Private Label Magazine

Behind the shelf. Collaborations and protocols with private label suppliers

Carrefour: private label for export

OrtoRomi, vegetables climbing to the top of PLs 1/2023

3 Editorial Private Label, the table has turned. Posivetely.

4 PLM Awards

An award to the best co-packers

6 Cover story Behind the shelf. Collaborations and protocols with private label suppliers

16 Interview with distribution Carrefour: private label for export

20 The private label scenario Inflation is rising and Italians have their shopping cart more and more filled with PL products

24 Interview with the company OrtoRomi, vegetables climbing to the top of Pls

28 Markets

Consumers prize the IV and V range of brands

34 QBerg observatory

How much does private label advertising in the fruit and vegetable market impact large-scale retail flyers?

PLMagazine

Quarterly supplement of Distribuzione Moderna magazine, a media outlet registered with the Court of Milan Registration No. 52 of 30 January 2007

Editor-in-chief

Armando Brescia

Editorial director

Maria Teresa Manuelli

Translation Jcs - Language Services info@jcslanguage.it

Scientific Committee

Stefano Ghetti, Managing Partner Expertise on Field/partner IPLC Italy

Gianmaria Marzoli, Retail Solutions Vice President IRI Italia

Alberto Miraglia, General Manager Retail Institute Italy

Paolo Palomba, Managing Partner Expertise on Field/partner IPLC Italy

Emanuele Plata, Co-Founder, Past President, Board Advisor PLEF

Contributing Authors

Federica Bartoli, Stefania Colasuono, Maria Teresa Giannini, Fabio Massi, Fabrizio Pavone, Luca Salomone

Creative Director Silvia Ballarin

Editor Edizioni DM Srl - Via A. Costa 2 20131 Milano

P. Iva 08954140961

Contact Phone 02/20480344

redazionedm@edizionidm.it

Advertising Sales office: commerciale@edizionidm.it

Tel: 02/20480344

There is no guarantee that we will publish the original versions or any part of submissions (texts, articles, news, images, data, charts, research, etc.) sent by authors outside the Editorial Board. Submissions may, however, be published in a revised form for editorial reasons. It should also be noted that sending a submission constitutes an automatic authorisation by Edizioni DM Srl to publish it free of charge in all its publications.

4 6 28 24 16 34

SUMMARY - PLM

Private label, the table has turned. POSIVETELY.

Maria Teresa Manuelli Editorial director

There was a different atmosphere during the last edition of Marca By BolognaFiere tradeshow, held on January 18-19. Walking through the stands and talking with the manufacturers, you could finally feel the pride of producing for brands of different distributors and the gratitude for the good choice made several years ago, which turned out to be a solid lifeline and a growth opportunity, in such a difficult period for the brand industry. However, less than a year ago, in April 2022, during the previous edition of the trade show (postponed due to the Covid-19 restrictions), the atmosphere was totally different: more than one company described its collaboration with the PL as ‘a necessary evil for getting on the shelf’ or ‘the price to pay for their collaboration with the large-scale distribution’. What has changed in these few months? A lot, actually. Starting from the fact that consumers, after the pandemic, plunged into a scenario of war and inflation. A war that we thought was going to end soon, which instead, has undermined the basis of the Western economy, leading to skyrocketing production costs, from raw materials to energy. And while the shopping cart of Italians in 2022 had to face a very high inflation, private labels started to grow, turning into consumers’ favorite in this period of crisis. PLs, in fact, have continued to grow, by recording a trend in volume equal to + 2.9%, despite the major impact of inflation. This is a cross-channel growth encompassing hypermarkets, supermarkets, mini-marts and discounters (see p. 20). And it helped generate value on all the production supply chain: 7 PL partner companies out of 10 estimated a turnover increase, according to a survey carried out on the exhibitors of Marca 2023. So what’s the future for PLs and its partners? According to the Position Paper, created for Adm - Associazione Distribuzione Moderna by The European House - Ambrosetti, the forecasts are largely optimistic: PLs won’t simply widen their supply and be more attentive to the promotion of their products, but will also be able to meet the evolving consumers’ needs. In fact, they will be more focused on the premium segment, more sustainable, and will greatly contribute to the promotion of certified, Made-in-Italy products - on average every brand proposes 125 Dop and Igp PL references - and of those who produce them. And the credit for this optimistic forecast goes to the foresight of large-scale distribution and the companies that were able to predict it wasn’t the ‘price to pay’, but, rather, a great opportunity of high-added value production in the long term.

3

EDITORIAL - PLM

An award to the best CO-PACKERS

On the initiative of our magazine and in collaboration with IPLC Italy, PLM Awards - "Best Copacker Profile," the first award to the best suppliers of PL products was launched. As we all know, there are many prices and competitions to award the best FMCG products put into the market each year, perhaps far too many. But is it the same for awards dedicated to companies, and in particular to suppliers of private label products? A question that we at PL Magazine asked ourselves and could help but answering: no, none at all. An “unreasonable lack” given the growing importance of PLs in national and European retailers- supply. And an inexplicable neglect of the thousands of small and large enterprises that collaborate with the major distribution groups in the market, subject to selection criteria that are even stricter than those of the main distribution groups in the market.

AN AUTHORITATIVE CONTEST

Hence, the idea of launching a new contest for co-packers only, promoted by our magazine in collaboration with IPLC Italy, a consulting firm specialized in PL. A contest to finally give recognition to those suppliers of PL products that boast all the ideal characteristics necessary for large-scale distribution. Thus, the name of the initiative: "Best Co-packer Profile". An ambitious project, whose first stumbling block was choosing solid and credible criteria to identify the best “profiles”. As a result, the companies nominated for the award will be evaluated on both quantitative and qualitative parameters. As for the quantitative parameter, the assessment will be based on a self-certified form preset by the PL Maga-

4 PLM - AWARDS

zine Editorial Office (see the grid of required information given in the box below/right). The qualitative parameter, instead, will be evaluated based on the motivation for application exhibited by the competing companies and the evaluation of a selected jury of PL Managers from both Italian and European distribution chains.

CATEGORIES AND TERMS FOR PARTICIPATION

There will be eight awards in total, spanning both food and non-food categories: grocery food, beverage, fresh, cold, home care, personal care, petcare, and other non-food products. In addition, a special award will be reserved for start-up companies, regardless of their sector. The deadline for submitting the applications for the PLM Awards - Best Co-packer Profile (each company can compete in more than one category) is next March 5,2023. The awards will be held in Bologna in April as part of an event organized by our Magazine. For more information, to download the regulations, to know in detail how to participate or to contact the organizing secretariat, it is possible to visit www.plmawards.it. l

Not just retailers

PLM Awards - Best Co-packer Profile is a new contest sponsored by PL Magazine for suppliers of PL products. The goal is to give recognition to suppliers with the manufacturing - and not only - characteristics that most appeal to retailers. However, another contest is organized in connection with PL Magazine, which is part of the EDM Award, given by the magazines of our publishing house. In this case, only retailers can participate, with their most innovative PL product.

"BEST CO-PACKER PROFILE": THE (QUANTITATIVE) SELECTION CRITERIA

★ Existing maximum production capacity

★ Possibility of expansion at current sites

★ PL vs. own brand production share

★ Willingness to produce exclusive formats upon request

★ Preference for fixed-term contracts

★ Availability for scheduled auditing

★ Availability for short schedules and stockpiling

★ Assurance of traceability throughout the supply chain

★ Presence of after-sales support

★ Availability for environmental product declaration

★ Existence of control over work relations upstream of supplies

★ Number of certifications nationally and internationally

★ Presence of in-house R&D department and number of employees

★ Drafting of sustainability report

★ Number of brands in Italy

★ Number of brands abroad

★ Number of PL references supplied to retailers in the last year (March 1, 2022 - February 28, 2023)

5 AWARDS - PLM

Behind the shelf. Collaborations

and protocols with private label suppliers

In Italy, 83.2% of the collaborations between brands and suppliers in the world of private labels last for over 4 years. Specifically, 36.6% last between 4 and 8 years and 46.6% for over 8 years. Collaborations between companies and distributors are not only increasing, but also perfecting.

One of the factors brands rely on for the development and success of PL is winning collaborations. In some cases, their strength lies in their solidity, which is ensured by reliable and quality suppliers. In other cases, such strength comes from

PLM

COVER STORY

-

New targets and the need for cooperation

A research study published in June 2022 by Ipsos e McKinsey commissioned by Gs1 has shown the latest new-normal consumption trends. Not only were consumers grouped by category, named based on their expectations and shopping behavior (from “you don’t need much to be happy” to “nostalgic of genius loci”), but also the characteristics of the collaborations between the industry and distribution were reviewed, among which, the first is precisely cooperation. The document was used as a basis to draft the New Consumption Code.

7 COVER STORY - PLM

A land almost unexplored (so far)

Of all the logos on food products and others, two are highly underestimated in Italy: Kosher and Halal. Even though experts and habitual consumers of such products consider these to be the safest certifications, Italy doesn’t even rank among the first 10 destinations for the members of these two target communities. A land almost unexplored, metaphorically speaking, especially in light of the increase in Islamic and Middle-eastern tourism in Italy. Not to mention that, based on forecasts by Fortune Business Insights, Allied Market Research and Il Sole24Ore, the global Kosher market will record +6.5 billion euros by the end of 2026. As for Halal, it’s expected to record +1.18 trillion dollars by the end of 2028.

