CEO OUTLOOK 2023

PAGE 14

CHANNEL CHIEFS 2023

PAGE 20

THE SECURITY 100

PAGE 58

THE CLOUD 1OO

PAGE 68

NEWS, ANALYSIS AND PERSPECTIVE FOR VARs AND TECHNOLOGY INTEGRATORS

CEO OUTLOOK 2023

PAGE 14

CHANNEL CHIEFS 2023

PAGE 20

THE SECURITY 100

PAGE 58

THE CLOUD 1OO

PAGE 68

Palo Alto Networks CEO Nikesh Arora spent over four years transforming the security giant’s product portfolio, and now he says it’s time for him to have a more visible role with partners. ‘This year is going to be all about go-to-market and the channel, and they’ll be surprised to find me,’ he tells CRN. PAGE 8

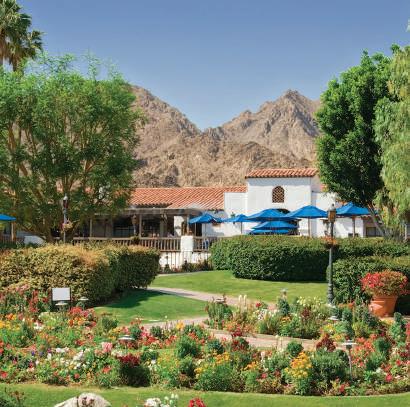

The Women of the Channel Event Series empowers and cultivates the next generation of women leaders. These one-of-a-kind, engaging events offer the most prominent and rising women in the IT channel an opportunity to advance their skills, connect with peers, and develop their personal, professional, and corporate goals.

Keynote

Individual Passes and Tables of 10 Available

www.womenofthechannel.com

May 16-17

La Quinta Resort Palm Springs, CA

Laura Ling

Emmy Award-Winning Journalist

May 16-17

La Quinta Resort Palm Springs, CA

Laura Ling

Emmy Award-Winning Journalist

CRN (ISSN 1539-7343), also known as Computer Reseller News, is published 14 times a year (February, April, June, August, October, December and 8 Special Issues) by The Channel Company, One Research Drive, Suite 410A, Westborough, MA 01581, and is free to qualified management personnel at companies involved in the reselling/distribution of computers/ networking systems, software and services. One-year subscription rates for all others in the United States are $209.00;

Palo

We asked, they answered. A number of the industry’s prominent technology CEOs provide insight into where they are placing their bets this year and how they are banking on partners to help them tackle emerging opportunities.

be bold.

As uncertainty around the global economy continues to swirl and companies across the tech industry make headlines left and right with layoffs by the thousands, it might be tempting to hunker down and play it safe when it comes to channel partnerships: Stick with what you know, maintain the status quo. But in reality, times such as these create a tremendous opportunity for technology manufacturers to gain both mindshare and market share within the channel for those daring enough to grab them.

Winners and losers in the Everything-as-a-Service revolution will be decided during this downturn as customers gravitate toward more cost-effective, efficient and flexible solutions and Capex-only deals continue to lose their luster.

That’s why it’s critical for technology vendors to do everything in their power to position themselves as strategic partners to the solution providers they work with rather than just building transactional relationships. That means creating new services opportunities, offering tighter collaboration, sharing quality leads, or any of a number of other things that prove valuable to channel partners.

about how vendors such as Amazon Web Services and VMware, among others, are taking steps to drive closer alignment and bolster services opportunities for the channel, moves that stand to benefit both sides of the partnership.

The “smart” vendors will move past the knee-jerk tendency to pull back from channel investments in uncertain economic times and instead leverage the channel’s wealth of talent, according to Scott Winslow, president and founder of Waltham, Mass.-based Winslow Technology Group.

“We have sales, engineering, marketing, finance services, managed services folks that we are employing on our payroll that are available to our [vendor] partners. What better way for them to become more efficient themselves than to do more with a channel?” Winslow said in the article.

We asked our Channel Chiefs honorees for up to three of their top channel goals for 2023. The top three answers— each selected by roughly 33 percent of respondents—were adding more qualified partners, increasing the number of netnew accounts coming through partners, and increasing the overall percentage of revenue that comes through the channel.

Times such as these create a tremendous opportunity for technology manufacturers to gain both mindshare and market share within the channel for those daring enough to grab them.

In our cover story on Palo Alto Networks on p. 8, CRN Senior Editor Kyle Alspach looks at the journey the security company has embarked on to transform its product line since naming Nikesh Arora as its chairman and CEO in 2018. Now that Arora has assembled the cloud services portfolio he wants, he’s ready to focus on the go-to-market strategy in general and the channel in particular.

Solution providers told CRN they are already reaping the benefits of the security vendor’s efforts, which have created high-margin growth opportunities in professional and managed services for the channel. Multiple partners throughout the piece describe the ways Palo Alto Networks has shifted to make itself a more strategic partner for them.

Meanwhile, in CRN’s 2023 Channel Chiefs project, featured on p. 20, our reporters talked to a slew of solution providers

Sitting just below those at Nos. 4 and 5 were improving partner profitability (29 percent of responses) and increasing the amount of recurring revenue going through partners (27 percent).

While the first three could be interpreted as channel executives focusing heavily on what partners can do for them, the next two certainly point to awareness that it’s also critical to focus on what vendors can do for the channel.

What’s also essential is to not only become a more strategic technology partner to the channel but also to communicate that strategic sales strategy to them to drive partner engagement.

Fortune favors the bold, as the adage goes. In 2023, the boldest channel executives will get strategic. n

BACKTALK: Do you have a good story about how a technology vendor has made itself more strategic to you? Share it with me at jfollett@thechannelcompany.com.

IF YOU WANT TO KNOW what makes Amazon Web Services’ channel so unique you need look no further than AWS Global Systems Integrator Partner of the Year Classmethod.

Classmethod beat out AWS systems integrators more than 100 times its size because of its engineering prowess and unprecedented commitment to keep pace with the fast-moving AWS cloud innovation juggernaut.

The Classmethod business model, in fact, is to stay in lockstep with AWS in pushing the cloud technology envelope at a relentless pace to drive breakthrough productivity, cost and competitive advantages for customers. That, of course, is where the highest margins are for partners.

The systems integrator’s secret sauce is its technology thought leadership. That can also be said for AWS, with CEO Adam Selipsky and Vice President of Worldwide Channels and Alliances Ruba Borno driving forward AWS’ unique channel advantage.

Classmethod’s DevelopersIO website with more than 40,000 technical articles acts as an open-source clearinghouse of sorts for customers looking for answers to hard-to-solve cloud issues. The Tokyo-based company’s 500-plus engineers—who make up 71 percent of its employees—do deep drill-downs into AWS technology in blog posts each day.

In 2022, Classmethod provided technical support to over 18,000 AWS accounts with more than 200 technical case studies on its corporate website. That means that the company stays up to date on all things AWS.

For seven consecutive years, Classmethod has obtained Premier Tier Services Partner status from AWS—the highest in that category. In addition, Classmethod employees hold well over 2,200 AWS certifications. That AWS certification depth and breadth put it ahead of systems integrators many times its size in annual revenue.

Customers know that when they go to Classmethod’s DevelopersIO website for answers on any and all kinds of cloud challenges—including the latest AWS innovation—they will not be disappointed.

More than 1 million unique users visit the Classmethod website each month, with many of them going on to hire the AWS superstar as their primary cloud consultant and integrator. The Classmethod model is a lead generation machine that provides a constant flow of new customers.

In fact, Classmethod, with its 100 sales reps, generates more sales opportunities than nearly every other AWS systems integrator.

“The culture of Classmethod is technology thought leadership for the benefit of all,” said Chris Sullivan, general manager of worldwide systems integrators and strategic alliances at AWS. “The company publishes all of its technical content on its website. Customers come to their website for answers and then engage with them based on their technology thought leadership.”

Sullivan is a huge fan of Classmethod, crediting the company with an uncanny ability to leverage AWS’ cloud services to solve customer problems in new and innovative ways. “We innovate every day, and Classmethod is right beside us,” he said.

