We live in interesting times. Geopolitical and geostrategic factors are impacting confidence and exacerbating the already volatile and unpredictable economic environment. Growing awareness of impending environmental crises is generating increasing public and political pressure to make changes. And the mature markets are seeing demographic shifts that are having a profound impact on how both young and old see their roles in the workplace.

So interesting times are not good for business. Nowhere is that more true than in the petrochemical industry, which – at least in Europe – is coming under immense pressure to make changes and to do something about closing the plastics waste stream. Industry has been talking about environmental stewardship and sustainability for years – but the time for talking is over and it is now time to make some concrete changes.

The European Petrochemical Association’s (EPCA) Annual Meeting, which takes place this month in Berlin, comes therefore at a crucial time for the industry. While it may have recovered well in the past few years, after something of a slump following the 2008 financial crisis, that very success has helped to highlight some vital issues, and nowhere more so than in the areas of sustainable development and inefficiencies in the logistics sector.

It has been clear for years now that the petrochemical industry must work hard to attract, retain and develop young talent. In this, its efforts are in competition with other industries, which is bad news for a sector that has often struggled to present the sort of image that the young are likely to find attractive. And it is in youth that the industry will find the energy and the new ideas that will be needed to drive the transformation that is necessary – and increasingly urgent.

EPCA has worked hard in recent years to do something to change that image, by providing the space where its members can discuss the issues of talent and diversity in the workplace, and by promoting scientific and technical education in schools. But in this crucial year, EPCA’s Annual Meeting will also be looking in particular at developing leadership talent to drive the industry’s response to the need to become more sustainable.

Sustainability is also pressing on the supply chain and, while digitisation has made some headway in reducing inefficiency in the logistics function in recent years, there is still more to be done. The chemical supply chain in Europe has also been hit by infrastructure bottlenecks, with a lack of progress in improving the usability of rail, growing road congestion (not least around Antwerp) and disruption in inland waterway transport caused by more frequent occurrences of low water – something that may well be related to climate change.

All of these themes will be topics for discussion at EPCA’s Annual Meeting, which once more has drawn some very knowledgeable speakers and panellists. It has, as ever, also attracted a huge list of delegates, who attend as much for the business opportunities as for the speaker presentations.

However, this year more than ever, delegates should not miss the chance to sit in on those business sessions. The European petrochemical industry is in the midst of a period of fundamental transformation and businesses need all the help they can get to navigate what will inevitably be choppy waters ahead. HCB looks forward to seeing you in Berlin!

Peter Mackay

VOLUME

Letter from the Editor

Years Ago

by Training

Getting together

What to look for at EPCA

The road to sustainability

Talking to EPCA’s CEO Caroline Ciuciu

Plan your journey

Dirk Verstraeten takes the lead

Gathering thoughts EPCA’s SCPC works on the future

Change is gonna come Future on the agenda at FETSA

XL Med

Tarragona prepares for growth

Advantage Antwerp Standic’s plans for new terminal

Ready to roll Oiltanking’s new focus

Stronger together Eddyfi adds phased array

Get back to work Fast recoating from Jotun

News bulletin – storage terminals

Get off the road Antwerp aims for sustainability

Peter Mackay

Email:

Deputy Editor

Alex Roberts

Email:

Hands in pockets

Charterers face rising freight

News bulletin – tanker shipping

Sensor sensibility

Hoyer rolls out smart tanks

State of play

M&S’s view of the market

Man Oman

JTS expands out of UAE

Driving safety home

Chemical Express majors on training 66

The Italian job

Marcevaggi upgrades fleet 68 Bigger is better

Van Hool’s jumbo tanks for BASF 70 News bulletin – tanks and logistics

Now try the best Log4Chem says 4PLs have a role 79 Swiss state sells share

SBB commercialises freight 80

A new chapter

VTG prepares for the future 82 Progress by partnership Blackmer pumps in Spanish market 84 Smart cooperation

IMT strikes deal with NTtank 86

Future days

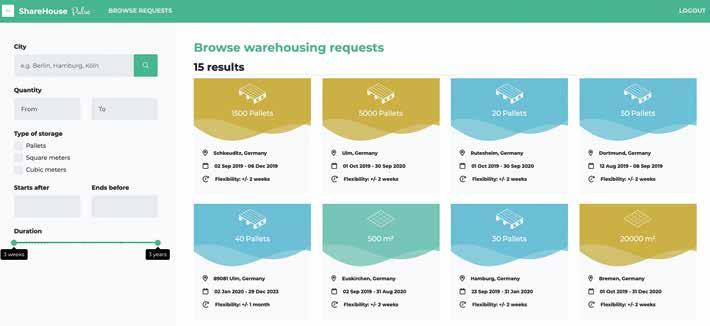

Fecc looks to youth 88 Window shopping E-commerce with GoBuyChem 91 Selecting the best Warehouse with ShareHouse 92

News

Perfecting production

to

Packwise smartens up

bulletin – industrial packaging

Training courses

Getting clinical

Clinital trials event comes to PA

Diary

Incident Log

Silver medal

CDI going strong at

Fixing a hole

Labelmaster survey identifies gaps

Devil in the detail

Joint Meeting looks at tanks

ça change

Same enforcement issues at VCA

all about it

Stay up to date with IATA

Not otherwise specified

Steel drum manufacturing survey

terminal equipment news

on tank container depots

market developments

Craig

Email:

Production Manager

Mitchell

Designer Natalie Clay

Cargo Media Ltd

Marlborough House

ISSN

Commercial Director

There was a time when the LNG industry was small; thirty years ago there were fewer than 100 LNG carriers in the entire world fleet, and massive barriers to entry kept it tight. It’s very different nowadays, with the trade in LNG having expanded immensely. But back in October 1989 HCB was one of the very few publications with any particular interest or expertise in the sector, and our issue led with news of the inauguration of the massive North West Shelf project in Australia and an overview of world LNG trade and ships on order.

In that issue we also looked at the bulk liquid chemicals trades, with an overview of the chemical tanker market and an article on the opening of Stolt Tankers & Terminals’ new storage and distribution hub in Houston. In those days, we felt it necessary to put air-quotes around ‘hub’ as it was such a new-fangled term, as well as around ‘owner’s berth’ – Stolt-Nielsen was looking to improve its own tanker efficiencies in one of the world’s major bulk liquids ports by having its own terminal with berths reserved for its own ships.

One innovation that we reported on in October 1989 did not come off: this was a new design for a ‘bottle tanker’ for the transport of liquid chemicals on shortsea and river trades in Europe.

But perhaps the item in the October 1989 issue that has most resonance today was the comment piece by editor Mike Corkhill, in which he highlighted the growing practice of outsourcing waste treatment and the increasing volume of maritime trade in hazardous wastes. His comments were sparked in part by militant action by Greenpeace against shipments of PCB-contaminated waste from Canada to the UK.

He pointed out that the UK was equipped with specialist waste treatment units capable of handling such material, in contrast to the position in Quebec, and that the material is not particularly hazardous in transport. Therefore, such trade should be supported, not attacked.

On the other hand, he also made the following point: “We must also strive to ensure that the invidious practice of dumping hazardous wastes in developing countries, which has sprung up in recent years, is halted forthwith and that efforts to minimise the generation of such materials at sources are given a high priority.”

Spool forward thirty years and public concern has swung round from obviously hazardous pollutants to the apparently more benign issue of waste plastics. Recent publicity highlighting the dangers that plastics pollution presents to the world’s oceans – and to humans and all other animals on the plant – has coincided with China’s decision to ban the import of plastics and other wastes, a ban that has been mirrored by other Asian nations. Those bans have forced consumers and industrial producers and users in the developed world to look more closely at how they can prevent such waste from being generated at all.

