VOLUME 40 I ISSUE 8 I AUGUST 2022 EAGE NEWS President’s interview INDUSTRY NEWS BP Statistical Review of Energy CROSSTALK Why TGS has made a triple swoop SPECIAL TOPIC Near Surface Geo & Mining

cgg.com/earthdata OUR

FROM

PERSPECTIVE. SE E THINGS DI FF ERE NT LY

PLANET.

A NEW

CHAIR EDITORIAL BOARD

Gwenola Michaud (Gwenola.Michaud@cognite.com)

EDITOR Damian Arnold (editorfb@eage.org)

MEMBERS, EDITORIAL BOARD

• Paul Binns, consultant (pebinns@btinternet.com)

• Lodve Berre, Norwegian University of Science and Technology (lodve.berre@ntnu.no) Satinder Chopra, SamiGeo (satinder.chopra@samigeo.com)

• Anthony Day, PGS (anthony.day@pgs.com)

• Peter Dromgoole, Retired Geophysicist (peterdromgoole@gmail.com)

• Rutger Gras, Consultant (r.gras@gridadvice.nl)

• Hamidreza Hamdi, University of Calgary (hhamdi@ucalgary.ca)

• John Reynolds, Reynolds International (jmr@reynolds-international.co.uk) James Rickett, Schlumberger (jrickett@slb.com) Peter Rowbotham, Apache (Peter.Rowbotham@apachecorp.com)

• Dave Stewart, Dave Stewart Geoconsulting Ltd (djstewart.dave@gmail.com)

• Femke Vossepoel, Delft University of Technology (f.c.vossepoel@tudelft.nl)

• Angelika-Maria Wulff, Consultant (gp.awulff@gmail.com)

EAGE EDITOR EMERITUS

Andrew McBarnet (andrew@andrewmcbarnet.com)

MEDIA PRODUCTION

Saskia Nota (firstbreakproduction@eage.org)

PRODUCTION ASSISTANT

Ivana Geurts (firstbreakproduction@eage.org)

ADVERTISING INQUIRIES

corporaterelations@eage.org

EAGE EUROPE OFFICE

Kosterijland 48 3981 AJ Bunnik

The Netherlands

• +31 88 995 5055

• eage@eage.org

• www.eage.org

EAGE MIDDLE EAST OFFICE

EAGE Middle East FZ-LLC

Dubai Knowledge Village Block 13 Office F-25 PO Box 501711

Dubai, United Arab Emirates +971 4 369 3897

• middle_east@eage.org www.eage.org

EAGE ASIA PACIFIC OFFICE

UOA Centre Office Suite 19-15-3A No. 19, Jalan Pinang 50450 Kuala Lumpur Malaysia

• +60 3 272 201 40

• asiapacific@eage.org

• www.eage.org

EAGE AMERICAS SAS

Calle 93 # 18-28 Oficina 704 Bogota, Colombia

• +57 1 4232948

• americas@eage.org

• www.eage.org

EAGE MEMBERS CHANGE OF ADDRESS NOTIFICATION

Send to: EAGE Membership Dept at EAGE Office (address above)

FIRST BREAK ON THE WEB www.firstbreak.org

ISSN 0263-5046 (print) / ISSN 1365-2397 (online)

47

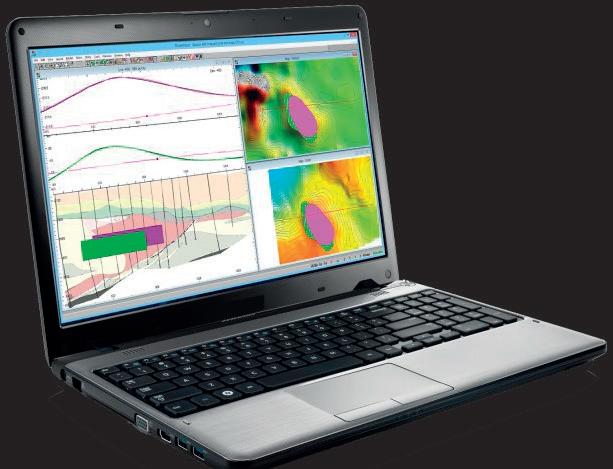

On the development and application of airborne GPR solutions

Editorial

3 EAGE News

Personal Record Interview

Monthly Update

Crosstalk

Industry News Sp ecial Topic: Near Surface Geo & Mining 37 Semi-airborne electromagnetic exploration using a scalar magnetometer suspended below a multicopter Michael Becken, Philipp O. Kotowski, Jörg Schmalzl, Gregory Symons and Klaus Brauch 47 On the development and application of airborne GPR solutions Jesper Emilsson, Johan Friborg, Jaana Gustafsson, Jimmy Adcock and Andreas Viberg 55 Active and passive-source underground seismic data acquisition T.-J. Hupe, D. Draganov, and D. Orlowsky 61 Aggregate (sand and gravel) exploration with 2D electrical resistivity imaging and test drilling on the western limits of the Balcones Fault Zone in Texas, US Hector R. Hinojosa 69 Advanced imaging techniques provide new near surface details in 3D seismic exploration data and an application to new energy-related offshore shallow subsurface investigations Julien Oukili, Terje Kultom Karlsen, Bertrand Caselitz, Jens Beenfeldt and Allan McKay 75 Finding blind ore bodies using 3D seismic: St Ives-Victory, Western Australia Kevin Jarvis, A. Foley, M. Falconer, G. Turner, J. Kinkela, R. Smith, S. Bright and S. Ziramov 79 Application of 3D optical fibre reflection seismic in challenging surface conditions

Sasha Ziramov, Andrej Bona, Konstantin Tertyshnikov, Roman Pevzner and Milovan Urosevic

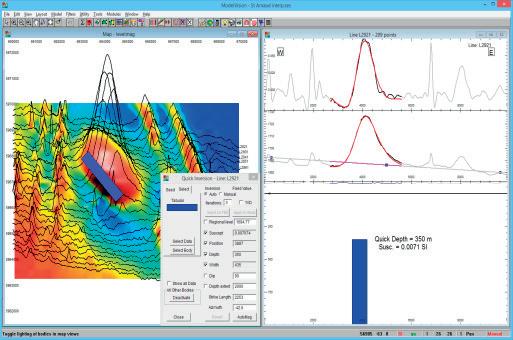

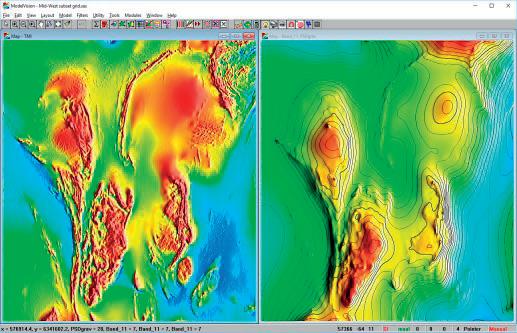

91 Application of the magnetic geophysical method to exploration of the Potassic Zone in some Porphyry Copper Deposits (Iran) Shohreh Hassanpour, Mehmet Salih Bayraktutan and Snežana Komatina

98 Calendar

cover: Chuquicamata, open-pit copper mine, Calama, Chile.

FIRST BREAK I VOLUME 40 AUGUST 2022 1

Contents

17

18

20

23

FIRST BREAK ® An EAGE Publication

European Association of Geoscientists & Engineers

Board 2022-2023

Near Surface Geoscience Division

Esther Bloem Chair

Andreas Aspmo Pfaffhuber Vice-Chair

Alireza Malehmir Immediate Past Chair

Micki Allen Contact Officer EEGS/North America

Adam Booth Committee Member

Hongzhu Cai Liaison China

Eric Cauquil Liaison Shallow Marine Geophysics

Deyan Draganov Technical Programme Officer

Wolfram Gödde Liaison First Break

Hamdan Ali Hamdan Liaison Middle East

Vladimir Ignatev Liaison Russia / CIS

Musa Manzi Liaison Africa

Myrto Papadopoulou Young Professional Liaison

Catherine Truffert Industry Liaison

Panagiotis Tsourlos Editor in Chief Near Surface Geophysics

Florina Tuluca Committee member

Oil & Gas Geoscience Division

Lucy Slater Chair

Yohaney Gomez Galarza Vice-Chair

Michael Peter Suess Immediate Past Chair; TPC

Erica Angerer Member

Wiebke Athmer Member

Juliane Heiland TPC

Tijmen Jan Moser Editor-in-Chief Geophysical Prospecting Francesco Perrone Member

Matteo Ravasi YP Liaison

Jonathan Redfern Editor-in-Chief Petroleum Geoscience

Giovanni Sosio DET SIC Liaison

Aart-Jan van Wijngaarden Technical Programme Officer

SUBSCRIPTIONS

First Break is published monthly. It is free to EAGE members. The membership fee of EAGE is € 80.00 a year including First Break, EarthDoc (EAGE’s geoscience database), Learning Geoscience (EAGE’s Education website) and online access to a scientific journal.

Companies can subscribe to First Break via an institutional subscription. Every subscription includes a monthly hard copy and online access to the full First Break archive for the requested number of online users.

Orders for current subscriptions and back issues should be sent to EAGE Publications BV, Journal Subscriptions, PO Box 59, 3990 DB, Houten, The Netherlands. Tel: +31 (0)88 9955055, E-mail: subscriptions@eage.org, www.firstbreak.org.

First Break is published by EAGE Publications BV, The Netherlands. However, responsibility for the opinions given and the statements made rests with the authors.

COPYRIGHT & PHOTOCOPYING © 2022 EAGE

All rights reserved. First Break or any part thereof may not be reproduced, stored in a retrieval system, or transcribed in any form or by any means, electronically or mechanically, including photocopying and recording, without the prior written permission of the publisher.

PAPER

The publisher’s policy is to use acid-free permanent paper (TCF), to the draft standard ISO/DIS/9706, made from sustainable forests using chlorine-free pulp (Nordic-Swan standard).

2 FIRST BREAK I VOLUME 40 I AUGUST 2022

Caroline Le Turdu Membership and Cooperation Officer

Peter Rowbotham Publications Officer

Pascal Breton Secretary-Treasurer

Aart-Jan van Wijngaarden Technical Programme Officer

Esther Bloem Chair Near Surface Geoscience Division

Lucy Slater Chair Oil & Gas Geoscience Division

Edward Wiarda Vice-President

Jean-Marc Rodriguez President

Maren Kleemeyer Education Officer

How EAGE can meet the need to change

Incoming EAGE president Jean-Marc Rodriguez (recently vice president exploration, Asia Pacific, TotalEnergies) has a clear vision of how to address the challenges ahead for EAGE.

A first self-imposed challenge for our 2022-23 president of EAGE Jean-Marc Rodriguez is wrestling with how to bring the Association’s mission statement up to date. ‘It needs to change,’ he says, ‘Energy transition and clean energy including oil and gas are now priorities. It is also what young members want to be part of.’

Modernizing the mission statement to keep geoscience and engineering relevant is indicative of Rodriguez’s recognition that EAGE needs to continue to evolve.

In his view, it is ahead of its peer societies in responding to the changing professional landscape. That said, the future focus of the Association, how it operates and meeting members expectations pose some chal lenging questions for Rodriguez, his Board colleagues and the executive management.

He identifies some basic trends start ing with the undeniable shrinking of the traditional base of geoscience and engi neering professionals. ‘At the current rate we are going to face a serious shortage of talent in five years time. We know that oil and gas activity will be around for decades to come, yet the next generation is shying away from involvement. Of course we cannot change the world, but we have to provide an attractive vision of the profession with education and train ing support, for example, liaising more closely with the academic world. It is up to us to promote the need to develop clean

technology solutions and the employment opportunities this presents.’