BACKTALK: What is your winning formula for success in the cloud? Let me know at sburke@thechannelcompany.com.

Sign Up for List Notifications

Elevate your people, organization, and solutions through high-visibility recognition across the entire channel.

These 10 startups have rolled out new products that are solving niche storage issues or tackling critical challenges that haven’t yet been resolved.

By Joseph F. Kovar1. 22DOT6 226-212NSS

Bozeman, Mont.-based 22dot6 is rolling out its new 2U, 12-bay highperformance 226-212NSS hybrid storage system. Designed for the new Intel Xeon-D 1700 SoC-based motherboard architecture, it comes with two 25-Gbit network cards plus four Gigabit Ethernet ports native as well as 12 3.5-inch bays in front that support a U.3 backplane for use with NVMe or SAS drives. With its NVMe/SAS SSD and hard-drive support, it allows flexible true active/ active and active/passive multitier support.

2.

Mill Valley, Calif.-based Iodyne’s Pro Data storage device is an all-NVMe all-SSD Thunderbolt RAID device combining multiple SSDs and eight 40-Gbit Thunderbolt ports in a single enclosure. The Pro Data is protected by RAID-6 and AES-XTS-256 encryption and can be connected to multiple PCs in a workgroup. It is available in 12-TB, 24-TB or 48-TB capacities.

3. INTERNXT DRIVE

Internxt Drive from Valencia, Spainbased Internxt, is an open-source, zero-knowledge cloud-based storage service which, because the company is based in Europe, offers full privacy features including user-coded decryption. Files uploaded to Internxt Drive are first encrypted on the client side and then fragmented into independent shards that are stored on servers distributed around the world.

Icedrive from the Swansea, U.K.-based company of the same name is a cloud-based storage offering that uses twofish encryption, which the company said is more secure than the commonly used Rigndael algorithm-based AES encryption. Everything, including file and folder names, are encrypted on the client device before being moved to the cloud. Plans start from $20 per year for 150 GB to a one-time $999 payment for lifetime 10 TB.

Nexfs intelligent software-defined storage from Wellington, New Zealandbased Nexustorage unifies block, file, cloud and object storage technologies, combining up to three tiers of storage into a massively scalable single pool of storage with data protection and automated data life-cycle management. The software, which works with standard x86 server hardware, can be licensed in capacities from 10 TB to 1PB.

Liege, Belgium-based startup Nodeum is the developer of Nodeum Data Management software, which runs on the Linux platform and commodity hardware to provide a platform to optimize data movement, move inactive data to the secondary storage of choice, and virtualize data so it can be accessed and synced from anywhere.

The Nvisionx Nx Platform from Santa Monica, Calif.-based Nvisionx is a data intelligence platform that combines storage, analytics and security. The platform analyzes all business data and correlates cyberintelligence to help businesses contextually classify data, provide the right protection, purge stale and toxic data, and minimize cybersecurity and compliance risks.

Pliops, based in San Jose, Calif., in November unveiled the Pliops XDP-Rocks, a version of the company’s Pliops Extreme Data Processor, or XDP, aimed at overcoming architecture limitations of traditional RocksDB deployments. XDP-Rocks can increase throughput by 20X while reducing tail latency by 100X and normalized CPU by 10X in RocksDB-based databases.

The P44 Pro SSD was introduced in October by Solidigm, a San Jose, Calif.-based SSD startup launched in December 2021 when Intel decided to sell its SSD business, some NAND SSD technology and a NAND facility to SK Hynix. The P44 Pro offers PCIe 4.0 performance with up to 7,000MBps sequential read speeds while drawing just 5.3 watts. It is available in 512-GB, 1-TB and 2-TB capacities.

Wult is a Copenhagen, Denmark-based builder of a platform by the same name that provides real-time data compliance automation to help address companywide governance, risk and compliance. It includes data mapping to get a full view of all data in all silos, automates how third-party vendors interact with data and helps control employee data. ■

Palo

By Kyle AlspachIn December, a few months after onShore Security had joined Palo Alto Networks’ managed security services provider program, the Chicago-based MSSP received what founder and CEO Stel Valavanis could only describe as “manna from heaven.”

That month, onShore received the first of three highly valuable customer leads from the cybersecurity titan, all for opportunities involving the vendor’s Prisma Access offering for zero trust network access. OnShore has done far more business with other cybersecurity vendors in the past and never gotten a single lead from them, so being handed three leads in a manner of weeks, Valavanis said, “is unheard of.”

He is now expecting Chicago-based onShore’s revenue with Palo Alto Networks to more than double in 2023 from last year. And he’s got a message for other MSPs and MSSPs: “Don’t assume that big, giant Palo Alto [Networks] is out of your reach.”

In recent years, Palo Alto Networks has moved aggressively to expand its product portfolio beyond its signature next-generation firewall offerings, a move that is now creating major opportunities for a wider range of partners, executives from multiple solution providers that work with the vendor told CRN

For one thing, the cloud- and zero-trust-focused platform now being offered by Palo Alto Networks requires a lot of additional services from the channel to implement, solution providers said. Offering security to customers with distributed workforces “adds a level of complexity that you have to design around,” Valavanis said. “It’s not the same as just putting up a firewall somewhere.”

This expanded Palo Alto Networks portfolio is creating huge opportunities for high-margin growth in managed and professional services, solution providers said. For example, at Cleveland-based Advizex, the IT services powerhouse is expecting revenue from its Palo Alto Networks business to grow by 80 percent to 90 percent this year over last year, CTO Chris Miller said.

And like at onShore, the team at Advizex, No. 104 on the 2022 CRN Solution Provider 500, has seen Palo Alto Networks go the extra mile to team up on prospective deals.

Case in point: After providing some basic cybersecurity services to a large manufacturer in the Midwest, Advizex had been working to land a more extensive deal with the customer. Now, the solution provider is closer to achieving its goal after Palo Alto Networks intervened on its behalf, according to Advizex President C.R. Howdyshell.

Alto Networks CEO Nikesh Arora spent over four years transforming the security giant’s product portfolio, and now he says it’s time for him to have a more visible role with partners. ‘This year is going to be all about go-to-market and the channel, and they’ll be surprised to find me,’ he tells CRN.

“Palo [Alto Networks] said, ‘Hey, we know you guys. Let’s go at this together.’ And they went to the customer with that recommendation,” Howdyshell said. “That doesn’t happen with a lot of other partners.”

Palo Alto Networks executives told CRN that 2023 is all about bringing its work with the channel to the next level as it seeks wider customer adoption of its newer products, which span from cloud and application security to zero trust and secure access service edge (SASE) to extended detection and response (XDR) and automated security operations.

Among other things, this partner push will mean Palo Alto Networks CEO Nikesh Arora will be taking a more visible role in the vendor’s channel efforts. In a recent interview with CRN, Arora said that channel partners may be “surprised” by how much they see of him going forward.

“We’ve taken four and a half years to get to a place where we believe we have a robust product portfolio in the most relevant categories of today,” Arora told CRN in December at the company’s 2022 Ignite conference. That has meant spending 70 percent of his time focusing on the product portfolio, leaving other executives to worry about the go-to-market and channel strategy, he said.

“If I didn’t fix the product portfolio, it wouldn’t matter if I had a good channel strategy or a bad one, so I spent my time [on products],” Arora said, likening himself to a doctor who had to triage the damage. “People didn’t see me in the channel because I was busy fixing the broken elbow and the bleeding arm.”

Now that the portfolio he envisioned is a reality, Arora said his focus over the next three years will shift to spending 70 percent of his time “to make sure we actually take all these products to market and upsell all of our customers into a better security proposition.”

That will include a lot more involvement with initiatives that impact the channel, he told CRN. More than 95 percent of the security vendor’s revenue is generated through its partners. “[This] year is going to be all about go-to-market and the channel,” Arora said, “and they’ll be surprised to find me.”

