This document provides citizens with a comprehensive overview of the Town’s adopted budget, the budget process, Town services and operations, and the resources that fund them. This document first outlines the process, policies, goals and issues involved in developing the budget. It then discusses the financial structure of the Town with an overview of the Town’s various funds, including where the money comes from and how it is spent. Details about the budget, forecasted revenue and appropriated expenditures follow, along with an in-depth look at Town departments and programs. This document is divided into the following sections:

The purpose of this section is to provide the reader with general information about the Town’s history, demographics and economy. The Town’s vision, mission, goals and strategic initiatives, organizational structure, and a message from the Town Manager are also included.

Information in this section gives the reader an understanding about the services the Town provides to our citizens and the costs incurred in the provision of those services. It includes the sources of funding, including long-term debt financing that support the Town’s operations and capital needs. This section also contains summaries of the budget process, the budget, a fund structure matrix, a description of major fund types and a discussion of revenue and expenditures and how they are forecasted.

The section presents a ten-year road map for the operations and finances of the Town. The tenyear plan for the major operations and funds follows a townwide overview.

This section includes summaries of the overall budget by fund, sources of revenue, types of expenditures and costs by department, along with the authorized staffing levels by department or division. For comparison, three years of historical results and the prior year amended budget and projections are presented alongside the budget. There is also a fund balance summary for each fund.

Following each fund summary is information at the department and division levels, including explanations of significant budget variances, prior year accomplishments, goals for the current year, authorized positions and significant changes within the department or division.

This manual provides information on the Town’s major revenues that are received primarily from outside sources. Major revenues are those in excess of $100,000 annually.

This section provides detail on the Capital Budget and the 10-Year Capital Improvement Plan (CIP). The capital projects are presented by fund and are grouped by new capital, reinvestment in existing capital, facilities and machinery, equipment and software.

This section contains a copy of the signed budget ordinance, demographic information, and a glossary.

Features to Support the Reading of PDFs by People with Disabilities

All versions of Adobe Acrobat DC, Adobe Acrobat Reader DC, Acrobat Standard DC and Acrobat Pro DC provide support for the accessible reading of PDF files by persons with disabilities:

• Preferences and commands to optimize output for assistive technology software and devices, such as saving as accessible text for a Braille printer

• Preferences and commands to make navigation of PDFs more accessible, such as automatic scrolling and opening PDFs to the last page read

• An Accessibility Setup Assistant Wizard for easy setting of most preferences related to accessibility

• Keyboard alternatives to mouse actions

• Reflow capability to temporarily present the text of a PDF in a single, easy-to-read column

• Read Out Loud text-to-speech conversion

• Support for screen readers and screen magnifiers

• Support for high contrast and alternative foreground and background colors

For more information about PDF accessibility, see www.WebAIM.org.

January 3, 2023

On behalf of the Town of Parker, I am pleased to present the Town of Parker’s 2023 Annual Budget. This budget is the result of collaborative work between the Mayor, Town Council, staff and Parker community. I am proud of the hard work that has been accomplished, resulting in a comprehensive and fiscally sound budget. The Mayor, Town Council and staff diligently worked together to serve the Parker community and set the path for the future.

The Town Council adopted the 2023 Budget on December 5, 2022, following an extensive process by staff working with the Mayor and Council. As transparency and community engagement are essential to the Town’s success, budget discussions with the Mayor and Town Council occurred at a Budget Retreat in October and Study Sessions in October and November, which were open to the public to attend. Additionally, the budget was posted on the Town’s website and presented during two public hearings, allowing for community feedback.

The Town’s Strategic Goals continue to guide decisions for our 2023 Budget priorities and our operations.

• Promote a safe and healthy community

• Innovate with collaborative governance

• Enhance economic vitality

• Foster community creativity and engagement

• Support an active community

• Develop a visionary community through balanced growth

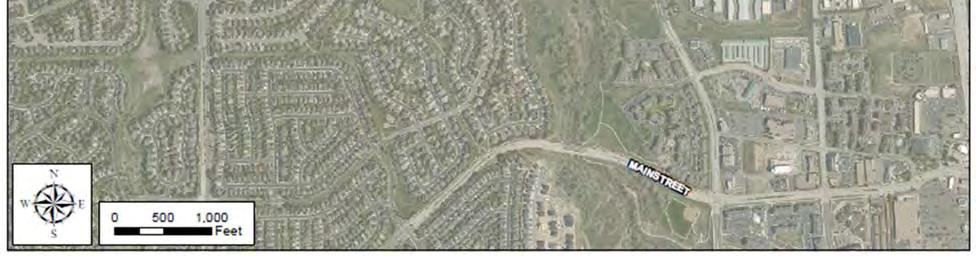

The Mayor, Town Council and staff worked diligently in 2022 to serve the community and set the path for a strong future. We brought a variety of new and exciting projects and programs to fruition that will add to Parker’s high quality of life for current residents and future generations. The past year was highlighted by the approval of the My Mainstreet Project, an important project for our Town’s future. This public-private partnership will lead to the activation of six vacant sites in our downtown area over the coming years, creating a destination for residents, workers and visitors in the heart of Parker through the addition of new restaurants and retail and residential options and providing increased revenue for the Town. Areas outside of Parker’s downtown also continued to grow. The southwest area of Town is on pace to build out the last of the largescale residential developments planned for our community in the coming years. Infrastructure is following suit. Despite cost increases due to inflation, many capital projects and initiatives were accomplished in 2022, including trail and road improvements such as the Cottonwood Drive widening, the Parker Road Multi-use Trail and downtown circulation improvements. Longrange planning initiatives, such as the comprehensive Facilities Master Plan Study and the Land Development Ordinance (LDO) Modernization project were completed or are nearing completion.

The highly anticipated new playground equipment and amenities at O’Brien Park Playground were installed, much to the delight of all ages. We were able to achieve other milestones through the 2022 Budget such as improvements to our network security through advanced endpoint protection and multifactor authentication for Town applications.

Looking ahead, the 2023 Budget demonstrates the Town’s continued commitment to advancing our strategic goals, including innovation and partnerships, while focusing on delivering exceptional services and maintaining a vibrant and healthy community.

Priorities include meeting the General Fund required minimum cash balance; continuing operational recovery in the Recreation and Cultural Funds; balancing the competing needs of our organization such as operational expenses, infrastructure requirements and employee recruitment and retention; and ensuring maintenance and growth of community programs to meet the needs of our growing public.

The 2023 Budget ensures funding for the continuation of our existing services and some new initiatives. Variations are expected in the 2023 Budget as compared to the 2022 Budget, such as a lower sales tax growth rate in 2023 due to economic challenges at the national level; additional key positions across several departments to better meet growth demands and maintain service levels; increased operational costs; and additional capital projects/purchases. It also recognizes the national challenge of workforce recruitment. Some highlights of the 2023 Budget include:

• Planning for future funding requirements related to Town infrastructure and Town buildings

• Implementing the first steps of the Facilities Master Plan Study, including the expansion of Town Hall

• Funding performance pay at an average of 5% for staff and the Police Officer Step Plan

• Implementation of expected compensation study recommendations

• Addition of nine (9) full-time positions across several departments

• Funding to develop studies and plans, such as a Language Access Plan and Traffic Signal Timing Optimization Study

• Investing in public capital improvements throughout the Town, such as Salisbury Park North development and Harvie Open Space improvements

