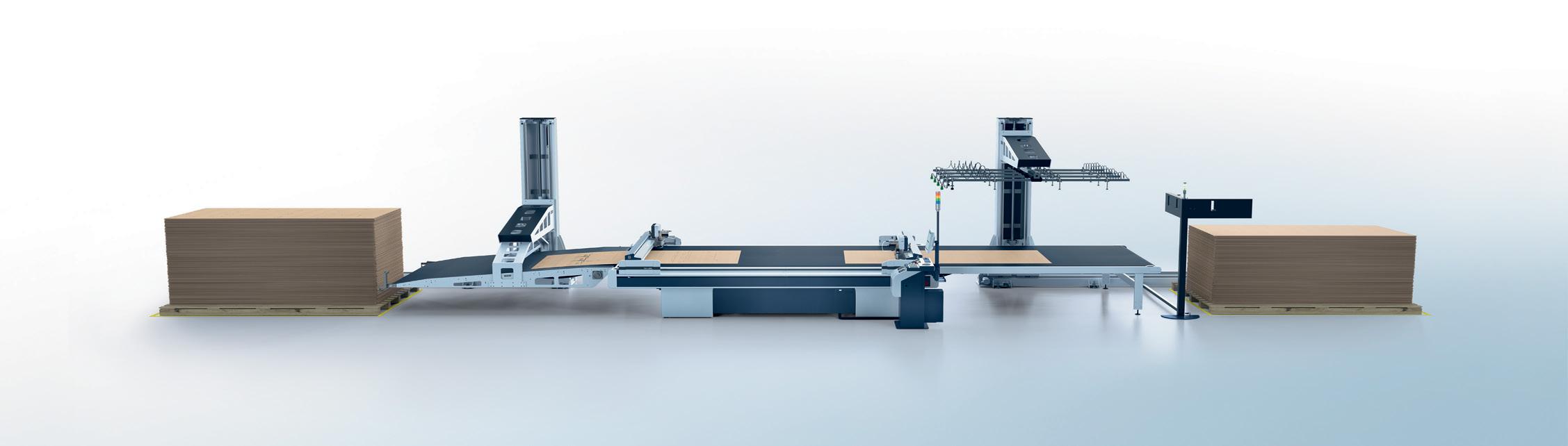

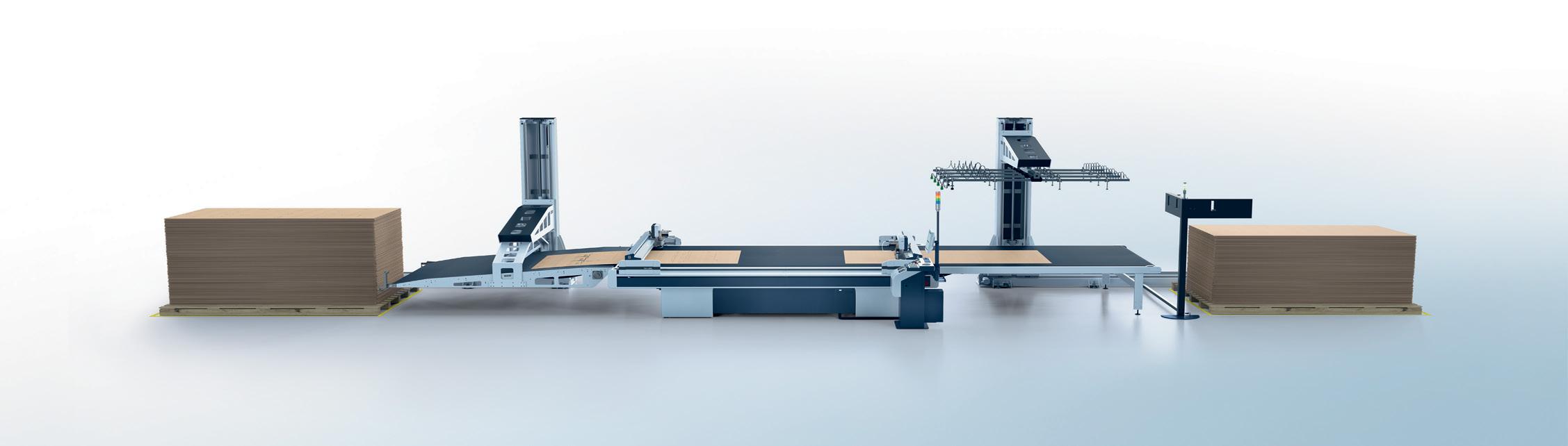

Digital cutting at an industrial level. Time to automate? #LetsTalkWorkflow! 1.5 m