Formerly the chief business officer at Google and president of prominent investment firm SoftBank Group, Arora landed at Palo Alto Networks as chairman and CEO in June 2018. From the start, Arora recalled having “transformation” on his mind— transformation of the vendor’s product offerings and, over time, of the company itself.

“When I came to Palo Alto Networks, I said, ‘We have two

years to transform our product portfolio. Otherwise, we run the risk of being yet another cybersecurity company which [loses relevance],’” Arora told CRN. And so in the years since, “I spent a disproportionate amount of my time focusing on fi xing our product portfolio,” he said.

Without question, the Santa Clara, Calif.-based company has reinvented itself under Arora’s leadership. In less than five years, it’s shifted from being known predominantly as an on-premises network security vendor into becoming the provider of a full platform for modern cybersecurity. The product lines that have been built out under Arora’s leadership include Prisma SASE and Prisma Access to provide secure remote access to applications; Prisma Cloud for application and cloud security; and Cortex for endpoint security, XDR and machine-learning-powered security operations.

The Palo Alto Networks portfolio today brings together numerous best-of-breed tools to form a “robust endto-end platform that can solve nearly all the issues that we’re seeing in cybersecurity,” said Mark Jones, founder and CEO of Austin, Texas-based BlackLake Security, No. 270 on the 2022 CRN Solution Provider 500. “I’m not saying that they’re the one-stop shop, but they’re very close to it.”

Jones gives much of the credit to the vendor’s leadership team and to Arora in particular: “The guy understands the market. He’s not chasing the ball—he’s well ahead of it.”

Competing players in network security didn’t move as quickly to transition to the cloud and embrace zero trust and didn’t invest in these areas as effectively as did Palo Alto Networks, solution providers said. “Over the years, they keep making the right acquisitions at the right time,” Jones said.

While the company had already begun its cloud transition prior to Arora’s hiring, including through acquisitions such as Evident.io, the pace of technology acquisition picked up after his arrival. Starting with the acquisition of cloud security startup RedLock a few months after he joined, Palo Alto Networks has completed 14 acquisitions under Arora so far, according to the company.

The series of acquisitions has endowed the Prisma and Cortex offerings with the majority of functionality that’s considered essential in today’s pandemic-altered security landscape, solution providers said.

The Palo Alto Networks platform, in other words, is “literally a single pane of glass for 99 percent of what you’d want to do on your network,” said Max Shier, CISO of Denver-based Optiv, No. 25 on the 2022 CRN Solution Provider 500. “That is pretty ground-breaking.”

“When I came to Palo Alto Networks, I said, ‘We have two years to transform our product portfolio. Otherwise, we run the rist of being yet another security company which [loses relevance].’”

—Nikesh Arora, Charirman, CEO, Palo Alto Networks

In addition to choosing its startup acquisition targets wisely, Palo Alto Networks has been skillful at integrating its acquired technology into a cohesive platform, according to Chuck Crawford, senior vice president of solutions architecture at Kansas City, Mo.-based Cyderes.

“It’s one thing that we see a lot of other large companies fail at—the mergers and acquisitions of products into their portfolios tend to stay siloed,” Crawford said. “Palo [Alto Networks] did a really great job of integrating all those solutions in one place.”

In recent months, Palo Alto Networks has unveiled updates to its channel partner program, NextWave, that aim to enable partners to sell more of the portfolio.

“When we look at our data, the partners who are growing the fastest are the ones that have branched out beyond fi rewalls,” said Tom Evans, who was named vice president of worldwide channel sales in December after former channel chief Karl Soderlund took a new role leading Palo Alto Networks’ North America ecosystem organization. “Our answer to [partners] is, ‘If you want to make more money, you want to sell more, you want to grow more, you want to have more opportunities to deliver services—sell the rest of the portfolio,’” Evans said.

The strategy with NextWave is to tailor channel enablement based on each partner’s business model. The program includes five distinct “paths” for partners depending on whether they’re predominantly a solution provider (focused on offering specialized expertise in products and services); an MSSP; a services partner (for consulting, professional or risk liability services); a distributor; or a cloud service provider (focused on marketplace transactions).

According to Larry Fulop, senior vice president of marketing and technology at Phoenix-based MicroAge, the move to “put a unique partner program in for each of us is a great strategy.” Given the vastly different partner types today, “I think that’s the right way to go,” Fulop said.

On the whole, Palo Alto Networks is “becoming much more specific on the solutions themselves and how partners can drive those services,” Evans said. That includes efforts to help partners with building a services practice, based on their partner type, and providing guidance about how partners can bundle together multiple solutions and compete more effectively with single-function point products from other vendors, he said.

“We’re heavily focused on teaching our partners how they can

drive those solutions and how our solutions complement each other,” Evans said.

The channel program shift to encourage partners to sell a broader piece of the portfolio dovetails with the platform developments that have made Palo Alto Networks now highly appealing to the growing number of customers who’d prefer to consolidate down to fewer security vendors, according to solution providers.

Many businesses have been struggling with complexity in their security architectures due to an overabundance of tools for cyberdefense, an issue that’s referred to as “tool sprawl.” Consolidating vendors can potentially reduce this complexity while cutting costs as well. Fewer vendors also means fewer skilled security professionals—who are perpetually in short supply—are needed to learn and operate the tools.

The current customer appetite for tool consolidation is one reason why Palo Alto Networks is coming to rely more heavily on partners, Arora said.

“Our customers are realizing they need to get rid of the point products that they have in the infrastructure. They need to go toward a more consolidated solution outcome. And that solution outcome requires a transformation at each customer’s end,” he said.

Customers can’t find the security talent to do this on their own, however, Arora said. And Palo Alto Networks doesn’t have the resources to “transform every customer” either. For that work, “I need to rely on a partner. And the partner is the channel,” he said. “I need all of their support to make that transformation happen.”

All in all, “the channel is becoming more relevant in the new world of cybersecurity,” Arora said.

Helping customers to consolidate on Palo Alto Networks has been a regular occurrence lately at CDW, according to Stephanie Hagopian, vice president of cybersecurity solutions at the Lincolnshire, Ill.-based solution provider giant, No. 4 on the 2022 CRN Solution Provider 500. She cited a number of recent cases where customers added an assortment of Prisma and Cortex products when their firewall contracts came up for renewal.

Those included a customer in the gaming and entertainment industry that recently tripled the size of its contract for Palo Alto Networks offerings at renewal time. Likewise, a customer in the utilities industry recently “bought everything under the Palo [Alto Networks] umbrella” at renewal time for its firewalls, she said. In all of these instances, the teams at CDW and Palo Alto Networks were working side-by-side to showcase the value of using more of the platform, Hagopian said.

“Our answer to partners is, ‘If you want to make more money, you want to sell more, you want to grow more, you want to have more opportunities to deliver services— sell the rest of the portfolio.’”—Tom Evans, VP, Worldwide Channel Sales, Palo Alto Networks

As weaker economic conditions take hold, the demand for cost-saving consolidation is only likely to accelerate, according to Jones of BlackLake Security, which recently helped an oil and gas industry customer replace multiple tools by consolidating on the Palo Alto Networks platform.

“We’re placing our bets on Palo Alto Networks as a company,” Jones said. “Because of the acquisitions they’ve made that have been so clutch, I think they are going to reap the benefits now in this environment.”

Meanwhile, intensifying cyberthreats, requirements by cyber insurance providers and increasing regulations are a few of the factors that could keep spending on cybersecurity more resilient than other areas of the economy.

For Palo Alto Networks’ fi scal fi rst quarter of 2023, which ended Oct. 31, 2022, revenue and profit beat analyst forecasts, and the company raised its financial guidance, all despite the weakening economy. Those results—including year-over-year revenue growth of 25 percent to reach $1.56 billion—led to gains in its stock price, even as other top security vendors saw their stock price sink after falling short of Wall Street expectations amid macroeconomic challenges.

Among publicly traded stand-alone cybersecurity vendors, Palo Alto Networks boasted the highest market capitalization as of this writing, at $47.96 billion.