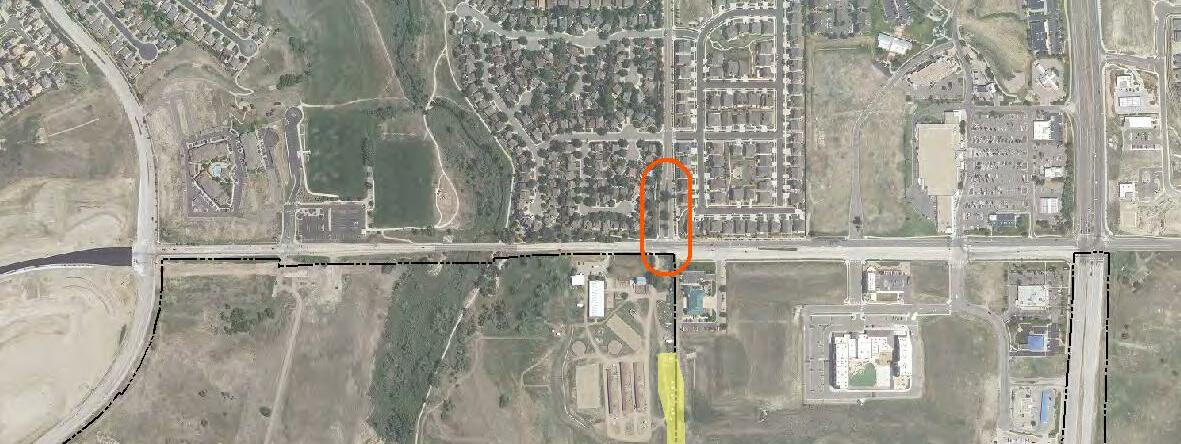

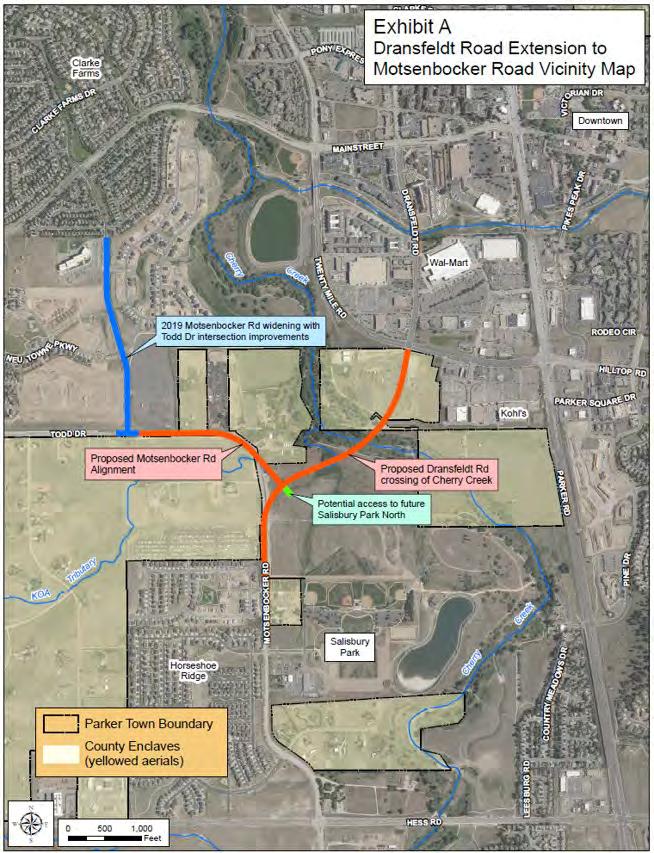

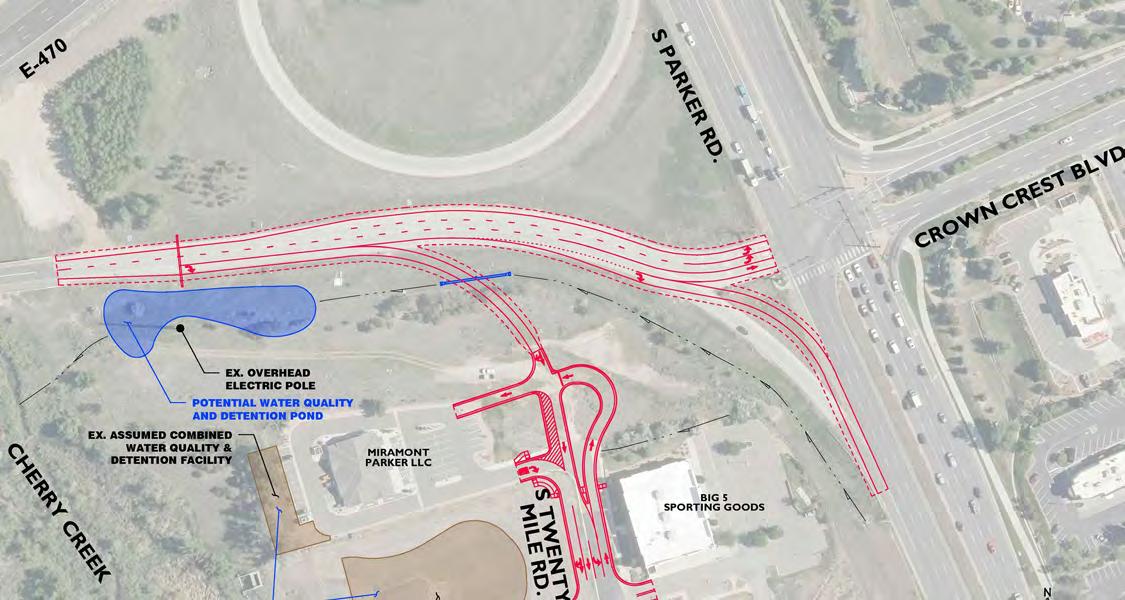

• Improvement projects for several major roadways, including the Dransfeldt Road extension, Chambers Road extension and North Parker Road improvements.

I want to thank our Town staff, the Mayor and Town Council for the many hours of work and discussion that resulted in a fiscally responsible budget that positively impacts our community, now and in the future. Thanks to all these efforts, Parker continues to be highly regarded for our overall quality of life, safety, recreation opportunities and wellness.

The Town of Parker is organized as a Council-Manager form of government. This form of government combines the political leadership of elected officials in the form of a Council with the managerial training and experience of an appointed local government manager. Elected leadership encourages citizens’ civic participation and sets policies and priorities that represent the people of the Town. A full-time professional manager ensures that the policies and priorities are effectively and efficiently implemented and oversees day-to-day Town operations.

The Town hierarchy supports the strategic plan of the Town. Through elections and regular opportunities for citizen input, Town citizens direct the Council’s vision and mission, which are achieved through the strategic plan. The Town Manager reports directly to the Town Council and implements the strategic plan. The Town Attorney and Municipal Judge ensure the Town is operating legally and enforce the Town Code. Citizen boards and commissions provide additional feedback on Town operations with regards to the strategic plan and goals. Finally, the departments support the strategic plan through service delivery that supports one or more of the strategic goals. More information on the creation of the strategic plan is found in that section.

The Town of Parker’s vision is to be the pre-eminent destination community of the Denver Metro area for innovative services with a hometown feel. We will be an area leader in economic and community development, and strive to be at the forefront for services, civic engagement, and quality of life.

The mission is the way in which the Town intends to achieve its vision of being an area leader and pre-eminent destination community. The Town mission is to enrich the lives of residents by providing exceptional services, engaging community resources, and furthering an authentic hometown feel. We promote transparent governing, support sustainable development, and foster a strong, local economy.

Leadership, innovation and good governance are not possible unless all of Town staff from the Council down operate using a shared set of values. The Town values are as follows:

Teamwork

• Communicate openly, honestly and frequently with all members of our team

• Demonstrate fairness, compassion, and consistency in our interactions with others

• Recognize the value of all members of our organization

• Form partnerships with the community

• Listen to and respect the ideas and concerns of others

• Enable team members to strike a healthy work and life balance

Quality Service

• Treat each customer with professional courtesy, warmth and friendliness

• Create a hometown feeling in our facilities and our community

• Focus on problem solving by listening empathetically while responding promptly and fairly

• Serve our customers efficiently and knowledgeably

• Strive to meet or exceed the expectations of our customers

• Treat all coworkers as customers

Integrity

• Embrace a culture of honor and trustworthiness

• Exhibit conduct that inspires public confidence

• Manage the Town’s business honestly and directly

• Honor commitments and promises

• Be reliable, dependable, and accountable for our actions

• Learn from our mistakes

Innovation

• Create a proactive, empowering environment

• Embrace the challenge of change

• Encourage and develop creative ideas in all areas of the Town

• Transform innovative ideas into reality

The strategic goals represent a combination of organizational and town-wide goals for the community. Each goal supports an aspect of the Town mission, and each department develops its annual operational budget and strategies to support one or more goals. A more in-depth discussion of the strategic goals are found in the Strategic Plan detailed on the Town of Parker website.

Parker will stimulate community creativity and engagement through high-quality cultural and educational programs and amenities. These will include family-friendly community events, accessible cultural venues, state-of-the-art facilities and innovative lifelong learning opportunities, all of which are vital to a creative community.

Parker will promote the public health and safety of our community by protecting our residents’ welfare through prevention services and a safe transportation network. Parker fosters a feeling of personal safety and security through a visible, responsive public safety presence and a proactive focus on prevention, intervention and safety education.

Parker will demonstrate our commitment to balanced growth, community development and infrastructure using a visionary plan for a sustainable future. We support a healthy, futurefocused community with exceptional services and a hometown feel. Parker supports well-planned development and excellent infrastructure.

The mission of the Town of Parker is to enrich the lives of residents by providing exceptional services, engaging community resources and furthering an authentic hometown feel. We promote transparent governing and support sustainable development and a strong, local economy.

Parker will demonstrate our commitment to the health of our community, both indoors and out by providing access to outstanding parks, trails and recreation amenities and activities. We promote a healthy lifestyle and work to meet the needs of a diverse, multigenerational community.

Parker will be an area leader for economic growth by supporting the development of thriving businesses and industry. We will play a critical role in shaping quality of life, creating a sense of place, and providing fiscal stability for the community.

Parker will support transparency, accountability, and fiscal sustainability by using innovative techniques to optimize performance. We engage in regional relationships and governing partnerships, including our education, fire, water providers and governmental agencies. Parker employs a high quality, dedicated workforce to support these goals.

The Town of Parker’s vision is to be the pre-eminent, destination community of the Denver Metro area for innovative, top-quality services with a hometown feel. We will be an area leader in economic and community development, and strive to be at the forefront for services, civic engagement, and quality of life.

The strategic plan evolved during 2015 as a cooperative project led by the Town Manager’s office and included participation by the Town Council and Town staff. Citizen participation was funneled through the elected officials. The outcome was the development of a vision statement, mission statement, and strategic goals. The plan complemented the Parker 2035 Master Plan, and it guides budgeting as new and ongoing budget requests must align with the strategic goals and objectives in the plan.

The strategic goals are meant to be high-level and guide the Town for many years, but the strategic plan to accomplish the goals is not static. As priorities of Town citizens evolve, Town leadership uses citizen engagement to make changes to the strategic objectives and the ongoing departmental strategies that support them. Citizens have input through Town elections, citizen boards and commissions, feedback on social media and through the various community surveys put out by the Communications team. For example, the most recent community survey was completed in 2021. The results affirm that the Town’s strategic goals are still in line with the citizens’ values and priorities. The community survey also provides one measure of the Town’s performance regarding its mission. The survey shows that most citizens are happy with the overall direction of the Town, while managing growth is an area of concern. To that end, the 2023 budget and 10-year Long-Range Plan are both focused on balancing infrastructure growth with community programming and achieving an optimal timing for capital projects.

Guided by the strategic plan and elected leadership, the departments develop operational strategies every year that support the strategic goals and ultimately, the mission and vision. The budget process is the catalyst for this planning since the Town does not have unlimited financial resources to implement every possible strategy. Once each department identifies their operational strategies, they are used to develop the annual budget requests. All capital expenses, new personnel and significant incremental operational expenses must be presented with an explanation of how the item supports one or more strategic goals. The strategic goals are also used in the annual pay-for-performance reviews completed each year. Specific departmental strategies are organized by the goal they support and included in the following pages of this section. The departmental strategies are also included in the budget detail section by department, where they are referred to as 2023 Goals and Performance Measures.

In addition to soliciting citizen feedback on Town performance, each department also reflects annually on its progress towards its past and current strategies. The result is a discussion of prior year accomplishments and performance measures by department in the budget detail section.

The Town Manager’s is leading an ongoing project to further operationalize the strategic plan. The project will ensure that departmental strategies are actual goals (vs. activities) that support the Town’s mission and vision through the strategic framework discussed above. The project will also create more robust performance measurement for the various Town departments. The process has started with select departments and will be rolled out in conjunction with new performance measures software to all departments in the near future.

A complete list of departmental goals and strategies is found in the Budget Detail section of this document. The following is a summary of the key strategies that exemplify each Strategic Goal.