Rodriguez points to the emerging importance of critical subsurface resources such as mined minerals and metals in deliv ering decarbonisation through technologies such as wind turbines and batteries for electrification. He is also convinced that the increasing need to share knowledge and data across geographical borders, between industries and among all subsurface stake holders will lead to jobs, investment and economic growth.

On the horizon Rodriquez believes that, of the many possibilities out there, green hydrogen may prove to be one of most significant technologies, i.e. produc ing hydrogen processed with the output of emission-free solar, wind or hydro power.

Of most direct significance for our professional community will be the ongo ing development of carbon capture and storage. ‘This is familiar territory for any one who has been involved in oil and gas exploration and production. It promises a long-term activity. In the first place there is the technology for identifying potential locations. Once a project has started, then it has to be kept going, basically for ever. That means regular repeat geophysical surveys to ensure the safety of the site and thus a steady flow of employment.’

In the short term, probably the key issue for EAGE is how to manage its

events and education programmes to meet members’ expectations. ‘It has become obvious that there are too many events worldwide being offered in our sector,’ Rodriguez says. ‘We see meetings held by different societies overlapping and, frankly, sometimes recycling the same papers with a little bit of updating. Among other things, this affects attendance and the viability of these gatherings. In fact organisations have begun to question the value proposition, putting a limit on both in-person and online participation by their staff.’

The priority, says Rodriguez, is to offer quality events. ‘EAGE’s strategy is to basically build the schedule around our key proven and emerging events, adding others by exception when the demand is clear.’

Especially when it comes to serving members in the regions such as Southeast Asia, the Middle East, Latin America and Africa where members and support services are spread thinner, he believes that there is a good case for cooperation with sister societies. ‘Collaboration makes sense avoiding unnecessary duplication of topics and all the effort and resources which go into organizing an event. This need not dilute the EAGE and our core mission. But having spent much of my time in the US, I think I understand the differences and believe we can do better on the cooperation front with our sister US societies.’

FIRST BREAK I VOLUME 40 AUGUST 2022 3

EAGE Annual in pictures 06

HIGHLIGHTS

NSG2022 heads for Belgrade 10 Uppsala students up for debate 15

Madrid proved a great return for the EAGE Annual

It was an amazing week in beautiful, sunny Madrid for the 83rd EAGE Annual Conference and Exhibition. The convergence of science, technology, policy and ambition was the focus of many discussions throughout the programme of the EAGE Annual 2022 demonstrating how geoscientists and engineers contribute to solving the world’s greatest resource challenges.

hydrocarbon exploration are changing and where the evolving role of the exploration function will inevitably lead.

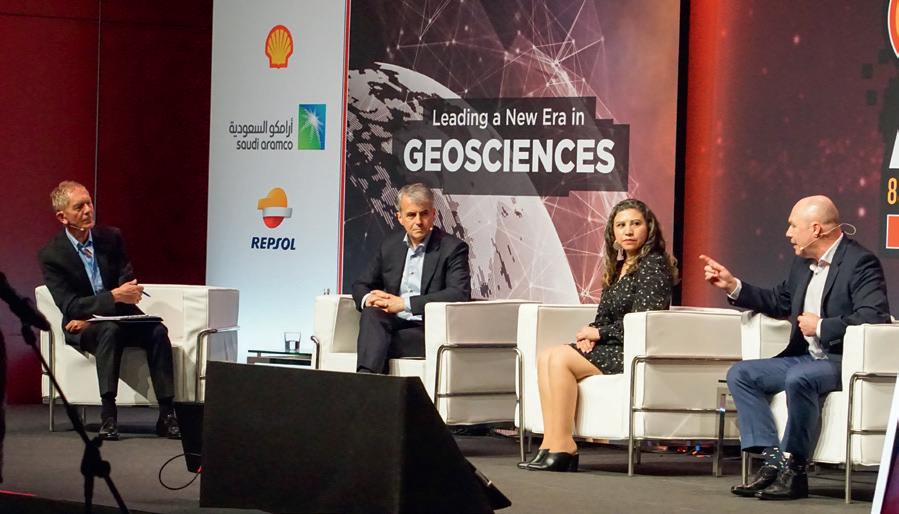

Opening Session

‘Leading Geosciences in a New Era’ was the theme of the event, introduced at the Opening Session by a brief video drawing attention to the new competencies and practices that will make geoscientists and engineers more competitive in access ing the opportunities that the future will provide.

We began with the official welcome from EAGE president Dirk Orlowsky. A new feature of the Opening Session this year was the live ‘fireside chat’ between Josu Jon Imaz (CEO, Repsol) and Andrew McBarnet (EAGE Editor Emeritus). Imaz emphasised that demonising the oil indus try was not helpful in addressing energy transition and that his company was play ing a leading role in affecting change.

This was followed by the Awards Ceremony highlighting outstanding tech nical papers together with professional achievements and contributions to the geoscience community.

The afternoon was completed by the first of four plenary forums entitled ‘How Energy Transition Will Unfold: The Big Picture’ in which Imaz (Repsol) was joined by Leanne Todd (S&P Global Commodi ty Insights) and Simon Flowers (Wood Mackenzie). The panellists highlighted the increasing pressure and challenges that the energy resource industries are facing and the need to reframe the energy

transition process (See First Break July 2022, p.19 for a report on this discussion and Crosstalk for commentary).

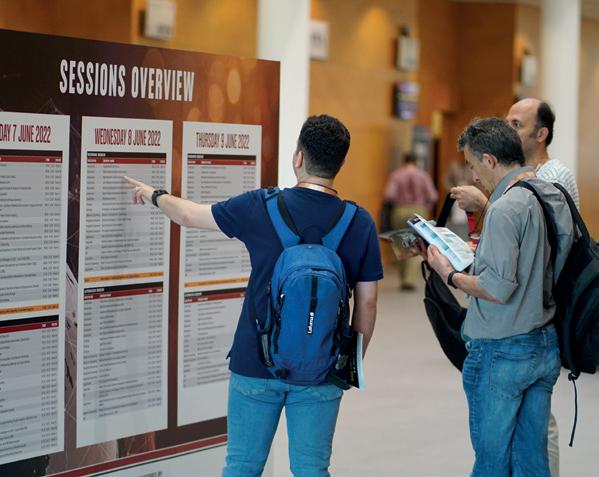

Technical Programme

The Technical Programme this year included more than 800 presentations, over 124 sessions covering the spectrum of EAGE’s multi-disciplinary community such as digitalisation, sustainability, geo thermal energy, imaging, full wave inver sion, seismic acquisition and processing, mineral exploration, etc. Complementing the Technical Programme were 12 work shops with over 130 presentations.

The conference domes were once again implemented in the Exhibition Hall and continued to prove their success in being able to bring Technical Programme partic ipants and the exhibitors closer together.

Plenary Forums

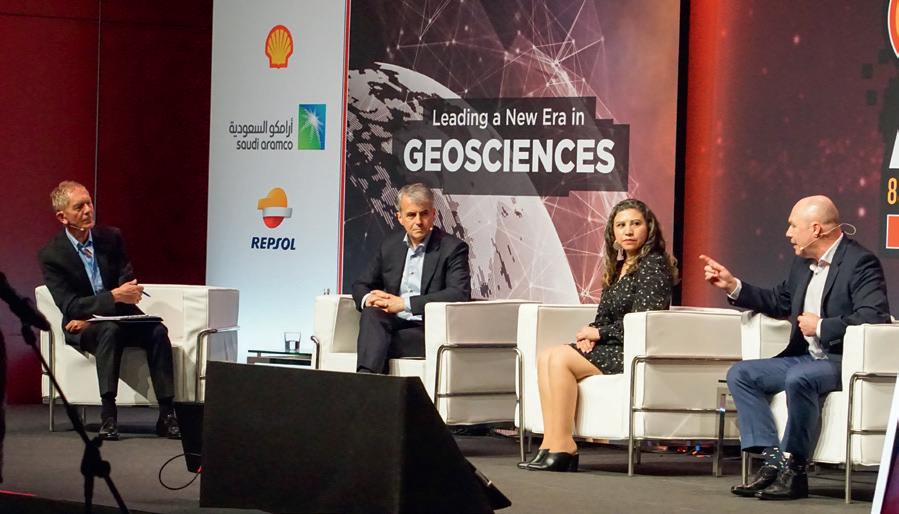

Other major features of the EAGE Annual 2022 included the insightful discussions between international energy industry leaders and analysts held as plenary forums each day between technical ses sions. Tuesday’s forum entitled ‘Adapting O&G Exploration to the New Energy Era’ featured a stellar line up of Marc Gerrits (Shell), Irene Basili (Shearwater), Michael Wynne (S&P Global Commodity Insights) and Joseba Murillas (Repsol) highlighting how the geography and technology of

Wednesday’s forum ‘Advancing Sub surface Low Carbon Solutions’ tackled the challenges in decarbonisation of the world’s energy and industrial activities. Ariel Flores (BP), Mikel Erquiaga (Rep sol), Ann Robertson-Tait (GeothermEx) and Claude Bordenave (TotalEnergies) outlined where current research and investment are focused. They also empha sized the skill sets likely to be required for the upcoming generation of professionals.

The forum series ended on Thurs day with a discussion on ‘Why Minerals Matter for the Geoscience Community’. Minerals and metals are in increasing demand to make energy transition a real ity. Our panellists - Campbell McCuaig (BHP Resource Centre of Excellence), Torgeir Stordal (Norwegian Petroleum Directorate), Adriana Citlali Ramírez (TGS) and Paul Lusty (British Geological

Survey) - discussed the developments of mineral exploration and production, together with the fresh opportunities that may be opening up for our geoscience and engineering professions.

Exhibition Networking at the conference was as usual a key ingredient. At this year’s Annual we welcomed 150 exhibitors and

EAGE NEWS 4 FIRST BREAK I VOLUME 40 I AUGUST 2022

Repsol CEO Josu Jon Imaz talks with EAGE Editor Emeritus Andrew McBarnet during the Opening Session.

Panel session on future of minerals and mining.

had around 70 dedicated talks on market developments and services.

We were delighted to introduce a brand-new Energy Transition Area in the Exhibition of our Annual Meeting in Madrid this year. The area was filled with companies working in the energy transition sector and beyond, and included a theatre programme where we could take a look at the energy transmission and distribution networks worldwide and identify how to create a fully integrated energy system to deliver affordable zero carbon energy.

Meanwhile, the now established Digital Transformation Area continued to explore and showcase forward-thinking technology and workflows. The highlights in this area were two panel discussions on ‘Challeng ing Decision for O&G Data Management Departments’ and ‘The Future of Comput ing in the Energy Industry’.

Field Trips

Three one-day geological field trips near Madrid city were held during the EAGE Annual 2022: 1) a site visit to the under ground natural gas storage at Yela (Guada lajara), including stops at outcrops of the gas storage reservoir and top seal rocks analogues; 2) a discovery of geothermal potential of the Madrid Basin, visiting outcrops of the Madrid Basin basement and the Mesozoic/Cenozoic sedimentary infill; and 3) a visit to Molina-Alto Tajo Global UNESCO Geopark (Guadalajara), an outstanding geological heritage with a remarkable geodiversity.

Community and student activities Being the focal point of the EAGE’s non-technical activities, the Communi ty Hub was buzzing during the week. Through our network of communities and local chapters, we explored inter-disci plinary connections in geosciences and exchanged experiences in a series of talks. The session hosted by our Young Professionals Community explored how organisations – from large internation al energy companies to start-ups and universities – adapted to the new era of remote-office work and education.

We exceeded our expectaions

Reflecting on the week, Marcel van Loon, EAGE chief executive, said: ‘Madrid definitely exceeded our expectations. It was great to welcome nearly 5000 participants in person and online. People clear ly wanted to reconnect, but equal ly important for us is that they appreciate that EAGE is offering a programme and strategy relevant to the needs of the geoscience and engineering professional commu nity. We now look forward to seeing you all again next year in Vienna, 5-8 June.’