While the company doesn’t disclose revenue by product segment, its zero trust and SASE offerings appear to be gaining the most traction with partners and customers among the newer solution set. Channel chief Evans said that right now, “SASE is definitely the No. 1 thing partners are talking to me about [for their] expansion.”

Indeed, for ePlus Technology, No. 30 on the 2022 CRN Solution Provider 500, Prisma Access and Prisma SASE are seeing the strongest customer adoption so far among the newer Palo Alto Networks products, said Lee Waskevich, vice president of security at the Herndon, Va.-based solution provider. That’s in part because implementing these solutions is a natural step for many customers that use the vendor’s next-generation firewalls but now want to provide secure remote access to distributed workforces, leveraging zero trust principles rather than VPNs and firewalls, he said.

Prisma Access includes security capabilities such as zero trust network access in place of a VPN, and cloud access security broker to protect their use of SaaS apps. Prisma SASE provides a combined security and networking offering through the addition

of SD-WAN. Palo Alto Networks is considered a “single-vendor” SASE provider thanks to delivering all of the core capabilities that are needed for deploying a SASE architecture, according to research firm Gartner.

“SASE naturally lends itself to being that intermediary layer, the same way that the next-gen firewalls from before were at that perimeter,” Waskevich said. “SASE becomes that new perimeter, that new layer, where you can connect from anywhere [and get] secure access to your applications, whether they’re on-prem or in the cloud.”

The Prisma SASE platform is also tailored to meet the needs of MSPs, offering multiple capabilities specially designed for them, according to Palo Alto Networks. The company’s interest in working with MSPs—even smaller companies like onShore Security, which employs 25—is only likely to grow, according to onShore’s Valavanis.

With offerings like Prisma Access and Prisma SASE, Palo Alto Networks knows “they need some kind of service provider— not just a VAR,” he said.

“They need to be able to add on the services along the way.”

Prisma Cloud, meanwhile, provides offerings for securing applications and the cloud or hybrid cloud infrastructure that runs them. And that platform has huge potential for the channel as well, including for serving customers that operate hybrid infrastructure, solution providers said.

The cloud-native application protection platform offers capabilities such as protection for cloud workloads, container security, monitoring for misconfigurations and, most recently, security for code and the software supply chain.

“Palo Alto [Networks] made a tremendous investment in advance of cloud workloads coming into play—and in particular, the integration between hybrid environments,” said Rocco Galletto, a partner and national cybersecurity leader at Toronto-based BDO Canada. For customers with both on-premises and cloud environments, “they do a fantastic job” in providing security capabilities across environments, Galletto said.

In addition, the introduction of code and software supply chain security now enables Prisma Cloud to secure every part of an application and its associated development process—or from “code to cloud,” as Palo Alto Networks has termed it. That’s a growing priority for many organizations in the wake of critical open-source vulnerabilities such as Log4Shell and software supply chain attacks such as 2020’s SolarWinds breach.

Crucially, this type of platform balances the development team’s needs—to fit code security into their workflows—with the security team’s need for visibility into the process, said Katie Norton, a

‘SASE naturally lends itself to being that intermediary layer, the same way that the next-gen rewalls from before were at that perimeter. SASE becomes that new perimeter, that new layer, where you can connect from anywhere [and get] secure access to your applications ’

Lee Waskevich, VP, Security, ePlus Technology

senior research analyst at IDC. Through that approach, “you’re striking that balance that’s needed to bring those two disciplines together effectively.”

Rounding out its newer portfolio is the Cortex line of products, which includes EDR and its more recent successor, XDR.

Nir Zuk, who founded Palo Alto Networks in 2005 and remains its CTO, coined the term XDR in 2018. XDR is seen as a major step forward in thwarting cyberattacks because it brings together data from numerous security tools, devices and environments for improved threat analysis and prioritization. Attackers typically move between systems and environments, Zuk observed—and so data needs to be correlated across all of them, which is what XDR seeks to do.

While many competing vendors have latched on to XDR in recent years, Palo Alto Networks not only pioneered the concept but also remains a top provider, thanks in part to having such a broad range of its own tools that can feed data into the analytics engine, solution providers said.

The more data you have, the better your decisionmaking can be around responding to threats, and Palo Alto Networks excels at doing this with its XDR approach, according to Logicalis US’ Brad Davenport. “They were really hot out of the gate in bringing that capability to market, and that has been a huge differentiator for them,” said Davenport, vice president of technical architecture for cybersecurity, networking and collaboration at the Bloomfield Hills, Mich.-based company, No. 66 on the 2022 CRN Solution Provider 500.

Palo Alto Networks also specializes in automating the Security Operations Center with its Cortex platform. Among the vendor’s most discussed new offerings is Cortex XSIAM (extended security intelligence and automation management), which the company has touted as an “autonomous SOC” platform. Generally available as of October, Cortex XSIAM aims to rapidly detect and respond to a greater number of threats than was previously possible.

At Chicago-based Ahead, security operations tools such as SIEM have never been a focus in the past. But the Cortex autonomous SOC platform is “a very interesting play,” said Dustin Grimmeissen, senior director of technical specialists at Ahead, No. 32 on the 2022 CRN Solution Provider 500.

With the platform, Palo Alto Networks is “challenging the status quo on the traditional SIEM-SOC service using more realtime data feeds, more automation, more machine-learning-type analytics—to make decisions quicker and to automate some of

the response,” Grimmeissen said.

Taken together, Palo Alto Networks is now offering a platform that can replace practically all of the major security tools, solution providers said, with just a few exceptions such as identity security.

According to Arora, the once-popular conclusion by some in the security industry that “nobody wants a consolidated platform” was premature. “There has never been one offered,” he said. “So how would you know?” In today’s security environment, “I think the market is ripe for a platform because the older [approaches] haven’t worked,” Arora said. “And if you crack that code, I think the sky’s the limit.”

His goal is to double revenue within the next three to four years, which he acknowledged would require more than 20 percent growth throughout that time frame. That’s a rate that would be no small feat to maintain as the company grows in size. Revenue for its most recently completed fiscal year, which ended July 31, 2022, was $5.5 billion, up 29 percent from the prior year.

Arora made it clear that he intends to rely on the channel for driving this ambitious growth. But in reality, there’s no other way to do it, he noted: Serving customers today is no longer just about selling them physical firewalls, which the customer could potentially set up itself. “You can’t do that on SASE. You need implementation capability,” he said. “That’s where the channel has been great in the last four or five years—transforming themselves to build that capability.”

Without a doubt, partners are “getting more solution-oriented and services-oriented. And it’s our job to make sure we have ample resources [to be] partnering with them to make sure that our strategy is amplified,” he said. “Because now our products lend themselves to more transformational [projects] with our customers, which do require a significant services capability with our partner ecosystem.”

Ultimately, Palo Alto Networks now has a platform for enabling transformation across the three biggest areas of cybersecurity today—cloud, zero trust and security operations, according to Arora.

“Our product portfolio is in place. The customers are trying to solve those three big problems,” he said. “I think the real opportunity for 2023 is to really start transforming our go-to-market capabilities to deliver that transformation to our customers.”

And more than ever before at Palo Alto Networks, he said, “the partner ecosystem is the key catalyst, enabler and amplifier of our ability to deliver those solutions.”

‘ ey were really hot out of the gate in bringing that [XDR] capability to market, and that has been a huge di erentiator for them.’Brad Davenport, VP, Technical Architecture, Cybersecurity, Networking, Collaboration, Logicalis US, on Palo Alto Networks

We’ve taken four and a half years to get to a place where we believe we have a robust product portfolio in the most relevant categories of today.Whether it’s cloud transformation with Prisma Cloud, whether it’s network transformation with our zero trust capability across hardware, software, SASE [secure access service edge]. Or it is the beginning of the SOC [Security Operations Center] transformation strategy—to take people to more real-time protection, from what I think is reactive protection. So our product portfolio is in place. The customers are trying to solve those three big problems. I think the real opportunity for 2023 is to really start transforming our go-to-market capabilities to deliver that transformation to our customers. And I’d say the last three or four years, I’ve spent 70 percent of my time on product to get our portfolio working with [Chief Product Officer] Lee [Klarich]. And the next three years I’m going to spend 70 percent of my time with [President] BJ Jenkins to make sure we actually take all these products to market and upsell all of our customers into a better security proposition.