RELIABILITY AND CERTIFICATION: CURRENCIES OF EXCHANGE FOR VISIBILITY IN THE POS

In Italy, 83.2% of collaborations between private labels and suppliers last for over 4 years. Specifically, 36.6% last between 4 and 8 years, while 46.6% for over 8 years. This is what the position paper ‘Marca del distributore e consumatore nella società che cambia’ (Private labels and consumers in a changing society) by Forum Ambrosetti, in collaboration with Adm and Ipsos, revealed. The paper was presented in Bologna during the 2022 Marca exhibition. «There have been collaborations between companies and distributors for decades, but now, in the era of the new-normal, they’re growing and improving. In the last years, the way projects are “built” not only reflects the needs of retailers, but also the production capacity and know-how of suppliers, who increasingly work as co-packers too», says Carlo Alberto Buttarelli, Managing Director at Adm and Director of Studies and Relationships at Federdistribuzione . Nevertheless, the position paper also shows that, specifically in the food industry, 83% of people are willing to pay more for certified products, and that

8 PLM - COVER STORY

91% of those buying PL products want to read the names of producers on the packaging. This shows how Italian consumers seek to know more about products to favor proximity, community work and attention towards the environment in their choices. “If, on the one hand, today’s consumers are on average more informed on products than in the past, on the other hand, only few are able to technically assess PL products according to scientific standards or ethical and legal policies between suppliers and large-scale distribution. They trust the choices made by the brands, which, however, earned their respect over the years and put themselves out there for their private labels”, says Carlo Alberto Buttarelli.

CARREFOUR AND SUPPLIERS:

A CODE TO REGULATE THEM ALL AND A CODE TO DIRECT THEM

Carrefour’s code of ethics is a mandatory step for all suppliers. It sets out the company’s values and what it expects from its suppliers, that is, refraining from unfair commercial practices and bribery. It defines ‘quality’ and ‘traceability’ as principles underpinning the supply chain. In the wake of this ‘polar star’, in the 2022 edition of Salone Carrefour, two new agreements with suppliers from Treviso were signed: one with Trevisanalat, for the supply of mozzarella cheese, and the other with Frescolat, for the supply of crescenza cheese, both under the name of Filiera Qualità, the PL that has celebrated its 20th anniversary. This private label has always paid attention to animal wellbeing and good animal husbandry practices, as well as environmental protection and enhancement of made in Italy products. The brand currently boasts over 300 references and about 8,500 collaborators among farmers and zoo technicians.

9 COVER STORY - PLM

Moreover, with its Act for Food project, the company has implemented a simplified (two-page long) supply contract for local producers, which allows the company to have access to Carrefour Italia purchasing center, and therefore the sales network, within a week.

COOP: A MATTER OF PRINCIPLES (AND CODES OF CONDUCT)

Besides the adoption of the Sa8000 standards since 1998, which require suppliers to ensure specific guarantees in terms of work, such as the prohibition to employ minors and the reduction of gender inequalities, under penalty of exclusion from the network, in 2021, Coop Italia was also one of the first 65 companies to sign the EU Code of conduct on responsible food. The adoption of the Code is a further step towards the ‘Farm to Fork’ strategy, launched in May 2020, under which all the individuals in the supply chain voluntarily undertake to actually improve their environmental, social and financial performance. Such commitment became even more compelling in 2021 with the subscription of the ‘Women Empowerment Principles’ (WEPs) supporting gender equality and women’s financial emancipation. As for product-related aspects, Coop aims to extend the rules on phytosanitary product use to all its 35 fruit and vegetable supply chains by the end of 2023. Among others, the rules include a ban on

10

PLM - COVER STORY

glyphosate and neonicotinoids (according to 2018 EU bans). “In November 2022, Coop launched ‘3 Grani Pregiati Italiani’ pasta under ‘FiorFiore’, which was the result of a collaboration between mills and pasta makers,” says Paolo Bonsignore, Marketing and PL Director . This project was made possible thanks to the collaboration between Molino De Vita, located in Apulia, and two pasta factories in the South of Italy: Gramm, in Bari, for four references, and De Matteis, in Avellino, famous for its Armando brand, for other 11. Ensuring a minimum wage to farmers, that of De Vita is a fair supply chain where we can grow and mix three types of 100% Italian quality organic wheat. In addition to that, the company proves to be flexible and nature-oriented also when it comes to its farm produce. Indeed, there is no obligation to sow the same variety every year, but the best one is chosen for each year.

11 COVER STORY - PLM

83.2% private label collaborations between brands and suppliers over 4 years.

Specifically:

36.6% between 4 and 8 years;

46.6% collaborations over 8 years

ESSELUNGA: FARMERS EMBRACING FAIR TRADE

The collaboration with suppliers is ever more crucial to the monitoring of production chains, both in terms of freshness and ethics, and it isn’t limited to food products. As part of Esselunga’s ‘Rose Fairtrade ’ project, launched in collaboration with the Cooperative Flora Toscan, the sale of certified roses has finally been allowed. Flowers are sold 3-4 days after being picked, thus ensuring a short chain and products with higher quality and longer shelf life on average. As for food, some references of ‘Naturama’ line, such as apples, clementines, trimmed green beans, new potatoes, peppers, Sardinian tomatoes and pomegranates, as well as some ‘Organic’ line products, such as bananas, obtained the ‘Etico Certificato’ label, which ensures the adoption of good practices by each single farm through the participation in programmes of renowned associations, such as Global G.A.P., Grasp and Altromercato.

PLM - COVER STORY

12

ALDI: ALL FOR ONE... COMMON GOAL

The all-round commitment of suppliers is therefore often a need rather than a possibility, especially when it pursues global, such as climate neutrality. The new year and the next one are expected to be crucial for Aldi Süd, which decided to make private labels a vital asset in its path towards sustainability. Within the scope of its 2030 Vision, the German Group aims to minimize its carbon footprint and it’s therefore working on a policy on greenhouse gas emissions for Italy. This is set to be released by the end of 2024 and will be addressed to suppliers, who are responsible for 75% of PL emissions. The idea is indeed to implement an approach based on scientific evidence throughout the whole supply chain. The German discounter is also working on a compendium including 50 practical tips to adopt an environmentally-friendly lifestyle and behavior. Finally, in November 2022, within the scope of the ‘Oggi per domani’ (Tomorrow is today) strategy, Aldi Süd updated its guidelines for animal protection in breeding farms, that grants their right to have the right amount of space, air and light, not to be tortured, to receive for (in every sense of the word), and not to be subject to further sufferings in the last moments of their lives. These guidelines were reinforced as a result of Efsa’s recommendations on animal welfare, the latest of which focuses on pigs.

Protocols and certifications: a multitude of logos

The 2022 report by Osservatorio Immagino dedicated an in-depth analysis to certifications and claims on shelves: ‘Organic’ (9% of total sales, despite recording -1.3% in 2021), ‘antibiotic free’ (+5.6%), ‘Vegan’ (+1%) and ‘fair-trade’ (+6% but only for Fairtrade), are just a few examples of the labels of the best-selling products. As for the certifications related to the production process, which guarantee the compliance with international work, environmental and biodiversity protection standards, the most important ones are Fssc (on products of 634 companies in Italy), Fsc (on 5.2% of products), Msc (0.6% of total, despite having recorded an upward trend of 6.8% in 2021).

COVER STORY - PLM

13

The top 5 european food certifications

The Brc Certification certifies that a given company ensures work environments and controls on both its products and production process, in compliance with the British market. Ifs shares the same goal as Brc, a standard actually shared among the food and agriculture production chains of the French and German large-scale distribution. The Iso 22000 certification harmonizes all national and international standards applying the Haccp method. Fssc combines the requirements of Iso 22000 and Iso/Ts 22002 standards, as well as some required by Gfsi. Last but not least, the Organic certification.Mandatory since 2007 for all organic products produced in the EU, it requires that the food in question contain at least 95 percent organic ingredients and meet stringent conditions for the remaining 5 percent.

LIDL: REPLACING WOOD AND PAPER. THE CRUSADE OF PRIVATE LABELS

Also the reduction in the use of wood, cellulose and paper for packaging is subject to agreements and common views among private labels suppliers. Lidl has been committed for years to replacing virgin fibers with recycled ones and using Fsc certified virgin fibers for those products where no recycled material can be used. By the end of 2025, the company aims to use recycled or Fsc certified materials throughout the whole private label packaging process for food, household essentials and personal care. To date, numerous products in Lidl Italia's continuous assortment are certified, such as Floralys tissues, napkins and toilet paper, Lupilu diapers and Aromata baking paper.

PLM - COVER STORY 14

IPER-LA GRANDE i: THE PHARMA PL OF IPER-LA-GRANDE i, INNOVATION IN THEIR MEDICAL CORNERS

In Iper-la grande i of Seriate (Bergamo, Italy) the synergies between external service suppliers and Iper private label OTC pharmacies resulted in a space dedicated to telemedicine, inaugurated in September 2022, open every day from 8:00am to 9:30pm. This innovative project was possible thanks to Buongiornodottore and Whealthy Care Solutions companies. Buongiornodottore provides the personnel of SOS Dottore and SOS Pediatra, two services for house calls. Whereas, Whealthy Care Solutions has been a partner of Iper-la grande i, with Più Medical and G.S.M OTC pharmacies, the company managing Iper’s OTC pharmacies for years.The state-of-the-art service is provided in a dedicated area inside the hypermarket: after only 10 minutes, a doctor will connect and visit the patient through technological devices activated by Iper Pharma staff, Iper’s pharmaceutical brand, supporting the service. There, a qualified healthcare worker records the physiological parameters of the patient (blood pressure, body temperature and oxygen saturation) and starts the measurements (for instance Ecg) at the request of the doctor connected and based on the patient’s clinical needs, all by transmitting information in real time. After the consultation, the doctor provides a report and therapeutic indications, if any. Together with general practitioners and pediatricians, 24 specialists, such as cardiologists, nutritionists and dermatologists, provide consultation via telemedicine and are available within an hour of requesting a consultation or by appointment.