And that will provide a big challenge to the European petrochemical industry in the years to come. Indeed, so great is that challenge that the European Petrochemical Association (EPCA) has put sustainability in general and plastics pollution in particular high on its agenda in the conference sessions at its Annual Meeting this month.

I’d like to tell you something about behavioural safety. As a professional trainer in our industry I developed a two-day course called BBS, Behaviour Based Safety, which in fact is a voyage into oneself. The course concentrates on self-reflection and psychology because students don’t often ask themselves why they behave in a certain, sometimes dangerous manner. Neither do they often realise that stress can lead to narrowmindedness.

Ethics is a condition for safety, because it means ‘doing the right thing.’ But what happens when someone who believes he is doing the right thing is doing it wrong? People are not flawless, they make mistakes or perceive situations differently. A good start is to understand ourselves and specifically our own brain.

Different parts of the brain have different responses to decision making. Understanding that people actually have three brains might help.

1. If the decision has to do with what is perceived as danger, the first, Reptilian brain will respond fast and instinctively.

2. If the decision has to do with relationships and emotions, the second, Mammalian brain will take more time to respond based on feelings and emotions.

3. If the decision has to do with an analytical challenge, the third, Neocortex brain weighs options and demands careful deliberation.

Reptilian Brain - Instinct (survival, breathing/swallowing/heartbeat, startle response). The brain stem is the reptilian brain. It is a remnant of our prehistoric past. The reptilian brain acts on stimulus and response. It is useful for quick decisions without thinking. It focuses on survival and takes over when you are in danger and you don’t have

time to think. In a world of survival of the fittest, the reptilian brain is concerned with getting food and keeping you from becoming food. The reptilian brain is fear-driven and takes over when you feel threatened or endangered. Fear is a survival mechanism. It triggers the Fight, Flight or Freeze response: faster breathing, increased heart rate, higher blood pressure and metabolism, muscle tension, dizziness, headache, alertness, improved hearing, seeing, getting stronger, faster by stress hormones (adrenaline) (these reactions are unconscious). Limbic System - Emotion (feelings, relationship/nurturing, images and dreams, play). The modules that lie beneath the corpus callosum are known as the limbic system. This area is older than the cortex in evolutionary terms and is also known as the Mammalian brain because it is thought to have first emerged in mammals. This part of the brain, and even that below it, is unconscious, and yet has a profound effect on our experience because it is densely connected to the conscious cortex above it and constantly feeds information upwards. The limbic stem is the root of emotions and feelings. It affects moods and bodily functions. Neocortex - Thought (including planning, language, logic & will, awareness). The neocortex is the most evolutionary advanced part of your brain. It governs your ability to speak, think, and solve problems. The neocortex affects your creativity and your ability to learn. The neocortex makes up about 80 per cent of the brain.

This is the latest in a series of articles by Arend van Campen, founder of TankTerminalTraining. More information on the company’s activities can be found at www.tankterminaltraining.com. Those interested in responding personally can contact him directly at arendvc@tankterminaltraining.com.

The European Petrochemical Association’s (EPCA) 53rd Annual Meeting, which opens its doors to delegates on 6 October in Berlin, comes at what EPCA CEO Caroline Ciuciu describes as a “crucial year” for the industry. Geopolitical and global economic stresses are posing challenges for Europe’s chemical manufacturers and their logistics partners.

EPCA’s role lies in helping its members navigate this evolving world, not to lobby for it, and so its Annual Meeting will present the results of ongoing work in three main areas that is designed to provide industry with the tools it needs. Specifically, these involve the promotion of relevant education in scientific and technical areas, the attraction of new and diverse talent to

the industry, and research into ways of improving efficiency and sustainability in the supply chain.

EPCA’s Annual Meeting always provides a locus for discussion, not just through the various business sessions that take place over the four days of the event but also through the unrivalled opportunities it provides for attendees to meet industry leaders and external stakeholders.

The theme of this year’s EPCA Annual Meeting is ‘Writing Together the Next Chapter of the European Petrochemical Industry’, reflecting its belief that it is the community of chemical producers, specialist logistics providers and their strategic partners down the supply chain that are best placed to develop the way forward. EPCA stands for connecting, for sharing knowledge and forward thinking that can contribute to greater efficiency and sustainability in the sector. That means finding practical ways to strengthen cooperation between partners across the value chain and embed innovative thinking into industrial strategies, with the aim of generating sustainable growth in Europe.

To help that process, EPCA has brought in some high-profile speakers who will provide delegates with knowledge to inform their decision-making as industry faces up to the uncertain future. To start the event, Paul Romer, co-winner of the 2018 Nobel Prize in Economic Sciences, will speak about ‘growth economics’;

the chemical industry is a prime motor of economic development, both in the developed and developing areas of the world, and has an important role to play in ensuring that growth is maintained. Recent game-changing investments in Europe announced by major international producers show that the region still has the potential to play that role.

But that growth can come at a price and the petrochemical industry is having to deal with growing concern over plastics pollution. Finding a way to close the plastics recycling loop is a major task and one that will require innovation to solve. This topic will be debated during the EPCA Annual Meeting by Tom Crotty, INEOS Group managing director, and Patrick Labat, senior executive vice-president, northern Europe at Veolia, one of the founding members of the Alliance to End Plastic Waste (AEPW).

On the topic of sustainability, regular visitors to the EPCA Annual Meeting will notice some changes this year, not least the absence of a bag full of printed material. The attendance

booklet and other publications will instead be available on the EPCA website and on a dedicated mobile app.

The magnitude of sustainability challenges demands transformational changes that require some reengineering of business as well as new social skills and competences. Addressing issues of recycling and sustainability will inevitably require new approaches, which may be best managed by attracting young talent with energy and new ideas to put them into practice.

Not only does that talent need to be brought into the industry, it also needs to be developed, as the young people joining the chemical industry today will be its leaders tomorrow. How current business leaders can embrace these challenges and develop the right competences to take industry forward will be discussed in the business session on 'Talent of Today, Leaders of Tomorrow', with keynote presentations from Stephen Hahn-Griffiths, chief »

reputation officer at the Reputation Institute, and Professor Wayne Visser, holder of the BASF-Port of Antwerp-Randstad Chair in Sustainable Transformation at the Antwerp Management School, who is supporting EPCA in exploring the concept of sustainability leadership.

For the fourth time, the EPCA Annual Meeting will also play host to the Grand Finals of the European Youth Debating Competition, where participants will present their ideas for shaping a sustainable future for plastics and petrochemicals.

The competition is more than just about winning prizes: it draws together students between the ages of 16 and 19 from across Europe, representing different origins, genders, ages and

cultures, and highlights the importance of science, technology, engineering and mathematics (STEM) education. In addition, participants gain soft skills that will help them interact in a fast-changing and sometimes divisive environment.

HCB readers may be most interested in the business session on logistics and supply chain issues, which has the theme of ‘Investing in Infrastructure in Europe for Strategic and Sustainable Supply Chains’. Under the new chairmanship of Dirk Verstraeten, director of global logistics procurement at Covestro

Deutschland, EPCA’s Supply Chain Program Committee (SCPC) is focusing on the strategic importance of transport infrastructure in Europe as a key asset for the sustained and sustainable growth of the European petrochemical sector and industry at large.

The session will emphasise the contribution that transport and storage infrastructure can make in terms of meeting the economic, energy and sustainability challenges of today and of the future, as well as the need to foster investment in new capacity and upgrading existing assets. In particular, given the projected 30 per cent increase in freight transport over the next ten years, Europe will need to shift further towards »

intermodal transport, which will bring rail infrastructure squarely into the spotlight.