The Women in Geoscience and Engineer ing session on ‘Navigating Career and Life in a New Era’ was an interactive discussion about finding your place in the rapidly changing world and setting your own meaningful path in a career and life at large. With the opportunity of hosting the event in the Spanish capital, our Local Chapter Madrid had the pleasure of intro ducing delegates to some of the hidden gems of the city.

Our Career Advice Centre continued its mission to assist delegates in their personal development and career outlook through interactive sessions such as men toring, LinkedIn training, CV advice and professional portrait photography.

Students attending the Annual also found dedicated activities to navigate the next steps of their academic path. After two years being held online, this year’s Laurie

Dake Challenge final round was brought back to in-person at the EAGE Annual 2022. Five best teams presented their final development plans to an expert jury. Let’s cheer the team of University of Miskolc (Hungary) for winning the challenge!

This year two Geo-Quizzes were organised, one for the student delegates attending the conference in-person and one for those attending online. Congrat ulations to the winners: Adrián González Gallego (MIERES), Mahdi Bakhtbidar (University of Barcelona) and Anthony Yorillo (EOST) for in-person participa tion; Raha Hafizi (University of Barce lona), Parth Patadiya (Pandit Deendayal Energy University) and Ismailalwali Babikir (Universiti Teknologi PETRO NAS) for online participation.

We also brought together local stu dents in Spain and student chapter rep resentatives to meet and talk about their experience and offer them opportunities for social interaction with their peers.

Social programme

Finally, no Annual would be completed without a Conference Evening! This year our Conference Evening was held at Pala cio del Negralejo and it was sensational. Colleagues got together, enjoyed a wide selection of Spanish traditional foods (from jamón, paella and tortilla de patatas to arroz con leche), saved the good vibes at our photo booth and danced the night away.

For the success of the conference, thanks are due to everyone who helped make it possible: our reviewers, chairper sons, sponsors, exhibitors, and of course, all presenters and attendees.

EAGE NEWS FIRST BREAK I VOLUME 40 AUGUST 2022 5

FOR THE FULL STORY IN PICTURES, SEE FOLLOWING PAGES

Conference Evening on a beautiful night in Madrid.

EAGE chief executive Marcel van Loon with president Dirk Orlowsky.

ANNUALWELCOME HIGH LEVEL SPEAKERS REVELATION MOMENTS SPECIAL SESSIONS EAGE ANNUAL - MADRID 2022

EAGE

We can’t thank you enough for joining us at the EAGE Annual 2022. Take a look back at some great moments captured in Madrid and see how the event looked like in numbers here.

-

MADRID 2022

LIVELY EXHIBITION PARTY TIME NETWORKING EVERYWHERE

EAGE in co-launch of new journal for the transition era

Officially announced in June at EAGE Annual, Geoenergy is a new co-owned journal of EAGE and the Geological Society of London to be launched in January 2023. In tandem with its sister journal, Petroleum Geoscience, it will focus on the publication of timely and topical research in subsurface geosci ence and the emerging energy transition field.

Welcoming the initiative, EAGE publications officer Peter Rowbotham said: ‘With EAGE’s priority to be mem ber-centric, Geoenergy provides a home for those members wishing to publish their latest research and case studies in sustainable energies. By continuing to support the Petroleum Geoscience journal, both EAGE and the Geological Society of London acknowledge that energy transition encompasses both oil and gas as well as old and new non-fossil fuel energy topics.’

Key themes of Geoenergy are expect ed to include energy storage, geothermal energy, subsurface disposal and storage, hydrogen energy, critical minerals and sustainability.

Rob Strachan, Geological Society Publications Secretary, said: ‘The Geolog ical Society is delighted to be developing its collaboration with EAGE, and building on the success and reputation of Petrole um Geoscience, to launch Geoenergy, a timely and relevant new journal covering energy geoscience. The geosciences have a key role in the development of sustain able energies and the energy transition, and we expect Geoenergy to become a leading outlet for publication of key work in this area by an international geoscience community. The launch of the journal aligns with the Society’s Energy Transi tion scientific theme launched in 2019 and broader work in serving the community in this space.’

Jonathan Redfern (University of Man chester) will be the journal’s first Editor-inChief. Working in tandem with Geoenergy and Petroleum Geoscience, he will have the task of ensuring that Petroleum Geo science continues to publish a balanced mix of traditional hydrocarbon-related and applied subsurface geoscience research, still highly relevant to today’s society. The increasing submissions of non-petroleum related subsurface geoscience, critical for this new era of sustainable energy, will be published in Geoenergy.

Find out more at https://www.geolsoc. org.uk/geoenergy.

ADDITIONS THIS MONTH

The Third EAGE Marine Acquisition Workshop will take place in Oslo (Norway), on 22-24 August. Proceedings will include approximately 13 abstracts and will become available on EarthDoc around two weeks before the event.

Full papers of the European Conference on Mathematics of Geological Reservoirs (ECMOR 20220), to be held in The Hague (Netherlands), on 5-7 September 2022, will also be hosted on EarthDoc.

25-30 extended abstracts from the Second EAGE Workshop on Advanced Seismic Solutions in the Gulf of Mexico (7-8 September 2022, Mexico City) will enable the sharing of knowledge on seismic acquisition, data processing and imaging, and the role of seismic interpretation and shallow structure

New issues of Petroleum Goescience and Near Surface Geophysic s will be accessible on EarthDoc in August.

Lastly, all EAGE book titles are now available in the Epub format on EarthDoc. For reading Epub there are all kinds of e-readers available. Find more information at https://www.earthdoc.org/content/books. Active EAGE members can use MyEAGE credentials to order books and benefit from a 15% member discount. You do not need to be an EAGE member in order to access EarthDoc and purchase books.

