What do your Moments of Truth say about your client experience?

@ReceiptBank

Damien Greathead, Vice President of Business Development for North America, Receipt Bank Damien is responsible for building Receipt Bank’s accounting channel in the United States and Canada. He works with accounting firms of all sizes who want to leverage cloud technology to grow their firm. Prior to Receipt Bank, Damien was a Director at 2020 Group USA, which was acquired by Panalitix in 2016. Damien speaks to state and national accounting associations around the world on topics including change management, marketing and technology.

Accountants are not in the business of grand gestures. Firefighters swoop in and rescue you from a burning building. Accountants, however, should be watching every flammable object in the house to make sure a fire never starts in the first place...

T

his point is summed up nicely by Jan Carlzon, former CEO of SAS, in his book Moments of Truth. For Carlzon, Moments of Truth are those 15-second interactions where customers interact with front-line employees. He explains, “These 50 million ‘moments of truth’ are the moments that ultimately determine whether [we] will succeed or fail as a company.”

The Danger of Front Loading Value

To bring these terms closer to current accounting vernacular, these Moments of Truth are the building blocks of client experience. They are the moments where you fulfill the promises you made when the client signed up.

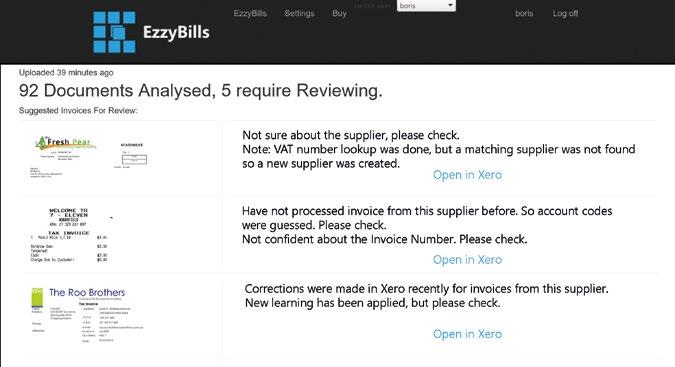

Once, most clients would have given their right arm to never have to look at an accounting product. Now businesses like Xero are competing to create client-facing products that customers enjoy using and that provide tangible value. But while Xero is the basis for managing your clients’ finances, it’s often the add-ons that provide the front-facing value.

It may not be as tangible as your office or your team, but the trust of your clients is one of your practice’s most important assets. The Moments of Truth can make or break individual client relationships. And just as they do for SAS, they will determine whether you succeed or fail as a practice.

80 / Issue 15

Client experience has become a buzzword in recent years largely due to the proliferation of new technology. These tools make traditional accounting processes much simpler, faster and more valuable. This means that the way you employ them – the experience you offer – is now a powerful sales tool.

For example, in your next meeting with a new client, you could bring out your phone and take a picture of a receipt with the Receipt Bank app. In under 5 seconds, you’ve just shown them the only thing they will ever have to do to keep up with their expenses.

For you that means you’ll never have to enter data again or store paperwork in your office, but for your client it means so much more. It means no more receipts in their car, no more filing and, no more driving bags of receipts to your office. It means a great experience, which could well be enough to seal the deal. But it also sets a standard that you need to follow. You can’t offer all the value up front, when it matters to close a sale, and not follow through once they are a client. That’s a quick route to a ruined client relationship and lost business. A Thread of Excellence In order to retain and increase value from your clients, you need to able to own these Moments of Truth. This goes for the lifetime of the client, from prospecting interview, to onboarding, to tax season and beyond. So how do you maintain that level of quality? Inconsistent experiences come from

XU Magazine - the independent magazine for Xero users, by Xero users. Find us online at: xumagazine.com