IN CONCLUSION

When it comes to reaching agreements and choosing the most innovative partners, who are willing to obtain the largest number of certifications possible and, why not, identify new consumer perceptions, what comes into play, besides the duration of the collaboration, is a sort of ‘selection of the best players’. The hope is that among these new perceptions is that of having only one planet and only one humanity.l

15 COVER STORY - PLM

83% Italians willing to spend more for certified quality products

91% of consumers purchasing private label products are interested in knowing the names of the producers

Maria Teresa Giannini, Professional Journalist specialized in Large-scale Distribution.

16 PLM - INTERVIEW …. FROM THE DISTRIBUTION’S POINT OF VIEW

CARREFOUR: private label for export

But also for import: if our Italian supply chain excellencies are sold overseas, the wide network they’re part of facilitates the entry of international specialties.

At the end of summer, Carrefour Italia ranked first for PLs in the ranking by Altroconsumo. .

What’s the opinion of the management?

We’re very satisfied with this important acknowledgement, because PL development is essential in our strategy and business model. Of course, we always try to protect the consumer purchasing power, working together with our manufacturers on different aspects to maximize our supply, such as, the new price positioning in the last year, which is particularly relevant in the current market situation.

You’re a multinational company. So, what PL products do you export from Italy to other Carrefour countries? And, on the other hand, what do you import?

Considering its strong surrounding network, Carrefour Italia promotes local excellencies in the geographical markets where it is not present. The most exported market categories concern the wide assortment of fruit and vegetables, wine and grapes (for example the Italian Grapes, certified Fqc - First Quality Certification). In the traditional FMCG industry, the most popular requests come from pasta, extra-virgin olive oil, bread substitutes (such as breadstick and taralli) and cookies (especially cantucci and chocolate cream cookies).

17

INTERVIEW …. FROM THE DISTRIBUTION’S POINT OF VIEW - PLM

We’ll continue to invest also in export, especially in our local excellencies, which are represented by Filiera qualità Carrefour and Terre d’Italia, which will widen their supply also abroad. As far as import is concerned, among others, we can find - for example, Carrefour sensation, which make up the product selection from around the world and give clients the chance to taste food specialties from Mexico, China and from many other countries .

Let’s talk about figures. What’s the PL share today on sales?

In 2022, the PL share was about 30% for food products (traditional FCGM and fresh produce), a growing trend compared to 2021. Private labels are, in fact, more and more essential also for the Group, within which we hope they can reach 40% of our 2026 sales. In Italy, we launched over 200 products in 2022 in the PL assortments - which include more than 3,000 references today. Together with mainstream Carrefour products, which meet all the needs of our assortment, there is also a premium reference. Terre d’Italia enhances regional Italian excellencies, while Carrefour Bio comprises agricultural food certified by organic farming. Carrefour Bio also boasts more than 400 products and dedicated corners in a number of our pos. Last, but not least, there’s Filiera qualità Carrefour, the line with fresh produce, products controlled from beginning to end, in full respect for the environment, animals and humans.

Where’s your PL innovation heading?

PL is growing and it’ll be so in the next year as well, with some new launches and the consolidation of some lines, among which our Simpl brand. Today, it represents a basket of 140 products and we expect to reach 200 products in the first months of 2023.

2021 TURNOVER Yearly turnover variation (with the same network) -3% Total points of sale more than Total PL references PL share on food sales about 30% CARREFOUR ITALIA and ITS BRANDS 18 4,416 mln euro Yearly turnover variation second quarter 2021 (with the same network) +1.7% 1,500 3 thousands over +2.5% (with more than 1,200 in franchising) Yearly turnover variation fourth quarter 2021 (with the same network)

PL LINES

ALIMENTARI NON-FOOD

CARREFOUR IL MERCATO (FRESH VEGETABLES)

CARREFOUR CLASSIC (DAILY-CARE PRODUCTS)

CARREFOUR ESSENTIAL (HOMECARE)

CARREFOUR EXPERT (HOME CLEANING)

CARREFOUR EXTRA (QUALITY INGREDIENTS) TEX (SUSTAINABLE FASHION)

CARREFOUR SENSATION (PRODUCTS FROM THE WORLD)

CARREFOUR HOME (HOME PRODUCTS AND ACCESSORIES)

CARREFOUR ORIGINAL (TRADITIONAL PRODUCTS) MY CARREFOUR BABY (CHILDREN HYGIENE AND CARE)

SIMPL (DAILY AND AFFORDABLE PRODUCTS)

CARREFOUR COMPANINO (PETFOOD)

CARREFOUR ECOPLANET (SUSTAINABLE HOMECARE PRODUCTS)

CARREFOUR NECTAR OF BIO (PERSONAL CARE ORGANIC PRODUCTS)

CARREFOUR BIO CARREFOUR SOFT (DAILY PERSONAL CARE)

FILIERA QUALITÀ CARREFOUR (CONTROLLED FRESH)

TERRE D’ITALIA (TRADITIONAL ITALIAN PRODUCTS)

CARREFOUR SELECTION (GOURMET PRODUCTS)

CARREFOUR NO LACTOSE

CARREFOUR NO GLUTEN

Your relationship with suppliers: what’s the average duration?

Carrefour has a long-lasting relationship, also of 20-30 years, with different suppliers, among which, for example, those of Terre d’Italia, Carrefour bio and Filiera Qualità. Precisely this year, it’s our 20th anniversary with Filiera qaulità and with other companies, which have been with us since the very first day.

Are there any tensions due to macro-economical factors?

In difficult moments, like the one we’ve been living in for several months now, characterized by inflation and price increase - it’s essential, for us, to act responsibly. Not just with our consumers, but also with all the Italian producers we collaborate with, to find common solutions to mitigate the consequences of this situation. In the current scenario of an overall price increase we, distributors, don’t have big margins to counteract it. For this reason, the objective is to do our job, by optimizing the system, where possible, to limit the impact on consumers and protect their purchasing power. Moreover, we need to make a distinction between suppliers, as some sectors have faced greater problems due to drought, or sharp increases in raw materials. To mention one, the confectionery industry.

Any solutions?

In 2021 we launched an initiative with more than 80 of Carrefour product suppliers, to reduce end-to-end costs, for example by perfecting logistic flows and limiting the use of plastic. The project represented a great example of collaboration with partners, with whom we collaborated for greater sustainability and efficiency. l

19

INTERVIEW …. FROM THE DISTRIBUTION’S POINT OF VIEW - PLM

Luca Salomone Professional Journalist specialized in Consumer Goods, Distribution, Shopping Centres and Finance.

Inflation is rising and ITALIANS have their shopping cart more and more filled with PL PRODUCTS

Consumers prefer private label products, excellent performances also for the Fresch and Pet Care categories. An insight into the data of XIX Marca Report by BolognaFiere presented by Iri.

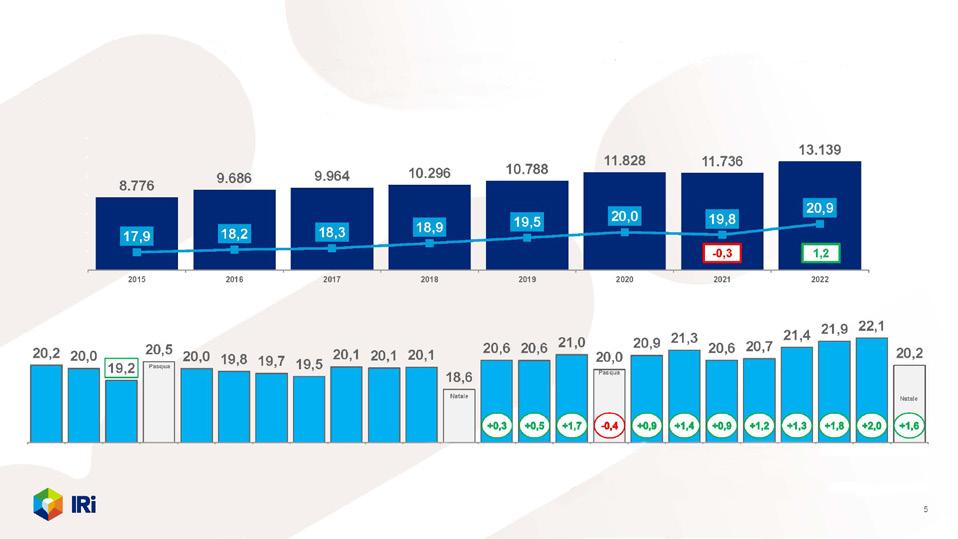

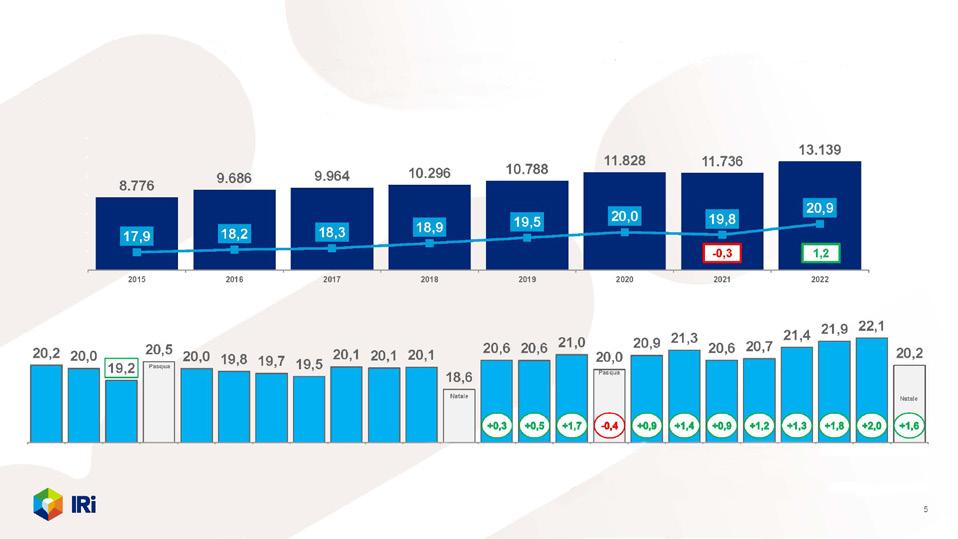

While the shopping cart of Italians in 2022 had to face a very high inflation and the cut on promotions applied by the large-scale distribution chains, PLs continue to grow. In fact, PLs prove to be consumers’ favorite in such a period of crisis where the world has been disrupted first by the pandemic and then by the war and the consequent inflation. The picture of PL’s 2022 essential role can be found in the XIX Marca Report carried out by IRI-Information Resources, and presented on January 18 at BolognaFiere during the 19th edition of the exhibition. Considering all the channels, the most important datum of the Report is that, after 2021, which was characterized by a PL contraction, 2022 ended with a positive trend and a total turnover of 13.1 billion euros (+12%) and a 20.9% share, +1.2% more than the previous year.