EAGE NEWS 8 FIRST BREAK I VOLUME 40 I AUGUST 2022

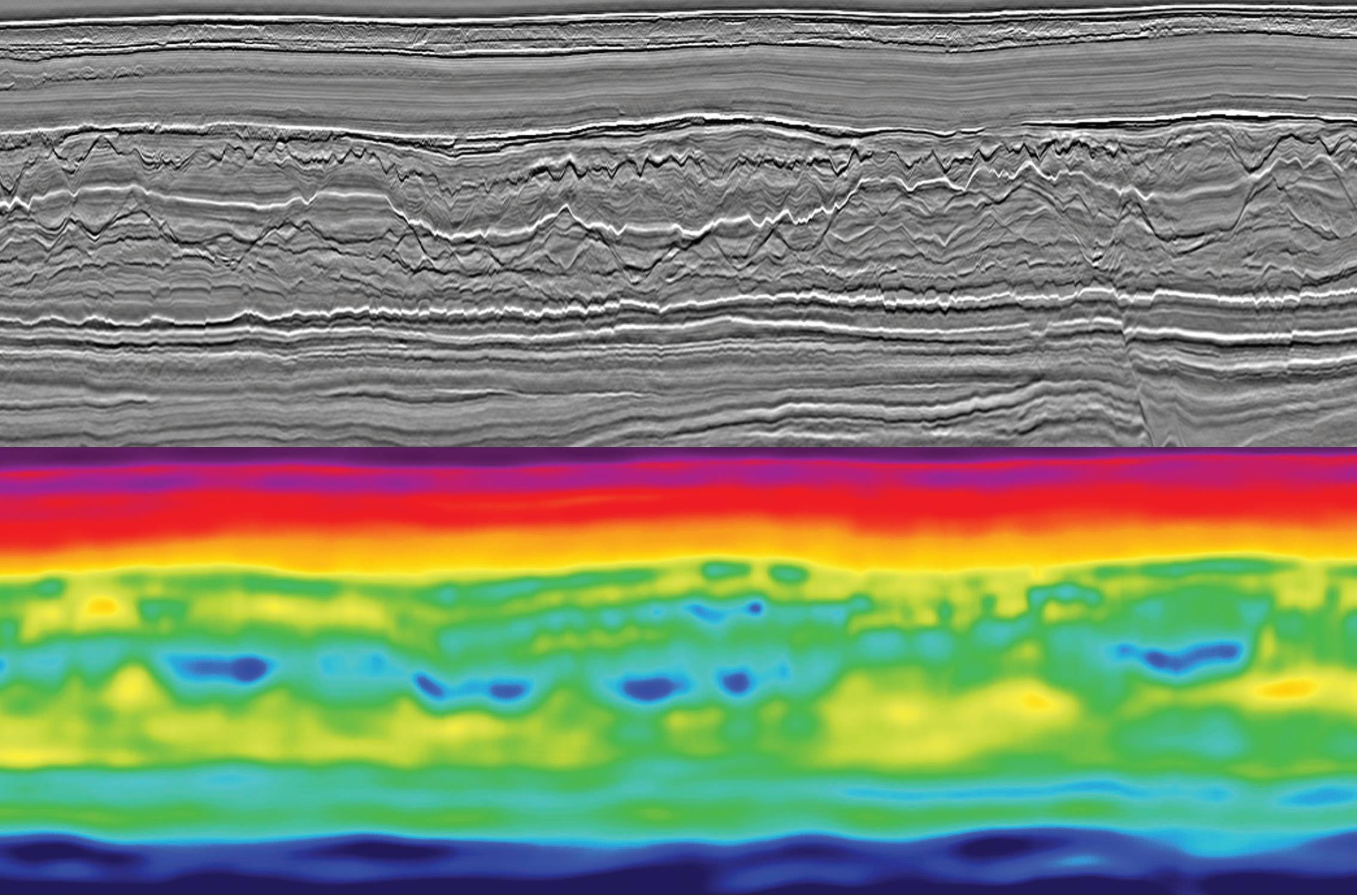

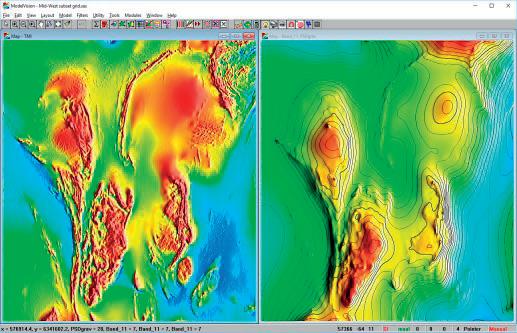

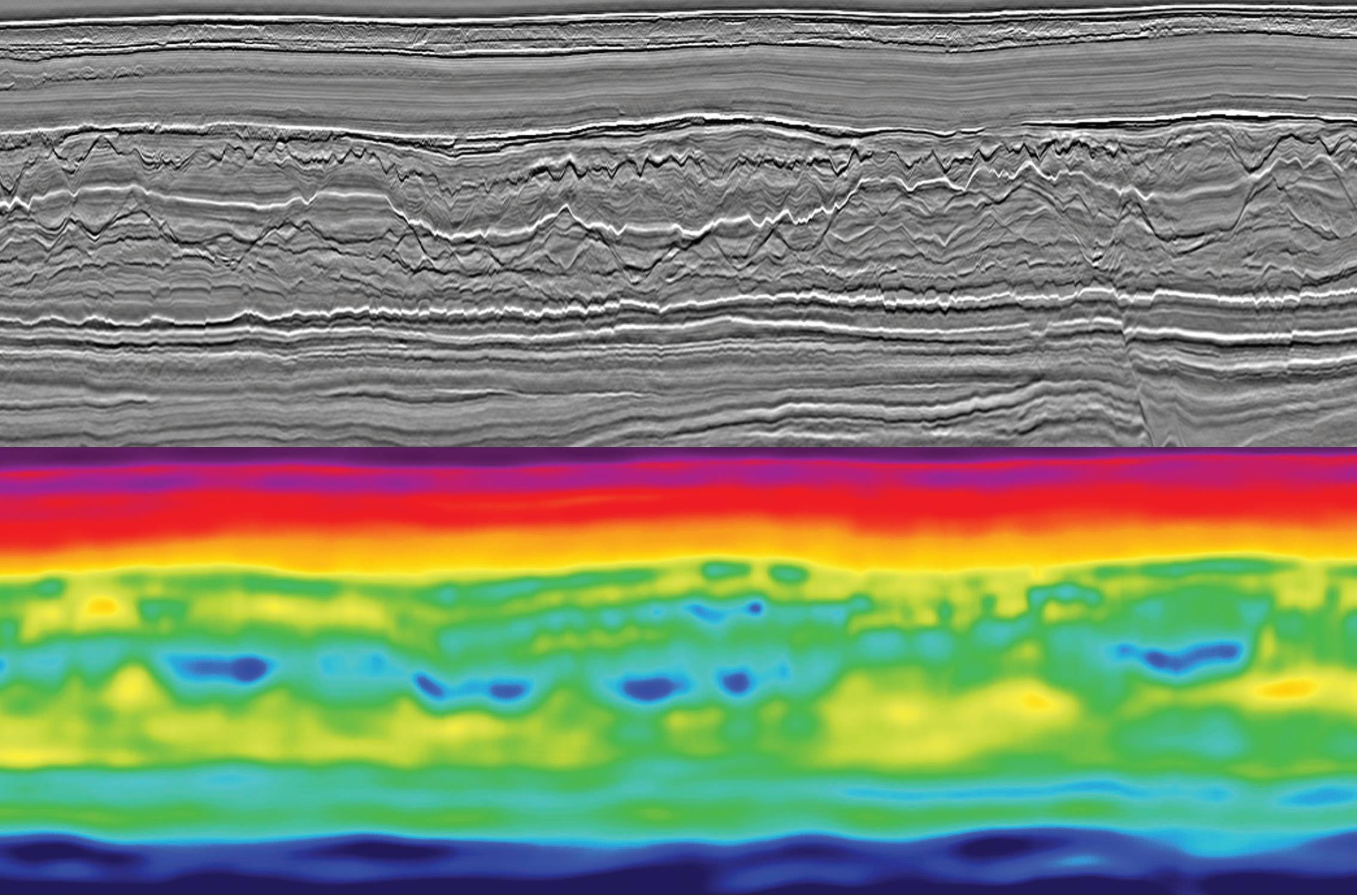

FWI VELOCITY

SIMULTANEOUS MODEL-BUILDING AND LEAST-SQUARES IMAGING

There’s no need to pull a rabbit out of a hat when it comes to reflection FWI. DUG’s unique augmented acoustic wave equation isolates the “roo ears” for high-resolution velocity updates beyond the diving-wave limit. It also enables least-squares imaging using the entire wavefield providing high-frequency reflectivity volumes for quantitative interpretation. Simultaneous velocity model building and least-squares imaging directly from field data.

85 Hz FWI IMAGE

BEX MC3D data courtesy of Multi-Client Resources

For more information contact us at info@dug.com

A roo-volution in seismic imaging!

seismic

Near-surface community heading for memorable Belgrade event

The waiting is nearly over. We are closing in on this year’s Near Surface Geoscience Conference & Exhibition (NSG2022) which is being held for the first time in Belgrade on 18-22 September.

The landmark event consists of three parallel meetings – the 28th European Meeting of Environmental and Engineer ing Geophysics, the 4th Conference on Geophysics for Mineral Exploration and Mining and the 3rd Conference on Air borne, Drone and Robotic Geophysics – with compelling workshops, dedicated talks on EU Affairs, a special programme for student and young professional dele gates and a leading-edge exhibition.

The scientific committees have worked on creating a comprehensive technical programme with a wide range of presentations and engaging discus sions. There will be a special session on ‘Applied Geophysics Case Studies from the Balkans’ and a joint session on ‘Airborne EM for Mineral & Mining’. The technical programme will be com plemented by the EU Affairs programme focusing on EU funding projects tack ling near-surface studies. The schedule and more information is available on our website.

The ever-popular exhibition will once again welcome international com panies from the near-surface industry to showcase their newest technologies and services, including demonstrations.

Students and young profession als attending NSG2022 will have an opportunity to meet representatives from companies in the exhibition to learn more about career possibilities, as well as to take part in career boosting activ ities including speed mentoring and CV check.

You can top up your week by par ticipating in one of our four workshops. The workshop on ‘2D and 3D Seismic Data Processing Focused on the Near Surface’ will cover processing of several types of near-surface seismic data. The workshop on ‘Geotechnical Applications

of Geosciences’ aims to bridge the gap between geosciences and ground/geo technical engineering, intended for both geoscientists and engineers. Meanwhile, the other two workshops entitled ‘Pro cessing, Inversion and Visualisation of Towed TEM Data for Aquifer Mapping’ and ‘From AEM Data to 3D Hydroge ological Conceptual Model’, are both related to software and equipment for near-surface uses and will combine short lectures with hands-on exercises.

Belgrade, our host city is especially relevant to the near-surface professional community. It is an urban gem of Eastern Europe lying on the confluence of the Sava and Danube rivers. The Balkans and especially Serbia are facing familiar issues and societal challenges - from access to critical raw materials for the energy transition, climate action strategy to environmental issues such as geohaz ards, water accessibility for agriculture, and archaeology.

There are so many good reasons to join us in Belgrade and find out how the near-surface geosciences have advanced, meet your peers and experience the diverse activities NSG2022 will offer you. Save on your attendance at this very special EAGE event by registering before 22 August at www.NSG2022.org.

EAGE NEWS 10 FIRST BREAK I VOLUME 40 I AUGUST 2022

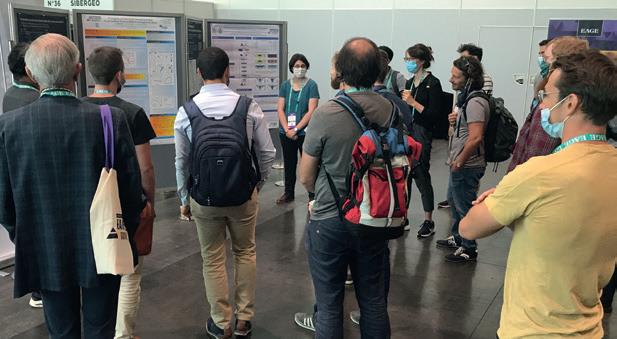

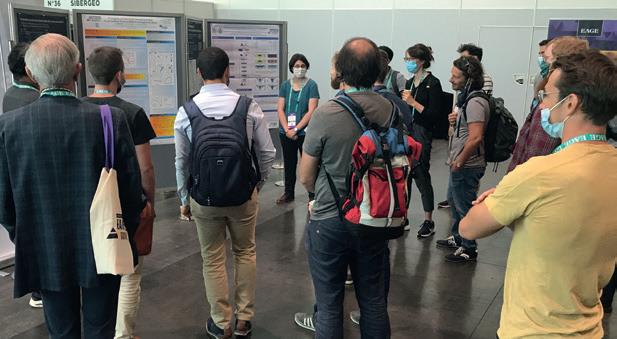

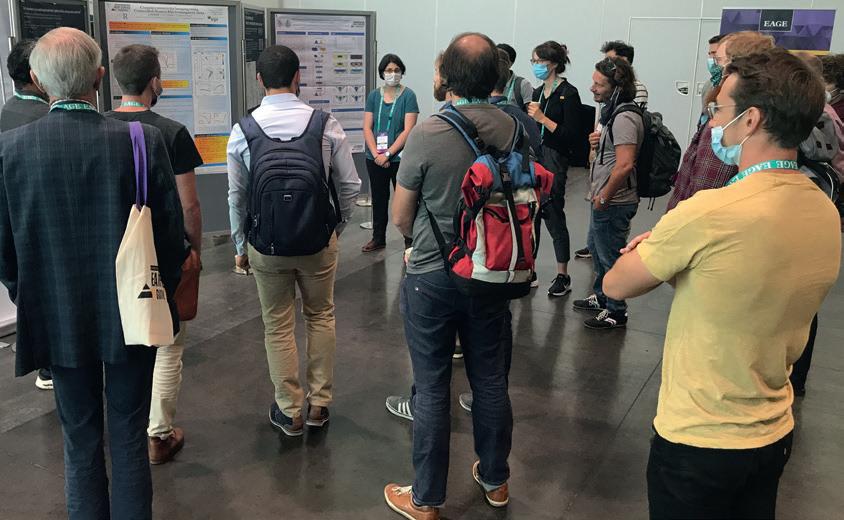

Busy session at 2021 Near Surface meeting.

Poster session in progress.

All important networking occasion.

Eighteenth ECMOR returns as an in-person meeting in The Hague

EAGE’s three-day European Conference on the Mathematics of Geological Res ervoirs (ECMOR) will once again be an in person event when it arrives in The Hague on 5-7 September (with some online elements). Our last on-site meeting was in Barcelona in 2018.

ECMOR, being held for the 18th time, is a key conference for applied mathema ticians, engineers, and geoscientists from academia, governmental bodies and indus try working on subsurface energy system modeling. Its technical programme this year has much to offer for those who are interested in topics such as physical mod elling, computational methods and uncer tainty modelling and optimisation. The Technical Committee received more than 110 abstracts acceptable for presentation in all categories from 25 countries world wide. Application domains are extended from hydrocarbon recovery towards new requirements on carbon capture storage, H2 storage and geothermal energy. This time several contributions highlight the potential opportunities in the fields of digitalisation, artificial intelligence and automation for increasing the efficiency and productivity of subsurface energy systems.

The programme will consist of 18 oral sessions, divided over three days and two parallel sessions. Participants attending on-site will benefit from the full experi ence of the conference, which will also address challenges related to the energy transition, promote open debates during technical sessions and foster exchang es between participants in an informal atmosphere.

The venue chose for this year’s meet ing is The Hague Conference Centre, New Babylon. Situated right next to the central

train station, it is only a couple of minutes walk to the city centre. As with previous on-site ECMOR events, participants can also expect a unique networking reception experience accompanied by two poster sessions on the first evening of the confer ence. The ECMOR committee is looking forward to welcoming participants to The Hague and re-connecting once again with this specialist community. For more infor mation on the Technical Programme and details on how to register, please visit www.ecmor.org.

Milan to host sixth HPC workshop

tional ways of interpreting seismic and reservoir data.

This is why the sixth edition of the successful EAGE High Performance Computing workshop presents such a great opportunity. It is due to take place at the Rosa Grand Hotel, Milan, Italy from the 19-21 September 2022.

(HPE), Michael Sprague (National Wind Technology Centre) and Victor Martin (TotalEnergies).

High Performance Computing (HPC) plays a leading role in our current energy business and will be of critical importance for a successful energy tran sition. The explosion of data and the recent rapid development in machine learning (ML) are leading to non-tradi

Main topics to be covered include Geoscience & HPC, Performance Anal ysis and Optimisation, Emerging HPC Technologies and HPC for the Energy Transition. Keynote speakers on this dramatically changing climate within the industry include Luca Bertelli (ENI), Daniela Galetti (CINECA), Maxim Alt

The workshop will also provide par ticipants a chance to visit the Green Data Centre in Ferrera Erbognone. This is home to HPC4 and its upgraded HPC5, one of the most powerful and efficient supercomputers in the world.

You can now review the technical programme on the website for the event, made possible thanks to the support from Platinum sponsors Eni, Hewlett Packard Enterprise and AMD. The workshop begins with an IceBreaker Reception hosted by Shell.

EAGE NEWS FIRST BREAK I VOLUME 40 AUGUST 2022 11

Eni Green Data Centre, Italy.

Majestic buildings of The Hague.