With that in mind, the logistics and supply chain business session will feature presentations by Jacques Vandermeiren, CEO of the Port of Antwerp, Clemens Först, spokesman of the board of Rail Cargo Group and chair of the CEO Group at UIC and CER, and Bernhard Kunz, managing director of Hupac Group.

Prior to that, though, there will be a ‘Digital Café Workshop’ on innovation and digitisation in petrochemical supply chain, facilitated by Professor Ann Vereecke, partner at Vlerick Business School, who worked closely with EPCA on a joint study published in 2017 and a seminar in Brussels in June 2018 on the topic of digitisation, which sought to identify the extent to which the chemical supply

chain has embraced digitisation and the benefits enjoyed by those who are leading the journey towards the Industry 4.0 future.

EPCA feels that, with digitisation really picking up speed in the sector, the time is right to tackle some of the larger digital transformation challenges. One particularly interesting concept that touches upon both digitisation and climate change, is the circular economy and how new business models, some of which are ‘digital-by-design’, can facilitate that transformation.

This session is strictly limited in size and attendance is by invitation only.

Wrapping up the 2019 EPCA Annual Meeting,

the closing lunch on 9 October will feature a speech by Pascal Lamy, director general of the World Trade Organisation (WTO) from 2005 to 2013, who promises to provide delegates with his interpretation of the fast-changing geopolitical and current turbulent trading environments and give an insight into how he sees future relations between Europe, the US, Russia and China developing under a more protectionist new world order.

Pascal Lamy is ideally placed to help Europe’s businesses reflect on the current geopolitical and trade environments and choose the appropriate paths to prosper, in cooperationwith their strategic partners around the world, and to reinvent themselves to continue to deliver sustainable and sustained economic growth in the evolving world ahead. HCB

When the doors open on the 53rd Annual Meeting of the European Petrochemical Association (EPCA) in Berlin on 6 October, it marks not just the start of four days of intense discussions and debates, but the opportunity to finally share with the wide EPCA community the outcomes of intense preparatory work for EPCA CEO Caroline Ciuciu and her team.

Not that Ciuciu is daunted by the task. “It’s a privilege and true pleasure to elaborate a programme that reflects the environment in which our sector operates, its challenges and opportunities and to engage with all these seasoned experts,” she says, referring not just to the list of high-profile speakers lined up for the Annual Meeting’s business sessions, but also the members of the Board of Directors and the three advisory bodies (SCPC, TDIC and YETT) of EPCA itself.

“We are pursuing our transformation journey initiated in 2017,” Ciuciu says. She sees EPCA not only as a major business network in Europe for the sector but also as a ‘knowledge centre’ and considers that this year is part of a transformational journey that the industry and the Association itself are on.

“It is important to continue the journey,” Ciuciu adds, “and to talk about the more unusual developments that are coming.”

Some of those developments have been investigated through collaboration with academic institutions, such as the work done with Vlerick Business School on digitisation in the

Left: Caroline Ciuciu, EPCA CEO

petrochemical supply chain since 2017 with the support of the Supply Chain Program Committee (SCPC). This generated a report in 2018 that identified a baseline in the application of digitised systems among both chemical producers and their logistics service providers, which was followed up by a workshop in Brussels in June 2018. This work was instrumental in identifying the level of awareness of digitisation within our sector, the drivers for transformation, inspiring case studies and the change in mindset needed to reap the full benefits.

Building on that work, this month’s Annual Meeting will focus on digitisation as an enabler for a sustainable future. There are, Ciuciu says, a lot of technologies and platforms already available that can be applied to improving operational efficiency, asset utilisation and customer services, but digitisation can also bring other benefits and the Annual Meeting will look in particular at the intersection of digitisation and sustainability, including ecoefficiency and other emerging practices.

EPCA wants to support its member companies in identifying existing solutions that can improve processes and planning, again in collaboration with Vlerick Business School, whose partner Ann Vereecke will lead a ‘Digital Café’ workshop during the Annual Meeting where participants will be able to discuss their experiences and their needs. “I’m really enthusiastic about this programme, which will unfold some new developments illustrating how digitisation is growing in scope and magnitude and which will offer the possibility to discuss and shape a path forward together to approximately 90 delegates,” Ciuciu says. Initiatives such as this are just one way in which »

EPCA can support its members and, she adds, there will be more to come next year.

EPCA is also continuing to promote science, technology, engineering and mathematics (STEM) education, not least through the European Youth Debating Competition, which will hold its Grand Finals during the Annual Meeting for the fourth year in succession. The Association is also part of STEM Alliance, a cross-industry partnership devoted to the promotion of STEM education, and EPCA is participating in direct contact with schools via webinars with teachers and students.

Over the year several ‘online chats’ were organised by the STEM Alliance on the topic of STEM careers in the petrochemical industry, in which several industry representatives enthusiastically participated.

EPCA is serving as a bridge between industry and schools, fostering dialogues between students, teachers and industry representatives. “This is ongoing work,” Ciuciu notes. She is very enthusiastic about this mission and reports that EPCA’s members are being both very supportive and contributive.

EPCA’s Talent & Diversity Inclusion Council (TDIC) has explored this year ‘individual sustainability leadership’ and this will be reflected

in a session on the theme of ‘Petrochemicals: An Industry where You Make an Impact!’.

EPCA began work on a research study earlier this year in order to understand the main competencies and talents that define sustainability leaders and to gather more evidence on the employee benefits of individual leadership, especially – for example – how it can attract and retain talent to the industry and develop today’s talent into tomorrow’s leaders. This new research was triggered by the results of the EPCA study on age diversity finalised in 2018 and by the magnitude of sustainability challenges many industrial sectors are confronted with, that demand transformational changes requiring both reengineering of business and new social and leadership skills.

Led by Prof Wayne Visser, holder of the BASF-Port of Antwerp Randstad Chair in Sustainable Transformation at the Antwerp Management School, this research involved interviews with thought leaders in the petrochemical and other technology sectors, together with a literature review. Prof Visser will be speaking again this year at the Annual Meeting and will share the final results during the renamed ‘Talents of Today, Leaders of Tomorrow’ session.

The ultimate aim of all this work, Ciuciu explains, is to bring meaningful and inspiring perspectives from external experts, front-runners

within the industry and other sectors. It is not enough to merely attract talent; industry has to develop that talent in order to support it in its transformation to meet the demands of a sustainable future.

EPCA’s 53rd Annual Meeting comes at a time of political and institutional renewal in the EU, with elections for the European Parliament, the appointment of a new European Commission, and the as-yet uncertain outcome of the Brexit process. Amidst all that, there have been what Ciuciu terms “game-changing investment” announced in the petrochemical industry in Europe, notably within the Antwerp chemical cluster.

At the same time, several initiatives are flourishing within the industry and its strategic partners along the value chain to develop innovative solutions towards greater circularity. This is saving resources, enhancing the reuse and recycling of valuable products and assets, and reducing the overall environmental footprint of today’s society. EPCA continues to act as a hub where those interests can come together and write the next chapter of the European petrochemical industry.

How can the European petrochemical industry reinvent itself to continue to deliver sustained and »

sustainable economic growth in an ever-changing economic and geopolitical environment? That question will be addressed in various ways during the 2019 Annual Meeting, with Ciuciu pointing in particular to the opening session, where Nobel Prize-winning economist Paul Romer will expand on his theory of the connection between regulation, innovation and growth creation.

Tom Crotty, director of INEOS Group, and Patrick Labat, senior executive vice-president Northern Europe, member of the Executive Committee Veolia will share their vision on the contribution of the petrochemical value chain from upstream to downstream to long-term growth.

