@SVB_Financial

Jason Kobus, Managing Director Platform Strategy, Silicon Valley Bank

The Order of Operations for Startup Financials:

Paving the Way for Fundraising

Jason specializes in financial product development and integration. Prior to SVB, Jason worked for Deloitte in audit, data privacy, and cybersecurity. He immigrated from Toronto, Canada where he was VP of Infrastructure and Data Services for Merrill Lynch Canada. He holds a B.A. in Finance and Economics from the University of Western Ontario and numerous technical and risk certifications.

As an accounting professional, you can do no greater service to an entrepreneur than to prepare their finance stack for future funding or financing opportunities. Founders need to focus on building their business and product, so you can save them tremendous time by optimizing their financial operations...

H

ere are several ways to help your clients prepare for the next step in their startup journey:

established their company, connect them with a lawyer or reliable platform to help them with the process.

1. Get their basic financial operations in order

2. Financial integration and automation

First, get all of the company’s financial data in one place. By using an accounting application like Xero, you can transform data chaos into financial order. Founders should transition away from using their personal bank accounts for running their business.

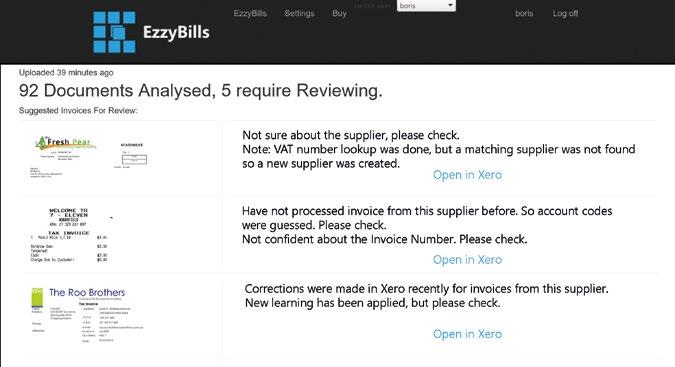

Integrating systems and automating processes will let you focus on planning. Do away with low-level accounting drudgery and unleash your inner advisor super powers!

Then, help set up the company’s bank feeds and automate vendor invoicing, payments and bank reconciliation. You may recommend setting up multiple bank accounts to increase control, but ensure that the client controls the money and delegates only the appropriate access for each bank account. Typically, advisor access to bank feeds is fine but not for international wires. If your clients have not yet 20 / Issue 15

If a client has just launched its product, help the team set up easy ways to get paid, such as merchant services and marketplaces (which you, as the advisor, can use as well). Fintech applications really put your bank data to work for you, especially with automatic categorization algorithms. Expense management is another function which can leverage data and automation. Xero offers this as a native capability for smaller companies as part of its platform, as well as through an easy upgrade for partners in the Xero

Marketplace. Show your clients that while their sales team needs to spend money to grow their customer base, they must remain vigilant to ensure that expenses stay under control and the reimbursement process is efficient. Expense apps can auto-generate an IRS acceptable receipt using a bank provided transaction feed for smaller transaction amounts, and apply machine learning, AI and virtual assistance to help control expenses. 3. Find the right finance professional to help set the stage for investment The right finance professional will provide validation that financials are in some form of order. This can be a fractional CFO on a temporary basis if your client can’t afford someone full-time. Payroll and tax both have drastic legal implications if done incorrectly. Plus, it’s always great to have someone experienced in your corner! Partner with these professions to

XU Magazine - the independent magazine for Xero users, by Xero users. Find us online at: xumagazine.com