Petroleum Geoscience (PG) transcends disciplinary bound aries and publishes a balanced mix of articles that drives the science to enhance sustainable development covering all aspects of the petroleum system. The journal content reflects the international nature of the research. A new edition (Volume 28, Issue 3) will be published in August, featuring 8 articles.

Editor’s Choice articles:

• Petrographic and diagenetic investigation of the distal Triassic ‘Budleighensis’ fluvial system in the Solway and Carlisle Basins for potential CO2 storage

– Joshua R. Marsh et al.

• Comparison of shale depth functions in contrasting offshore basins and sealing behaviour for CH4 and CO2 containment systems – Oscar J. Nhabanga and Philip S. Ringrose

Near Surface Geophysics (NSG) publishes primary research on the science of geophysics as it applies to the exploration, evaluation and extraction of earth resources. Drawing heav ily on contributions from researchers in the oil and mineral exploration industries, the journal has a very practical slant. A new edition (Volume 20, Issue 4) will be published within August, featuring 7 articles.

Editor’s Choice articles:

• Near-surface three-dimensional multicomponent source and receiver S-wave survey in the Tannwald Basin, Germany: Acquisition and data processing – Thomas Burschil et al

• Marine karst environment characterization using joint geophysical and geotechnical data – Judith Dusart et al.

EAGE Annual bags donated to The Gambia

As part of our corporate social responsibility, EAGE is committed to recycling our event materials and supporting good causes. After the 82nd EAGE Annual in Amsterdam in October 2021, EAGE was approached by the Buganala Foundation regarding any unclaimed delegate bags left over after the event that could possibly be donated to charity. The Buganala Foundation aims to make a positive contribution to the lives of children and young adults in The Gambia, West Africa, their families and other people in their living environment, through education and relevant activities.

The request prompted us to hunt down any remaining bags from previous EAGE events that had been stored in the Houten office. We eventually located a total of 1500 bags from a variety of events held in recent years.

Some 100 bags were picked up by a representative of the Buganala Foundation from EAGE’s premises at the end of December 2021 and then the rest were shipped to The Gambia directly from the port of Rotterdam.

We are told that students in The Gambia have received the bags and use them daily to take their study belongings with them. Among the recipients were teachers and students from a school for the deaf and a teacher training institution.

EAGE NEWS 12 FIRST BREAK I VOLUME 40 I AUGUST 2022

OUR

CHECK OUT THE LATEST JOURNALS PG NSG

JOURNALS THIS MONTH

The distinguished Czech geophysicist Prof Vlastislav Červený has died at the age of 90. His whole professional life was associated with the Depart ment of Geophysics of the Faculty of Mathematics and Physics of Charles University in Prague. He graduated in 1956, becoming associate pro fessor in 1966 and full professor in 1987.

During his career he became a world leading scientist in seismic ray theory and one of the most cited seismologists. He published three well-known books and numerous pub lications. He founded the consortium Seismic Waves in Complex 3-D Struc tures in 1993 and led it for over 25 years, attracting worldwide attention from both industry and academia. He was also a founder of the famous series of workshops ‘Seismic Waves in Laterally Inhomogeneous Media’, which proved an ideal platform for meetings of seismologists from the East and West during the Cold War era.

Professor Červený was an active member of several international insti tutions, member of the German Aca demia Leopoldina and the Academia Europaea, and an Honorary Member of the European Association of Geoscien tists and Engineers and the Society of Exploration Geophysicists. He received the Beno Gutenberg medal of the European Geophysical Society (now European Geosciences Union), the Maurice Ewing medal of the Society

of Exploration Geophysicists, the Ernst Mach medal of the Czech Academy of Sciences and the Gold Memorial medal of Charles University. His work will continue through his numerous students and colleagues who always enjoyed his generous and kind nature and benefited from his wisdom and great insight.

Prof Červený will be remembered as a great educator, who never hesitated to explain even the simplest facts down to the smallest detail. This is what made his book Seismic Ray Theory such an extremely well readable textbook. Those who had contact with him will treasure visits to his office at Ke Kar lovu and the tea or coffee prepared by his secretary Mrs Drahotová. He will be greatly missed.

Remembered by Petr Bulant, Leo Eis ner, Zuzana Jechumtálová, Petr Jílek, Luděk Klimeš, Tijmen Jan Moser, Ivan Pšenčík and many others all over the world who came into contact with Slava and his work.

EAGE NEWS FIRST BREAK I VOLUME 40 AUGUST 2022 13 EAGE Online Education Calendar FOR THE FULL CALENDAR, MORE INFORMATION AND REGISTRATION PLEASE VISIT WWW.EAGE.ORG AND WWW.LEARNINGGEOSCIENCE.ORG. * EXTENSIVE SELF PACED MATERIALS AND INTERACTIVE SESSIONS WITH THE INSTRUCTORS: CHECK SCHEDULE OF EACH COURSE FOR DATES AND TIMES OF LIVE SESSIONS START AT ANY TIME VELOCITIES, IMAGING, AND WAVEFORM INVERSION - THE EVOLUTION OF CHARACTERIZING THE EARTH’S SUBSURFACE, BY I.F. JONES (ONLINE EET) SELF PACED COURSE 6 CHAPTERS OF 1 HR GEOSTATISTICAL RESERVOIR MODELING, BY D. GRANA SELF PACED COURSE 8 CHAPTERS OF 1 HR CARBONATE RESERVOIR CHARACTERIZATION, BY L. GALLUCCIO SELF PACED COURSE 8 CHAPTERS OF 1 HR 2-5 AUG INTRODUCTION TO DATA ANALYSIS: CONCEPTS AND EXAMPLES, BY R. GODFREY IOSC 4 HOURS/DAY, 8 MODULES 9-12 AUG BOREHOLE SEISMIC FUNDAMENTALS AND INTRODUCTION TO ADVANCED TECHNIQUES, BY A. CAMPBELL IOSC 4 HOURS/DAY, 6 MODULES 23-26 AUG CONSTRUCTION OF FRACTURED RESERVOIR MODELS FOR FLOW SIMULATION INCORPORATING GEOLOGY, GEOPHYSICS AND GEOMECHANICS, BY REINALDO MICHELENA, CHRIS ZAHM & JAMES GILMAN IOSC 4 HOURS/DAY, 8 MODULES 24-26 AUG SUB-SURFACE UNCERTAINTY EVALUATION (SUE), BY MANISH AGARWAL

30 AUG

2 SEP

IOSC 4 HOURS/DAY, 6 MODULES 6-9 SEP

-

UPSCALING AND ARTIFICIAL INTELLIGENCE BASED PROXIES FOR UNCERTAINTY ASSESSMENT OF RESERVOIR PRODUCTION, BY DR DOMINIQUE GUERILLOT

IOSC

4 HOURS/DAY

INTEGRATED

SEISMIC ACQUISITION AND PROCESSING BY JACK BOUSKA IOSC

4 HOURS/DAY, 8 MODULES

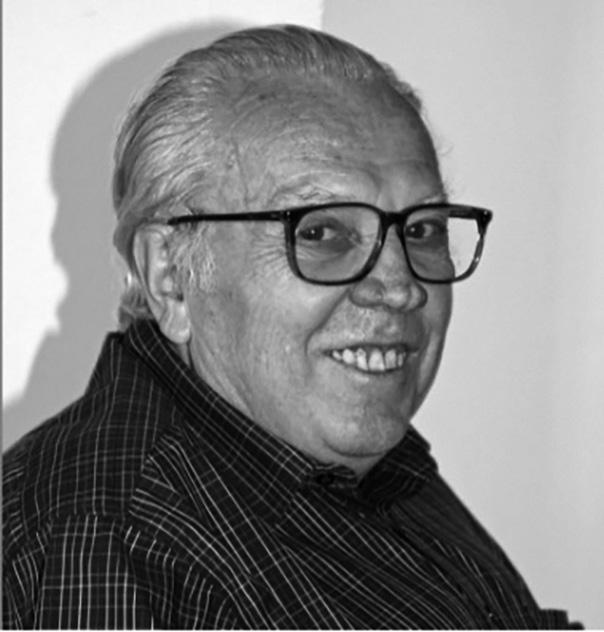

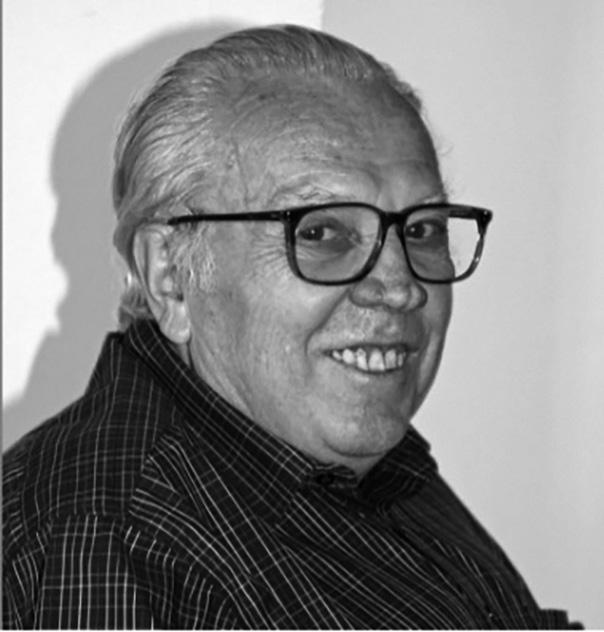

Vlastislav C ˘ ervený 1932-2022

Etienne Robein 1949-2022

Former EAGE president Etienne Robein has died after a long illness.

Etienne graduated from Ecole Nationale Supérieure de l’Aéronau tique et de l’Espace in 1972, followed by the Ecole Nationale Supérieure du Pétrole et des Moteurs/IFP, where he trained as a geophysicist. He started his career with Shell in The Hague, before joining Elf, now TotalEnergies, where he worked on operational, research and managerial assignments in France, Italy, the UK and Azerbaijan.

Etienne authored or co-authored many presentations at international conferences, including those of EAGE, SEG, WPC and AAPG. His first text book Vitesses et Techniques d’Image rie en Sismique Réflexion; Principes et Méthodes was published, in French, in 1999. In 2003 he published the text book Velocities, Time-Imaging and Depth-Imaging in Reflection Seismics and in 2010, as part of his EAGE Education Tour, a textbook on Seismic Imaging. A Review of the Techniques, their Principles, Merits and Limitations. All these books have been best-sellers among tutors and students. In 2015 and 2016, he record ed two EAGE e-lectures as part of the Learning Geoscience prgramme, namely Reverse-Time Migration, How Does it Work and How to Use it? and On the Use of Epsilon and Delta in Anisotropic Velocity Model Building. To watch his lectures again is to understand the gift Etienne had to simplify topics that appeared com plicated. After retiring from Total,

Etienne continued his career as a successful instructor for international companies.

Etienne was president of EAGE in 2000 where, thanks to his strong worldwide network of geoscientists, he contributed to the international growth of EAGE and to the coor dination between EAGE and SEG activities. He was also chairman of EAGE’s Research Committee, mem ber of the EAGE Awards Committee and Europe’s representative on the SEG Council. In 2009, Etienne was made an EAGE Honorary Member.

During his international assign ments, like those at the Elf /Total Geo science Research Centre in the UK, Etienne loved mentoring his young international staff, many of them now pursuing very successful careers in the industry.

Etienne could not spend a day without some form of physical activity, the minimum being an hour running

or cycling before his working day. When he was posted abroad, the routine was the same, only the circuits were different, jogging in Hyde Park when in London or cycling to the office through the Trastevere when in Rome.