Sustainability is also the focus of EPCA’s work in the petrochemical supply chain, which is, Ciuciu says, “crucial to security supply”. A series of incidents over the last few years, such as the Rastatt incident in 2017 which disrupted supply chains along the south-west rail corridor and throughout Europe, or the extreme low water levels on the Rhine river in the second part of 2018 highlighted how key reliable, modernised, efficient and well-connected infrastructures are for the petrochemical industry.

“The planned increase of 30 per cent in freight transport in Europe on the horizon 2030, combined with the requirements of the Paris Agreement in terms of greenhouse gas emissions reduction by the same deadline, impose a reality check on the state of the existing infrastructures and the measures that need to be put in place to truly connect the two expressions of a challenging equation,” Ciuciu says. EPCA wants to identify where the bottlenecks are and how operators can come together to improve efficiency.

“We have to focus on what is ahead of us and how each player can contribute to writing the next chapter and continue the success of the industry,” Ciuciu says. One part of that focus will be the closing lunch at the 2019 Annual Meeting, where Pascal Lamy, former director general of the World Trade Organisation (WTO), will address topics of particular relevance at the moment, not least the future of trade relations in the current polarised world.

EPCA’s role is to support its members, identify the upcoming hurdles as well as best practices and innovative initiatives, and share this knowledge within its wide community. And, as Ciuciu says, EPCA’s members are recognising the value in that effort and are playing their part.

There is growing participation in EPCA’s three committees - the Supply Chain Program Committee (SCPC), YETT and TDIC – and Ciuciu says she is glad to see new members coming forward to take part.

“We have gathered great people in these committees exhibiting a wide range of indepth expertise and experience,” she says.

“These industry experts are the ones who help us build our yearly programme, put us in the right direction and create inspiring projects together. That is certainly a reflection of the industry at large.”

To support EPCA’s mission, several professionals with complementary background have joined the team over the last two years. The latest recruit is Gerardo Ambrosecchia, who serves as project manager in charge of SCPC and TDIC activities and projects, who arrived on 1 July 2019. Bringing in diverse background and competencies is also part of the transformation EPCA is going through in order to continue meeting the evolving expectations of the EPCA customers, its more than 700 member companies. HCB

Dirk Verstraeten, director of global logistics procurement at Covestro Deutschland, became chair of the European Petrochemical Association’s (EPCA) Supply Chain Program Committee (SCPC) in November 2018. He took over from Bertschi’s sales director Johan Devos, who had been in the role for an unprecedented five years, in a transition that normally sees the chair alternating between representatives of the chemical industry and their logistics service providers (LSPs).

“Although people come and go, the SCPC team has the crème de le crème in supply chain and logistics specialists both from manufacturing and service providers side,” Verstraeten says. “We were also very pleased to see that the EPCA team has been enlarged with the arrival of Gerardo Ambrosecchia as a project manager. The EPCA teams are getting stronger, which allows us to create more value.”

Less than a year into his planned three-year term in the role, Verstraeten tells HCB that he would like to identify a topic for the SCPC to look at during his tenure; over the coming year EPCA and the Committee could engage with that topic; in his final year, he hopes to be able to deliver a report and implement a project supported by EPCA.

So what is this big idea? As with all EPCA activities it is part of a journey, and one that was started by Johan Devos in 2017. Digitisation was one of those waves that starts with a

buzzword and takes off; those waves, Verstraeten says, always start with the customer. In the case of digitisation, those customers had become used to the practice of home shopping, with its live tracking of parcels and seamless online payments.

In the chemical industry, such transparency has historically been missing. “You put your cargo on a ship and hope that it will get to the destination,” is how Verstraeten explains it.

But having picked up on that topic, EPCA went to work in its normal way, engaging with academia – in this case Vlerick Business School – and doing some research, before issuing a report (in 2018) and following up with a workshop in Brussels in June 2018 at Vlerick’s site in Brussels.

It is, Verstraeten says, vital to work with an external eye if EPCA is to generate value that its members do not necessarily have the time or the expertise to deliver. The Brussels workshop in particular led to lots of ideas and lots of talk.

“It was a great event,” Verstraeten says. It also revealed that everyone is doing something in the realm of digitisation, addressing their own needs with the technologies available. Furthermore, it confirmed the earlier research that indicated that the petrochemical industry is behind the curve, and set some priorities for taking the process forward.

Verstraten says he likes the way the conversation is going on digitisation and hopes to follow this up during his chairmanship, to see if digitisation will turn into a full-blown enabler for business transformation.

This is where digitisation dovetails with the next wave: sustainability. “The next big challenge could »

very well be the circular economy,” Verstraeten says. “Just like digitisation, this new challenge seems to be coming from customers. One just needs to observe the next generation and their behaviour and expectations. For sure this will trigger again attention and projects within the chemical industry and this could very well change our supply chains.”

The younger generation wants a circular economy with less (ideally no) waste and, potentially, no plastics. “That doesn’t fit with traditional ways of doing business,” Verstraeten says. “It’s scary – but important.” And it is nowhere more important than in the petrochemical industry, supplier of those very plastics to which upcoming generations are so antipathetic.

The demands for sustainability present a big challenge to the chemical industry but the industry has to acknowledge the inevitability of the change, which is built into the mentality of younger generations, who merely want to use things and see no reason to own things any more.

The world is unlikely to do without plastics altogether and even environmental groups

recognise that the characteristics of plastics – their malleability and longevity – make them extremely useful in certain long-term applications. What is needed is greater awareness of the need to collect, recycle and re-use plastics at the end of their initial life; the petrochemical industry has now established a $1.5bn fund to change behaviour and teach industry and the public how to handle and use plastics more responsibly.

“It’s a joint effort,” Verstraeten notes.

Verstraeten’s time as the chair of SCPC will, therefore, concentrate on the intersection of digitisation and supply chain sustainability.

As with the focus on digitisation, this responds to the concerns of EPCA’s members in respect of structural and infrastructure issues in European transport: increasing road congestion, the challenges presented by the existing rail network, and low water on the Rhine.

Each of these factors impacts the effectiveness and efficiency of the European chemical supply

chain and, certainly when it comes to low river levels, they may also be related to climate change. There is certainly a connection with the idea of sustainability and this is the question that Verstraeten would like to see answered: what potential is there for digitisation to make a difference for sustainability?

Some work has started on this question, again with the collaboration of Vlerick Business School, but the 2019 EPCA Annual Meeting provides an ideal opportunity to take the conversation forward.

To do that, it was agreed that it would be useful to hold a ‘Digital Café’ during the Annual Meeting. This concept was used to good effect at the 2018 workshop on digitisation in Brussels and will once again be moderated by Ann Vereeke, partner at Vlerick Business School.

The Digital Café will create a framework for a series of short and tightly focused discussions in a small round-table format, with strictly limited participation, with the aim of discussing the impact of sustainability and climate change on the chemical supply chain and identifying whether there is an intersection with digitisation. “We want »

to see what the group feels,” Verstraeten says, “and though it may be early days perhaps we can inspire our members to adjust their mindsets.”

“At the end of the day, we’re trying to provide a service to our members,” Verstraeten says. “If this is a topic they want help with, we will look more deeply into it.”

One obvious route to delivering a more sustainable supply chain is the use of intermodal transport, which implies greater use of rail. But over recent years, issues such as the Rastatt closure and

continued problems with interoperability have put a limit on how prepared the chemical industry has been to embrace the rail mode.

It comes as no surprise, then, that the logistics and supply chain business session during EPCA’s 2019 Annual Meeting will have a strong focus on rail, with presentations by Clemens Först, spokesman of the board of Rail Cargo Group, and Bernhard Kunz, managing director of Hupac Group. Verstraeten says: “There is a lot of development coming in rail, especially around Antwerp,” which is timely given the planned roadworks that will temporarily add to road congestion around the port. Först and Kunz

will be joined at the session by Jacques Vandermeiren, CEO of the Port of Antwerp, which hosts Europe’s largest integrated oil and chemical cluster and the selected location of megainvestments for the sector. Vandermeiren will illustrate the strategic role that ports like Antwerp play today in the security of the supply of the European petrochemical industry, the supply chain of which is not only regional but global.

