EDITOR'S COMMENT

OILS & FATS INTERNATIONAL

VOL 38 NO 6 JULY/ AUGUST 2022

EDITORIAL: Editor: Serena Lim serenalim@quartzltd.com +44 (0)1737 855066 Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 (0)1737 855157 SALES: Sales Manager: Mark Winthrop-Wallace markww@quartzltd.com +44 (0)1737 855114 Sales Consultant: Anita Revis anitarevis@quartzltd.com +44 (0)1737 855068 PRODUCTION: Production Editor: Carol Baird carolbaird@quartzltd.com CORPORATE: Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 (0)1737 855164 SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 (0)1737 855028 Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK © 2022, Quartz Business Media ISSN 0267-8853 WWW.OFIMAGAZINE.COM

A member of FOSFA Oils & Fats International (USPS No: 020-747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437 Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 (0)1737 855000 Printed by Pensord Press, Gwent, Wales

@oilsandfatsint

Oils & Fats International

2 OFI – JULY/AUGUST 2022

Comment.indd 1

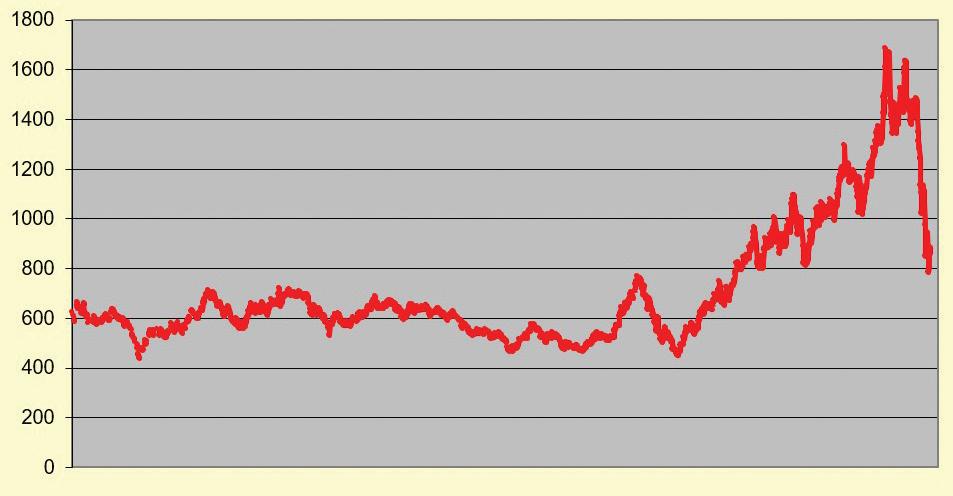

Shipping costs The war in Ukraine has brought into sharp focus the key role of shipping and logistics in global commodity markets. It’s not just how much grain or oil crops are produced, there’s the key question of how they can get to those needing them. “Perhaps not since the Cold War have supply chain resilience and geopolitical turmoil loomed so large in global trade,” writes shipping consultant Michael King in World Grain. “The disruptions have arguably impacted the grain shipping trade more than any other, with grain prices and shipping costs soaring.” Just as we went to press, Russia and Ukraine signed a landmark deal to unblock grain and oilseed exports from Black Sea ports (see p4). The re-opening of the ports could lift Ukraine’s export capacity towards 5M tonnes/month – on a par with its pre-war capacity – but obstacles, such as insurance and how ships will navigate heavily-mined waters, remain. According to S&P Global Market Intelligence, total seaborne agri-bulk shipments from the Black Sea region fell 37% year-on-year to 11.2M tonnes in second quarter 2022, with reductions from Ukraine accounting for a large part of the loss. How quickly can Ukraine clear its large build-up of grain and oilseed stocks, as this could pose a serious storage capacity issue during its July-November harvest period? Meanwhile, exports from Russia – also a global leader in grain, oilseed, fertiliser and energy products – are being held back by quotas, sanctions and ship owners’ difficulties in procuring insurance. Much of export trade from Russia is going “dark” and obtaining information is getting harder and harder,” speciality bulk liquid ship broker Riverside Tanker Chartering Riverside wrote in its June market report. The volatile nature of global events such as the Ukraine invasion and the COVID-19 pandemic has been reflected in shipping prices, according to King. The Baltic Dry Index (BDI) was below 500 in May 2020 as COVID-19 began its global spread but stood at 2,240 points on 30 June. The BDI is a daily index of average prices paid to ship dry bulk products such as grains/oilseeds, coal, sugar, minerals, cement, metals and fertiliser across more than 20 routes for Capesize, Panamax, Supramax and Handysize vessels. It measures demand for shipping capacity against the supply of vessels and is viewed as an economic indicator of growth and production. The International Grains Council Grains and Oilseeds Freight Index also shows that freight costs have also risen much faster than grain and oilseed prices since June 2020. It is unclear which way dry bulk shipping rates will head. Some analysts believe they will remain high due to high bunker (fuel) and crude oil prices; and new International Maritime Organization emission rules coming into force on 1 November, leading to more ship retirements and higher compliance costs. However, others feel that slowing economic growth, strong domestic production of bulk commodities in major importing countries, weaker demand linked to rising inflation and low ship deliveries this year might put downward pressure on rates. As for shipping activity in vegetable oils, the entire tropical oil freight market went “ballistic” in May and rose even higher in June, with IMO2 rates from Straits (Malaysia) to Rotterdam reaching over US$170/tonne and IMO3 rates around US$120/tonne in June, according to Riverside. “Sustained demand … and ongoing market disruptions due to the war in Ukraine are expected to keep all markets firm over the summer months. Not surprisingly, this has given ship owners broad smiles. If you believe in only half of what you hear in the market place, we are all in for a challenging summer,” the company says. Serena Lim, serenalim@quartzltd.com www.ofimagazine.com

25/07/2022 13:06:32