But his real passion was moun taineering. At regular intervals, with a group of friends, he pushed the limits during different expeditions, just miss ing the 8000 m mark in the Himalaya. He also explored a few other peaks around 6000 m in the Andes, Africa and Russia, or went ice-climbing in Scotland. When he was not climbing, he would do some ski touring or some mountain biking in the Alps or the Pyrenees.

Etienne loved classical music, and when in a big city, he would never miss an opportunity to attend an opera or a good concert with his wife or with some friends. Thanks to his good ear, he became totally fluent in Italian and enjoyed entertaining his friends by picking different accents.

Etienne was one of those opinion leaders who did not need to raise their voice to be listened to. His natural authority came from his great level of geophysical expertise, but also his capacity to listen and to adopt new ideas, especially when they came from another discipline.

Our thoughts are with his wife Francine, who often joined Etienne at EAGE events.

EAGE NEWS 18-22 SEP NEAR SURFACE GEOSCIENCE CONFERENCE & EXHIBITION 2022 BELGRADE, SERBIA 7 OCT MINUS CO2 FINAL ONLINE 13 OCT STUDENT WEBINAR TAKING YOUR RESEARCH ONLINE WITH AN OPEN RESEARCH WEBSITE BY STEVES PURVES ONLINE EAGE Student Calendar FOR MORE INFORMATION AND REGISTRATION PLEASE CHECK THE STUDENT SECTION AT WWW.EAGE.ORG

Contributed by Olivier Dubrule and Philippe Malzac.

Uppsala students debate energy transition and raw materials

The EAGE Board members in town for a meeting were among the audience at the conference on energy transition and raw materials held on 3 May at Uppsala University, Sweden.

The conference was organised by young professionals from Uppsala Uni versity drawing attendance from different academic levels (bachelor to researchers) including top researchers and professors form Department of Earth Sciences and Chemistry Department of Uppsala Univer sity as well as from the Geological Survey of Sweden. Keynote talks were presented on various aspects of the energy transition, starting with EAGE’s strategy supporting

relevant initiatives and continuing with ongoing research projects within Uppsala University and Geological Survey of Swe den tackling this topic.

The conference included two sessions carried out by young professionals present ng a wide range of topics that support ener gy transition from different perspectives. Those presentations were developed in a ‘rapid-fire’ format consisting on nine slides each displayed for one minute according to a template provided by the organising com mittee. Around ten students from Uppsala University shared their research topics with the audience on subjects related to raw materials exploration, ground water mod elling, solutions for environmental batteries and so on.

Both keynote and young profession al speakers found this space fruitful to brainstorm ideas and make connections at different academic levels.

As a part of the programme, a formal discussion took place on energy transition and raw materials worldwide. The debate was moderated by the president of EAGE’s Uppsala University Student Chapter. Her main role was to manage the different viewpoints from a selected group of experts

integrating senior and junior professionals in energy transition. Those taking part were the EAGE vice-president, two professors from Department of Earth Sciences, a researcher from Geological Survey of Swe den and a PhD student from Department of Earth Science, Uppsala University.

At the end of the conference, an award was presented to PhD student Lucia Gutiér rez for the best ‘rapid fire’ presentation ‘The ocean as a carbon sink or source. What controls the air-sea CO2 exchange?’ She received a diploma and travel grant to the EAGE Annual Meeting in Madrid presented by EAGE chief executive officer Marcel Van Loon.

Near surface and mineral exploration are the topics for Bogotá workshop

Bogotá, the vibrant and sprawling capital of Colombia, will host the Second EAGE Conference on Near Surface & Mineral Exploration in Latin America, on 3-4 November 2022.

For the first time, the event will be held in-person, offering a great chance to get acquainted first-hand with lat est developments and applications. The intention is to highlight geophysics for geothermal energy and energy transition, mining, geological, hydrogeological, geotechnical, environmental, engineer

ing, archaeological, and other applica tions, as well as physical soil and rock properties.

Sponsored by Iris Instruments, the conference welcomes industry experts, professionals, authorities, researchers, students, and companies, interested in joining a space to exchange ideas, best practices, and grow their network. Ben efit from the early registration fee until 23 September 2022. More details at: https://eage.eventsair.com/second-eageconference-on-near-surface-in-latin-america/

EAGE NEWS FIRST BREAK I VOLUME 40 AUGUST 2022 15

The EAGE Board among the audience at the conference on energy transition and raw materials at Uppsala.

Bogota will host this key event for Latin America.

Award to PhD student Lucia Gutierrez for the best rapid fire presentation.

Czech Local Chapter holds varied talks programme

Over the course of the past few months

LC Czech Republic organised four com munity meetings on topics ranging from caves to meteorites.

February saw Petr Tabořík (Insti tute of Rock Structure and Mechanics) discussing whether the Hranice Abyss, the deepest cave in the world, can real ly reach 1 km depth. It was a hybrid meeting with 25 online participants and 20 - mostly students - attending the presentation hosted at the Faculty of Natural Sciences. Numerous geophysical measurements, e.g., gravity, resistivity, gravity, seismic, etc., were discussed along with the constraints on the shape of the deep cave.

The March meeting consisted of a remote presentation by Dr Andrew Parsekian (University of Wyoming) on the changing Arctic climate entitled ‘The role of geophysics for measuring lakes in permafrost regions’. He provided some interesting insights into shallow geo physical methods and their limitations in the Arctic environment. Once again

the event was in collaboration with the Faculty of Natural Sciences, Seismik hosted Prof Gunther Kle tetschka (Faculty of Natural Sciences, Charles University) in April. He talked about infrequent yet present geophysical evidence for airbursts of meteorites in the earth atmosphere like the Tunguska (Russia) airburst. He showed evidence for similar blasts destroying Tall el Ham mam in Jordan and Abu Hureira in Syria, with the former being a candidate for bib lical Sodoma and Gomora destruction.

In May, Brij Singh (Institute of Geo physics of the Polish Academy of Scienc es) provided a second talk on seismic imaging in the hard rock environment. The audience included members of Local Chapters Germany and Poland leading to an interesting discussion.

LC Czech Republic was also recently involved in the co-organised workshop APSLIM II on active and passive seismics in laterally inho mogeneous media and IWSA 19, the International workshop on seismic anisotropy.

Some 20 participants met at the Želiv Premonstratensian Monastery, Czech Republic from May 30 to June 3 to enjoyed a great technical programme in a peaceful atmosphere.

Students can keep an eye out for the 11th Student Prize which the Local Chapter will support for the third year in collaboration with Seismik s.r.o. and G-Impuls Praha s.r.o. Visit https:// www.seismik.cz/index.php/careers/seis mik-prize for more information about this and applications.

The EAGE Student Fund supports student activities that help students bridge the gap between university and professional environments. This is only possible with the support from the EAGE community. If you want to support the next generation of geoscientists and engineers, go to donate.eagestudentfund.org or simply scan the QR code. Many thanks for your donation in advance!

EAGE NEWS 16 FIRST BREAK I VOLUME 40 I AUGUST 2022

DONATE TODAY!

Participants of the workshop APSLIM II and IWSA 19 organized by EAGE Local Chapter Czech Republic.

Presentation at the EAGE Local Chapter Czech Republic spring event.

Personal Record Interview

What happened when airline career

Career didn’t start with geoscience?

No, I first worked with the British Over seas Airways Corporation (BOAC), the forerunner of British Airways (BA).

What made you change course?

It just wasn’t for me. I came across geology in a library and it connected with climb ing. So I left BOAC to study ‘A’ Levels, working intermittently as a road sweeper. The KPIs were set for age 50!, so I could do my stint quickly then study. I had some good advice when starting at Aberdeen University – ‘do two years of Maths’.

BGS and Sea of Hebrides research?

Brilliant job – an unmapped marine area around the well-known geology of the islands. Robert Eden and Gordon Craig, my bosses at BGS and Edinburgh Univer sity, arranged for me to submit the work for a PhD supervised by Bryan Lovell. Apart from shipborne surveys, we dived in the Hebrides and around Rockall – the only time I’ve used a hammer professionally is under water; the rest was seismic. We also dived in a submersible, including a traverse up the Hebridean slope from 381 m.

How did you come to join Shell?

The nature of the survey work changed. We were visited by Ken Glennie and Miles Bowen, and Shell Research advertised for a seismic stratigrapher. I found myself as the ‘geological conscience’ in the Geo physics Department. The Aberdeen maths enabled me to survive five years. This was

at the beginnings of quantitative interpre tation and a great learning experience.

What was special about Oman?

In the early 1980s there was a demand for exploration and the Oman Government was hugely encouraging. I was asked to test QI on the Oman carbonates. Working with Paul de Groot, David Mithen, Nic van Ooyen and others we made a series of successful predictions and seven discov eries. It was a stimulating environment. Life outside the office was good too, with walks in the Oman mountains. I have always been a regular runner and was able to continue this with ‘The Hash’ and Muscat Road Runners, though it took some acclimatisation.

Ups and downs in The Hague?

The ‘down’ was the first three years. The ‘up’ was the next four on the Middle East Africa Desk. Initially as the regional geolo gist then the area engineer jobs for Nigeria and Oman were added – a really interesting mix of business and science in several countries. It included acquisition of the Nigeria deepwater acreage, which was to generate the Bonga development and sever al other overseas commercial agreements. I also acquired a Dutch pilot’s licence.

What did you do in Nigeria?

I was exploration manager in SPDC’s Eastern Division. I wouldn’t have missed this for anything, but there were some very difficult times and situations. It was not easy for my wife Ceri, who was not able to continue teaching. At first funding

was restricted; under the government of the time exploration was to be axed. However, we survived. Fidel Onichabor’s prospect Santa Barbara South found 100 million barrels and, together with the seis mic industry, we increased field reserves.

How was Egyptian experience?

We had a very good department but again a budget-constrained situation – the oil price was $10/bbl. We had the deepwater block in which Eni made the 2015 Zohr discovery. We recognised the play but there were less risky first prospects than a 4 kilometre deepwater well.

Tell us about retirement?

We returned to the village we left 27 years earlier. A typical day is work, gardening and a run. Shortly after arriving back Arie Speksnijder asked me to help in the Shell Learning Centre. Together we set up an online course and I did this until recently – so 47 years doing something with Shell. Pat Corbett suggested teaching at Heriot Watt. I much enjoyed this and it lasted until now. After meeting Qing Sun, I wrote reports for C&C Reservoirs. So, a portfolio of interesting projects. I continued to fly and did a geology associateship with the Royal Photographic Society. I’ve been on the Board of the Scottish Energy Forum and its predecessor for some years and have just stepped down as an associate editor for First Break. Now I’m contracted to write a book and am finding out just how many hours this takes. I told someone it was ‘popular geoscience’ to which the response was ‘That’s a really good oxymoron’.