“We will also touch on pipelines as a valid alternative and actually one of the most efficient ways of moving big material flows,” Verstraeten says, concluding by saying: “It’s a journey. We need to bring some value to EPCA members and open their eyes.” HCB

The European Petrochemical Association (EPCA) meeting provides chemical and petrochemical manufacturers, future customers and logistics service providers the opportunity to meet and discuss developments on key topics. The global chemical business community can network, collaborate and receive expert insights from a line-up of world-class speakers on topics that affect the industry daily.

There have been some incredible developments in technology and operations since the last EPCA meeting, but there has also been the spectre of issues old and new. Industry is always evolving and EPCA’s Annual Meeting is the perfect opportunity for industry leaders to stay abreast and reflect upon international market developments as well as technological and societal trends.

The Safety and Quality Assessment for Sustainability (SQAS) is a cornerstone within the petrochemical industry, established by the European Chemical Industry Council (Cefic) with the aim of providing the best insight into the current strengths of and ways in which future service providers might improve. Chemical »

companies can use the SQAS assessment reports during selection processes of new service providers and for evaluating existing service providers. SQAS reports are used to support the dialogue between chemical companies and logistics service providers as part of a continuous improvement process.

Peter Devos, managing director of the European Chemical Transport Association (ECTA), explains: “Alongside Cefic, ECTA has created the SQAS Task Force. This has led us to put recommendations in place, some of which have already been proposed to the SQAS assembly. We are very pleased to have the collaboration and SQAS remains a key pillar in the responsible care programme. With the new Cefic management team and the SQAS Task Force we will be able to move forward.

“With the Task Force, we agreed we had to do something because, when looking at new organisations, from a procurement point of view, they can ask ‘what is your score? Do you have a certificate?’ We want to make sure it’s fully understood and properly positioned in every company and we can move forward with a common understanding and respect for the effort being put in to responsible care.”

“SQAS is very important for our industry,” says Jan Arnet, Group CEO at Bertschi. “Most recently, companies had to increase quality, particularly when market volumes were enormously high. Supply chain departments and procurement departments had to increase quality, which led to them wanting to do their own audits of key suppliers. This slightly damaged the use of SQAS in the industry but, throughout the year, many businesses realised that SQAS was the best standard and the most effective tool to assess companies.”

Devos explains that there will be more publicity from SQAS: “I think the problem with SQAS is that is has been around for 25 years and people take it for granted. Organisations and people are changing, and we need to put SQAS back on top. Priority topics such as safety, security, compliance and responsible care are pivotal. However, during busy times these topics tend to slip down the list. We need to do this together, which is another reason why the Task Force is so important, to make sure that this remains a priority while investigating new opportunities.”

“We still believe in SQAS,” Devos stresses.

GET THE PEOPLE IN Encouraging talent to the chemical industry is nothing new and the problem has been challenging. Members of EPCA mentioned their concerns about the recruitment and retention of talent at last year’s Annual Meeting and members are still discussing it today.

“I believe the chemical industry is still very attractive for people to join, but the right initiatives need to be undertaken to improve upon it,” comments Leo Brand, global ICT director at Vopak.

“I think EPCA is doing well when looking at encouraging new talent to join the industry,” says Jean-Marc Viallatte, vice-president supply chain at Arkema. “Overall, the issue of recruiting and retaining talent is getting far more visibility, leading to developments in finding the best way to attract new employees.”

“We need to present our industry in a more positive light to society,” says Arnet. “The chemical industry is still seen as old-fashioned and harmful to the environment, but this isn’t the case – we need to do more to reflect this. This will be the first step to attract talent as people want a greater sense of meaning in their professional lives and see something good for the future generations.

“Industry needs to communicate in a more efficient way about its contribution to solving complex global challenges, especially on social media,” Arnet adds. “This will require collaborations and even financial investment from businesses to target future talent. We need to remember that this is not just about office workers, marketing teams or customer services, it’s also about the drivers, terminal workers, production teams and more. Everyone needs to be encouraged.”

“If you look back over the last year, everybody was searching for talent in every discipline,” adds Devos. “Resources to recruit have been scarce the past 12 months and I don’t think it has improved as they should have. People are still trying to fill vacancies and employment rates are low. Seeking talent and retaining people remain priorities, but will they still be priorities in six months?”

Brand explains: “I think digitisation plays an important part in making the industry more attractive. The moment we are able to fully digitise our operations, we take people out of hazardous environments as assets can be managed remotely. The workforce will become different as it

will require far greater digital skills, but also remote working can attract a different group of people to the industry which was not possible before.

“In the future there could be a robot in every tank performing inspections without having to stop operations. It’s a huge development. We are a strong believer in this kind of technological development that stops people being at risk,” Brand says.

“The best advocate we can have is showing that we are bringing in results. We are promoting supply chains by showing that we can make a change,” concludes Viallatte.

The implementation of digital solutions and connectivity in the industry has revealed opportunities. Last year, EPCA members that were discussing how to prepare different sectors of their businesses for digitisation are now speaking in terms of utilising the new processes.

Brand says, “[2018] was a wake-up call. We told members that they really need to start developing and translating these new technologies to their business. Companies are definitely becoming more knowledgeable and embracing the initiatives on what they should actually do when it comes to digitisation. There has been a

significantly higher interest in the topic itself in recent months.”

“There are plenty of digitisation projects going on,” enthuses Viallatte. “Most of these are in the design stage but we have projects covering everything from track and trace to increased integration and more. New means of collaboration for teams internally have been developed in the past 12 months. For us, this is a top priority. It’s been incredibly busy.”

Arguably, the main hurdle to jump when wanting to use digitisation as an industry-wide process is crafting a standard for the sharing of information. “To some extent, companies have been more open to sharing data recently. For example, there

is currently a project underway where each business is transparently sharing their production plans. Not all details can be shared as companies often prefer to keep things to themselves in the development phase,” says Viallatte.

When discussing the willingness for businesses to share information and how much visibility should be provided, Arnet explains that “in European land transport, the sharing of data can cover the loading location, unloading location, volumes, products and more. This is where companies get hesitant to share their information. I predict that sharing of data will become very common within just a few years. There is simply no alternative for it when going for supply chain transparency.” »

Arnet believes that the conversations at this year’s EPCA Annual Meeting will shift to how digitisation can be standardised. “Initially, digitisation can involve a lot of manual effort and processes until things can be succinctly shared. We are busy trying to standardise data coming from our suppliers of all sectors to be put into a format that can be used to inform customers.

“It also depends on what people are talking about with specifics to digitisation. One needs to appreciate that if you are speaking to customers, they are interested in visibility, trend predictions and alerts – it’s very end-goal focused. But if you speak to the supply chain businesses this is where the conversation changes to what type of data needs to be shared and in what way this can be done.”

Arnet continues: “The sharing of information is a second step. I believe the first step is to discuss what kind of data should be exchanged and in what format. Over the last 12 months businesses have realised it isn’t as easy as it sounds to share information, as all of us – shippers, logistics providers, trailer operators – are working with different data. Even if the willingness to share information exists, there is a way to go in finding the best way to share information.”

“I think the interest in discussing digitisation will be higher at this year’s meeting and people will be discussing their own experiences, struggles and challenges with digitisation,” adds Brand. “It will

become a more mature discussion than previous years. I see different members recognising the need for collaboration and sharing data, so they are starting initiatives in this area. This is a very good sign, but how quick and successful it will be remains to be seen.