The channel is becoming more relevant in the new world of cybersecurity. The reason is our customers are realizing they need to get rid of the point products that they have in the infrastructure. They need to go toward a more consolidated solution outcome. And that solution outcome requires a transformation at each customer’s end. But customers don’t have the resources. We’ve heard about the cybersecurity [talent] shortage. So they rely on somebody else. I don’t have the resources to go transform every customer. I have resources to build great products. But to create that transformation capability, I need to rely on a partner. And the partner is the channel. And the channel—[whether it’s] the system integrators, the traditional channel partners, the [service providers] as well as [cloud service providers]—I need all of their support to make that transformation happen. … They’re more important because it’s no longer selling a box that the customer needs to implement. In the past, we sold boxes. The boxes were taken

by the channel and delivered to the customer. The customers typically had some of their own engineers or channel support to do the deployment. You can’t do that on SASE—you need implementation capability. You can’t do that on [managed detection and response]. You need managed services capability. That’s where the channel has been great in the last four or five years—transforming themselves to build that capability.

Since joining Palo Alto Networks, how involved would you say you’ve been with channel-related issues? How would you respond to those who suggest you haven’t been very visible in the channel?

When you are a triage doctor and somebody rushes in and they have a bleeding arm and a broken bone—you focus all your attention on the bleeding arm and the broken bone. You don’t pay attention to the eczema they have on their leg or other issues that are not as urgent. When I came to Palo Alto Networks, I said, ‘We have two years to transform our product portfolio. Otherwise, we run the risk of being yet another cybersecurity company which [loses relevance].’ I spent a disproportionate amount of my time focusing on fixing our product portfolio. Think about it—we built SASE, we built Prisma Cloud, we built Cortex. I had to learn the product industry to be able to make those decisions and buy those things … I let BJ Jenkins, [Chief Business Officer] Amit Singh, [President of North America Sales] Rick Congdon, [Senior Vice President of Ecosystems] Don Jones worry about go-to-market and channel. Because if I didn’t fix the product portfolio, it wouldn’t matter if I had a good channel strategy or a bad one. So I spent my time there. People didn’t see me in the channel because I was busy fixing the broken elbow and the bleeding arm. Now, as I said, the next year is going to be all about go-to-market and the channel, and they’ll be surprised to find me. But once you have the best product portfolio, then you can go spend your life trying to sell it to all the customers out there. If I’d focused on channel and we didn’t have the products we have today, we’d be having a different conversation. You’d be asking me how I am going to compete on firewalls with Check Point and Fortinet and Cisco.

Palo Alto Networks Chairman and CEO Nikesh Arora discusses his 2023 strategy, his long-term vision and why partners are the key to delivering transformation to the cybersecurity titan’s customers.

If the past couple of years have taught the IT industry anything, it’s that businesses need faster returns on their IT investments and flexibility in the form of cloud-first offerings and Capex-based consumption models.

For many vendors, Everything as a Service is the name of the game for 2023. Cisco Systems Chair and CEO Chuck Robbins pledged that the networking giant will continue to accelerate its as-a-service offerings and partner managed services, which Robbins called a $113 billion opportunity for Cisco by 2025.

Meanwhile, Hewlett Packard Enterprise has made good on its 2019 promise to deliver the company’s entire portfolio as a service by 2022. Now, the company is continuing its mission this year with the help of its channel partners.

“Our goal is to give our partners the tools and flexibility to deliver modern cloud services in different ways, depending on where they and our shared customers are in their digital transformation

journeys,” said HPE President and CEO Antonio Neri.

But in a time of constant change and architectural shifts—whether it’s grappling with brand-new deployment models or geographically distributed employees—one thing remains certain: Security is at the forefront of everything these companies are doing.

Arista Networks CEO Jayshree Ullal called out security attacks and the ability to truly deploy networks and edge as a service as some of the biggest challenges facing the enterprise today.

“Customers are going to be challenged on whether to add to, refresh or completely redesign their networking capabilities, but we are excited to address the client-to-cloud network experience,” she said.

Here is where some of the leading technology CEOs are placing their bets in 2023 and how the channel will tackle emerging opportunities along with them.—By

Scan here for all of our CEO responses

Gina Narcisi

Gina Narcisi

François Locoh-Donou, President, CEO, F5

François Locoh-Donou, President, CEO, F5

The biggest opportunity F5 and our partners have is to take something that is dauntingly complex—managing and securing apps—and make it ridiculously easy. We believe that applications are the most valuable asset of the modern digital enterprise. Applications and APIs are essential building blocks for new and better digital experiences that improve customer and employee engagement, streamline back-end operations and drive differentiation. ... There is tremendous opportunity this year for our partners to combine their services with F5’s growing portfolio of application security solutions to deliver impact for our joint customers.

Amidst the current macroeconomic environment, we are relentlessly focused on how AMD and our partners deliver the most value for our customers. Using our latest EPYC processors, businesses can significantly increase the computing capacity and overall performance of their data centers, while lowering their operating costs and reducing their energy usage and carbon footprint. Using PCs powered by our Ryzen CPUs, customers can ensure their employees have the tools they need to collaborate anytime and anywhere without worrying about battery life.

Together with our partners we are changing the ways businesses are communicating and collaborating and, as a result, we are improving customer and employee experiences. In the last two years, we doubled our channel contributions and have set the bold and ambitious goal of doing so yet again for the next two years. With our partners, we provide a leading and complete platform for communication and collaboration, reaching further and serving even more customers across different segments and geographies. Together, we can deliver more happiness and accomplish more than we can do alone.

Hybrid cloud and AI are the most powerful drivers of digital transformation for businesses today. Together they represent a $1 trillion market opportunity, and that is what we are tackling alongside our partners. Modernizing with hybrid cloud enables organizations with data located across multiple clouds, on-premises or at the edge to drive value across these different environments. It also offers compelling economics for both IBM and our ecosystem partners. ... In addition, we see tremendous opportunity in the channel around how enterprises can integrate artificial intelligence into their operations to improve sustainability efforts, narrow important skills gaps and enhance productivity.

Kris Hagerman, CEO, Sophos

Cybersecurity as a Service represents a massive opportunity for channel partners in 2023 and beyond. Today’s threat landscape is too difficult, too complex and changes too quickly for the vast majority of organizations to effectively manage cybersecurity on their own—and the hard truth is that most probably shouldn’t even try. ...

We have pivoted all of Sophos to embrace the opportunity of delivering CSaaS with industry-best MDR capabilities that partners can use to better defeat persistent, well-funded and organized attackers targeting their customers.

Arvind Krishna, Chairman, CEO, IBM

Arvind Krishna, Chairman, CEO, IBM

In 2019, I committed to delivering HPE’s entire portfolio as a service by 2022. Last year, I am proud to say we delivered on that commitment, and HPE GreenLake has emerged as a leading hybrid cloud platform. In 2023 and beyond, we will continue to make key investments across our HPE GreenLake platform and portfolio of cloud services to extend our hybrid cloud leadership. Our innovation and pipeline of new HPE GreenLake offerings in 2023 is stacked across our entire product portfolio from compute, storage, supercomputing, AI, data analytics, private cloud enterprise and networking.

Fortinet will continue investing in longer-term innovation and go-to-market initiatives to fuel future growth, further validating our long-term commitment to customers and partners. For example, for over 20 years Fortinet has been a driving force in the evolution of cybersecurity and the convergence of networking and security. This leadership is the reason why Fortinet can help customers consolidate point products and features across both security and networking. Channel partners can offer their customers robust solutions based on an integrated cybersecurity platform that comprises a broad portfolio of solutions that are designed to work together.