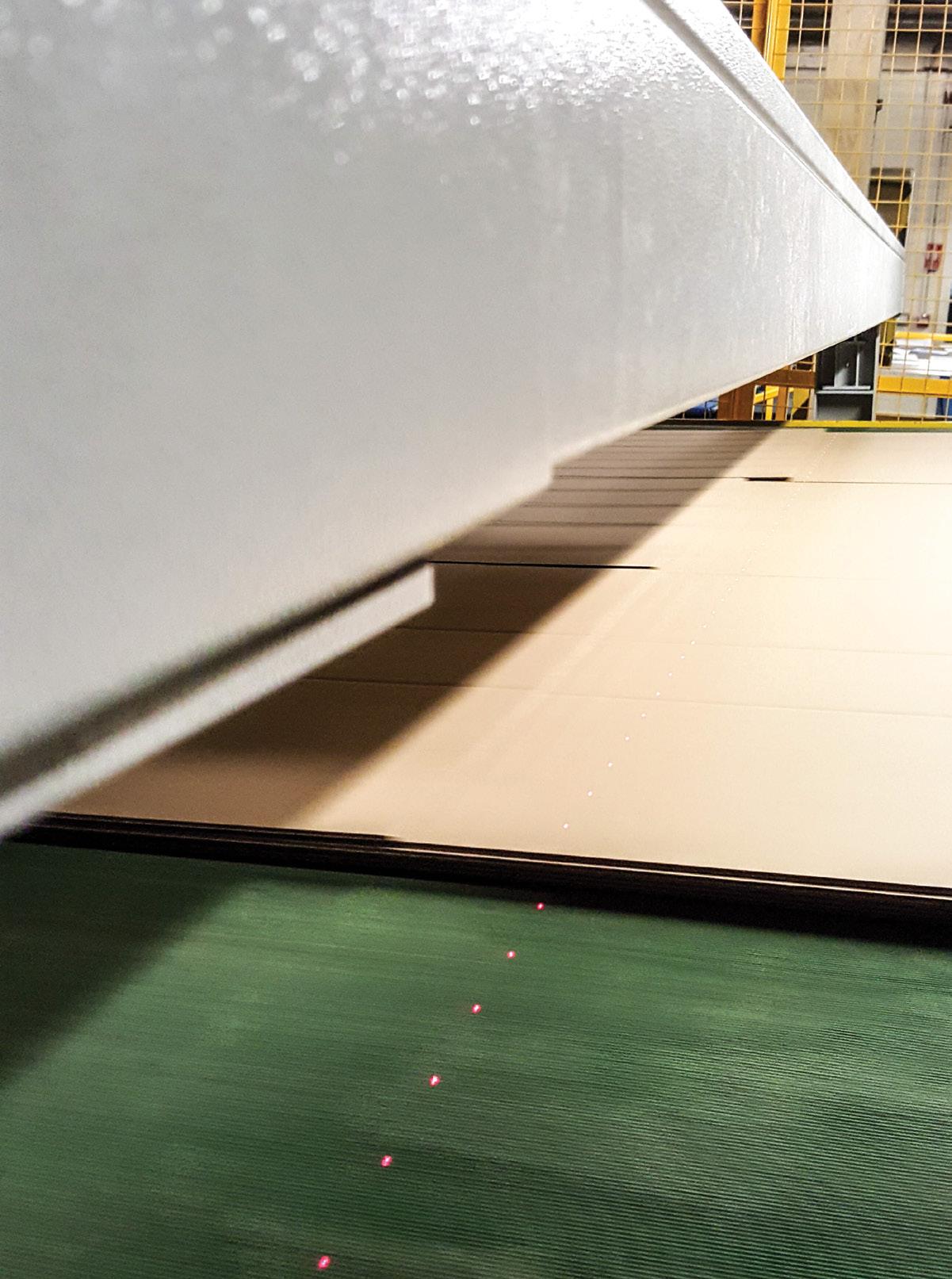

presence-sensing devices be placed on a testing schedule as the failure of these devices does not always lead to a fail-safe outcome. Lack of a testing schedule will eventually result in an injury or a willful OSHA violation. While conveyor rollers are not designed as machine guards, they often function as such, protecting moving parts beneath. While the focus may be placed on production machinery, do not treat missing conveyor rollers lightly. Conveyors should not be in operation without all rollers in place.