• Improve sound quality in the PACE theater with the redesign and replacement of the current system

• Evaluate ways to utilize the Let’s Talk Parker community engagement platform to promote public participation and obtain community input on multiple projects and initiatives

• Explore new Diversity, Equity and Inclusion (DEI) platforms

• Identify underserved populations and create improved outreach mechanisms

• Establish and launch the Parks, Recreation and Open Space Commission

• Explore new community outreach activities to better connect residents with their local government

• Expand the use of video as a communications and engagement platform

SUPPORT

• Complete site plan, construction drawings and construction activity for a 1.4-mile soft-surface trail along the Xcel Energy right-of-way from Latigo Lane to Canterberry Parkway

• Complete planning, design and construction drawings for the 90-acre Salisbury North Master Plan Improvements

• Partner with Therapeutic Recreation to expand accessible art and cultural programs/events

• Renovate Parker Recreation Center’s pickleball courts; evaluate upgrading courts to LED lighting

• Renovate the USMC CPL David M. Sonka Dog Park surface with a more sustainable and suitable material

• Develop the next steps for implementation of the Development Agreement for the My Mainstreet project

• Development and implementation of the Economic Development Strategic Plan through a visioning and goal setting process with the Mayor and Council, staff, and community partners to advance economic vitality by building a strong local, diverse, and resilient economy

• Approve and entitle new developments generating economic development benefit by increasing the commercial and light industrial base by 25,000 square feet

• Expand the Community Response Team (CRT) to enhance mental health crises and emergency response

• Increase involvement with Douglas County’s Homeless Assistance & Resource Team (HART) to respond to community calls regarding homelessness and provide support to individuals experiencing homelessness

• Evaluate 911 and emergency dispatch technology in the Communications Center for potential updates, building on the recently completed conversion to the Emergency Services Internet Protocol Network (ESinet)

• Complete MUTCD (Manual on Uniform Traffic Control Devices) warrant studies of 6 relatively high-volume locations to see if new signals are needed

• Complete crash analyses for 6 intersections to see if geometric or engineering applications may improve safety

• Process and approve all building and construction permits using the 2021 International Building Code (IBC) building and fire codes and the 2020 national electrical code

• Present the 2025 Bicycle and Pedestrian Master Plan Update for Town Council adoption by Q2 2023

PROMOTE A SAFE AND HEALTHY COMMUNITY PROMOTE A SAFE AND HEALTHY COMMUNITY

• Implement initiatives within the Procurement Division that would allow recognition via the Achievement of Excellence in Procurement (AEP) through the National Procurement Institute

• Partner with the City of Centennial in a design and systems engineering project to improve connectivity between the neighboring communities

• Meet the State of Colorado’s new website accessibility standards, which will take effect in 2024

• Launch a redesigned Parker at Work Employee Intranet to better support all departments across the organization

• Complete the Land Development Ordinance Modernization project (public comment period in Q1 2023; Planning & Zoning Commission and Town Council consideration in Q2 2023)

• Complete Phase Three of the Parks Dedication Standards Project (Planning & Zoning Commission and Town Council consideration by end of 2023)

• Initiate the Zoning Map Amendment project to implement the Land Development Ordinance Modernization

To support transparency, the Town of Parker has a variety of online resources available to allow the public easy access to information.

TOWN

The Town of Parker’s website (www.ParkerOnline.org) offers access to more information from the Finance Department, such as Accounting, Budget, Purchasing, Sales Tax and Business Resources.

• Town of Parker Strategic Goals and Plan: www.ParkerOnline.org/StrategicPlan

• Town of Parker Open Budget: www.ParkerOnline.org/OpenBudget

• Master Plans and Guiding Documents: www.ParkerOnline.org/MasterPlans

• Partnering for Parker’s Progress (P3) Website (Urban Renewal Authority): www.P3Parker.com

• Parker Business Resources: www.ParkerOnline.org/Business

• Talk of the Town (Monthly Newsletter): www.ParkerOnline.org/TalkoftheTown

• Town of Parker Annual Report: www.ParkerOnline.org/AnnualReport

• Town of Parker Fact or Fiction: www.ParkerOnline.org/FactOrFiction

• Let’s Talk Parker (Community Engagement): www.LetsTalkParker.org

• Parker Arts Website: www.ParkerArts.org

• Parker Parks and Recreation Website: www.ParkerRec.com

• Parker Police Department Website: www.ParkerPolice.org

• @TownofParkerCO

• @ParkerArts

• @ParkerPoliceDepartment

• @ParkerRec

• @TownofParkerCO

• @ParkerArtsCO

• @ParkerPolice

• @ParkerRec YouTube

• @TownofParkerCO

• @ParkerRecreation

• @TownofParkerCO

• @ParkerArtsCO

• @ParkerPolice

• @ParkerRec

Located 20 miles south of Denver, the Town of Parker offers the perfect balance of a full-service community with a hometown feel. A community that is highly rated for safety, Parker provides nearly 62,000 residents with an unmatched quality of life, spectacular parks and recreation amenities, a great business mix, world-class cultural facilities and a wide variety of community events. With a highly-educated population and average household income that exceeds much of the Denver Metro area, Parker is well positioned for the future.

Parker operates under a Town Council/Manager form of government. The Mayor and Town Council, who are elected at large, make policy decisions, approve the Town budget and enact and provide for the enforcement of Town ordinances (laws). Town Council hires and directs the Town Manager, who oversees Town staff and the day-to-day operations of the organization.

The Town employs 313 full-time and 542 part-time employees who are dedicated to providing services to our residents, with the highest number of staff employed by the Parks, Recreation and Open Space Department. Parker’s Arts, Culture and Events (PACE) Center also bustles with activity year round. 2022 continued to be a year of adaptation with unique events, classes and programs designed to engage the community and keep the arts alive in Parker.

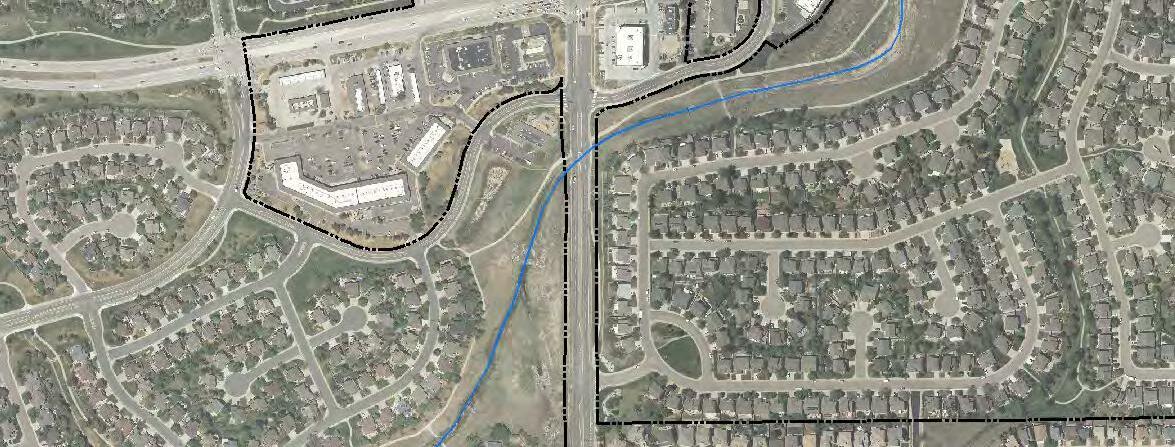

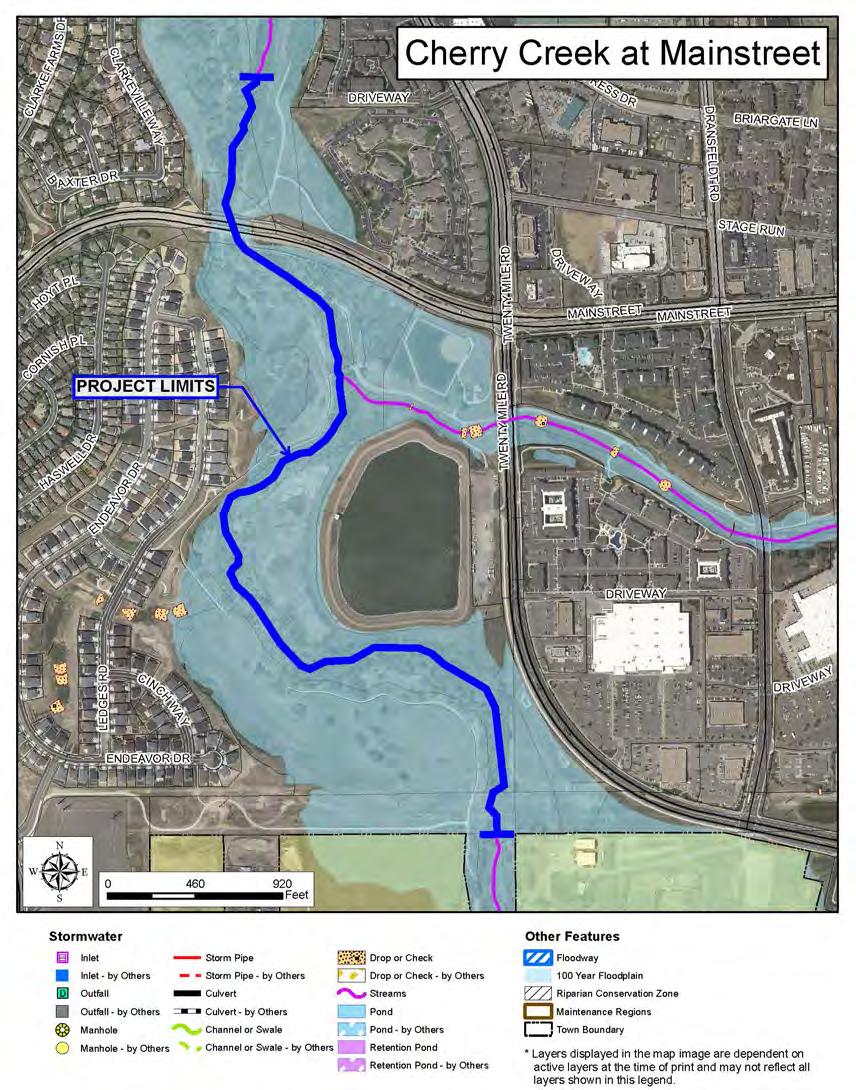

The Town continues to grow quickly and works diligently to provide and maintain the necessary community infrastructure, including 630 lane miles of roadway, 94 traffic signals, 7,615 storm drains/inlets and manholes, 147 miles of storm pipe, 381 ponds and 30 Town-owned buildings. Our Police Department is an accredited industry leader and has implemented a wide variety of innovative initiatives, including a nationally-recognized body-worn camera program.

In addition to the many services offered by the Town, we strive to engage our community through social media, opportunities for involvement and a wide range of activities and events. We encourage community engagement in all we do, especially through our online engagement platform, www.LetsTalkParker.org. Even through Parker’s growth, we’ve managed to maintain a palpable feeling of community.

Parker is a well-planned community that offers excellent opportunities for investors, retailers and developers to relocate or expand. Both businesses and residents enjoy the open space and trails, recreational amenities, opportunities for community involvement and great schools. They also enjoy a wide range of shopping venues, access to many modes of transportation and quality services.