PLM - THE PRIVATE LABEL SCENARIO 20 -

The PL Share is growing, supported by the turnover and volume increase

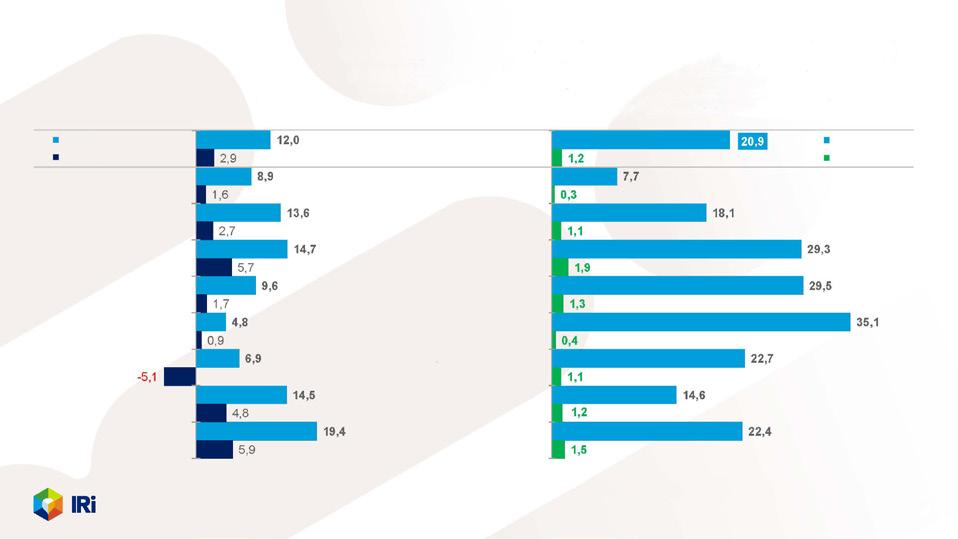

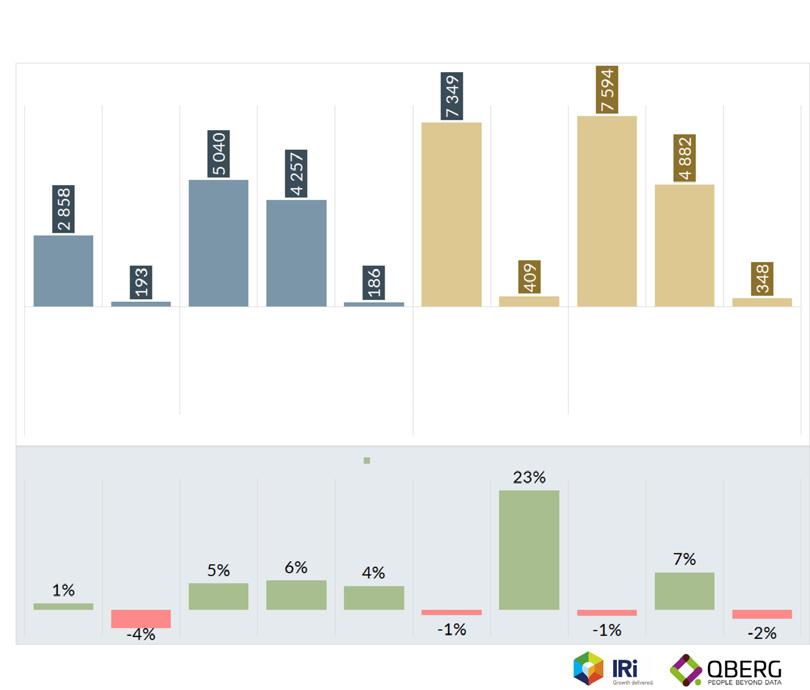

PL LCC - Channel performance - 2022

share

The year 2022 seems to have reversed any paradigm previously observed. Inflation, for example, which in 2021 showed a decrease (- 0.7%), last year accounted for +7.9% with a remarkable upswing in the last months of the year. December 2022 ended with a double digit inflation in packaged FMCG (+14.1%). Speaking of reversed trends, this strong price increase has two other consequences: reversal of promotion and volume trends.

In 2022, PLs goes back to gaining market share, on the upswing in particular in the second half of the year