OSHA’s lockout/tagout (LOTO) standard is designed to prevent “caught in machinery”-type injuries. However, minimum compliance with the standard is not suffi cient in the corrugated industry. Th ere are complexities within corrugated machinery that the LOTO standard does not

account for. Keys, rather than locks, are used to de-energize many pieces of equipment. It is essential to verify that no two keys are cut the same for other equipment or for sections of the same equipment. It is also recommended that employees be trained annually rather than just upon their hire and when new equipment is introduced. LOTO machine-specifi c procedures should be reviewed annually for accuracy, in addition to the “periodic inspection” requirement of the standard. When reviewing machine-specifi c procedures, pay particular attention to the “verify isolation” step, which ensures the lockout was conducted properly, leaving the equipment completely de-energized.

2. Struck by Forklift

Although forklift injuries are infrequent, the injury outcome is almost

always severe. Aside from required training (upon hire and every three years) and pre-shift inspections, additional steps can be taken to lessen the chance of a pedestrian being struck by a forklift. Where possible, protect pedestrians from forklift traffi c with walls, protective rails, bollards, etc. For pedestrian and forklift intersections, strobes triggered by oncoming forklifts can be eff ective, as well as strategically placed mirrors. All forklifts should be equipped with blue light systems, which shine a blue dot on the fl oor ahead of the oncoming forklift. High-visibility shirts and vests can also help make pedestrians more visible to drivers. Th ere are so many variables with forklift and pedestrian interaction that a variety of preventive measures need to be considered.

The Board Handling System

BOXSCORE www.AICCbox.org 39

BHS150. infous@zund.com T: 414-433-0700 www.zund.com

3. Fall From Heights

Employees conducting work above 4 feet must be protected by a railing or must wear a fall-arrest system. The former is preferred over the latter as there are many variables to a fall-arrest system, including the fact that the user must put it on. Areas of fall exposure in the corrugated industry are as follows:

MEZZANINES

Where product is loaded or staged on overhead platforms, mezzanine safety gates should be considered instead of removable rails or chains. Flip gate systems provide 100% protection during this task.

LOADING DOCKS

If above 4 feet, dock doors must be closed when the dock is empty. All unprotected areas of the dock should be equipped with an approved railing (42-inch top rail, 21-inch midrail).

ROOF WORK

Roof work performed within 6 feet of the edge on a flat roof requires a fall-arrest system. When working 6–15 feet from

the edge, a warning line must be installed. When working on a pitched roof, a fall-arrest system is always required.

FIXED LADDERS

Fall protection systems are required to be installed on fi xed ladders greater than 24 feet in height. Existing fi xed ladders are grandfathered until 2036, at which time they must also be equipped. Self-closing safety gates are recommended at the top of each fi xed ladder.

SCISSOR AND AERIAL BOOM LIFTS

While OSHA mandates the use of fall-arrest systems only when operating an aerial boom lift and not a scissor lift, falls frequently occur from scissor lifts when occupants climb onto the protective railings. It is strongly recommended that company policy mandate the use of fall-arrest systems when working within scissor and aerial boom lifts.

CLEANING ON TOP OF MACHINERY

If cleaning tasks at heights above 4 feet are not contracted out, physical protection or a fall-arrest system must

be considered. If installing a fall-arrest system, it is recommended that an expert in the field be consulted as there are many variables.

4. Confined Spaces

Confined spaces are rarely discussed within the corrugated industry, yet they present a significant risk if handled improperly. Confined spaces in the corrugated industry often include storage tanks, pits beneath machinery, manholes, dust collection systems, and more. Almost all confined spaces can further be defined as “permit required” as they contain an internal hazard (atmospheric, physical, etc.). Dabbling in confined space entry is a recipe for disaster. Therefore, after assessing and labeling the space, the following should be considered.

PREVENT THE NEED TO ENTER

In many cases, pits beneath machinery are entered for cleaning purposes. Many companies have fi gured out ways to minimize scrap from entering these pits. In addition, they have utilized manual “grabbers” to pull out larger pieces of scrap and have implemented vacuuming systems to extract the remaining portions.

CONTRACT OUT CONFINED SPACE ENTRY

Permit-required confined space entry can be complex and costly. Infrequent entry usually results in improper entry with varied levels of compliance. It is recommended that confined space entries be preplanned and contracted out using a company that specializes in confined space entry.