When the Town incorporated in 1981, it was one square mile and had a population of 285. Since then, Parker has transformed from a rural equestrian community to an exciting town with nearly 60,000 residents, beautiful open spaces and well-planned residential and commercial developments. The municipalities of Lone Tree and Aurora are directly adjacent to Parker, while Castle Rock is located just to the south.

The Town is a home-rule municipality governed by a Council-Manager form of government. Six Councilmembers and the Mayor are elected to staggered four-year terms, so no more than three Councilmember terms expire every two years. Councilmembers and the Mayor are limited to four, four-year terms of office. Town Council is given the power by the Town Charter to enact and provide for the enforcement of ordinances, make policy decisions and approve the Town budget. They also hire, supervise and direct the Town Manager, Town Attorney and Municipal Court Judge. The Town Manager carries out the Council’s directives and is responsible for all other Town staff and day-to-day activities.

Parker’s residential communities include a variety of well-planned housing opportunities, ranging from entry level homes to luxury executive housing to multi-family townhomes, condos and apartments. Mixed-use neighborhoods are being developed in Parker, as well as a variety of homes along golf courses, parks and open space. The median home value in Parker is $665,000.

Three special districts serve the greater Parker area’s water needs: Parker Water and Sanitation District, Cottonwood Water and Sanitation District and Stonegate Village Metropolitan District.

Parker Adventist Hospital is located in Parker and offers a wide array of specialists and services, including a branch of The Children’s Hospital. New medical offices and practices continue to locate near this facility and the surrounding area, attracting a high-quality workforce to the community. In addition, the Skyridge Medical Center is located in Lone Tree, just 10 miles west of Parker. Both hospitals have recently added new facilities to accommodate the growth that Parker and Douglas County have experienced in recent years.

Parker is also home to the Rocky Vista University College of Osteopathic Medicine. The Rocky Vista University campus includes leading-edge technology, AV capabilities and educational support which are evident throughout the approximately 145,000 square feet of campus and buildings of the University.

Parker is served by the Douglas County School District Re. 1 (DCSD). The third largest school district in the state, DCSD serves more than 64,000 students and is one of the highest performing districts in Colorado. In addition to the Rocky Vista University College of Osteopathic Medicine, Parker is also home to the Arapahoe Community College Parker Campus, which provides a convenient location for educational opportunities for higher education to those living or working in and around Douglas County.

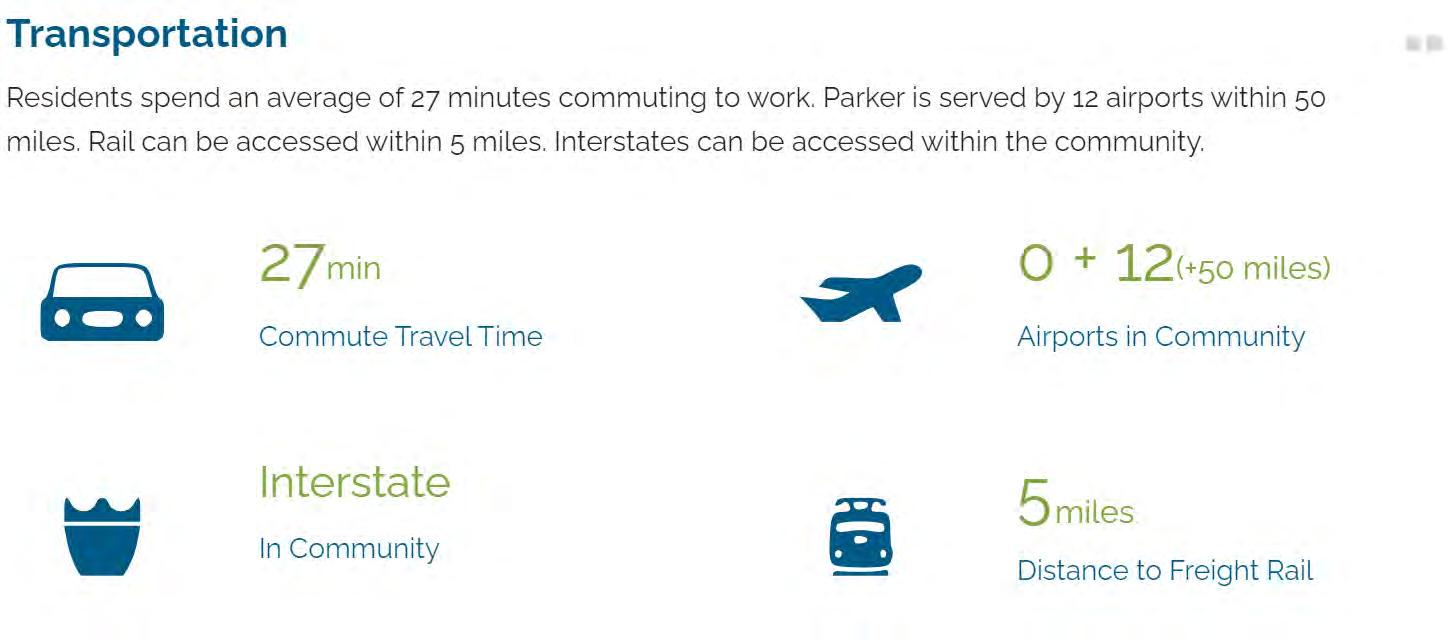

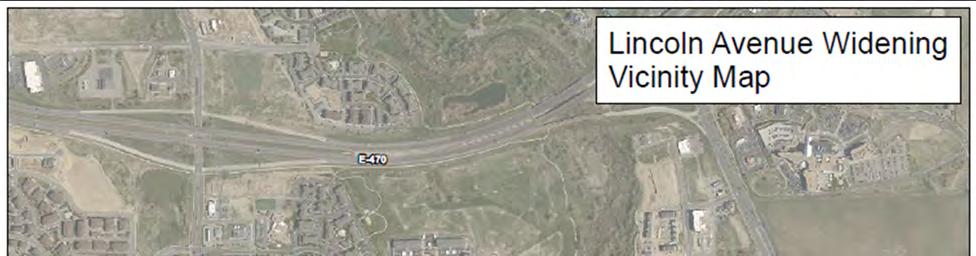

Parker is located in northeast Douglas County, approximately five miles east of I-25. The E-470 tollway runs through the northern portion of town and the 15 to 20-minute commute to the Meridian, Inverness and Denver Tech Center business parks is easily made via the expressway.

South Parker Road (Highway 83) provides connectivity and convenient access for commuters. The Regional Transportation District (RTD) also serves the Parker community by providing rapid transit services, including the Light Rail on Lincoln Avenue and a FlexRide system to various businesses and residential areas.

Centennial Airport, located about 15 minutes from central Parker, is the third-busiest general aviation facility in the country, handling corporate and charter air traffic. Denver International Airport (DIA) is approximately 30 miles northeast of Parker and can be reached in 30 minutes via E-470.

Parker residents enjoy many recreational opportunities, including a state-of-the-art library, a senior center and 17 public parks. The public parks contain a variety of facilities including soccer, baseball and softball fields, basketball courts, tennis courts, an ice skating trail, skate park, walking trails, picnic pavilions and playgrounds, as well as a dog park and disc golf course. The Town’s Railbender Skate and Tennis Park is a favorite for many local in-line skaters and skateboarders.

The Parker Fieldhouse is a 100,000-square-foot indoor facility that features basketball courts, a 25-foot climbing wall, inline hockey rink, turf field, fitness center, running track and batting cages. Program participation continues to exceed expectations.

The Recreation Center is home to an Olympic-size indoor swimming pool that is used by the high school swim teams, as well as for swimming lessons, exercise classes and year-round recreational swimming. The facility also includes basketball courts, work-out area with state-of-the-art equipment, cycling area and classrooms for various activities.

H2O’Brien Pool, the recently renovated outdoor swimming pool, features slides, a zero-depth entry, water cannons and a fort in the pool that allows kids and adults to play and relax.

Parker Recreation is much more than facilities. Our community enjoys a full range of adult and youth programming, including year-round swimming lessons, youth and adult sports and special interest classes, arts and crafts classes and cultural events. Recreational sport leagues are available year-round for nearly all age groups.

From festivals and events to public art and performances, Parker is an exceptionally artistic and creative community.

The Parker Arts, Culture and Events (PACE) Center celebrated its 10-year anniversary in 2021. Home to a 500-seat theater, 250-seat amphitheater, art gallery, event room, dance studio, culinary teaching kitchen, visual arts studios, media room and several classrooms, the PACE Center provides a wide variety of family-oriented cultural, arts, scientific and educational programming to the region and serves as a rental venue for community, business and social events.

The Schoolhouse, located in the heart of downtown Parker, continues to house fantastic events, shows, classes and art. Originally opened in 1915 as the Parker School House, the building operated as a school until 1967 and was acquired by the Town in 1995. The Schoolhouse includes a 200seat theater, as well as a dance studio and classrooms for community, cultural and recreational activities.

The Town’s property tax rate is 2.602 mills, which is one of the lowest property tax rates in the state. The Town’s sales tax rate is 3% and is the largest revenue source for the Town. The total sales tax rate in Parker is 8% and includes the state, county and RTD. Of the Town’s 3% sales tax, 2.5% is directed to the General Fund to support the majority of the Town’s operations including public safety and public works. The other 0.5% is dedicated to meeting Parker’s parks, recreation and open space needs.