PL LCC - Turnover in million€ and PL Value Share - Years 2015-2022

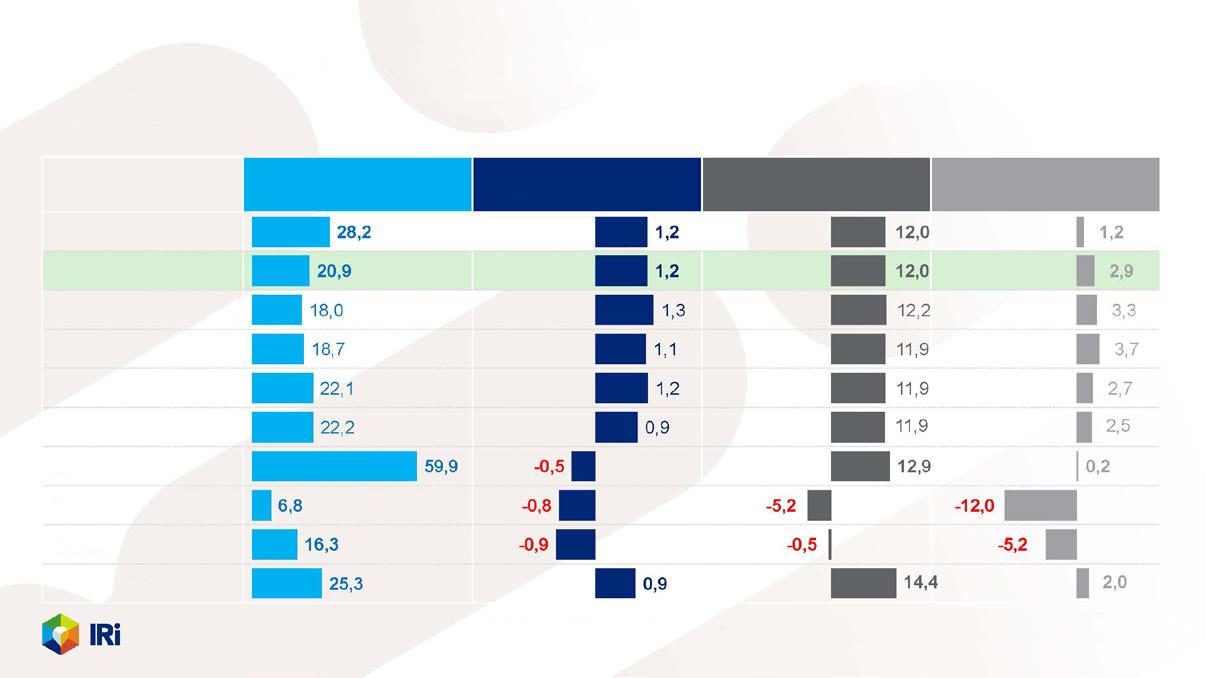

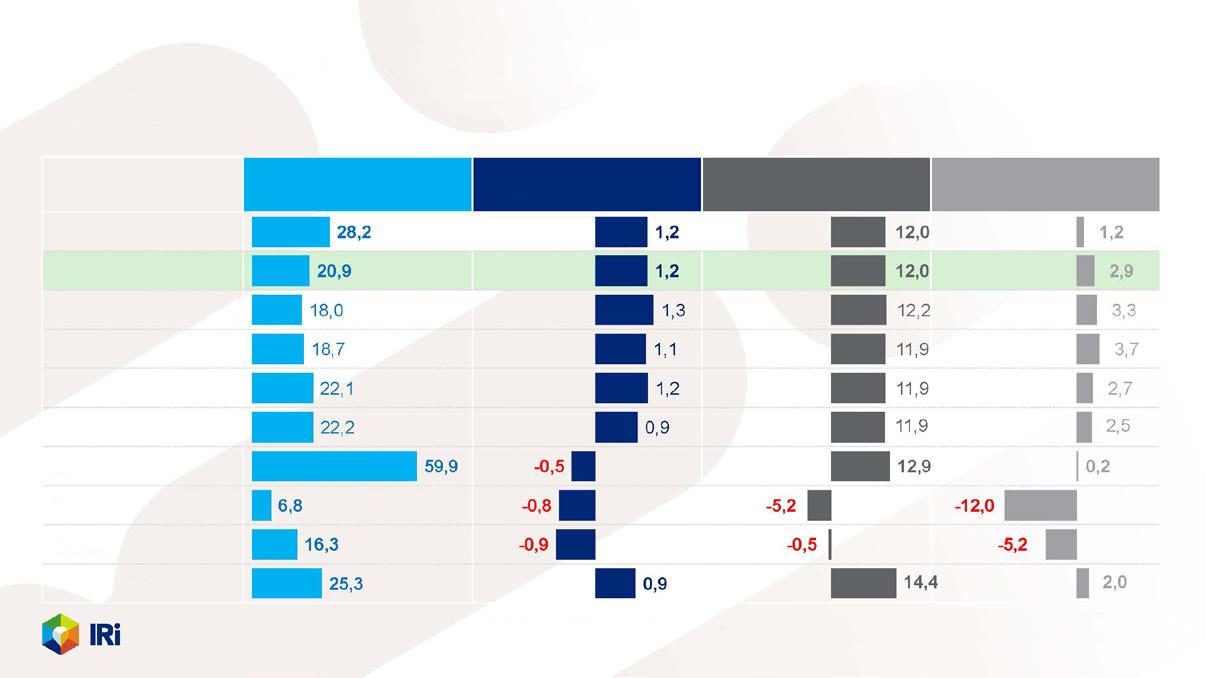

After a slight increase in the promotional pressure observed in 2021, 2022 ended with promotions accounting for 22.5% of sales (-2.3 percentage points compared to the previous year and -3.9 points compared to the period before Covid-19 pandemic). Finally, volumes, after a positive sales trend in the last 3 years, saw a negative trend in 2022, recording a contraction of 0.3%. In this difficult context, PLs continue to grow substantially, recording a 2.9% trend in volume, despite the major impact of inflation. This is a cross-channel growth, encompassing hypermarkets, supermarkets, mini-marts and discounters.

21 THE PRIVATE LABEL SCENARIO - PLM

PL

Omnichannel Hypermarkets Superstores Supermarkets Mini-marts Discounters CP specialists Online Generalists Petshop chains Source: IRI Liquid Data. Hypermarkets + Supermarkets + Mini-marts + Home and Personal care Specialists + Discounters + Pet Shop chains + Online generalists. 2022: 52 weeks ended on January 1, 2023. Volumes = value at a constant price. ISLsp Point Share Difference Trends in Value Trends in Volume

Source: IRI Liquid Data. Hypermarkets + Supermarkets + Mini-marts. Years: ...... : 52 weeks until January 1, 2023. January January February February March March April April May May June June July July August August September September October October November November December Christmas Christmas December

The novelty that has conquered Italy, now storable at room temperature!

Fresh, ready in 5 minutes!

Hand made

With mother yeast

Preservative free Cooked on stone

www.lapizzapiuuno.it

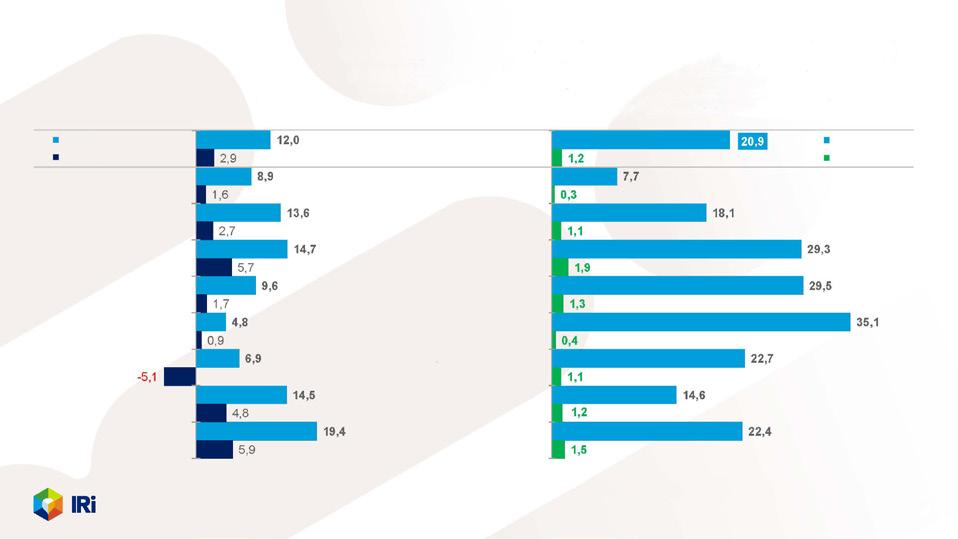

Looking at the PL market product, the competitive positioning of all product sections, especially in the Fresh and Pet care categories, has improved. Not only has a growth in value been recorded, but also a strong increase in volume (Fresh +5.7% and Pet Care +5.9%).

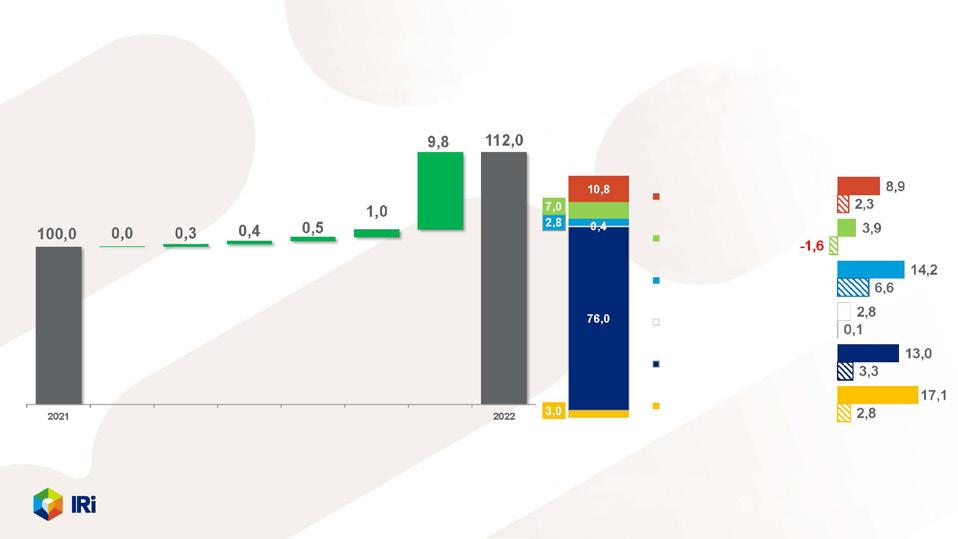

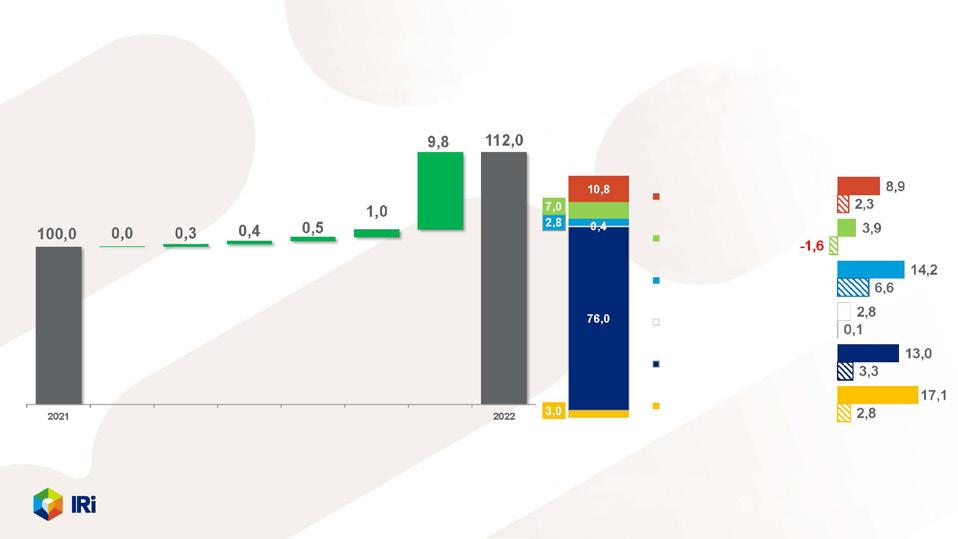

The growth of PLs goes hand in hand with that of the supply, reaching an assortment share of 15.5%, +0.5 point. This supply, despite the inflation, had positive performances/trends in 2022 in its specialized lines and high-added value: the Premium segment recorded +8.9% in value and +2.3% in volume, while the Functional line +14.2% in value and 6.6% in volume. As for the Organic segment, it has slowed down: in fact, despite its increase in volume (+3.9%), it’s the only negative figure recorded in volume (-1.6%).

High-range lines are constantly dynamic, with the exception of Organic/Eco. First-price grows, but the Mainstream continues to be determinant

The mainstream segment, the most important for PL accounting for 76% of the total turnover, drives growth: 9.8 points out of 12 of the PL trend, in fact, come from these products. As in the market, PL prices skyrocketed: on average, in 2022, the inflation on PL products was 9.2% with the Store Brand reaching 9.8%. In other words, being relatively affordable is the main growth factor for PLs. Despite the high rate of inflation, the ‘affordability positioning’ together with the quality of products, let the volume grow. The introduction of new products also continues to generate growth, as do both the segmentation of supply and the constant expansion of PL assortments and, consequently, their share on the shelf. l

THE PRIVATE LABEL SCENARIO - PLM 23

PL improves its competitive positioning in all sections, especially in Fresh and Pet Care, where it’s supported by a strong growth in volume PL LCC - % variation -2022 Share in Values /Percentage point difference Share 2022 Source: IRI Liquid Data. Hypermarkets + Supermarkets + Mini-marts Volumes: value at constant price. 2022: 52 weeks ended on January 1, 2023. Value LCC Beverage Food Fresh Cool Fruit and Vegetables Home care Personal care Pet care Value share Volume Difference share

LCC - contribution to the growth of sales in VALUE of PLs Percentage - 2022 PL LCC - The supply segmentation %Shareand Trends VALUE/VOLUME - 2022 Source: IRI Liquid Data. Hypermarkets + Supermarkets + Mini-marts. Brands + Large-scale distribution brands + others. Variation in percentage points compared to 2021. Percentage variation compared to 2021. Values sales at constant prices. 2022: 52 weeks on January 1, 2023. 2021: 52 weeks on January 2, 2022. Premium Organic Functional Kid Mainstream First-price Kid Organic Functional First-price Premium Mainstream 2022 Snapshot of Pls Trend in value +12,0% "Brand" incidence 70,0% (+0,2%) Promotion 15% (-1,2) Average References 1,735 (+2,4%) 13,9% (-0,9) "Brands" 25,1% (-0,9) "Premium" Assortment share 15,5% (+0,5) Value trend “Premium” +8,9% Trend in volumes +2,9% Value share 20,9% (+1,2) PL LCC - PL performance indexes - 2022 Source: IRI Liquid Data. Hypermarkets + Supermarkets + Mini-marts. 2022: 52 weeks on January 1. Value sales at constant prices. Average number of References in December 2022 vs December 2021.