“As a comparison, eight oil and gas companies and four banks successfully launched their community initiative in November to standardise data exchange. This has created huge savings already as it would previously take three months to close a deal, but it can now be done in 10 minutes. Although initiatives in the chemical industry will be a little different, I feel this is a nice example of what it possible.” »

Below: Leo Brand

“Digitisation within companies is a journey,” Devos states. “It’s not something that you ever fully achieve because, as new technologies emerge, you need to search for new opportunities. It’s not only about data and visibility, but it’s also about integrating new sensors and technology into existing systems to keep progressing. This of course takes time and is not something that will happen overnight. Digitisation is a topic that, I think, will be around for at least another four years as it is an enabler to achieve a better service,

higher compliance, higher sustainability levels and more,” says Devos.

The members of EPCA believe there is every reason to be positive about the next 12 months, even with the unknown implications of issues such as Brexit and continuing global trade wars.

Looking forward, Arnet hopes for “more agile supply chains” to provide support for the uncertainty that has been growing in the industry but is swift to point out the healthy consumption in

the industry is predicted to continue. “As long as companies can deliver through their supply chains, they will succeed,” Arnet says.

“People will need to wait and see how the recent global trade wars pan out – but this is a bit like predicting Brexit; impossible,” adds Devos.

Arnet continues: “I think one of the big talking points at this year’s EPCA will be around climate change. I’m pretty sure this will affect our industry a lot, particularly when developing circular economies, as we are using oil as a main product. The more opportunities there are to do things such as reusing oil, the longer our industry will survive. This also ties in with retaining talent – if we can prove to society that we are circular, it will become far more attractive.”

ECTA thinks that looking to the East is where the next chapter of the industry lies. “There are definitely new markets in Asia,” says Devos. “We are seeing a shift in manufacturing volumes towards Asia. From a chemical logistics point of view, third-party logistics service providers will follow this evolution. What we have to do as logistics service providers is to keep this market agility in mind as things can change rapidly. Markets are developing in Asia which can lead to new possibilities and a prime opportunity to see how the industry can adapt its trade links and learn new ways of conducting logistics and intermodal transport.”

However, Viallatte says: “There is some opportunity with new routes opening towards the east, but it doesn’t seem to be a game changer and is more of a minor adaptation that businesses are accommodating. Looking at European operations, it still seems to be very western Europe-centric.”

“Focusing on chemical markets, I think there is an opportunity for people to optimise the way in which business is conducted and logistical changes,” adds Brand. “Another topic of conversation this year will likely be on the shortage of drivers across the industry.”

The concluding words from Brand are one of ambition and collaboration for those attending the Annual Meeting in Berlin: “My message to EPCA members would be to think in platforms and to take the initiative. In the end, all will benefit. Let’s get rid of all the paperwork, the double processes, the double data entries and more. If all parties can get their acts together, this will be very beneficial for all.”

HCB

More broadly, though, Europe has to be more efficient and flexible, and invest in human capital. Sañudo was pleased to see the petrochemical industry showing its confidence in Europe, with recent projects announced in Antwerp, Hamburg and Tarragona, and he noted that Europe is leading the way in developing the sustainable economy, an economy in which storage terminals will play an important role.

THE FEDERATION OF European Tank Storage Associations (FETSA) held its 2019 Annual General Meeting in Tarragona, Spain on 12 June. It came at a time of great change, not just for the storage terminal industry and the global economy as a whole, but also for the Federation, as it marked the swansong of the organisation’s executive director, Marc de Witte, who was due to hand over the reins to Ravi Bhatiani two months later.

The Port of Tarragona had arranged a somewhat surreal venue in the congress centre at the PortAventura theme park,

just out of season, so proceedings were punctuated by the screams of thrill-seekers riding the roller coaster in Ferrari Land, but it did mean that delegates were able to get to the bar with no trouble and they had the restaurants more or less to themselves. The Port had also laid on a wonderful opening dinner in the tunnels of the Roman circus.

The AGM featured a one-day conference, chaired by HCB’s editor-in-chief, Peter Mackay. It was opened by Eduardo Sañudo Sánchez, FETSA’s president, who explained the choice of his home town as the venue for the event: Tarragona is home to the main chemical cluster in southern Europe and, through its ChemMed initiative, is seeking to establish the same sort of position in the chemical supply chain as enjoyed by Antwerp and its neighbours in northern Europe.

More local detail was provided by Josep Maria Cruset, president of the Port of Tarragona and of ChemMed, who said the port is “ready for the future”.

But it was Blanca Andrés Ordax who really got the conversation going. Andrés, policy officer at the European Commission’s (EC) DG Energy, spoke about the ‘Energy Union’, the EC’s ambitious plan to accelerate the energy transition. The EC’s fourth report on the State of the Energy Union had been published on 9 April 2019, giving an update and overview of the Commission’s work on energy and climate and including the adoption of the Clean Energy for All Europeans (CE4AE) legislative package.

More significantly for industry, EC has agreed the 2030 targets for greenhouse gas

(GHG) emissions reductions, use of renewable energy, impact of energy efficiency and reduction in carbon dioxide emissions from road transport. The GHG emissions reduction target of 20 per cent by 2020 tightens to 40 per cent by 2030, and may yet be revised upwards. Carbon dioxide emissions from cars are expected to be reduced by 37.5 per cent, which implies widespread use of electric vehicles – with a potentially very significant impact on the volume of petroleum products to be handled at storage terminal facilities.

Andrés laid out the legislative process to implement the CE4AE package, which has already led to directives on energy performance in buildings, the use of renewable energy, energy efficiency, and the governance of the Energy Union. Still to come, although expected this year, were directives on electricity generation and use, risk preparedness and the role of the Agency for Cooperation of Energy Regulators (ACER).

The governance mechanism of the Energy Union is based on integrated ten-year plans in all EU member states to ensure that all national and EU-wide trajectories are aligned. The plans cover all dimensions of the Energy Union, including energy security, the internal market, inter-connections, and research, innovation and competitiveness.

The ultimate aim is to achieve a carbonneutral Europe by 2050, which Andrés said is “challenging but technically feasible”. Indeed, EC has laid out a detailed plan of how to achieve it, based primarily on electrification in all sectors, increasing use of hydrogen as a power source in industry, transport and buildings, “deep energy efficiency” in all sectors, increased resource and material efficiency in a circular economy, and what is being termed ‘Power-to-X’ or P2X. This is the use of electricity to create ‘e-fuels’ based on renewable energy sources that can be applied in such areas as the heating of buildings, transport fuels, and ‘e-gas’ in targeted industrial applications and in the gas distribution grid. Adding in bio-energy with carbon capture and storage (BECCS) and lifestyle changes – which include alternatives to air travel and dietary changes – could deliver a complete removal of GHG emissions by 2050.

EC was at the time of the FETSA event seeking feedback from stakeholders prior to the new Commission taking office in November. “Nothing’s decided yet,” Andrés said. “There’s still time for input.” She was not short of input during the conference, being called on repeatedly to explain the plans in more detail and being offered plenty of advice on how the EC could improve its understanding of the idea of ‘carbon-neutral’.

That energy transition appears to be inevitable, at least in Europe. There is huge political backing behind it and industry –including the oil, gas and petrochemical sectors and their logistics service providers –will have to figure out how to work within this new framework. Some views on the necessary adaptation were given by Jorge Lanza Perea, CEO of CLH. “What are we going to do in 15 to 20 years when everyone is driving electric cars?” he asked.

He also tried to put the EC’s Energy Union into a global perspective, noting that, while it’s great that Europe is taking a lead, Europe only accounts for some 10 per cent of global carbon dioxide emissions. Large parts of the world lack any access to clean energy – “it’s a global challenge,” Lanza said. The energy

sector will have to be able to guarantee a supply of affordable energy while maintaining environmental sustainability, he said; in order to resolve this “trilemma”, it will be necessary to develop energy policies with a global perspective.