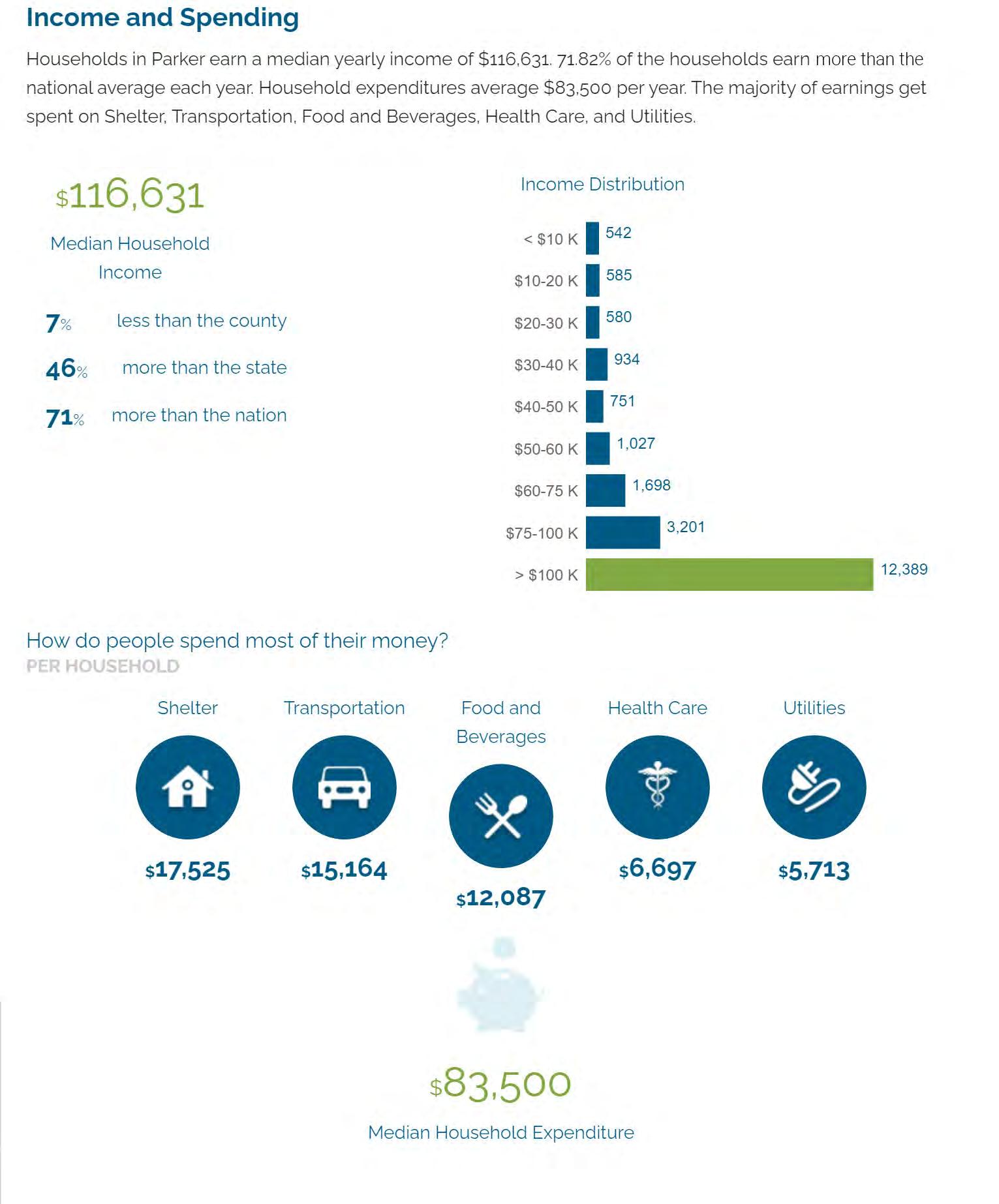

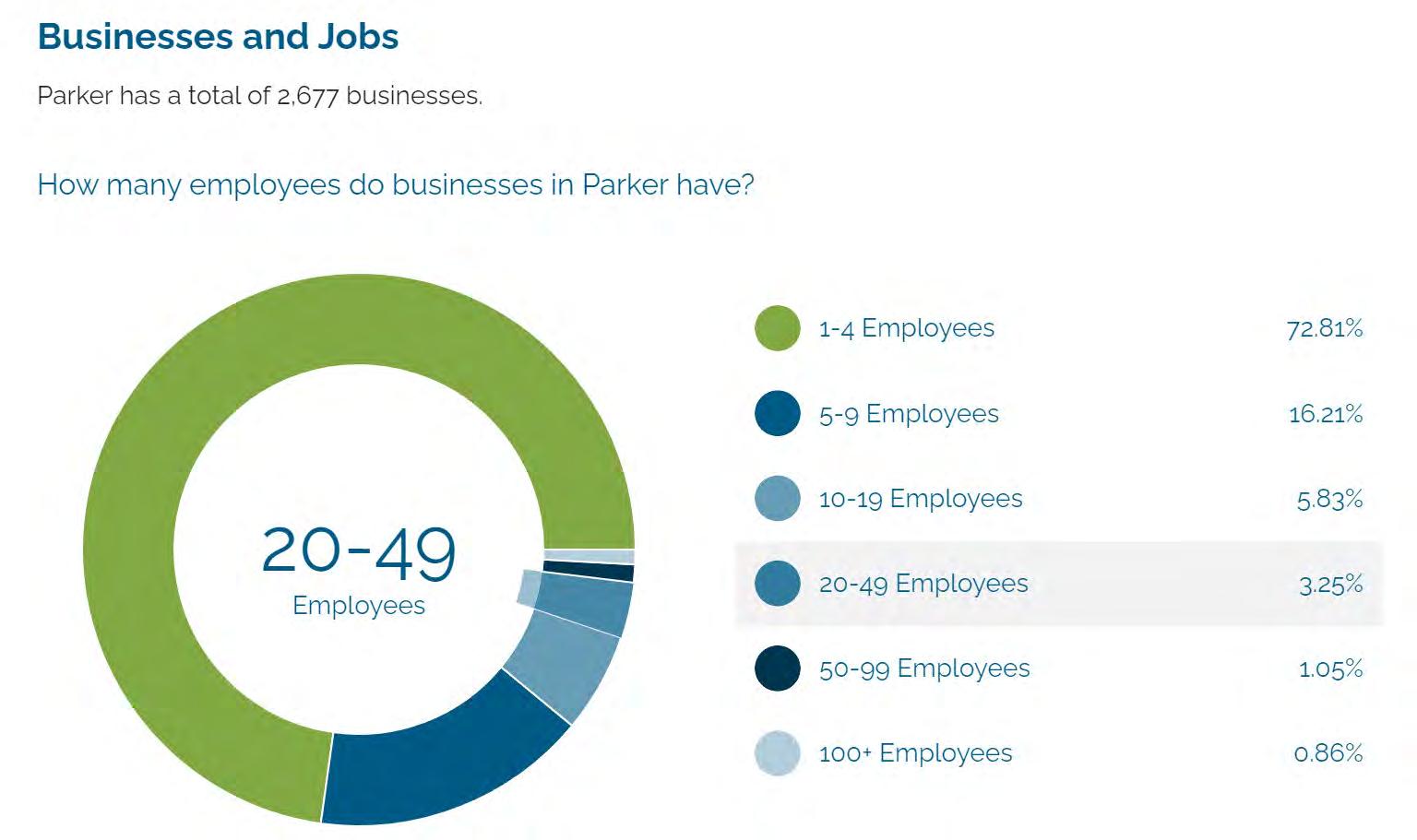

In addition to the excellent recreation, education, health care, transportation access and water amenities currently available, strong demographics in Parker and Douglas County support the Town’s economic activity and growth. The following set of data and graphical information illustrates various demographic and economic indicators of the Town and the surrounding area.

The Government Finance Officers Association of the United States and Canada (GFOA) presented a Distinguished Budget Presentation Award to Town of Parker, Colorado, for its Annual Budget for the fiscal year beginning January 1, 2022. In order to receive this award, a governmental unit must publish a budget document that meets program criteria as a policy document, as a financial plan, as an operations guide, and as a communications device. This award is valid for a period of one year only. We believe our current budget continues to conform to program requirements, and we are submitting it to GFOA to determine its eligibility for another award.

PRESENTED TO

For the Fiscal Year Beginning January 01, 2022

Executive Director

The budget is prepared annually according to the Town of Parker Charter, State of Colorado budget law and the Government Finance Officers Association guidelines. The Town uses an incremental approach to budgeting. An incremental approach uses a base, or existing, budget and adjusts up or down as necessary.

The steps that occur during the annual budget cycle are as follows:

• Town goals are developed or reaffirmed by the Town Council. Budget requests must demonstrate how they align with the goals.

• Proposed capital expenses over $100,000 for the next ten years are submitted by each department and are scored by a cross-departmental team to develop the long range plan.

• Proposed capital expenses for the current year are submitted by each department and are scored by a cross-departmental team for the capital budget. The proposed capital expenses are limited by revenue projections.

• Expense line item budgets are submitted by the departments with the initial budget request equal to the current year’s amended budget less any one-time expenses in the prior year. Certain expense lines require a detailed worksheet listing each expense within the line item.

• Expense justifications for new expenses over $50,000 for the current year, including new personnel requests of any amount, are submitted by each department and scored by a crossdepartmental team for the expense budget. The proposed expenses are limited by revenue projections.

• Revenue projections are developed by the Finance Department together with each department using internal trends and external economic indicators.

• The Town executive management team reviews the requests and makes a recommendation to the Town Council through the Town Manager. Study sessions are held throughout the process to inform and seek the input of the Town Council. Adjustments are made as necessary.

• The Town Manager must submit a proposed budget to the Town Council by October 15. The Town Council must then hold two public hearings, with one of those by November 15, and adopt the budget and the annual appropriations by December 15.

• Based on the number of strategic planning and study sessions held with the Town Council, revisions to the proposed budget are usually minimal or not needed at all.

• Budget amendments are presented to Town Council two or three times a year as needed. These are passed by Town Council via budget ordinance after a public hearing.

Citizen involvement in the budget ensures the participation of the people affected by it. The proposed budget is made available on the Town’s website by October 15th. Through the Talk of the Town newsletter, social media and online communication, interested citizens are made aware that the proposed budget is available online for their review, and they are invited to provide feedback. Prior to adoption of the budget, the Town holds several study sessions which are open to the public. At these meetings, Council and staff openly discuss budget requests, including proposed major capital projects and new staff positions, capital outlay and special project items. Then, two public hearings are held as Council considers the annual budget adoption. The Town of Parker website includes information on Agendas, Minutes and Packets for the Council Meetings.

DATE ACTIVITY

April 26, 2022 2023 budget process discussed with Executive Management Team (EMT)

April 27Kick-off of cross-functional team to develop the 10-year capital plan

May 9Scoring of 10-year capital requests completed by team

June 23Kick-off of cross-functional team to prioritize the 2023 capital requests

July 11Scoring of 2023 capital requests completed by team

July 13Allocation process methodologies for Internal Service Funds established

July 18Town Council Retreat - Long Range Plan Study Session

July 25Completion of expense line item requests and expense justification sheets

July 25Revenue budget drafted

July 27Kick-off of cross-functional expense team to prioritize the 2023 expense requests August 4Scoring of expense requests completed by the expense team

1, 2023 2023 fiscal year begins

1 2 3 4 5 6

7 8 9 10 11

27 2023 budget filed with the State of Colorado Department of Local Affairs and with the Governmental Finance Officers Association

Strategic PlanningStrategic PlanningOperating Budget

This section presents the highlights of the 2023 Budget. Following this section is detailed background information on the Town’s basis of presentation, budgeting and accounting, the Town’s budget and financial policies, and the debt service and financial obligations of the Town.