IT’S NOW MARTINA BOROMELLO, MARKETING AND COMMUNICATION DIRECTOR AT ORTOROMI WITH PL MAGAZINE .

OrtoRomi, vegetables climbing to the top of PLs

Mixed salads and baby salad, bagged iceberg lettuce, endive or escarole, mushrooms or vegetables ready to be cooked: these are the specialties of a company that get great satisfaction from working for PLs.

by Maria Teresa Giannini

24

PLM - FROM THE POINT OF VIEW OF THE INDUSTRY

Set up in 1996, in Veneto, from the experience of the two co-founders, the farmers Elio Pelosin and Rino Bovo, OrtoRomi originally sold I range products, and started to invest in the IV range products in 1999. In 2006, the company turned into a Cooperative and it now has 10 shareholders (9 farms and the Co.Ve.Ca.A. cooperative), as well as 40 farms throughout Italy providing it with their own raw materials. Mixed salads and baby salads, bagged iceberg lettuce, endive or escarole, mushrooms or vegetables, ready to be cooked such as spinach, savoy cabbage, chard and kale: these are the specialties of OrtoRomi, which boasts two plants one in Borgoricco (Padua) - fully automatized in 2013 - and the other in Bellizzi (Salerno). The company ended 2022 with a turnover of almost 120 million euros with 37,000 tons of production in volumes, confirming its great national position among other competitors and it had great satisfactions also working for private labels, as Martina Boromello, Marketing and Communication Manager at OrtoRomi.

According to Nielsen, you rank third among the IV range suppliers. However, as suppliers of PLs, what’s your positioning?

That's right, as a branded industry our 4% market share places us in third spot after Bonduelle and private labels, put together, which hold the largest share (over 60%). On the other hand, if you look at the industry itself, our share, as far as the sector we operate in is concerned, is far greater and is about 14%.

Over your total turnover, what’s the percentage of contract manufacturing?

In 2022, 118 million euros, 58%, so most of it, comes from contract manufacturing.

25

FROM THE POINT OF VIEW OF THE INDUSTRY - PLM

What are the benefits of being PL suppliers? And what are the advantages you provide?

As PL suppliers, we get the chance to strengthen the relationship we’ve built over the years with large-scale distribution and to prove every day the effort and the quality of our job. As partners of distributors for several years now, we have been able to grow together and improve, stimulating each other. Plus, we can offer expertise and innovation, which are reflected in our products and professionalism.

What Italian and foreign brands do you, as PLs, supply?

As far as the Italy is concerned, we are PL suppliers for all the major national brands, such as Conad, Coop, MD, Crai, Gruppo Selex, Prix and IN’s market (Pam Group), but also for those international ones like Carrefour, Despar, Penny, Eurospin. On the other hand, abroad, we supply Lidl and Erisprin Croatia.

Your collaborations with the brands are so successful that on May 31, 2022, one of your PL products was awarded in Amsterdam, during the event of the pre-tradeshow of PLMA...

We were awarded with one of the International Salute to Excellence Awards for the ‘Apulian Soup’, which we produce for Lettere dall’Italia by MD. It is a tasty fresh soup,

26 PLM - FROM THE POINT OF VIEW OF THE INDUSTRY

Plants,

2

million euros 2022 Turnover OrtoRomi

thousand tons Production in volume

Turnover share obtained as PL producers

Market share a Industry brand, 3° place in the IV range

Market

Companies that provide fruit and vegetable to OrtoRomi

Borgoricco (Padua) and Bellizzi (Salerno)

40

118

37

58%

4%

14%

share of PL food produce (salads, soup and vegetables to cook)

with no glutamate nor preservatives, that you only need to warm up before tasting. The soup has all the typical Apulian flavors, since it’s made of regional high quality ingredients: - turnip tops, peas, onion, extra-virgin olive oil, pepper. Salute to Excellence Awards prizes innovation and quality in food, non-food and wine industries. During the last edition, they especially rewarded sustainability, from product to packaging. In fact, the great value of our product comes from its affordability, taste and packaging: the latter, in particular, made the product get the highest score in the category, which makes us very proud.

According to your experience, do you think supplier-brand relationship is important only within the company (working rules, quality standards, business rules) or is it something that also customers perceive and which drives their choice?

We’re positive that the relationship between OrtoRomi and large-scale distribution is essential not just for B2B, among industry professionals, but that it is also something the end consumer is able to feel. This is because, when consumers are loyal to the brand, they trust the choices the brand makes.

According to Ipsos data, the majority of Italians that regularly buy PLs are willing to spend more for certified foods: what are the certifications you have obtained so far?

Certifications, for us, are synonymous with freshness and quality in terms of products, but also of safety in terms of industrial process, which undergoes many voluntary audits: in the first case, we can mention the Ifs and Brc certification, for the second one, Global G.a.p. and the adoption of Uni En Iso 11233 and Dtp021 standards.

What’s cooking for 2023, in terms of PL innovation?

For 2023, the goal is to continue to grow as partners and co-packers, together. In this particular historical period, we want to face first those difficulties linked to the price increase and the drop of the purchasing power of families, with constructive dialogue and a bi-directional exchange. The idea is to start from constructive dialogue and bidirectional exchange to move towards a proactive approach and, consequently, the possibility to leverage our know-how of the industry.l

27 FROM THE POINT OF VIEW OF THE INDUSTRY - PLM

Consumers prize the IV and V RANGE of brands

PL products, especially those of the fresh food department, are ever more present in consumers’ shopping carts. Among them, the lines of ready-to-eat bagged salad or other vegetables represent the most important segment.

Against the backdrop of the quite complex economic scene of the last months, private label products, especially those of the fresh food department, are ever more present in consumers’ shopping carts. Based on Iri data, between January and October 2022, PL fresh produce has generated a turnover of about 1,250 euros, recording a 4.4% increase compared to the same period in the previous year, performing better than any other in the whole department (+3.7%). Conversely, in terms of volume, the section decreased by 0.8%, whereas PL fresh produce went up by 1.1%, increasing its market share to 35.2%. Within this department, the lines of ready-to-eat bagged salad or other vegetables represent the most important segment. As a matter of fact, the IV range recorded a turnover of about 380 million euros, a little less than one third of the total value of the industry, reaching a volume share of 57.5% (+1%)

28

PLM - MARKETS

+15% value growth and +9% volume growth by Todis IV and V range fresh produce lines in 2022.

+5% increase by Penny IV and V range sales in 2022. +4.5% in 2021.

29 MARKETS - PLM

Il premio alle imprese italiane fornitrici di prodotti MDD che presentano caratteristiche ideali per i retailer, selezionate sulla base di oggettivi criteri di eccellenza produttiva e di affidabilità

1°EDIZIONE COPACKER PROFILE PLM AWARDS 2023 BEST

PER SCOPRIRE TUTTO SUL PREMIO E CANDIDARE LA TUA AZIENDA Le candidature dovranno pervenire entro il 5 marzo 2023 in collaborazione con un progetto di con il patrocinio di clicca qui

CLOSER ATTENTION TO RAW MATERIALS AND ITALIAN INGREDIENTS

Simone Zerbinati, Zerbinati General Manager , claims that the world of private labels plays a major role in his company. «According to 2022 figures, we produced about 65% of our IV range products under PL. The most popular references within large-scale distribution are undoubtedly fresh and ready-to-eat salads, together with ready-to-cook bagged vegetables. After recording a plateau for months during the Covid-19 pandemic, the market is now growing steadily, and brands aim to widen their product assortment both in terms of recipes and formats. Besides the advantage of being ready-to-eat, these products are always produced paying close attention to raw materials and, where possible, using Italian ingredients grown according to Integrated Crop Management systems and 100% recyclable packaging. As for the V range, large-scale distribution is mainly focused on mainstream recipes, such as minestrone soups, vegetable purees and legume or cereal soups, which are recording a significant increase».

BAGGED SALADS CROSSING THE FINISHING LINE

Back to their busy life, spending less time at home compared to the period of the Covid-19 pandemic, consumers seem to prize highly practical and convenient products again, ever more important in private label assortments. «In 2022, the Bontà dell’Orto and L’Arte delle Specialità brands of our IV and V range went up by 15% in value and by 9% in volume. Mixed bagged salads, growing by over 22% in turnover, were the best-performing category. Tender greens (+14%) and soups (8%) performed well too. Nowadays consumers seem to pay closer attention to these products and are more and more interested in recipes with crunchy salad, such as iceberg lettuce, as the main ingredient. In terms of this year's sales, these references recorded exceptionally high sales peaks compared to last year's sales during the same period. We continue focusing on soups, as innovative recipes and new trends are making our fresh produce assortments ever more unique» says Pietro Fiore, Todis Fresh Produce (Department) Manager .