PERSONAL RECORD INTERVIEW

Paul Binns is proof positive that a career change to geoscience can be rewarding. He spent 27 years with Shell, including stints as exploration manager in Nigeria and Egypt, preceded by the British Geological Society (BGS) researching the unmapped Sea of Hebrides. Still busy consulting and teaching, he also has a book in progress.

didn’t cut it

FIRST BREAK I VOLUME 40 AUGUST 2022 17

PAUL BINNS

FIRST BREAK I VOLUME 40 I AUGUST 2022 18 The new Impact Factors have been released! Check out our journals’ scores here: Make sure you’re in the know EAGE MONTHLY UPDATE Second EAGE Workshop on Advanced Seismic Solutions in the Gulf of Mexico 4 August 2022: Regular Registration Fourth HGS/EAGE Conference on Latin America 12 August 2022: Regular Registration Near Surface Geoscience Conference & Exhibition 2022 22 August 2022: Regular Registration Sixth International Conference on Fault and Top Seals 31 August 2022: Regular Registration EAGE Conference on Digital Innovation for a Sustainable Future 15 August 2022: Early Registration ECMOR 2022 31 August 2022: Regular Registration 3rd EAGE Global Energy Transition Conference & Exhibition (GET 2022) 15 September 2022: Early Registration 31 October 2022: Regular Registration Second EAGE Workshop on East Canada Offshore Exploration 7 October 2022: Regular Registration Third EAGE Conference on Pre Salt Reservoir 1 September 2022: Early Registration 23 October 2022: Regular Registration Fourth EAGE Workshop on Unconventional Resources 15 October 2022: Early Registration 15 November 2022: Regular Registration 15 August 2022 3rd EAGE Global Energy Transition Conference & Exhibition (GET 2022) 15 August 2022 Fourth EAGE Workshop on Unconventional Resources 14 September 2022 Second EAGE Workshop on East Canada Offshore Exploration CALL FOR ABSTRACTS DEADLINES 2022 REGISTRATION DEADLINES 2022 5-7 SEPTEMBER 2022 I THE HAGUE, THE NETHERLANDS & ONLINE REGISTER NOW! POWERED BY

CROSSTALK

BY ANDREW M c BARNET

Dividing up the spoils and more

‘Another one bites the dust’ is the irresistible refrain of the 1980 chart-topping song by Queen. It rather sums up the unfortunate sale of ION Geophysical assets in a month that also saw TGS’s surprising move into the seabed seismic operational space. In the light of such significant market disruption, the imponderable questions are what’s next? and indeed who’s next?

But first, a nod to the fateful story of ION Geophysical. A brutal obituary might conclude that it acquired a string of quality assets but failed to convert them into the persuasive integrated offering to the oil industry that successive managements had aimed for. Lack of capital and the fickle seismic services market were undoubtedly contributing factors. Two or three years ago Chris Usher, who in 2019 took over as CEO, was belatedly pushing the ‘One ION’ idea.

Founded in 1968 as Input/Output (changed to ION Geophysical in 2007), it became a public company in 1991 as the unquestioned leading land seismic equipment supplier with its System One acquisition system. In 1995 marine products and vibrator trucks bought from Western Atlas were introduced plus in 1998 the DigiCourse range of streamer control and positioning devices. Around this time it also acquired two land seismic software companies Green Mountain Geophysics and Compuseis and, in 2001, the Pelton line of vibrator control accessories was added. However, the market downturn in 1999/2000 took its toll along with the impact of a declining but competitive land seismic technology market. The company was floundering when Bob Pee bler arrived in 2003 to inject new energy although never achieving the integrated solutions he envisaged during the several years he was heading the company. His landmark purchases were Concept Systems, a navigation and positioning software company, and seismic data processor GX Technology. During the Peebler era the company dabbled in truly innovative seabed seismic and cableless land seismic technology but ultimately came up short.

In 2010, ION divested its entire land seismic business to Inova Geophysical, a joint venture between BGP (51%) and

ION (49%), since 2019 fully owned by BGP. The deal included Aram Systems, a rival Canadian manufacturer that had been quite expensively acquired only two years previously.

ION’s 2022 bankruptcy effectively exposed how easily its main revenue sectors could be separated and sold off and just how valuable these might be in other hands. In the auction of the spoils, still to be ratified, CGG’s Sercel Sensing and Monitoring division looks to have a winner as successful bidder for ION’s software business. This presumably includes products developed by ION Concept Systems in Edinburgh including Orca, arguably the industry standard in towed-streamer command and control software used on 2D, 3D, high-resolution and multi-vessel seis mic programmes. The combination of Orca and the company’s own SeaPro navigation and positioning offerings will give Sercel a dominant position in the sector.

However, in line with CGG’s ‘Beyond the Core’ diversification strategy, ION’s Marlin software may be the real prize in terms of future potential devel opment. It is said to be the only commercially available marine management system that combines temporal project planning with 3D spatial situational awareness. It integrates AIS, GPS, GIS, MetOcean and visual data between onshore operations, offshore structures and other vessels to create a common operational picture of any given theatre of operations. MarlinPort has been particularly successful in offering better understanding of harbour ship activity from a safety, efficiency and environmental perspective.

Over its history ION built up a significant multi-client library. It had considerable success with its BasinSPAN mult-client surveys conducted in many prospective areas using a long offset and depth imaging to 40 km to provide a regional crustal-scale framework of PSTM and PSDM data for basin-scale geological studies, under standing petroleum 3D systems, and basin modelling. Fairfield Geotechnologies beat TGS to win the right to take ION’s US onshore multi-client datasets along with the offshore GulfSPAN and FloridaSPAN datasets. However, TGS is to pick up the rest of

20 FIRST BREAK I VOLUME 40 I AUGUST 2022

BUSINESS • PEOPLE •

TECHNOLOGY

‘Around the turn of the century the company lost its way.’

ION’s global offshore multi-client data library consisting of more than 637,000 km of 2D and over 317,000 km2 of 3D multi-client seismic data in major offshore petroleum provinces worldwide.

In addition, TGS is buying ION’s well-regarded data process ing capabilities built on its original GX Technology acquisition 15 or so years ago. This will enable TGS to significantly enhance the processing of its multi-client survey data, but also allow the com pany to market more aggressively its data processing capabilities.

The saying ‘luck is what happens when preparation meets opportunity’, usually attributed to the Stoic philosopher Seneca, seems to apply to TGS in buying the ION businesses. The company was perfectly positioned for this growth by acquisition.

However, the coincidental outright purchase announced in late June of seabed seismic contractor Magseis Fairfield marks a stunning change of course. Apart from one brief flirtation, TGS has for two decades steadfastly shunned the overhead and oper ational issues of owning seismic vessels and equipment. This enabled it to prosper like no other company in the sector by commissioning multi-client surveys, and in some years actually being the largest customer for marine seismic surveys.

Many say that TGS dodged the bullet in 2007 when its offer to buy marine seismic contractor Wavefield Inseis came to grief. At the time, this out of character move was widely interpreted as a bid to ensure vessel availability for its multi-client business during a boom period of intense competition between contractors. CGG eventually bought the assets a year later for a greatly reduced amount and was miserably rewarded by a major collapse in the market leaving the company’s fleet operations uncomfortably exposed.

TGS is right to insist that market conditions have changed so significantly since 2007-8 that comparisons with the Wavefield Inseis episode do not apply. For a start, this is a straight purchase unlike the Wavefield Inseis merger proposal. Even so, securing capacity looks like a key factor in the Magseis Fairfield deal. The demand for node-based seabed surveys has increased to the point that they comprise more than 30% and counting of all marine seismic surveys, and TGS wants to maximise its exposure. It has its eye particularly on opportunities offshore South America and West Africa. The company also believes that ocean bottom node (OBN) surveys offer a more stable market to ride the cycle because they are associated with meeting routine 4D monitoring requirements and low risk near field exploration. Further down the road it sees OBN playing a part in technologies such as off shore wind farms and carbon capture and storage, again offsetting the highs and lows of marine seismic demand.

What better solution than to own Magseis Fairfield, the largest operator in the business with a major track record in the US Gulf of Mexico and the North Sea, is how TGS seems to be thinking. It allows the company to plan and develop its future

seabed seismic multi-client surveys more thoroughly without the hassle of finding and negotiating an operator for the survey. There are cost benefits in this estimated at between $7 and $9 million a year. The strategy also fits with the company’s expectation of more ‘converted contracts’, meaning fewer potential clients providing higher prefunding but lower sales to cost.

But there is also a lot to be sceptical about. The seismic business has seen so many asset purchases transacted when market expectations are high only to see things fall apart at the first sign of a downturn. In the past TGS has been asset light and able to escape the burden of vessel and equipment ownership. Furthermore it has been able to invest in its multi-client library at lower cost when contractors have struggled to keep their vessels working.

Now that TGS is part of the OBN market as an operator and equipment supplier, everything changes. It will be in direct compe tition with existing survey operators and their technology offerings, not to mention any newcomers attracted by today’s optimistic market talk and the relatively low cost of entry compared, for example, with towed-streamer acquisition. Magseis Fairfield as the largest and most established player in the field seems to have little to fear in the short term from rivals such as Shearwater GeoServices, PXGeo, or PGS should it enter the fray. For the time being there seems to be enough work to go around and reportedly the demand for nodes could easily exceed supply by next year.

That said TGS has to commit resources to research and development to keep in the game, and who knows where that may lead and at what cost. Magseis Fairfield itself was born less than four years ago out of a defensive merger between two companies with very different cultures and OBN solutions. Whether all the integration challenges have been resolved is unclear, and the profitability of the merger is unproven.

TGS will surely have taken all the naysaying into account before making its move. OBN business will form only a minor part of the company’s overall business at a time when it is seeking to diversify in a number of directions.

Last month the company announced the acquisition of Predik tor, a Norwegian company supplying asset management and real-time data management solutions to renewable and energy asset owners around the world. Since 1995 the company is said to have carried out thousands of installations on industrial and energy assets enabling data-driven, automated operational solutions.

The Prediktor purchase provides an indication of the direction that TGS is taking with its New Energy Solutions initiative. The company is targeting opportunities opening up as the focus turns increasingly to energy transition. It is following closely develop ments in carbon storage, geothermal and deep-sea mining.

Meantime expect more consolidation moves in the seismic sector.

expressed in Crosstalk are solely those of the author, who can be contacted at andrew@andrewmcbarnet.com.

CROSSTALK FIRST BREAK I VOLUME 40 AUGUST 2022 21

‘Magseis Fairfield purchase marks a stunning change of course’

Views

TGS swoops to buy ION Geophysical’s multi-client business and Magseis Fairfield

TGS has announced a triple swoop of acquisitions: ION Geophysical’s mul ti-client and processing businesses, Mag seis Fairfield and the software provider Prediktor.

ION’s assets were auctioned after the company filed for Chapter 11 bankruptcy in the United States Bankruptcy Court for the Southern District of Texas.

2021. TGS said that it intends to employ a number of the ION employees associated with the acquired business.

TGS expects to close the transaction early in the third quarter.

Kristian Johansen, CEO of TGS, said: ‘We are now uniquely positioned in the traditional multi-client business, converted contracts, production seismic and 4D – all supported by a strengthened data processing business.’

TGS will fund the transaction from its current cash holding.

Meanwhile, TGS has agreed to buy Magseis Fairfield after putting forward a voluntary exchange offer to acquire all shares of Magseis in the form of 0.0426 ordinary shares of TGS and NOK 2.30 ($0.23) in cash per Magseis share. Based on the closing price of TGS on 28 June 2022, the value of the offer consideration is equal to NOK 8.6048 ($0.85) per Mag seis share, and the offer values the total issued share capital of Magseis at approxi mately NOK 2.333 billion ($231 million).

the Magseis shares of NOK 5.60 ($0.56) on 28 June 2022.

‘With a strengthening focus on costs and cycle times in the exploration and production of oil and gas, an increasing amount of demand of geophysical data is driven by infrastructure-led exploration (ILX) and production monitoring (4D seismic). Combining Magseis’s leading position in the ocean bottom node (OBN) market with TGS’s multi-client and data processing capabilities creates a unique offering of superior quality products and services across the value chain,’ said Johansen.

TGS will acquire all of ION’s global offshore multi-client data library and ION’s data processing and imaging capabili ties and intellectual property. ION’s data library consists of more than 637,000 km of 2D and more than 317,000 km2 of 3D multi-client seismic data in major offshore petroleum provinces globally. The revenues associated with the acquired assets were in excess of $86 million in

The board of directors of Magseis has unanimously recommended the offer. Magseis shareholders, including the larg est shareholder, Fairfield MS, LLC, and members of the Magseis Board and man agement, who collectively own 33.4% of the outstanding share capital of Magseis, have accepted the offer.

