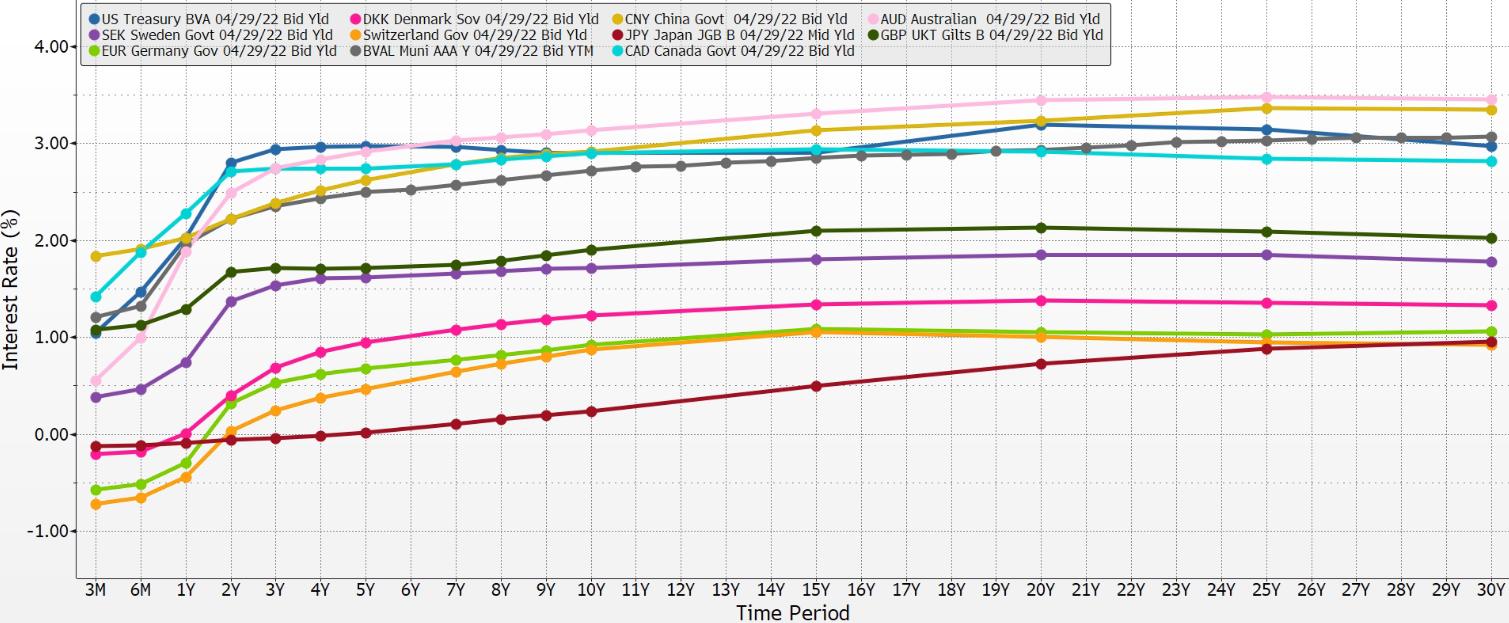

After Japanese Yen Weakness, BOJ Policy in Doubt (04/29/2022) We’re at the end of the yield curve chart pack for this pamphlet. Bunching in the intermediate spread measure is very tight, nearly down to 60 basis points. In the longer-term spread, things are widening, and the unbunching mechanism is at work. Australia is now an apparent outlier, as a comparison of the intermediate-term with the longer-term demonstrates. We do not know when and how Japan will change its policy course. We watch the news of the Russia-Ukraine war and observe the continuing Covid lockdown in China. Note how the muni term structure in the U.S. continues to reveal that munis appear to be very cheap for an American bond buyer. And this is also true for a crossover buyer. The Fed has achieved market influence through “jawboning,” and the market is pricing in several rises in policy short-term interest rates. Note that yield curves are still mostly parallel. So far, the cumulative evidence points to successful use of swaps by market agents as they apply the cross-currency interest rate swap techniques. As for tomorrow, more will be revealed.

One Sarasota Tower: 2 N. Tamiami Trail, Ste 303 Sarasota, FL 34236

|

T: 800.257.7013

|

F: 941.960.2047

70