The Town experienced strong revenue growth in 2022. Growth in the Town of Parker and inflation were the primary growth factors for the Town. Additionally, changes to the municipal code in late 2020 and collaboration with the state on sales tax have increased the number of remote sellers remitting sales tax to the Town. Growth is expected to level off as inflation eases somewhat and also begins to impact consumer spending. Inflation is a mixed indicator for the Town because higher prices result in more sales tax revenue, but they also blunt demand and raise the Town’s operating costs. Also, in some categories such as construction, the rate of cost increases has exceeded the revenue growth in 2022; this trend is expected to continue into 2023. The 2023 budget reflects a flatter projected revenue growth rate as compared to 2022.

Another major impact to the 2023 budget is the level of capital needs throughout the Town, both within the community and Town government itself. As the Town grows and returns to a prepandemic level of service provision, modest expense growth must be balanced with necessary capital spending. The overall strong financial position of the Town guided planning for the 2023 capital program and the 10-year capital improvement plan (CIP). Cash reserves at the end of 2022 and beginning of 2023 are set aside in the Capital Renewal and Replacement Reserve Fund for near-term infrastructure needs.

On the operational expense side, the Town is managing cost-increases in every category in order to maintain the same programs and service levels. For the 2023 budget, growth in discretionary categories was contained as much as possible to accommodate these increases. To that end, the Town continued the new process from 2022 for prioritizing incremental expenses over $50,000. The process mirrors the existing scoring process for capital items. In 2023, not every capital need or incremental expense request was able to be funded. Items at the bottom of the priority list were not included in 2023, and will be revisited in future years if needed.

Finally, the impact of the COVID-19 pandemic was not considered for budget development as demand for cultural and recreation programming returned in 2022. These were the two departments most impacted by closures and restrictions. The Cultural department is well positioned for 2023 after ticket sales, rentals and class registration are projected to exceed the budget in 2022. The Recreation department has seen permanent shifts in demand for some offerings following the pandemic, but it also had a strong return to rentals and youth sports and programs. The town has taken steps to build up a minimum cash balance in these funds to hedge against any future impactful events, and the departments are continuing to work towards greater efficiencies in cost recovery and matching programming to citizens’ needs.

The objective of the 2023 budget is to preserve the current level of services to the community while managing increased operational expenditures and capital needs. Significant assumptions that impact the budget include the following:

• The Town will sustain the current level of community programming and repair and maintenance of infrastructure.

• Sales tax revenue growth is budgeted at 8% for 2023.

• Both performance pay and commissioned officer step increases are budgeted at 5% due to the current labor market.

• A compensation study will be completed in 2023, and the Town will implement some or all of the recommendations.

• Growth in discretionary expenses is contained to balance capital needs and inflation.

Four priorities were established for the 2023 budget:

• Maintain required General Fund cash reserves and build cash reserves for the Cultural and Recreation Funds

• Maintain community programs and the repair and maintenance program for infrastructure

• Balance competing funding needs between operating expenses, increased staffing and infrastructure

• Identify funding sources for needs identified in the 2021 Facilities Master Plan

The first two priorities remain in place from the 2022 budget. First, General Fund cash reserves remain a priority as they are a legal requirement and are set by the Council. Additionally, the COVID-19 pandemic highlighted the need for cash reserves in the Cultural and Recreation funds, since a significant portion of their revenue is from charges for services. Unforeseen events that impact demand or the Town’s ability to provide programming also impact these departments’ ability to cover overheard operating costs. Now that the funds have recovered from COVID-19, the Town is taking steps to grow the cash balance as a hedge against future impactful events. Second, citizen demand for community programs is strong, and maintaining infrastructure before costly failures is both a best practice and Town responsibility

Third, development growth in the Town has created a need for additional infrastructure investment and increased operational expense, including increased staff to manage the growing number of new capital and infrastructure repair and maintenance projects. These must be carefully balanced to fit within the revenue constraints of the Town. The Town used a scoring process for capital projects, incremental expense increases over $50,000 and new personnel to prioritize the most important items for each category by fund.

Finally, Town municipal buildings are aging and required to support increasing numbers of staff and community members. Recognizing that significant repairs and expansion are becoming necessary, the Town undertook a Facilities Master Plan in 2021 to identify needs for repair and/ or replacement of Town equipment, facilities and other assets. The plan identified four projects to accommodate needed growth. Funds were set aside starting in 2021 in the Capital Renewal and Replacement Reserve Fund to help fund the needs identified in the plan; however, cost increases in all public works projects indicate that the original project cost estimates in the master plan

are likely too low. Therefore, additional funding was set aside in 2022 and the 2023 budget to fund these projects, and other potential revenue sources, such as the Excise Tax Fund, are being considered if necessary as the projects progress.

Town staff has implemented a thoughtful process of strategic planning and preparing a carefully balanced budget that supports the direction of the Town Council and the Town’s strategic goals. The Council has ample opportunity for input as the proposed budget is being prepared. Therefore, Town Council passed the 2023 budget as originally presented, with no changes between the proposed and final adopted budget.

Sales tax makes up almost 71% of the General Fund revenue, so estimating the 2022 projected and 2023 budgeted revenue accurately is key to the overall direction of the 2023 budget. Sales tax growth has fluctuated for several years. Growth was 6.3% in 2019, 7.8% in 2020, 18% in 2021 and is projected to close 2022 at 12%. With some of the growth attributed to short-term factors, a conservative projection of 8% was used for 2023. The experience of other Denver area municipalities, local economic projections and continued population growth were all considered in developing the budget.

The top five General Fund revenue sources, including sales tax, account for about 85% percent of the total revenue in the General Fund. Overall, growth for these revenue sources in the General Fund is budgeted to grow 7% from the 2022 projection and generate $4.4 million in incremental revenue.

The Town uses an incremental approach to budgeting. An incremental approach uses a base, or existing, budget and adjusts up or down as necessary. Discretionary spending has been reduced significantly through several years of cost cutting, so a base level of expenditures is considered necessary as a starting point. Funding of personnel-related costs, including a 5% increase for performance pay and commissioned officer step plan, compensation study related changes, medical benefit cost increases and new full-time positions require an additional $5.3 million in expenditures in the General Fund.

Other expenditure increases include inflation related cost increases in operations and community programs. Repair and maintenance costs for streets and snow removal activities are also increasing by about $1.3 million due to increased labor and materials costs.

Several small capital projects are also included in the 2023 General Fund budget, including traffic safety, police and parks maintenance equipment. The Town Hall expansion project was moved to the Capital Renewal and Replacement Reserve fund where all of the facilities master plan projects are now held.

In summary, the 2023 General Fund budget implements the Town’s four budgetary priorities. The resulting balanced budget maintains excellent service to the community and Town employees while maintaining and improving Town infrastructure.

This section begins with a look at total revenues and expenditures in all funds excluding interfund transfers. The Compound Annual Growth Rate (CAGR) shows the average annual percentage change over the period 2019 – 2023.

Overall revenue growth in all funds has been an average of 3% year-over-year. Operational funds including the Cultural and Recreation funds had a drop in revenues due to the COVID-19 pandemic. The capital funds and Stormwater Utility have variable growth rates because developer contributions fluctuate from year to year. The Medical benefits fund has also seen higher than average growth due to cost recovery for increased benefits costs.

Note: Interfund transfers are not included

The overall expenditure growth in all funds has averaged 9% year-over-year. Capital projects are the primary driver of growth in the Parks and Recreation, Capital Improvement and Stormwater funds. The number of construction projects varies every year in those funds. The Cultural Fund shows flat growth due to the dip in program expenditures during the COVID-19 pandemic. Recreation costs have increased due to increased program costs and higher capital needs in recent years. Both the Fleet Services and Technology Management funds have increased due to cost increases and growth in service levels as the Town grows. Finally, the activities in the Law Enforcement Assistance Fund were moved to the General Fund in 2022.

Note: Interfund transfers are not included

The General Fund is the main operating fund of the Town. Town operations, which include Police/ Public Safety, Public Works, Building Inspection, Community Development, Municipal Court and Administration (which includes Town Administration, as well as the Communications, Finance and Human Resources Departments) are accounted for in this fund.

Excluding transfers in, total 2023 budgeted revenue is $76.4 million, with sales tax being the largest revenue source. The sales tax growth rate has been increasing since 2019, reflecting growth in the Town. Growth in 2021 jumped to 18%, due in part to short term factors, and is expected stabilize somewhat to end 2022 at 12%. Therefore, a moderate rate of 8% has been used for the 2023 budget to account for slowing in Town growth and easing of inflation.

The Parks and Recreation Fund transfers in $1.6 million to partially offset the parks and recreation administration costs included in the General Fund. An interfund transfer of $0.4 million from the Stormwater Utilities Fund offsets work completed by the Public Works Department on behalf of the Stormwater Department. Additional revenue discussion is in the Revenue Manual section of this document.

Total expenditures are $7.8 million lower in the 2023 Budget as compared to the 2022 Projected Actuals. Most of this variance is due to a transfer of $24.4 million to the Capital Renewal and Replacement Reserve Fund in 2022. The 2023 budgeted transfer declined to $8.2 million based on the available cash reserves.

Another significant variance of $6.8 million is in Salary and Benefits. The budget assumes all positions will be filled for the full year, while the 2022 Projected amount reflects vacancies that have occurred throughout the year. The 2023 Budget also includes 5% performance pay increase and police step increases, funding to implement the 2023 compensation study recommendations and increased healthcare costs. Finally, purchased services are increasing $1.3 million to account for inflation in repair and maintenance and the cost of community programs. Utilities and internal services are also increasing due to inflation.

Major variances by department are largely personnel related but also include inflationary increases in repairs and maintenance. The following are notable variances between the 2022 Projected and 2023 Budget:

• The variance in Community Development reflects the removal of the 2022 Parker Master Plan update that was a one-time expense and an increase in both building inspections and bank fees for which there is offsetting revenue.

• Interfund transfers are decreasing due to the one-time $24.4 million dollar transfer to the Capital Renewal and Replacement Reserve fund in 2022. The 2023 budget includes a transfer of $8.2 million based on available cash reserves.

• The Parks, Forestry and Open Space increase of $1.0 million is due to an increased level of repairs and maintenance and increased personnel costs.

• The Police Department shows an increase of $3.3 million, of which $1.2 million is related to the step increases and structural changes to the compensation plan for sworn officers. It also accounts for positions that were vacant in 2021 but fully budgeted in 2022. Performance increases for civilian staff and a taser maintenance plan make up the rest of the difference.