The offer represents a premium of 53.7% compared to the closing price of

Carel Hooijkaas, CEO of Magseis, said: ‘The seismic industry is undergo ing a significant transformation brought about by fundamental structural chal lenges facing the industry. Adapting to these changes via consolidation will be beneficial to our investors and customers. The combined company will be a leading integrated seismic provider with a bestin-class OBN technology and track-re cord, strong data processing capabilities, and a multi-client business with a large customer base for the company’s oper ations and a truly global geographical footprint.’

Finally, TGS has acquired Prediktor, an asset management and real-time data management solutions provider. Predik tor’s software and systems are being utilized on: Benban (Egypt), the world’s

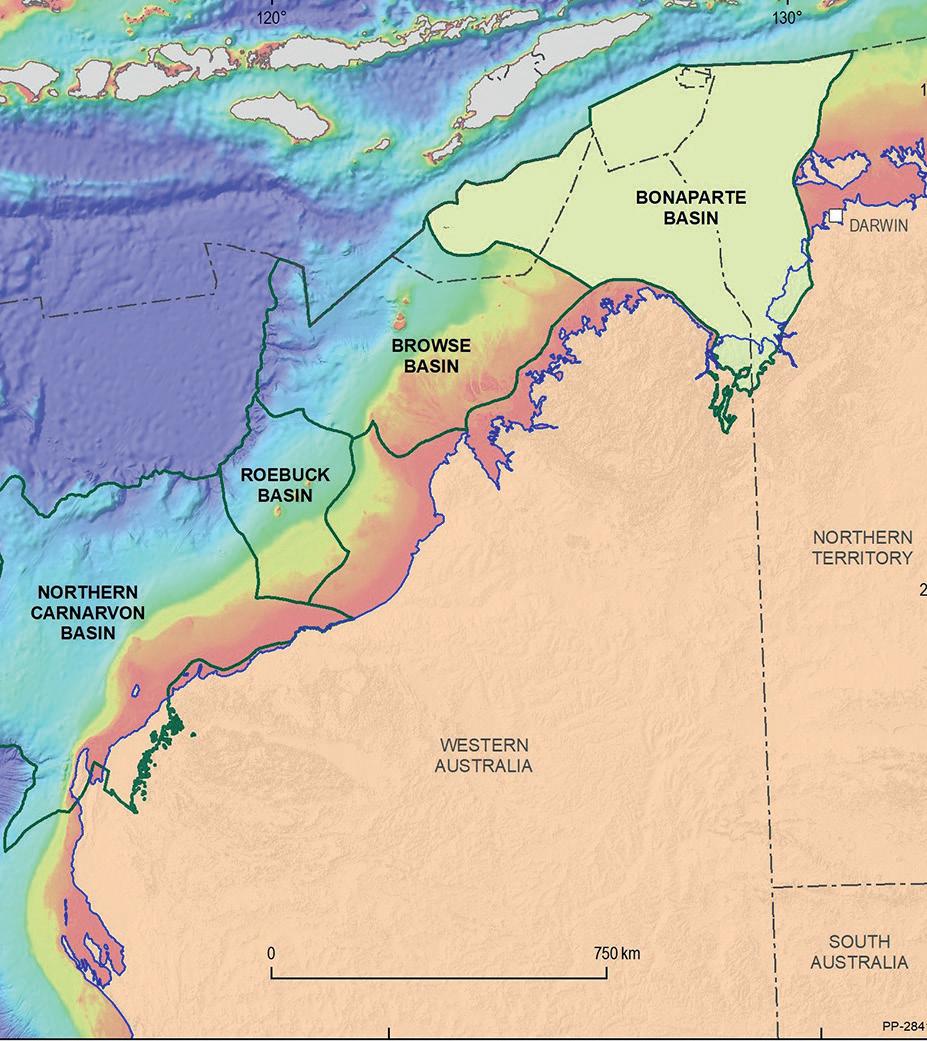

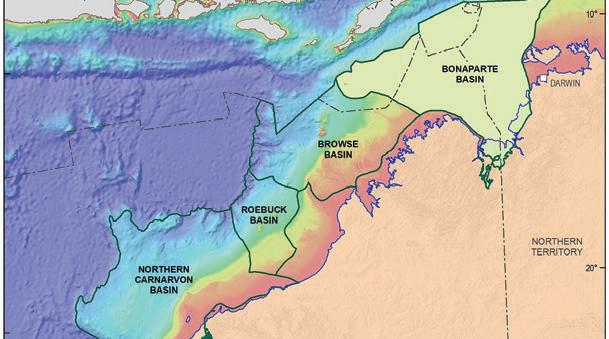

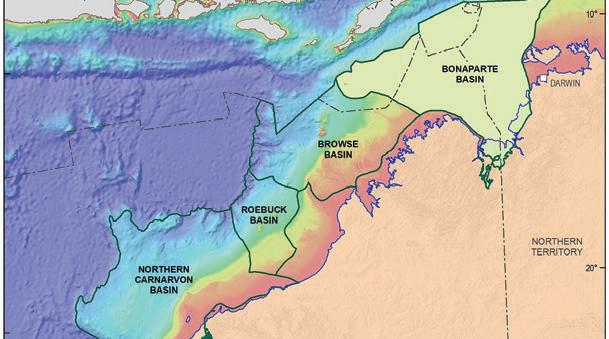

SLB shoots survey offshore Australia 28

CGG wins OBN contract in Nile Delta 31

HIGHLIGHTS INDUSTRY NEWS FIRST BREAK I VOLUME 40 AUGUST 2022 23

Searcher adds Indonesia to subsurface database 35

Kristian Johansen, CEO of TGS.

largest PV solar plant, built in 2019; Dogger Bank (UK), the world’s largest offshore wind farm, currently under construction; and Johan Sverdrup oil field (Norway), one of the world’s largest offshore oil and gas assets developed in recent times.

Based in Fredrikstad, Norway, with 40 employees, Prediktor current ly supports 7 GW of renewable energy assets (mainly PV solar).

Johansen said: ‘In February 2021, we introduced our New Energy Solu tions initiative, which provides data and insights for industries actively contributing to reducing greenhouse gas emissions. Since then, we have launched several organically developed data-driven solutions for offshore wind, geothermal energy and carbon storage, as well as acquired offshore wind mar ket intelligence provider 4C Offshore. Prediktor will become another impor tant building block for realizing our vision of creating an energy industry gateway providing integrated solu tions for data and actionable insights to facilitate decision making, project development and asset performance management across energy project life cycles and markets.’

Espen Krogh, CEO of Prediktor said: ‘We are currently in a phase of industrial energy asset-building of wind and solar assets at a vast global scale. Prediktor’s biggest challenge is the ability to scale fast enough in all our business processes to deliver to our clients’ ambitious pipeline. In TGS, we see the vision, resources, culture and infrastructure to meet this challenge.’

TGS expects net revenues for Q2 2022 to be £230 million, compared to $72 million in Q2 2021. Kristian Johansen, said: ‘The second quarter of 2022 was another solid quarter with late sales of close to $100 mil lion, driven by a further improvement of activity in frontier areas and trans fer fees. With a quarter-end cash bal ance of approximately $255 million in addition to an undrawn revolving credit facility of $100 million, we have a solid financial position that can comfortably fund the recently announced M&A transactions.’

PGS reprocesses data offshore Uruguay

PGS has completed an 11,600 km repro cessing project offshore Uruguay covering the 2nd Uruguay Licensing Round, sched uled for November 2022.

The reprocessed 2D volume covers the great extension of Uruguay’s shallow and deepwater provinces, with ties to 15,600 km2 3D GeoStreamer data. Notable improvements in data quality are visible across the basin, said PGS.

Increased resolution reveals mini basins in the shallow water areas, and confirms sizable amplitude leads in the deepwater. A better understanding of the petroleum system is now possible, by identifying the distribution of the source rocks, seal and trap mechanisms of the reservoirs, PGS added.

The company has rejuvenated datasets from the 1970s through to 2011, using a broadband pre-processing flow and mod ern depth velocity model building, with imaging benefiting from PGS’ hyperBeam tomography and Kirchhoff pre-stack depth migration.

‘As the recent discoveries of Graff and Venus in Namibia Orange Basin highlight, across the conjugate margin, better-quality data can support a re-assessment of Uru

guay’s potential related to different play levels and locations,’ said PGS.

Meanwhile, PGS has won an acqui sition contract over the Smeaheia carbon storage site in the North Sea, operated by Equinor. Acquisition is scheduled to start this month and complete in September. PGS acquired data for the Northern Lights JV, which includes Equinor, earlier this year.

Finally, PGS has won a contract to shoot several 4D surveys for an international oil company offshore West Africa. Acquisition is scheduled to start early November 2022 and is expected to complete in early May 2023. The contract award secures work for the vessel Ramform Vanguard until the summer season.

US launches oil and gas leasing plan for next five years

The US Department of the Interior (DOI) has put its oil and gas leasing programme for 2023-2028 out to public consultation.

The programme includes ten poten tial lease sales in the Gulf of Mexico (GoM) and an option for one potential lease sale in the northern portion of the Cook Inlet of Alaska. No lease sales are proposed for the other Alaska planning areas, nor for the Atlantic or Pacific plan ning areas during the five-year period.

The plan puts forward several options from no lease sales up to 11 lease sales over the next five years.

Secretary of the Interior Deb Haaland said: ‘The DPP released in 2018 by the previous administration proposed 47 lease sales across 25 of 26 OCS planning areas. Under the Proposed Programme, the secretary significantly narrowed the area considered for leasing to the Gulf of Mexico and Cook Inlet, where there is existing production and infrastructure.’

After the public consultation peri od, the US Bureau of Ocean Energy Management will prepare a proposed final programme and analysis of the size, timing, location, and number of potential lease sales.

INDUSTRY NEWS 24 FIRST BREAK I VOLUME 40 I AUGUST 2022

Ramform Vanguard is acquiring data offshore West Africa.

Global recoverable oil resources dip by 9%, says Rystad

Rystad Energy analysis shows that global recoverable oil now totals an estimated 1572 billion barrels, a drop of almost 9% since last year and 152 billion fewer barrels than 2021’s total.

The drop in reserves is driven by the 30 billion barrels of oil produced last year, plus a significant reduction in undiscov ered resources, to the tune of 120 billion barrels. The US offshore sector accounts for the largest drop, where 20 billion barrels of oil are expected to remain in the ground, largely thanks to leasing bans on federal land.

Of the 1572 billion barrels of techni cally recoverable oil, only about 1200 bil lion barrels are likely to be economically viable before 2100 at $50 per barrel. This economically extractable oil would con tribute about 0.1°C of additional global warming by 2050, and somewhat less by 2100 thanks to natural carbon sinks.

‘While the drop in oil availability is positive news for the environment, it may threaten to further destabilize an already precarious energy landscape. We need more of everything to meet the grow ing demand for transport and any action to curb supply will quickly backfire on pump prices worldwide, including large producers such as the US. Politicians and investors can find success by targeting energy consumption, encouraging electri fication of the transport sector and drasti cally improving fuel efficiency,’ said Per

Nysveen, Rystad Energy’s head of analysis.

Nysveen, Rystad Energy’s head of analysis.

Rystad Energy has updated its esti mates for total undiscovered oil from 1 trillion barrels in 2018 to 350 billion barrels, due to a rapid collapse in investor appetite for exploration exposure, leading to fewer government leases.

All OPEC countries have proven reserves that are expected to last over 10 years, ranging from Iraq with just over 10 years to more than 14 years in Saudi Arabia. In non-OPEC member countries, Mexico ranks last among individual coun tries with fewer than five years of proven reserves, whereas Canada’s reserves are projected to last almost 20 years.

Saudi Arabia holds the most recover able oil reserves with 275 billion barrels, followed by the US with 193 billion barrels. Russia with 137 billion barrels, Canada with 118 billion barrels and Iraq with 105 billion barrels.