We are very focused on investments in digital transformation and how we can help our customers deliver great user experiences, attract new clients and increase customer value. Our customers are investing in solutions like custom software development, data analytics, AI/ML and IoT to better inform decision-making and foster a more data-driven culture. This type of focus on digital transformation helps our customers adapt to market demands while seamlessly integrating data and insights into new policies and processes that enhance overall productivity and cybersecurity.

We will continue to invest in ways that empower our partners to compete and win in their markets, and that includes further enhancing our observability platform, LM Envision. With an intuitive interface, ecosystem of 2,000-plus integrations and agentless deployment, LM Envision offers fast time to value and return on investment. We have released hundreds of core and cloud expansions to allow monitoring more technologies for end customers, and we continue to improve our AIOps capabilities with robust alert filtering and analytics.

We know customer usage and adoption are key to our success along with our partners’ [success]. In order for our partners to drive customer success, we have to enable them with insights into how their customers are using and adopting our products in their organization. To do this, we plan to invest more resources into getting this data to our partners so they can have meaningful, data-driven interactions with their customers to drive more adoption, expansion opportunities and better success in landing renewals.

Joyce Mullen, President, CEO, Insight Enterprises

Joyce Mullen, President, CEO, Insight Enterprises

Continued economic uncertainty in 2023 is forcing organizations to be as cost-conscious as ever, and our challenge is to help our clients make high-value decisions amid the uncertainty. But this is also an incredible opportunity for everyone to get wiser about how they use their resources, where modern technology like automation can open the door to greater agility and new insights about the business. ... Being a trusted partner means that we can meet clients where they are to help them get to where they want to be—from IT strategy and design to implementation, organizational change and day-to-day management.

The toughest challenge we see is securing a modern enterprise in an environment where data and users are everywhere. Many clients struggle just being able to identify where their data is, who has access to it, who is supposed to have access to it and when they should have access to it. These are tough challenges for our clients. This is particularly true in an environment where they are short-staffed and access to talent is still a struggle. In addition, CISOs now find themselves with increased board oversight. As a result, they are looking to work with trusted partners and a reduced ecosystem to simplify wherever they can.

Customer experience will require additional channel transformation and will pose challenges, especially for VARs and MSPs that serve the SMB and midmarket sectors. CX and life-cycle management is critical for customer retention, driving consumption and renewals as the market moves to as-a-service models. Many vendors are requiring certifications and investments in this area. D&H is investing in Customer Success Specialists to help partners execute CX responsibilities and evolving automated resources such as the D&H Cloud Marketplace and Cisco Partner Enablement platforms with business intelligence data to make the process easier.

Technology leaders are challenged with how to manage data across an ever-changing infrastructure landscape and, for many, the enterprise data center is in a bit of a crisis. An explosion of unstructured data, a ‘reconciliation’ from cloud to on-premises, hybrid cloud, multi-cloud and so on has placed cost, complexity and flexibility squarely at the top of customers’ concerns. ... By fostering an ecosystem of collaboration and leveraging the full weight of Hitachi’s industrial expertise, we’re enabling our partners to provide trusted solutions and unmatched reliability to any customer, regardless of size or industry.

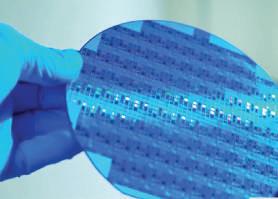

Pat Gelsinger,

Globally, we continue to see macroeconomic headwinds and economic uncertainty. ... Semiconductor manufacturing that is too concentrated in any one region can cause rapid and extraordinary disruption like we saw during the pandemic. ... Even as we all continue to face these global challenges, semiconductors remain as critical as ever to power essential technologies. With everything going more digital, we believe the long-term demand for semiconductors will continue to grow. This is why Intel continues to focus on navigating the challenges of today while still investing for the needs of tomorrow.

The complexity produced by our industry continues to grow without bound, and our partners are struggling to keep up with that craziness. As such, I believe the key for success of our channel partners is to continue working closely with us as we simplify the cloud edge and data protection. We’ll continue to simplify the buying motion, the training engagement and other operational tasks. Partners can become successful by just caring about solving our customers’ biggest problems and not worrying about complicated processes and tools. processes

The key success factor is to grow, learn and transform together in a changing world. Today, many small and medium businesses and large enterprises are moving toward the Everything-as-a-Service consumption model, and Lenovo has built our solutions and services business into a new growth engine. We will work with our channel partners and seize these opportunities together. In the past few years, the industry has faced many uncertainties such as manufacturing disruptions, supply risks and the global pandemic, and some of them are likely to persist for a while. So we will continue to help our channel partners and navigate through these challenges together. navigate

Customer success in multi-cloud depends on a connected ecosystem. Neither VMware nor any single partner can solve all of a customer’s needs alone. Through our interconnected and diverse global partner ecosystem, we enable more partner-to-partner collaboration to help customers to become ‘cloud smart’ and achieve outcomes faster. ... Partners focusing on business outcomes, such as accelerating app modernization, enabling enterprise cloud transformation and securing the hybrid workforce, will be best positioned for success.

Arista has been rapidly expanding into the campus as a natural adjacent selling opportunity. With businesses changing rapidly, as evidenced by new hybrid work environments and distributed enterprises to support them, channel partners have a complete Arista solutions portfolio to address these evolving needs. This shift, along with the transition to data-driven cloud networking, is driving the need for technology refreshes that can support these changing needs. Channel partners can now leverage innovations from Arista to introduce anti-legacy technologies that truly address 21st century data-driven networking requirements.

We can see that more and more MSPs are looking to diversify their offerings and to generate more revenue streams from each individual customer without necessarily having to invest more in people or expertise. This means that MSPs will rely even more on vendor services. Also, the inability of many MSPs to build their own SOC provides great opportunities to sell or upsell Kaspersky’s managed security services into their existing install base. We also continue to accommodate more advanced security needs to larger MSPs and MSSPs by making more products available through our subscription price list.

Technology has never been more central to the world, and we are at the center of the technology ecosystem. It is exhilarating. In 2023, I want to drive even more progress for our partners, our customers and our world, enabling more positive change than ever before.

The CrowdStrike ecosystem. That’s our partners. It’s our customers. And it’s our people. We’re going to keep delivering and innovating the world’s premier cybersecurity platform. We’re approaching the market in new ways in 2023. We just brought on Daniel Bernard as our Chief Business Officer, who leads our partnering organization. He’ll be working with our worldwide alliances team to evolve CrowdStrike’s channel program. ... This change allows CrowdStrike and our teams to focus on the channel in new ways and double down on winning together.

Mary Nardella, CEO, ConRes

Building on our success from 2022 and the continued expansion of our cloud offerings, we will continue to focus on expanding services and consumption models such as managed services, workplace transformation, security and cloud services. In addition, our goal year after year is to empower our employees and maintain a high level of customer satisfaction, meeting or exceeding our existing rating of 98 percent.

The past few years have been about transforming our identity as a company, shifting our heritage of hardware to software, infusing more AI and automation throughout our portfolio and continuing to leverage our significant footprint in the service provider and cloud provider segments to fuel our enterprise growth. This foundation ... now means we’ve given ourselves a license to invest in Juniper to scale and truly achieve the vision we’ve staked out: to be the leader in AI-driven, secure and cloud-delivered networking. Our channel partners play a significant role in achieving this, and we can’t scale without the formidable army of partners. So in 2023 expect to see us continue investing in our channel program with more incentives and more programming.

George Kurian,

Partnering closely with NetApp customers and partners to help them leverage the power of data and the cloud to transform their businesses. ... When cloud is fully integrated into your architecture and operations, and not just another walled garden, it has the potential to live up to its full promise. Moving data, migrating and deploying applications also become remarkably easy when your storage foundation is the same on-prem and across every cloud. With this approach, applications can pull data effortlessly from multiple clouds, data can move freely, securely and with consistency between clouds to keep business logic moving forward, and businesses can quickly adapt to deliver on the outcomes they need to for their customers.