While it is clear that there will be a shift towards greater use of gas, we still need all available energy sources, Lanza said; that means oil will continue to be an essential part of the energy mix in 2040. And with the developing world catching up, and lower population growth in developed nations, there will be a shift in consumption away from Europe and North America towards South America and Asia. In other words, for those in the European energy business, the opportunities for growth lie in other parts of the world.

CLH is aiming to adapt to the new reality by applying the latest technology in order to make it the most cost-effective and reliable supplier of energy to its customers. It will seek to minimise its environmental impact and reduce externally generated power consumption; it plans to facilitate efficiency access to energy where it is lacking, through investment in new infrastructure and by applying new technologies; and it will seek to diversify into new fuel streams, such as hydrogen.

A broader view of the European fuels sector’s approach to the energy transition was offered by Georgia Manno, senior policy advisor at FuelsEurope. She noted that 65 per cent of refinery output currently goes to the transport sector, with only 10 per cent used in the petrochemicals sector. Any major shift in the use of transport fuels will inevitably have a significant impact on Europe’s refineries but all sectors need to contribute to the energy transition, she said.

There are, Manno added, no silver bullets when it comes to making the transition to low-carbon or carbon-neutral fuels. E-fuels and advanced biofuels will be needed in the transport sector, which means there will still be some demand for bulk liquids storage capacity. Indeed, a study carried out by Ricardo for FuelsEurope indicated that the use of low-carbon fuels can have a similar impact

on carbon dioxide emissions as a total switch to electric vehicles by 2050.

FuelsEurope believes that the use of e-fuels, advanced biofuels and other measures, including carbon capture and use (CCU) and improvements in refinery efficiency, can deliver the emissions reductions being demanded. Not all electricity is ‘clean’ and the current use of electric vehicles often just shifts emissions from the tailpipe to the power plant.

Manno offered a future scenario in which the refinery takes the place of an energy hub within an industrial cluster. While continuing to produce fuels (from crude oil, bio-feedstocks, carbon dioxide or wastes), residual heat can be distributed to homes and factories and, through the use of CCS/CCU, sustainable biofuels and low-GHG fuels and other products delivered to industrial users and consumers.

Manno urged EC to ensure that the role of refineries in producing low-carbon fuels is recognised in its industrial and technology strategies and to provide a policy framework that will give investors long-term confidence in the sector. She suggested to Andrés that EC amend its current strategy by adopting carbon dioxide credits for new fuel technologies and CCS in the period to 2030 and, in the longer term, to set a standard price for carbon across the economy, taking a lifecycle approach.

Further thoughts on the topic were provided by Matthias Plötzke, director general of the Mittelständische Energiewirtschaft Deutschland eV (MEW), a German trade association representing independent fuel importers, distributors, traders, suppliers and tank storage operators. He noted one problem with the current outlook on the energy transition: current electricity storage capacity in Germany is equivalent to only 41 minutes of demand. Despite this, the current conversation on future energies is skewed very heavily to electric vehicles.

In addition, Plötzke said, it would be a “tremendous effort” to produce enough synthetic fuel to meet domestic demand. It would take a lot of investment and international cooperation, plus a sound business case.

Where his argument was heading was for greater use of synthetic fuels: the replacement of fossil hydrocarbons with renewably produced hydrocarbons, using electrolysis and synthesis to combine hydrogen with waste carbon dioxide to produce methanol, methane, ammonia and synthetic jet fuel, gasoline and diesel.

Such synthetic fuels would allow the use of the existing supply chain infrastructure and existing vehicle fleet – with some modification – and avoid the need for investment in largescale automotive battery manufacturing. He echoed Manno’s comments about the need for a global approach and a consistent price for carbon credits.

Later in the conference, Marcel van de Kar, director of new energies at Vopak, brought the argument closer to home with a presentation on adapting the terminal business model to fit the new energy environment. “The link to society is crucial,” he began. Vopak sees its role as providing a conduit for vital products by connecting sources of supply and demand. But the world is changing – the global population is growing and people have new demands. Vopak has to change with the times. Furthermore, the world is embracing the energy transition: there is a global transformation underway, although it is not clear exactly how that will happen and how fast the change will take place. It will be different in various regions of the world: there is a need to end energy poverty and to provide access to electricity or clean cooking facilities to the 40 per cent of the world’s population that currently lacks them. At the same time, energy suppliers need to provide clean air by curbing emissions and to combat climate change. For Vopak, those changes mean that all its terminals around the world stand to be affected.

One major hurdle in the energy transition is the lack of adequate infrastructure to distribute energy to the right location at the right price. That is where terminal operators such as Vopak can facilitate the energy transition, van de Kar said. In order to be able to do that, Vopak has to look at itself and reduce its own environmental footprint. Its current terminal portfolio will need to shift to be able to handle the right products in the right places, and that includes the new, lighter fuels that will be part of the solution.

Hydrogen will be a vital element in the new energy picture, van de Kar said, but he was not sure how this would be handled. If it is to be a completely new solution, it will take time to get the infrastructure in place; but there are alternatives, such as the use of a carrier liquid, that could help accelerate the change. Vopak has to be prepared for any eventuality.

Carbon capture and storage or use will be vital too. Plötzke had already brought ideas of electrolysis and synthesis to the meeting and van de Kar offered some illustrations

of how that might happen, for instance by cracking methane to generate hydrogen, while capturing the resulting carbon dioxide. He also addressed the shortage of electricity storage capacity, suggesting that this could be done through the use of charged liquids. Overall, though, it makes sense to electrolyse hydrogen where there is cheap electricity and ship it in some form to where it is needed.

These ideas gave a strong impression that there will still be a need for tank storage companies, though they will need to reinvent themselves to cope with future fuels. It is noticeable, for example, that Vopak has lately put much of its effort into areas such as LNG and in hub facilities that are closely linked to industrial consumers.

FETSA’s conference also featured presentations on the role of strategic storage, bunkering, digitisation and the role of automotive manufacturers in shaping the future of mobility. All these ideas will doubtless be pursued under the leadership of FETSA’s new executive director; it is worth keeping an eye on the Federation’s work at www.fetsa.eu. HCB

ChemMed comprises more than a hundred chemical companies (both manufacturers and service providers) and a first-rate cargo port. One of the key points of the cluster is the wide range of pooled infrastructure and services it has, which includes two combined-cycle power plants with a total capacity of 820 MW, reclaimed water supply, a pooled underwater sewage outlet pipe, extensive pipeline infrastructure for the transport and exchange of materials, and three pooled fire stations.

The port is working hard to improve its facilities and services to provide the safest and most sustainable operations. There is a safety strategic park inside the port facilities and a pooled service between the port and the chemical terminals to provide swift response in case of any maritime pollution.

Tarragona’s annual Med Hub Day is a very important event for the port, and takes place this year on 21 and 22 November. This workshop, which is sponsored by the Port Authority and ChemMed, has the main goals of presenting, analysing and discussing the potential the Mediterranean has to be a key regional hub for liquid bulk products. This annual meeting is dedicated to enhancing the potential of the Mediterranean region as a logistics platform for petrochemical products in order to become a regional hub for those products.

THE PORT OF Tarragona is one of the most important Spanish ports and a key location for Mediterranean trade. Located an hour along the Catalan coast from Barcelona, the port handles more than 32m tonnes of cargo per year – 19m tonnes of which is liquid bulk freight. Tarragona is aiming to consolidate its position as a Mediterranean hub for the production, storage and distribution of chemicals and petrochemicals and is seeking to capitalise on this sector by leveraging its relationship with the regional chemical cluster. This is done through the ChemMed Tarragona initiative, representing an industrial, logistic, academic and scientific cluster in the area.