31 MARKETS - PLM

A WIDER RANGE OF PL PRODUCTS

Nicolò Padrin, Senior Buyer F&V at Penny, shares the view that the V range is an interesting segment to develop. «We significantly widened the ready-to-eat soup supply, by betting on more regional recipes and differentiating our assortment by geographical area. However, we’re also concentrating on new ingredients for our summer recipes. Moreover, our maxi bagged salads are sold at a discounted price in order to preserve the purchasing power of consumers. Together with spinach, which is already part of our assortment, in January we’re going to introduce new PL ready-to-cook bagged vegetables (e.g. ready-to-cook mixed vegetables, puntarelle, chard). I’d like to also highlight the performance of our pre-cooked unpeeled vegetables that, being practical and convenient, seem to be particularly appreciated by our customers. On the whole, after recording +4.5% in 2021, last year the sales of our IV and V range PL products increased by 5%».

CLOSE ATTENTION TO QUALITY AND FRESHNESS

Pier Luigi Lauriola, Fresh produce Manager at Carrefour, estimated a steady value increase of +3% for the brand’s PL category in 2022, with an incidence of about 15% on the fresh produce section. «Single-type or mixed bagged salads account for over 50% of the turnover. However, it’s the V range to record the most significant performance with its soups, cooked vegetables and fruit. Nevertheless, the ready-to-eat section plays a key role in ensuring quality and freshness to our customers.

Expertise and innovation at the service of PLs

Martina Boromello, Marketing and Communication Manager at OrtoRomi, believes that the role of private label supplier has more than one advantage for her company. «On the one hand, through our products and professional skills, it allows us to convey the expertise and innovation skills we’ve acquired over the years. On the other hand, give us the chance to strengthen the relationships with our retailers, some of whom have shared with us an important journey towards constant improvement and growth. We applied the same concept last year too. As a matter of fact, PL products accounted for 58% of our turnover. We were also extremely proud to see our PL Zuppa Pugliese being awarded with the International Salute to Excellence Award 2022 by the Plma. Our goal for the next months is to continue growing as co-packers and large-scale distribution partners, always ensuring our expertise in terms of quality and innovation».

PLM - MARKETS 32

This includes ready-to-eat or ready-to-cook fruit and vegetables prepared by designated operators, specifically trained in dedicated laboratories in some of our stores. In general, in the fresh produce industry, highly practical and convenient products are becoming increasingly important, as consumers are now looking for ready-to-eat products, produced in a way that makes it easy to prepare them at home». l

Experience and technology for a customized supply

According to Andrea Battagliola, Chairman of La Linea Verde , the relationship between brands isn’t merely based on supply, but it’s instead a true partnership. «With our extensive expertise and state-ofthe-art technologies, as co-packers, we’re able to provide the innovative solutions PLs need, but also to help them convey their brand’s identity. We’re indeed very receptive when it comes to consumer inputs, and we’re able to provide a customized supply to each of them, while ensuring those strengths that have always characterized our products, such as authenticity, utmost freshness, a controlled and certified supply chain, up-to-date product range and sustainable packs. Looking at last year’s figures, we can see that some trends recur: fresh soups, also under PLs, drive our growth, whereas salads, which have always represented the major component of our PL supply, win the top spot of the PL podium».

33 MARKETS - PLM

In 2022, Carrefour IV and V range products recorded a value increase by 3%, with an incidence of about 15% on the fresh produce section.

Fabio Massi, Journalist specialized in Retail and Mass market issues.

How much does private label advertising in the fruit and vegetable market impact large-scale retail flyers?

QBerg, Leading Italian research institute for pricing intelligence and cross-channel assortment strategies analysis, examined supply chain trends of fresh, IV range and V range fruit and vegetables in 2022 and 2021.

34

PLM - QBERG OBSERVATORY

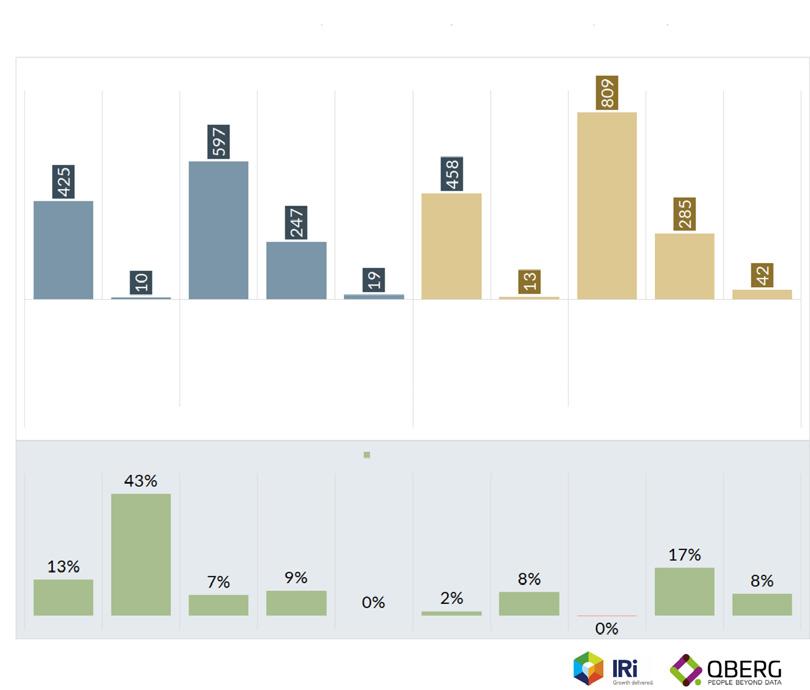

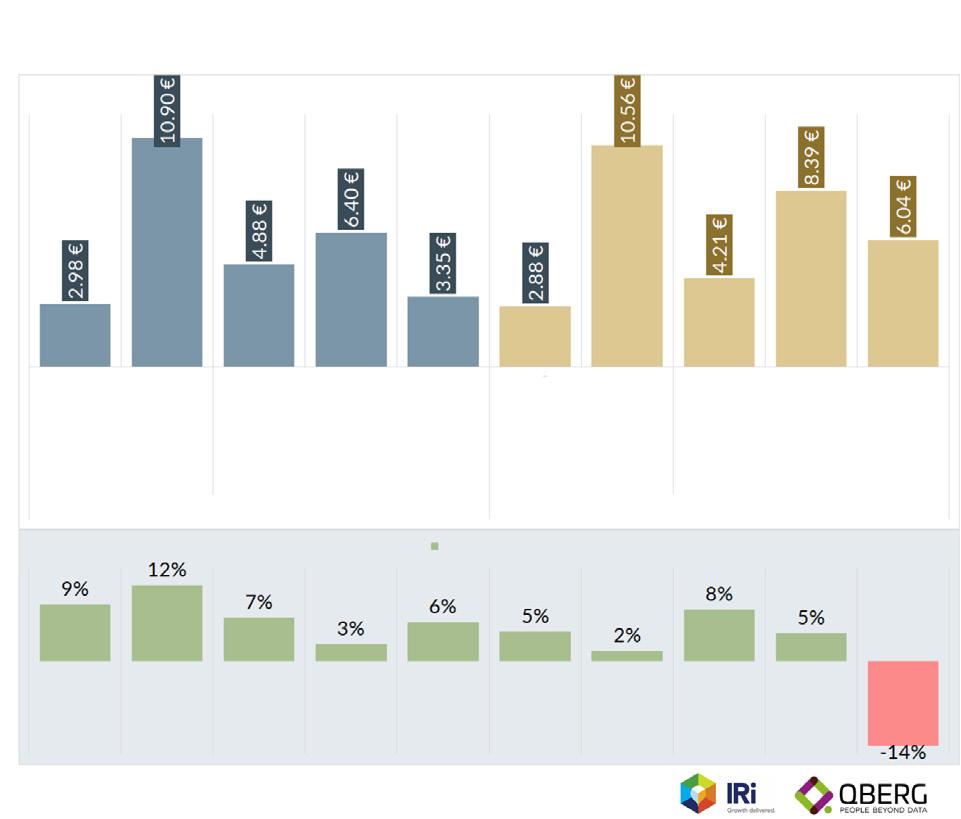

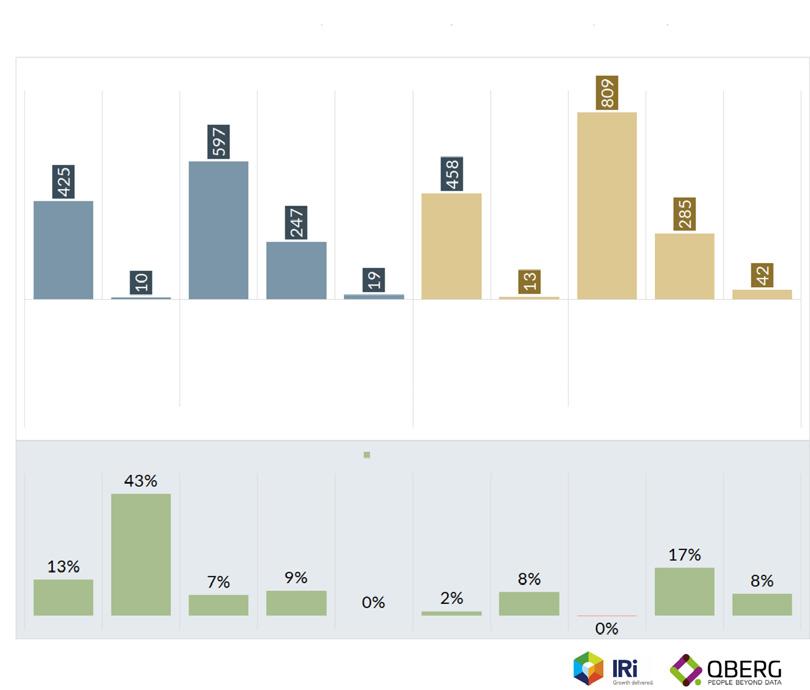

In 2022, the number of advertising campaigns increased by approximately 2% from 2021, with more than 33 thousand campaigns, where branded products featured in 2 out of 3 campaigns. It is worth noting that:

• Advertising campaigns on PL flyers increased for all ranges, especially for vegetables, except, however, for the small segment of prepared fruit (4th range).