The IT industry and the channel entered 2023 with perhaps the greatest economic uncertainty in decades, creating more challenges for channel executives and the partner programs they develop and manage.

“Partners are choosing their line cards very carefully,” said Frank Rauch, global channel chief at Tel Aviv-Yafo, Israel-based Cato Networks. “The economy is probably not where we need it to be, and this is a time of choice for some channel partners even though they may be very, very comfortable with some of the vendors on their line card right now.”

As it does each year, CRN has assembled the 2023 Channel Chiefs, a list of the pre-eminent channel executives in the IT industry. Within the list are the 50 Most Influential Channel Chiefs of 2023, an elite group drawn from the larger pool of honorees who drive the channel agenda and evangelize the importance of partnerships. The 50 Most Influential Channel Chiefs are recognized on the following pages with a star.

At Palo Alto, Calif.-based VMware, the 2023 channel strategy has two prongs: One is to get solution providers to take on higher-level services and the second is to drive more opportunities to partners, said Ricky Cooper, head of worldwide partner and commercial sales. That includes VMware’s new Partner Connect 2.0 program, slated to launch in the first quarter, that will place more emphasis on partners becoming technically proficient, offering systems integrators points for services as well as test and development work.

“We will make a huge effort to ensure that we’re passing as many services opportunities as we can to our partner ecosystem, and you’ll see a huge change there,” Cooper said. “Things are really opening up [for partners].”

Koorosh Khashayar

VP, Global Channel Khashayar merged the channel programs of four companies acquired by 11:11 Systems. From legal contracts to compensation structures to new product announcements, he unified every detail of the programs and on-boarded partners.

8x8

Lisa Del Real

Global Channel Chief

Del Real completed her first full year leading the 8x8 global channel program, launching the new 8x8 Elevate Partner Program and the benefits available to tiered partners. She is continuing to build the partner support team.

By CRN Sta

By CRN Sta

There is sometimes a knee-jerk tendency to pull back from channel investments in uncertain economic times, but “smart” vendors leverage the channel’s wealth of talent, said Scott Winslow, founder and president of Winslow Technology Group, Waltham, Mass.

“We have sales, engineering, marketing, finance services, managed services folks that we are employing on our payroll that are available to our [vendor] partners. What better way for them to become more efficient themselves than to do more with a channel?” Winslow said.

Also looking to win more partner mindshare is Seattle-based Amazon Web Services. The company is forming strategic collaboration agreements (SCAs) with more partners, laying out its commitment to train and pass along customer opportunities to partners if they agree to invest in areas such as hiring AWS professionals, growing their AWS portfolio offerings and winning new customers.

Innovative Solutions, Rochester, N.Y., recently signed an SCA through which AWS is investing to help it build new sales teams that are business-outcome-oriented versus transactional, quickly train and certify new hires, and offer dedicated AWS salespeople to work hand-in-hand with the solution provider.

“AWS wants us to help drive 1,000 net-new AWS SMB customers over the next four years, which is a huge lift that we wouldn’t be able to do without them,” said Justin Copie, Innovative Solutions CEO. “As part of the SCA, we’ll hire 200 new people. … Even in this economy, we’re hiring—not firing.

“They need armies of partners that are aligned to the core values of AWS,” Copie said. “They’re really looking to see where their most strategic partners can lead customer journeys instead of AWS leading those journeys. The opportunity is just so massive.”

Bertrand Yansouni VP, Worldwide Channels

S ince joining Abnormal Security in early 2022, Yansouni has built the channel sales organization by attracting strong talent. He has grown the team 4X since the start of 2022 and continues to recruit and hire for key positions.

Accedian

Kevin Baranowski

Sr. Director, Global Channels

Baranowski launched the MSP Advantage methodology that combines business consulting, product line management and sales enablement to identify, guide and execute new services for the company’s MSP and MSSP partners.

Accedian

Sergio Bea VP, Global Enterprise, Channel Sales Bea funded and led the initiative to implement a disruptive Digital Sales Enablement offering that partners can leverage to map and enhance the buyer’s journey. He also built new enablement tracks for partners.

Acer

Philip Burger

VP, U.S. Channel

Burg er’s team collaborated to build an education road map this past year centered around premium, higher-spec devices, which was a winning strategy. The team embraced new technologies and educated the partner base on new service offerings.

Jason Dettbarn

Founder, CEO

Dettbarn has been hard at work educating partners on the Apple device management opportunity. He launched an integration with Malwarebytes whereby partners can deploy Malwarebytes OneView directly from the Addigy portal.

Karen Thomas Chief Growth Officer

Thomas led efforts to achieve a partnerfirst focus at Alegeus. By aligning to partner objectives in providing customers with the best benefit options, the company and its partners are collectively creating operating leverage.

Pratt Dey Director, Strategic Partner Collaboration, Governance

With a sharp focus on partner transformation, Dey achieved a pivotal AWS sales and marketing goal by signing multiyear strategic collaboration agreements across five key industry verticals.

Acer

Jennifer Wadland VP, U.S. Commercial Sales Wadland works with channel partners to grow Acer’s education and commercial business, focused on call center, kiosk and health-care verticals. Partners have seen strong revenue and market-share growth in these areas.

Adlumin

Jim Adams CRO Adams created a tiered channel program that rewards partners for their investment and success with Adlumin. Included in the program was the launch of a quarterly rebate and quarterly MDF funding based on their sales.

Alludo

Jaime Becker Sr. Global Director, Partner Experience

Becker built her team around a clear focus: making it simpler for partners to empower their customers and grow their business with Alludo products. She recently spearheaded the launch of the Parallels Partner Program.

Chris Grusz GM, ISV Alliances, Marketplace

Previously, AWS Marketplace was seen as a tool to automate channel business, but Grusz has spent time meeting with channel teams at some of AWS’ top ISV partners to go beyond that and actually grow their business.

Acronis

Alex Ruslyakov

Channel Chief

Ruslyakov is laserfocused on making sure that Acronis is more partner-driven by improving channel programs. More workloads means smarter AI and better protection so as the number of partners increases, so does the effectiveness of Acronis’ products.

Chris Joe VP, Channels, Distribution Joe launched a comprehensive MSP program, leveraging Adlumin’s purpose-built platform to assist partners in building out or expanding their cybersecurity practice. He also developed a distribution strategy, inking a partnership with Ingram Micro.

Barb Huelskamp SVP, Global Partners, Alliances

Huelskamp updated Alteryx’s partner program to provide more benefits to growing partners. She also created a go-to-market structure focused on the partner type, leading to year-over-year growth in partner revenue.

Amazon Web Services

Jeff Kratz GM, Worldwide Public Sector Partners Kratz’s team has launched Solution Spark, which helps partners build tools; Smart City Competency, which helps partners market solutions; and six Accelerators, which help startups learn to sell to public sector customers.

Lindsay Boullin VP, GM, International Boullin embraced the launch of a new ACT product line and grew top-line performance year over year. He also transferred an add-on marketplace from a partner to Act corporate, enabling the expansion of the company’s ecosystem.

Advantix

Natasha Royer Coons CRO

Royer Coons rolled out a new partner enablement strategy that has been replicated and scaled across an extensive portfolio of partners but especially solution providers moving into wireless connectivity solutions.

CJ Boguszewski

VP, Partner Programs, Strategy

Acumatica has developed its Services Partner Program with the leadership of Boguszewski. He has also reduced pre-existing capacity issues, offered business referrals and restructured the partner margin program to make it easier to navigate.

John Young SVP, Channel Sales

Young has doubled the channel team with a focus on integrity and relationships and introduced several new growth roles into AireSpring’s channel. Young is in the field every week working with partners and channel managers toward collective success.

Ruba Borno VP, Worldwide Channels, Alliances

In her first year at AWS, Borno has pursued hundreds of thousands of opportunities with partners. She also has met with over 1,000 partners and customers across geographies, sizes and industries to understand their needs.