Tarragona completed an expansion of its chemical quay in 2014, which is now almost all under concession. Its clients store a wide variety of products and are currently expanding storage capacity from 800,000 m3 to some 1.5m m3

There are three main competitive advantages that strengthen the position of Tarragona in the international chemical trades. It has plenty of expertise in the market, making Tarragona the epicentre of the Mediterranean chemical industry. It has deep draught access, allowing larger tankers to call, and offers berth-to-berth and rail interconnectivity. It is also efficient, offering round-the-clock operations and favourable weather conditions all year. Additionally, the port is connected to the local chemical industry by a major pipeline network, providing strong optimisation.

Each year a range of stakeholders meet to discuss how to increase the competitiveness of the Mediterranean region. Topics for discussion at this year’s Med Hub Day will include current logistic routes, how costs can be reduced, improving delivery times and reducing CO2 emission. New production and consumer centres around the world will shift chemical trade flows and make the Mediterranean a key zone to optimise the petrochemical logistic chain on a global scale.

The main benefits to be found from attending the 2019 event will be:

• Learning about new liquid bulk flows to the Mediterranean area

• Networking with prospective clients, peers and other stakeholders in the supply chain industry

• Identifying business opportunities and areas of focus to improve competitiveness

This event allows the Port of Tarragona to present its infrastructure as one of the main nodes in the Mediterranean for both chemical and petrochemical products. It also highlights that the port is an important player in the organisation of international events. HCB www.hubdaytarragona.com www.porttarragona.cat

ANTWERP IS PROVING to be a magnet for investment in petrochemical production in Europe, its hub status and connectivity proving attractive to manufacturers. This is drawing in support from logistics service providers, particularly in the realm of bulk liquids storage.

The latest proof of this is a plan by Standic to build a new terminal for the storage of chemicals. The new terminal is located in the 5th Haven dock, with plans for an initial capacity of 95,000 m3 ramping up to some 230,000 m3, doubling Standic’s capacity in the region once it opens in the first quarter of 2021.

The Port of Antwerp handles some 235m tonnes of international freight annually and is also home to the largest integrated chemical

and petrochemical cluster in Europe. It is easy to see why Standic is looking to expand here, as Antwerp is a main artery and a continental hub for Europe, connecting with more than 300 liner services and 800 destinations.

Automation has become essential in the development of the most sophisticated and flexible projects and this new Standic facility is no exception. The most striking feature of the new state-of-the-art terminal, aside from full automation, will be the builtin sustainability features that have been specifically designed to meet customer requirements, such as onshore power for ships moored at the terminal. Additionally, large chemical tankers will be able to reach the terminal easily thanks to the favourable depth in the port.

Much like the sister facility in Dordrecht, the Netherlands, Standic’s Antwerp terminal is being designed to focus on niche chemical markets and the distribution of chemical products. The Dordrecht facility is home to 163 tanks that offer 230,500 m3 capacity. It is planned that the storage tanks at 5th Haven Dock will vary in size from 500 to 3,500 m3

“The Port of Antwerp is known as one of the largest maritime clusters in the world, which is why we chose it for our expansion,” says Ronald Ooms, managing director of Standic’s family-owned parent, Hametha. “We aim to build on our success with chemical storage and further expand it. In Antwerp we will be able to further develop in the niche market of more specialised chemicals and serve our customers from all over the world.”

“The new Standic terminal will further boost the synergy between the various industrial companies in the port, thus helping to make logistic operations and processes even more cost-efficient,” says William Demoor, customer relations manager at the Port of Antwerp. “Furthermore, the location is ideal for multimodal access, a key factor for sustainable distribution of chemicals.”

The Port of Antwerp has been pursuing a platform of sustainable development as a key part of its business plan, a concept that has been readily accepted by Standic. Environmental requirements and compliance have been at the forefront of the design process, ensuring that the lasting impact of the development is as minimal as possible. Part of this sustainable development includes improving the multimodal nature of cargo as even though Antwerp is famed for its accessibility by water – both by sea and by inland waterway – the location is highly favourable for rail transport. HCB www.standic.com

THE GLOBAL ENERGY markets are experiencing a period of structural change due to a slowdown in global GDP growth, decreasing energy intensity and the energy transition. Operators of bulk liquids terminals all around the world are having to face up to that structural change and determine how best to face the future.

One such operator, Oiltanking, has recently announced a new strategy to respond to changing market conditions. It includes internal restructuring and a focus on asset optimisation, which may result in further changes in its terminal network following the recent sale of its Tallinn terminal in Estonia to a local fuel distributor.

The ‘Oiltanking strategy 2025’ has three main legs:

• Maximising the value of current assets, including cost optimisation and “reshaping the portfolio”

• Achieving profitable growth by prioritising projects with a focus on gas and chemicals, while also enhancing customer-centricity, and

• Providing the necessary enablers in terms of safety performance and driving sustainability.

“I am convinced that our strategy 2025 will pave the way to a sustainable future,” says Matti Lievonen, who took over as CEO of Oiltanking in April 2019. “In line with our strategic directions, we will focus on operational excellence, safety performance, project execution, and sustainability. I look forward to working with the new Oiltanking Management Team as well as with the entire organisation to make our new strategy a success.”

To be able to deliver on the strategy, one key objective is to consolidate the regional structure in order to simplify and streamline the organisation. Instead of the current eight regions there will be three, more balanced, regions in future: Americas, EMEA (Europe, Middle East, Africa) and APAC (Asia Pacific including China and India). Furthermore, there will be four central functions: Finance (CFO), Portfolio & Strategy, Assets & Operations (A&O including HSSE) and Human Resources (HR). The heads of the new regions as well as the heads of the central functions will report directly to the CEO.

The new management team, as from 1 October, comprises Lievonen (CEO), Holger Donath (senior vice-president Americas), Douglas van der Wiel (senior vice-president EMEA), Claas Pinkenburg (senior vicepresident portfolio and strategy), Yvan Tavernier (senior vice-president A&O) and René Anghel (CFO). Oiltanking is currently looking to appoint senior vice-presidents for the APAC region and for HR; van der Wiel will take interim charge of the APAC region.

The new management team will collectively work out detailed strategic directions and related initiatives. Oiltanking plans to have the process completed by January 2020 at the latest and to then start full implementation.

One project that perhaps indicates the direction that Oiltanking will be taking is its participation in the German LNG Terminal GmbH, alongside Gasunie and Vopak, which plans to construct an LNG import and distribution terminal in Brunsbüttel in northern Germany. The project has won interest from prospective customers and has the support of local and federal authorities in Germany. Pre-qualification EPC bids are due to be received by this month, with a selection due to be made early in 2020.

Oiltanking, a privately held subsidiary of trader Marquard & Bahls, currently owns and operates more than 70 bulk liquids terminals around the world with a combined storage capacity of some 20m m³. HCB www.oiltanking.com

USERS RELIANT ON non-destructive testing (NDT) now have an additional option as Eddyfi Technologies launches the RMS PA, a powerful new corrosion mapping solution that delivers high-resolution imaging without sacrificing speed. Users of the RMS PA will discover a complete system aimed at significantly improving data quality while reducing inspection times for nonintrusive inspections (NII) of critical assets. Detection capabilities of the latest innovation include corrosion, erosion and microbial induced corrosion with quantifiable, detailed defect characterisation.

The new RMS PA integrates the robust field-proven RMS robotic scanning head –from Eddyfi’s Silverwing brand – with Eddyfi’s cutting-edge portable machine-to-machine (M2M) systems, Mantis™ and Gekko®