INTERNATIONAL MARKET REVIEW

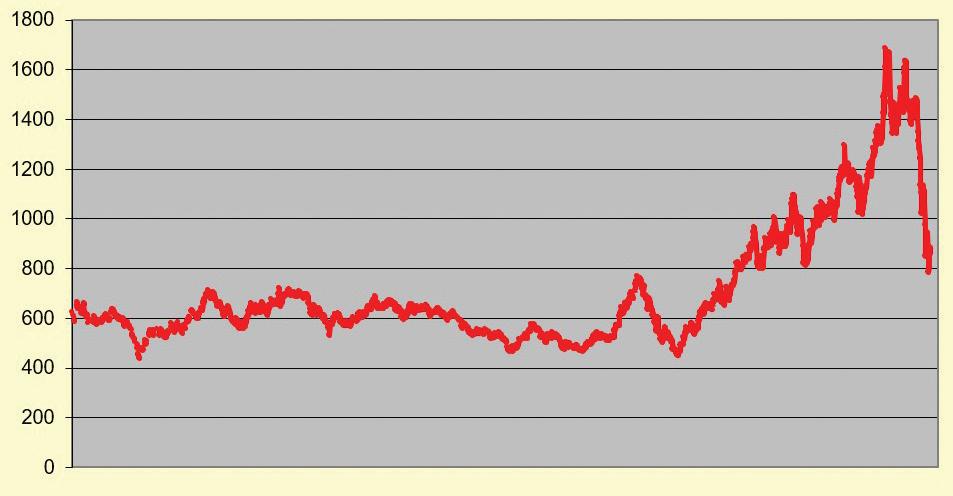

The year 2022 to date has demonstrated that there is never room for complacency over supplies of raw materials for food. Global palm oil supply growth had been slowing in recent years but nobody expected top producer Indonesia to impose, without warning, a more or less total export ban to protect its own consumers from rocketing domestic costs. Coming so soon after top sunflower oil supplier Ukraine’s forced export halt (who expected a Russian invasion before February?) and last year’s collapse in top rapeseed supplier Canada’s crop, it would have been surprising if this had not caused something akin to panic on the markets, not to mention the impact on consumers. The irony is that the Indonesian ban did not achieve its objective in bringing domestic palm prices down to target levels as we went to press. There was clearly a lot of market ‘sentiment’ in the domestic/ global palm oil price boom, borne of fears it would gain unsustainable demand from customers like top importer India, unable to buy Ukrainian sunflower oil. The ban did, however, stir predictions of a surge in Malaysian palm oil exports, resulting in some record prices trading on the Bursa Malaysia futures market – equivalent to over US$1,600/tonne at one point, against the US$600-800 range of several years past (see Figure 1, right). The swift end to the Indonesian ban was inevitable given: • The importance of palm oil to Indonesia’s foreign exchange earnings. • The lack of tank storage for a 7M tonne stockpile at the start of June. • Market talk of inflation/recession curbing global demand for oils. 18 OFI – JULY/AUGUST 2022

John Buckley July.Aug 2022.indd 2

Figure 1: Malaysian palm oil prices (Bursa US$ equivalent) since 2015

Graph: John Buckley

Larger palm, soyabean and rapeseed crops, along with more cottonseed, groundnut and palm kernel oil supplies, should moderate oil prices over the coming months. A slower pace of growth in global food oil consumption may also contribute to more restrained pricing John Buckley

Graph: John Buckley

Palm oil leads reversal in

Figure 2: CBOT soyabean futures prices (US$ cents/bushel) • The ban’s ineffectiveness in controlling prices. • A storm of protests from millions of Indonesia’s smallholder farmers. • The industries involved in palm oil’s journey to market. Things could get overdone on the downside. Top importer India is already forecast to take far larger quantities as the palm oil price dips further below that of chief rival soyabean oil. Other customers may respond similarly. In addition, Malaysia is still struggling with labour shortages and may not match expected production outlooks, even during the approaching seasonal peak period of fruit collection. Although recently seeming to go all-out to reclaim its export role with expanding quotas and reduced export duties, Indonesia has still been moving to raise its palm biodiesel mix from 30% to 35%.

Both Indonesia and Malaysia recently indicated their supplies would probably not rebound as much as markets hoped in second-half 2022. Indonesia’s government has forecast calendar year 2022 production rising to 48.24M tonnes from 2021’s 46.85M tonnes, while its own consumption has jumped almost 7M tonnes in the last five years. Malaysian first-half 2022 output is meanwhile only fractionally ahead of last year’s at 8.36M tonnes. Still tight rapeseed and sunflower oil supplies could also slow the palm oil price descent. But against that, Malaysian exports are falling and key importer China could impose new COVID restrictions that curb demand in its restaurant sector, which account for half the country’s vegetable oil consumption. China’s vegetable oil imports have already plunged by almost 63% in first quarter 2022 to under 1.05M www.ofimagazine.com

25/07/2022 09:45:19