Amazon Web Services

Rachel Mushahwar Managing Director, Head of Channel, Partner Sales, N.A.

Mushahwar led a global transformation of the Partner Success organization into Partner Sales to reflect a new responsibility for driving net-new revenue. This evolution positioned Partner Sales as the scaling engine for AWS.

Amazon Web Services

Julia Chen VP, Partner Core

Chen joined AWS in June 2022 and is now defining the company’s global partner strategy and scaling mechanisms to achieve the goal of delivering a more simple, predictable and profitable experience for partners.

Amazon Web Services

Chris Sullivan GM, Global Systems Integrators

Sullivan dramatically increased the company’s focus and investment in distribution partners, resulting in accelerated business volumes and increased capabilities for partners and customers.

Sachin Vora

Global Leader, AWS Partner Network ProgramsIn June 2022 Vora took on a broader role leading all AWS Partner Network programs, with the charter of simplifying the programs by aligning them to partner journey stages.

Darrel Letcher

President, CEO

With the company’s distribution partners, Letcher spearheaded an initiative to expand a channel-exclusive endpoint device warranty offering. He also garnered support from distribution to grow its focus on diversity spending.

Arctic Wolf

Will Briggs

SVP, Global Channels

Briggs invested in topperforming channel partners while outlining a clear path for partners of all sizes to grow. He is focused on helping partners build out services-based, strategic engagement models that will provide them with recurring revenue streams.

Arrow Electronics

Danielle Post Global VP, Marketing, Customer Experience

Post has overseen strong progress in the global brand awareness of Arrow’s enterprise computing solutions business. She also has increased the emphasis on annual integrated business planning.

Amazon Web Services

Matt Yanchyshyn

GM, AWS Marketplace, Partner Engineering Yanchyshyn joined AWS in 2012 when cloud computing was just a glimmer in most CIOs’ eyes. He has led multiple AWS service teams and technical sales organizations and now leads all engineering for AWS’ partner organization.

AppDirect

Renée Bergeron COO

Bergeron completed the acquisition of IT Cloud, expanding the footprint of AppDirect’s adviser business in Canada. She also led the unification of all operations to support advisers, providers and business customers.

Arctic Wolf

Bob Skelley VP, Channel Strategy, Development

Skelley helped develop new channel communities in the cybersecurity insurance and incident response arenas. He also worked with the channel community and product group to launch new channel services for partners.

Arrow Electronics

Dana Zaba

Supplier Management Director

Zaba drove growth in strategic focus areas such as hybrid cloud, public sector, flash storage and software. She also operationalized the distribution process for IBM software transactions through the AWS Marketplace and partners.

AMD

Marty Bauerlein

Head of North American VAR Channel, Commercial Distribution

Bauerlein implemented a robust channel program and enhanced AMD’s field coverage model with a 75 percent increase in channel head count. He also created a CIO Advisory Council to keep customers at the center of everything.

Colin Puckett SVP, Global Channel, Field Operations With no direct sales team, the channel program is Appfire’s primary path to market. Under Puckett’s leadership, the purposebuilt program has been successful and enables partners’ business to see growth as well.

Armis

Tim Mackie VP, Worldwide Channels

Mackie launched the Armis Partner Experience program and APEX Manage track. He also instilled a “channel-first” philosophy within Armis and oversaw the development of operational visibility into the business.

Aruba, a Hewlett Packard Enterprise company

Donna Grothjan

VP, Worldwide Channels Grothjan led Aruba’s efforts transforming the partner base to enable the delivery of XaaS/NaaS offerings. She has transformed all aspects of the partner operating model, from partner goto-market strategy to all aspects of partner enablement and sales capabilities.

AMD

Terry Richardson

North America

Channel Chief Richardson has made AMD a channel force to be reckoned with through his focus on a “land and expand” strategy that delivers business outcomes. This has resulted in 100 percent sales-out growth in data center servers.

Aqua Security

Jeannette Lee Heung

Sr. Director, Global Channel, Ecosystems Lee Heung created and launched a new global partner program, streamlined strategic partners, increased value to the sales team from the channel and launched a global partner promotion— all leading to an increase in channel revenue.

Arrow Electronics

Andy Banks VP, Supplier Alliances, North America Banks leads a team of supplier managers and engineers who support all existing and new supplier lines and alliances. Under his direction, the team of channel professionals overachieved their targets year to date.

Aruba, a Hewlett Packard Enterprise company

Jim Harold VP, North American Channels Harold implemented a highertouch, more focused model by improving the CAM-to-partner ratio and making CAMs more accountable for partner growth. This allows them to concentrate on fewer partners and customize partner plans.

Anomali

Chris

Peterson VP, Global PartnershipsPeterson has reinvented Anomali’s partner model from the ground up. He has embraced a channel-first strategy, rolled out an allnew margin-based partner program and expanded the channel-dedicated field team.

Arcserve

Denise Parker

EVP, Global Sales

Parker leads Arcserve’s global sales and teams and go-to-market initiatives, providing customers with a unified data protection and management platform to ensure data resilience everywhere and every time.

Arrow Electronics

Tamara Ells VP, GM, U.S. Public Sector

Ells has increased the number of field representatives and sales support personnel in her first six months on the job. This focus allows Arrow to support channel partners more effectively and tighten operational SLAs.

Craig Patterson

SVP, Global Channels

Patterson launched the Aryaka Accelerate Global Partner Program. He also restructured staffing channel sales, marketing and support by region and partner model and created an elite partner tier with access to account-based marketing and sales.

Katiyar is defining the kind of channel partnerships to pursue, given the stage of Asimily’s growth. He is creating collateral for channel sales enablement, building key relationships with channel executives and setting business values for both sides.

Atlassian

Ko Mistry

Head of Global Channels

Mistry saw the need to further align with the greater Atlassian sales team and accomplished this through compensation neutrality and rewarding sales members for introducing partners to new and existing customer opportunities.

Avant

Jen Gallego EVP, Global Sales Gallego built a highperformance sales team, removing barriers and stepping out of the way so the team could thrive. As a result, Avant has a close alignment of the entire organization in terms of mission, vision and goals.

Nicholas Mirizzi

Head of Global Channels, Alliances

Mirizzi identified key target partners and then onboarded them, enabling Axis to ramp up sales quickly. He simplified programs and delivered call-to-action promotions and spiffs that significantly increased pipeline and strengthened close rates.

AT&T

Rick Chapes

Associate VP, Partner Exchange Chapes has helped to educate over 1,000 solution providers and their key channel representatives on how to adopt a solutionsbased approach to selling versus a product approach. This helped increase their revenue growth rates.

ATSG

Warren Greenberg

Chief Client Officer Greenberg worked to drive thought leadership and his channel philosophy into the ATSG organization. He has built partner programs and engagement that create value for partners and drive optimal business outcomes.

Avaya

John Lindsley VP, North American Channel Sales Lindsley focused Avaya’s CAMs on business development, planning and partner enablement. He consolidated the traditional channel and cloud channel into one integrated team to improve partner coverage across all Avaya platforms.

Axonius

Mark Daggett VP, Worldwide Channels, Alliances Daggett led the Axonius channel program to explosive growth over the past two years, including more than doubling the number of partners. With his guidance, the program now has leadership and program support in every major region worldwide.

AT&T

Christopher Jones

Associate VP, Alliance Channel, ACC Business

Jones implemented a partner expansion and participation focus within his organization. He reinforces that the organization needs to be responsive and easy to do business with.

Augmentt

Ali Mahmoud VP, Product, Partner Success

Mahmoud revamped Augmentt’s on-boarding process to accelerate partner time to value. He also deployed analytics software to gain visibility into partner adoption of the company’s software and programs.

AvePoint

Heather Murray Chief Channel Officer

In her first few months at AvePoint, Murray made it a priority to listen to every contributor on the channel team to get an understanding of their opportunities and challenges. That helped identify areas for improvement for fiscal year 2023 planning.

AT&T

Randall Porter

VP, Partner Solutions