• Branded products were more or less stable for fresh fruit and vegetables, as well as V range vegetables , but the number of campaigns for IV range fruits and vegetables have significantly increased.

• The largest increase in the number of advertising campaigns for PLs was for IV range vegetables. It is worth highlighting how this is the market segment that displays the smallest difference in campaign presence between branded and PL products.

As far as unique products are concerned, they have experienced a 10% increase (up to 2,905).

Breakdown:

• For IV range vegetables, the promotional offer indicates an increase of 9% for PL products and an increase of 17% for non-PL products. The latter marked the largest increase in 2022.

• On the other hand, we can observe different strategies from large-scale retail chains for fresh fruit and vegetable products: there is significant growth in PLs for both fruit and vegetables (+13% and +7% respectively), while, on the other hand, these two segments in the range of nonPLs have suffered a stagnation. • The number of unique PL vegetable products has nearly caught up with that of branded products (425 vs. 458).

35 QBERG OBSERVATORY - PLM

No. FLYER campaigns 2022 % Diff. 2022-2021: FRUIT VEGETABLES PRIVATE LABEL Fresh Prepared (4th range) Prepared (4th range) Prepared (4th range) Prepared (4th range) Cooked (5th range) Cooked (5th range) Fresh Fresh Fresh NO PRIVATE LABEL VEGETABLES FRUIT

In-Store POINT 2023

Number of Flyer Campaigns for Hypermarkets, Supermarkets and Mini-marts for Fruit and Vegetables (2021 and 2022; N.Campaign and delta % vs. A.P.)

Source:

No.Flyer

% Diff. 2022-2021: FRUIT VEGETABLES PRIVATE LABEL Fresh IV range prepared IV range prepared IV range prepared IV range prepared V range cooked V range cooked Fresh Fresh Fresh NO PRIVATE LABEL VEGETABLES FRUIT Source: In-Store POINT 2023

Number of Unique Products on Flyers of Hypermarkets, Supermarkets and Mini-marts for Fruit and Vegetables (2021 and 2022; No.Campaign and delta % vs. Previous Year)

Products 2022

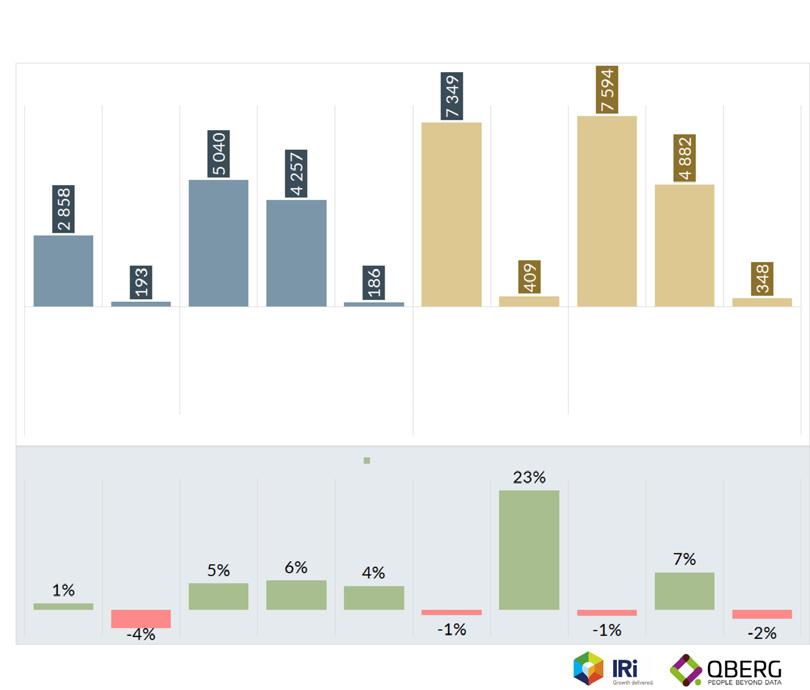

Although both the number of fruit and vegetable campaigns and products increased in 2022 compared to 2021, the same cannot be said for the visibility space (Qp4 is the indicator constructed by QBerg) in the two assortments, where a decrease of roughly 3-4% in fruits and vegetables can be seen.

The decrease in advertising visibility in large-scale retail flyers was not, however, consistent between private label and non-private label fruit and vegetable products:

• Decrease for fresh fruit (-2%) and vegetables (-5%) for both PL and branded products.

• Increase in shelf visibility of prepared fruit (4th range) for PL products and decrease for non-PL products (-11%).

• On the contrary, there was a decrease for PL in prepared vegetables (-10%) but, at the same time, increases for branded products (-5%).

• The only similarity recorded was the cooked vegetable/ready meal (5th range) segment.

Concentration of Promotions on Flyers of Hypermarkets, Supermarkets and Mini-marts for Fruit and Vegetables (2021 and 2022; No.Campaign and delta % vs Previous Year)

PLM - QBERG OBSERVATORY

36

QP4 FLYER Value 2022 % Diff. 2022-2021: FRUIT VEGETABLES PRIVATE LABEL Fresh IV range prepared IV range prepared IV range prepared IV range prepared V range cooked V range cooked Fresh Fresh Fresh NO PRIVATE LABEL VEGETABLES FRUIT

Source: In-Store POINT 2023

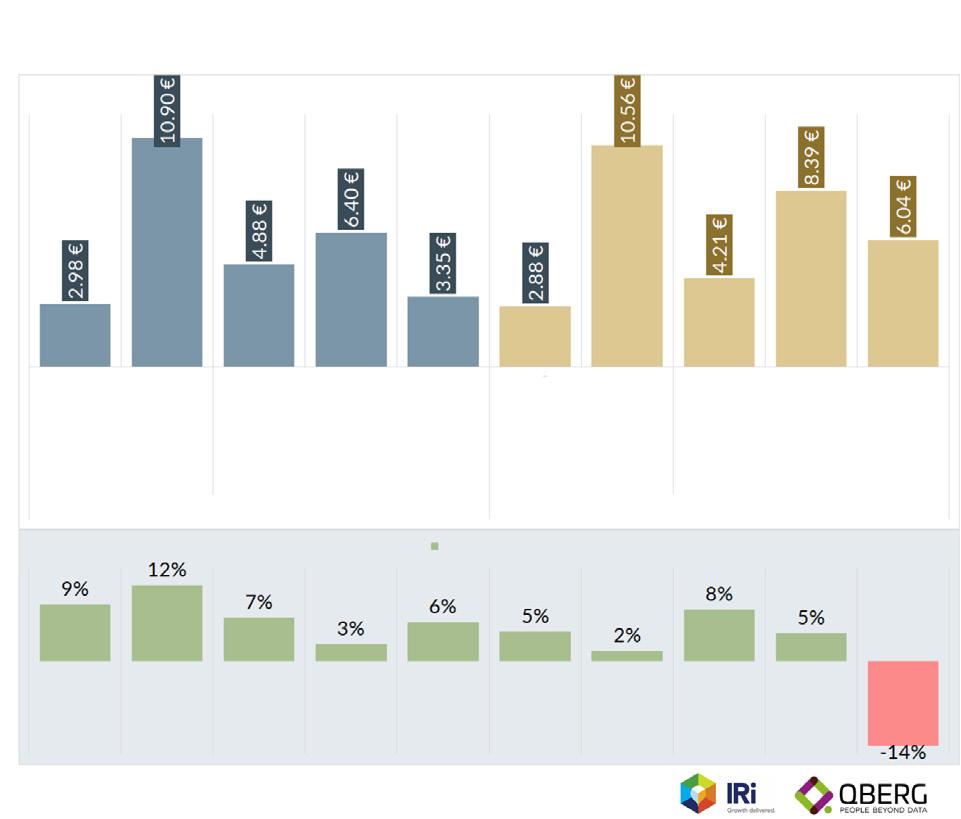

There were clearly many pricing strategies adopted by large-scale retail chains regarding fruit and vegetable flyer advertising in 2022. Breakdown of the average prices charged:

• There was an overall growth of 8% compared to 2021.

• It is evident that non-PL fruit advertising is roughly 3% cheaper than PL advertising

• For fresh vegetables, PL prices are roughly 15% higher than for branded products.

• The highest average promotional prices were charged for prepared fruit and vegetables (4th range), and while promotional prices for prepared fruit (e.g., fruit salads) between PL and non-PL products are essentially equivalent, those for prepared vegetables (mixed salads in bags, for example) sees private label prices significantly lower (about 23% lower) than those of its competitors. l

Average price of promotions on Flyers of Hypermarkets, Supermarkets and Mini-marts for Fruit and Vegetables (2021 and 2022; Average promotional price and delta % vs Previous Year)

Source: In-Store POINT 2023

37

QBERG OBSERVATORY - PLM

promotional price FLYER 2022 % Diff. 2022-2021: FRUIT VEGETABLES PRIVATE LABEL NO PRIVATE LABEL Fresh IV range prepared IV range prepared IV range prepared IV range prepared V range cooked V range cooked Fresh Fresh Fresh VEGETABLES FRUIT

Average

Fabrizio Pavone Marketing Manager and Business Development of QBergg