• The Public Works Department increase of $1.7 million is split between personnel and increased repair and maintenance costs. The Department is adding four positions to account for the increased lane miles and new infrastructure projects. Labor and materials cost increases are also impacting the budget for street maintenance and snow removal.

Individual departmental summaries with more detail are presented in the Budget Detail section

* The Ending Fund Balance to Total Expenditures for the 2022 Amended Budget indicates a 16% ratio. The 2022 Budget has been amended for expense revisions approved by Town Council. It does not reflect revenue increases that have occurred.

General Fund expenditures are lower than revenue for the 2023 Budget, which results in a increase to the ending fund balance of $6.2 million (12.8% increase) from 2022 projected actuals. Responsible fiscal policy dictates that the use of cash balances should be limited to one-time expenditures, and this is the case for 2023. A one-time transfer of $8.2 million to the Capital Renewal and Replacement Reserve Fund is being made with excess cash reserves. The Town Charter requires the General Fund maintain a ratio of 25% of cash to total expense; the ratio for the 2023 Budget is 38% after this one-time transfer.

The additional cash being maintained in the General Fund will be utilized to offset increased inflationary impacts above what was budgeted. Project bids opened in fall 2022 indicated a need to provide potential funding for bid overruns. Budget amendments will be presented to Council for their approval as projects require additional funding.

In addition to the General Fund, the Town has five other main operational and capital project funds. These are the Parks and Recreation, Cultural, Recreation, Public Improvements and Stormwater Utility Funds. Financials for each may be found under the Budget Detail tab. Highlights of variances between the 2023 Budget and the 2022 Projected Actuals for these funds follows.

The total revenue decline of $0.8 million is due to increased tax revenue of $0.5 million, decrease in transfers in of $1.1 million and a decrease of $0.2 million in contributions. On the expense side, the capital projects budgeted for 2023 are in line with the projects in 2022. The annual transfer to the Recreation Fund for parks and recreation programs is being moved from the Parks and Recreation Fund to the General Fund to free up cash for the robust Parks capital program.

Charges for services in the Cultural Fund are in line with the 2022 Projection. The 2022 Projection is higher than the 2022 Budget due to robust return of demand for programs and tickets following the COVID-19 pandemic. Revenues are not expected to increase significantly in 2023 due to the PACE center being almost at capacity for offering programs and shows. Expenditures are increasing by $0.8 million, reflecting the full cost of programs following COVID-19 and inflationary impacts in overhead costs. The Fund Balance decreases just under $600,000 (24.7%) due to funding one-time expenditures in 2023.

Charges for services in the Recreation fund are increasing $.8 million due to a strong return of demand for sports and youth programs. Expenditures are increasing $1.5 million, primarily in personnel. One full time position for a marketing coordinator is being added and the cost of the position is being shared with the Parks and Recreation Fund. The Fund Balance decreases approximately $310,000 (10.9%) due to funding one-time expenditures in 2023.

Revenues in the Public Improvements Fund are increasing $6.9 million due to an increase in project partner contributions. The Town is starting two major infrastructure projects with regional partners, including extending Dransfeldt Road. Projects in 2023 total $44.9 million, half of which is for the Dransfeldt Road Project. More information on capital projects can be found in that section of this document. The Fund Balance decreases $19.4 million (57.9%) due to the timing of capital projects. The Town is undertaking several major projects in 2023 due to available funding.

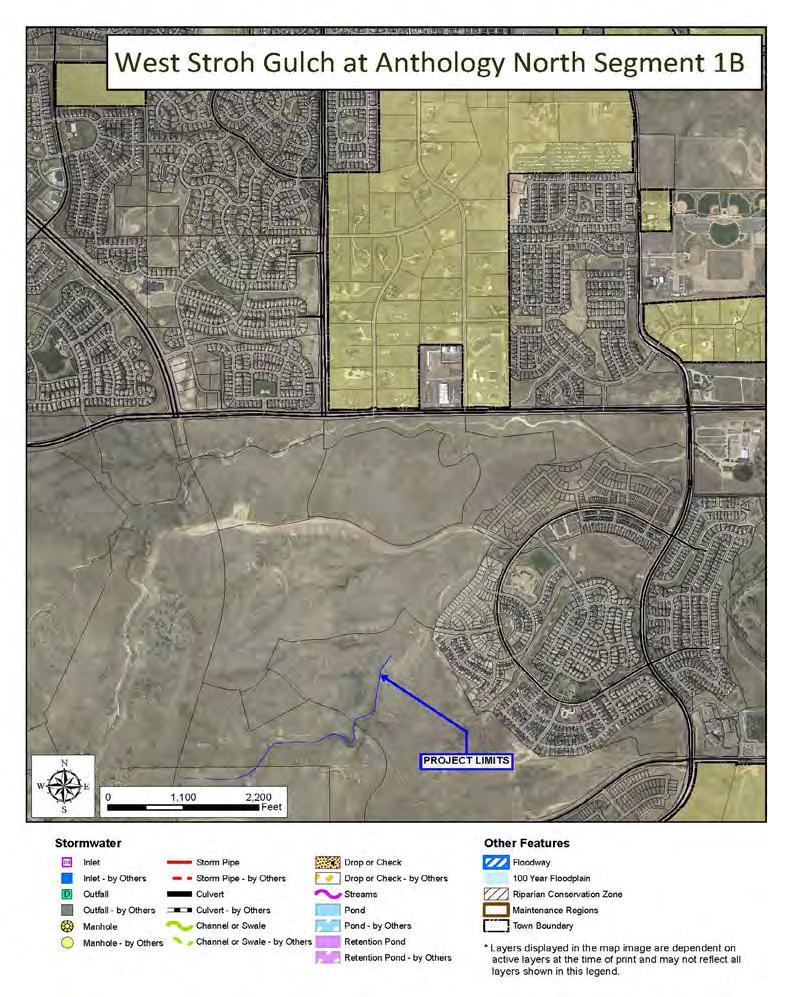

Stormwater revenue is down $5.6 million in 2023 due to fewer planned developer-funded capital projects as compared to 2022. Expenses are decreasing by $7.6 million for the same reason. The Fund Balance decreases just over $850,000 (37.9%) due to the timing of receipt of developer contributions.

All of the Town funds are included in the Budget Detail section of this document. Additional variance information may be found there for the above funds and also for those remaining funds not included above.

The chart below summarizes the full-time equivalent (FTE) employee numbers by department and fund for the time period 2019 through the 2023 Budget. Full-time equivalent numbers convert staff time into the decimal equivalent. One full-time position (1.0 FTE) is defined as containing 2,080 hours (typically 40 hours per week); a half-time position (.5 FTE) requires 1,040 work hours (20 hours per week).

The chart on the following page adds the additional detail of separating the full-time and parttime benefited category from the part-time and seasonal counts.

* The amounts presented under Part-Time/Seasonal represent Full-Time Equivalents and not actual positions.

The changes in the part-time and seasonal staff from 2022 to 2023 are primarily in the Cultural and Recreation Funds where the number of employees increased to accommodate the return of demand for programs and services following the COVID-19 pandemic.

The full-time staffing variances reflect the need for additional operational and support staff as the Town grows. Full-time staffing increases have been kept to a minimum in prior years as the Town focused instead on operational efficiencies and relied on part-time and seasonal employees for

many services. The Town is now at a point where more employees are needed to maintain the level of service expected by the citizens. The difficulty in hiring part-time and seasonal staff in the current economic climate was also a factor in adding full-time positions.

The impact of the increased FTEs is found in all employee-related cost areas. The increases impact the areas of salary and benefits, computer and software, office or work equipment, uniforms, office furniture, vehicle, training and travel.

Click on the fund name in the table below to go directly to the detail for this fund including sources of revenue and types of expenditures.

This chart is included to show the fund balances for each of the Town’s funds. A fund balance reflects the net financial resources of a fund; in other words, assets minus liabilities. In simpler terms, this is equivalent to dollars available to spend. If some of the funds’ resources are not available to spend, those resources would be indicated by “restricting” or “reserving” a portion of the fund balance.

The Governmental Accounting Standards Board (GASB) Statement Number 54 (Reporting and Governmental Fund Type Definitions) is used by the Town. The statement provides clearlydefined categories of fund balance to make the nature and extent of the constraints placed on a government’s fund balance more transparent. The categories of fund balance are as follows: nonspendable, restricted, committed, assigned and unassigned. The fund balances reported in this document reflect the total of these categories. The Town’s Annual Comprehensive Financial Report (ACFR) provides the breakdown on a historical basis.

Updated budget information by fund is always available online via Town of Parker Open Budget

The activities of the Town are organized into separate funds that are designated for a specific purpose or set of purposes. Each fund is considered a separate accounting entity, so the operations of each fund are accounted for with a set of self-balancing accounts that comprise its revenues, expenses, assets, liabilities and fund equity as appropriate.

The number and variety of funds used by the Town promotes accountability but can also make municipal budgeting and finance complex. Therefore, understanding the fund structure is an important part of understanding the Town’s finances. The three basic fund categories are Governmental Funds, Proprietary Funds and Fiduciary Funds; within each fund category there are various fund types. Following is a description of the seven fund types that contain the Town’s various funds. Only six of these funds are budgeted as the Town does not have the authority to spend on its own the resources accounted for in the Fiduciary Fund.

The General Fund is the Town’s primary operating fund and is used to track the revenues and expenditures associated with the basic Town services that are not required to be accounted for in other funds. This includes services such as police, public works, parks and recreation, and other support services such as finance and human resources. These services are funded by general purpose tax revenues and other revenues that are unrestricted. This means that the Town Council, with input from the public, has the ability to distribute the funds in a way that best meets the needs of the community as opposed to other funds that are restricted to predefined uses.

Special Revenue Funds account for activities supported by revenues that are received or set aside for a specific purpose that are legally restricted. The Town has four Special Revenue Funds that it budgeted in 2023, the Parks and Recreation Fund, Conservation Trust Fund, Cultural Fund and Recreation Fund. A fifth, the Law Enforcement Assistance Fund, was closed in 2022, and the activities in this fund were moved to the General Fund.

Capital Projects Funds account for financial resources that must be used for the acquisition, improvements or construction of major capital projects. The Town has eight Capital Projects Funds:

• Public Improvement Capital Project Fund

• Excise Tax Fund

• Capital Renewal and Replacement Reserve Fund

• Impact Fee Funds

• Public Works

• General Government

• Police Facility

• Court Facility

• Hess Ranch Metro District Fund

Three funds were closed as of 2022: the Parks and Recreation Impact Fee Fund, the Transportation Impact Fee Fund and the Parkglenn Construction Fund. The monies in these funds were allocated toward eligible projects and the funds were closed.

The 10-year capital improvements plan lists approved and anticipated capital projects of the Town, and is located in the capital section of the budget document.

Debt Service Funds

Debt Service Funds are used to account for resources that will be used to pay the interest and principal of long-term debts. The Town has two Debt Service Funds: General Debt and Recreation Debt.

Enterprise Funds

Enterprise Funds account for operations that are financed and operated in a manner similar to private business, where the intent of the Town is that the fund will be self supporting. This requires that the ongoing expense of providing goods and services to the general public be financed or recovered primarily through user charges. If these user charges are insufficient to cover the operations of the Enterprise fund, transfers can be made from other fund types to provide additional support. The Town’s Enterprise fund is the Stormwater Utility Fund.

Internal Service Funds account for the financing of goods and services provided primarily by one Town department to other Town departments or agencies, or to other governments, on a cost-reimbursement basis. The Town’s Internal Service Funds consist of the Fleet Services Fund, Technology Management Fund, Facility Services Fund and Medical Benefits Fund.

Trust Funds

Fiduciary Funds account for resources that the Town does not have the authority to spend on its own because the Town is holding assets of these funds in a trustee capacity or as an agent for another organizational unit. The Town has one Fiduciary Fund which is not budgeted, the Security Escrow Fund.

The information on the previous pages is summarized below in a table format. Also included is an indication of which funds are considered to be major funds based on the definition by the Governmental Accounting Standards Board (GASB). All other listed funds are classified as nonmajor funds. All of these listed funds, except for the Fiduciary Funds, are included in the Town’s audited financials. Budgets are included in this document for all listed funds, except for Parker Authority for Reinvestment, Greater Parker Foundation fund, and the Fiduciary Funds.

The following chart illustrates the fund structure and the various funds the Town uses. Also shown is the total expense budget further split by fund and fund type The total appropriation amount for all funds, including interfund transfers, is $185,891,808.

Basis of budgeting refers to the methodology used to include revenues and expenditures in the budget. The Town of Parker primarily budgets all funds on a cash basis. The Town does not budget for non-cash items such as depreciation and amortization. The revenues and expenditures are assumed to be collected or spent during the period appropriated. Using this assumption, the current year revenues are compared to expenditures to ensure that each fund has sufficient revenues to cover expenditures during the budget year, or that there are sufficient available cash reserves in the fund to cover a revenue shortfall.

Basis of accounting refers to the point at which revenues or expenditures are recognized in the accounts and reported in the financial statements. The government-wide financial statements, as well as the financial statements for proprietary funds and fiduciary funds, are reported using the economic resource measurement focus and the accrual basis of accounting. Under accrual basis of accounting, revenues are recorded when earned and expenses are recorded when a liability is incurred, regardless of when the cash is received or disbursed.

Governmental fund financial statements are reported using current financial resources measurement focus and the modified accrual basis of accounting. Under modified accrual basis of accounting, revenues are recognized as soon as they become both measurable and available, and expenditures are recorded in the period that the expenditure occurs and becomes a liability.

An economic or financial resources measurement focus is similar to the basis of accounting where non-cash items are not budgeted and those items budgeted are within the appropriation period (fiscal year). Governmental fund financial statements also focus on the fiscal year period.

The basis of budgeting differs from the basis of accounting only by the assumptions that are made in regards to the timing of the recognition of revenues and expenditures. The budget assumes that all revenues and expenditures, as well as the associated cash, will be expended or received during the budget period. Conversely, the basis of accounting only recognizes revenues when they become both measurable and available, and expenditures when incurred. Cash is not necessarily received or expended at the same time.

The summary on the following pages depicts the relationships between departments/division and the fund categories into which they fall.

The Town of Parker has an important responsibility to its citizens to account for public funds and manage municipal finances wisely. This section provides a summary of the significant elements of the adopted Annual Budget and major financial policies in place to ensure the funding for the Town’s services is managed responsibly. Financial policies are reviewed with Town Council annually during the budget review for ongoing relevance and adherence to the policy.

The Town of Parker prepares the operating and capital budgets simultaneously each year. All funds are included in the operating budget.

• The budget is considered to be balanced when proposed expenditures do not exceed proposed revenues and available fund balances for any budgeted year. This applies to all funds contained in the budget.

• The budget must be balanced when it is formally presented to the Town Council by the Town Manager and when it is passed by the Town Council.

• Sales and excise taxes are the primary revenues used by the Town to offset expenditures and balance the budget. Property taxes, charges for services and other revenues are also used.

• Alternative forms of revenue may be used to balance the budget, such as bonds, grants and lease and purchase agreements.

• Revenues remaining from the previous year will be placed in the fund balance and can be used for the purpose of balancing the budget, as long as the Council-mandated contingency amount is maintained.

• The non-appropriated General Fund balance will be maintained at levels sufficient to provide necessary working capital and contingency reserves. Beginning with 2018, the reserve was set at a minimum of 25% of the total General Fund expenditures. In addition, reserves for future major capital expenditures may be accrued in the fund balance.

• Non-appropriated emergency reserves will be maintained at 3% of budgeted expenditures, in accordance with Article X of the Colorado Constitution (TABOR).

• Use of the budget reserves must be recommended by the Town Manager and be approved by a majority vote of the Town Council.

• If the Town Council approves the use of budget reserves, at the time of approval the Council must also approve a plan to replenish the reserves back to a minimum ratio of 25%.

One-time Revenues

One-time revenues are federal, state or private grants and tax windfalls that may occur in any given year.

• Grants must be shown as revenue in the appropriate fund and approved for expenditure by the Town Council. Also, the funds may only be used for the intended purpose as outlined by the contributing party.

• One-time revenues, such as tax windfalls, will be placed into the fund balance of the appropriate fund. The funds can be utilized only after the Town Council has approved the expenditure.

• It is likely the one-time revenues and corresponding expenditures were unknown at the time of budget development. The budget adjustments must be included as a budget amendment once they are known.

Service charges and fees should be reviewed annually. This review process should coincide with the annual budget process.

The transfer of revenues between funds to cover temporary shortfalls in cash revenue is at the discretion of the Finance Director, but is only permissible under the following circumstances:

• A temporary loan can be made to funds that may experience a revenue lag due to collections.

• A temporary loan can be used to satisfy a shortfall in a transfer to a subsidized fund until the budget can be revised to the required transfer amount.

The expenditure types that are used throughout all Town funds include salary and benefits, supplies, purchased services, internal services, utilities, capital outlay, debt service, contributions, interfund transfers and other.

Only positions approved by Council may be filled. New positions may not be created during the year without Council approval.

Budget reallocations may be made between line items by completing a budget reallocation form and obtaining the approval of the Town Manager and Finance Director. Reallocations must be approved before goods or services are ordered. Budget reallocations to or from personnel line items will not be approved.

Capital outlay funds are to be appropriated for specific capital assets. Purchasing, acquiring or constructing a capital asset must be verified by the Finance Department prior to the purchase or contract to ensure that the expenditure of capital outlay funds has been specifically approved by Council during the budget process. Expenditure of capital outlay funds that are not on the approved list must be reviewed by the Finance Director and the appropriate Department Director prior to approval by the Town Manager and before making the purchase.

In 1992, voters approved the Taxpayer’s Bill of Rights (TABOR) Amendment to the Colorado Constitution that places limits on revenue and expenditures of the state and local governments. Even though the limit is placed on both revenue and expenditures, the constitutional amendment in reality applies to a limit on revenue collections. Growth in revenue is limited to the increase in the Denver-Boulder Consumer Price Index plus local growth (new construction and annexation). This percentage is added to the preceding year’s revenue base and the result is the dollar limit allowed for revenue collection in the ensuing year. Any revenue collected over the limit must be refunded to the citizens. Federal grants or gifts to the Town are not included in the revenue limit.

In April 1996, voters in Parker approved an amendment to the Home Rule Charter which authorizes the Town to collect, retain and expend all revenue of the Town for 1996 and each subsequent fiscal year, not withstanding any limitation contained in Article X, Section 20 of the State Constitution. The Amendment is complex and subject to judicial interpretation. The Town believes it is in compliance with the requirements of the Amendment; however, the Town has made certain interpretations in the Amendment’s language in order to determine its compliance.

The Amendment requires that emergency reserves be established. These reserves must be at least 3% of fiscal year spending (excluding bonded debt service). The Town is not allowed to use the emergency reserves to compensate for economic conditions, revenue shortfalls or salary or benefit increases.

Enterprise funds act like a private sector enterprise and revenues must cover 100% of the expenditures.

All expenditures for the Town must be for Town business, properly authorized and approved, and within the Town Council’s approved budget.

The Chief Procurement Officer (CPO) is the public purchasing official for the Town, responsible for providing direction and assistance in the acquisition of goods and services. The CPO will procure all goods and services in excess of $5,000 with some limited exceptions specifically defined in Town policy. These purchases also require a pre-approved Authorization for Expenditure. Procurements of $20,000 or more require a competitive process with the award given to the lowest responsible and responsive bidder.

Expenditures of any amount must be authorized by the Department Director, accomplished by signing the source document to be paid or approving an Authorization for Expenditure. The Director may provide written authorization delegating his or her approval authority as follows:

• The Department Director may delegate his or her approval to a direct report when the director will be away from the office for a period longer than one (1) week.

• The Department Director may delegate his or her approval on invoices or other cash disbursements under $10,000 to a Deputy Director or under $5,000 to a direct report.

• The Department Director may delegate his or her approval to another director for purchases that are routinely made by the other department on behalf of his or her department.

Although the ultimate responsibility for a departmental budget lies with that Department’s Director, purchases greater than $5,000 require further approvals. Purchases between $5,000 and $100,000 also require approvals from the budget authority, procurement and the Town Manager. Purchases of $100,000 and more also require Town Council approval.

The Town Operations Manual provides complete policy and procedural detail on all expenditures.

The Town Manager may stop a department from spending appropriated funds in the event there is evidence that funds are being misused. The Town Manager must present the reasons for the action to the Town Council within thirty days of the expenditure stoppage.

Short-term borrowing or lease-purchase contracts may be considered for financing major operating capital equipment when the Finance Director, along with the Town Manager, determine that this is in the Town’s best financial interest and the Town Council concurs. Lease-purchase decisions should have the approval of the appropriate operating manager.

Long-term debt will not be used to finance current operating expenses. When long-term debt is warranted for a project, the payback period for bonds used for the project must not exceed the useful life of the project.